(

Sole24Ore) What is going to happen in the future if the computer is always becoming smaller? Always less expensive, and always more mobile?

Soon, we’ll need to link these computers together in a way that is different from the past, with less centralization. Here, we explain the birth of distributed systems, that coexist alongside the traditional systems without replacing them.

The inherent problems in verifying access rights to information and their management has hindered the development of distributed networks until the publication of the famous Bitcoin

whitepaper by Satoshi Nakamoto.

Nakamoto solved two economics problems:

-

Make digital information (for example, a

bitcoin) a “rival good;” and, preventing the owner to spend it a second time

-

Achieving said result with a public register (the blockchain), where the access to information is “not-excludible”, because it is available without intermediaries – it is public and permanent.

The consequences of the adoption of the blockchain is twofold: on one hand it will lower transaction costs; on the other hand, it creates a trust network with a group of people who do not know each other. All ensured thanks to the certainty guaranteed by asymmetric encryption.

With the blockchain, we have found a means for automatically certifying our money transfers, in the case of mathematical coins. In terms of property, with the smart contract first described by

Nick Szabo, the blockchain can one day enable patent protection, trusted electronic voting remotely, and even more.

Decentralization has an important effect on transactions. Three areas that benefit are as follows:

-

Anonymity – if no one knows the identity behind the lists of parties.

-

Privacy – in the sense that no one knows what you purchased and at what price.

-

Irreversible – which comes with a lack of monitoring and compensation body.

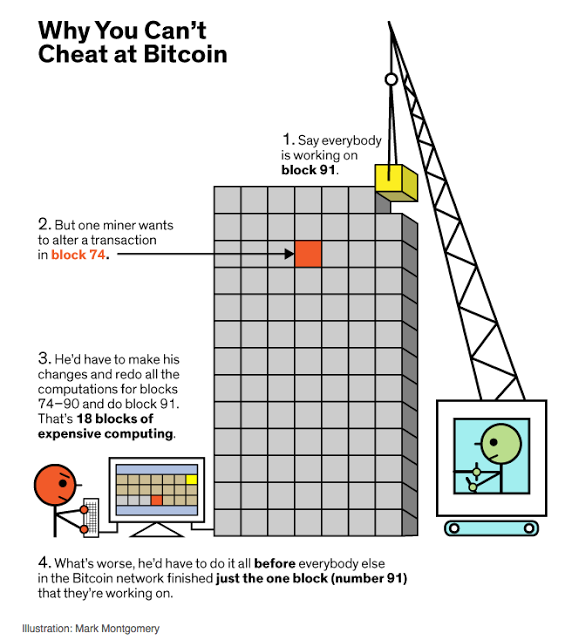

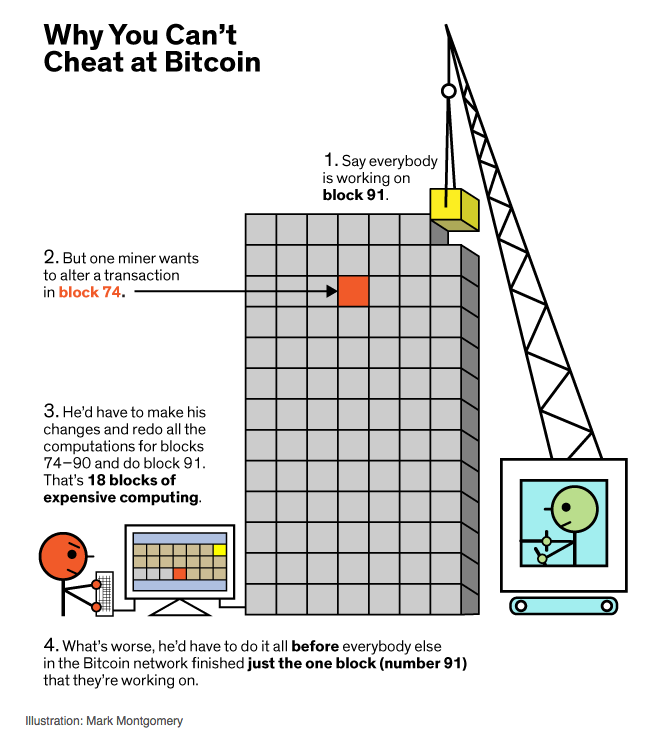

Now we are able to immortalize forever the information (amounts, documents, debts and credits, etc) and transfer them alone, without intermediaries such as notaries and lawyer. The work to certify these transactions are carried out by the “miners.” They are incentivized by receiving for a small fee (and with the prize of new bitcoins) to cover the fixed costs of specialized equipment and the variable costs of consumed energy.

However, not everything can be fully decentralized. The more mining power is distributed and fragmented, the less risk the network runs into. The power, thus decentralized, is inversely related to corruption.

On this issue, the known Bitcoin popularizer Andreas Antonopoulos, in an incredible

article, describes the possible totalitarianism that could happen once someone has taken control of the valuable information that people exchange on the way they spend money.

“If there is control, there is power.”

What innovation can be achieved if you have to ask permission to exchange data?

It is decentralization that creates the conditions that can develop a competition in the offer of services conveyed by the network.

We probably can’t imagine what will happen after the mass adoption of this network for the exchange of information. Just like it was not imaginable what Google and Facebook would come to be before the advent of the Internet. Billions of interdependent people and machines give rise to new business; and when are grouped in federations, thanks to the standard, they create new and completely unexpected ecosystems.

The blockchain is, therefore, a public digital good.

In this field, there is new research in the universities; one of those carried out by an Italian scholar at Harvard known as

Primavera De Filippi.

Now you can reverse incentives that led to the infamous “tragedy of the commons”. Because the use of policies based on a blockchain makes it possible to design new systems of incentives, which are certainly more transparent, you can therefore achieve a new form of consent for the self-government of public goods.

Power of intangibles: we now have a (info)structure that does not consume with its use and that we build together.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

6 thoughts on “Economic problems Bitcoin solves and why it could change our lives”

Bit PagarPosted on 3:36 am - Jul 26, 2015

Great source of information thanks for putting it together.

AnonymousPosted on 10:43 am - Jul 26, 2015

So glad you found it useful!

Francesco SimonettiPosted on 10:43 am - Jul 26, 2015

So glad you found it useful!

Nat SchoolerPosted on 8:00 pm - Jul 27, 2015

Fantastic thanks for writing this!

MassimoPosted on 8:27 am - Aug 8, 2015

thanks!

MassimoPosted on 10:25 am - Aug 8, 2015

thanks!