Ethereum now has privacy thanks to zero-knowledge proof technologies, specifically zk-STARKs. But before we can assess zk-STARKs, it is important to define a zero-knowledge proof (ZKP).

Understanding the Basics of Zero-Knowledge Proofs (ZKPs)

A ZKP is a cryptographic technique that enables a prover to confirm another person’s assertion without disclosing any supporting data. zk-STARKs and zk-SNARKs are two of the most compelling zero-knowledge technologies available today, standing for zero-knowledge succinct non-interactive argument of knowledge and zero-knowledge scalable transparent argument of knowledge, respectively. These technologies allow one party to demonstrate their knowledge to another without actually revealing the knowledge, making them both scaling technologies, as they can enable faster proof verification, and privacy-enhancing technologies, as they reduce the amount of information shared between users.

zk-STARKs, specifically, enable users to communicate validated data or carry out computations with a third party without the other party knowing the data or results of the analysis. They are an advancement over zk-SNARKs because of their reduced algorithmic complexity, making them easier for even crypto experts to find mistakes in. These types of knowledge testing tools are primarily used to build highly private and secure systems that are decentralized and can only be accessed under specific, difficult-to-obtain conditions, such as those found in cryptocurrencies. These systems not only secure the network but also protect and anonymize users.

Comparing zk-SNARKs and zk-STARKs

There are a few main differences between zk-SNARKs and zk-STARKs. Firstly, zk-SNARKs require a reliable configuration phase, while zk-STARKs create verifiable computing systems without trust using publicly verifiable randomness. Secondly, zk-STARKs are more scalable in terms of speed and computational size when compared to zk-SNARKs. And thirdly, zk-SNARKs are vulnerable to attack by quantum computers, while zk-STARKs are currently immune. However, it is important to note that STARKs have larger proof sizes than SNARKs, meaning they take longer to verify and require more gas. In addition, the STARKs developer community is smaller and has less documentation compared to SNARKs.

Support from the Developer Community

Despite these differences, both the SNARKs and STARKs communities have support from developers. The Ethereum Foundation, in particular, has shown support for Starkware, a company using STARKs, by awarding them a $12 million grant. While documentation for STARKs is currently less comprehensive than that for SNARKs, the technical community has recently created more resources for those interested in the technology.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Short for decentralized finance, DeFi is a new wave taking over the world’s financial market; the cryptocurrency world. DeFi is the conception that entrepreneurs can provide traditional financial institutions functions through a decentralized medium. There are cryptocurrencies like Bitcoin and Ethereum, the former of which has been causing significant ripples in the crypto-world since the last quarter of 2020 and the beginning of this year.

Although Bitcoin and Ethereum are the forerunners of DeFi, newer and somewhat better altcoins are coming into view. An example is Dai, a bitcoin-resembling digital token that hopes to remain independent of the world’s central banks’ influence. Unlike centralized finance and traditional banks, DeFi takes away all the cumbersome operations, go-betweens, and high costs often involved. This it does via smart contracts and to the benefit of the end-user. The closure of many industries during this era of the COVID-19 pandemic has served as a wake-up call to consumers of fiat currencies on the futility and loss of value of such coins.

This wake-up call has been occurring in places where the government has been pumping more money into their economies even though they have taxes to be paid. Such practices make the value of such currencies questionable. As a result of such act, fiat currencies’ values have been seen to fluctuate and fall considerably, often leading to inflation. An example is in Venezuela’s economy where inflation has risen by more than 1,000,000% due to the influx and pumping of more bills into the economy.

Often, the influx of newly minted bills into the economy does not mean these bills will get to such currencies’ end-users. These often serve as injections into the banking sector. But when they come as benefit checks and government aids, this inflation in money supply results in taxes. Also, they help boost the stock market and the stocks of the top 1%, rather than help the thousands and millions of individuals and businesses that need such aids.

The increasing dissatisfaction and discontent with traditional banks and centralized financial systems are momentous. The high availability of information about the growing offers in the crypto sector is finally providing people with better alternatives to traditional banks. These alternatives come in the form of DeFi (decentralized finance) where people can now take part in a mode of operation that will work for them. This means that people’s money will now work for them instead of the other way round.

Investing in the cryptocurrency market is becoming more comfortable and more widespread than when it first emerged with Bitcoin as its forerunner. As the first DeFi system, this paved the way for other altcoins, including Ethereum, Tether, Polkadot, XRP, and Cardano. These cryptocurrencies have come a long way and have become potential collaterals when taking out traditional bank loans. These loans can be collected regardless of what your credit score is. They serve as a way of getting cash when you need it irrespective of the availability of physical collateral.

The influence of cryptocurrency is rising steadily in developing countries where inflations often caused by government policies and central bank cash injections result in the loss of value of people’s savings and business capitals. Buying and investing in DeFi systems has provided a remedy to that, whereby the value of fiat currencies that have been converted to cryptocurrencies experience growth and provide means of decentralized financial transactions with relatively low costs from traditional banks.

The opportunities created by cryptos seem even better in developed countries. Large amounts of money are readily available and can be invested in trusted cryptosystems where stable profit and immense gain are assured. This steady return has been made evident in Bitcoin and Bitcoin price prediction, which has been steadily increasing more than fiat currencies. Its independence from centralized financial systems has served as a contributing factor rather than a deterring factor.

Amidst the use of DeFi systems by individuals and some businesses, there is a need to increase its development and efficiency to encourage its adoption by institutions. Through this, the DeFi industry will rise from the position now as a Billion-dollar transaction pathway to a trillion-dollar one, where the costs of transactions go down while profits and investment increase. This aim of getting institutions into the DeFi industry is already in motion. Individuals and groups are coming together to develop decentralized financial apps that are better and more decentralized than their forerunner. Such a better DeFi system could come in the form of large and small security circles where a single user cannot overturn the currency’s stability, and a central body cannot determine a price change.

With this growth in the use of DeFi systems and the coming in of institutions into the crypto market, real-world assets can be brought into the blockchain, which will help and promote the growth of DeFi. This would include transferring trillions of fiat currencies and precious stones such as gold or silver onto the blockchain. And their movement can be done at the cost of no more than a nickel and no intermediary fees and liquidity limits. With DeFi as an alternative to centralized financial systems, governments will have little to no control over the wealth that cannot be generated by individuals that make use of the system.

With the growth of decentralized financial systems in the last two decades, the move from fiat currencies to cryptocurrencies seems irreversible. And that’s a good thing since, through DeFi systems, the distribution of wealth among crypto-users can be regularized and stabilized. This would ensure equal wealth distribution on the platform, which can only be influenced by cryptocurrency owners when they invest more fiat currency into the platform.

BIO John Edwards

John Edwards is a writing specialist who works at The Writing Judge. He is looking for ways of self-development in the field of writing and blogging. New horizons in his beloved business always attract with their varieties of opportunities. Therefore, it is so important for him to do the writing.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Can you imagine the speed required to make 250 trillion attempts to solve a puzzle in one second? Stop imagining! We already have the answer figured out for you!

On 6th October 2020, the Ethereum-mining hash rate made a new record by reaching a figure of 250 trillione hashes per second. Ether miners are more active than ever before, and the Ethereum network is now more powerful than ever before.

To your surprise, Ethereum is not a mineral found in the mountains. Miners have made $300 million without even stepping outside their homes. Without confusing you any further, let me explain how ETH mining can make you a millionaire.

It is a platform that makes use of a blockchain database to allow developers to create applications on it. The apps that are built on Ethereum are decentralized; Any computer that connects to the Ethereum network can access these apps. You can make online payments, trade cryptocurrency, and sell products without the involvement of third parties like banks.

Ether (ETH) is Ethereum’s cryptocurrency that has $40 billion worth of market capitalization in 2020.

It indicates the overall health or power of the Ethereum network. The combined computing power of all the mining machines is directly proportional to the hash rate; When power increases, the hash rate goes up. This means that the miners play a vital role in strengthening the cryptocurrency network.

Initially, low-power machines were used, but as the popularity of the network grew, more users jumped in, and more powerful mining rigs were introduced. This caused the hash rate to reach trillion hashes per second and enhanced the network’s security.

What is the hype all about? How are the hash rate and mining rigs related to money? Let us find out!

People spend thousands of dollars on building powerful mining rigs that can generate more ETH in less time.

Mining rigs are basically computers with an extremely powerful graphics processing unit. Application-Specific Integrated Circuits have now been introduced for mining purposes. Mining is not an easy task, so it requires a lot of energy in the form of electricity.

The main reason behind using GPUs and ASIC instead of simple CPUs is to lower energy consumption.

The capacity of the supply unit (in watts) must be greater than the total power consumption of all the units of your rig. If you have 4 GPUs that consume a total of 800 watts and other units consume 200 watts, a supply unit of at least 1000 watts is needed for the smooth working of the rig.

Your SSD requirement depends on the operating system of your rig. A 120 GB hard drive is required for mining rigs that run windows. For Linux users, 60 GB SSD would get the job done.

The number of PCIe slot connectors in a motherboard corresponds to the number of GPUs that can be installed. ASRock H110 Pro BTC+, Asus B250 Mining Expert, and Gigabyte GA-H110-D3A are some of the best motherboards for mining. The average cost of these motherboards is around £110.

Your rig’s processing speed depends on the size of its RAM. At least 4GB RAM is required for fast calculations.

GPUs are the actual driving force in a rig, so make sure that you have plenty of them. GeForce GTX 1060, RTX 2080 Ti, and RX Vega 56 are some of the most popular graphics cards on the market.

Let me link all the dots here!

A powerful mining rig can make more attempts at solving puzzles in one second. More attempts mean that there are high chances of working out the right answer. When the right answer is generated, a new block is added to the chain, and the miner gets ETH as a reward. It would not be wrong to say that ETH is sitting in the coaxial cables of your rig.

Mining is not just about solving the mathematical puzzle but being the first miner to discover or guess the solution is a must for earning a reward. Millions of people are working on the same puzzle at one time, so the processing speed of your rig determines your success rate.

Today, one ETH is worth $467. An ETH miner makes money by processing transactions for the application users on the Ethereum network. ETH is a miner’s reward for solving the complex puzzle. When the miner has processed a certain number of transactions, he/she is rewarded with ETH.

Ethereum serves as the platform for the buying and selling of ETH. Miners’ task is to verify and secure transactions resulting from trading on which they also earn a transaction fee.

One important point to note here is that when the hash rate goes up, the difficulty level of the puzzle also increases to balance it out.

Eth miners working with powerful graphics cards can make $15 in 24 hours, which is much higher than the profit in Bitcoin.

High profits do not come solely from ETH mining, but from the transaction fee, which is the main attraction.

The transaction fee in the Ethereum network rose to $11.61 in September 2020, producing millions of dollars in profits. Experts suggest that Ethereum is a good investment as Ether’s price is expected to grow over $2000 by the end of 2025.

Cryptocurrency is on the rise these days, and according to the experts, it is the future of online trading. Although there are security issues like double spending and 51% attacks, Ethereum and Bitcoin continue to attract investors.

If you have some extra cash lying in your bank, my advice would be to invest it in buying cryptocurrency. You do not need to go big at this point! Start with 1 token and just analyze its value in the market.

Where do you see the price of 1 Ether going in 2030?

Author Bio:

Myrah Abrar is a computer science graduate with a passion for web development and digital marketing.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

GAME has been upgraded from a Proof-of-Work blockchain to an ERC20 Ethereum token.

Game Credits users will retain the balance of their GAME addresses, which have been migrated to an Ethereum ERC20 token with the GAME ticker symbol. Balance totals for HolyTransaction GAME users will reflect the same GAME total that they had prior to the GAME Token Swap.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

DAI users will retain the balance of their DAI addresses, which will be migrated to a new multi-collateral contract with the DAI ticker symbol. Balance totals for HolyTransaction DAI users will reflect the same DAI total that they had prior to the contract swap.

DAI has been upgraded from a single-collateral token to a Multi-Collateral DAI token.

SAI (single-collateral token) will no longer be supported or traded on HolyTransaction.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Please note that we have migrated your Tether balance to USDT on Ethereum (ERC20). Thank you for your continued support for HolyTransaction. If there are any doubts or questions, please don’t hesitate to contact us.

Stay tuned!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

As of today, you can instantly purchase MKR on HolyTransaction, transfer them to any HolyTransaction’s customer for free, and do crypto-to-crypto swaps between your Wallet MKR and more than other 30 cryptocurrencies.

MakerDAO it’s a prime example of Ethereum’s smart contract platform.

Maker is a decentralized autonomous organization on which the MKR token and DAI operate, and it is built on Ethereum. Essentially, it exists to reduce the price volatility of the Dai against the US Dollar. MakerDAO’s native cryptocurrency token is MKR, which can be stored on HolyTransaction now.

Dai and MKR are dependent on each other to operate, Dai offers stability, while MKR offers involvement and potential on MakerDAO.

As the technology and methodology behind MakerDAO continues to progress the future of stablecoins and DAO are certain to bring interesting evolution to the cryptocurrency economy.

All HolyTransaction customers can create a new address for MKR and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other cryptocurrency.

Just like with Bitcoin, you can:

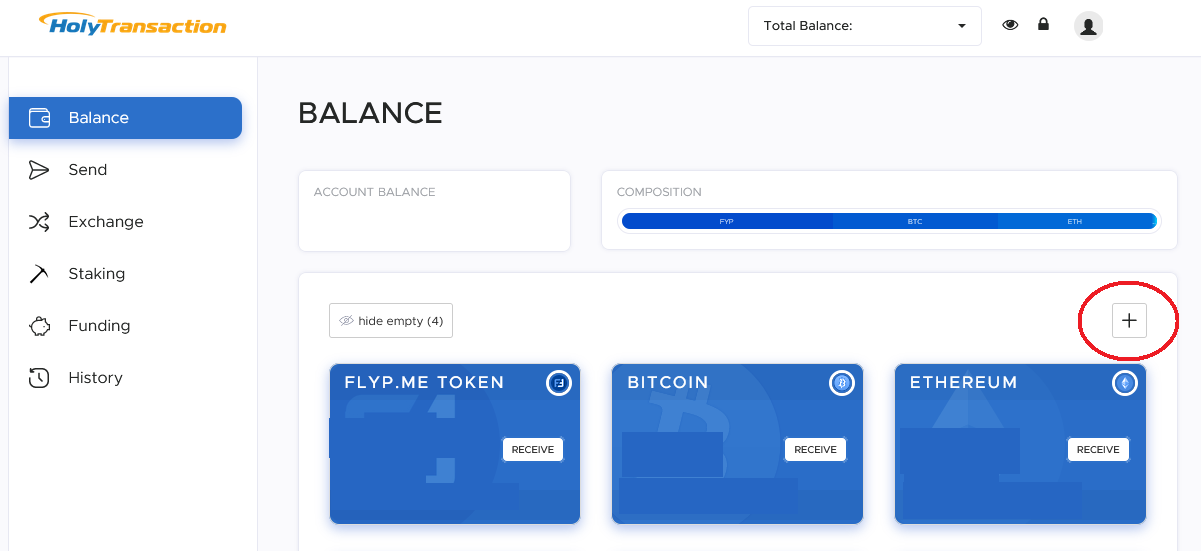

To add Wallet Storj just click on the “plus” button you find at the top right of the balance page, once you successfully enter into your wallet.

You can find the “plus” button to select the wallets you want to see in the main page like shown in the picture below:

We’re excited to be part of the STORJ community!

NOTE: Our multicurrency wallet can store more than 30 cryptocurrencies, including: Bitcoin, Dash, Ethereum, Dogecoin, Litecoin, Decred, Zcash, Dai Stablecoin, DigixDao, Augur, 0x Project, Gamecredits, Enjin Coin, Blackcoin, Gridcoin, Aidcoin, Peercoin, Syscoin, Groestlcoin, Power Ledger, BAT, BlockV, PIVX, TrueUSD, Cardano, STORJ, Monero and MakerDAO among the others.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ethereum Hard Fork Please note that the Ethereum (ETH) Hard Fork is scheduled for February 28, 2019. Consequently, HolyTransaction wallet services for ETH will be temporarily suspended to perform this update. The services will be suspended from around 6:00pm UTC on February 28, 2019. Note that the time might vary depending on average block time and mining difficulty. We appreciate your understanding regarding this matter and thank you for your continued support for HolyTransaction. If there are any doubts or questions about the Ethereum Hard Fork, please don’t hesitate to contact us.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

With the first creative campaign “Not a Myth”, we at HolyTransaction target the new Crypto-generation with an almost-irreverent and fresh concept, while blinking an eye to our fellow old-school Believers.

It’s the year 9 after Bitcoin.

And today, we are proud to stand still in front of all our customers and supporters, announcing a new era for our common venture. Launching our first creative campaign. Reaching out to new shores.

We are here to empower people, and engage the world in the greater adoption of this new and exciting technological revolution. And so far, we made the most popular digital currencies accessible, storable, tradable, and secure for every user in our community, all from one single account.

Now, it’s time to celebrate.

Follow us on our official twitter account @holytransaction and get to know everyone in the Crypto-Pantheon at https://holytransaction.com/landing/not-a-myth.html

Holy transactions are not a myth anymore.

About HolyTransaction:

HolyTransaction SA was launched in 2015 and since then it provides crypto enthusiast with the most complete and user-friendly platform to store and exchange multiple currencies. Indeed, in its first five years of business HolyTransaction already managed to make 25 of the most popular digital currencies accessible, storable, tradable, and secure for every user in our community; all from one single account.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

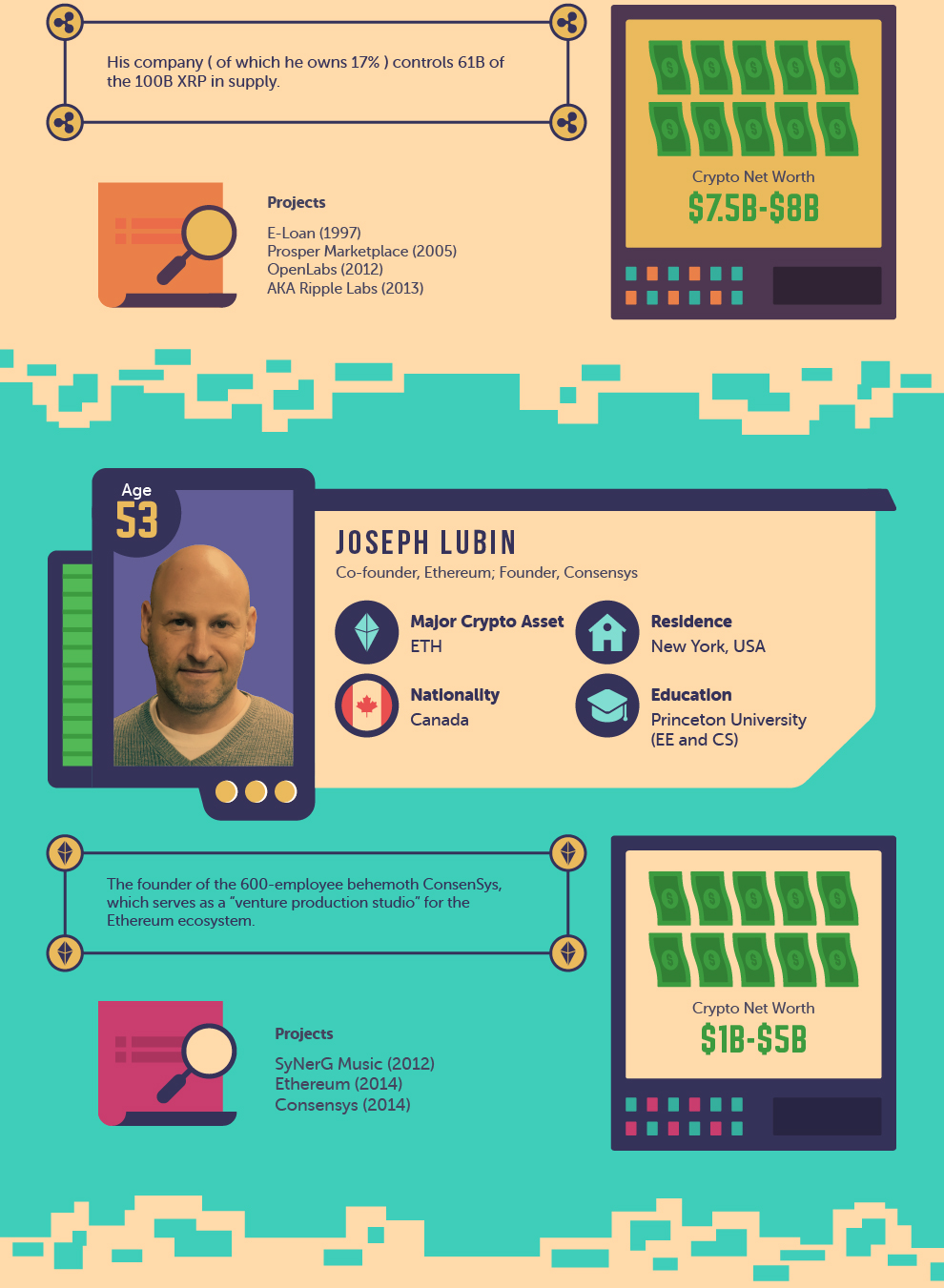

The skepticism around cryptocurrencies, specially at the beginning of the blockchain era, was very high.

Things, however, are much more different now.

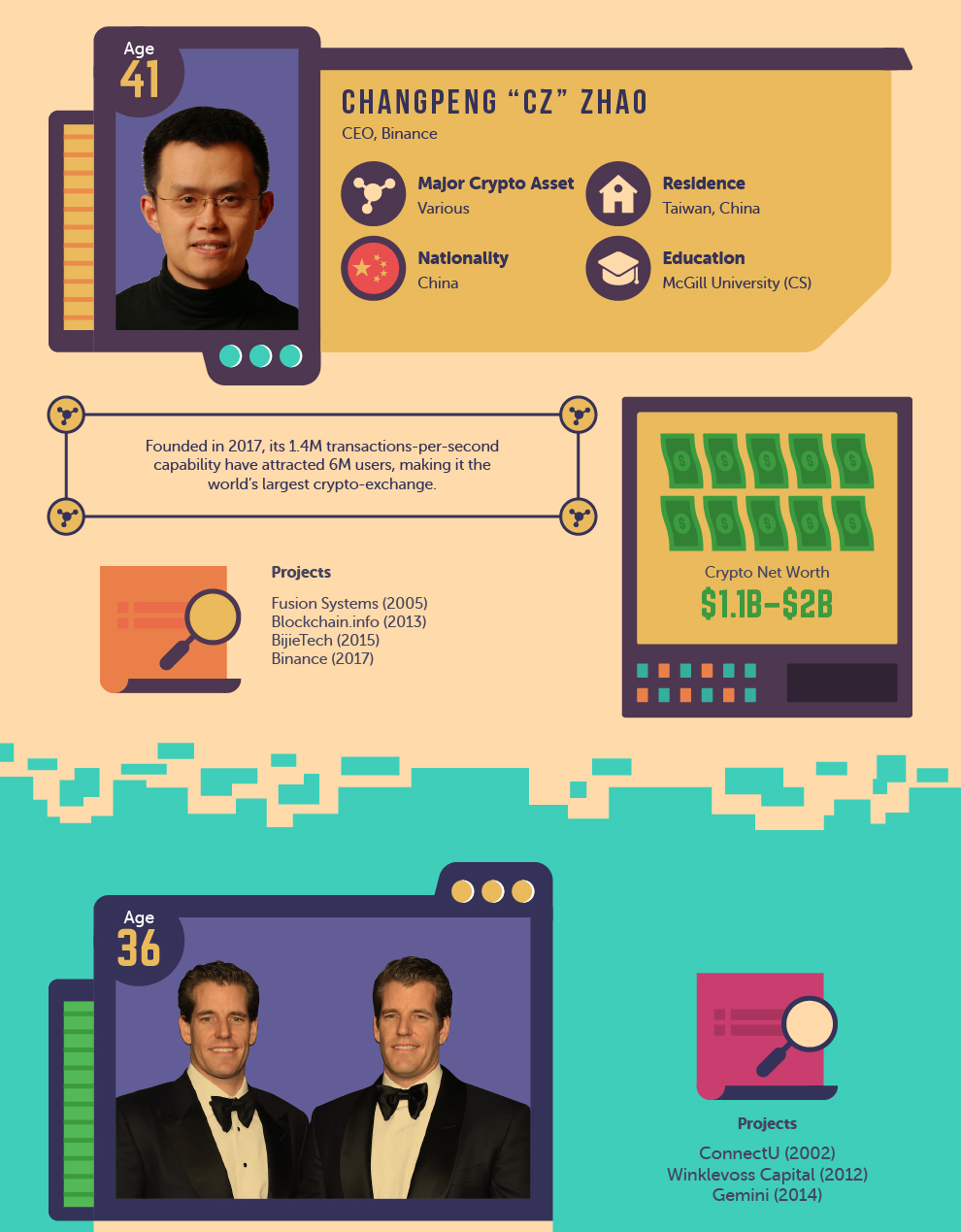

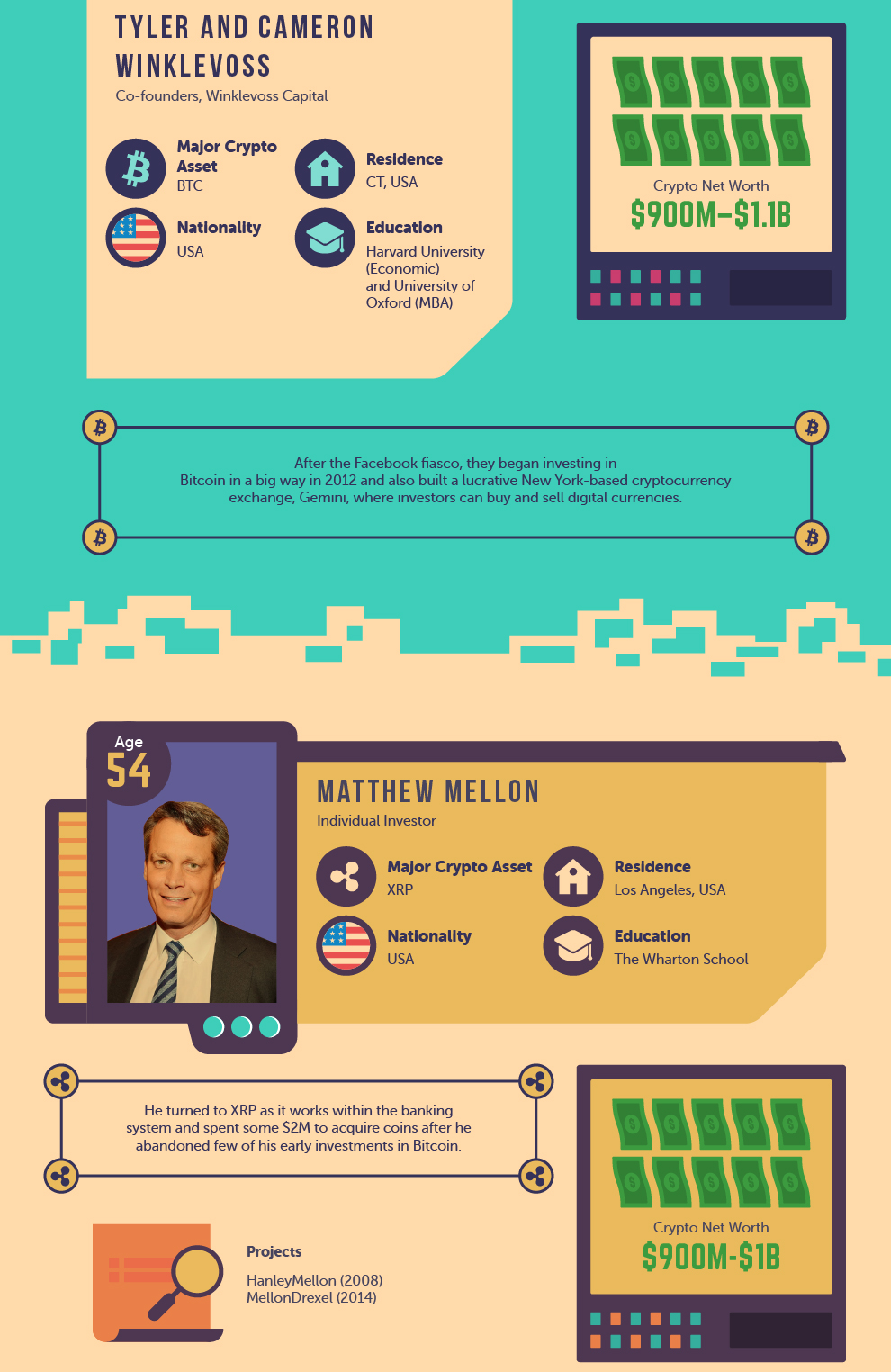

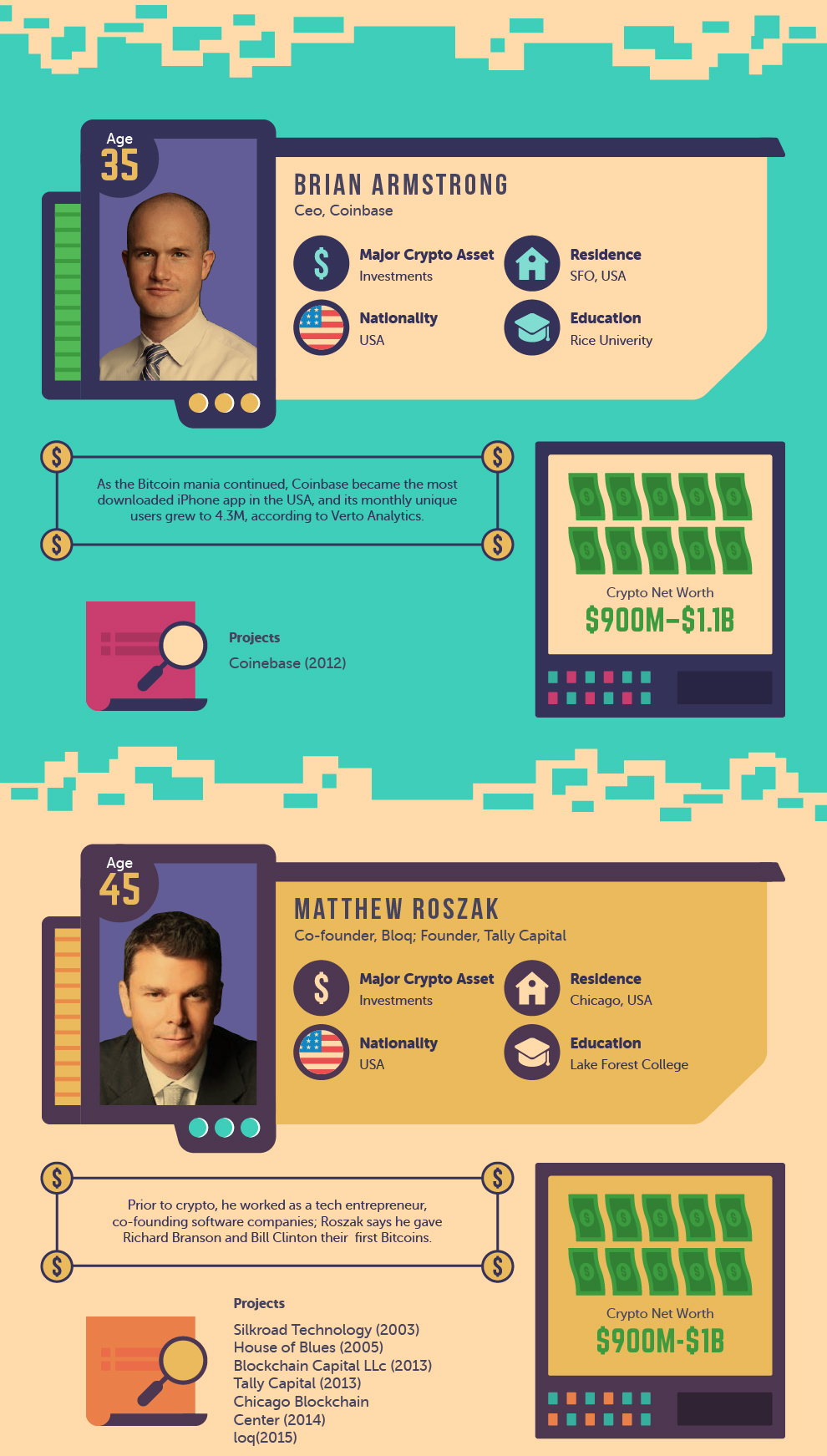

In 2017, the popularity and value of cryptos literally skyrocketed as the fame of some crypto-investors did.

The various features and benefits of the blockchain, which have allowed its incredible growth, probably are still misunderstood by many. But everybody knows someone who have become millionaire/billionaire thanks to this technology. And probably this has a lot to do with all those “normal” people who tried to invest in BTC. Money has been their drive.

Instead, (many of) the ones who earned real fortunes were prepared, competent and profoundly committed to a higher vsion.

Below, you will see a list of 15 crypto kings that are making history with their engagement in the field of cryptocurrencies. Check out the infographic below provided by our friends of BitFortune.net to learn all about these people.

Open your free digital wallet here to store your cryptocurrencies in a safe place.