Short for decentralized finance, DeFi is a new wave taking over the world’s financial market; the cryptocurrency world. DeFi is the conception that entrepreneurs can provide traditional financial institutions functions through a decentralized medium. There are cryptocurrencies like Bitcoin and Ethereum, the former of which has been causing significant ripples in the crypto-world since the last quarter of 2020 and the beginning of this year.

Although Bitcoin and Ethereum are the forerunners of DeFi, newer and somewhat better altcoins are coming into view. An example is Dai, a bitcoin-resembling digital token that hopes to remain independent of the world’s central banks’ influence. Unlike centralized finance and traditional banks, DeFi takes away all the cumbersome operations, go-betweens, and high costs often involved. This it does via smart contracts and to the benefit of the end-user. The closure of many industries during this era of the COVID-19 pandemic has served as a wake-up call to consumers of fiat currencies on the futility and loss of value of such coins.

This wake-up call has been occurring in places where the government has been pumping more money into their economies even though they have taxes to be paid. Such practices make the value of such currencies questionable. As a result of such act, fiat currencies’ values have been seen to fluctuate and fall considerably, often leading to inflation. An example is in Venezuela’s economy where inflation has risen by more than 1,000,000% due to the influx and pumping of more bills into the economy.

Often, the influx of newly minted bills into the economy does not mean these bills will get to such currencies’ end-users. These often serve as injections into the banking sector. But when they come as benefit checks and government aids, this inflation in money supply results in taxes. Also, they help boost the stock market and the stocks of the top 1%, rather than help the thousands and millions of individuals and businesses that need such aids.

The increasing dissatisfaction and discontent with traditional banks and centralized financial systems are momentous. The high availability of information about the growing offers in the crypto sector is finally providing people with better alternatives to traditional banks. These alternatives come in the form of DeFi (decentralized finance) where people can now take part in a mode of operation that will work for them. This means that people’s money will now work for them instead of the other way round.

Investing in the cryptocurrency market is becoming more comfortable and more widespread than when it first emerged with Bitcoin as its forerunner. As the first DeFi system, this paved the way for other altcoins, including Ethereum, Tether, Polkadot, XRP, and Cardano. These cryptocurrencies have come a long way and have become potential collaterals when taking out traditional bank loans. These loans can be collected regardless of what your credit score is. They serve as a way of getting cash when you need it irrespective of the availability of physical collateral.

The influence of cryptocurrency is rising steadily in developing countries where inflations often caused by government policies and central bank cash injections result in the loss of value of people’s savings and business capitals. Buying and investing in DeFi systems has provided a remedy to that, whereby the value of fiat currencies that have been converted to cryptocurrencies experience growth and provide means of decentralized financial transactions with relatively low costs from traditional banks.

The opportunities created by cryptos seem even better in developed countries. Large amounts of money are readily available and can be invested in trusted cryptosystems where stable profit and immense gain are assured. This steady return has been made evident in Bitcoin and Bitcoin price prediction, which has been steadily increasing more than fiat currencies. Its independence from centralized financial systems has served as a contributing factor rather than a deterring factor.

Amidst the use of DeFi systems by individuals and some businesses, there is a need to increase its development and efficiency to encourage its adoption by institutions. Through this, the DeFi industry will rise from the position now as a Billion-dollar transaction pathway to a trillion-dollar one, where the costs of transactions go down while profits and investment increase. This aim of getting institutions into the DeFi industry is already in motion. Individuals and groups are coming together to develop decentralized financial apps that are better and more decentralized than their forerunner. Such a better DeFi system could come in the form of large and small security circles where a single user cannot overturn the currency’s stability, and a central body cannot determine a price change.

With this growth in the use of DeFi systems and the coming in of institutions into the crypto market, real-world assets can be brought into the blockchain, which will help and promote the growth of DeFi. This would include transferring trillions of fiat currencies and precious stones such as gold or silver onto the blockchain. And their movement can be done at the cost of no more than a nickel and no intermediary fees and liquidity limits. With DeFi as an alternative to centralized financial systems, governments will have little to no control over the wealth that cannot be generated by individuals that make use of the system.

With the growth of decentralized financial systems in the last two decades, the move from fiat currencies to cryptocurrencies seems irreversible. And that’s a good thing since, through DeFi systems, the distribution of wealth among crypto-users can be regularized and stabilized. This would ensure equal wealth distribution on the platform, which can only be influenced by cryptocurrency owners when they invest more fiat currency into the platform.

BIO John Edwards

John Edwards is a writing specialist who works at The Writing Judge. He is looking for ways of self-development in the field of writing and blogging. New horizons in his beloved business always attract with their varieties of opportunities. Therefore, it is so important for him to do the writing.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The world’s financial institutions are currently observing a vast digital ecosystem being expanded with reports for new digital currencies akin to the likes of cryptocurrencies to be launched soon. While these CBDCs (central bank digital currencies) are proclaimed not to harm or replace cash and other forms of legal tenders, we cannot help but talk about the ones instigating the change.

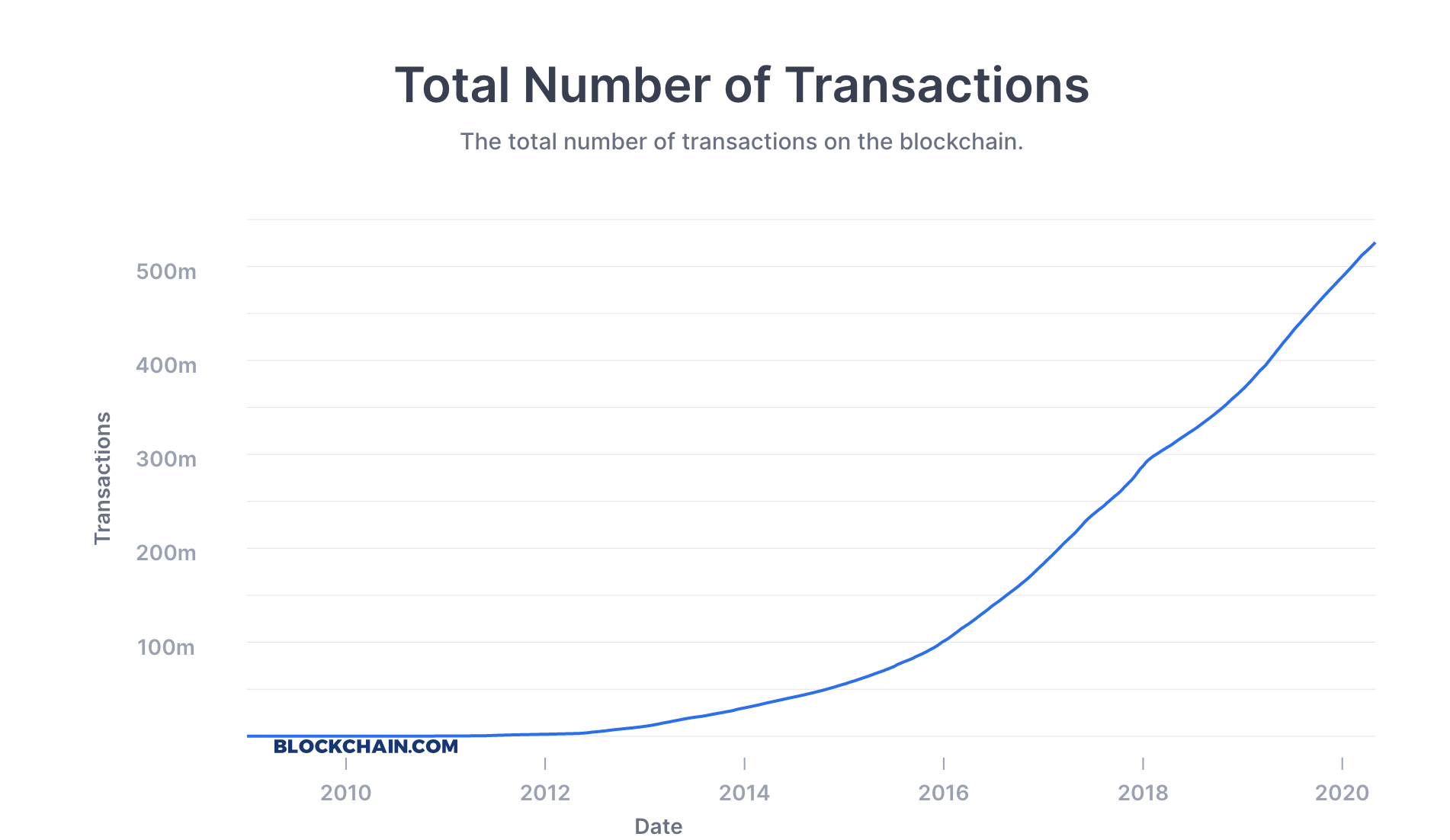

Cryptocurrency became popular since the launch of Bitcoin back in Jan 3rd, 2009. Ever since then, cryptocurrencies have seen a rise in popularity amongst the masses.

According to a recent study by Tech Jury, the cryptocurrency market cap has reached $265.545 billion as of May 2020. By 2023, the global blockchain market is expected to reach $23.3 billion. Furthermore, Bitcoin alone accounts for $6 billion of daily online transactions.

Moreover, cryptocurrency users have exceeded 40 million globally. In light, of this information, let’s take a quick look at how Millennials compare to Generation X when it comes to adopting cryptocurrencies.

Generation X is widely regarded as the generation that followed Baby Boomers and preceded Millennials. Their age groups range from 40 to 55 years old as of 2020. Here is how Generation X is reacting towards cryptocurrency:

While Millennials are regarded as the prime suspects for capitalizing on the crypto market, surprisingly both Baby Boomers and Gen X are being currently observed to closely follow the trends.

Hence in recent years, many sources have cited an increase in investment of cryptocurrency as both Boomers and Generation X take charge to close the gap. In some cases, they were also found to have more than doubled their investments.

It seems like the word of mouth and awareness about cryptocurrency is spreading like wildfire as Generation X is seen to understand the value and find blockchain as a reliable security measure. Understanding the benefits of fast and instantaneous transactions, the group of disaffected people and entrepreneurs is already showing signs of crypto is affecting their thinking for the future.

Reports are coming in, showing an evident increase and Month on Month growth patterns. According to a study by Mode Banking, both Baby Boomers and Gen-X have shown a trend of increasing their investment in cryptocurrency by over 100%, especially during the COVID-19 pandemic.

With the current economy ridiculed by the pandemic, the growing fear for wealth protection has led Baby Boomers and those belonging from Gen-X to invest in resources that can allow for asset diversification. Cryptocurrency so far has been observed as the most favorable type of investment to safeguard personal wealth.

Otherwise known as Millennials, Generation Y is widely regarded as the generation succeeding Gen-X and Baby Boomers. Their age groups range from 24 to 39 years of age. Often regarded as the parents of Generation Alpha (like my darling son!) they were born into a world that as quickly becoming familiarized with the internet, mobile devices, and social media.

Millennials view of cryptocurrency is that of an alternative asset. Surprisingly not many of us want to invest in stocks and are more interested in assets that are backed by technologies. According to a recent study by Coin Telegraph, Millennials are three times more likely to invest in cryptocurrency as compared to Generation X. Furthermore, 9% of Millennials chose crypto as their long-term investment option.

Students applying for and seeking dissertation assistance are also looking for ways to invest alternative asset that can help secure their personal wealth for the future. It is important to note here that while both real estate and stocks are also good options for Millennials, they are currently dominated by Baby Boomers in the present times.

Studies from different financial institutions and digital currency markets are coming in showcasing Millennials as a driving force for the adoption of Bitcoin for years to come. Zac Prince, the CEO and founder of BlockFi, identifies a major trend for Millennials where they seek everything digital.

Furthermore, with Bitcoin reaching its all-time high and pushing over $23,000 per coin as of Dec 17, 2020, who can blame Millennials for making the right choice so far!

There is a Japanese idiom that states the next generation as the actual king of the world. Come to think of it this world will always belong to the next generation that is how our life expectancy is all about. We may get to live 100 years, but eventually, the circle of life catches up to us. As we depart, the new generation takes to the throne.

For countless eras, this is how wealth has been passed down from old to the young. Currently, Millennials are in the process to take control and eventually move Boomers out to take their seat on the ruling chair. This transfer of power and wealth on a massive scale will indefinitely cause investment in cryptocurrency to rise by a tremendous rate.

Cryptocurrency is on the rise with Bitcoin riding the tidal wave in recent times. Not only digital assets and crypto are skyrocketing, but even the BIS (Bank of International Settlements) is also considering launching digital currencies with the help of IMF and 60 central bank members.

Someone really has to be blind enough to not see how things are rapidly changing and converging towards digital resilience. So far Millennials and Gen-X have shown their growing interest in adopting cryptocurrencies with Boomers lagging behind to catch up on the trend.

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Can you imagine the speed required to make 250 trillion attempts to solve a puzzle in one second? Stop imagining! We already have the answer figured out for you!

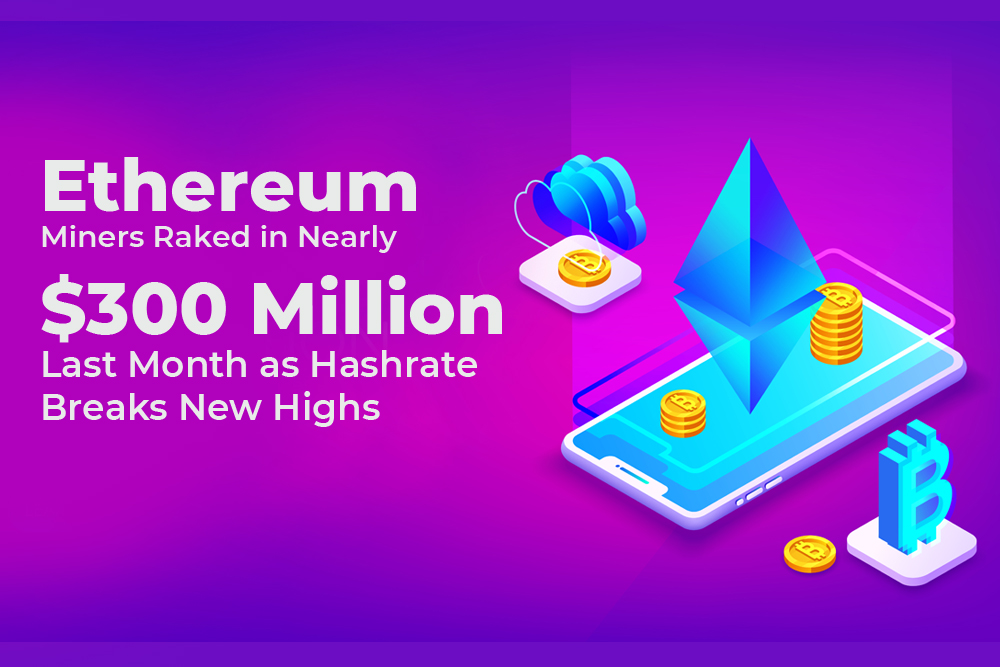

On 6th October 2020, the Ethereum-mining hash rate made a new record by reaching a figure of 250 trillione hashes per second. Ether miners are more active than ever before, and the Ethereum network is now more powerful than ever before.

To your surprise, Ethereum is not a mineral found in the mountains. Miners have made $300 million without even stepping outside their homes. Without confusing you any further, let me explain how ETH mining can make you a millionaire.

It is a platform that makes use of a blockchain database to allow developers to create applications on it. The apps that are built on Ethereum are decentralized; Any computer that connects to the Ethereum network can access these apps. You can make online payments, trade cryptocurrency, and sell products without the involvement of third parties like banks.

Ether (ETH) is Ethereum’s cryptocurrency that has $40 billion worth of market capitalization in 2020.

It indicates the overall health or power of the Ethereum network. The combined computing power of all the mining machines is directly proportional to the hash rate; When power increases, the hash rate goes up. This means that the miners play a vital role in strengthening the cryptocurrency network.

Initially, low-power machines were used, but as the popularity of the network grew, more users jumped in, and more powerful mining rigs were introduced. This caused the hash rate to reach trillion hashes per second and enhanced the network’s security.

What is the hype all about? How are the hash rate and mining rigs related to money? Let us find out!

People spend thousands of dollars on building powerful mining rigs that can generate more ETH in less time.

Mining rigs are basically computers with an extremely powerful graphics processing unit. Application-Specific Integrated Circuits have now been introduced for mining purposes. Mining is not an easy task, so it requires a lot of energy in the form of electricity.

The main reason behind using GPUs and ASIC instead of simple CPUs is to lower energy consumption.

The capacity of the supply unit (in watts) must be greater than the total power consumption of all the units of your rig. If you have 4 GPUs that consume a total of 800 watts and other units consume 200 watts, a supply unit of at least 1000 watts is needed for the smooth working of the rig.

Your SSD requirement depends on the operating system of your rig. A 120 GB hard drive is required for mining rigs that run windows. For Linux users, 60 GB SSD would get the job done.

The number of PCIe slot connectors in a motherboard corresponds to the number of GPUs that can be installed. ASRock H110 Pro BTC+, Asus B250 Mining Expert, and Gigabyte GA-H110-D3A are some of the best motherboards for mining. The average cost of these motherboards is around £110.

Your rig’s processing speed depends on the size of its RAM. At least 4GB RAM is required for fast calculations.

GPUs are the actual driving force in a rig, so make sure that you have plenty of them. GeForce GTX 1060, RTX 2080 Ti, and RX Vega 56 are some of the most popular graphics cards on the market.

Let me link all the dots here!

A powerful mining rig can make more attempts at solving puzzles in one second. More attempts mean that there are high chances of working out the right answer. When the right answer is generated, a new block is added to the chain, and the miner gets ETH as a reward. It would not be wrong to say that ETH is sitting in the coaxial cables of your rig.

Mining is not just about solving the mathematical puzzle but being the first miner to discover or guess the solution is a must for earning a reward. Millions of people are working on the same puzzle at one time, so the processing speed of your rig determines your success rate.

Today, one ETH is worth $467. An ETH miner makes money by processing transactions for the application users on the Ethereum network. ETH is a miner’s reward for solving the complex puzzle. When the miner has processed a certain number of transactions, he/she is rewarded with ETH.

Ethereum serves as the platform for the buying and selling of ETH. Miners’ task is to verify and secure transactions resulting from trading on which they also earn a transaction fee.

One important point to note here is that when the hash rate goes up, the difficulty level of the puzzle also increases to balance it out.

Eth miners working with powerful graphics cards can make $15 in 24 hours, which is much higher than the profit in Bitcoin.

High profits do not come solely from ETH mining, but from the transaction fee, which is the main attraction.

The transaction fee in the Ethereum network rose to $11.61 in September 2020, producing millions of dollars in profits. Experts suggest that Ethereum is a good investment as Ether’s price is expected to grow over $2000 by the end of 2025.

Cryptocurrency is on the rise these days, and according to the experts, it is the future of online trading. Although there are security issues like double spending and 51% attacks, Ethereum and Bitcoin continue to attract investors.

If you have some extra cash lying in your bank, my advice would be to invest it in buying cryptocurrency. You do not need to go big at this point! Start with 1 token and just analyze its value in the market.

Where do you see the price of 1 Ether going in 2030?

Author Bio:

Myrah Abrar is a computer science graduate with a passion for web development and digital marketing.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

When people talk about the entertainment industry and media, blockchain isn’t exactly the first thing that comes to their mind.

Wall Street and eCommerce are way ahead of the entertainment industry in terms of blockchain adoption, there’s growing evidence that things could change pretty soon. As more and more use cases for the technology emerge, major players in the industry are increasingly looking at blockchain as something that has the potential to resolve some pressing issues.

Warner Music Group, for example, has recently joined an $11 million investment round in Dapper Labs, a blockchain company seeking to create Flow, a rival to Ethereum. Already, the company is exploring a number of use cases for the cryptocurrency, including sales of digital merchandise with financial tokens.

The slow but sure progress of blockchain in the media and entertainment might be a sign that a breakthrough might be approaching. Currently, the technology is known to provide the following solutions.

The problem of middlemen is persistent and very well-known in the music industry. Even though it has come so far in terms of technology, it’s still in the same place when it comes to compensation distribution. The biggest losers in this situation are often the artists, who end up with a lack of opportunities to get sponsorship contracts with big-time labels.

The only viable option for an artist to minimize the dependence on managers and distribution services is streaming services. However, the compensation they get for the music is often inadequate, even for the well-known artists. Here are some examples (source: CNBC):

All of this translates into between €0.004 and €0.007 of pay per play.

Blockchain can reduce artists’ dependence on labels and other middlemen because it’s not run by a central body but rather everyone on the network. This means that the financial transactions – compensation for songs, etc. – could be conducted without the involvement of the middlemen.

Contract distribution and payment for property in the entertainment industry can be a complicated thing. The biggest problem is the sheer amount of work involved in payment processing, making exclusive distribution agreements, providing licensing, and other things. On top of that, there’s high fees and a lack of control over the process for artists.

Many artists delegate these business administration responsibilities surrounding contacts, licensing, and payment to their agents. As a result, the artists are once again left with high losses because they simply cannot sell their work directly peer to peer.

“Since blockchain is a distributed digital ledger system, it can enable almost complete automation of all business administration work surrounding payments, contracts, and licensing,” says Jason Rowe, a technology reporter. “The biggest benefit here, however, is the ability to enable artists to license their content directly to customers.”

WeMark is one example. It’s a distributed marketplace for stock photography that seeks to reduce the dominance of agencies like Getty Images and Shutterstock. According to WeMark’s white paper, these agencies now charge photographers up to 85 percent of the photos’ sale price, so the latter are left with a fraction of potential earnings.

Here’s how the WeMark platform works to provide artists with distribution agreements.

The solutions offered by blockchain-powered marketplaces like WeMark include:

Once blockchain marketplaces get more popularity among artists, chances are good they will prefer to use them instead of agencies like Getty Images. Each of the marketplaces will accept the most common cryptocurrencies as a payment method; moreover, as the costs of crypto mining gradually go down as blockchain gets more acceptance, chances are that artists will be willing to use cryptocurrencies for peer-to-peer sales.

The number of visits to media piracy sites in 2018 rose to 17.3 billion in the U.S. alone. With the volume of video-based traffic rapidly increasing around the world, online media piracy has skyrocketed; in fact, the television and film industry estimates about $52 billion in lost revenues by 2022.

Blockchain might be one of the solutions that will finally start to battle online privacy effectively. Its main promise, more comprehensive protection of digital assets, is perfectly aligned with the goal of combating pirates. For example, the technology can allow artists to transfer media files securely while having the complete visibility of the operation.

Another benefit of bitcoin is allowing it to catch pirates by identifying illegally obtained files. For example, if you’re a moviemaker looking to distribute a file to reviewers, you can use a blockchain-powered video distribution platform that embeds a special code, or a wallet, in every copy that gets distributed. The code remains in the file despite conversions or other processing operations.

If the file is leaked and found, then identifying the presence of the code, therefore, an illegally obtained file, becomes possible. The adoption of blockchain is still a problem, but it’s clear that the technology is on the way to become the future of the anti-piracy tactics (Warner is already investing in a blockchain company, remember?)

When people hear blockchain, they tend to think about Bitcoin. However, the technology stands to benefit many industries, including entertainment, and is already showing some good progress. The industry is highly centralized and there’s a great potential to increase earnings for people doing the creative work.

As the applications of blockchain become more common and the benefits visible, it’s possible that artists will be more willing to use the technology. However, the massive adoption is still yet to come, so stay tuned to blockchain news.

About the author: Jessica Fender is a content editor for TopWritersReview.com and a tech blogger. She is passionate about technology trends and finding new ways to help students improve their skills and become more successful.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The last five years have seen an incredible development in the blockchain industry. Because of its fast development, new and innovative ways of implementing blockchain technology and accepting cryptocurrency have emerged in the business world. One of the most promising developments is that of digital tokens. The idea of digital tokens has its roots in data security. Its scope in the financial field is fast-tracked on the path of transforming the way businesses handle their finances and specifically, secure their assets. Even though it is still a new development, the advantages of digital tokens are already taking the business world by storm. Among these, include accessibility at a lower cost and increased liquidity and security. Businesses who want a competitive advantage are increasingly looking hire C# coder teams with experience in implementing digital token development, to transform their financial processes to include digital tokens.

To understand digital token development, you have to understand what digital tokens are. Just like a coupon can benefit you with a product of a certain value at a grocery store, digital tokens work in the same way. A digital token is a unit of cryptographic information that can be used to facilitate different transactions, which includes trading, redeeming or assigning to another party.

Digital tokens can either be inherited or constructed using the software. Some of the most common examples of inherited digital tokens are Ether and Bitcoin.

Token development exists to represent assets of value which can be traded. This can include basic commodities and cryptocurrencies, such as Bitcoin. With token development, a standard template on a blockchain is followed to develop new tokens. Because it is emerging so quickly, choosing the best token development service provider is important when entering the blockchain technology field.

Recently, digital tokens have gained a lot of popularity with businesses, specifically because it offers secure transactions. But it has many other uses. Let’s explore a few ways digital token development can be used:

Payment between parties

Many businesses are accepting digital tokens as a form of payment. This makes it convenient for two parties to securely trade without involving cash. Some examples of leading businesses and industries that are already using digital tokens include:

Internet Services Providers (ISPs)

The hospitality industry

The e-commerce industry

Digital asset ownership

The process of digital asset tokenization includes the act of breaking a large asset, for example, a real estate investment, into small chunks. Furthermore, each broken chunk of that asset is individually represented with a specific token, and the ownership of that asset is recorded on a ledger system that resembles a blockchain.

Those specific tokens can then be traded in the open market casually, making the broken chunks of the larger asset tradable.

Rewards

Some businesses offer digital tokens as rewards to clients or customers. This is typically to encourage people to shop online and can be a valuable award for individuals who invest in digital currencies.

Donations

Some organizations are embracing digital tokens as a form of donations. It is a safer and faster way of donating.

Investments

Many are realizing the value of digital tokens and are starting to use it as an investment possibility. Instead of investing money in banks, stock markets, mutual funds or investment bonds, investing in digital tokens is faster and much more secure.

As the interest in blockchain and cryptocurrency increases, businesses are slowly starting to adopt the use of digital tokens. Compared to traditional ways of managing finances and transacting, digital token development generally provides both an alternative and more secure currency instrument and a convenient payment infrastructure. Transforming to digital tokens can be complicated for businesses and they generally require expert developers to implement it into their infrastructure. As a result, the C# programmer demand is also increasing. C# programmers are typically experienced in blockchain technology and successful digital token development.

Fast-developing blockchain technology combined with the existing finance ecosystems produces new business model opportunities every day. One of the most innovative models is the idea of each finance ecosystem developing its own digital currency. Ever since Bitcoin came into being, it became more attractive for businesses to invest in blockchain technology.

The typical process of blockchains is storing data in different blocks that are interlinked with each other in a way that portrays the entire path of transactions in chronological order. Due to a blockchain’s distributed and transparent nature, people can transfer ownership from one party to another while eliminating the necessity of a trusted intermediary.

An experienced C# coder can develop structures to help businesses invest in token development. With the help of the C# programmer framework, businesses can develop digital tokens that can be used for safe and secure financial transactions.

As businesses are embracing the modern world and cutting-edge technology, the field of finance is also changing. Specifically, businesses in the financial field must take the opportunity of implementing digital tokens to gain a competitive advantage. The benefits include:

Enhanced liquidity and accessibility

Liquidity means how quickly a business or individual can get access to assets. Digital tokens allow stakeholders to access specific assets which are seldomly traded almost immediately.

More transparent transactions

The transactions conducted with digital tokens are much more transparent. Both the seller and the buyer know their rights and are aware of exactly who they are trading with.

Lower transaction fees

Because they work on blockchain tech, the administrative cost involved in transacting with digital tokens is much more cost-effective compared to traditional financial functions that involve third parties or legal entities.

Considering this, it is important to keep in mind that bringing the culture of digital currencies in the financial field can be a complex task. Developing and implementing a blockchain can take time because it requires thorough design and consideration. To launch an idea successfully, it is crucial to rent a coder team with experience in the field.

With the benefits digital tokens offer, more and more businesses and individuals are adopting it as an alternative to traditional financial processes. With the growing number of things that can be done with cryptocurrencies, it is clear that the world is slowly transforming into a more digital way of doing business.

Businesses who want to achieve better competitiveness by tapping into the liquidity, transparency and accessibility offered by tokenization, should implement digital token development. It appears that it is fast becoming the future of finance. The right way to go about it is to hire senior programming teams with experience in blockchain and digital token development to ensure successful implementation, from start to finish.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

By far the biggest threat to banking in, well, living memory, has been blockchain technology. More specifically, cryptocurrency, but we’ll focus on the technology as a whole since this is what has been driving the movement.

All the tech companies in the world have been using it, including Google, Facebook, Apple, and Amazon, and a vast number of FinTech services, which is why it’s being seen as such a threat to traditional banks, but why is this happening?

What’s so important about blockchain?

In today’s post, we’re going to explore how and why blockchain technology is making such a big difference to the traditional banking format, and how the future of this industry is looking.

Source: Adarsh Goldar

First and foremost, and by far the biggest form of change that blockchain is bringing into the world, is how financial payments are made and the way modern-day payment systems work. Whereas traditional banks can take a few working days to make a payment, meaning some international payments can take a very long time, blockchain payments are instant.

Since all you need is an internet connection to make the transaction, most will be handled and completed in a matter of minutes. These transactions can happen across borders to anywhere in the world, are extremely secure (especially when compared to traditional methods) and happen pseudoanonymously.

Due to the nature of blockchain technology, the costs involved in these transactions are usually very small, typically only several cents per transaction. This means that sending money across to the other side of the world is far cheaper than traditional wire companies, such as Visa or Western Union.

In the same way, remittances are also changing. Whereas overseas remittances are expensive and long-winded, with high processing times and the fact the money can be stolen, taxed, or subject to legal issues along the way, a blockchain process basically eradicates all these issues. There are dozens of companies already set up and operating to offer these services.

In the traditional way the world works, consumers tend to use banks to hold money in either their savings or checking accounts. Then, the bank will loan out the money being held to make money on top of the money you’re saving, and the cycle continues. This means when you look into your bank account, much of the money you have isn’t actually being held by the bank, but instead is out in other people’s accounts as loans.

If every customer of a bank went to the bank and withdrew everything they had, the bank would collapse. It’s a very fragile system that many consumers are unaware of. However, while this system isn’t going to change any time soon, blockchain technology can make the management of this system far more effective.

Due to the benefits that blockchain technology provides, these account ledgers are far more secure, far more reliable, and far more accessible. This means banks can accurately manage their ledgers to ensure that they aren’t taking out too many loans and will actively help reduce the risk of bank run, or the system crumbling.

Fraud has always been a problem in the financial industry, and it costs people around the world billions of dollars every single year. However, for the similar benefits, we’ve spoken about above, blockchain is making things far more secure.

Since the vast majority of traditional banks are set up and organised around a centralised system, malicious people can target the centralised system to commit the acts of fraud. While there have been many measures to make the system as secure as possible, this isn’t fall-proof, and statistics show around 45% of all financial institutions are prone to fraud attempts.

Blockchain is a decentralised system, which means it’s everywhere and nowhere at the same time, which makes it incredibly difficult to fraud and theft to take place. There’s no single point of access like there is with a centralised banking system and trying to get into such a system means diving into layer upon layer of encryption, all spread out in hundreds of thousands of locations.

What’s more, every single change that takes place on the ledge is capable of being seen by every other person and system that has access to the ledger. This means if any fraudulent activity takes place, everyone can see it instantly and correct it. This will help protect people’s money and keep the system afloat.

Katherine Rundell is a finance writer at Academic Writing Services and Essay Writing Services. She writes about blockchain and banking and aims to help the world get educated about finances in a time where they can seem so out of control.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The second half of 2019 was really difficult for Bitcoin. According to independent experts, the total volume of public digital assets has decreased by more than 50% – from $388 billion to $166 billion. However, there is other evidence. Yes, the cryptocurrency market really fell to the bottom if you look at these statistics, but let’s not forget that market conditions are dynamic. And the factor that means failure today may well mean success tomorrow.

There were periods of stabilization of the exchange rate, but for a long time cryptocurrency lost much in price. At one time, panic even started on the market, and Bitcoin was predicted to soon fall to zero. Against this background, the results of the year sounded quite unexpectedly: cryptocurrency turned out to be the most profitable investment. The coin rate rose from $4035 to $ 7344, providing investment growth by 82%.

This year will be great for Bitcoin, Wall Street analyst and Fundstrat founder Tom Lee suggested. The destabilization of relations between Iran and the United States is one of the reasons.

Plus, modern realities make it possible to add a supposedly modern coronavirus epidemic to these factors. However, at the moment there is no consensus among experts on how the coronavirus will affect the Bitcoin exchange rate. It is still unclear whether we are dealing with a real threat to people’s lives or is this another hype, a political company, or an attempt to distract investors from other, more important issues.

However, even those experts who believe that the disease can affect the main digital coin explain that this will happen only if the outbreak develops into a full-fledged epidemic.

Venture capitalist Tim Draper is also confident in the long-term growth in Bitcoin value. In an interview with FOX Business, he advised millennials to invest in cryptocurrencies, as they are on the verge of a new financial revolution. However, the explosion of the financial revolution will slow down due to the influence of the values of older generations and the obsolescence of the current banking system.

Bitcoin exchange rates are very unstable. Cryptocurrencies have already shown that it can rapidly fall and take off at a breakneck pace. Due to this state of affairs, bitcoin does not inspire confidence among many investors who would be happy to invest big money in the development of the blockchain, but fear for their savings. In 2020, we are unlikely to have to observe the strong influence of this factor, but we should not forget about it.

About the author: Gregory is passionate about researching new technologies in both mobile, web and WordPress. Also, he works on Best Writers Online the best writing services reviews. Gregory in love with stories and facts, so Gregory always tries to get the best of both worlds.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

For those interested in digital currencies, It has changed the way we do business and the way investors invest in a company. Employers are offering crypto as pay and others, such as music artists, are accepting them in exchange for singles. The attention crypto has attracted made it popular among many. One the biggest reason why many are attracted to crypto is that many of them sit on a decentralised network. This means an organisation or a government does not control them, unlike Fiat currency. Ther is also no physical form of cryptocurrency, but it can be converted into the more familiar notes and coins we know and love.

The introduction of Bitcoin brought with it new technology such a blockchain. The nature of blockchain makes it a secure way of working, and we will go into more detail about it below. It is essential to mention, however, that not all countries share standard consensus o what crypto is. Some view Bitcoin as exchange tokens. Others view crypto in the same light as hard cash. These anomalies in the crypto world mean taxes for Bitcoin differ from country to country which why before investing, purchasing or dealing with crypto, it would be wise to find out the countries views on it.

A big part of making an investment in Bitcoin and other cryptocurrencies and being successful at it means learning the lingo. Here are some of the underlying crypto trading terms that are commonly used. Knowing these terms will help you navigate your way through the world of crypto in ease.

Blockchain is a decentralised and distributed public ledger which means it is a database that is validated by a vast community of people rather than a central authority. In most cases, blockchain refers to the bitcoin blockchain, which is made up of blocks. It allows data to be stored globally on thousands of servers and lets individuals enter the networks to see all the entries in real-time. By doing this, it makes it hard for users to gain control of the system. The immense reach of blockchain makes it harder to hack as all transactions are transparent for all to see. Falsifying a single record in the chain means you would need to forge the entire chain. Bitcoin transactions sit on a blockchain.

A wallet is a secure digital wallet that is used to store, send and receive digital currency like bitcoin. It is typically a string of numbers and letters. Many official coins like bitcoin have official wallets, but you can find wallets which hold different types of currencies in one place.

To use a crypto wallet users will usually be given an ID as a way to identify the wallet along with its own private key which will help to authenticate and prove possession of the wallet by the person who owns it.

To carry out a transaction with digital currency, you will need two things. The first is a wallet which acts as your address and a private key. The private key is a string of random numbers, but unlike address, the private key must be kept secret. The private key gives users authority to digitally sign and authorise different actions that are done by the digital identity when used with the public key.

The main priority when dealing with cryptocurrencies is to keep the private key secure. It the key gets lost or stolen; there is no means to recover it.

The order book displays current prices with volumes in real-time of current order from buyers and sellers.

The price at which a person is trying to sell an asset is known as the Bid Price.

The ask price is the price individuals are trying to buy an asset for.

A period during which asset prices consistently keep rising is known as a Bull Market. To get the most out of investments, users are likely to enter the market at the beginning or just before the start of a Bull market. This is so the assets they buy become more valuable.

In the flip side to the Bull market, a bear market is a period during which the prices of assets consistently fall. The silver lining to this si that the drop in prices means that entering the market becomes cheaper, and it becomes possible to buy the same amount of assets for a lower price. Generally, Bear markets are not specific to cryptocurrencies, and any tradeable asset can go through the same life cycle.

Spread is referred to as the price difference between the buy price and the sell price of an asset. The exchange between the individuals defines them.

When an individual wants to purchase an asset at a designated price, buy order or bids are created. When an individual wants to sell an asset at a selected amount, sell orders, or asks are created.

In a 24-hour trading cycle, high means the peak price Bitcoin or other assets have reached in 24 hours. And so low means the lowest price the particular assets has become in the 24-hour trading cycle.

The difference between the price a trader expects and the trade to execute at, and the price it eventually executes at known as Slippage.

The official completion of a trading process is known as Execution.

Storing digital money in an offline wallet is known as cold storage and usually stored on a platform that has no connection to the internet. There are many Blockchain smartphones which now have cold storage capabilities.

Satoshi, named after the creator of Bitcoin, is the smallest unit of Bitcoin (BTC) recorded on the blockchain.

The act of a transaction which is included in a single block within the Bitcoin blockchain is known as confirmation.

Like a fingerprint, a digital signature is an e-signature which is created by using the Publick Key Cryptography (PKC). The digital signature associates securely, a signatory with a document in a recorded transaction. Every transaction has a different digital signature that depends on the users private key.

Each Bitcoin transaction incurs a fee. It is processed by a miner who is paid for their services, and the Bitcoin network confirms the results.

Author: Yasmita Kumar

A little bit about me: I am a writer and have been writing about various topics over many years now. I enjoy writing about my hobbies which include technology and its impact on our everyday life. Professionally I write about Technology, Health and Fashion and previously worked for the NHS.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Cryptocurrency has been impacting lives, no doubt, and Bitcoin has now become quite popular among the youth and even the adults, making smart investors extremely rich.

Cryptocurrency has been in existence for more than 10 years now. There is hardly a developed country, a civilized geographical location, or an economy of significance around the world still ignorant of the word “cryptocurrency.”

The fact is that even if one does not know what cryptocurrency is all about. Then definitely, you have heard about it from the news, colleagues, neighbors, friends, internet, newspapers, handouts, and souvenirs, and so on.

Bitcoin is taking the lead as the most popular and the most utilized cryptocurrency with billions of dollars of transactions being carried out with it daily. Now, this begs the question, why is cryptocurrency still not taught to students?

Schools are institutions for educating people. Thus, it is of great importance and a matter of necessity that courses or subjects related to cryptocurrency be taught in school systems. This initiative will serve as a means of equipping our young generations for the future to come since cryptocurrency symbolizes a new viewpoint on finance and, primarily, the economy.

In lieu of these, it is worthy of mention that schools should also consider teaching online academic translation services as provided by The Word Point. Nowadays, such skills are essential in virtually all spheres of life.

Why not read on as you discover the five(5) essential reasons why cryptocurrency should be taught to students.

The knowledge of cryptocurrencies have increased in the general population of the world and have undertaken a new shape over time. According to BitcoinWiki, in 2009, there was no cryptocurrency exchange; the users at that time were majorly cryptography fans who transferred bitcoin mainly as a hobby.

In 2010, a user, known as “Smoke too much,” auctioned 10,000 BTC for $50 without any buyer. Lazlo Hanyecs was also reported to have successfully bought two pizzas at Jacksonville, Florida, on the 22nd of May, 2010. This was the first recorded successful bitcoin transaction. On the 26th of June, 2019, Bitcoin hit $13000, which notable experts attributed to the development of the cryptocurrencies technology industry. This is to enlighten you concerning the history of the significant changes of Bitcoin as a major cryptocurrency. To open your minds to a new life-changing experience, and for you to reason and agree with me as per why cryptocurrency should be taught to students.

Taking into consideration, the rate at which cryptocurrency is growing concerning its wide acceptance, thousands of career opportunities are bound to manifest within the years to come.

Concerning a report by Coinbase, it was brought to public knowledge that the population of students from various departments who have become interested in cryptocurrency is growing so fast.

Some companies today are on the lookout for job-seeking graduates who are progressive-minded and are interested in fast-growing technologies. Likely, most of these employers are not well-grounded in the knowledge of cryptocurrency themselves. Hence, they need workers who are capable of bringing this knowledge to an organization.

In the world of crypto, Many opportunities abound, and the possibilities are limitless. Cryptocurrency and digital currency go hand in hand, such that a wide range of opportunities are opened for young scholars. The lists of potential careers for cryptocurrency lovers are virtually enormous.

Here are some few potential career opportunities you should look forward to:

According to the SI News blog, Cryptocurrencies have been forecasted to be utilized extensively in industries like Agriculture. Going by this report, it becomes evident that cryptocurrency technology is here to revolutionize the way we run our businesses.

In current times, workers are highly required by employers to collaborate and work across different departments. Several Interdisciplinary research is also growing in popularity in various universities in most developed countries.

For instance, the University of California-Berkeley started delivering a cryptocurrency class called “Blockchain, Crypto economics, and the Future of Technology, Business and Law” which has become quite popular among students.

Investment in cryptocurrency is highly encouraged for every business person or investor looking to make it big within a short period. It is indeed an excellent Investment platform given the astronomic rise in bitcoin rate in the year 2007 when it rose to its highest-ever to about $20,000, by which investors made a whole lot of money as a result of their investment.

Even though some investors or individuals will argue that Bitcoin is highly volatile and full of risk, the same principles that apply to businesses and investment opportunities are still applicable to an investment in cryptocurrency.

Following the growing trend of cryptocurrency, the impacts are becoming greater and more significant over time. This further stresses the reason why the course should be taught to students. Students need to be prepared for the crypto revolution to come.

Jake Gardner, a crypto analyst once said that “the impact of cryptocurrency is omnipotent considering the huge amount of benefits attached to it”. He also gave some notable advantages of cryptocurrency, which includes:

There is a strong need for cryptocurrency classes to be held in various schools, and it should not be handled with levity. Students should be well equipped and fortified with the knowledge of cryptocurrency to be economically relevant towards its full implementation in a few years to come. Given the reasons above, should cryptocurrency be taught in schools or not? I leave you with this question to ponder on.

About the author: Frank Hamilton is a blogger and translator from Manchester. He is a professional writing expert in such topics as blogging, digital marketing and self-education. He also loves traveling and speaks Spanish, French, German and English.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

At this point, cryptocurrencies will play a major role in the global financial industry soon. Millions of people are already using them, and these digital assets had a massive breakthrough in 2021. What’s even more important is that many companies and countries are starting to accept them.

In a world’s first, El Salvador became the only country to fully adopt Bitcoin and even use it for various trading purposes. That allowed the cryptocurrency to grow and stabilize itself even more. Even though many would think that El Salvador will be leading the pack in the crypto world, that did not concern Europeans too much.

Why? Because they already have a country that kind of regulates these digital assets and allows them to trade with them. That country is Estonia, and, in this article, we’ll be looking at why Estonia is considered the crypto capitol of Europe. Let’s dive into the details.

First, Estonia was among the first countries in the world to start regulating cryptocurrencies. It started accepting them around a decade ago and since then, became a haven for all crypto traders. That ‘tradition’ was kept over the years as all new traders in the continent are advised to invest in crypto here.

Aside from trading and making a profit, crypto users keep these digital assets to pay for services/products and for entertainment. One of the most popular entertainment types that you can participate in with crypto is online gaming, specifically casino sites.

Since online casinos operate on the Internet now and cryptocurrencies are fully optimized for online use, they were more than fond of allowing registered players to deposit and withdraw money with them.

Next up, Estonia is well-known for leaning towards technology. After all, apart from being known as the first country in Europe to regulate cryptocurrencies, it is also the first country in the world to introduce the e-Residency program, which is like digital citizenship.

This allows participants to use numerous services from the government, including starting an EU-based company without the need of travelling to Estonia.

When it comes to cryptocurrencies and payment methods, one interesting fact about Estonia is that it is a cashless society. Statistics show that 99% of all transactions are conducted digitally. Residents here are always looking for more efficient online payment methods and that is what led the country to cryptocurrencies.

As you may know, crypto transactions are instant, whereas transactions with regular payment methods can take up to a few days to be completed. That makes these digital assets perfect for paying online and conducting business.

Lastly, the Estonian government has recently tightened regulations as the Financial Intelligence Unit, which is under the wing of Estonia’s Finance Ministry, is now able to revoke crypto licenses in efforts to fight money laundering.

That makes this country extremely safe for all those who are willing to invest in cryptocurrencies. Extra security is always welcomed, especially in times when online scams are proving to be a massive problem. As data shows, more than $240 million has been lost in scams so far in 2021. Millions of people fall victim to this problem and all of us want that extra security layer.

Thanks to the fact that cryptocurrencies utilize cryptography, which provides a certain level of online anonymity, users are safer, but with Estonia’s regulations, that security is taken to the next level.

Open your free digital wallet here to store your cryptocurrencies in a safe place.