The Big Four of Bitcoin’s L2 Ecosystem: Unleashing Innovation and Efficiency

The Big Four of Bitcoin’s L2 Ecosystem: Unleashing Innovation and Efficiency

As the cryptocurrency landscape evolves, Bitcoin’s Layer 2 (L2) ecosystem emerges as a beacon of innovation, promising to redefine the scalability, speed, and efficiency of transactions. Among the burgeoning projects within this space, four stand out for their unique contributions and potential to shape the future of Bitcoin: the Lightning Network, Stacks, Liquid, and Rootstock. Each project brings its own set of capabilities and innovations to the table, collectively enriching the Bitcoin ecosystem with new functionalities and applications.

Lightning Network: Speed and Micropayments Revolution

The Lightning Network is perhaps the most well-known of the L2 solutions, designed to enable instant, low-cost transactions. By creating a network of payment channels operating off the main Bitcoin blockchain, it significantly reduces transaction times and fees, making Bitcoin practical for everyday transactions and microtransactions. This innovation is not only crucial for scaling the network but also for facilitating new use cases, such as micropayments, that were previously impractical due to high transaction costs and slow confirmation times.

Stacks: Building Smart Contracts on Bitcoin

Stacks, formerly known as Blockstack, takes a different approach to enhancing Bitcoin’s functionality. By enabling smart contracts and decentralized applications (DApps) on Bitcoin, Stacks introduces the capabilities of Ethereum-like platforms without compromising the security and stability of Bitcoin. This opens up a new realm of possibilities for developers to build on Bitcoin’s robust network, offering a unique blend of innovation without sacrificing the core principles that make Bitcoin the gold standard of cryptocurrencies.

Liquid: Enhanced Privacy and Efficiency

The Liquid Network focuses on improving the privacy and efficiency of Bitcoin transactions, especially for traders and exchanges. As a sidechain solution, Liquid allows for faster settlements, enhanced confidentiality through confidential transactions, and the issuance of digital assets. Its role is particularly pivotal in the context of institutional and professional trading environments where speed and privacy are of the essence. Liquid’s contributions to the Bitcoin ecosystem highlight the growing need for scalable and confidential transaction solutions that cater to a diverse range of user needs.

Rootstock (RSK): Smart Contracts Meet Bitcoin Security

Rootstock (RSK) adds yet another layer of functionality to Bitcoin by integrating smart contracts into the network. Similar to Stacks, RSK aims to leverage Bitcoin’s unmatched security by allowing developers to create smart contracts and DApps within the Bitcoin ecosystem. However, RSK operates as a sidechain that is merge-mined with Bitcoin, providing a unique blend of smart contract functionality with the security and decentralization of the Bitcoin network. This makes it a compelling option for developers looking to deploy secure and interoperable DApps.

Synergies and the Future of Bitcoin’s L2 Ecosystem

The synergy between these four projects exemplifies the potential of Layer 2 solutions to not only alleviate the scalability concerns associated with Bitcoin but also to introduce a wide array of functionalities that extend beyond simple transactions. From enabling microtransactions with the Lightning Network to fostering new applications through Stacks and Rootstock, and enhancing privacy and efficiency with Liquid, the L2 ecosystem is at the forefront of Bitcoin innovation.

The future of Bitcoin’s L2 ecosystem lies in its ability to harmoniously integrate these solutions, fostering an environment where efficiency, scalability, and functionality coexist. As these projects continue to evolve and mature, the Bitcoin network stands to benefit from increased adoption and utility, further cementing its position as the cornerstone of the cryptocurrency world.

Moreover, the success of Bitcoin’s L2 projects offers valuable insights into the potential of Layer 2 solutions across the broader cryptocurrency ecosystem. By addressing the inherent limitations of blockchain technology, such as scalability and transaction speed, without compromising on security or decentralization, L2 solutions represent a pivotal step towards achieving the mass adoption of cryptocurrencies.

Conclusion

The “Big Four” of Bitcoin’s Layer 2 ecosystem—Lightning Network, Stacks, Liquid, and Rootstock—symbolize a significant leap forward in the quest for a more scalable, efficient, and functional Bitcoin. Through their individual and collective contributions, these projects are not only enhancing the capabilities of the Bitcoin network but also paving the way for a future where digital currencies are seamlessly integrated into everyday life. As the cryptocurrency landscape continues to evolve, the innovations stemming from Bitcoin’s L2 ecosystem will undoubtedly play a critical role in shaping its trajectory.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Evolution of Bitcoin Treasuries: A Strategic Asset in the Digital Age

In the digital era, Bitcoin has transitioned from a speculative investment to a strategic reserve asset for both sovereign nations and global corporations. This shift reflects growing confidence in cryptocurrency’s potential to serve as a hedge against inflation, a means for diversification, and a symbol of technological advancement. Below, we explore how different entities are leveraging Bitcoin, the impact of these investments, and the broader implications for the global financial ecosystem.

Sovereign Wealth in the Age of Cryptocurrency

Rumors swirl around Bulgaria’s acquisition of over 200,000 BTC, purportedly through law enforcement seizures. This positions Bulgaria as potentially one of the largest national holders of Bitcoin, sparking discussions on the implications for national financial strategies and the potential for Bitcoin to contribute to sovereign wealth funds.

In a striking move, German authorities seized Bitcoin worth approximately $2.1 billion, linked to criminal activities. This not only underscores the asset’s value but also highlights the growing role of cryptocurrencies in legal and financial frameworks within state operations.

On the national front, the United States leads with a staggering 207,189 Bitcoins in its possession, much of which has been acquired through seizures from criminal activities, including the notable Silk Road case. Following closely is China, with 194,000 Bitcoins, and Ukraine with 46,351 Bitcoins. These holdings by governments indicate a significant shift towards acknowledging the potential of Bitcoin not just as an investment but also as a strategic reserve akin to gold.

El Salvador has been particularly noteworthy for its proactive stance towards Bitcoin, officially adopting it as legal tender and actively purchasing Bitcoins to hold in its national treasury with a current 40% increase in value since adoption. This bold move by El Salvador represents one of the most significant endorsements of cryptocurrency by a sovereign state, aiming to leverage Bitcoin for economic growth and to increase financial inclusion for its citizens.

Corporate Holdings in Bitcoin

Leading the charge in the corporate sector is MicroStrategy, which holds a massive 190,000 Bitcoins, making it the top private holder of the cryptocurrency. This move underscores a growing trend among companies to diversify their assets and bet on the appreciating value of Bitcoin as a digital gold. Other notable companies with substantial Bitcoin investments include Marathon Digital Holdings, Galaxy Digital Holdings, Coinbase Global, and Tesla, Inc., each holding thousands of Bitcoins. These investments are not just a testament to Bitcoin’s growing acceptance but also reflect a strategic approach to hedge against traditional financial volatility and inflation.

The total holdings of Bitcoin by ETFs, excluding Grayscale’s GBTC, have surpassed those of MicroStrategy, reaching a combined total of 192,255 BTC. This number is more than the 190,000 BTC held by MicroStrategy, making these ETFs significant holders of Bitcoin. The recent addition of nearly 5,000 tokens to their holdings indicates a growing interest and investment in Bitcoin through ETF vehicles. These funds have attracted billions of dollars from investors seeking exposure to Bitcoin without the direct purchase and storage of the cryptocurrency

Sovereign Bitcoin Treasuries

On the national front, the United States leads with a staggering 207,189 Bitcoins in its possession, much of which has been acquired through seizures from criminal activities, including the notable Silk Road case. Following closely is China, with 194,000 Bitcoins, and Ukraine with 46,351 Bitcoins. These holdings by governments indicate a significant shift towards acknowledging the potential of Bitcoin not just as an investment but also as a strategic reserve akin to gold.

El Salvador has been particularly noteworthy for its proactive stance towards Bitcoin, officially adopting it as legal tender and actively purchasing Bitcoins to hold in its national treasury. This bold move by El Salvador represents one of the most significant endorsements of cryptocurrency by a sovereign state, aiming to leverage Bitcoin for economic growth and to increase financial inclusion for its citizens.

bitcoin treasuries april 2024

The Global Perspective

The strategic accumulation of Bitcoin by both corporations and countries highlights a growing recognition of its value as a digital asset. The adoption and investment in Bitcoin are driven by various factors, including its potential for high returns, its role as a hedge against inflation, and its increasing acceptance as a legitimate financial asset on the global stage. This trend is indicative of a broader shift in the financial world, where digital assets are increasingly seen as integral components of investment portfolios and national reserves.

The implications of these investments are vast, affecting everything from the valuation of Bitcoin to the regulatory and economic policies surrounding cryptocurrencies. As more entities continue to explore and invest in Bitcoin, its role in the global financial ecosystem is likely to evolve, potentially leading to increased stability, acceptance, and integration into mainstream financial systems.

The landscape of Bitcoin treasuries is a dynamic and rapidly evolving field, reflecting the broader shifts towards digital currency and assets in the global economy. As companies and countries navigate this new terrain, the strategies and impacts of Bitcoin holdings will continue to be a significant area of interest and analysis for investors, policymakers, and the public alike.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Global Landscape of Bitcoin Ownership: A Comprehensive Analysis

The world of cryptocurrency, particularly Bitcoin, has seen exponential growth over the last decade, transcending borders and economic statuses to become a global digital asset powerhouse. This surge in popularity and adoption has led to a diverse landscape of Bitcoin ownership, with several countries emerging as key players. In this detailed analysis, we’ll explore the global distribution of Bitcoin ownership, focusing on the leading countries, their unique adoption stories, and the multifaceted benefits of embracing cryptocurrency.

India’s Pioneering Digital Leap

India stands at the forefront of the Bitcoin revolution with an estimated 93 million cryptocurrency users. This remarkable figure not only highlights the country’s rapid digital transformation but also its populace’s eagerness to embrace alternative financial instruments. India’s massive user base is indicative of a broader trend towards digital currencies, driven by factors like technological advancement, economic aspirations, and a young, tech-savvy population.

United States: A Mixed Landscape of Government and Private Ownership

In the United States, the scenario is twofold, with both the government and private citizens holding significant amounts of Bitcoin. The U.S. government’s acquisition of Bitcoin, primarily through seizures related to criminal activities, underscores the complex relationship between state authorities and the cryptocurrency world. On the other hand, with 48 million Americans owning Bitcoin, the country reflects a robust interest in digital currencies as a means of investment and financial diversification. This dual narrative of governmental and retail ownership presents a unique case study in the global Bitcoin ecosystem.

The Asian Giants: Vietnam and Pakistan

Vietnam and Pakistan are noteworthy mentions in the Asian continent, with 20 million and 15 million Bitcoin users, respectively. These numbers are not just statistics but represent a burgeoning interest in digital currencies as tools for economic empowerment, investment, and technological innovation. The widespread adoption in these countries signals a shift towards more inclusive financial systems and the potential for cryptocurrencies to bridge economic disparities.

Brazil and Indonesia: The Rising Titans of Cryptocurrency

Brazil and Indonesia share a remarkable statistic: 41% of their populations are invested in cryptocurrencies, making them two of the most enthusiastic adopters globally. This significant penetration rate is a testament to the growing recognition of cryptocurrencies as viable financial and investment vehicles. In these nations, Bitcoin and other digital currencies are seen not only as hedges against economic instability but also as gateways to the digital economy.

Nigeria, Venezuela, and Kenya: Embracing Bitcoin Amid Economic Challenges

Nigeria, with its vast Bitcoin user base, leads Africa in cryptocurrency adoption, followed closely by Venezuela and Kenya. These countries have turned to Bitcoin and other digital currencies as beacons of hope amidst economic uncertainties. The adoption of Bitcoin in these regions illustrates its potential as a stabilizing force, offering an alternative to traditional financial systems and enabling more accessible and secure transactions.

Government Holdings: A Global Overview

The role of governments in the Bitcoin space is increasingly significant, with countries like the United States and El Salvador holding substantial Bitcoin reserves. These holdings are not merely financial assets but also strategic reserves that reflect the governments’ acknowledgment of Bitcoin’s potential impact on economic stability and sovereignty. El Salvador’s adoption of Bitcoin as legal tender is a pioneering move, signaling a new era of digital currency integration into national economies

The Benefits of Global Bitcoin Adoption

The adoption of Bitcoin and cryptocurrencies at large brings with it a plethora of benefits. For individuals, it offers an alternative to traditional banking systems, especially in regions with unstable currencies or restrictive financial policies. For businesses, accepting cryptocurrency payments can open up new markets, attract a more diverse customer base, and lead to higher transaction values. Moreover, the decentralized nature of cryptocurrencies like Bitcoin provides enhanced security, reduced transaction costs, and greater financial inclusion, making it an attractive option for people and businesses worldwide.

The global landscape of Bitcoin ownership is as diverse as it is dynamic, with each country bringing its unique narrative to the broader story of cryptocurrency adoption. From the massive user bases in India and the United States to the strategic governmental holdings in El Salvador and beyond, Bitcoin’s global footprint is undeniable. As the world continues to navigate the complexities of the digital economy, Bitcoin and other cryptocurrencies will undoubtedly play a pivotal role in shaping the future of finance, offering opportunities for growth, innovation, and financial empowerment across the globe.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Saifedean Ammous Joins El Salvador’s National Bitcoin Office as Economic Advisor

El Salvador’s commitment to embracing Bitcoin as legal tender continues to make waves in the crypto industry. In a significant development, Saifedean Ammous, the renowned economist and author of “The Bitcoin Standard,” has joined the National Bitcoin Office of El Salvador as an economic advisor. This strategic move highlights the country’s determination to leverage the potential of cryptocurrencies and promote financial innovation. Ammous has shared his insights on El Salvador’s Bitcoin strategy, expressing optimism about the country’s potential for economic growth and debt reduction. This article delves into Ammous’s role, his views on El Salvador’s initiatives, and the broader implications for cryptocurrency adoption.

Ammous’s Vision for El Salvador

In an interview with the local newspaper ‘Diario El Salvador,’ Ammous expressed confidence in El Salvador’s ability to become debt-free within the next five to ten years. He emphasized the country’s immense potential to become a hub of innovation, owing to its progressive policies, including the adoption of a zero tax rate for technology companies. Ammous commended President Nayib Bukele’s initiatives, highlighting their attractiveness compared to nations adopting contrasting cryptocurrency taxation policies. Although not explicitly mentioned, Ammous alluded to recent debates on cryptocurrency taxation in countries such as the United States, the United Kingdom, Portugal, and Italy. El Salvador’s commitment to creating a favorable environment for businesses and entrepreneurs positions it as a leader in the global crypto landscape.

The Role of the National Bitcoin Office

The National Bitcoin Office, established through Decree No. 49, has been pivotal in driving El Salvador’s cryptocurrency strategy. Its formation last year involved collaboration between President Bukele and prominent Bitcoin supporters Stacy Herbert and Max Keiser. The office plays a central role in overseeing cryptocurrency-related matters in the country, ensuring regulatory clarity, and facilitating the integration of Bitcoin into the economy. Ammous’s appointment as an economic advisor adds another layer of expertise to the office, enhancing the President’s decision-making process. Notably, Ammous has volunteered his services without requesting financial compensation, underscoring his commitment to advancing the adoption of cryptocurrencies in El Salvador.

El Salvador’s Pioneering Initiatives

El Salvador has been a trailblazer in its national cryptocurrency strategy. It became the first country to adopt Bitcoin as legal tender in September 2021, signaling a major milestone in the mainstream acceptance of cryptocurrencies. Furthermore, the introduction of innovative Bitcoin bonds last year demonstrated El Salvador’s commitment to harnessing the potential of digital assets to stimulate economic growth. While initial reports on Bitcoin adoption in the country varied, recent trends indicate an upsurge in uptake, fueled in part by increased tourism. El Salvador’s proactive approach to cryptocurrency integration has attracted global attention and positioned the nation as a vanguard of financial innovation.

US Regulatory Developments

The United States, a global powerhouse in finance and technology, has recently witnessed significant regulatory discussions surrounding cryptocurrencies. President Joe Biden’s administration proposed imposing excise taxes on Digital Asset Mining Energy (DAME), which could have subjected cryptocurrency mining companies to a 30% tax. However, as part of the agreement reached on the US debt ceiling, this tax proposal is currently being blocked. The Biden administration argued that such taxes were necessary to address the environmental and social impacts of mining operations. The ongoing debates on cryptocurrency taxation highlight the contrasting approaches countries are taking toward digital assets, further emphasizing the significance of El Salvador’s progressive stance.

Conclusion

Saifedean Ammous’s appointment as an economic advisor to El Salvador’s National Bitcoin Office marks a significant milestone in the country’s journey towards cryptocurrency adoption. His expertise and insights will undoubtedly contribute to shaping the nation’s economic strategies and further solidify its position as a leader in the crypto industry. With Ammous’s guidance, El Salvador is poised to achieve its ambitious goals, including debt reduction and the establishment of an innovative hub for cryptocurrency innovation.

As El Salvador continues to implement its progressive cryptocurrency policies, other nations around the world are closely observing the outcomes. The country’s pioneering initiatives, such as adopting Bitcoin as legal tender and creating a supportive regulatory framework, have attracted attention and sparked conversations about the future of finance. El Salvador’s bold approach serves as an inspiration for countries grappling with the challenges and opportunities presented by digital currencies.

Furthermore, the collaboration between the National Bitcoin Office and Saifedean Ammous underscores the importance of bringing together diverse expertise to drive meaningful change. As cryptocurrencies gain traction and reshape the global financial landscape, the input of renowned economists like Ammous becomes invaluable in navigating the complexities of this evolving ecosystem. To conclude, Saifedean Ammous’s role as an economic advisor to El Salvador’s National Bitcoin Office adds a new dimension to the country’s cryptocurrency journey. With his expertise and insights, coupled with El Salvador’s progressive initiatives, the nation is poised to make significant strides in leveraging the potential of cryptocurrencies for economic growth and financial empowerment. As the global community watches El Salvador’s progress, it is clear that the country’s commitment to innovation and inclusion has the potential to reshape the future of finance.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Impact of DeFi on the Cryptocurrency market of 2021

Short for decentralized finance, DeFi is a new wave taking over the world’s financial market; the cryptocurrency world. DeFi is the conception that entrepreneurs can provide traditional financial institutions functions through a decentralized medium. There are cryptocurrencies like Bitcoin and Ethereum, the former of which has been causing significant ripples in the crypto-world since the last quarter of 2020 and the beginning of this year.

Although Bitcoin and Ethereum are the forerunners of DeFi, newer and somewhat better altcoins are coming into view. An example is Dai, a bitcoin-resembling digital token that hopes to remain independent of the world’s central banks’ influence. Unlike centralized finance and traditional banks, DeFi takes away all the cumbersome operations, go-betweens, and high costs often involved. This it does via smart contracts and to the benefit of the end-user. The closure of many industries during this era of the COVID-19 pandemic has served as a wake-up call to consumers of fiat currencies on the futility and loss of value of such coins.

This wake-up call has been occurring in places where the government has been pumping more money into their economies even though they have taxes to be paid. Such practices make the value of such currencies questionable. As a result of such act, fiat currencies’ values have been seen to fluctuate and fall considerably, often leading to inflation. An example is in Venezuela’s economy where inflation has risen by more than 1,000,000% due to the influx and pumping of more bills into the economy.

Often, the influx of newly minted bills into the economy does not mean these bills will get to such currencies’ end-users. These often serve as injections into the banking sector. But when they come as benefit checks and government aids, this inflation in money supply results in taxes. Also, they help boost the stock market and the stocks of the top 1%, rather than help the thousands and millions of individuals and businesses that need such aids.

The Impact of DeFi in the cryptocurrency market

The increasing dissatisfaction and discontent with traditional banks and centralized financial systems are momentous. The high availability of information about the growing offers in the crypto sector is finally providing people with better alternatives to traditional banks. These alternatives come in the form of DeFi (decentralized finance) where people can now take part in a mode of operation that will work for them. This means that people’s money will now work for them instead of the other way round.

Investing in the cryptocurrency market is becoming more comfortable and more widespread than when it first emerged with Bitcoin as its forerunner. As the first DeFi system, this paved the way for other altcoins, including Ethereum, Tether, Polkadot, XRP, and Cardano. These cryptocurrencies have come a long way and have become potential collaterals when taking out traditional bank loans. These loans can be collected regardless of what your credit score is. They serve as a way of getting cash when you need it irrespective of the availability of physical collateral.

The influence of cryptocurrency is rising steadily in developing countries where inflations often caused by government policies and central bank cash injections result in the loss of value of people’s savings and business capitals. Buying and investing in DeFi systems has provided a remedy to that, whereby the value of fiat currencies that have been converted to cryptocurrencies experience growth and provide means of decentralized financial transactions with relatively low costs from traditional banks.

Opportunities and Growth

The opportunities created by cryptos seem even better in developed countries. Large amounts of money are readily available and can be invested in trusted cryptosystems where stable profit and immense gain are assured. This steady return has been made evident in Bitcoin and Bitcoin price prediction, which has been steadily increasing more than fiat currencies. Its independence from centralized financial systems has served as a contributing factor rather than a deterring factor.

Amidst the use of DeFi systems by individuals and some businesses, there is a need to increase its development and efficiency to encourage its adoption by institutions. Through this, the DeFi industry will rise from the position now as a Billion-dollar transaction pathway to a trillion-dollar one, where the costs of transactions go down while profits and investment increase. This aim of getting institutions into the DeFi industry is already in motion. Individuals and groups are coming together to develop decentralized financial apps that are better and more decentralized than their forerunner. Such a better DeFi system could come in the form of large and small security circles where a single user cannot overturn the currency’s stability, and a central body cannot determine a price change.

With this growth in the use of DeFi systems and the coming in of institutions into the crypto market, real-world assets can be brought into the blockchain, which will help and promote the growth of DeFi. This would include transferring trillions of fiat currencies and precious stones such as gold or silver onto the blockchain. And their movement can be done at the cost of no more than a nickel and no intermediary fees and liquidity limits. With DeFi as an alternative to centralized financial systems, governments will have little to no control over the wealth that cannot be generated by individuals that make use of the system.

Conclusion

With the growth of decentralized financial systems in the last two decades, the move from fiat currencies to cryptocurrencies seems irreversible. And that’s a good thing since, through DeFi systems, the distribution of wealth among crypto-users can be regularized and stabilized. This would ensure equal wealth distribution on the platform, which can only be influenced by cryptocurrency owners when they invest more fiat currency into the platform.

BIO John Edwards

John Edwards is a writing specialist who works at The Writing Judge. He is looking for ways of self-development in the field of writing and blogging. New horizons in his beloved business always attract with their varieties of opportunities. Therefore, it is so important for him to do the writing.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Generation X vs. Generation Y | Adopting Cryptocurrencies

Generation X and Generation Y Adoption of Cryptocurrencies: A Comparison

The world’s financial institutions are currently observing a vast digital ecosystem being expanded with reports for new digital currencies akin to the likes of cryptocurrencies to be launched soon. While these CBDCs (central bank digital currencies) are proclaimed not to harm or replace cash and other forms of legal tenders, we cannot help but talk about the ones instigating the change.

Cryptocurrency became popular since the launch of Bitcoin back in Jan 3rd, 2009. Ever since then, cryptocurrencies have seen a rise in popularity amongst the masses.

According to a recent study by Tech Jury, the cryptocurrency market cap has reached $265.545 billion as of May 2020. By 2023, the global blockchain market is expected to reach $23.3 billion. Furthermore, Bitcoin alone accounts for $6 billion of daily online transactions.

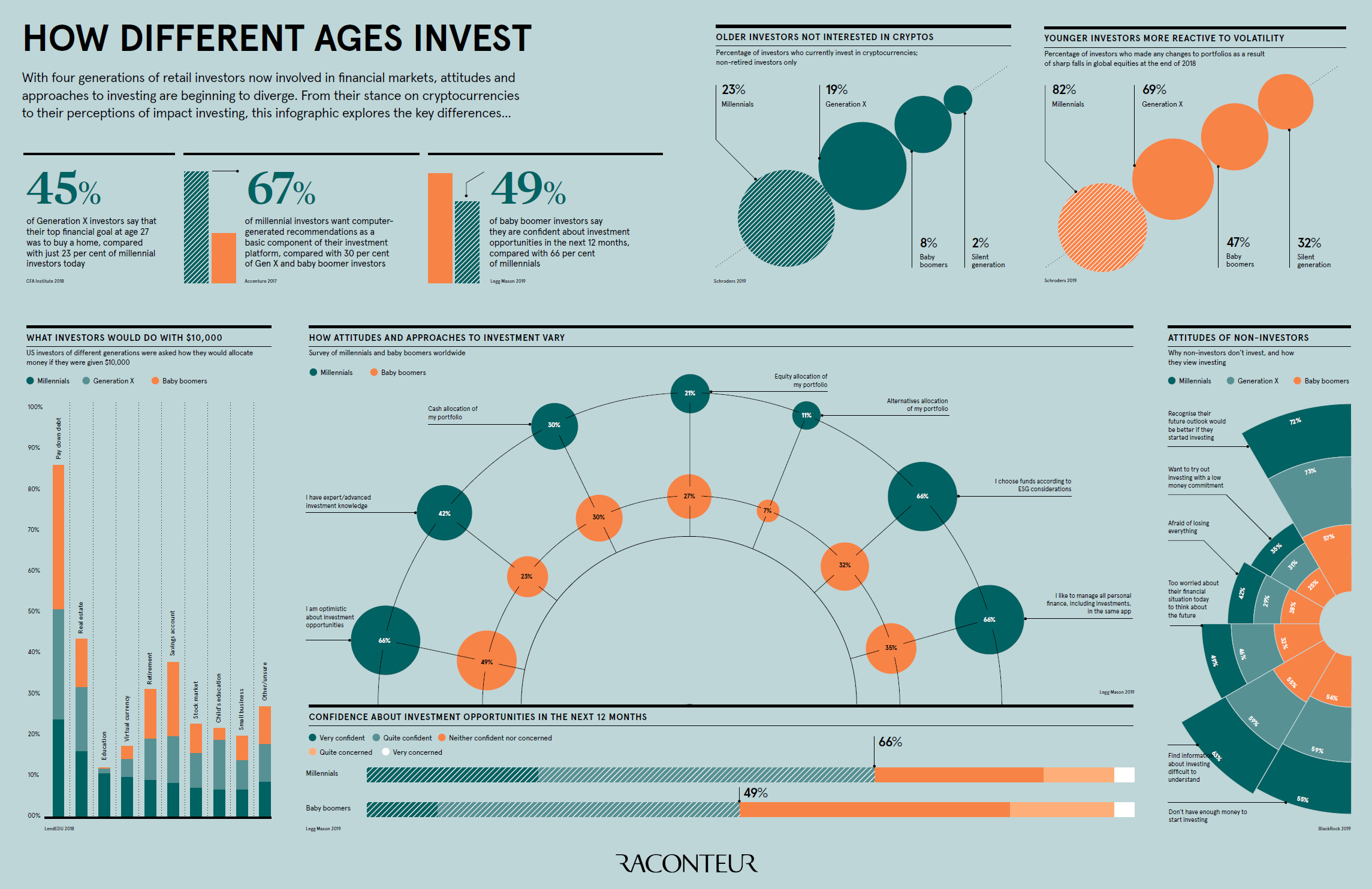

Moreover, cryptocurrency users have exceeded 40 million globally. In light, of this information, let’s take a quick look at how Millennials compare to Generation X when it comes to adopting cryptocurrencies.

Generation X

Generation X is widely regarded as the generation that followed Baby Boomers and preceded Millennials. Their age groups range from 40 to 55 years old as of 2020. Here is how Generation X is reacting towards cryptocurrency:

-

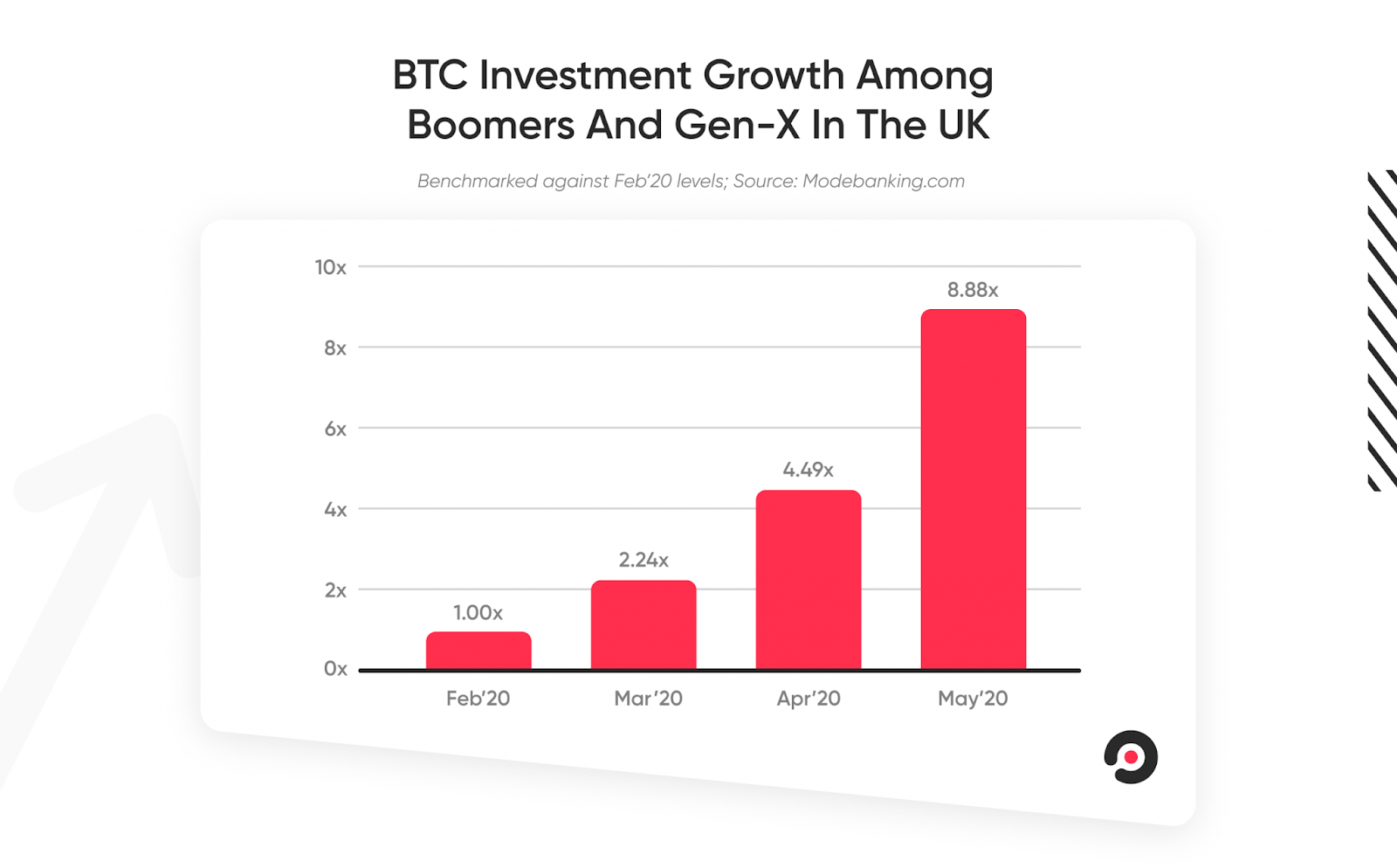

Investment Growth among Boomers & Gen X

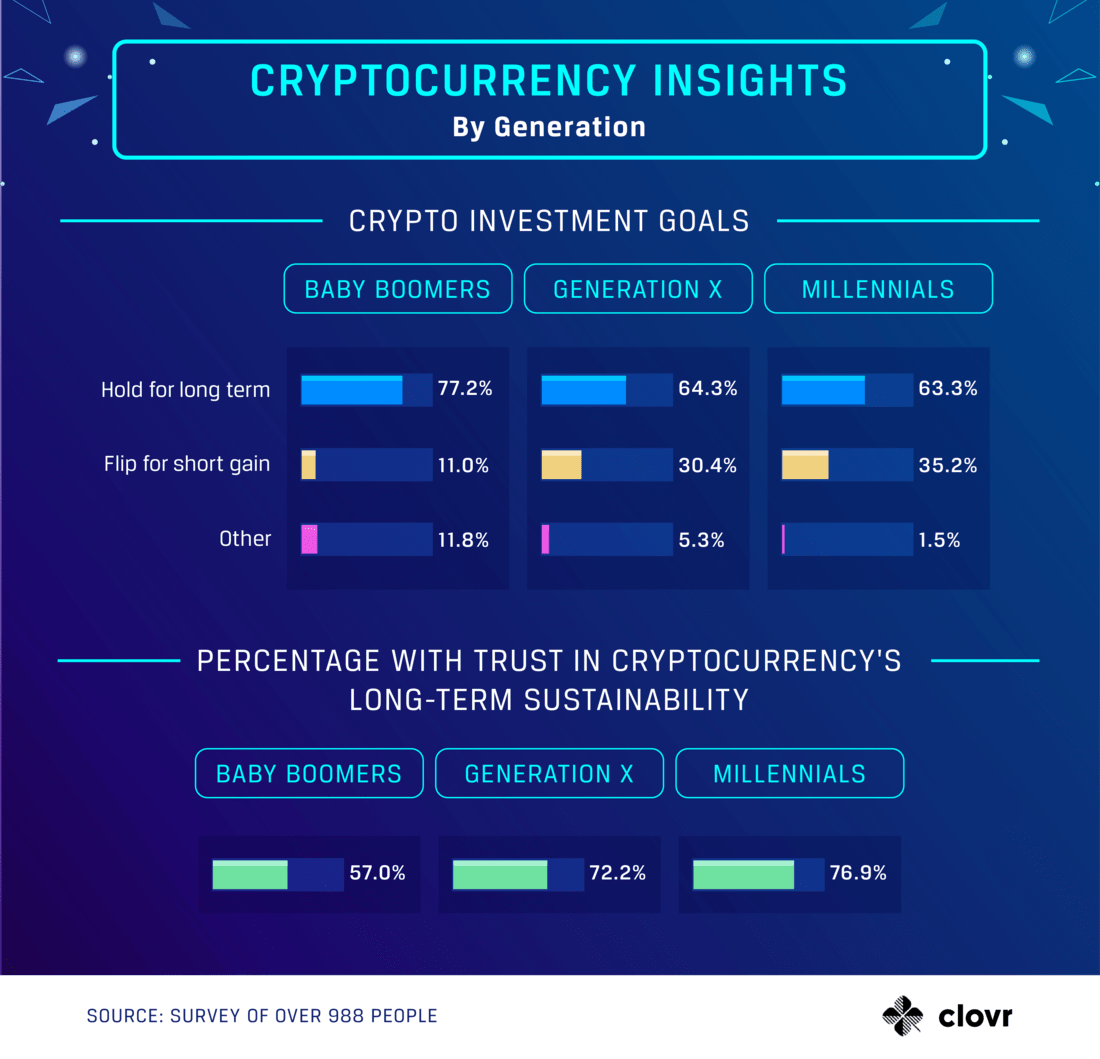

While Millennials are regarded as the prime suspects for capitalizing on the crypto market, surprisingly both Baby Boomers and Gen X are being currently observed to closely follow the trends.

Hence in recent years, many sources have cited an increase in investment of cryptocurrency as both Boomers and Generation X take charge to close the gap. In some cases, they were also found to have more than doubled their investments.

-

Month on Month Growth

It seems like the word of mouth and awareness about cryptocurrency is spreading like wildfire as Generation X is seen to understand the value and find blockchain as a reliable security measure. Understanding the benefits of fast and instantaneous transactions, the group of disaffected people and entrepreneurs is already showing signs of crypto is affecting their thinking for the future.

Reports are coming in, showing an evident increase and Month on Month growth patterns. According to a study by Mode Banking, both Baby Boomers and Gen-X have shown a trend of increasing their investment in cryptocurrency by over 100%, especially during the COVID-19 pandemic.

-

Wealth Protection & Asset Diversification

With the current economy ridiculed by the pandemic, the growing fear for wealth protection has led Baby Boomers and those belonging from Gen-X to invest in resources that can allow for asset diversification. Cryptocurrency so far has been observed as the most favorable type of investment to safeguard personal wealth.

Generation Y

Otherwise known as Millennials, Generation Y is widely regarded as the generation succeeding Gen-X and Baby Boomers. Their age groups range from 24 to 39 years of age. Often regarded as the parents of Generation Alpha (like my darling son!) they were born into a world that as quickly becoming familiarized with the internet, mobile devices, and social media.

-

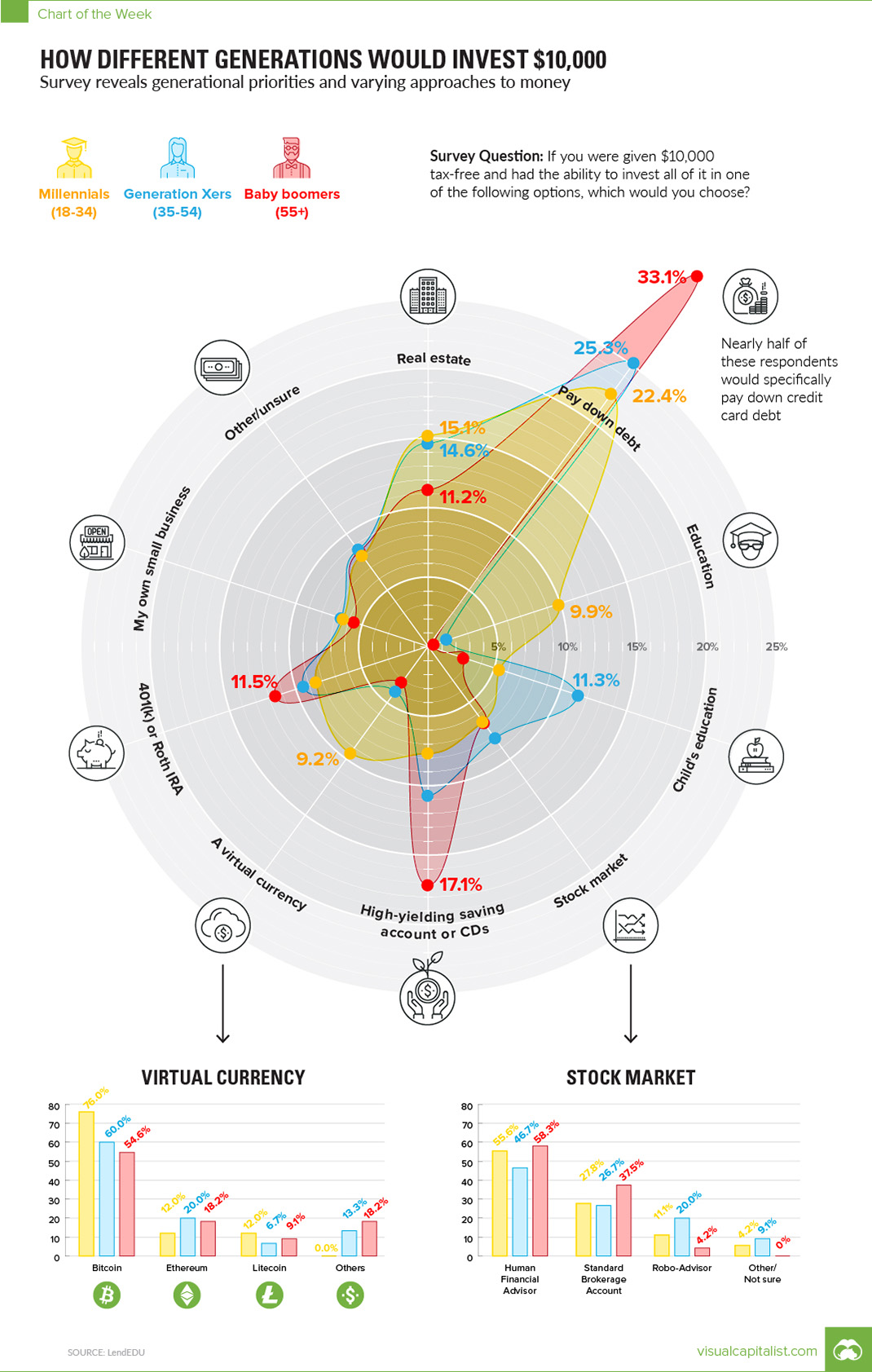

Growth of Alternative Asset

Millennials view of cryptocurrency is that of an alternative asset. Surprisingly not many of us want to invest in stocks and are more interested in assets that are backed by technologies. According to a recent study by Coin Telegraph, Millennials are three times more likely to invest in cryptocurrency as compared to Generation X. Furthermore, 9% of Millennials chose crypto as their long-term investment option.

Students applying for and seeking dissertation assistance are also looking for ways to invest alternative asset that can help secure their personal wealth for the future. It is important to note here that while both real estate and stocks are also good options for Millennials, they are currently dominated by Baby Boomers in the present times.

-

Shifting Presence for Everything Digital

Studies from different financial institutions and digital currency markets are coming in showcasing Millennials as a driving force for the adoption of Bitcoin for years to come. Zac Prince, the CEO and founder of BlockFi, identifies a major trend for Millennials where they seek everything digital.

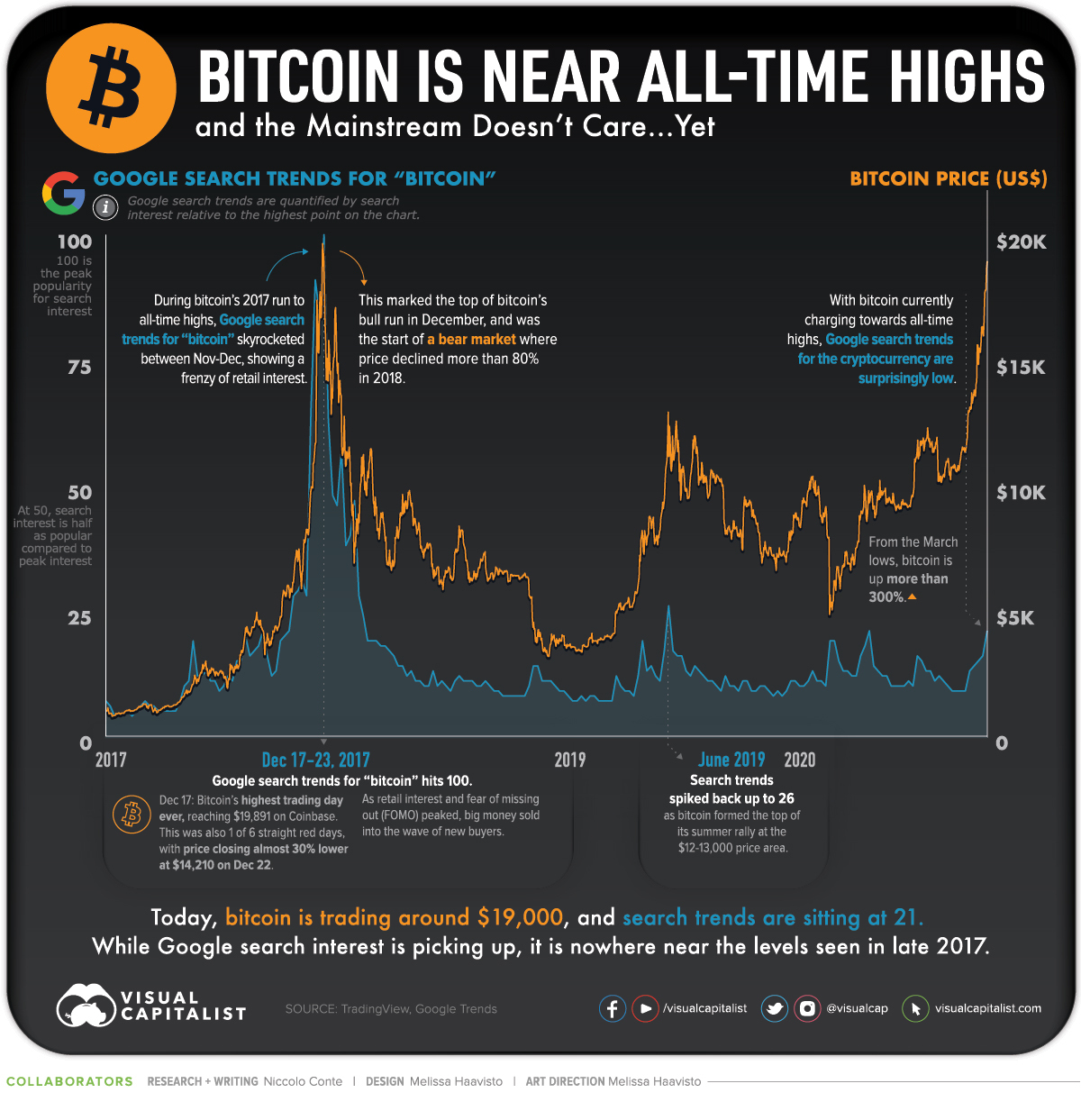

Furthermore, with Bitcoin reaching its all-time high and pushing over $23,000 per coin as of Dec 17, 2020, who can blame Millennials for making the right choice so far!

-

Wealth Transfer to the Young

There is a Japanese idiom that states the next generation as the actual king of the world. Come to think of it this world will always belong to the next generation that is how our life expectancy is all about. We may get to live 100 years, but eventually, the circle of life catches up to us. As we depart, the new generation takes to the throne.

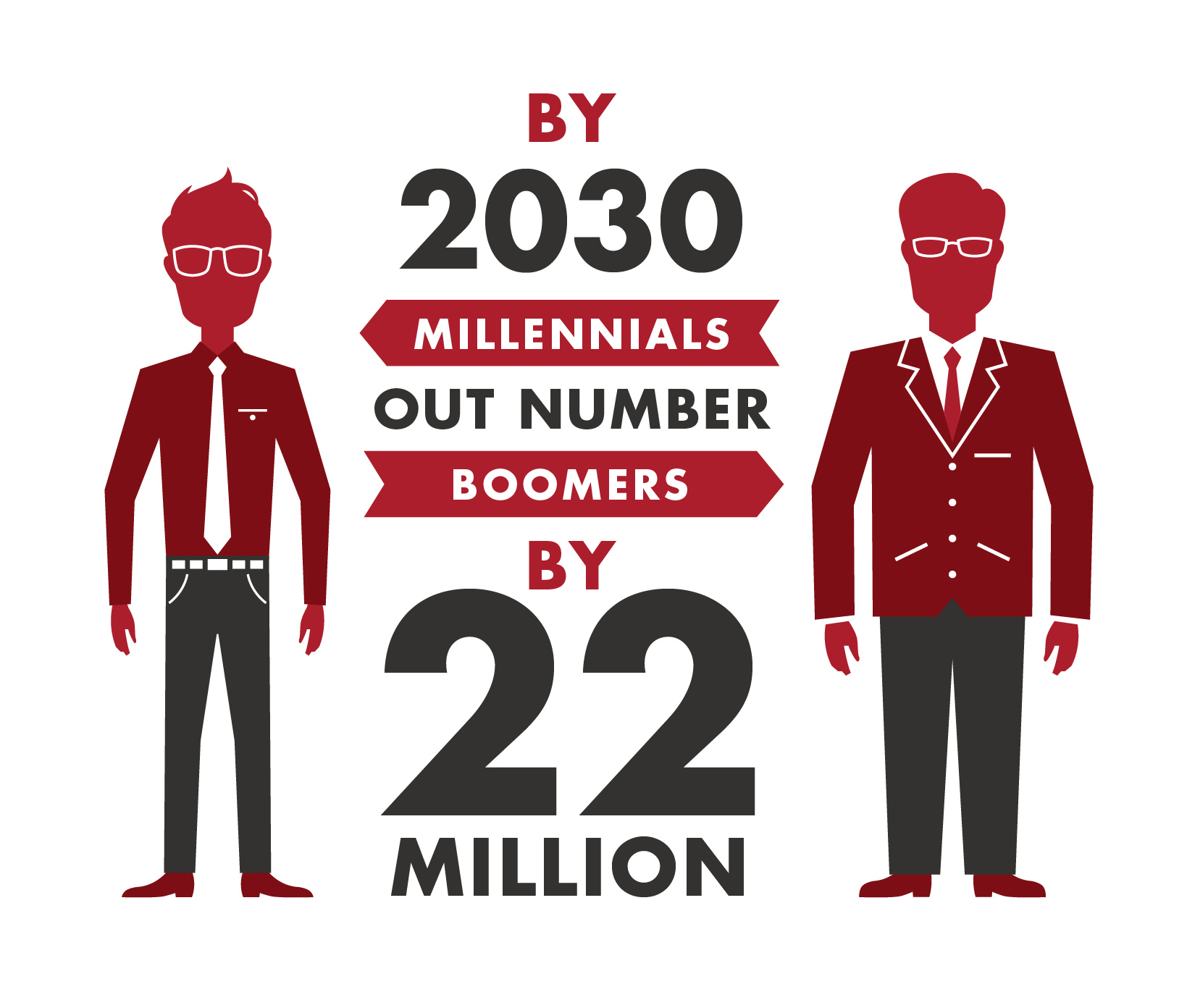

For countless eras, this is how wealth has been passed down from old to the young. Currently, Millennials are in the process to take control and eventually move Boomers out to take their seat on the ruling chair. This transfer of power and wealth on a massive scale will indefinitely cause investment in cryptocurrency to rise by a tremendous rate.

Conclusion

Cryptocurrency is on the rise with Bitcoin riding the tidal wave in recent times. Not only digital assets and crypto are skyrocketing, but even the BIS (Bank of International Settlements) is also considering launching digital currencies with the help of IMF and 60 central bank members.

Someone really has to be blind enough to not see how things are rapidly changing and converging towards digital resilience. So far Millennials and Gen-X have shown their growing interest in adopting cryptocurrencies with Boomers lagging behind to catch up on the trend.

Author Bio

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Blockchain Cybersecurity: read the full report

As explained by a major IT agency for the European Union, financial companies should be careful to blockchain cybersecurity issues if they want to implement the blockchain.

The European Union Agency for Network and Information Security (ENISA), in fact, published a new report on the distributed ledger, highlighting the security issues that large companies might experience if they decide to adopt blockchain tech.

Key management, data privacy and smart contracts are some of the most important topics discussed in the ENISA report.

This is the first time the agency, created back in 2004, published a report on the technology. Last year, ENISA published a glossary on its official website.

On the page there was an overview of blockchain, saying “it is too soon to tell whether blockchain will live up to its promise”.

According to this newest report, financial businesses should give high attention to security issues.

Udo Helmbrecht, executive director of ENISA, explained in an official statement:

“Cybersecurity should be considered as a key element in the blockchain implementation by financial institutions.”

Code review and mechanisms for accessing to distributed networks should be important, commented the report. Also it highlights that banks and financial institutions should think about the blockchain cybersecurity challenges of handling digital asset wallets.

Click on the link below to read the full copy of the report:

WP2016 3-1 4 Blockchain Security by CoinDesk.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Philips announces its own Blockchain Lab

Previous Statement

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ethereum used for Car Charging in Germany

Germany supports green power

Car Charging with Smart Contracts

Open your free digital wallet here to store your cryptocurrencies in a safe place.

9 Best Bitcoin Video Animations

Open your free digital wallet here to store your cryptocurrencies in a safe place.