Basic terminology for beginners in regards to Bitcoin trading

For those interested in digital currencies, It has changed the way we do business and the way investors invest in a company. Employers are offering crypto as pay and others, such as music artists, are accepting them in exchange for singles. The attention crypto has attracted made it popular among many. One the biggest reason why many are attracted to crypto is that many of them sit on a decentralised network. This means an organisation or a government does not control them, unlike Fiat currency. Ther is also no physical form of cryptocurrency, but it can be converted into the more familiar notes and coins we know and love.

The introduction of Bitcoin brought with it new technology such a blockchain. The nature of blockchain makes it a secure way of working, and we will go into more detail about it below. It is essential to mention, however, that not all countries share standard consensus o what crypto is. Some view Bitcoin as exchange tokens. Others view crypto in the same light as hard cash. These anomalies in the crypto world mean taxes for Bitcoin differ from country to country which why before investing, purchasing or dealing with crypto, it would be wise to find out the countries views on it.

A big part of making an investment in Bitcoin and other cryptocurrencies and being successful at it means learning the lingo. Here are some of the underlying crypto trading terms that are commonly used. Knowing these terms will help you navigate your way through the world of crypto in ease.

Blockchain

Blockchain is a decentralised and distributed public ledger which means it is a database that is validated by a vast community of people rather than a central authority. In most cases, blockchain refers to the bitcoin blockchain, which is made up of blocks. It allows data to be stored globally on thousands of servers and lets individuals enter the networks to see all the entries in real-time. By doing this, it makes it hard for users to gain control of the system. The immense reach of blockchain makes it harder to hack as all transactions are transparent for all to see. Falsifying a single record in the chain means you would need to forge the entire chain. Bitcoin transactions sit on a blockchain.

Wallet

A wallet is a secure digital wallet that is used to store, send and receive digital currency like bitcoin. It is typically a string of numbers and letters. Many official coins like bitcoin have official wallets, but you can find wallets which hold different types of currencies in one place.

To use a crypto wallet users will usually be given an ID as a way to identify the wallet along with its own private key which will help to authenticate and prove possession of the wallet by the person who owns it.

Private Key

To carry out a transaction with digital currency, you will need two things. The first is a wallet which acts as your address and a private key. The private key is a string of random numbers, but unlike address, the private key must be kept secret. The private key gives users authority to digitally sign and authorise different actions that are done by the digital identity when used with the public key.

The main priority when dealing with cryptocurrencies is to keep the private key secure. It the key gets lost or stolen; there is no means to recover it.

Order Book

The order book displays current prices with volumes in real-time of current order from buyers and sellers.

Bid Price

The price at which a person is trying to sell an asset is known as the Bid Price.

Ask Price

The ask price is the price individuals are trying to buy an asset for.

Bull Market

A period during which asset prices consistently keep rising is known as a Bull Market. To get the most out of investments, users are likely to enter the market at the beginning or just before the start of a Bull market. This is so the assets they buy become more valuable.

Bear Market

In the flip side to the Bull market, a bear market is a period during which the prices of assets consistently fall. The silver lining to this si that the drop in prices means that entering the market becomes cheaper, and it becomes possible to buy the same amount of assets for a lower price. Generally, Bear markets are not specific to cryptocurrencies, and any tradeable asset can go through the same life cycle.

Spread

Spread is referred to as the price difference between the buy price and the sell price of an asset. The exchange between the individuals defines them.

Buy order

When an individual wants to purchase an asset at a designated price, buy order or bids are created. When an individual wants to sell an asset at a selected amount, sell orders, or asks are created.

High and Low

In a 24-hour trading cycle, high means the peak price Bitcoin or other assets have reached in 24 hours. And so low means the lowest price the particular assets has become in the 24-hour trading cycle.

Slippage

The difference between the price a trader expects and the trade to execute at, and the price it eventually executes at known as Slippage.

Execution

The official completion of a trading process is known as Execution.

Cold storage

Storing digital money in an offline wallet is known as cold storage and usually stored on a platform that has no connection to the internet. There are many Blockchain smartphones which now have cold storage capabilities.

Satoshi

Satoshi, named after the creator of Bitcoin, is the smallest unit of Bitcoin (BTC) recorded on the blockchain.

Confirmation

The act of a transaction which is included in a single block within the Bitcoin blockchain is known as confirmation.

Digital signature

Like a fingerprint, a digital signature is an e-signature which is created by using the Publick Key Cryptography (PKC). The digital signature associates securely, a signatory with a document in a recorded transaction. Every transaction has a different digital signature that depends on the users private key.

Transaction Fee

Each Bitcoin transaction incurs a fee. It is processed by a miner who is paid for their services, and the Bitcoin network confirms the results.

Author: Yasmita Kumar

A little bit about me: I am a writer and have been writing about various topics over many years now. I enjoy writing about my hobbies which include technology and its impact on our everyday life. Professionally I write about Technology, Health and Fashion and previously worked for the NHS.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Easy Bitcoin Exchange: how to use HolyTransaction

Are you looking for an easy Bitcoin exchange?

Holytransaction offers a simple solution for your needs, as you can convert bitcoin and other digital currencies within your multi-currency wallet.

So, if you have a wallet on HolyTransaction or you want to open one, you can exchange your cryptocurrencies in a few minutes and without providing any personal documents.

This way you can avoid the long wait you experience on the common exchange platforms.

So, let’s try to understand how to use our easy bitcoin exchange.

Read this step-by-step guide to convert your digital currencies on HolyTransaction.

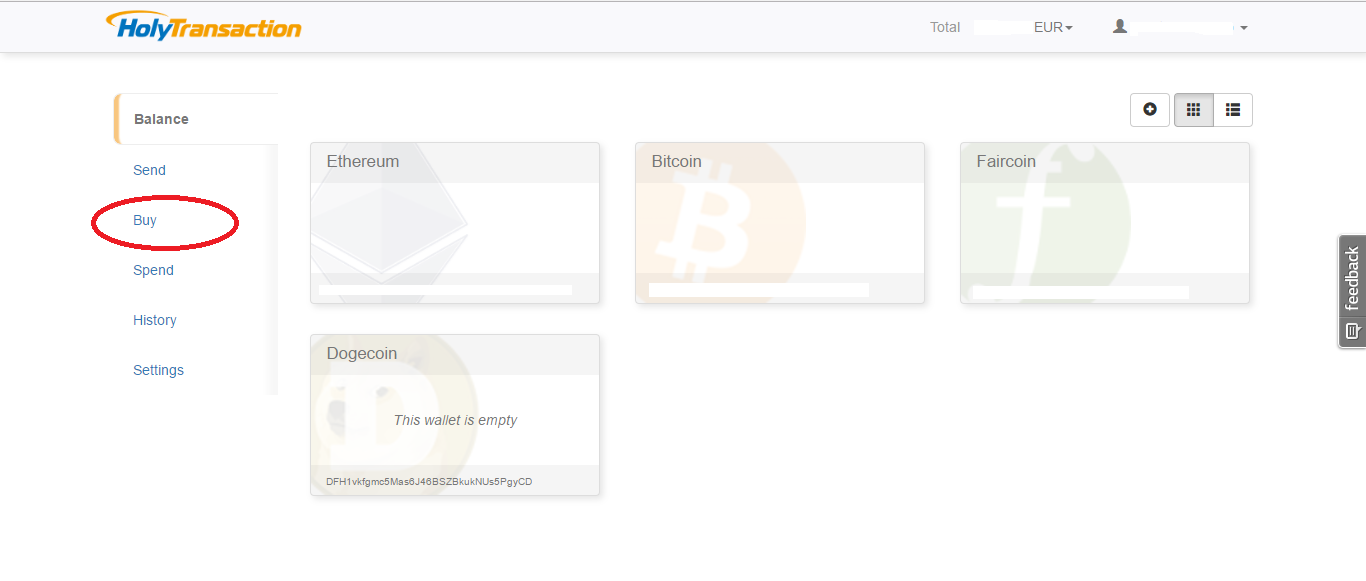

- Login or sign up on HolyTransaction.com;

- Click on “Buy” in the menu you can find on the left as shown below:

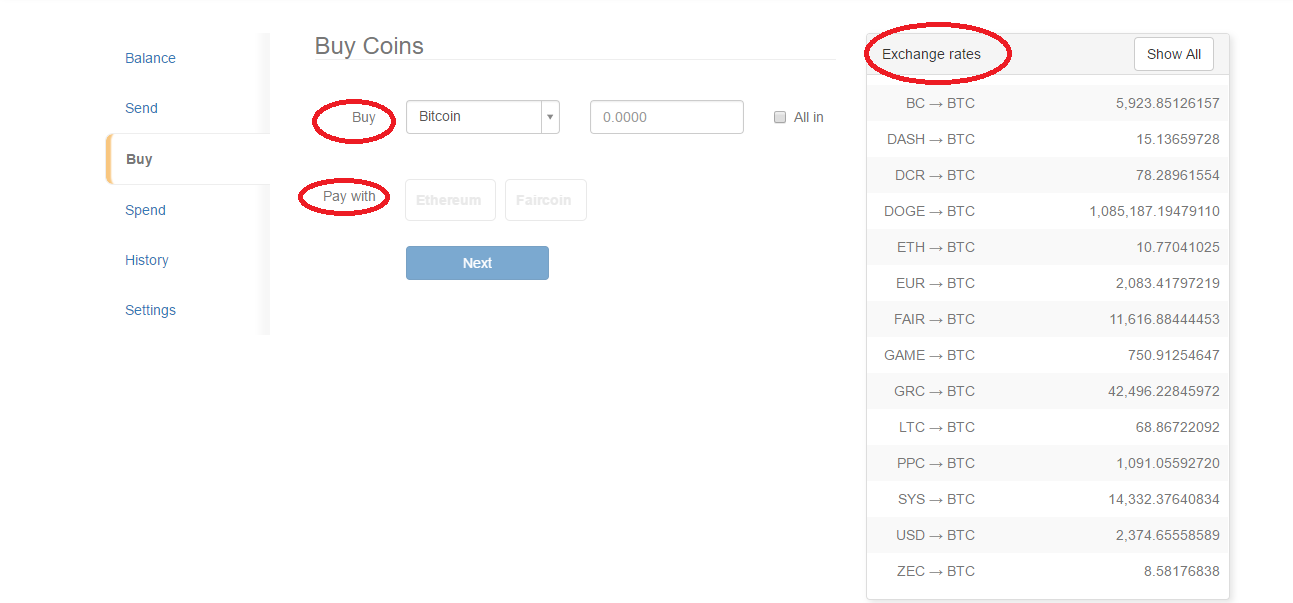

3. You will see the page below where you can set the digital currency you want to buy and the cryptocurrency you want to spend. You can see the exchange rates in the tab on the right;

3. You will see the page below where you can set the digital currency you want to buy and the cryptocurrency you want to spend. You can see the exchange rates in the tab on the right;

4. Then you can click on the blue “Next” button;

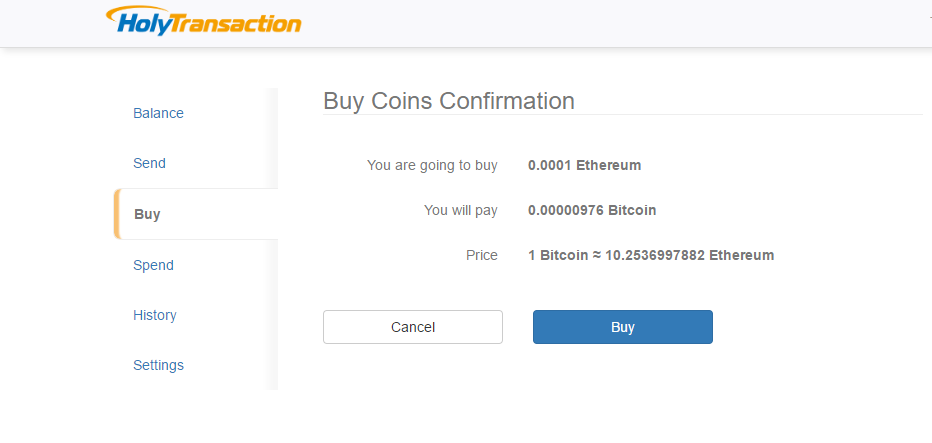

5. You will see the confirmation page. Click on “Buy” to confirm the conversion:

This is a very easy digital currencies exchange, isn’t it?

Please note: it only works between the 30 digital currencies we support (bitcoin, ethereum, zcash, peercoin, dogecoin, litecoin, gamecredits, faircoin, decred, dash, blackcoin, gridcoin and syscoin).

Conversely, if you want to buy bitcoin with fiat currencies, you need to use HolyTransaction Funding to buy bitcoin with credit card, or buy Bitcoin with bank transfer

Enjoy our wallet and our easy bitcoin exchange here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

9 Best Bitcoin Video Animations

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Infographic: A basic overview of storage practices

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin ~ Hands On Code: Discover Bitcoin Open-Source Technology

LUISS ENLABS in collaboration with Bitcoin Foundation Italia and

Codemotion presents the first of a series of technical conferences

“Bitcoin ~ Hands On Code”.

The event will take place on Wednesday, 2nd of July, from 4pm to 8pm and enjoys the participation of speakers Thomas Bertani, Founder&CEO BitBoat Ltd, Guido Dassori, IT&building automation Freelancer, Luca Matteis, Semantic Web Developer, as well as Francesco Simonetti, Andrey Zamovskiy, Nickolay Babenko in live streaming from San Francisco.

The mission of the conference is to remove friction between bitcoin and

developers, encouraging the development of an appropriate tech scene

around Bitcoin, an incredible open-source based technology, aiming to

disrupt finance and money as we know them today.

There’s an

enormous opportunity for developers, who are already jumping in and will

have a real impact on the future, contributing to this open-source

technology.

Jump on board!

Program:

16.00 – Welcome: Tobia De Angelis, Augusto Coppola

16.15 – 17.15 – Panel moderated by Franco Cimatti, Developer and President of Bitcoin-Italia: Speakers’ interventions

17.15 – 17.30 – Break

17.30 – End (Around 20.00) – Hands on Code, guided by Thomas Bertani, a developer with a deep expertise in bitcoin/blockchain and founder of BitBoat.net.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

You say Bitcoin has no intrinsic value? Twenty-two reasons to think again!

Intrinsic Value Defined:

we will use the common Wikipedia entry for the intrinsic theory of

value. This is found at: http://en.wikipedia.org/wiki/Intrinsic_theory_of_value

An intrinsic

theory of value (also called theory of objective value) is any theory

of value in economics which holds that the value of an object, good or

service, is intrinsic or contained in the item itself. Most such

theories look to the process of producing an item, and the costs

involved in that process, as a measure of the item’s intrinsic value.

the properties that make it valuable? Some pundits like Warren Buffett

seem to remain stuck in the belief that only things you can touch, feel,

and see can be intrinsically valuable.

are unique or ground-breaking. These properties did not exist before

bitcoin. Some people would rightly point out that many of these

properties can be duplicated. There is, however, one extremely important

factor that separates bitcoin from any other digital coins on the

horizon: the protective shell created by the network that prevents it

from being hacked or commandeered

Bitcoin intrinsic value properties:

- It transcends nations, politics, religions, cultures and regulations.

These vary from country to country in ways that may seem bizarre to

populations out of its own borders. While one may believe that

governments always have their best interests at heart, it may be wise to

see that knife cuts both ways. Some drugs are banned in certain states

or countries that are allowed in others. Bibles are banned from purchase

is some countries. Religion, custom, dogma, superstitions prevent

various purchases based on man-made borders that continually shift over

time. These policies tend to be created by limited segments of

populations that can be self-serving. If one happens to be included in

the “correct” political party, race, religion, items can be purchased or

outlawed. It’s all opinion.

Is this a moral decision? Many of the same governments think it morally

acceptable to hold their own state-lotteries. The lotteries hold

significantly worse odds and tends to target those in the community that

are the least educated and most susceptible to poverty, alcohol abuse,

and have a generally poor understanding of mathematical probability.

Many have gone on to say that lotteries are simply “a tax on people bad

at math”. Many argue that this is a double standard of governments

which prevents them from taking the moral high ground.

the short term). It can’t be counterfeit. There is a record of who owns

it (by wallet id) and its validity is publicly known. It requires no

central clearing house. With any other currency, one must trust the

government from which it is issued will continue to maintain its value

by not “overprinting” to pay for its own mismanagement. You can send it

globally without having to trust anybody. This is not true with any

state issued country, bank, credit card company, or anybody else.

Volatility and long-term trust is still building, but when one transacts

in bitcoin, nobody gets in-between sender and receiver unless agreed

beforehand. It’s permission-less.

By making wallet IDs public, one can track the flow of money through

other transparent wallets. You cannot do that with any other currency.

You can use this feature to do things like monitor your children’s use.

This can make obsolete entire industries that are built solely on the

fact that money can be hidden, disguised, cheated, etc. These can also

happen to bitcoin, but pressure can be applied by the people to make it

transparent and accountable when needed. Auditors may insist on it for

compliance. The list of possibilities of this intrinsically valuable

feature can scarcely be imagined.

Plans for product layers on top of bitcoin to further its use to become

spendable based on contracts that can be programmed to complete with

built in variables, or be valid to purchase only certain items. Insist

your college bound kid buys books and not beer for example. Or based on

GPS in a cell phone, you could send your kids off shopping and it could

be programmed to be spendable only in certain stores.

Wallets containing the currency can be set to only unlock with more

than one signing key. This will leave hackers and thieves frustrated.

Try doing that with your grandpa’s money. It is an intrinsic piece of

bitcoin technology.

Prepaid credit cards can do some of these functions, but only to

locations and countries that accept credit cards. This list of locations

in countries outside of the US is actually decreasing with the amount

of fraud in the networks. Technically, the only item limiting of bitcoin

is the merchant’s acceptance of it. Given the natural law of least

resistance, these limitations could erode as more merchants around the

world realize the potential savings. The network effect will continue to

work its magic.

Absolute clarity of events and their corresponding order is available

in the block chain. Proof of ownership and purchase can be established

without a third party. The trusted and reliable distributed ledger

cannot reasonably be altered (barring a massive scale network attack

which becomes less likely as the network grows).

is nobody’s debt. Paying with bitcoin isn’t a “promise to pay”. It is

payment in full. This could potentially reduces fraud related expenses

on massive scale. http://www.statisticbrain.com/credit-card-fraud-statistics/ There

is no need for a merchant to get bank information or any other kind of

personal information that can be later used in identity theft.

It can defeat government issued capital controls. The same governments

try to hold their own citizens “hostage” monetarily by outlawing

movement of money outside its own borders. Ask any citizen from any

country ravaged by hyperinflation if this is important. Could it be

possible that it might ever become important

in the USA? If you can foresee the day people will be clamoring to get

out of the US dollar, where do you think they are going to go? Ask

Argentina.

As the money exists on the global ledger, all you need is the key. This

can be memorized, or written on any piece of paper – even confined

inside a microdot

the size of the period that ends this sentence. Some old time gold bugs

say you can’t bribe the border guards with bitcoin like you can gold. In

the future, border guards will have cellphones and internet access too.

We aren’t living in the 1960s Vietnam or before any longer.

The people in the USA may think this unimportant in their bubble view

of the world, but is this also true of the 150 or so currencies and countries with terrible track records?

Which other currency enjoys this property? Will enough of the world

outside of the US believe it to be so? Is it hard to imagine the

properties of bitcoin being intrinsically valued by populations

subjected to terrible economic policies? It only takes a billion people

in India fed up with corruption to want an escape mechanism out of the

control of the system. At that point, they won’t give a hoot about what

some American pundit said on “bubble vision” about intrinsic value.

If the citizens stand up united and demand a transparent government,

they can use bitcoin to follow the money in the same way governments use

powers at their disposal for surveillance on their own populations. In

today’s world money corrupts. In tomorrow’s maybe it will become

vice-versa. Let’s see if 86% of the world agrees that any tool that makes less opportunity for corruption is valuable.

You can program it to settle contracts based on certain events such as

date, proof of ownership, death, or a host of other factors that can be

validated programmatically without a third party to validate if the

conditions were met. It can be used as a record keeping asset tag, and

proof of ownership. Ownership of the private key to the bitcoin is by

definition, the owner. In addition, it can be the source record of

ownership for property title, copyrights, and intellectual property that

transcends borders and locally interpreted laws. In effect, the

records become the de-facto “single source of truth”. The currency

itself is globally accessible proof of ownership. Can these functions

and properties be reasonably argued to be valuable beyond the currency

itself?

Paying for items in a global world requires bank accounts. Bank

accounts are legal properties that can only be established with those of

legal age (18 in most locations). There is no minimum age requirement

to pay for items globally using bitcoin. How many people under 18 have

cell phones, AND need to spend money with no credit card. Smart

businesses have started to recognize this intrinsically valuable

potential.

The main attributes of money are often quoted these days, but one

attribute is rarely mentioned. Money has become surveillance. As people

continue to learn of the horrors of the NSA and other government efforts

to spy on every aspect of their lives, it only takes one person drunk

with power to make all the well-intention sounding policies reverse into

shocking horror. One government required Jews to register themselves

for easy identification, which was then used to “dispose” of them.

national origin, political party, age, place of work, address, and much

more can be determined by how and where one spends their money. To those

who think they have nothing to worry about because they are not doing

anything wrong, might ask themselves, what did the Jews have to fear

during the time they were self-registering? They also were not

(generally) doing anything wrong. That’s only one example in a history

littered with them. Is the ability to obscure one’s spending habits

intrinsically valuable? Is it possible to imagine how much of the

population of the world would think it is?

If one were to transfer value between large companies or nations, much

of the world has discovered bitcoin to be a very efficient payment

network to do this. If bitcoin was thought of as envelopes to be stuffed

with dollars or other currencies for transport, only the size of the

envelope itself that contains the dollars inside would be the limiting

factor. To increase the ability and usefulness of this feature, the

envelopes represented in bitcoin price will have to inflate enormously

to take on that load. The Federal Reserve and former Vice Presidents have caught on. So has smart Venture Capitalist firms that have a knack for being one step ahead of everybody else.

are being built up around the new currency (in use, if not government

recognition). Gold towns sprang up into eco-systems but crashed when

the gold veins ran dry. We know exactly how deep the bitcoin well can go

and the rate at which it will be found. What other modern day

ecosystems are being built because of the intrinsic values of a

currency?

for centuries. Bitcoin has the possibility to change the paradigm

completely. These banks will likely find ways to maintain their power

and wealth and there is nothing preventing them from moving into digital

currencies to maintain it. However, which other currency has the

possibility to change the dynamic? Many in the world will likely place

much value in the paradigm shift that is possible. When was the last

time a monetary unit threatened to rewrite the rules from the ground up?

from a whistleblower from the World Bank reports that all networked

banking infrastructure throughout the entire world can be traced back to

12 people who make decisions at the privately controlled US Federal

Reserve bank. Consensus driven, public records, and democratization of

money made possible by bitcoin, might change the rules.

the poverty riddled villages with no access to banking were able to

lift themselves out of poverty with simple abilities to pay suppliers

and start businesses. With the cross border scale and usability of

bitcoin, imagine the same results x 1,000. Are there any national

currencies up to this task?

Muggers of the future will be at a loss for what to do with the bitcoin

they can’t take from your wallet or purse. That money will be no good

to them without the private keys to spend it. There likely will no

longer be credit cards there was well. Could robbery itself become

obsolete? Hackers will soon have a difficult time stealing money from

multi-signature wallets.

Because of all of the reasons stated above, it might as well be called

the currency of freedom. Dictators will hate it. Totalitarian

governments will hate it in proportion equal to the amount of corruption the government enjoys.

The worst countries for freedom believe that money exist primarily to

serve the country and personal ownership of it is just an illusion they

can confiscate at will. Banks technically own it as soon it’s deposited.

Through court order, government taxation, or inflation, they always get

it back. Bitcoin offers some protection. We become our own bank.

Others might be open to the suggestion that if just ONE of these

factors is agreeable to most reasonable people, the description used by

Wikipedia might also be applied to bitcoin. A year from now, there

might be another list compiled that is just as long as this one – of

things that can’t possibly be imagined today.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Twenty mind-bending secrets about Bitcoin

(BitcoinMagazine) This article will introduce some of bitcoin’s Mind-Bending amazing

abilities only few people know. As you read this list, remember your

favorite so can impress your friends with your new

incredible bitcoin knowledge.

1. Fun with programmable money

- Bitcoin wallets are like personal debit cards that you can create

and assign yourself to store your bitcoin. Some new wallet versions can

be programmed with bizarre abilities. - You can program features like GPS coordinates on your phone that make the money unavailable off if your kid leaves the city.

- You can also create “treasure hunts” where coins will suddenly be

released for you to use if you find yourself in the right place at the

right time. - You may also release money by calendar dates – gifting bitcoin

money that can’t be used until their 18th birthday or Christmas. Or set

up a will that releases amounts in intervals long after your death. - Huge potential for ideas not yet imagined.

2. First purchase with bitcoin

- Bitcoin’s price wasn’t established by a committee, government, or special council.

- Florida resident Laszo Hanyez may go down in history for buying the

most expensive pizza ever recorded. He also makes history for making the

first significant purchase using bitcoin. - His 10,000 bitcoins used in June of 2010 bought two Papa John’s Pizzas worth about $30 at that time.

- Today’s equivalent price is about $5 million.

- For the first 18 months they were worthless. The pizza purchase was

the event that set the price of bitcoin at about a third of one penny

each. - Within weeks, they were being bought and sold for 8 cents, representing a price increase of over 1,000%.

3. Bitcoins to billions

- In 2013 the price of a single bitcoin went from $13 to over $1,000 for an increase over 7,000%.

- At that rate, the owner of one bitcoin today would be a millionaire in two years.

- And would become a billionaire only 18 months after that.

4. Bitcoin is not alone

- Thousands of other digital currencies have since been created once bitcoin became popular.

- Litecoin, Peercoin, Dogecoin and many more can be purchased on various online exchanges.

- Thousands of people buy altcoins, hoping the bitcoin lighting strikes twice.

5. World’s fastest supercomputer

- The current computing power protecting the Bitcoin network is over

6,000 times more powerful than the top 500 supercomputers of the world

combined. And still growing faster. - Computer power is measured in “petaflops”. One petaflop is equal to one thousand trillion calculations per second.

- Top 500 supercomputers combined can calculate 250 petaflops. (Indicated by the arrow on the graph below).

- By comparison, the bitcoin network can calculate 883,000 petaflops.

- It is roughly the equivalent in scale between eight sticks of butter verses the largest 15,000 pound African Elephant.

6. The amazing bitcoin wallet

- Before you buy bitcoin you can create your own personal bitcoin wallet before you fund it.

- The number of possible wallet IDs that can be created are roughly the same amount as atoms on the earth.

- You can create as many as you want. They are free.

- New wallets can be secured with two or more passwords.

- You can also print your wallet to make a “Paper Wallet” that allows you to store your bitcoin off-line.

7. Spend bitcoin with smart phones for everyone

- The $25 smartphone is on the way.

- It is estimated that in 2014 there will be more cellphones than people on earth.

- Many poor countries just skipped land-line telephones and went straight to cellphones.

- Where they don’t have electricity, they charge them daily using solar panels.

- Most developing countries do not have access to banking – but the bank can come to them with bitcoin and a smartphone.

- Sending digital cash has already proven to lift entire villages out of poverty.

- This opens up their entire world from which to buy and sell items rather than just a few neighbors with cash on hand.

8. Magic the Gathering and bitcoin

- The first big online bitcoin exchange was Mt. Gox. It got its start and name by trading playing cards for “Magic The Gathering Online EXchange.

- They once accounted for over 80% of all Bitcoin trades.

- They started trading bitcoins when they were worth less than a dollar.

- Unsurprisingly, when the world found out that bitcoins were worth a

lot more than playing cards, the tiny company was overwhelmed. - More than half of all first generation Bitcoin exchanges have closed down.

- Now big finance companies are creating their own exchanges in the US that are regulated and insured.

9. Say goodbye to “Bitcoin” and hello to “Bits”

- Currently, one full bitcoin is divisible down to eight decimal places.

- The Bitcoin community has started referring the the sixth decimal point from a full bitcoin where they will be called “bits.”

- Bits are part of bitcoins as pennies are to a dollar – except it would take a million of them to buy a full bitcoin.

- Calling them “nano-dimes” sounded dumb.

- Today one hundred dollars migh buy you .2 bitcoins. Or it can buy

you 200,000 bits. It’s the same amount, but which one makes you feel

richer? - At some point, we might be able to sing that song (commonly played with hand- drums). “Shave and a haircut.. 2 BITS”

10. Spy Vs Spy. Your bank in a microdot

- Future Bitcoin billionaires can include their entire banking Bitcoin

fortune – in a dot the size of a period. When you have access to any

computer or phone with Internet connection you can simply type in your

account number and password as needed. - Your account is all stored and available to you on the public ledger

available anywhere in the world with an Internet connection.

11. Forget money laundering. Your activity is recorded

- Every transaction is tracked the Bitcoin public ledger, recorded and

shared around the world. The ledger cannot be changed and it’s

continually reconciled, verified and protected by bitcoin’s world-wide

network. - Every time a bitcoin trades hands, a trail of digital breadcrumbs follows it forever.

- You may or may not allow people to know your personal wallet

information, so your bitcoin account is as secret as you want it to be. - Once bitcoin passes through widely known wallet addresses, it may be

traceable by super-secret organizations that may, or may not, rhyme

with Em- essay. - Relax, if you aren’t doing any really, really bad – it’s probably

not worth the trouble for anybody to track your every spend. Not one

bit.

12. Gambling once accounted for most transactions

- The web gambling site “Satoshidice” once accounted for about half of bitcoin transactions.

- Due to murky gambling laws in various jurisdictions, gaming on Satoshidice is currently not allowed from US-based IP addresses.

- Provably Fair (http://provablyfair.org/)

is a website that has risen to act as an independent probability odds

checker for people to validate the odds of customer bets being

mathematically fair for the computers running the gaming systems. - Many online casinos are having their computer programs independently and voluntarily certified.

- Today bitcoin use is spread over several industries in addition to gambling.

13. Watch people trade in their paper money

- The website Fiat Leak shows a world map which allows you to see which country is exchanging their native currency for bitcoin in real-time.

- The larger the coin floating up – the bigger the dollar amount.

- The amounts all accumulate over a 10 minute period, which is the

point that the ledger is reconciled and copied throughout the world for

verification. - Once you go digital, you don’t go back.

- Ask the tape recorder.

14. It might become currency for poorly run countries

- Total value of bitcoin measured in US Dollars has surpassed 100 national currencies out of 160.

- Some are

beginning to ask if it is possible to one day to scrap some smaller

national currencies that continue to fail – and use bitcoin instead.

15. Bitcoin may be more important than the internet

- Several hundred million dollars are projected to be invested into Bitcoin startups by large corporations in 2014.

- Comparisons of importance are made by experts and scientists daily,

who often talk about the importance of how this will change the world

and often compare it with the invention of the Internet itself. - Marc Andreessen, who invented Mosaic, the first web browser, is one of many technical professionals who talk about Bitcoin and

reminds him of how he and his friends changed the Internet and World

Wide Web back in 1993 when it was still considered a techie geek

technology. As a reference point, most of the US was using the internet regularly just seven years later.

16. Watch bitcoin network grow

- See the time-lapse representation of the bitcoin network build out as it assembles and grows together around the world.

- It’s not much different than watching the progress of the early internet grow.

17. Robbing money may become obsolete

- New digital wallets will require at least two signatures (passwords) or more to use.

- This might include government’s robbery of its own citizens as many countries help themselves to one’s banking funds when they want.

- One can require as many signature passwords as you like. Go nuts and

require 51 signatures… Imagine the Senate being compelled to reach

majority before spending your taxes locked in a public wallet.

18. It can stop identity theft

- As making payments with bitcoin is the equivalent of cash, there is no banking information required from a retailer.

- The hacker attack at Target, Neiman Marcus, and Michael’s (among a

host of others) that stole users banking credit card information

wouldn’t have happened if they had only accepted bitcoin payment. - Paying in bitcoin is not a promise to pay. It’s payment in full.

19. No permission required

- Over half of the world have no banking account. They can’t get

access to regular loans, credit or checking account. They can’t get

permission from the creditors. - Bitcoin doesn’t require a bank account or credit report, and you

don’t have to be of legal age for contracts. And they can buy and sell

in a world-wide market for once. They didn’t need permission from the

courts. - One doesn’t need to be a citizen, or have identification or forms to fill out to own it. It requires no government permission.

- You are your own bank. No permission required.

20. Bitcoin the currency is only the beginning

- The Bitcoin network and ledger has features that can also function

as a way to store records of ownership, titles, copyrights and

trademarks, home and car titles. - It can replace the function of a notary public.

- All records are shared and distributed in a central location shared

by the entire world copied on thousands of millions of computers. - As the Internet did to the publishing industry, Bitcoin could

similarly disrupt several other fields or even render them obsolete. - Anybody’s job it is to move funds from one account to another may

need to learn a job as those functions can now be programmed, automated

and transparent. - Bitcoin 2.0 technologies and new start-up companies have already begun.

This list is only the start. Look into the amazing bitcoin and report

back your own found mind-benders in the comments section. Then play

bitcoin trivia with your friends – they may not believe you.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

10 things you should know about Bitcoin and digital currencies

cryptocurrencies, but not all of them are.

to reach a broader demographic than Bitcoin did. As of March, more than 65 billion Dogecoins have been mined, and the production schedule of this

cryptocurrency is in production faster than most.

regulations on digital currencies, but it often warns about investment schemes and fraud. The Financial Crimes Enforcement Network (FinCEN), an agency under the Department of Treasury, took initiative and published virtual currency guidelines in 2013. Many countries are still deciding how they will tax virtual currencies. The IRS is specifically concerned with virtual currencies being used for unreported income.

outline the pros and cons of Bitcoin. The hearing ended up providing a

financial boost for the currency, because US officials talked about it as a

legitimate source of money, as opposed to only discussing its role in illegal

activities.

Wallet for Android runs on your phone or tablet. To store the Bitcoins, you have three options:

doing your own backups.

are responsible for them. Mobile apps allow you to scan a QR code or tap to

pay.

anything happens on their side or it gets hacked, you run the risk of losing

the Bitcoins, so extra backups and secure passwords are suggested.

is, Bitcoins can be stolen in huge quantities, just like money, and with no

centralized bank, there’s no way to recoup the losses. There are several types of Bitcoin ATMs, which exchange Bitcoins for flat currencies. Most machines are expensive and rare, ranging from $5,000 to $2,000. Skyhook,

a Portland, Oregon-based company, demoed a $1,000, machine at a conference this month. It is the first portable, open source ATM.

specific software, which is free and open source. The most popular is GUIMiner, which searches for the special number combination to unlock a transaction. The more powerful your PC is, the faster you can mine. In the early days, it was easy to find Bitcoins, and some people found hundreds of thousands of dollars worth of the cryptocurrency using their computers. Now, though, more expensive hardware is required to find them. Each Bitcoin blockchain is 25 Bitcoin addresses, so it takes a lot of time to find them on your own. The exact amount of time ranges depending on the hardware power, but mining all day could drive your energy bill up and only mine a tiny fraction of a Bitcoin — it may take days to mine enough to purchase anything.

security issues remain, and that will continue to be a problem. In 2013, Mt. Gox, a Japanese exchange, handled 70% of all Bitcoin transactions, but they lost some 750,000 Bitcoins in February 2014 and filed for bankruptcy, and nothing has been proven in the case. Since it’s universal, it’s useful for international transactions, and could be helpful for transactions in developing countries.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Building a Bitcoin Economy: how to stimulate adoption

evangelist? Want to learn how to start your mission into the world of

fiat economics? Having preached the good word of Satoshi to laymen of

all kinds, I’ve made my mark and learned a lot about promoting crypto

adoption. Before you begin your journey, take a moment to read and learn

about the science of Bitcoin evangelism.

things: intellectual capital (to code the software and design the

systems that make everything work) and financial capital (to pay for

hardware, commercial space, legal fees, and intellectual capital if it

is lacking). Adoption is probably the only field of the crypto industry

that requires cultural or social capital, at least at the grassroots

level. But what does that mean in practice?

connections you already have. In my case, that was a network of notable

Vancouver Meet Up groups, and a job as a venue promoter. At first you

won’t have existing merchants to refer to as references, so you’re going

to need to find people who really trust you. Plenty of free solutions

to accept exist, and once they realize the advantages of cryptocurrency,

they’re likely to stick with it.

superiority of accepting payments via Bitcoin is meaningless if nobody

is spending their bitcoins. Even if Bitcoiners prefer to spend

fiat–maybe because the price is on an upswing–just bringing their

business to the adopting merchant provides the necessary incentive, and

there are a number of ways you can do that.

come in handy. If you’re not a member of your local cryptocurrency Meet

Up, already, become one, or start your own group if none exists.

Community pages at Facebook and Google Plus will also help. Since all of

the businesses I signed up were event venues like coffee shops,

restaurants and bars, I was able to bring them business directly by

holding Meet Ups at their locations. Even for non-venue businesses,

though, a community allows you to connect producers to consumers and get

the word out.

more businesses on board, and that network should grow. In addition to

the natural benefits of cryptocurrency, you now can now promise

additional benefits in the form of direct customers–look for businesses

likely to be open minded, like those already hosting Meet Ups or listed

on websites like GroupOn or LivinSocial. Each new adopter you post to

social media will bring more Bitcoiners into the fold, which in turn

increases the amount of business (and incentive) you can provide.

you can bring more customers indirectly via publicity than you can

directly. You should probably have a couple local reporter contacts, by

now. New crypto Meet Ups and splinter groups will form, and inevitably

the majority of events and merchant connections will be initiated by

people other than yourself. This is natural in community building, and

even moreso in a community based on techno-libertarian roots–don’t be

discouraged.

marketing power to promote those working together for the cause. If you

maintain an honest, non-profit-focused campaign, you will become the

face of this new community; forward media inquiries where appropriate,

and engage positively with the mainstream media. Soon you’ll be ready to

take Bitcoin adoption to the next level.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why simplicity is best for bitcoin growth

With the many people who have boarded the bitcoin train

lately, and bitcoin acceptance growing each and every day, security is

still of paramount concern and for those new to bitcoin or wondering

about buying some, there are still many doubts and uncertainties, which

hang over them.

(BitScan) Bitcoin

(BitScan) Bitcoin

is a fascinating technology and our job as users is to keep it safe. I

had a friend tell me this weekend that bitcoin was “too hard for people

to learn.” I reminded him that email is used by so many people and that

less than 10% of those who use it, understand it all. The same will go

for bitcoin.

Often these newcomers to bitcoin are overwhelmed with

- facts and figures

- hash rates

- difficulty

- brain wallets

- blockchain

- cold storage

- private keys

- the list goes on

It is not surprising it all sounds too complex to even begin to understand and get involved.

The email analogy

Imagine if I had told you when email was starting that there was this

cool electronic mail available now and I think you should check it out.

To that, you ask, “How does it work?” I could answer you in two ways:

1. “You type out a message, put in the intended recipients address, and click send.” Or

2. “To start, you go to your mail user agent, or your MUA. You

address your message to the intended recipient and click the “send”

button. This causes the MUA to format the message using Simple Mail

Transfer Protocol, or SMTP and delivers the message to a local mail

submission agent, an MSA that is located at an SMTP address that is run

by your ISP.

Your MSA looks at the destination address provided in the SMTP

protocol, starting with the part before the @ sign, which is the local

part of the address and often a username, and then the part after the @

sign, which is a domain name. The MSA resolves a domain name to

determine the fully qualified domain name of the mail server in the

Domain Name System or DNS. The DNS server responds with any MX records

that are listed as the mail exchange servers for that domain.

SMTP transfers the message and your recipient then needs to press the

“get mail” button in his MUA, which picks up the message using either

Post Office Protocol also named POP3 or the Internet Message Access

Protocol or IMAP. It’s easy as pie!”

I wonder how many of us would have forged ahead with email had the

second version been the usual explanation given. Bitcoin is still in its

infancy and products will be coming along as well as solutions to make

it easier on the user. Much like Outlook and Google made email easier,

so too will product developers and businesses make bitcoin easier.

Keep It Simple

So, when talking bitcoin, keep it simple.

Allaying Fears

One of the main worries that anybody, new to or expert in bitcoin

has, is over security and potential theft. With hackers and their tools

getting better and faster with each day, we must protect ourselves now

before it it’s too late.

First, line of defense is a secure password.

NEVER use the same password on more than one site. You may end up

giving a scammer universal access. So now they have your bitcoin, and

passwords to all your online wallets, exchanges, email and more.

An easy and free solution might be LastPass. It is a simple and

effective way to manage all of your passwords as it stores your entire

password, encrypted on your device and all you need is to remember one

master password. There are other options as well. Do a search for

password managers and make sure they are secure and reputable.

The take away here is every password you have should be unique, at

least 15 characters with some of each upper and lower case letters,

numbers and symbols, and not contain dictionary words, names or places.

There are other safety steps that can be taken including storing bitcoin offline or in a paper wallet. See what the creator of bitcoinpaperwallet.com has to say here.

All these measures can be used when greater amounts of bitcoin are

involved but for ease of use for a new user with a small amount, finding

the best bitcoin wallet or wallet app is key.

Your Bitcoin Wallet is like the wallet in your pocket – except you

have the private key for that wallet – so it is incredibly difficult for

anyone to steal your wallet and make use of the bitcoin without your

private key.

Together

The more people who are encouraged to adopt bitcoin, the stronger and

more normal it becomes. There are no regulators for bitcoin,

decentralization means that the bitcoin community has to keep its own

house in order. By sharing information and spreading the word the

community can help bitcoin in its progress. By helping each other stay

safe, the bitcoin horror stories can be kept to a minimum.

Open your free digital wallet here to store your cryptocurrencies in a safe place.