Starbucks Announces the Pilot Launch of the Web3 Loyalty Program Using Blockchain Technology

Introduction of Starbucks Odyssey, the company’s first significant blockchain integration into its rewards program.

Starbucks, the world’s largest coffee corporation, has announced the beta launch of Starbucks Odyssey, the firm’s first significant attempt to integrate blockchain technology into its current rewards program. The program will begin with a small group of members and staff in the United States, with intentions to expand to include more individuals in January 2023.

Starbucks integrates NFTs into its loyalty program

Starbucks is now one of the largest brands to include non-fungible tokens (NFTs) into its loyalty program, a concept that more and more businesses are investigating as they seek methods to make digital assets more valuable. The Odyssey program will feature activities such as virtual tours of coffee farms, learning about the history of Starbucks, and interactive games. The benefits of accumulating “stamps” (NFTs) include virtual espresso martini workshops, product and artist collaborations, and invitations to events at Starbucks locations and coffee farms.

The business declined to comment on Odyssey in an interview, but Starbucks CMO Brady Brewer touted it as the “next great breakthrough” and a method to thank customers in a blog post. “We are employing Web3 technology to reward and interact with our members in new ways, such as creating collectible, own-able digital stamps, launching a new digital community, and providing access to new benefits and immersive coffee experiences – both physically and online.” Odyssey was created with the assistance of Forum3, a Web3 loyalty network co-founded by Adam Brotman, former Starbucks Chief Digital Officer. He designed the coffee company’s existing loyalty program as well as its mobile ordering and payment mechanisms. Starbucks is also collaborating with Nifty Gateway, a well-known NFT marketplace.

Starbucks Odyssey launch a barometer of consumer interest in branded NFTs

The prolonged crypto bear market, along with economic uncertainty, has some marketers questioning if it is really worthwhile to invest time and money in blockchain-based ventures. But, the ubiquity of the Starbucks brand and its history of digital innovation put Odyssey under even more scrutiny. Marketers and industry experts are keeping an eye on the program’s introduction because it might be a barometer of how much consumers care about branded NFTs. “The Starbucks Odyssey launch is a litmus test for Web3’s readiness to help a major QSR brand take customer engagement to the next level, as much as it is a test of the brand’s ability to build compelling experiences on top of that foundation,” said Israel Mirsky, a partner at the innovation firm House of Attention. Mirsky also stated that Starbucks is correct to focus Odyssey on community building, fan interaction, and consistency with other aspects of the brand, including as its current loyalty program and digital platforms. However, success will be determined by how innovative the experience turns out to be.

Companies should keep an eye on Odyssey’s success as a loyalty program, according to Liron Shapira, a former investor in the crypto giant Coinbase who is now a crypto-skeptic. But if it succeeds, he says other companies should duplicate it but leave out the blockchain portion because many people may not require it. “They’re suggesting the user might not even realize it’s a blockchain thing, so it’s just a loyalty program,” Shapira explained. “Since Starbucks is basically a trusted entity in the system, the use of blockchain technology to track the ledger of who now possesses what in this system is absurd.”

According to Matt Wurst, CMO and co-founder of Mint, an NFT platform for brands, several key groups will be watching Odyssey to see if it’s a canary in the coal mine, including established brands that were early to adopt Web3 tech, other brands that have been watching from the sidelines, and investors wondering if it’s worth funding the space.

Starbucks Odyssey is a bold move that may pave the way for other companies to explore similar blockchain solutions.

Starbucks might also provide a prospective data strategy from which others could learn. The organization will have a unique way to track client involvement and behavior by incorporating NFTs into their loyalty program. This information can be utilized to tailor the consumer experience and develop targeted marketing strategies. Furthermore, the program’s usage of blockchain technology allows for enhanced security and transparency in data administration.

The most difficult difficulties for Starbucks Odyssey will be communicating the value to customers and keeping them engaged over time. Many individuals may be unfamiliar with the notion of NFTs and the benefits they give, so the organization must properly convey how the program works and the rewards users can receive. Furthermore, the program must provide a variety of interesting experiences and prizes to keep clients interested in the long run.

Overall, Starbucks Odyssey is a daring move for the firm, as well as an intriguing test case for the usage of blockchain technology and NFTs in loyalty programs. It will be interesting to see how the program evolves and whether it is successful. If it is effective, it may pave the way for other corporations to investigate similar solutions, bringing a new level of customer interaction to the sector.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Investigating the use of blockchain technology in digital identity management

Blockchain Technology and its Potential in Digital Identity Management

Digital identity management is a crucial aspect of our digital lives, as it enables us to prove our identities online and access a wide range of services. However, current digital identity management systems are often centralised and controlled by a few large corporations, which can lead to issues such as data breaches and lack of control over personal information. Blockchain technology has the potential to revolutionise digital identity management by creating a decentralised, secure, and user-controlled system.

Blockchain technology is a decentralised, digital ledger that records transactions across a network of computers. It is the technology behind the popular cryptocurrency, Bitcoin, but its potential uses go far beyond just financial transactions. One of the key features of blockchain technology is its ability to enable secure and transparent transactions, without the need for a central intermediary.

In digital identity management, blockchain technology can be used to create a decentralised system, where users have complete control over their personal information and can prove their identities without relying on a central authority. This would allow for greater security and privacy, as personal information would be stored on the blockchain and protected by cryptographic techniques. Additionally, the use of blockchain technology would increase transparency, as all transactions and changes to personal information would be recorded on the blockchain, creating an auditable and immutable record.

OpenTimestamp and Digital Identity

The importance of OpenTimestamp in digital identity management cannot be overstated. OpenTimestamp is an open-source protocol that enables secure and verifiable time-stamping of data in the blockchain. This means that it can be used to create a tamper-proof record of a user’s digital identity, making it more difficult for others to manipulate or alter the data. This added security and trust will further contribute to the success and widespread adoption of blockchain-based digital identity management systems.

Decentralised Identity Management

A decentralised digital identity management system would allow for greater control over personal information, as users would be able to store and manage their own personal information, rather than relying on a central authority. This would also increase security, as personal information would be stored on the blockchain and protected by cryptographic techniques. Additionally, a decentralised system would be more resilient to data breaches and cyber attacks, as there would be no central point of failure.One of the key benefits of a decentralised digital identity management system is that it would allow for greater interoperability between different systems and platforms. This would enable users to prove their identities across a wide range of services, without the need to create multiple identities or share personal information with multiple organisations.

Self-Sovereign Identity

Another potential use of blockchain technology in digital identity management is the concept of self-sovereign identity. This would allow users to have complete control over their personal information and use it to prove their identities across a wide range of services. This would be done through the use of digital identity credentials, which are stored on the blockchain and can be used to prove identity without the need for a central intermediary. The use of blockchain technology in self-sovereign identity would also increase transparency and trust in the digital identity management system, as all transactions and changes to personal information would be recorded on the blockchain, creating an auditable and immutable record. This would help to prevent fraud and manipulation in the digital identity management system, and increase trust among users.

Conclusion

Blockchain technology has the potential to revolutionise digital identity management by creating a decentralised, secure, and user-controlled system. This would allow for greater control over personal information, increase security and privacy, and enable users to prove their identities across a wide range of services. While the technology is still in its early stages, the potential benefits of blockchain technology in digital identity management are clear, and it will be interesting to see how it develops in the coming years.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Exploring the use of blockchain technology in the renewable energy sector and its potential to create a decentralized energy market

Blockchain Technology and its Impact on the Renewable Energy Sector

The renewable energy sector has been growing at a rapid pace, with a growing demand for clean and sustainable energy sources. However, the conventional energy market is centralized and controlled by a few large corporations, leading to a lack of transparency. Blockchain technology has the potential to transform the energy sector by creating a decentralized market, where consumers can generate, share, and trade energy directly with one another.

What is Blockchain Technology?

Blockchain is a decentralized, digital ledger that records transactions across a network of computers. It is the technology behind the popular cryptocurrency, Bitcoin, but its potential uses go far beyond just financial transactions. One of its key features is the ability to enable peer-to-peer transactions without the need for a central authority, making it a valuable tool for creating a decentralized energy market.

Decentralized Energy Market

A decentralized energy market would increase competition in the energy sector, as more players would be able to participate in the market. This would lead to a more efficient market, with lower costs for consumers. Additionally, a decentralized energy market would better integrate renewable energy sources as the distributed nature of renewable energy generation would align with a decentralized market. One of the key benefits is that it would allow for greater participation by individuals and communities in the energy sector, empowering communities to generate their own energy and sell the excess back to the grid. This would also increase energy security, as communities would not be dependent on a central authority for their energy needs.

Peer-to-Peer Energy Trading

One of the most significant potential uses of blockchain technology in the renewable energy sector is peer-to-peer energy trading. This would allow individuals and communities to trade energy directly with one another without the need for a central intermediary, increasing competition in the energy market and lowering costs for consumers. It would also allow for greater flexibility in the energy market, as energy could be traded in real-time, meeting the changing needs of the market. Blockchain technology would increase transparency in the energy market, as all transactions would be recorded on the blockchain, creating an auditable and immutable record, preventing fraud and increasing trust among market participants.

PowerLedger: A Decentralized Energy Trading Platform

PowerLedger is a blockchain platform that provides a solution for a decentralized energy market. It enables consumers to trade renewable energy directly with one another without the need for a central intermediary. The platform uses smart contracts to facilitate transactions and provides a transparent and secure record of all energy transactions. PowerLedger has already been implemented in a number of successful pilot projects and has been recognized for its potential to disrupt the traditional energy market.

Conclusion

The potential benefits of blockchain technology in the renewable energy sector are numerous. A decentralized energy market would increase competition, lower costs for consumers, and allow for greater participation by individuals and communities in the energy sector. Peer-to-peer energy trading, enabled by blockchain technology, would increase transparency, trust, and flexibility in the energy market. PowerLedger is a leading project in the decentralized energy market, using blockchain technology to trade excess renewable energy and create a transparent record of all energy trades. In conclusion, blockchain technology has the potential to create a more efficient, sustainable, and transparent energy market for the future.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Cryptocurrency and the Future of Business

Cryptocurrency and the Future of Business

Cryptocurrency users are still a small minority. The total number of users was at 106 million as of January 2021. That sounds like a lot, but when you consider a global population that is nearing 8 billion, you can see that it is just a tiny fraction of people using crypto.

Whether you are in crypto or not, it is going to have an increasing effect on business. You can see Bitcoin mining operations selling shares on stock exchanges, large businesses looking into uses for crypto coins, and more people taking an interest in buying and using cryptocurrency.

At the current trend, crypto coins are becoming more common every year. If it holds, it might not be a matter of if people start using different cryptocurrencies, it could just be a question of when.

Crypto for International Transactions

In the digital age, businesses are now connected internationally like they never before. Beyond the large multinationals, it is increasingly becoming common for smaller businesses to have significant international connections. This is not only true as it concerns deals with other companies, but businesses now have employees or contractors they work with from around the world.

Using cryptocurrency as a medium of exchange for international transactions could solve a lot of problems for these businesses. First, cryptocurrency could ease the burden of having to convert currency for several different countries. Beyond that, it could also make transactions faster, cheaper and more convenient by cutting out the traditional middlemen that would typically be in the middle of these transactions.

Adoption by Mainstream Institutions

One of the factors that have held back many cryptocurrency markets is the lack of support from mainstream institutions. Banks wouldn’t let you make transactions with crypto exchanges, and it was hard to find businesses that would allow you to use your cryptocurrency. This is changing rapidly.

Beyond the ability of investors to use an ultra fast trading app to make trades, we now see a range of big institutional investors buying cryptocurrency. Along with that, some of the world’s largest financial businesses are starting to work with crypto. As an example, PayPal started offering a range of cryptocurrency services earlier this year. You also have major credit card companies that are starting to work with crypto on a limited level.

Crypto as a Real Store of Value

One of the main claims of many crypto skeptics is that the coins have no inherent value. This is true in a sense. The value of most crypto coins is solely based on the perception of people in the market. While that might be true, you could make the same argument for most fiat currencies. The value is based on the fact that people will accept it in exchange for goods and services.

Crypto has an advantage over many fiat currencies: the fact that many crypto coins have a limited supply. As inflation acts on fiat currencies, crypto could grow in popularity as a hedge. In the future, many investors will hold crypto in the way that they hold gold as a protection against inflation.

Tokens as Business Equity

Raising or distributing equity usually means creating conventional shares of the business. While this could be a way to raise money or provide value to employees, it does come with a range of hurdles. One way to get around many of these hurdles would be to create crypto coins that represent shares in the company.

Instead of jumping through all of the regulatory hoops to issue shares, the business could give people crypto coins as equity. Instead of holding an IPO, the business could do an ICO as a way to raise capital from investors.

Crypto for Crowdfunding

With the rise in crowdfunding platforms, the ability to raise money is easier than it ever has been. These platforms not only make it easy to raise money from the public, but they also offer a level of transparency that is popular among those looking to donate or invest. With that said, these platforms often take a significant portion of the funds in fees.

Using a blockchain wallet for crowdfunding could be a way to get the transparency of a crowdfunding platform while avoiding the fees. This would allow those looking to raise funds to do so off a platform, but with the blockchain ledger, potential donors or investors could still see the donations coming in.

Crypto is a field that is always evolving. As businesses see the benefits and new applications become available, it will become more common. With that said, the markets are unpredictable. The only thing that we can be sure of is that there will be ups and downs along the way.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Impact of DeFi on the Cryptocurrency market of 2021

Short for decentralized finance, DeFi is a new wave taking over the world’s financial market; the cryptocurrency world. DeFi is the conception that entrepreneurs can provide traditional financial institutions functions through a decentralized medium. There are cryptocurrencies like Bitcoin and Ethereum, the former of which has been causing significant ripples in the crypto-world since the last quarter of 2020 and the beginning of this year.

Although Bitcoin and Ethereum are the forerunners of DeFi, newer and somewhat better altcoins are coming into view. An example is Dai, a bitcoin-resembling digital token that hopes to remain independent of the world’s central banks’ influence. Unlike centralized finance and traditional banks, DeFi takes away all the cumbersome operations, go-betweens, and high costs often involved. This it does via smart contracts and to the benefit of the end-user. The closure of many industries during this era of the COVID-19 pandemic has served as a wake-up call to consumers of fiat currencies on the futility and loss of value of such coins.

This wake-up call has been occurring in places where the government has been pumping more money into their economies even though they have taxes to be paid. Such practices make the value of such currencies questionable. As a result of such act, fiat currencies’ values have been seen to fluctuate and fall considerably, often leading to inflation. An example is in Venezuela’s economy where inflation has risen by more than 1,000,000% due to the influx and pumping of more bills into the economy.

Often, the influx of newly minted bills into the economy does not mean these bills will get to such currencies’ end-users. These often serve as injections into the banking sector. But when they come as benefit checks and government aids, this inflation in money supply results in taxes. Also, they help boost the stock market and the stocks of the top 1%, rather than help the thousands and millions of individuals and businesses that need such aids.

The Impact of DeFi in the cryptocurrency market

The increasing dissatisfaction and discontent with traditional banks and centralized financial systems are momentous. The high availability of information about the growing offers in the crypto sector is finally providing people with better alternatives to traditional banks. These alternatives come in the form of DeFi (decentralized finance) where people can now take part in a mode of operation that will work for them. This means that people’s money will now work for them instead of the other way round.

Investing in the cryptocurrency market is becoming more comfortable and more widespread than when it first emerged with Bitcoin as its forerunner. As the first DeFi system, this paved the way for other altcoins, including Ethereum, Tether, Polkadot, XRP, and Cardano. These cryptocurrencies have come a long way and have become potential collaterals when taking out traditional bank loans. These loans can be collected regardless of what your credit score is. They serve as a way of getting cash when you need it irrespective of the availability of physical collateral.

The influence of cryptocurrency is rising steadily in developing countries where inflations often caused by government policies and central bank cash injections result in the loss of value of people’s savings and business capitals. Buying and investing in DeFi systems has provided a remedy to that, whereby the value of fiat currencies that have been converted to cryptocurrencies experience growth and provide means of decentralized financial transactions with relatively low costs from traditional banks.

Opportunities and Growth

The opportunities created by cryptos seem even better in developed countries. Large amounts of money are readily available and can be invested in trusted cryptosystems where stable profit and immense gain are assured. This steady return has been made evident in Bitcoin and Bitcoin price prediction, which has been steadily increasing more than fiat currencies. Its independence from centralized financial systems has served as a contributing factor rather than a deterring factor.

Amidst the use of DeFi systems by individuals and some businesses, there is a need to increase its development and efficiency to encourage its adoption by institutions. Through this, the DeFi industry will rise from the position now as a Billion-dollar transaction pathway to a trillion-dollar one, where the costs of transactions go down while profits and investment increase. This aim of getting institutions into the DeFi industry is already in motion. Individuals and groups are coming together to develop decentralized financial apps that are better and more decentralized than their forerunner. Such a better DeFi system could come in the form of large and small security circles where a single user cannot overturn the currency’s stability, and a central body cannot determine a price change.

With this growth in the use of DeFi systems and the coming in of institutions into the crypto market, real-world assets can be brought into the blockchain, which will help and promote the growth of DeFi. This would include transferring trillions of fiat currencies and precious stones such as gold or silver onto the blockchain. And their movement can be done at the cost of no more than a nickel and no intermediary fees and liquidity limits. With DeFi as an alternative to centralized financial systems, governments will have little to no control over the wealth that cannot be generated by individuals that make use of the system.

Conclusion

With the growth of decentralized financial systems in the last two decades, the move from fiat currencies to cryptocurrencies seems irreversible. And that’s a good thing since, through DeFi systems, the distribution of wealth among crypto-users can be regularized and stabilized. This would ensure equal wealth distribution on the platform, which can only be influenced by cryptocurrency owners when they invest more fiat currency into the platform.

BIO John Edwards

John Edwards is a writing specialist who works at The Writing Judge. He is looking for ways of self-development in the field of writing and blogging. New horizons in his beloved business always attract with their varieties of opportunities. Therefore, it is so important for him to do the writing.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How Blockchain Is Changing Media and Entertainment Industry

When people talk about the entertainment industry and media, blockchain isn’t exactly the first thing that comes to their mind.

Wall Street and eCommerce are way ahead of the entertainment industry in terms of blockchain adoption, there’s growing evidence that things could change pretty soon. As more and more use cases for the technology emerge, major players in the industry are increasingly looking at blockchain as something that has the potential to resolve some pressing issues.

Warner Music Group, for example, has recently joined an $11 million investment round in Dapper Labs, a blockchain company seeking to create Flow, a rival to Ethereum. Already, the company is exploring a number of use cases for the cryptocurrency, including sales of digital merchandise with financial tokens.

The slow but sure progress of blockchain in the media and entertainment might be a sign that a breakthrough might be approaching. Currently, the technology is known to provide the following solutions.

Reduce the Dependence of Artists on Middlemen and Labels

The problem of middlemen is persistent and very well-known in the music industry. Even though it has come so far in terms of technology, it’s still in the same place when it comes to compensation distribution. The biggest losers in this situation are often the artists, who end up with a lack of opportunities to get sponsorship contracts with big-time labels.

The only viable option for an artist to minimize the dependence on managers and distribution services is streaming services. However, the compensation they get for the music is often inadequate, even for the well-known artists. Here are some examples (source: CNBC):

- Taylor Swift’s compensation for her famous song “Shake it Off” was between €240,000 and €335,000 even though it attracted more than 46 million streams

- 1 million plays on a streaming service like Shopify translates only about €6,000 in earnings for the artist

- 1 million plays on Pandora gets the artist less than €1,700.

All of this translates into between €0.004 and €0.007 of pay per play.

Blockchain can reduce artists’ dependence on labels and other middlemen because it’s not run by a central body but rather everyone on the network. This means that the financial transactions – compensation for songs, etc. – could be conducted without the involvement of the middlemen.

Secure Peer-to-Peer Sales

Contract distribution and payment for property in the entertainment industry can be a complicated thing. The biggest problem is the sheer amount of work involved in payment processing, making exclusive distribution agreements, providing licensing, and other things. On top of that, there’s high fees and a lack of control over the process for artists.

Many artists delegate these business administration responsibilities surrounding contacts, licensing, and payment to their agents. As a result, the artists are once again left with high losses because they simply cannot sell their work directly peer to peer.

A blockchain-powered marketplace for entertainment content is a solution here.

“Since blockchain is a distributed digital ledger system, it can enable almost complete automation of all business administration work surrounding payments, contracts, and licensing,” says Jason Rowe, a technology reporter. “The biggest benefit here, however, is the ability to enable artists to license their content directly to customers.”

WeMark is one example. It’s a distributed marketplace for stock photography that seeks to reduce the dominance of agencies like Getty Images and Shutterstock. According to WeMark’s white paper, these agencies now charge photographers up to 85 percent of the photos’ sale price, so the latter are left with a fraction of potential earnings.

Here’s how the WeMark platform works to provide artists with distribution agreements.

The solutions offered by blockchain-powered marketplaces like WeMark include:

- Reform of the super-centralized system for distributing digital content

- Artists license their content directly to users, keep all the rights and manage pricing

- More secure content distribution terms and fees with smart contracts that are programs that are unchangeable unless all the conditions are met

- More effective referral programs to assist artists to share their content and reach more customers.

Once blockchain marketplaces get more popularity among artists, chances are good they will prefer to use them instead of agencies like Getty Images. Each of the marketplaces will accept the most common cryptocurrencies as a payment method; moreover, as the costs of crypto mining gradually go down as blockchain gets more acceptance, chances are that artists will be willing to use cryptocurrencies for peer-to-peer sales.

Combat Piracy

The number of visits to media piracy sites in 2018 rose to 17.3 billion in the U.S. alone. With the volume of video-based traffic rapidly increasing around the world, online media piracy has skyrocketed; in fact, the television and film industry estimates about $52 billion in lost revenues by 2022.

Blockchain might be one of the solutions that will finally start to battle online privacy effectively. Its main promise, more comprehensive protection of digital assets, is perfectly aligned with the goal of combating pirates. For example, the technology can allow artists to transfer media files securely while having the complete visibility of the operation.

Another benefit of bitcoin is allowing it to catch pirates by identifying illegally obtained files. For example, if you’re a moviemaker looking to distribute a file to reviewers, you can use a blockchain-powered video distribution platform that embeds a special code, or a wallet, in every copy that gets distributed. The code remains in the file despite conversions or other processing operations.

If the file is leaked and found, then identifying the presence of the code, therefore, an illegally obtained file, becomes possible. The adoption of blockchain is still a problem, but it’s clear that the technology is on the way to become the future of the anti-piracy tactics (Warner is already investing in a blockchain company, remember?)

Blockchain: The Missing Link in the Entertainment Industry?

When people hear blockchain, they tend to think about Bitcoin. However, the technology stands to benefit many industries, including entertainment, and is already showing some good progress. The industry is highly centralized and there’s a great potential to increase earnings for people doing the creative work.

As the applications of blockchain become more common and the benefits visible, it’s possible that artists will be more willing to use the technology. However, the massive adoption is still yet to come, so stay tuned to blockchain news.

About the author: Jessica Fender is a content editor for TopWritersReview.com and a tech blogger. She is passionate about technology trends and finding new ways to help students improve their skills and become more successful.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How Blockchain Technology is Changing the Banking Industry Forever

By far the biggest threat to banking in, well, living memory, has been blockchain technology. More specifically, cryptocurrency, but we’ll focus on the technology as a whole since this is what has been driving the movement.

All the tech companies in the world have been using it, including Google, Facebook, Apple, and Amazon, and a vast number of FinTech services, which is why it’s being seen as such a threat to traditional banks, but why is this happening?

What’s so important about blockchain?

In today’s post, we’re going to explore how and why blockchain technology is making such a big difference to the traditional banking format, and how the future of this industry is looking.

Source: Adarsh Goldar

How Blockchain Technology is Changing Payments

First and foremost, and by far the biggest form of change that blockchain is bringing into the world, is how financial payments are made and the way modern-day payment systems work. Whereas traditional banks can take a few working days to make a payment, meaning some international payments can take a very long time, blockchain payments are instant.

Since all you need is an internet connection to make the transaction, most will be handled and completed in a matter of minutes. These transactions can happen across borders to anywhere in the world, are extremely secure (especially when compared to traditional methods) and happen pseudoanonymously.

Due to the nature of blockchain technology, the costs involved in these transactions are usually very small, typically only several cents per transaction. This means that sending money across to the other side of the world is far cheaper than traditional wire companies, such as Visa or Western Union.

In the same way, remittances are also changing. Whereas overseas remittances are expensive and long-winded, with high processing times and the fact the money can be stolen, taxed, or subject to legal issues along the way, a blockchain process basically eradicates all these issues. There are dozens of companies already set up and operating to offer these services.

The Way Account Managing and Deposits are Handled

In the traditional way the world works, consumers tend to use banks to hold money in either their savings or checking accounts. Then, the bank will loan out the money being held to make money on top of the money you’re saving, and the cycle continues. This means when you look into your bank account, much of the money you have isn’t actually being held by the bank, but instead is out in other people’s accounts as loans.

If every customer of a bank went to the bank and withdrew everything they had, the bank would collapse. It’s a very fragile system that many consumers are unaware of. However, while this system isn’t going to change any time soon, blockchain technology can make the management of this system far more effective.

Due to the benefits that blockchain technology provides, these account ledgers are far more secure, far more reliable, and far more accessible. This means banks can accurately manage their ledgers to ensure that they aren’t taking out too many loans and will actively help reduce the risk of bank run, or the system crumbling.

A Reduction in Fraud

Fraud has always been a problem in the financial industry, and it costs people around the world billions of dollars every single year. However, for the similar benefits, we’ve spoken about above, blockchain is making things far more secure.

Since the vast majority of traditional banks are set up and organised around a centralised system, malicious people can target the centralised system to commit the acts of fraud. While there have been many measures to make the system as secure as possible, this isn’t fall-proof, and statistics show around 45% of all financial institutions are prone to fraud attempts.

Blockchain is a decentralised system, which means it’s everywhere and nowhere at the same time, which makes it incredibly difficult to fraud and theft to take place. There’s no single point of access like there is with a centralised banking system and trying to get into such a system means diving into layer upon layer of encryption, all spread out in hundreds of thousands of locations.

What’s more, every single change that takes place on the ledge is capable of being seen by every other person and system that has access to the ledger. This means if any fraudulent activity takes place, everyone can see it instantly and correct it. This will help protect people’s money and keep the system afloat.

Katherine Rundell is a finance writer at Academic Writing Services and Essay Writing Services. She writes about blockchain and banking and aims to help the world get educated about finances in a time where they can seem so out of control.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

9 Reasons Cryptocurrencies Are So Important

Image courtesy of GammaLaw

Digital currencies have created a buzz since the sudden rise of the Bitcoin price. They have, over time, become a new trend in the global money market due to their incredible benefits. Here are some of the aspects that tend to make cryptocurrencies so important.

Safety

Bitcoin and Litecoin are arguably the most trusted and safest digital currencies in the world. In a world where looters and cons are everywhere, virtually everyone wants to trade safely. Cryptocurrencies give online traders that assurance, and that’s why people consider them as a reliable means of exchange.

Policies

The recent increase in the demand for Litecoin and Bitcoin can be attributed to policies that govern cryptocurrency networks. Cryptocurrencies are a digital currency, which means traders rarely need a third-party to complete a transaction. That often gives online traders a sense of security and reassurance. Cryptocurrencies tend to allow online retailers to transact anytime and anywhere.

Cost

Bitcoin and Litecoin are considered a low-cost means of transaction. The cost of transacting with cryptocurrencies can be far less than other currencies. The fact that the cryptocurrency network is responsible for compensating miners tends to eliminate transaction fees. Low-cost transactions could mean that cryptocurrency users won’t shell out money in exchange for Bitcoin and Litecoin. All a cryptocurrency user may need to transact is knowledge of cryptocurrencies and a smart phone.

Storage

Cryptocurrencies can be stored in a safe e-wallet or USB drive. Storing your bitcoin or Litecoin in either an e-wallet or USB drive may not attract any fee.

Privacy

Privacy has been a concern for most people transacting over the internet. Cryptocurrency users can expect their financial transactions to be highly confidential. You can transact using bitcoin and still be anonymous. With digital currencies, the seller and buyer don’t transfer money directly. Instead, the cryptocurrency network often serves as an intermediary, which means that users may not share their credentials with anyone. Cryptocurrencies can be used as a new measure to curb identity theft, which has become a menace in the global money market. If something seems doubtful, you are at liberty to share any information you may want with your merchant. By accepting payment in digital currencies, online traders tend to accept and welcome clients who would wish to remain anonymous. Accepting payments in bitcoin can make a brand an industry leader and increase its awareness.

Investment

Cryptocurrencies can be bought in a fraction. That means you can invest any amount of money in cryptocurrencies. For example, if you can’t afford a full unit of bitcoin, you can split it and invest in a quarter or half of it. That can help reduce the cost of investing in cryptocurrencies and avoid overspending. With a crypto converter, an investor can find out the price of any digital currency in their country.

Autonomous

Using digital currencies can make you autonomous. Cryptocurrencies tend to eliminate third-parties, so you can be sure that no fees or commissions are involved. These currencies can also allow online traders to manage their accounts.

Decentralization

Decentralization is a feature that often makes cryptocurrencies lucrative for merchants and customers alike. It means that digital currencies can’t be subservient to any authority or agency. No one owns digital currencies, which means no individual can have control over it. Digital currencies can provide online retailers with the freedom to transact without worrying about geographical barriers.

Digital currencies are considered a game-changer in the global money market. Their incredible benefits are arguably the reason behind their recent popularity. Cryptocurrencies are considered the safest and most trusted currencies around the world. You can store Bitcoin and Litecoin in the cloud or USB drive and move with them anywhere around the world. By using bitcoin, online traders can expect their transactions to be confidential. Digital currencies are also a reliable medium of exchange that can give sellers and buyers control over their accounts. The fact that Bitcoin and Litecoin can be bought in a fraction can make digital currencies an affordable investment.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

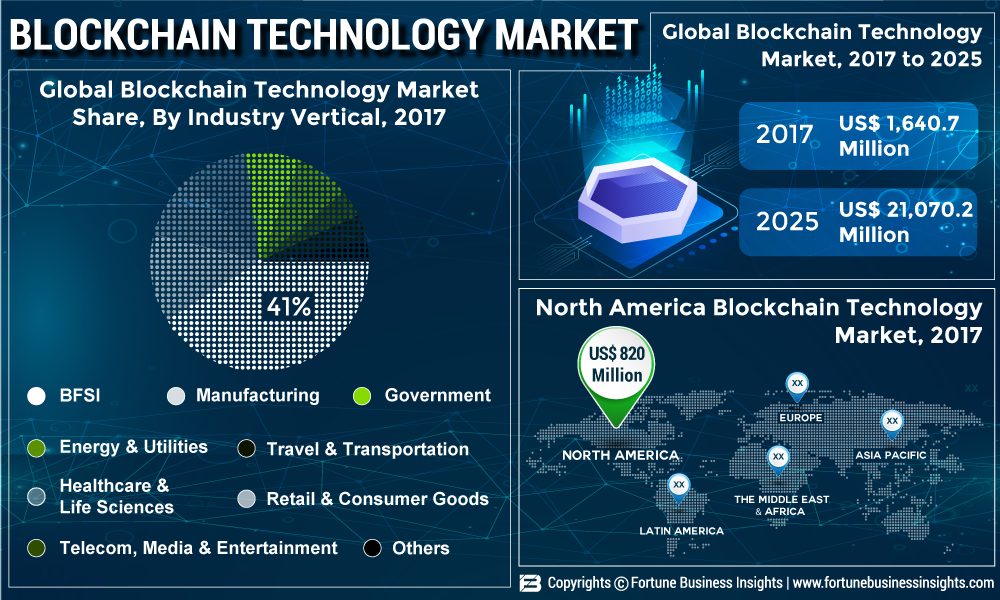

How is Blockchain Technology Market Going to Rise at High CAGR of 38.4% Till 2025?

The global Blockchain Technology Market is forecast to rise exponentially in the coming years. The market is expected to witness high demand from diverse industries, especially the banking, financial services, and insurance (BFSI) industry.

In terms of industry vertical, the banking, financial services, and insurance segment held the leading share of 41% in global blockchain technology market in 2017. The segment will gain further impetus following introduction of bitcoin. “Rampantly increasing cyber-attacks and frauds in the BFSI industry accounts for millions of dollars. This has become a global concern. To make the technology used in the industry safer and more secure, Deloitte and Microsoft Azure and other tech giants are offering blockchain services,” said a lead analyst.

In terms of deployment, the proof of concept segment is gaining traction and is expected to witness impressive growth during the forecast period 2018-2025. Growth witnessed in this segment is backed by high need of transparent transaction across industries such as healthcare, retail and BFSI.

Increasing Demand for Secure Blockchain Technology to Guarantee Growth at Promising Rate

“Government initiated awareness programs regarding benefits of blockchain technology among undeveloped nations is anticipated to fuel the demand in the global blockchain technology market“, said a lead analyst at Fortune Business Insights.

Increasing adoption of e-financial services and rapid adoption of the blockchain technology in developed nations are expected to drive the global blockchain technology market during the forecast period.

Increasing number of new blockchain products and their approval grants is also anticipated to act as a driving factor for the global Blockchain technology market.

Partnerships Among Key Market Players and Blockchain Developers Driving the Market in North America

North America emerged dominant in the global blockchain technology market in 2017. The North America market was worth US$ 820 Mn in 2017. The region will continue leading the market at a global level through the forecast period. Growth witnessed in the market is also attributable to recent collaborations between market players in the U.S. and blockchain service provides. Europe is also anticipated to witness impressive growth during the forecast period owing to high presence of blockchain technology developers.

In 2017, IBM was the leading organization in the global Blockchain technology market. Other companies operating in the global market are Oracle Corporation, Deloitte, Microsoft Corporation, IBM Corporation, The Linux Foundation, Chain Inc., Consensus Systems, Bits, Inc (Tendermint, Inc.), Schvey, Inc. (Axoni), VironIT, Altoros, and Fintech & Blockchain Software House.

Source: https://www.fortunebusinessinsights.com/industry-reports/blockchain-technology-market-100072

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Wallet Storj: STORJ token joins HolyTransaction

As of today, you can instantly purchase Storj on HolyTransaction, transfer them to any HolyTransaction’s customer for free, and do crypto-to-crypto swaps between your Wallet Storj and more than other 30 cryptocurrencies.

The Storj project provides for a decentralized cloud storage facility and is originally pronounced as “storage“.

Storj’s main aim is to rent a space on the secondary storage devices of the members of its network and pay them in cryptocurrency, for their service they provide. Therefore, Storj’s native cryptocurrency token is STORJ, which can be stored on HolyTransaction now.

“The main difference between Storj and other decentralized cloud storage platforms is that Storj only uses blockchain to manage payments and not to store data. This is due to the high cost and slow speeds found in blockchains. For example, even the fastest blockchains process data/payments in seconds. Meanwhile, traditional cloud storage solutions, like Amazon S3, can store files in milliseconds – many orders of magnitude faster than even the fastest blockchains.”

Shawn Wilkinson (Founder of Storj)

The Storj platform offers online storage similar to Dropbox or Google Drive, but does so over a distributed network. Renting out unused extra space on our hard drives is referred to as, Farming, for instance. The process as simple as downloading a client from the network, choosing the amount of space to be rented, and a wallet address to store the incentives received in the form of cryptocurrency.

All HolyTransaction customers can create a new address for STORJ and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other cryptocurrency.

Just like with Bitcoin, you can:

- Send STORJ to any address, even to addresses of other cryptocurrencies with instant conversion on the fly;

- Receive transactions;

- Exchange STORJ with any supported coins;

- Make instant transactions between HT users;

- Get real time exchange rates on the website;

- Set OTP for additional protection.

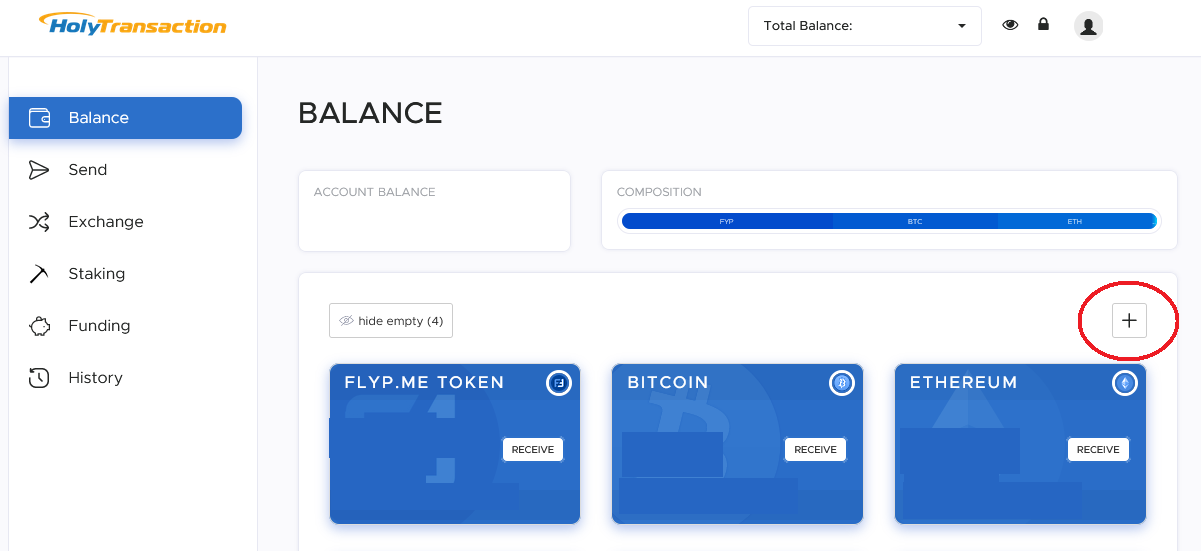

To add Wallet Storj just click on the “plus” button you find at the top right of the balance page, once you successfully enter into your wallet.

You can find the “plus” button to select the wallets you want to see in the main page like shown in the picture below:

We’re excited to be part of the STORJ community!

NOTE: Our multicurrency wallet can store more than 30 cryptocurrencies, including: Bitcoin, Dash, Ethereum, Dogecoin, Litecoin, Decred, Zcash, Dai Stablecoin, DigixDao, Augur, 0x Project, Gamecredits, Enjin Coin, Blackcoin, Gridcoin, Aidcoin, Peercoin, Syscoin, Groestlcoin, Power Ledger, BAT, BlockV, PIVX, TrueUSD, Cardano, and STORJ among the others.

Open your free digital wallet here to store your cryptocurrencies in a safe place.