Has The Crypto Market Bottomed After Bitcoin’s 50% Collapse?

The second half of 2019 was really difficult for Bitcoin. According to independent experts, the total volume of public digital assets has decreased by more than 50% – from $388 billion to $166 billion. However, there is other evidence. Yes, the cryptocurrency market really fell to the bottom if you look at these statistics, but let’s not forget that market conditions are dynamic. And the factor that means failure today may well mean success tomorrow.

Another Side of the Coin

There were periods of stabilization of the exchange rate, but for a long time cryptocurrency lost much in price. At one time, panic even started on the market, and Bitcoin was predicted to soon fall to zero. Against this background, the results of the year sounded quite unexpectedly: cryptocurrency turned out to be the most profitable investment. The coin rate rose from $4035 to $ 7344, providing investment growth by 82%.

Crypto Market and Bitcoin in Modern Political and Economic Conditions – What to Expect in 2020?

This year will be great for Bitcoin, Wall Street analyst and Fundstrat founder Tom Lee suggested. The destabilization of relations between Iran and the United States is one of the reasons.

Plus, modern realities make it possible to add a supposedly modern coronavirus epidemic to these factors. However, at the moment there is no consensus among experts on how the coronavirus will affect the Bitcoin exchange rate. It is still unclear whether we are dealing with a real threat to people’s lives or is this another hype, a political company, or an attempt to distract investors from other, more important issues.

However, even those experts who believe that the disease can affect the main digital coin explain that this will happen only if the outbreak develops into a full-fledged epidemic.

Venture capitalist Tim Draper is also confident in the long-term growth in Bitcoin value. In an interview with FOX Business, he advised millennials to invest in cryptocurrencies, as they are on the verge of a new financial revolution. However, the explosion of the financial revolution will slow down due to the influence of the values of older generations and the obsolescence of the current banking system.

Conclusion

Bitcoin exchange rates are very unstable. Cryptocurrencies have already shown that it can rapidly fall and take off at a breakneck pace. Due to this state of affairs, bitcoin does not inspire confidence among many investors who would be happy to invest big money in the development of the blockchain, but fear for their savings. In 2020, we are unlikely to have to observe the strong influence of this factor, but we should not forget about it.

About the author: Gregory is passionate about researching new technologies in both mobile, web and WordPress. Also, he works on Best Writers Online the best writing services reviews. Gregory in love with stories and facts, so Gregory always tries to get the best of both worlds.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

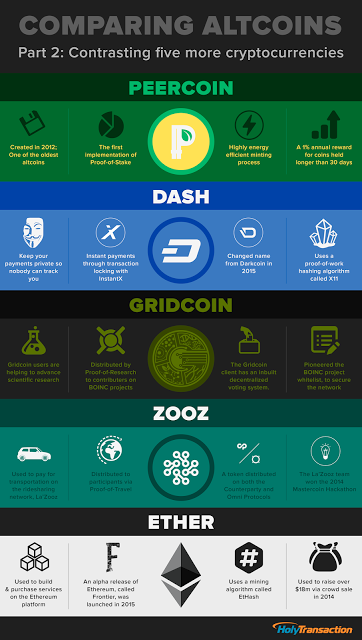

Infographic: Comparing Altcoins – Part 2

Open your free digital wallet here to store your cryptocurrencies in a safe place.

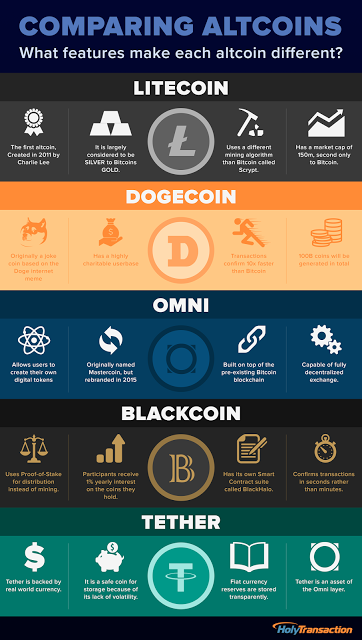

Infographic: Comparing Altcoins

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Australia investigating banks for anti-competitive behavior when closing Bitcoin company accounts

Australian authorities are looking into the bank account closures of several Bitcoin companies over the last few years. Specifically, the investigation is looking at anti-competitive behavior. Over the last year, bank actions have increasingly embraced blockchain technology instead of shunning it in the form of bank account closures. Though this type of account closure, for simply being associated with Bitcoin, is a common occurence in the United States, China, and some European countries as well, the Australian authorities are the first to look into at scale – a harrowing victory for those using blockchain technology. The Australia Competition and Consumer Commission (ACCC) chairman, Rod Sims, told the Australian Financial Review:”We are asking the banks why they acted as they did and what contact there was between them.“If ground reports from major Bitcoin companies such as BTC-e and OKCoin, that lost their accounts at the National Australia Bank, are to be believed, the contact was sparse and uninformative. Sims confirmed that the investigation had been ongoing for some time. Australian Senator Matthew Canavan also commented on the investigation:

Australian authorities are looking into the bank account closures of several Bitcoin companies over the last few years. Specifically, the investigation is looking at anti-competitive behavior. Over the last year, bank actions have increasingly embraced blockchain technology instead of shunning it in the form of bank account closures. Though this type of account closure, for simply being associated with Bitcoin, is a common occurence in the United States, China, and some European countries as well, the Australian authorities are the first to look into at scale – a harrowing victory for those using blockchain technology. The Australia Competition and Consumer Commission (ACCC) chairman, Rod Sims, told the Australian Financial Review:”We are asking the banks why they acted as they did and what contact there was between them.“If ground reports from major Bitcoin companies such as BTC-e and OKCoin, that lost their accounts at the National Australia Bank, are to be believed, the contact was sparse and uninformative. Sims confirmed that the investigation had been ongoing for some time. Australian Senator Matthew Canavan also commented on the investigation:

“We have strong laws against one business obstructing another business competing against it. These laws are even tougher for those companies that have the privileged position of a significant market share. Our banks wield great influence in the market and they have a great responsibility under our laws to not misuse that position. I am not sure if that has happened in this instance but there is no doubt that digital currencies do pose a threat to business of banks.”

Australian Senate that Might Actually Understand Bitcoin and its Promise

A Labor Party Senator, Sam Dastyari, was not surprised to hear about the ACCC investigation. He had previously chaired the Senate investigation into digital currencies. At this time, banks such as the National Australia Bank and other similarly sized institutions around the world are delving into blockchain technology. If anything, this is a clear indication that the swift actions of last year, where both domestic and international Bitcoin companies lost their accounts at Australian banks, were anti-competitive in spirit. Even without the emerging facts regarding bank’s research, investment, and involvement with blockchain projects, the majority of domestic companies brought down by Australian bank action were providing services that were in essence competing with banks.Australia has a large immigrant population from South East Asia that sends remittances back home. Some of the largest Bitcoin remittance companies are based in South East Asia in countries like the Phillipines or India. In Indonesia, Bitcoin is buyable at any of ten thousand plus IndoMaret stores. Australia now seems aptly prepared to benefit from the coming Bitcoin technology boom (bubble as called by some). Once the investigation is over, and banks are 100% clear on what not to do to Bitcoin companies, expect to see more Bitcoin companies return to Australia.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

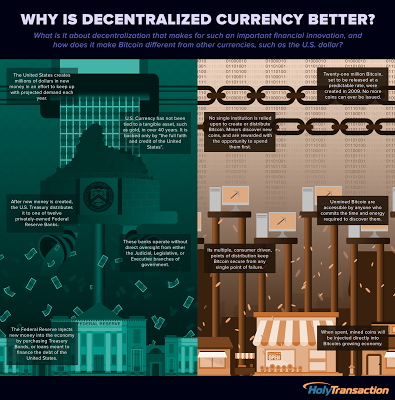

Infographic: Why Is Decentralized Currency Better?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft to Sponsor the Ethereum DΞVCON1 Conference

“DΞVCON1 is very excited to work with Microsoft and we look forward to having them in London.”Microsoft’s head of US Technology Financial Services, Marley Gray, explained more specifically why Microsoft had taken an interest in this international and decentralized technology event:“Microsoft is excited to sponsor and attend Ethereum’s DevCon1. We find the Ethereum blockchain incredibly powerful and look forward to collaborating within the Ethereum Community. We see a future where the combination of Microsoft Azure and Ethereum can enable new innovative platforms like Blockchain-as-a-Service. This will serve as an inflection point to bring blockchain technology to enterprise clientele”.

Ethereum DevCon1 Is Bringing Interesting Companies and People Together… For a Better FutureAlready, it has been confirmed that not only will Microsoft be in attendance, but so will Nick Szabo. That is actually no surprise given that Szabo coined the term “smart contract” many many years ago and has become increasingly vocal on the internet as his pet idea has started to come to fruition. Smart contracts are a large part of Ethereum’s mainstream appeal, though the concept is still in the process of gaining momentum. The future prospects of robots and computers replacing humans for certain types of jobs has always been on the fringe of human imagination. The more you think about smart contracts, the more you realize that such a futuristic world couldn’t exist in a stable state without something like smart contracts. As panelists at the Money20/20 conference stated:

“Cryptocurrency is the most natural way for machines to pay machines.”

Bitcoin-inspired blockchain technology, of which Ethereum definitely is, has seen a lot of validation lately. Other Bitcoin-inspired blockchain technology like BitShares is also gaining traction, though not in the form of Microsoft sponsorships. Besides the fundraising and actual release of Ethereum’s Frontier alpha and a shaky first few days, the formation of a conference is a milestone that most “altchains” never achieve – not that there was any doubt that Ethereum would make it this far, anyways. After all, even Imogen Heap has even started using Ethereum, why wouldn’t Microsoft be next?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

BitShares 2.0 – Will Users and Banks Be Using Graphene in the Future?

Graphene, the super material that our computer chips might be made of soon, still isn’t very well known. However, with BitShares 2.0 being called Graphene, the word might become a stable part of your lexicon soon. The BitShares 2.0 has been long anticipated by both the BitShares and cryptocurrency communities. Since its announcement earlier this summer, BitShares has started to restructure themselves in preparation for BitShares 2.0. Though they are adding a lot of functionality, the core stake distribution is not changing at all. In testing, they have been able to sustain 3000+ tx per 3sec block, compared to the 7 transactions per second that the Bitcoin network is theoretically limited to. To reach even larger network sizes, Graphene is tapping into the same future expectations that Bitcoin users expect to keep their network viable: Moore’s Law. The pace of technology is such that eventually just one rented VPS will be able to handle all of the world’s financial transactions.

Graphene, the super material that our computer chips might be made of soon, still isn’t very well known. However, with BitShares 2.0 being called Graphene, the word might become a stable part of your lexicon soon. The BitShares 2.0 has been long anticipated by both the BitShares and cryptocurrency communities. Since its announcement earlier this summer, BitShares has started to restructure themselves in preparation for BitShares 2.0. Though they are adding a lot of functionality, the core stake distribution is not changing at all. In testing, they have been able to sustain 3000+ tx per 3sec block, compared to the 7 transactions per second that the Bitcoin network is theoretically limited to. To reach even larger network sizes, Graphene is tapping into the same future expectations that Bitcoin users expect to keep their network viable: Moore’s Law. The pace of technology is such that eventually just one rented VPS will be able to handle all of the world’s financial transactions.BitShares Style Decentralization Is What Banks Need

Open your free digital wallet here to store your cryptocurrencies in a safe place.

EU’s Top Court Rules That Bitcoin Exchange Is Tax-Free

European Union’s top court said in a ruling that puts them on a more

equal footing with traditional cash.

sales levy — needn’t be applied because the business involves “the

exchange of different means of payment,” the EU Court of Justice in

Luxembourg ruled Thursday. The case was triggered by a dispute in

Sweden, where David Hedqvist set up a service for the exchange of

mainstream money for bitcoin and vice versa.

currency, introduced in 2008 by a programmer or group of programmers

under the name Satoshi Nakamoto, has no central issuing authority and

uses a public ledger to verify encrypted transactions. It has gained

traction with merchants selling legitimate products but also has been

used to facilitate illegal transactions because money can be transferred

anonymously.

to exchange traditional currencies for units of the bitcoin virtual

currency (and vice versa) constitute the supply of services” under the

bloc’s law “since they consist of the exchange of different means of

payment,” the court ruled. As such they are exempt from value-added

taxes, it said.

exemptions given to traditional exchanges “would deprive it of part of

its effects,” given that the exemption’s aim is to counter “the

difficulties connected with determining the taxable amount and the

amount of VAT deductible” in cases of taxation of financial

transactions, the court said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

What will be the future implications of Bitcoin?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

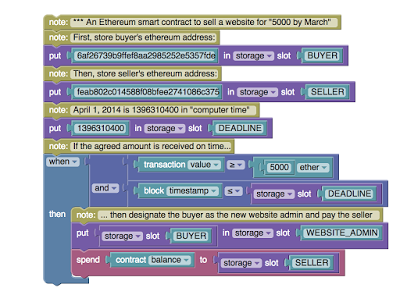

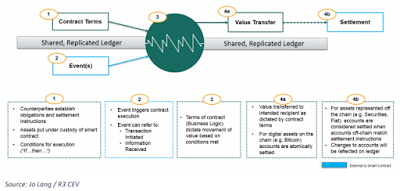

Smart Contracts as new laws? Better handle with care

Smart Contracts based on Blockchain technology.

Open your free digital wallet here to store your cryptocurrencies in a safe place.