Has The Crypto Market Bottomed After Bitcoin’s 50% Collapse?

The second half of 2019 was really difficult for Bitcoin. According to independent experts, the total volume of public digital assets has decreased by more than 50% – from $388 billion to $166 billion. However, there is other evidence. Yes, the cryptocurrency market really fell to the bottom if you look at these statistics, but let’s not forget that market conditions are dynamic. And the factor that means failure today may well mean success tomorrow.

Another Side of the Coin

There were periods of stabilization of the exchange rate, but for a long time cryptocurrency lost much in price. At one time, panic even started on the market, and Bitcoin was predicted to soon fall to zero. Against this background, the results of the year sounded quite unexpectedly: cryptocurrency turned out to be the most profitable investment. The coin rate rose from $4035 to $ 7344, providing investment growth by 82%.

Crypto Market and Bitcoin in Modern Political and Economic Conditions – What to Expect in 2020?

This year will be great for Bitcoin, Wall Street analyst and Fundstrat founder Tom Lee suggested. The destabilization of relations between Iran and the United States is one of the reasons.

Plus, modern realities make it possible to add a supposedly modern coronavirus epidemic to these factors. However, at the moment there is no consensus among experts on how the coronavirus will affect the Bitcoin exchange rate. It is still unclear whether we are dealing with a real threat to people’s lives or is this another hype, a political company, or an attempt to distract investors from other, more important issues.

However, even those experts who believe that the disease can affect the main digital coin explain that this will happen only if the outbreak develops into a full-fledged epidemic.

Venture capitalist Tim Draper is also confident in the long-term growth in Bitcoin value. In an interview with FOX Business, he advised millennials to invest in cryptocurrencies, as they are on the verge of a new financial revolution. However, the explosion of the financial revolution will slow down due to the influence of the values of older generations and the obsolescence of the current banking system.

Conclusion

Bitcoin exchange rates are very unstable. Cryptocurrencies have already shown that it can rapidly fall and take off at a breakneck pace. Due to this state of affairs, bitcoin does not inspire confidence among many investors who would be happy to invest big money in the development of the blockchain, but fear for their savings. In 2020, we are unlikely to have to observe the strong influence of this factor, but we should not forget about it.

About the author: Gregory is passionate about researching new technologies in both mobile, web and WordPress. Also, he works on Best Writers Online the best writing services reviews. Gregory in love with stories and facts, so Gregory always tries to get the best of both worlds.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Four charts that suggest Bitcoin value could be at 10,000 USD next year

The chart below shows us the Bitcoin/USD value over the same 2013-2104 period on a logarithmic scale.

Google Trends on Bitcoin

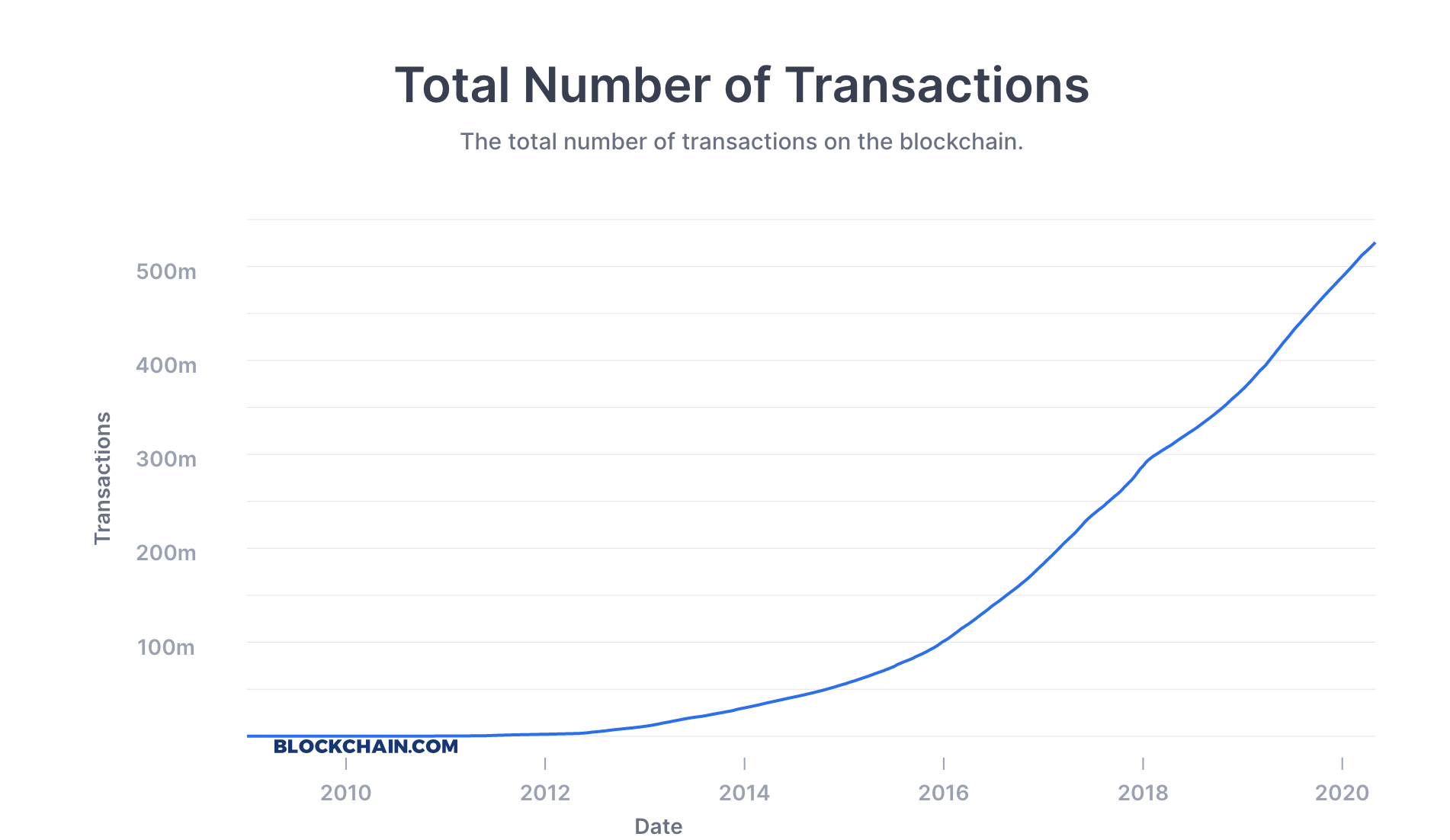

“Bitcoin is still in the earliest phases of industry development. The first years of Bitcoin were about building the infrastructure. Bitcoin entrepreneurs were busy setting up the most basic but fundamental aspects, including wallet and mining services. Today, Bitcoin is just starting to enter the investment phase, where venture capitalist, hedge funds and other financial firms are starting to invest money and capital into this nascent technology. Bitcoin isn’t quite ready for the consumer phase, where end users begin to utilize the services. If the entire history of Bitcoin was a clock, we’re still in the very early time. I would say were maybe in the second second of the entire history.” Nicholas Cary, CEO of Blockchain.info (source)

Disclaimer: The (funny) definition of an economist is “Someone that can use economic theory today to explain why he got all his predictions wrong yesterday“. The market is unpredictable and I can’t always be right

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Swedish central bank acknowledges benefits of cryptocurrencies

(CoinDesk) Sveriges Riksbank, Sweden’s central bank, has published a brief economic commentary on the impact of digital currencies on the retail payments market.

(CoinDesk) Sveriges Riksbank, Sweden’s central bank, has published a brief economic commentary on the impact of digital currencies on the retail payments market.Take-up remains limited

“Households make daily payments using cards and cash totalling 8 million in volume and to a total value of over SEK 3 billion. Even if the use of bitcoin in Sweden were to be much larger than the average exchange value of just over SEK 266,000, this is a relatively low value in relation to other types of payment. At present, there only seem to be around 25 swedish companies accepting Bitcoin.”

Risky but innovative

“It can contribute to meeting new payment needs and to making payments cheaper and more secure. Those who choose to use a particular payment service can be expected to do so because it gives them an added value in relation to other payment services. This also applies to virtual currencies, which can for instance make some cross-border payments simpler, faster and cheaper. Another advantage is if the payer does not need to share sensitive information, such as card number or bank account number, with the payee.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.