The digital age embraces new technology and adapts to it very quickly. Nowadays, investors have an opportunity to diversify their portfolio with digital assets and not just physical ones. However, while digital assets have risen in fame in the last few years, their volatility and unpredictability have investors question whether or not these types of investments are actually safe. On the other hand, gold has always been a “safe bet” among investors.

The main reason is that gold is an excellent hedge against inflation, global instability and economic crisis. As for Bitcoin, many people have claimed that it’s the digital gold, but so far, Bitcoin was unable to provide the same level of investment security as gold. Many people still wonder if Bitcoin and gold are correlated. When comparing prices, the Bitcoin price is certainly very volatile, while gold pretty much retains its price with slight variations. Here’s more insight into the correlation between gold and Bitcoin.

As mentioned before, investors have an opportunity to opt for digital assets instead of just physical ones. The rise of Bitcoin’s price in 2017 that was alongside a price increase in gold made people believe these two assets are correlated. However, people who invested in Bitcoin did so mainly because this digital asset was unregulated by governments and they intended to reap the benefits of that situation.

On the other hand, people investing in gold were looking for a safe investment to secure their funds, as gold is usually used for that. In other words, the cryptocurrency market was explored by investors who were speculating on the outcome, while gold was sought after by investors looking to secure their funds. Simply put, there was no direct correlation other than the investors’ interest in both assets during the same period.

The difference between the assets upholds their lack of correlation. Gold is a physical asset, which means its use and properties are much more flexible than Bitcoin which is purely a digital asset. Gold has inherent value, it can be used in various industries and has cultural value as well. That means that gold is, and will always be highly sought after and on high demand. That’s why the gold price has remained steady throughout the years compared to Bitcoin prices that experience extreme volatility. For instance, Bitcoin reached its top price of $17.900 on December 22, 2017.

On the 5th of February, 2018, the price of Bitcoin fell to $6.200, which is more than 50% decrease in less than two months. The price of gold is determined by the global economic situation and demand, whereas digital assets are unregulated and their prices are uncertain at best. For example, gold prices go up whenever there are fluctuations in the stock market. Investors prefer an asset that can secure their funds or even yield a profit as opposed to an asset that’s too risky.

The gold market is more mature and well-developed, as well as regulated. On the other hand, the crypto market is fairly new and still in the process of adjusting. The increased popularity of digital assets also leads to the adoption of more cryptocurrencies. Aside from Bitcoin, there are over a thousand different currencies on the market. However, not all currencies are sought after or have the potential to become investments. That’s why the crypto market still cannot correlate with gold, but that doesn’t mean digital assets won’t experience more stability in the future.

Even though the idea behind Bitcoin and blockchain technology was originally to be unregulated by officials and decentralized from a banking system, it seems that it does require a bit of regulation in order to stabilize and operate on an optimal level. The lack of security and safety does force investors to tread carefully when investing in cryptocurrencies, whereas gold can provide certain security even in the worst of scenarios.

So far, experts have been arguing about the existing or nonexistent correlation between gold and Bitcoin. Regardless of the current situation, there’s undeniably a relationship between the two. Both assets are considered hedges against inflation and global economic difficulties. However, gold is still perceived as a more stable investment than digital assets.

The fact of the matter is that whenever cryptocurrency value decreases, gold prices go up, as investors return to their “safe haven” investment. The main reason is digital asset volatility. Increased volatility means greater risks and investors would prefer not to risk it, making investments that are meant to secure their funds. With that in mind, when the digital currency market stabilizes, the relationship between these two assets may improve and there may even be more correlation between them as well.

Whether there’s a correlation between gold and Bitcoin is still debatable. Where one party sees a correlation, others see coincidence. That’s why it’s difficult to determine the relationship between these two assets. As for now, gold is considered a less risky and a more flexible investment, whereas Bitcoin, although perceived as a hedge, is considered too volatile to overtake gold. From an investor’s point of view, gold and digital assets are two very different assets.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

For people who have traced the movements of Bitcoin since its inception, it’s hard to believe that it has only been around for less than a decade. As discussed here on HolyTransaction, the world’s first cryptocurrency has had a wild ride so far, from the downright bizarre (two pizzas for 10,000 BTC) to the extremely exciting. As of the start of the year, Bitcoin’s market cap was valued at $280 billion (€226 billion), with cryptocurrency like Ethereum following at impressive valuations of $90.4 billion (€73 billion).

These figures make investing in cryptocurrencies incredibly tempting, but also quite daunting. With such a young market, there aren’t a lot of set rules or trends that can help guide you on your investment journey. This is where looking at similar trading commodities like gold and other precious metals come in. After all, FXCM explains that gold trading is simultaneously one of the oldest and most exciting ways to invest in global markets, and this remains true whether in times of war and turmoil or peace and prosperity. With the right focus and lots of discipline, there’s plenty of wisdom to be uncovered from looking at the history of gold trading.

Whether you’re a beginner looking to dip your toes into the cryptocurrency pool or an experienced trader hoping to build your wisdom in Bitcoin investing, here are five golden lessons for today’s cryptocurrency investors.

Diversify, diversify, diversify!

This tip seems basic, but focusing on a single trading commodity remains one of the most common mistakes investors make. A conservative position in gold investing means a maximum of 10% gold in your portfolio, and this is something that you can keep in mind when investing in cryptocurrencies. This can not only protect you from unexpected Bitcoin price dips, but can also open up better growth opportunities with lower risks and good returns. From the over 1,300 different cryptocurrencies in existence, This is Money recommends looking into altcoins like Litecoin, Monero, and Dash this 2018.

Stay calm in the face of volatility.

Gold can easily swing by a hundred pips and reverse every few minutes, which means trading in gold requires a certain degree of thick skin and steel-like determination. These are also very handy when trading cryptocurrencies, which are infamous for their volatility. In crypto-speak, be ready to “HODL”, or hold on for dear life (your coins), even when everyone else is panicking.

Set a loss limit.

Be sure to set acceptable loss limits for your investments and avoid buying too much. Financial Times reports that even a trusty commodity like gold has its own set of risks, which means it’s healthy to set stops for each individual trade for a maximum allowable loss that you are comfortable with. Invest only what you can stand to lose, and keep evaluating your trading strategies to learn which cryptocurrencies are best suited for you.

Keep your eyes on the prize.

Whatever your feelings are about shiny yellow metals or blockchain-enabled digital currencies, Forbes claims that these are still commodities that can be sold when prices are high and bought when prices are low. Focus on market trends and see where the prices are heading, and use these to inform your decisions. Pay attention to cycles, growth patterns, and market potential to make decisions, instead of which cryptocurrencies everyone else is buying.

Security and safety is a must.

Last but not least, invest only on trusted trading platforms and certified services. Millions of people have been victimised by gold-related scams and fraudulent brokers over the years, and it’s important to carry the same level of vigilance when carrying out cryptocurrency wallet transactions. Keep your money and investments safe with your free digital wallet here at HolyTransaction.

Do you have any other tips for cryptocurrency trading? Let us know in the comments below!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

When it comes to cryptocurrencies, one name stands out from the rest: Bitcoin. Bitcoin is the gold standard upon which all the other cryptocurrencies, cumulatively known as altcoins, are evaluated. And that’s rightly so because Bitcoin is the most popular, the biggest in terms of market capitalization and so far, the one most likely to break into mainstream use. But among the contenders for the throne, one cryptocurrency that closely resembles Bitcoin and the earliest altcoin is Litecoin. It was created primarily to be a “lighter” version of Bitcoin. In fact, many people refer to it as ‘silver’ to Bitcoin’s ‘gold’.

Why is that the case? An attempt to answer brings us to the issue of Bitcoin vs. Litecoin, exactly what we are trying to explore here. Let’s point out the similarities as well as explain the differences between these two cryptocurrencies.

A brief history

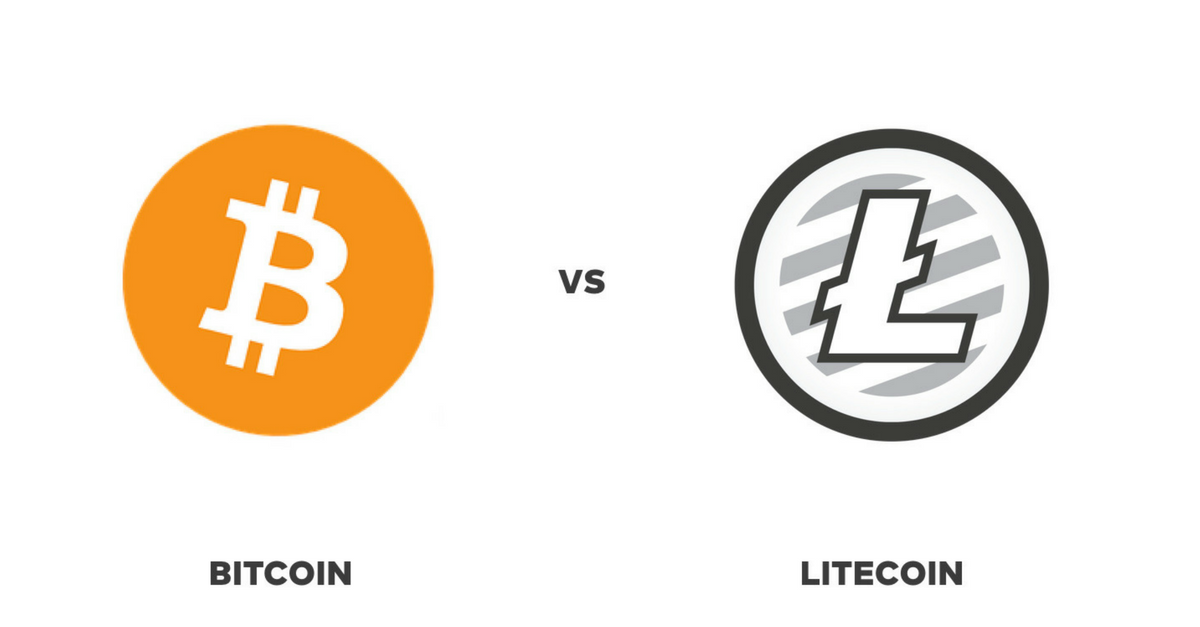

Bitcoin was created by Satoshi Nakamoto who released the Bitcoin whitepaper in 2008, before Bitcoin Core was launched on 3rd January 2009. On the other hand, Litecoin was created by Charles Lee and released on October 7th, 2011.

Price and Market capitalization

Whereas Bitcoin and Litecoin share a lot in terms of their blockchain protocols, the same cannot be said about their prices and market valuation. We could say both are dependent on the market trends and user flexibilities, but the variation isn’t even close. Today, bitcoin commands the largest market share, dominating by 42% of the total market capitalization to stand at $163 billion. BTC trades at $9636 against the USD and was at its all-time high of $19,535 on Dec 17, 2017. Bitcoin has a current circulating supply of 16,914,275 BTC against a maximum supply of 21 million coins.

Litecoin, on the other hand, is ranked 5th on coinmarketcap.com with a market cap of $10.4 billion. Its price today is $187, though it climbed to an all-time high of $366 on 19 December 2017 when its market cap was also just shy of $20 billion. Incidentally, Litecoin on that day had a daily volume of an incredible $2.3 billion. The circulating supply of LTC is currently 55, 592,093 LTC with a maximum supply of 84 million LTC.

When compared in terms of Market capitalization and price valuation, Bitcoin is 10x bigger or more than Litecoin. The same applies to popularity and use. While they both function as a store of value and can be used to make payments for goods and services, Bitcoin is accepted by far more companies and individuals than Litecoin.

Coin supply and transaction speed

Bitcoin and Litecoin differ in terms of the maximum coin supply. While Bitcoin’s total supply is capped at 21 million coins, Litecoin will have a total of 84 million coins. Though they differ in this aspect, both coins are deflationary, and their coin trajectory may appear similar. Another similarity is that both coins are divisible into smaller parts that enable micro-payments for goods and services. The smallest Bitcoin part is called a “Satoshi”.

But the two coins do differ in relation to the amount of time it takes to generate a new block. Litecoin block generation is halved after every 840,000 blocks, which is four times more than bitcoin at 210,000 blocks. For Bitcoin, a new block is generated after approximately 10 minutes. However, Litecoin miners use about two and half minutes to generate a new block. This results in the variation of transaction speeds between the two coins.

Due to having a faster block time, Litecoin’s network is normally able to confirm transactions much faster than Bitcoin. For instance, it would take 10 minutes to confirm four transactions on the Litecoin network, whereas the same amount of time would be just enough to verify one block of transactions on the Bitcoin network. Bitcoin has been implementing changes to its protocol to scale better and increase transaction speed.

It is expected that Lightning Network will make Bitcoin faster. However, Litecoin will look to implement the same protocol as it often times, does with every Bitcoin update.

Mining algorithms

Mining is a very vital component of cryptocurrency, precisely those that use the proof of work mining consensus mechanism. What we said earlier about block generation essentially amounts to the concept of mining. Basically, mining refers to the addition of new blocks to the main chain on the network to form a “blockchain”. Cryptocurrencies utilize different cryptographic algorithms to secure transactions on the blockchain. Bitcoin uses the SHA-256 algorithm that allows for the use of ASICs (Application Specific Integrated Circuits) for mining.

This hardware equipment came to replace the GPU and FPGA miners. Bitcoin mining is a complex activity but can be summarized as the solving of computational math problems to verify and secure a new block to the blockchain. Bitcoin miners (nodes) get rewarded 12.5 Bitcoins for every new block. One criticism leveled at bitcoin mining is that the process consumes a lot of energy resulting in massive electricity bills.

Mining is also an important aspect of Litecoin. Scrypt is the mining algorithm used on the Litecoin network. The Scrypt algorithm is designed to be resistant to customized ASIC miners due to its memory-hard nature. This makes mining Litecoin a lot easier as you can do it using a CPU or GPU. however, there are concerns that Litecoin’s CPU/GPU mining days may be soon over as ASIC miners targeting the Scrypt algorithm have been developed by companies like Zeus and Flower Technology. While miners on the Bitcoin platform get rewarded 12.5 BTC for every new block, Litecoin miners get 25 LTC for every new block validly added to the blockchain. It should be noted that mining Litecoin is relatively cheaper than bitcoin, but Bitcoin could be more profitable for those with the right equipment.

Conclusion

Bitcoin and Litecoin share a lot in common when it comes to the functional aspect of being stores of value. However, Bitcoin beats Litecoin on numerous fronts, specifically on price valuation and market adoption. Naturally, bitcoin would be an attractive coin for investment, but if you are looking for an affordable crypto with the potential to grow then Litecoin could be it.

This Article was provided by our friend Ronni Martelli

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin rose from unknown to mainstream recognition largely thanks the incredulous surge in value it saw in 2017. But then the price went down, sparking yet another heated discussion about the volatile unpredictability of the bitcoin.

Nowadays, discussions are all at their all time hype, but worth just as long as the participants know what they are talking about; and the audience has at least some grasp of the matter. But it rarely happens, as the vast majority of experts are as clueless about the intricacies of the crypto markets as is the general audience.

The infographic below, provided by our friends at BitcoinPlay, will not make us all marketing gurus but will give you a much better understanding about the driving forces behind the world’s first cryptocurrency, how it came to be, who embraced it first and how countries are handling it.

Here’s a selection of our favourite ones:

Open your free digital wallet here to store your cryptocurrencies in a safe place.

On March 1st, 2016, ISITC, the International Securities Association for Institutional Trade Communication, published the results of its annual survey about the financial services progress which it gives also a specific forecast on how the industry will be during the current year.

This annual survey polled 45 members who work in several sectors within the financial industries.The survey revealed that 62% of companies want to invest in technology with a lot of interest in blockchain and cybersecurity technology and 55% of those companies are studying or already developing solutions based on blockchain technology.

Also 74% of those companies have concrete plans to invest in cybersecurity by the end of 2016/17, up from 57% in the 2015 survey.

This annual survey also revealed:

Jeff Zoller, Chair of ISITC and Vice President at T. Rowe Price commented:

“New and emerging technologies have taken the financial services industry by storm. The results of our annual member survey confirm this sentiment, as firms plan increased investment in blockchain and cybersecurity technologies, as a method for combating long-term risk and cost. We look forward to continuing the dialogue around the challenges and opportunities these disruptive technologies bring to the industry at our March event in Boston”. In addition, according to Nigel Solkhon, CEO of ISITC Europe, the current interest and investment in the blockchain among financial companies will have a significant impact within the next 18 months.

The ISITC 22nd Annual Industry Forum and Vendor Show will be held March 20-23, 2016 at the Renaissance Boston Waterfront Hotel.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Flux Party is a new Australian political party that wants to renovate the voting system by using the blockchain.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.