Understanding the Basics of Zero-Knowledge Proofs (ZKPs) Before Examining zk-STARKs and zk-SNARKs

Ethereum now has privacy thanks to zero-knowledge proof technologies, specifically zk-STARKs. But before we can assess zk-STARKs, it is important to define a zero-knowledge proof (ZKP).

Understanding the Basics of Zero-Knowledge Proofs (ZKPs)

A ZKP is a cryptographic technique that enables a prover to confirm another person’s assertion without disclosing any supporting data. zk-STARKs and zk-SNARKs are two of the most compelling zero-knowledge technologies available today, standing for zero-knowledge succinct non-interactive argument of knowledge and zero-knowledge scalable transparent argument of knowledge, respectively. These technologies allow one party to demonstrate their knowledge to another without actually revealing the knowledge, making them both scaling technologies, as they can enable faster proof verification, and privacy-enhancing technologies, as they reduce the amount of information shared between users.

zk-STARKs, specifically, enable users to communicate validated data or carry out computations with a third party without the other party knowing the data or results of the analysis. They are an advancement over zk-SNARKs because of their reduced algorithmic complexity, making them easier for even crypto experts to find mistakes in. These types of knowledge testing tools are primarily used to build highly private and secure systems that are decentralized and can only be accessed under specific, difficult-to-obtain conditions, such as those found in cryptocurrencies. These systems not only secure the network but also protect and anonymize users.

Comparing zk-SNARKs and zk-STARKs

There are a few main differences between zk-SNARKs and zk-STARKs. Firstly, zk-SNARKs require a reliable configuration phase, while zk-STARKs create verifiable computing systems without trust using publicly verifiable randomness. Secondly, zk-STARKs are more scalable in terms of speed and computational size when compared to zk-SNARKs. And thirdly, zk-SNARKs are vulnerable to attack by quantum computers, while zk-STARKs are currently immune. However, it is important to note that STARKs have larger proof sizes than SNARKs, meaning they take longer to verify and require more gas. In addition, the STARKs developer community is smaller and has less documentation compared to SNARKs.

Support from the Developer Community

Despite these differences, both the SNARKs and STARKs communities have support from developers. The Ethereum Foundation, in particular, has shown support for Starkware, a company using STARKs, by awarding them a $12 million grant. While documentation for STARKs is currently less comprehensive than that for SNARKs, the technical community has recently created more resources for those interested in the technology.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Hal Finney’s Family Launches ‘Running Bitcoin Challenge’ to Support ALS Research

The Running Bitcoin Challenge: Honoring Hal Finney’s Memory and Supporting the Fight Against ALS

Hal Finney was a renowned computer scientist and cryptocurrency developer known for his contributions to the development of Bitcoin. In 2008, he received the first-ever Bitcoin transaction from Satoshi Nakamoto, the pseudonymous creator of Bitcoin. Tragically, Finney passed away in 2014 due to complications from Amyotrophic Lateral Sclerosis (ALS), also known as Lou Gehrig’s disease.

A Half Marathon Fundraiser for a Good Cause

In honor of Finney’s legacy, his spouse Fran Finney has organized the Running Bitcoin Challenge, a half marathon fundraiser that takes place between January 1 and January 10 each year. Finney was an avid runner before being diagnosed with ALS in August 2009. Despite a long battle with the disease, he was cryonically preserved in 2014. The Running Bitcoin event serves as a way to honor his memory and raise funds for an important cause. Those who donate at least $100 will receive an official Running Bitcoin T-shirt, and the top 25 fundraisers will receive a rare Hal Finney collectible.

The First Bitcoin Transaction and a Tweet That Changed the World

This timing coincides with the anniversary of Hal Finney’s famous “Running Bitcoin” tweet, in which he announced that he was contributing to the code to the Bitcoin codebase in 2008 and early 2009, and he was the recipient of the first-ever Bitcoin transaction, in which Satoshi Nakamoto sent him 10 BTC. Finney was a pioneer in the field of computer science and a strong advocate for privacy and civil liberties. His work in these areas continues to inspire others to fight for these values.

A Decentralized Event That Can Be Participated in From Anywhere

Participants in the Running Bitcoin Challenge can run, walk, roll, or hike the equivalent of a half marathon (Finney’s favorite distance) either in one go or over the entire 10-day period. There is no set location for the challenge, so participants can join from anywhere they wish. Those who donate at least $100 will receive an official shirt with the half marathon’s logo, and the top 25 fundraisers will receive a Hal Finney collectible signed by his wife. The Running Bitcoin Challenge serves as a way to honor Finney’s memory and raise funds for the important cause of finding a cure for ALS.

The Running Bitcoin Challenge has been a successful fundraiser, raising hundreds of thousands of dollars for ALS research. In addition to supporting research, the challenge also serves as a way for people to honor Finney’s memory and pay tribute to his contributions to the world of cryptocurrency.

Support the Cause and Honor Hal Finney’s Memory

By participating in the Running Bitcoin Challenge and raising funds for ALS research, individuals can help make a difference in the fight against this devastating disease and honor Finney’s memory at the same time. The event is being held in cooperation with the ALS Association Golden West Chapter, which provides equipment loans and educational materials to people living with ALS.

One of the unique aspects of the Running Bitcoin Challenge is that it is a decentralized event, meaning that it can be participated in from anywhere in the world. This makes it accessible to people from all walks of life and allows for a diverse group of participants to come together in support of the cause.

Overall, the Running Bitcoin Challenge is a unique and meaningful way to honor the memory of Hal Finney and support the fight against ALS. It is an opportunity for the cryptocurrency community to come together and make a difference in the world.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Central Africa Embraces Bitcoin and Cryptocurrency Adoption for Economic and Political Stability

Bitcoin, the world’s first decentralized digital currency, has seen growing adoption in Central Africa in recent years. This trend is driven by a number of factors, including the region’s high inflation rates, political instability, and lack of access to traditional banking services.

One of the main reasons for the adoption of Bitcoin in Central Africa is the high inflation rates that many countries in the region face. Inflation erodes the purchasing power of a currency, making it difficult for people to save and plan for the future. By using Bitcoin, which is not subject to inflation, individuals and businesses in Central Africa can protect their wealth and preserve its value over time.

Political instability is another factor driving the adoption of Bitcoin in Central Africa. Many countries in the region have a history of coups, civil wars, and political unrest, which can lead to the confiscation of assets and bank accounts. By using Bitcoin, which is decentralized and not controlled by any government or institution, individuals and businesses in Central Africa can protect their assets from seizure and avoid the risks associated with political instability.

In addition to high inflation and political instability, many people in Central Africa lack access to traditional banking services. In some rural areas, there are no banks or financial institutions, making it difficult for individuals and businesses to access credit, save money, and make payments. By using Bitcoin, which can be easily accessed and used with a smartphone and internet connection, people in Central Africa can enjoy many of the same benefits of traditional banking without the need for physical infrastructure.

The adoption of Bitcoin in Central Africa is also supported by a growing ecosystem of businesses and services that accept the cryptocurrency. This includes merchants who accept Bitcoin for goods and services, as well as exchanges and wallet providers that facilitate the buying and selling of Bitcoin. This ecosystem is helping to drive the adoption of Bitcoin and is making it easier for people in Central Africa to use the cryptocurrency in their daily lives.

In addition to the factors mentioned above, there are several other reasons why Bitcoin is gaining popularity in Central Africa. The increasing use of mobile phones and internet access in the region has made it easier for people to use Bitcoin and other digital currencies. The growing awareness of the benefits of Bitcoin, such as its decentralized nature, low transaction fees, and fast transaction times, has also contributed to its increasing popularity in the region. The growing adoption of Bitcoin in other parts of the world has also played a role in its acceptance in Central Africa.

Furthermore, the Central African Republic has recently unveiled its own cryptocurrency, Sango Coin, which will be the second cryptocurrency, after Bitcoin, to be recognized as legal tender in the country. The President of the Central African Republic has voiced support for blockchain, cryptocurrencies, and Bitcoin, further demonstrating the increasing interest and involvement in the cryptocurrency space in the region.

Overall, the adoption of Bitcoin in Central Africa is driven by a combination of economic, political, and technological factors. As the ecosystem of businesses and services that accept Bitcoin continues to grow, it is likely that the adoption of the cryptocurrency will continue to increase in Central Africa.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Role of Bitcoin in Building a Decentralized Financial System

Bitcoin, the world’s first and most widely-used decentralized digital currency, has an important role in building a decentralized financial system. One of the key advantages of Bitcoin is its potential for appreciating in value, thanks to its limited and predetermined supply. This can make it a potentially attractive investment, as it may increase in value over time.

In addition to its potential for growth, Bitcoin offers security and transparency through its distributed ledger, the blockchain. This means that transactions on the network are almost impossible to cheat or make fraudulent, making it a secure option for conducting financial transactions.

Bitcoin’s decentralized nature also means that it is not subject to the same risks as traditional currencies, such as inflation or government seizure. This makes it a useful option for individuals in countries with unstable currencies or high inflation rates, as it allows them to store value and make payments in a more stable and secure way.

The rise of DeFi, or decentralized finance, has also seen the development of a number of projects built on top of the Bitcoin network. These include RSK and tBTC, which allow users to access a wide range of financial services in a decentralized and trustless manner.

The Lightning Network, another layer built on top of the Bitcoin network, also offers users the ability to make fast and cheap transactions. This can make transactions faster and cheaper, and can also enable new use cases such as micropayments and instant payments. One such wallet that integrates with the Lightning Network is HolyTransaction, which offers a wide range of digital assets and other benefits such as an easy-to-use interface and fast and cheap transactions.

A leading project is Blockstream’s Liquid Bitcoin, also known as L-BTC. Liquid Bitcoin is a sidechain-based token that is pegged to the value of Bitcoin, allowing users to transfer value between the two networks quickly and securely. The Liquid Network is a federated sidechain that uses a consortium of trusted nodes to provide increased privacy and security for users.

Another project that leverages the Liquid Network is Fuji Money, a Lightning-enabled non-custodial synthetic asset protocol. Fuji Money allows users to create and trade synthetic assets, such as stablecoins or synthetic commodities, on the Liquid Network in a trustless and decentralized manner. This allows users to access a wider range of financial instruments and services, further expanding the capabilities of the decentralized financial system.

Overall, the role of Bitcoin in building a decentralized financial system is significant, thanks to its potential for appreciation in value, security and transparency, and ability to provide financial inclusion.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Wallet Storj: STORJ token joins HolyTransaction

As of today, you can instantly purchase Storj on HolyTransaction, transfer them to any HolyTransaction’s customer for free, and do crypto-to-crypto swaps between your Wallet Storj and more than other 30 cryptocurrencies.

The Storj project provides for a decentralized cloud storage facility and is originally pronounced as “storage“.

Storj’s main aim is to rent a space on the secondary storage devices of the members of its network and pay them in cryptocurrency, for their service they provide. Therefore, Storj’s native cryptocurrency token is STORJ, which can be stored on HolyTransaction now.

“The main difference between Storj and other decentralized cloud storage platforms is that Storj only uses blockchain to manage payments and not to store data. This is due to the high cost and slow speeds found in blockchains. For example, even the fastest blockchains process data/payments in seconds. Meanwhile, traditional cloud storage solutions, like Amazon S3, can store files in milliseconds – many orders of magnitude faster than even the fastest blockchains.”

Shawn Wilkinson (Founder of Storj)

The Storj platform offers online storage similar to Dropbox or Google Drive, but does so over a distributed network. Renting out unused extra space on our hard drives is referred to as, Farming, for instance. The process as simple as downloading a client from the network, choosing the amount of space to be rented, and a wallet address to store the incentives received in the form of cryptocurrency.

All HolyTransaction customers can create a new address for STORJ and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other cryptocurrency.

Just like with Bitcoin, you can:

- Send STORJ to any address, even to addresses of other cryptocurrencies with instant conversion on the fly;

- Receive transactions;

- Exchange STORJ with any supported coins;

- Make instant transactions between HT users;

- Get real time exchange rates on the website;

- Set OTP for additional protection.

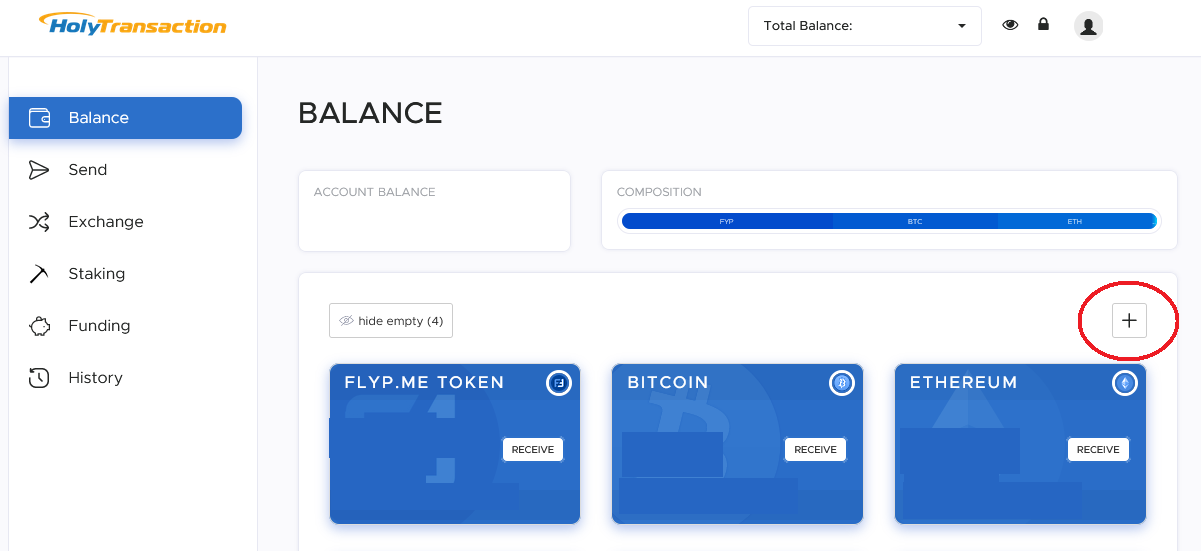

To add Wallet Storj just click on the “plus” button you find at the top right of the balance page, once you successfully enter into your wallet.

You can find the “plus” button to select the wallets you want to see in the main page like shown in the picture below:

We’re excited to be part of the STORJ community!

NOTE: Our multicurrency wallet can store more than 30 cryptocurrencies, including: Bitcoin, Dash, Ethereum, Dogecoin, Litecoin, Decred, Zcash, Dai Stablecoin, DigixDao, Augur, 0x Project, Gamecredits, Enjin Coin, Blackcoin, Gridcoin, Aidcoin, Peercoin, Syscoin, Groestlcoin, Power Ledger, BAT, BlockV, PIVX, TrueUSD, Cardano, and STORJ among the others.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

‘We’re All in on Blockchain’, says IBM

“We are all in on Blockchain”: these were the words of IBM Director John Wolpert during the today Blockchain Conference in San Francisco. According to Wolpert the blockchain needs a more collaborative approach, which is not always guaranteed by the blockchain developers.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction’s Bitcoin Monthly Roundup of January 2016

Thank you for reading our newsletter with the previous month’s best Bitcoin articles!

We tweet more cryptocurrency news and insights daily @HolyTransaction

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Infographic: What is Bitcoin Mining?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

9 Best Bitcoin Video Animations

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin is “digital gold” and will mark the end of cash. Ametrano from IMI Bank explains.

Bitcoin is a private currency, that isn’t issued by any central bank nor guaranteed by any institution. It is electronically transferrable in a practically instant way, utilising a cryptographic security protocol. It is based on a completely decentralized network: the transactions don’t require a middleman, cannot be censored, don’t have any kind of geographical or amount restriction, and are possible 24 hours a day every day and are substantially free.

Open your free digital wallet here to store your cryptocurrencies in a safe place.