Bitcoin, the world’s first and most widely-used decentralized digital currency, has an important role in building a decentralized financial system. One of the key advantages of Bitcoin is its potential for appreciating in value, thanks to its limited and predetermined supply. This can make it a potentially attractive investment, as it may increase in value over time.

In addition to its potential for growth, Bitcoin offers security and transparency through its distributed ledger, the blockchain. This means that transactions on the network are almost impossible to cheat or make fraudulent, making it a secure option for conducting financial transactions.

Bitcoin’s decentralized nature also means that it is not subject to the same risks as traditional currencies, such as inflation or government seizure. This makes it a useful option for individuals in countries with unstable currencies or high inflation rates, as it allows them to store value and make payments in a more stable and secure way.

The rise of DeFi, or decentralized finance, has also seen the development of a number of projects built on top of the Bitcoin network. These include RSK and tBTC, which allow users to access a wide range of financial services in a decentralized and trustless manner.

The Lightning Network, another layer built on top of the Bitcoin network, also offers users the ability to make fast and cheap transactions. This can make transactions faster and cheaper, and can also enable new use cases such as micropayments and instant payments. One such wallet that integrates with the Lightning Network is HolyTransaction, which offers a wide range of digital assets and other benefits such as an easy-to-use interface and fast and cheap transactions.

A leading project is Blockstream’s Liquid Bitcoin, also known as L-BTC. Liquid Bitcoin is a sidechain-based token that is pegged to the value of Bitcoin, allowing users to transfer value between the two networks quickly and securely. The Liquid Network is a federated sidechain that uses a consortium of trusted nodes to provide increased privacy and security for users.

Another project that leverages the Liquid Network is Fuji Money, a Lightning-enabled non-custodial synthetic asset protocol. Fuji Money allows users to create and trade synthetic assets, such as stablecoins or synthetic commodities, on the Liquid Network in a trustless and decentralized manner. This allows users to access a wider range of financial instruments and services, further expanding the capabilities of the decentralized financial system.

Overall, the role of Bitcoin in building a decentralized financial system is significant, thanks to its potential for appreciation in value, security and transparency, and ability to provide financial inclusion.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

As of today, you can instantly purchase Storj on HolyTransaction, transfer them to any HolyTransaction’s customer for free, and do crypto-to-crypto swaps between your Wallet Storj and more than other 30 cryptocurrencies.

The Storj project provides for a decentralized cloud storage facility and is originally pronounced as “storage“.

Storj’s main aim is to rent a space on the secondary storage devices of the members of its network and pay them in cryptocurrency, for their service they provide. Therefore, Storj’s native cryptocurrency token is STORJ, which can be stored on HolyTransaction now.

“The main difference between Storj and other decentralized cloud storage platforms is that Storj only uses blockchain to manage payments and not to store data. This is due to the high cost and slow speeds found in blockchains. For example, even the fastest blockchains process data/payments in seconds. Meanwhile, traditional cloud storage solutions, like Amazon S3, can store files in milliseconds – many orders of magnitude faster than even the fastest blockchains.”

Shawn Wilkinson (Founder of Storj)

The Storj platform offers online storage similar to Dropbox or Google Drive, but does so over a distributed network. Renting out unused extra space on our hard drives is referred to as, Farming, for instance. The process as simple as downloading a client from the network, choosing the amount of space to be rented, and a wallet address to store the incentives received in the form of cryptocurrency.

All HolyTransaction customers can create a new address for STORJ and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other cryptocurrency.

Just like with Bitcoin, you can:

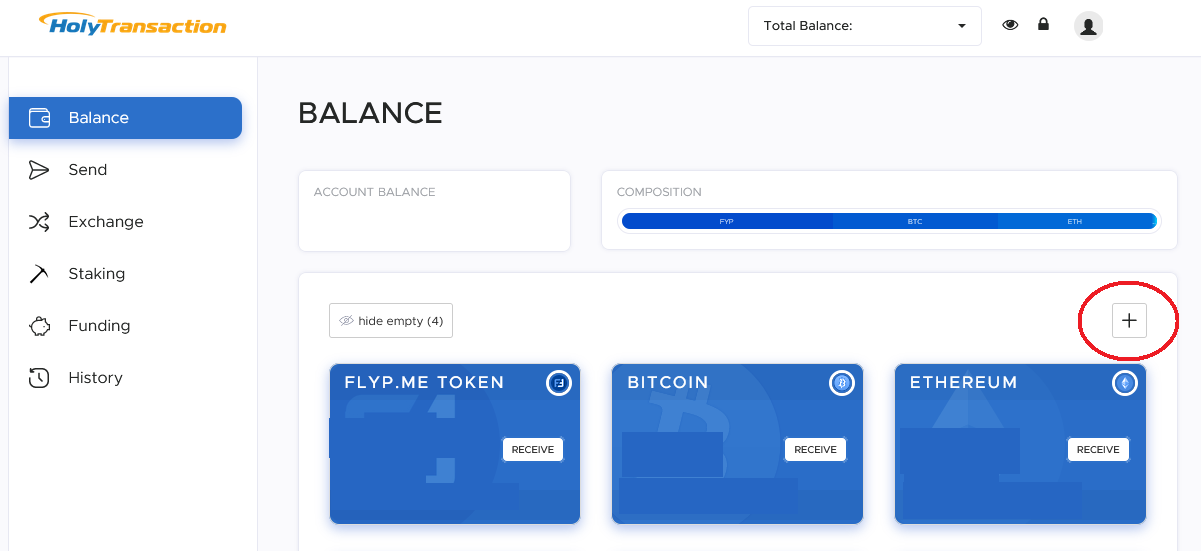

To add Wallet Storj just click on the “plus” button you find at the top right of the balance page, once you successfully enter into your wallet.

You can find the “plus” button to select the wallets you want to see in the main page like shown in the picture below:

We’re excited to be part of the STORJ community!

NOTE: Our multicurrency wallet can store more than 30 cryptocurrencies, including: Bitcoin, Dash, Ethereum, Dogecoin, Litecoin, Decred, Zcash, Dai Stablecoin, DigixDao, Augur, 0x Project, Gamecredits, Enjin Coin, Blackcoin, Gridcoin, Aidcoin, Peercoin, Syscoin, Groestlcoin, Power Ledger, BAT, BlockV, PIVX, TrueUSD, Cardano, and STORJ among the others.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

When ideas and community purpose matter more than the last fin-tech innovation.

Dogecoin is a cryptocurrency, a form of digital money that like bitcoin, enables peer-to-peer transactions across a decentralized network.

If you’ve spent any time on the internet during the last decade, you shall have heard of the Doge meme: the iconic Shibe, barking comic sans quote like, “so scare,” “much noble,” “wow.”

At the peak of the meme’s popularity near the tail end of 2013, Palmer, an Australian marketer for one of the world’s largest tech companies, made a joke combining two of the internet’s most talked-about topics: cryptocurrency and Doge.

It was a joke taking aim at the bizarre world of crypto and at the recent coin-naming hype.

“Investing in Dogecoin,” Palmer tweeted, “pretty sure it’s the next big thing.”

And the tweet got a lot of attention.

So the joke became a true play.

He bought the Dogecoin.com domain and uploaded a photoshopped Shibe on a coin. Adding a note on the site: If you want to make Dogecoin a reality, get in touch.

And this is just the tip. So, If you are interested in knowing the greatest detail of Dogecoin history, we bet you’ll like this article by Alex Moskov published at CoinCentral.com

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Do you want to open a Creativecoin wallet?

You are in the right place, as we at HolyTransaction decided to add this cryptocurrency among the 17 crypto available on our multicurrency wallet.

So, from now on you can store Creativecoin on Holytransaction, transfer them to any other wallet, and make crypto-to-crypto transfers from/to Creativecoin, and ten more cryptocurrency’s networks.

All HolyTransaction customers can create a new address for their own CREA Wallet and use the user-friendly HolyTransaction Wallet platform to send and receive transactions or to instantly convert them to any other cryptocurrency we currently support.

Just like Bitcoin and all the other supported digital currencies, you can now:

If you are not able to see your newest Creativecoin Wallet, you just need to click on the “plus” button on the top right of the balance page, once you successfully login into your own wallet.

Creativechain has created its own coin called Creativecoin (CREA), the first cryptocurrency designed to meet the needs of all creative communities that produce and distribute digital content.

Creativechain is a decentralized platform for the registration and distribution of multimedia content that proves in an indelible way the authorship and license of any work or creation.

Imagine a social network of content exchange like Facebook, Spotify or Youtube totally decentralized, without managers or intermediaries, without censorship and with its own P2P system of electronic money based on its own cryptocurrency.

The technological innovative proposal of this platform also directly challenges the centralized power of traditional systems of copyright management entities.

The platform applies the power of attorney of blockchain technology to create incorruptible timestamps that certify the authorship of any digital work such as photos, videos, films, texts, electronic books, software or any digitizable file. Creativechain is presented as a public and transparent alternative of intellectual property registration according to the new times, in which there are so much cultural production circulating on the internet.

Blockchain technology opens up a universe of possibilities for the registration and distribution of intellectual property without intermediaries. The power of attorney along with the decentralized p2p distribution of digital content create a new paradigm shift in the era of digital culture.

So, do you want to open your CREA wallet? Click here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Today we want to talk about the recent Russian Blockchain interest and the country major announcements related to bitcoin and the distributed ledger.

According to Economic Times, Russia wants to use the blockchain technology to improve its national payment system and to simplify clients’ identification.

The Association of Financial Innovation (AFI) in Russia, in fact, prepared a draft for improving the regulation of its own national payment system.

This draft has been shared for a first discussion on the Association’s official web site. After this discussion, the roadmap will be presented to the Russian Duma, the Ministry of finance and the Bank of Russia.

According to the official article, the roadmap includes the use of the distributed ledger technology for users identification. Here an extract:

“Along with expansion opportunities in the short term transactions under the simplified identification of clients, develop an approach and implement a single identifier (possibly using blockchain technology)”.

The Association for Financial Technologies Development (FinTech Association) was recently setted up by the Bank of Russia.

Its participants will study and test the most promising technologies, including the distributed ledger, open application program interface (open API) and remote identification technologies. Also, the association will create a single payment space both for households and legal entities.

Earlier in 2016, the Bank of Russia revealed its technical prototype for financial messaging, based on the blockchain and called Masterchain.

This tool would allow instant confirmation of data; also it would create a few financial opportunities for the market participants to provide game-changing products and services to their clients.

Recenlty Russia seems to love the Blockchain very much. In fact, the national tax authority recognized Bitcoin as a foreign money, expressing the legality of Bitcoin use and transactions.

Also, Siberia Airlines revealed its use of the Ethereum Blockchain Smart Contract in a few transations.

To read more about Russian Blockchain projects, click here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

“We are all in on Blockchain”: these were the words of IBM Director John Wolpert during the today Blockchain Conference in San Francisco. According to Wolpert the blockchain needs a more collaborative approach, which is not always guaranteed by the blockchain developers.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Thank you for reading our newsletter with the previous month’s best Bitcoin articles!

We tweet more cryptocurrency news and insights daily @HolyTransaction

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin is a private currency, that isn’t issued by any central bank nor guaranteed by any institution. It is electronically transferrable in a practically instant way, utilising a cryptographic security protocol. It is based on a completely decentralized network: the transactions don’t require a middleman, cannot be censored, don’t have any kind of geographical or amount restriction, and are possible 24 hours a day every day and are substantially free.

Open your free digital wallet here to store your cryptocurrencies in a safe place.