Bitcoin, the world’s first decentralized digital currency, has seen growing adoption in Central Africa in recent years. This trend is driven by a number of factors, including the region’s high inflation rates, political instability, and lack of access to traditional banking services.

One of the main reasons for the adoption of Bitcoin in Central Africa is the high inflation rates that many countries in the region face. Inflation erodes the purchasing power of a currency, making it difficult for people to save and plan for the future. By using Bitcoin, which is not subject to inflation, individuals and businesses in Central Africa can protect their wealth and preserve its value over time.

Political instability is another factor driving the adoption of Bitcoin in Central Africa. Many countries in the region have a history of coups, civil wars, and political unrest, which can lead to the confiscation of assets and bank accounts. By using Bitcoin, which is decentralized and not controlled by any government or institution, individuals and businesses in Central Africa can protect their assets from seizure and avoid the risks associated with political instability.

In addition to high inflation and political instability, many people in Central Africa lack access to traditional banking services. In some rural areas, there are no banks or financial institutions, making it difficult for individuals and businesses to access credit, save money, and make payments. By using Bitcoin, which can be easily accessed and used with a smartphone and internet connection, people in Central Africa can enjoy many of the same benefits of traditional banking without the need for physical infrastructure.

The adoption of Bitcoin in Central Africa is also supported by a growing ecosystem of businesses and services that accept the cryptocurrency. This includes merchants who accept Bitcoin for goods and services, as well as exchanges and wallet providers that facilitate the buying and selling of Bitcoin. This ecosystem is helping to drive the adoption of Bitcoin and is making it easier for people in Central Africa to use the cryptocurrency in their daily lives.

In addition to the factors mentioned above, there are several other reasons why Bitcoin is gaining popularity in Central Africa. The increasing use of mobile phones and internet access in the region has made it easier for people to use Bitcoin and other digital currencies. The growing awareness of the benefits of Bitcoin, such as its decentralized nature, low transaction fees, and fast transaction times, has also contributed to its increasing popularity in the region. The growing adoption of Bitcoin in other parts of the world has also played a role in its acceptance in Central Africa.

Furthermore, the Central African Republic has recently unveiled its own cryptocurrency, Sango Coin, which will be the second cryptocurrency, after Bitcoin, to be recognized as legal tender in the country. The President of the Central African Republic has voiced support for blockchain, cryptocurrencies, and Bitcoin, further demonstrating the increasing interest and involvement in the cryptocurrency space in the region.

Overall, the adoption of Bitcoin in Central Africa is driven by a combination of economic, political, and technological factors. As the ecosystem of businesses and services that accept Bitcoin continues to grow, it is likely that the adoption of the cryptocurrency will continue to increase in Central Africa.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Cryptocurrency users are still a small minority. The total number of users was at 106 million as of January 2021. That sounds like a lot, but when you consider a global population that is nearing 8 billion, you can see that it is just a tiny fraction of people using crypto.

Whether you are in crypto or not, it is going to have an increasing effect on business. You can see Bitcoin mining operations selling shares on stock exchanges, large businesses looking into uses for crypto coins, and more people taking an interest in buying and using cryptocurrency.

At the current trend, crypto coins are becoming more common every year. If it holds, it might not be a matter of if people start using different cryptocurrencies, it could just be a question of when.

In the digital age, businesses are now connected internationally like they never before. Beyond the large multinationals, it is increasingly becoming common for smaller businesses to have significant international connections. This is not only true as it concerns deals with other companies, but businesses now have employees or contractors they work with from around the world.

Using cryptocurrency as a medium of exchange for international transactions could solve a lot of problems for these businesses. First, cryptocurrency could ease the burden of having to convert currency for several different countries. Beyond that, it could also make transactions faster, cheaper and more convenient by cutting out the traditional middlemen that would typically be in the middle of these transactions.

One of the factors that have held back many cryptocurrency markets is the lack of support from mainstream institutions. Banks wouldn’t let you make transactions with crypto exchanges, and it was hard to find businesses that would allow you to use your cryptocurrency. This is changing rapidly.

Beyond the ability of investors to use an ultra fast trading app to make trades, we now see a range of big institutional investors buying cryptocurrency. Along with that, some of the world’s largest financial businesses are starting to work with crypto. As an example, PayPal started offering a range of cryptocurrency services earlier this year. You also have major credit card companies that are starting to work with crypto on a limited level.

One of the main claims of many crypto skeptics is that the coins have no inherent value. This is true in a sense. The value of most crypto coins is solely based on the perception of people in the market. While that might be true, you could make the same argument for most fiat currencies. The value is based on the fact that people will accept it in exchange for goods and services.

Crypto has an advantage over many fiat currencies: the fact that many crypto coins have a limited supply. As inflation acts on fiat currencies, crypto could grow in popularity as a hedge. In the future, many investors will hold crypto in the way that they hold gold as a protection against inflation.

Raising or distributing equity usually means creating conventional shares of the business. While this could be a way to raise money or provide value to employees, it does come with a range of hurdles. One way to get around many of these hurdles would be to create crypto coins that represent shares in the company.

Instead of jumping through all of the regulatory hoops to issue shares, the business could give people crypto coins as equity. Instead of holding an IPO, the business could do an ICO as a way to raise capital from investors.

With the rise in crowdfunding platforms, the ability to raise money is easier than it ever has been. These platforms not only make it easy to raise money from the public, but they also offer a level of transparency that is popular among those looking to donate or invest. With that said, these platforms often take a significant portion of the funds in fees.

Using a blockchain wallet for crowdfunding could be a way to get the transparency of a crowdfunding platform while avoiding the fees. This would allow those looking to raise funds to do so off a platform, but with the blockchain ledger, potential donors or investors could still see the donations coming in.

Crypto is a field that is always evolving. As businesses see the benefits and new applications become available, it will become more common. With that said, the markets are unpredictable. The only thing that we can be sure of is that there will be ups and downs along the way.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The digital age embraces new technology and adapts to it very quickly. Nowadays, investors have an opportunity to diversify their portfolio with digital assets and not just physical ones. However, while digital assets have risen in fame in the last few years, their volatility and unpredictability have investors question whether or not these types of investments are actually safe. On the other hand, gold has always been a “safe bet” among investors.

The main reason is that gold is an excellent hedge against inflation, global instability and economic crisis. As for Bitcoin, many people have claimed that it’s the digital gold, but so far, Bitcoin was unable to provide the same level of investment security as gold. Many people still wonder if Bitcoin and gold are correlated. When comparing prices, the Bitcoin price is certainly very volatile, while gold pretty much retains its price with slight variations. Here’s more insight into the correlation between gold and Bitcoin.

As mentioned before, investors have an opportunity to opt for digital assets instead of just physical ones. The rise of Bitcoin’s price in 2017 that was alongside a price increase in gold made people believe these two assets are correlated. However, people who invested in Bitcoin did so mainly because this digital asset was unregulated by governments and they intended to reap the benefits of that situation.

On the other hand, people investing in gold were looking for a safe investment to secure their funds, as gold is usually used for that. In other words, the cryptocurrency market was explored by investors who were speculating on the outcome, while gold was sought after by investors looking to secure their funds. Simply put, there was no direct correlation other than the investors’ interest in both assets during the same period.

The difference between the assets upholds their lack of correlation. Gold is a physical asset, which means its use and properties are much more flexible than Bitcoin which is purely a digital asset. Gold has inherent value, it can be used in various industries and has cultural value as well. That means that gold is, and will always be highly sought after and on high demand. That’s why the gold price has remained steady throughout the years compared to Bitcoin prices that experience extreme volatility. For instance, Bitcoin reached its top price of $17.900 on December 22, 2017.

On the 5th of February, 2018, the price of Bitcoin fell to $6.200, which is more than 50% decrease in less than two months. The price of gold is determined by the global economic situation and demand, whereas digital assets are unregulated and their prices are uncertain at best. For example, gold prices go up whenever there are fluctuations in the stock market. Investors prefer an asset that can secure their funds or even yield a profit as opposed to an asset that’s too risky.

The gold market is more mature and well-developed, as well as regulated. On the other hand, the crypto market is fairly new and still in the process of adjusting. The increased popularity of digital assets also leads to the adoption of more cryptocurrencies. Aside from Bitcoin, there are over a thousand different currencies on the market. However, not all currencies are sought after or have the potential to become investments. That’s why the crypto market still cannot correlate with gold, but that doesn’t mean digital assets won’t experience more stability in the future.

Even though the idea behind Bitcoin and blockchain technology was originally to be unregulated by officials and decentralized from a banking system, it seems that it does require a bit of regulation in order to stabilize and operate on an optimal level. The lack of security and safety does force investors to tread carefully when investing in cryptocurrencies, whereas gold can provide certain security even in the worst of scenarios.

So far, experts have been arguing about the existing or nonexistent correlation between gold and Bitcoin. Regardless of the current situation, there’s undeniably a relationship between the two. Both assets are considered hedges against inflation and global economic difficulties. However, gold is still perceived as a more stable investment than digital assets.

The fact of the matter is that whenever cryptocurrency value decreases, gold prices go up, as investors return to their “safe haven” investment. The main reason is digital asset volatility. Increased volatility means greater risks and investors would prefer not to risk it, making investments that are meant to secure their funds. With that in mind, when the digital currency market stabilizes, the relationship between these two assets may improve and there may even be more correlation between them as well.

Whether there’s a correlation between gold and Bitcoin is still debatable. Where one party sees a correlation, others see coincidence. That’s why it’s difficult to determine the relationship between these two assets. As for now, gold is considered a less risky and a more flexible investment, whereas Bitcoin, although perceived as a hedge, is considered too volatile to overtake gold. From an investor’s point of view, gold and digital assets are two very different assets.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

When it comes to cryptocurrencies, one name stands out from the rest: Bitcoin. Bitcoin is the gold standard upon which all the other cryptocurrencies, cumulatively known as altcoins, are evaluated. And that’s rightly so because Bitcoin is the most popular, the biggest in terms of market capitalization and so far, the one most likely to break into mainstream use. But among the contenders for the throne, one cryptocurrency that closely resembles Bitcoin and the earliest altcoin is Litecoin. It was created primarily to be a “lighter” version of Bitcoin. In fact, many people refer to it as ‘silver’ to Bitcoin’s ‘gold’.

Why is that the case? An attempt to answer brings us to the issue of Bitcoin vs. Litecoin, exactly what we are trying to explore here. Let’s point out the similarities as well as explain the differences between these two cryptocurrencies.

A brief history

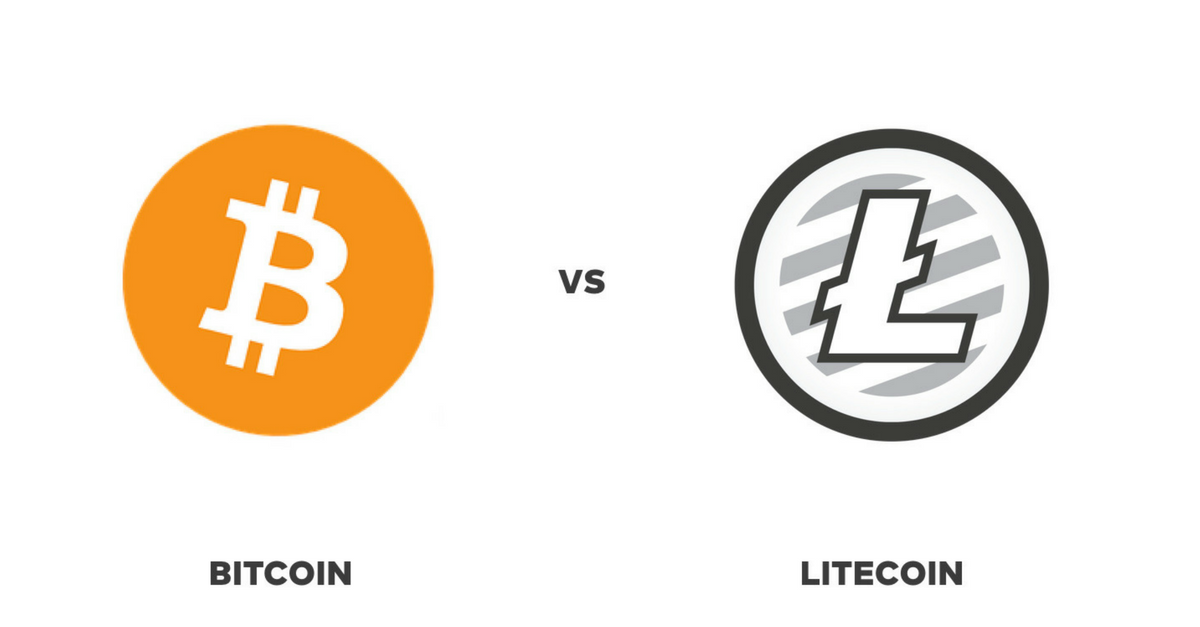

Bitcoin was created by Satoshi Nakamoto who released the Bitcoin whitepaper in 2008, before Bitcoin Core was launched on 3rd January 2009. On the other hand, Litecoin was created by Charles Lee and released on October 7th, 2011.

Price and Market capitalization

Whereas Bitcoin and Litecoin share a lot in terms of their blockchain protocols, the same cannot be said about their prices and market valuation. We could say both are dependent on the market trends and user flexibilities, but the variation isn’t even close. Today, bitcoin commands the largest market share, dominating by 42% of the total market capitalization to stand at $163 billion. BTC trades at $9636 against the USD and was at its all-time high of $19,535 on Dec 17, 2017. Bitcoin has a current circulating supply of 16,914,275 BTC against a maximum supply of 21 million coins.

Litecoin, on the other hand, is ranked 5th on coinmarketcap.com with a market cap of $10.4 billion. Its price today is $187, though it climbed to an all-time high of $366 on 19 December 2017 when its market cap was also just shy of $20 billion. Incidentally, Litecoin on that day had a daily volume of an incredible $2.3 billion. The circulating supply of LTC is currently 55, 592,093 LTC with a maximum supply of 84 million LTC.

When compared in terms of Market capitalization and price valuation, Bitcoin is 10x bigger or more than Litecoin. The same applies to popularity and use. While they both function as a store of value and can be used to make payments for goods and services, Bitcoin is accepted by far more companies and individuals than Litecoin.

Coin supply and transaction speed

Bitcoin and Litecoin differ in terms of the maximum coin supply. While Bitcoin’s total supply is capped at 21 million coins, Litecoin will have a total of 84 million coins. Though they differ in this aspect, both coins are deflationary, and their coin trajectory may appear similar. Another similarity is that both coins are divisible into smaller parts that enable micro-payments for goods and services. The smallest Bitcoin part is called a “Satoshi”.

But the two coins do differ in relation to the amount of time it takes to generate a new block. Litecoin block generation is halved after every 840,000 blocks, which is four times more than bitcoin at 210,000 blocks. For Bitcoin, a new block is generated after approximately 10 minutes. However, Litecoin miners use about two and half minutes to generate a new block. This results in the variation of transaction speeds between the two coins.

Due to having a faster block time, Litecoin’s network is normally able to confirm transactions much faster than Bitcoin. For instance, it would take 10 minutes to confirm four transactions on the Litecoin network, whereas the same amount of time would be just enough to verify one block of transactions on the Bitcoin network. Bitcoin has been implementing changes to its protocol to scale better and increase transaction speed.

It is expected that Lightning Network will make Bitcoin faster. However, Litecoin will look to implement the same protocol as it often times, does with every Bitcoin update.

Mining algorithms

Mining is a very vital component of cryptocurrency, precisely those that use the proof of work mining consensus mechanism. What we said earlier about block generation essentially amounts to the concept of mining. Basically, mining refers to the addition of new blocks to the main chain on the network to form a “blockchain”. Cryptocurrencies utilize different cryptographic algorithms to secure transactions on the blockchain. Bitcoin uses the SHA-256 algorithm that allows for the use of ASICs (Application Specific Integrated Circuits) for mining.

This hardware equipment came to replace the GPU and FPGA miners. Bitcoin mining is a complex activity but can be summarized as the solving of computational math problems to verify and secure a new block to the blockchain. Bitcoin miners (nodes) get rewarded 12.5 Bitcoins for every new block. One criticism leveled at bitcoin mining is that the process consumes a lot of energy resulting in massive electricity bills.

Mining is also an important aspect of Litecoin. Scrypt is the mining algorithm used on the Litecoin network. The Scrypt algorithm is designed to be resistant to customized ASIC miners due to its memory-hard nature. This makes mining Litecoin a lot easier as you can do it using a CPU or GPU. however, there are concerns that Litecoin’s CPU/GPU mining days may be soon over as ASIC miners targeting the Scrypt algorithm have been developed by companies like Zeus and Flower Technology. While miners on the Bitcoin platform get rewarded 12.5 BTC for every new block, Litecoin miners get 25 LTC for every new block validly added to the blockchain. It should be noted that mining Litecoin is relatively cheaper than bitcoin, but Bitcoin could be more profitable for those with the right equipment.

Conclusion

Bitcoin and Litecoin share a lot in common when it comes to the functional aspect of being stores of value. However, Bitcoin beats Litecoin on numerous fronts, specifically on price valuation and market adoption. Naturally, bitcoin would be an attractive coin for investment, but if you are looking for an affordable crypto with the potential to grow then Litecoin could be it.

This Article was provided by our friend Ronni Martelli

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Tomorrow is August 1st, the long-awaited date for the Bitcoin-blockchain upgrade. That’s why you are asking us: what’s about HolyTransaction and Bitcoin Cash?

This upgrade, in fact, will cause a hard fork and so the creation of a new chain (and so a new digital currency) called Bitcoin Cash. This will:

So, our users are asking if HolyTransaction will support Bitcoin Cash within the multicurrency wallet.

HolyTransaction, in fact, would like to announce that should UAHF choose to increase the Bitcoin block size on August 1st, our customer platform will not support the new blockchain or coin on that date.

Due to technical complexities, time and quality assurance needed to implement a second bitcoin ruleset and blockchain we will not support it.

We currently consider Bitcoin Cash as another cryptocurrency, though Bitcoin Cash’s transaction history would be the same as bitcoin’s .

A few days ago, we shared a blog post in support of UASF or User Activated Soft Fork.

It is a system for the activation of a soft fork that might occur on a specified time enforced by full nodes, a concept that is also called “economic majority”.

In the past years, a UASF was successfully developed to activate the P2SH soft fork (BIP16).

Instead, currently, the UASF is combined with the so-called SegWit activation in the BIP148 proposal.

Click here to read more about UASF.

We know that some users are curious to see what happens with Bitcoin Cash, but we are currently not supporting this altcoin.

Let’s see what happen and happy trading!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

While Bitcoin price is experiencing a new growth after the almost 50% drop from its all-time high, a few analysts of the crypto market suggest that bitcoin price at $4000 is in the air.

And this moment seems to come sooner than expected.

“When added to the professed agreement for major players to work together on the Bitcoin scaling issue starting September – if it becomes a reality, the price could see between $4,000 and $5,000 before the year ends,” said an expert to Cointelegraph.

2017 has been a good year for bitcoin price, as it traded at about $950 back in January and it reached its new all-time high a few months ago in June with a value of $3011: this means that bitcoin price grew of more than 3000% in a six-months period.

Compared to the all-time high we quoted above, the current price decrease is maybe due to the uncertainty around the upcoming SegWit activation that will take place on August 1st, 2017.

For those who are unfamiliar with this, SegWit is a new upgrade to the Bitcoin blockchain that will increase the block size to support more transactions and allow a faster confirmation for transactions.

At the moment, the blockchain supports up to 2000 transactions per block in 10 minutes and SegWit will double this capacity to 4000 transactions.

Also, Segwit2x will increase the size of each block from 1MB to 2MB.

SegWit will be implemented on August 1s, while it is not sure yet if Segwit2x will be implemented too.

That said, the real reason of uncertainty is caused by the hard fork needed to implement SegWit.

This might create two different chains in a similar way to what happened to Ethereum in 2016 with the DAO and Ethereum Classic.

According to many experts in the industry, while this event might create panic sell and uncertainty within the community, will not be a real problem in the next future.

Kumar Gaurav of Cashaa explained to Cointelegraph:

“When looking at 2017 so far, it still has been a good year for Bitcoin, starting just below 1000$ and now standing just below $2,000. Whether and to which extent this overall trend will continue will be seen more clearly after some crucial dates such as 1st August. If 80% of the Bitcoin community adopts the updates all should be fine. It seems most likely this will be reached, as the current signaling of intended support is at 87.8 percent, an increase from 83.28 percent in May. Comparable to when in May, following the New York agreement on SegWit2x, Bitcoin reached an all-time high of $2,160, it can reach new all-time highs after a successful activation as Bitcoin will be more attractive again and bring users of other cryptocurrencies back to Bitcoin.”

Another reason that might be influenced the price is the growing number of Bitcoin-based ICOs or Initial Coin Offerings.

ICOs managers might have cashed out during those days and this drove the prices because a huge amount of bitcoin appeared on the market.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

A new electronics retailer decided to start accepting bitcoin in Japan as one of the available payment methods in all its shops within the country.

It is Bic Camera that began to accept bitcoin at several shops back in April, and that is now it is looking to expand this payment after seeing huge levels of demand from its customers.

The retailer is taking payments in the digital currency thanks to a partnership with the domestic bitcoin exchange called bitFlyer, so they can convert bitcoin into yen right after the acceptance.

Bic Camera sells a wide range of products, including cameras, computers and home appliances like fridges and washing machines.

News that Bic Camera is accepting bitcoin at more locations came after the Japanese government’s new regulations around digital currencies and the exchange services. Among those, for example, there is a legal definition for bitcoin as a kind of payment instrument and the decision to eliminate bitcoin taxation.

Also, this could be one reason why we might aspect a new growth in the bitcoin price in the next days.

Read more about Bitcoin in Japan here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

On July 10th, a new Bitcoin meetup will be organized in Rome thanks to the Blockchain Education Network Italia.

This bitcoin meetup aims at spreading the word about the blockchain and being a meeting place for all the enthusiasts of the distributed ledger and digital currencies.

The evening will host different meetings with two major experts in the industry:

After their speeches, there will be a pitch with a few startups that work in the industry and free networking with pizza and beer for free.

The event is free, but in order to have access you need to register yourself on Eventbrite here:

https://www.eventbrite.it/

Click here to read more about this bitcoin meetup: https://www.meetup.com/

This event is sponsored by HolyTransaction.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Japan government officially eliminates bitcoin taxation after it recognized as legal method of payment a few months ago.

Consumption taxes on the sale of bitcoin will come into effect on July 1st.

According to a Deloitte’s report entitled “Japan: Inbound Tax Alert, 2017 Tax Reform Proposals,” digital currencies including Bitcoin will be exempt from the 8% consumption tax in Japan.

Deloitte’s report explains:

“The supply of virtual currency will be exempt from Japanese Consumption Tax (“JCT”). Currently, virtual currencies such as Bitcoin do not fall under the category of exempt sales, and as a result, the sale of virtual currencies in Japan have been treated as taxable for JCT purposes. Following the enactment of the amended Fund Settlement Law in May 2016, which newly defined “virtual currency” as a means of settlement, the sale of virtual currency as defined under the new Fund Settlement Law will be exempt from JCT. This change will apply to sales/purchase transactions performed in Japan on or after 1 July 2017.”

Back in March, the Japanese National Diet approved the tax reform proposed by Deloitte. The bill, which came into effect on July 1st will drastically increase bitcoin and cryptocurrency trading activities within the Japanese digital currency exchanges.

The bill will probably increase bitcoin and cryptocurrency trading activities within the Japanese digital currency exchanges.

On April 1, the Japanese government officially recognized Bitcoin as a legal payment method and currency.

The Japanese Bitcoin exchange industry is well regulated with Know Your Customer (KYC) and Anti-Money Laundering (AML) systems. AML policies are very strict in Japan and South Korea, and it is difficult for traders to take advantage of utilizing digital currencies to move large amounts outside of Japan.

Although it could be a coincidence- since Japan has proposed the end of Bitcoin taxation, Bitcoin price increased from around $2,450 to $2,570.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Today, on June 6th, a new Bitcoin all time high has been hit.

According to CoinMarketcap, in fact, the bitcoin price reached a value of $2,911.86, surpassing the previous bitcoin all time high of $2,791.69 set less than a month ago on May 25th.

Bitcoin began June with a price of about $2,500, trading at $2,300 on June 1st.

As always in these events, many are the possible causes for this recent growth in the bitcoin price.

Here a quick report on what is happening in the bitcoin industry during these days.

Click on the link below to read more about that specific topic.

Do you think there are more reasons for this bitcoin all time high?

Comment the news with us!

Open your free digital wallet here to store your cryptocurrencies in a safe place.