the space. An old hat at this young technology, he has been making

waves as the CTO of Ripple labs. In a recent effort he has set his

sights on smart contracts technology. The designs and implementation he

and his team have come up with are interesting, to say the least.

and contracts can interact with any service that accepts

cryptographically signed commands. The paper also includes an

implementation of smart oracles, called Codius (based on the Latin “ius” meaning “law”).

business, and law that have the potential to usher in a wave of

innovation and serve as a building block for a next chapter of the

internet.

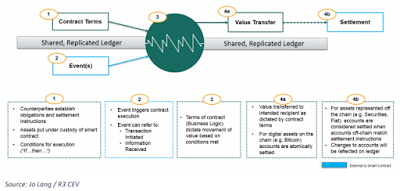

and outcomes of a legal agreement into a computer program. Rather than

rely on another party to enforce the terms of the arrangement, the

obligations of a smart contract are settled automatically and

autonomously through the execution of its code.

provide an important building block for smart contracts by allowing the

transfer of digital assets with a cryptographic signature. The benefits

of using smart contracts instead of traditional contracts are increased

speed, efficiency, and trust that the contract will be executed exactly

as agreed.

| Uatu, The Watcher |

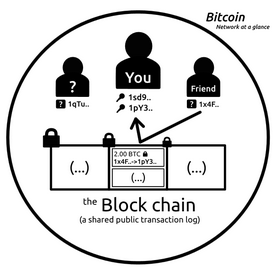

inform contracts about the state of the outside world. Bitcoin contracts

rely on “oracles”

to attest to facts from the outside world by introducing signatures

into the network if and only if specific conditions are met.

whether or not someone had died. Such a system typically requires the

smart contract code to be executed on the consensus network itself. But

encoding advanced logic and executing untrusted code is complicated to

integrate. Until now, this has been one of the primary obstacles for

creating a viable smart contract system.

the untrusted code execution in the oracles’ hands. Smart oracles, then,

are trusted or semi-trusted entities that can both provide information

about the outside world and execute the code to which the contracting

parties agreed.

databases and other services that track and transfer asset ownership,

smart contracts can be achieved without increasing the complexity of

existing consensus networks like Bitcoin and Ripple.

|

| Algolon, The Observer |

using smart oracles can interact with multiple networks at once as well

as virtually any type of online service. This means that a single smart

contract could interact with Bitcoin and Ripple, web-based services

like PayPal, Google, Ebay, etc. or even other Internet protocols, such

as SSH, LDAP, SMTP and XMPP.

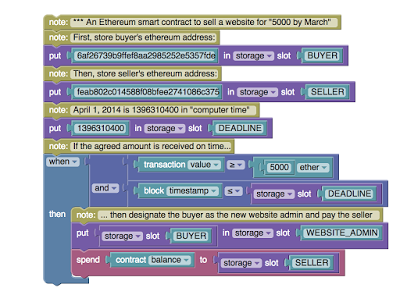

developers with a robust and familiar platform to build smart contracts

and hit the ground running. Because Codius uses Google’s Native Client to sandbox untrusted code, developers can write contracts in any programming language.

developers, entrepreneurs, and enterprising legal and financial

professionals. Agreements that previously required lengthy legal

contracts can be translated into code and run automatically by smart

oracles.

fairer, more affordable and more efficient legal system and smart

oracles are one of the simplest ways to realize that dream. Potential

use cases include bridges between value networks, escrow, cryptocurrency

wallet controls, auctions for digital assets, derivatives, debt and

equity, smart property and voting.