Why is Estonia Considered Crypto Capitol of Europe?

At this point, cryptocurrencies will play a major role in the global financial industry soon. Millions of people are already using them, and these digital assets had a massive breakthrough in 2021. What’s even more important is that many companies and countries are starting to accept them.

In a world’s first, El Salvador became the only country to fully adopt Bitcoin and even use it for various trading purposes. That allowed the cryptocurrency to grow and stabilize itself even more. Even though many would think that El Salvador will be leading the pack in the crypto world, that did not concern Europeans too much.

Why? Because they already have a country that kind of regulates these digital assets and allows them to trade with them. That country is Estonia, and, in this article, we’ll be looking at why Estonia is considered the crypto capitol of Europe. Let’s dive into the details.

Estonia Was the First Country to Regulate Cryptocurrencies

First, Estonia was among the first countries in the world to start regulating cryptocurrencies. It started accepting them around a decade ago and since then, became a haven for all crypto traders. That ‘tradition’ was kept over the years as all new traders in the continent are advised to invest in crypto here.

Aside from trading and making a profit, crypto users keep these digital assets to pay for services/products and for entertainment. One of the most popular entertainment types that you can participate in with crypto is online gaming, specifically casino sites.

Since online casinos operate on the Internet now and cryptocurrencies are fully optimized for online use, they were more than fond of allowing registered players to deposit and withdraw money with them.

Estonia Is Fond of Using Technology to Its Advance

Next up, Estonia is well-known for leaning towards technology. After all, apart from being known as the first country in Europe to regulate cryptocurrencies, it is also the first country in the world to introduce the e-Residency program, which is like digital citizenship.

This allows participants to use numerous services from the government, including starting an EU-based company without the need of travelling to Estonia.

When it comes to cryptocurrencies and payment methods, one interesting fact about Estonia is that it is a cashless society. Statistics show that 99% of all transactions are conducted digitally. Residents here are always looking for more efficient online payment methods and that is what led the country to cryptocurrencies.

As you may know, crypto transactions are instant, whereas transactions with regular payment methods can take up to a few days to be completed. That makes these digital assets perfect for paying online and conducting business.

The industry is Well-Regulated in the Country

Lastly, the Estonian government has recently tightened regulations as the Financial Intelligence Unit, which is under the wing of Estonia’s Finance Ministry, is now able to revoke crypto licenses in efforts to fight money laundering.

That makes this country extremely safe for all those who are willing to invest in cryptocurrencies. Extra security is always welcomed, especially in times when online scams are proving to be a massive problem. As data shows, more than $240 million has been lost in scams so far in 2021. Millions of people fall victim to this problem and all of us want that extra security layer.

Thanks to the fact that cryptocurrencies utilize cryptography, which provides a certain level of online anonymity, users are safer, but with Estonia’s regulations, that security is taken to the next level.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Blockchain Regulation in Europe: everything you need to know

Today I want to explain you everything you need to know about the Blockchain Regulation in Europe.

Recently, in fact, the executive arm of the European Union government revealed that is working on the blockchain to “support” distributed ledger-based projects.

According to this new official press release published on February 7th, the Commission is looking for growing its efforts on supporting more projects related to the distributed ledger technology (DLT).

The European Commission is “actively monitoring Blockchain and DLT developments” and is working on exploring “DLT benefits and challenges as well as fields for application in financial services”.

Also, the official press release explained that the Commission wants to “pilot projects to foster decentralised innovation ecosystems and help reshape interactions between consumers, producers, creators and among citizens, businesses and administrations to the end benefit of society”.

A task force for Blockchain Regulation

Last year, the European Parliament also created a new task force led by the Commission, to study the blockchain.

This task force has not only the goal of studying the blockchain but also to support projects related to the ledger and studying a way for a blockchain regulation.

The European Commissioner for Digital Single Market and Vice President of the European Commission, explained:

“The Commission is already supporting distributed ledger tech-enabled projects (DECODE, D-Cent, MyHealth MyData). Support activities are going to increase in the coming months (e.g. Decentralised Data Management). A study will be launched to investigate how DLT can help in reshaping public services and preparing for EU specific DLT actions to address relevant EU challenges.”

Ansip also said that the Commission will collaborate with the Parliament to organize blockchain events and workshops.

“The Commission will organise a kick-off conference with the European Parliament on Demystifying Blockchain and a series of workshops to look at Blockchain developments and use case applications”.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Burger King accepts bitcoin

But, why Arnhem?

Growing bitcoin enthusiasm

Life on Bitcoin

Where to live using bitcoin: CoinMap and BitMap

Open your free digital wallet here to store your cryptocurrencies in a safe place.

European Union wants to monitor virtual currencies

In fact, a few days ago Europol concluded that there is no connection between Bitcoin and terrorism: “Despite third party reporting suggesting the use of anonymous currencies like Bitcoin by terrorists to finance their activities, this has not been confirmed by law enforcement”, said Europol.“Virtual currencies and their underlying technologies can provide faster and cheaper financial services, and can become a powerful tool for deepening financial inclusion in the developing world,” said IMF Managing Director Christine Lagarde, who presented IMF paper at the World Economic Forum, in Davos, during the panel Transformation of Finance.

A conclusion of the report is that virtual currencies fall short of the legal concept of currency or money. While acknowledging that there is no generally accepted legal definition of currency or money, the authors note that both are associated with the power of the state to issue currency and regulate the monetary system.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

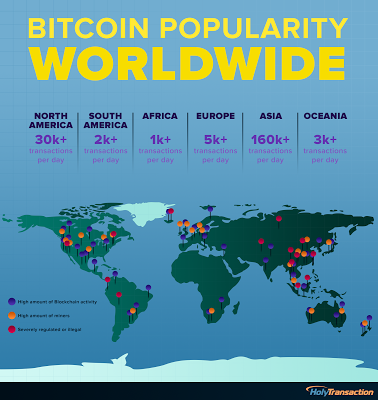

Infographic: Bitcoin Popularity Worldwide

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Microsoft to Sponsor the Ethereum DΞVCON1 Conference

“DΞVCON1 is very excited to work with Microsoft and we look forward to having them in London.”Microsoft’s head of US Technology Financial Services, Marley Gray, explained more specifically why Microsoft had taken an interest in this international and decentralized technology event:“Microsoft is excited to sponsor and attend Ethereum’s DevCon1. We find the Ethereum blockchain incredibly powerful and look forward to collaborating within the Ethereum Community. We see a future where the combination of Microsoft Azure and Ethereum can enable new innovative platforms like Blockchain-as-a-Service. This will serve as an inflection point to bring blockchain technology to enterprise clientele”.

Ethereum DevCon1 Is Bringing Interesting Companies and People Together… For a Better FutureAlready, it has been confirmed that not only will Microsoft be in attendance, but so will Nick Szabo. That is actually no surprise given that Szabo coined the term “smart contract” many many years ago and has become increasingly vocal on the internet as his pet idea has started to come to fruition. Smart contracts are a large part of Ethereum’s mainstream appeal, though the concept is still in the process of gaining momentum. The future prospects of robots and computers replacing humans for certain types of jobs has always been on the fringe of human imagination. The more you think about smart contracts, the more you realize that such a futuristic world couldn’t exist in a stable state without something like smart contracts. As panelists at the Money20/20 conference stated:

“Cryptocurrency is the most natural way for machines to pay machines.”

Bitcoin-inspired blockchain technology, of which Ethereum definitely is, has seen a lot of validation lately. Other Bitcoin-inspired blockchain technology like BitShares is also gaining traction, though not in the form of Microsoft sponsorships. Besides the fundraising and actual release of Ethereum’s Frontier alpha and a shaky first few days, the formation of a conference is a milestone that most “altchains” never achieve – not that there was any doubt that Ethereum would make it this far, anyways. After all, even Imogen Heap has even started using Ethereum, why wouldn’t Microsoft be next?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

EU’s Top Court Rules That Bitcoin Exchange Is Tax-Free

European Union’s top court said in a ruling that puts them on a more

equal footing with traditional cash.

sales levy — needn’t be applied because the business involves “the

exchange of different means of payment,” the EU Court of Justice in

Luxembourg ruled Thursday. The case was triggered by a dispute in

Sweden, where David Hedqvist set up a service for the exchange of

mainstream money for bitcoin and vice versa.

currency, introduced in 2008 by a programmer or group of programmers

under the name Satoshi Nakamoto, has no central issuing authority and

uses a public ledger to verify encrypted transactions. It has gained

traction with merchants selling legitimate products but also has been

used to facilitate illegal transactions because money can be transferred

anonymously.

to exchange traditional currencies for units of the bitcoin virtual

currency (and vice versa) constitute the supply of services” under the

bloc’s law “since they consist of the exchange of different means of

payment,” the court ruled. As such they are exempt from value-added

taxes, it said.

exemptions given to traditional exchanges “would deprive it of part of

its effects,” given that the exemption’s aim is to counter “the

difficulties connected with determining the taxable amount and the

amount of VAT deductible” in cases of taxation of financial

transactions, the court said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction welcomes new users from Greece, Europe, and the World over

Everyone with a finger on the pulse of the world’s financial health has been keeping their eyes peeled for the latest on the potential “Grexit” (Greek Exit) from the European Union. With negotiations of a final deal once again bearing no fruit, the average citizen’s faith in the traditional financial system is eroding at an ever-increasing rate. A few years ago, it was Cyprus; now, it is Greece. Frankly, the rest of the fiat-using world is right to believe that they may be next. In times like these, interest in Bitcoin tends to spike. In just the last week, Greek Google searches for the keyword ‘Bitcoin’ have increased notably. Let’s not forget that historically we have always seen a trickling effect where new Bitcoin users find themselves researching altcoins in an attempt to get ahead of the next big thing. It is possible that the current economic turmoil in Greece is the next big thing that pushes interest in Bitcoin and other digital currencies.

Everyone with a finger on the pulse of the world’s financial health has been keeping their eyes peeled for the latest on the potential “Grexit” (Greek Exit) from the European Union. With negotiations of a final deal once again bearing no fruit, the average citizen’s faith in the traditional financial system is eroding at an ever-increasing rate. A few years ago, it was Cyprus; now, it is Greece. Frankly, the rest of the fiat-using world is right to believe that they may be next. In times like these, interest in Bitcoin tends to spike. In just the last week, Greek Google searches for the keyword ‘Bitcoin’ have increased notably. Let’s not forget that historically we have always seen a trickling effect where new Bitcoin users find themselves researching altcoins in an attempt to get ahead of the next big thing. It is possible that the current economic turmoil in Greece is the next big thing that pushes interest in Bitcoin and other digital currencies.

We have seen fellow digital currency companies focus their attention and marketing on Greece and Europe, which is another indicator of the breadth of this event. The classical way to buy bitcoins is to use your bank. Unfortunately, with Greece’s banks closed for the next week and possibly more time after that, it is arguably too late for the Greek people to buy Bitcoin easily.

Since most Greeks have their money tied up in the banks that are currently shut down. The people on the ground can’t even buy Bitcoin through the banks. Bitcoin isn’t going to be accepted by Greece over night, but Bitcoin also isn’t going to be shut down by anyone over night. In the coming weeks, the contrast between digital currency and banks will sharpen for many onlookers. Observers the world over will be struck with a sort of enlightenment: their vision will clear. Bitcoin might not be able to help the Greeks buy a loaf of bread in their local economies tomorrow morning; however, Bitcoin and blockchain technology can and will be able to prevent similar economic disasters from happening ever again.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

European Central Bank hacked, personal data stolen

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Virtual and digital currencies can challenge the sovereignty of states

official. At a recent digital money conference in Dublin, he mentioned

that rivals are interfering with a bank’s ability to sway the price of

credit for the entire economy. Murphy warned that there might be

considerable threat to the finances of a country if increasingly more

transactions for services and goods fade away from the tax system due to

the use of crypto currencies such as Bitcoin. He added:

“Central banks, [out] of necessity, have monopolized the exercise

of these functions. Virtual currencies pose new challenges to central

banks’ control over these important functions.”

Bitcoin conference. It gathers the brightest minds in finance,

payments, banking, and business. The goal is to host fearless debates on

the risks and opportunities involved with decentralized currencies.

Bitfin (Bitcoin Finance) wants to shape

the future of corporate strategy, commerce, and economic policy in the

current industry of peer-to-peer digital money. “Bitcoin Finance is the

digital money conference you’ve been waiting for,” the official press

release reads.

trigger significant drops in economic activity. The Central Bank has

constantly emphasized that it doesn’t recognize digital currencies such

as Bitcoin in Ireland. Nonetheless, those who choose to use Bitcoin anyway won’t have consumer protection.

Murphy is well aware that virtual currencies could offer a great option

for people looking to buy and sell different services and goods. He

added that in these circumstances, the anti-money laundering rules will

be thoroughly tested. Failure of settlement infrastructure and

payments, or any sort of “financial plumbing,” could have a great impact

on the country’s economic activity and consumer confidence. Murphy

said:

“In effect, economic activity is the aggregate of domestic

transactions in the ‘euro-denominated economy’ and the ‘virtual currency

economy.’”

institutions and banks will most likely feel the effects. Other major

financial institutions don’t see Bitcoin as a threat to their

operations. However, in Murphy’s view, these institutions would be

foolish to have this kind of attitude towards the technology,

mentioning:

“This is likely to have a profound operational impact on these firms and their regulatory risk profile.”

economic challenges. Digital currencies defy the way these institutions

calibrate exchange rates, monetary policy and set price of credit.

Supporting Bitcoin and encouraging its growth would have to be

attentively monitored. Gareth Murphy added:

“The existence of a ‘euro-denominated economy’ and a ‘virtual

currency economy’ raises the prospect of an internal balance of payments

between two sub-economies where suppliers may prefer one currency over

another as a means of payment (for different goods and services).”

the most frequently used on a global scale. Bitcoin undermines a

central bank’s ability on matters such as economic analysis, data

collection, supervision, policy formation, enforcement and resolution,

so these sort of implications can’t be overlooked.

shouldn’t take things for granted and assume its actions will keep

falling under US and Switzerland regulations. He did mention that

Bitcoin should be used to support indefinite innovations that may come

from a wiser use of the technology:

“We should not presume that current regulations are

future-proof. It is possible that further innovations will mean that

these regulations may no longer apply. This suggests that new

regulations may ultimately be needed which are based on new legal

concepts with a clear scope which must stand the test of time.”

because they’re offering lower fees, commissions, greater convenience

etc. Bitcoin might gain control over the most important functions of

exchange rate and monetary policy. In spite of the currency’s relative

instability, more people are turning their attention to Bitcoin, and the

more publicity it receives the higher chances it has to become

ubiquitous in our everyday lives.

Open your free digital wallet here to store your cryptocurrencies in a safe place.