Emerging at the forefront of Bitcoin innovation, El Salvador is working toward achieving a level of financial independence and openness independent from a centralised banking system. El Salvador has paved the way for other nations to follow in its footsteps by becoming the first nation in the world to recognise Bitcoin as a legitimate currency.

To encourage worldwide collaboration and proliferate networking avenues for Bitcoin enthusiasts, El Salvador hosted the “Adopting Bitcoin” Conference over 3 days, between November 15 and 17. The event took place in San Salvador and at Bitcoin Beach and brought together members of the Bitcoin ecosystem from a multitude of states.

More than 110 speakers from over 30 countries discussed the most recent breakthroughs throughout the whole range of Bitcoin-related disciplines, including those pertaining to technology as well as economics.

In this setting, the presentation of the Bitcoin core engineer Jon Atack was a significant highlight, focused on technology and development, while the presentation of Mexican senator Indira Kempis will be the most famous name in the track focused on economics. The multi-stage event will be held in English, with Spanish translations provided in real-time for the most critical phases.

Paolo Ardoino, the Chief Technical Officer of Bitfinex, is one of the attendees at the crypto conference in El Salvador who gained the greatest notoriety. Arduino said in his statement that his company “would redouble its efforts to establish a free, unstoppable, robust, and open Bitcoin and technological infrastructure for El Salvador.”

Overall, Bitfinex has committed to working closely with the government of El Salvador, which is currently mired in debt and is governed by President Nayib Bukele, to devise an appropriate regulatory framework for the cryptocurrency market and other digital assets in the nation. Ifinex, the parent company of Bitfinex, has agreed with the government of El Salvador to work together on developing a regulatory framework for digital assets and securities.

While adverse market dynamics hindered the optimism around the event, there is a suite of conclusions that indicate the ongoing commitment of Bitcoin leaders and pioneering nations like El Salvador to still pursue the broader adoption of Bitcoin as a payment medium.

As the blockchain industry, as well as all the other financial sectors, witnessed in 2022, the price of Bitcoin and other cryptocurrencies declined primarily due to the Federal Reserve’s strategy of dramatically raising interest rates to curb rising inflation in the United States, which caused the cost of money to increase. Subsequently, the remainder of the decline was caused by a succession of events, including the bankruptcy of organisations involved in cryptocurrency trading and the collapse of currencies such as Terra USD. Large investors sold out these high-risk assets, precipitating a precipitous value decline.

El Salvador’s President, Nayib Bukele, announced that the nation would begin buying one Bitcoin each day starting with November 17, 2022. The use of dollar-cost-averaging (DCA) in Bitcoin transactions is widespread among the community, yet it is unprecedented for a nation-state. When Bukele’s proclamation was made, the nation possessed a Bitcoin treasury that included 2,381 BTC and had a worth of more than $39 million.

So far, Bukele has made it a pattern in the past to acquire a significant quantity of Bitcoin during periods of market instability and to “buy the dip.” This action would signal the end of a nearly five-month pause amid severe bear market circumstances and the collapse of Sam Bankman-massive Fried’s $32 billion FTX enterprise.

According to NayibTracker, Bukele made his most recent purchase of Bitcoin on June 30, 2022. At that time, he paid $1.52 million for 80 Bitcoins (worth around $1.33 million), which works out to an average price of $19,000 per coin.

Overall, El Salvador’s “Adopting Bitcoin” conference serves as a reminder of the ongoing commitment of crypto pioneers and their belief in the long-term potential of this cutting-edge technological revolution.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Investment opportunities are a dime a dozen in the digital world, but unsurprisingly, cryptocurrencies are among the most interesting prospects aspiring investors are looking at. Unlike their traditional counterparts such as gold, stocks, traditional currencies, and other, cryptocurrencies and the blockchain platform they reside on offer a chance at the big leagues for any investor that makes the right move at the right time. However, that doesn’t mean that established assets shouldn’t be ignored.

Bitcoin has turned eight years old this year, and the now mature digital asset has had a strong ROI rate throughout its life, fueled by its constant and steady adoption around the globe. With outstanding payouts that topple some of the most lucrative investment assets on the market, it’s time to take cryptocurrencies more seriously.

However, there are a number of factors that make shares a strong and secure investment opportunity that cryptocurrencies might not be able to match. Let’s consider the market trends and help you discern between shares and cryptocurrencies as viable investment prospects.

Through trial and error, through success and failure, Bitcoin has become a sound investment portfolio option. Out of the six previous years, Bitcoin has yielded a great return on investment and will only continue to rise in the months and years to come. With the computational networks becoming more secure and stronger than before, and with the coming of flexible and reliable wallet services, it only stands to reason that modern investors should look towards cryptocurrencies as viable investment opportunities.

Even though investors have had difficulties penetrating the market over the years because of the inherent volatility of the market and the unpredicted growth and fluctuations, modern market trends indicate a more secure investment arena for the upcoming period. The increase in market liquidity, regulatory oversight, and overall security is making Bitcoin and other cryptocurrencies more appealing to investors worldwide, as well as countries willing to adopt the cryptocurrency as a new method of payment in select instances.

The stock market is a veteran among investment assets and remains one of the most stable markets on the planet. Buying a share in a company that is operating profitably will grant you smaller or greater returns over a number of years, depending on the fluctuations in the market and the worth of the company’s stocks. You can choose to invest in a range of businesses varying in size and equity though a broker or an investment fund.

Over the last year, though, profitable small cap stocks have made a boom in the industry and created a lucrative investment arena that aspiring investors should take into consideration when planning their next big move. Even though major tech companies continue to garner the attention of the investment world, small cap stocks prove to be an easier way into a stable market and show a great potential for grand financial returns in the years to come. However, financial return should not be your only guiding star.

One of the greatest concerns for any investor is whether or not the market in question is safe and stable enough for storing assets without them vanishing into the abyss with no prior warning. It’s a well-known fact that the cryptocurrency market is not regulated by any traditional means, but rather is was envisioned and still serves as a public ledger that works as a decentralized data management system – a system where every transaction is stored.

This means that the cryptocurrency market is not regulated by any governmental body, nor is it recognized by legislature or financial institutions. As such, cryptocurrency transactions cannot be influenced, capped, reserved, or identified by third parties. However, this creates a possibly volatile investment environment the stock market is protected from.

The stock market is one of the safest investment markets in the world. The fact that it is extremely well-regulated by federal law and financial institutions ensures a higher level of security and accuracy, while the strict vetting process for participants from both sides ensures transparency for investors. All of this works together towards creating a safe investment arena, and it also helps make sound forecasts in terms of market fluctuations, giving more control to the investor.

With all of that said, it’s important to note that Bitcoin has never been hacked, nor is it likely to get hacked any time in the future. The projected amount of computing power and time needed to crack into individual transactions and wallets is almost impossible to replicate in real-life scenarios, and so blockchain stands tall as the most secure platform on the web.

While it is true that Bitfinex and Mt.Gox have been hacked in the past, nowadays the cryptocurrency game offers far more superior security options to its investors. With cryptocurrencies, the assets you store in your wallet are safe. This cannot be said for other investment assets, as every digital trading game has its set of liabilities and risks the hackers can exploit.

Investors are constantly looking for emerging opportunities and lucrative assets that will yield a high ROI over a specified number of years, and both the stock market and the crypto market offer a good chance of a high return on investment. That said, the stock market offers a more stable and well-regulated investment arena, whereas cryptocurrencies offer extreme returns to those who invest in the next big project.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

For people who have traced the movements of Bitcoin since its inception, it’s hard to believe that it has only been around for less than a decade. As discussed here on HolyTransaction, the world’s first cryptocurrency has had a wild ride so far, from the downright bizarre (two pizzas for 10,000 BTC) to the extremely exciting. As of the start of the year, Bitcoin’s market cap was valued at $280 billion (€226 billion), with cryptocurrency like Ethereum following at impressive valuations of $90.4 billion (€73 billion).

These figures make investing in cryptocurrencies incredibly tempting, but also quite daunting. With such a young market, there aren’t a lot of set rules or trends that can help guide you on your investment journey. This is where looking at similar trading commodities like gold and other precious metals come in. After all, FXCM explains that gold trading is simultaneously one of the oldest and most exciting ways to invest in global markets, and this remains true whether in times of war and turmoil or peace and prosperity. With the right focus and lots of discipline, there’s plenty of wisdom to be uncovered from looking at the history of gold trading.

Whether you’re a beginner looking to dip your toes into the cryptocurrency pool or an experienced trader hoping to build your wisdom in Bitcoin investing, here are five golden lessons for today’s cryptocurrency investors.

Diversify, diversify, diversify!

This tip seems basic, but focusing on a single trading commodity remains one of the most common mistakes investors make. A conservative position in gold investing means a maximum of 10% gold in your portfolio, and this is something that you can keep in mind when investing in cryptocurrencies. This can not only protect you from unexpected Bitcoin price dips, but can also open up better growth opportunities with lower risks and good returns. From the over 1,300 different cryptocurrencies in existence, This is Money recommends looking into altcoins like Litecoin, Monero, and Dash this 2018.

Stay calm in the face of volatility.

Gold can easily swing by a hundred pips and reverse every few minutes, which means trading in gold requires a certain degree of thick skin and steel-like determination. These are also very handy when trading cryptocurrencies, which are infamous for their volatility. In crypto-speak, be ready to “HODL”, or hold on for dear life (your coins), even when everyone else is panicking.

Set a loss limit.

Be sure to set acceptable loss limits for your investments and avoid buying too much. Financial Times reports that even a trusty commodity like gold has its own set of risks, which means it’s healthy to set stops for each individual trade for a maximum allowable loss that you are comfortable with. Invest only what you can stand to lose, and keep evaluating your trading strategies to learn which cryptocurrencies are best suited for you.

Keep your eyes on the prize.

Whatever your feelings are about shiny yellow metals or blockchain-enabled digital currencies, Forbes claims that these are still commodities that can be sold when prices are high and bought when prices are low. Focus on market trends and see where the prices are heading, and use these to inform your decisions. Pay attention to cycles, growth patterns, and market potential to make decisions, instead of which cryptocurrencies everyone else is buying.

Security and safety is a must.

Last but not least, invest only on trusted trading platforms and certified services. Millions of people have been victimised by gold-related scams and fraudulent brokers over the years, and it’s important to carry the same level of vigilance when carrying out cryptocurrency wallet transactions. Keep your money and investments safe with your free digital wallet here at HolyTransaction.

Do you have any other tips for cryptocurrency trading? Let us know in the comments below!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

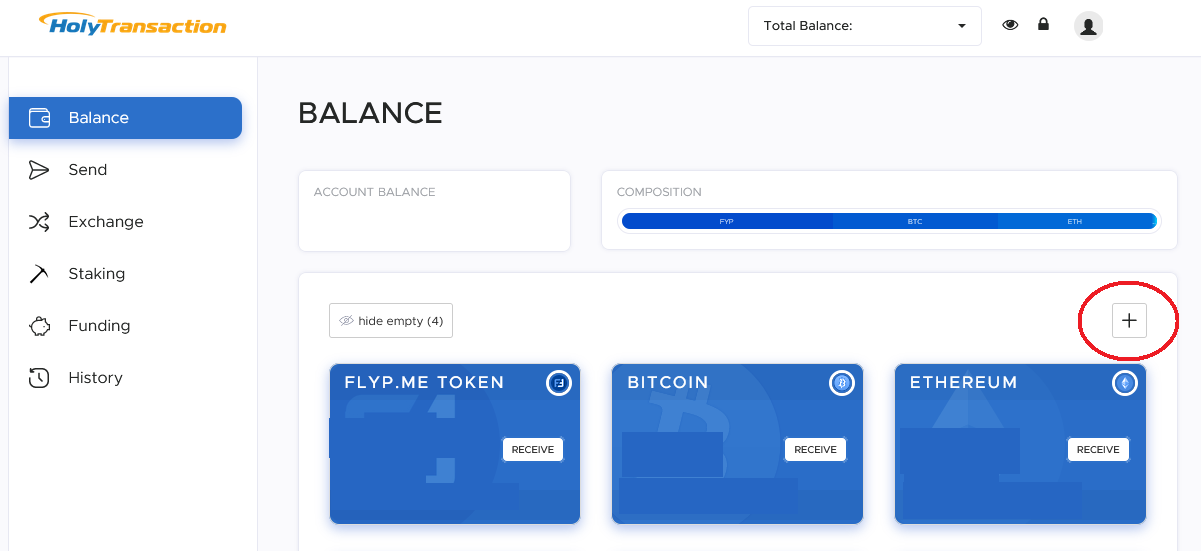

We’ve been working to provide you with two new Cryptocurrency portfolio options.

As of today, you can instantly purchase Faircoin and Gamecredits through your Holytransaction wallet, transfer them to

any HolyTransaction’s user for free, and make crypto-to-crypto transfers between Faircoin, Gamecredits, and seven more cryptocurrency’s networks.

Today Faircoin and Gamecredits join HolyTransaction.

All HolyTransaction customers can create new addresses for FAIR (Faircoin) and GAME (Gamecredits) balances and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other cryptocurrency.

Just like Bitcoin, you can now:

We’ve been working to provide you with two new Cryptocurrency portfolio options.

As of today, you can instantly purchase Faircoin and Gamecredits through your Holytransaction wallet, transfer them to

any HolyTransaction’s user for free, and make crypto-to-crypto transfers between Faircoin, Gamecredits, and seven more cryptocurrency’s networks.

Today Faircoin and Gamecredits join HolyTransaction.

All HolyTransaction customers can create new addresses for FAIR (Faircoin) and GAME (Gamecredits) balances and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other cryptocurrency.

Just like Bitcoin, you can now:

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.