Basic terminology for beginners in regards to Bitcoin trading

For those interested in digital currencies, It has changed the way we do business and the way investors invest in a company. Employers are offering crypto as pay and others, such as music artists, are accepting them in exchange for singles. The attention crypto has attracted made it popular among many. One the biggest reason why many are attracted to crypto is that many of them sit on a decentralised network. This means an organisation or a government does not control them, unlike Fiat currency. Ther is also no physical form of cryptocurrency, but it can be converted into the more familiar notes and coins we know and love.

The introduction of Bitcoin brought with it new technology such a blockchain. The nature of blockchain makes it a secure way of working, and we will go into more detail about it below. It is essential to mention, however, that not all countries share standard consensus o what crypto is. Some view Bitcoin as exchange tokens. Others view crypto in the same light as hard cash. These anomalies in the crypto world mean taxes for Bitcoin differ from country to country which why before investing, purchasing or dealing with crypto, it would be wise to find out the countries views on it.

A big part of making an investment in Bitcoin and other cryptocurrencies and being successful at it means learning the lingo. Here are some of the underlying crypto trading terms that are commonly used. Knowing these terms will help you navigate your way through the world of crypto in ease.

Blockchain

Blockchain is a decentralised and distributed public ledger which means it is a database that is validated by a vast community of people rather than a central authority. In most cases, blockchain refers to the bitcoin blockchain, which is made up of blocks. It allows data to be stored globally on thousands of servers and lets individuals enter the networks to see all the entries in real-time. By doing this, it makes it hard for users to gain control of the system. The immense reach of blockchain makes it harder to hack as all transactions are transparent for all to see. Falsifying a single record in the chain means you would need to forge the entire chain. Bitcoin transactions sit on a blockchain.

Wallet

A wallet is a secure digital wallet that is used to store, send and receive digital currency like bitcoin. It is typically a string of numbers and letters. Many official coins like bitcoin have official wallets, but you can find wallets which hold different types of currencies in one place.

To use a crypto wallet users will usually be given an ID as a way to identify the wallet along with its own private key which will help to authenticate and prove possession of the wallet by the person who owns it.

Private Key

To carry out a transaction with digital currency, you will need two things. The first is a wallet which acts as your address and a private key. The private key is a string of random numbers, but unlike address, the private key must be kept secret. The private key gives users authority to digitally sign and authorise different actions that are done by the digital identity when used with the public key.

The main priority when dealing with cryptocurrencies is to keep the private key secure. It the key gets lost or stolen; there is no means to recover it.

Order Book

The order book displays current prices with volumes in real-time of current order from buyers and sellers.

Bid Price

The price at which a person is trying to sell an asset is known as the Bid Price.

Ask Price

The ask price is the price individuals are trying to buy an asset for.

Bull Market

A period during which asset prices consistently keep rising is known as a Bull Market. To get the most out of investments, users are likely to enter the market at the beginning or just before the start of a Bull market. This is so the assets they buy become more valuable.

Bear Market

In the flip side to the Bull market, a bear market is a period during which the prices of assets consistently fall. The silver lining to this si that the drop in prices means that entering the market becomes cheaper, and it becomes possible to buy the same amount of assets for a lower price. Generally, Bear markets are not specific to cryptocurrencies, and any tradeable asset can go through the same life cycle.

Spread

Spread is referred to as the price difference between the buy price and the sell price of an asset. The exchange between the individuals defines them.

Buy order

When an individual wants to purchase an asset at a designated price, buy order or bids are created. When an individual wants to sell an asset at a selected amount, sell orders, or asks are created.

High and Low

In a 24-hour trading cycle, high means the peak price Bitcoin or other assets have reached in 24 hours. And so low means the lowest price the particular assets has become in the 24-hour trading cycle.

Slippage

The difference between the price a trader expects and the trade to execute at, and the price it eventually executes at known as Slippage.

Execution

The official completion of a trading process is known as Execution.

Cold storage

Storing digital money in an offline wallet is known as cold storage and usually stored on a platform that has no connection to the internet. There are many Blockchain smartphones which now have cold storage capabilities.

Satoshi

Satoshi, named after the creator of Bitcoin, is the smallest unit of Bitcoin (BTC) recorded on the blockchain.

Confirmation

The act of a transaction which is included in a single block within the Bitcoin blockchain is known as confirmation.

Digital signature

Like a fingerprint, a digital signature is an e-signature which is created by using the Publick Key Cryptography (PKC). The digital signature associates securely, a signatory with a document in a recorded transaction. Every transaction has a different digital signature that depends on the users private key.

Transaction Fee

Each Bitcoin transaction incurs a fee. It is processed by a miner who is paid for their services, and the Bitcoin network confirms the results.

Author: Yasmita Kumar

A little bit about me: I am a writer and have been writing about various topics over many years now. I enjoy writing about my hobbies which include technology and its impact on our everyday life. Professionally I write about Technology, Health and Fashion and previously worked for the NHS.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How to buy Bitcoin with bank account

How to buy bitcoin with bank accounts? Read this step-by-step guide to convert your fiat currencies into your favorite digital currency.

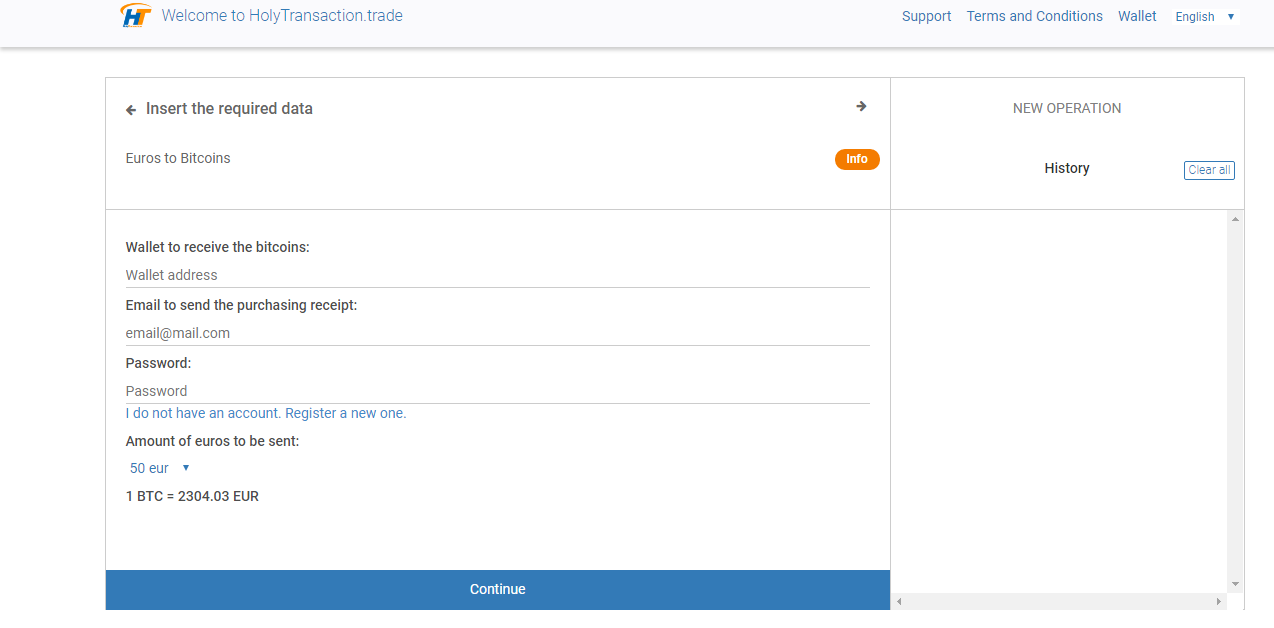

We recently opened a new service called HolyTransaction where you can buy and sell bitcoins.

This is an important feature when you need to buy or sell bitcoin immediately. You just need to create an account on HolyTransaction.

You just need to visit HolyTransaction and follow the process you can read below.

This guide will enable you to buy bitcoin with bank account.

- Visit the Funding page inside your account;

- Choose your method (bank transfer in this case)

- Click on the blue “Deposit” button;

- Fill the form with your information

5. Insert the amount that you want to transfer for your purchase and then click “Next”

6. Wait for the validation of your order. This process of verification will one or two minutes.

6. Then you will need to pay the amount of EUR you decided, so you need to order the bank transfer from your bank account. You will see the IBAN where you need to send the fiat currency to and you must include the reference.

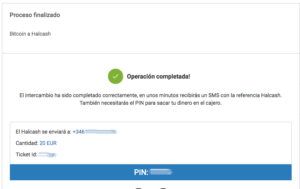

7. Then you will see a countdown that starts from 48h. At the end of that, the operation will be completed. You will see a similar image as shown below:

NOTE: the max amount you need to buy daily is 4500 EUR. Bank transfer needs 48h to be received.

Open your account on HolyTransaction here

Open your free digital wallet here to store your cryptocurrencies in a safe place.

IBM Blockchain Oil trade platform: a new innovative project

IBM – together with a group of other companies – has announced the development of a new blockchain-based crude oil trade finance platform.

This group also includes Trafigura and Natixis bank that decided to join the creation of this new tool.

The platform was created by using code from the Linux Foundation-led Hyperledger project. Also, IBM’s BlueMix cloud hosting service is utilized.

Thanks to this trade finance platform, users can view transaction data on the blockchain that also hosts documentation and updates on shipments, deliveries and payments.

Natixis is also a member of the R3 distributed ledger consortium and isn’t new to blockchain-related trade finance applications because it also joined the “Digital Trade Chain” project a few months ago.

According to, Natixis’ head of global energy and commodities, Arnaud Stevens, the bank believes the technolgy as a high potential of bringing down expense and boosting procedural transparency.

These are his words:

“We want to use blockchain to optimize the antiquated arena of commodity trade finance. The current process is paper and labor intensive, we have multiple friction points with high processing costs and limited automation. Distributed ledger technology brings some much-needed innovation into our industry.”

This news is only the latest related to projects that aims at bridging of the blockchain and trade finance worlds.

Also, we have to say that this is an application that attracted much interest from a wide range of companies and governments worldwide, including Dubai.

In the meantime there are also several other worldwide banks that are continuing to push ahead with related projects focused on the blockchain and commodities trade.

A few days ago, in fact, Dutch bank ING is working on an oil trading pilot built on the Ethereum blockchain that has already conducted live transactions.

Open your free digital wallet here to store your cryptocurrencies in a safe place.