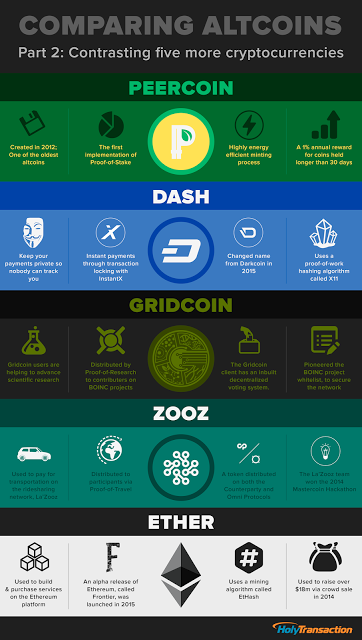

Bitcoin and many other early cryptocurrencies use a consensus model known as proof of work. This requires powerful computers to perform cryptographic problems that verify transactions on a blockchain. Peercoin originated an alternative to this that is used in many cryptocurrencies.

Peercoin introduced the concept of proof of stake, an alternative to the proof of work consensus model. In its initial stages, proof of work played a large part in the consensus model since it was a fork of Bitcoin. But the original proof of work-dominated model has almost fully given way to proof of stake. This is more environmentally friendly, removes the need for purchasing expensive mining equipment and allows transactions to be performed a lot more quickly than on proof of work blockchains.

HolyTransaction Wallet is excited to present to you the launch of our new staking service. You can now leverage Proof of Stake (POS) holdings to safeguard crypto networks while earning financial rewards. Staking PPC has become much easier with HolyTransaction!

This act of generating a new block is called minting, however staking is a more popular term today. In Peercoin’s implementation of proof of stake, each node tries to find a new block each second. If the block is valid and backed by sufficient coinage (coins*days), it is accepted by the network. Nodes are only eligible to find new blocks when their coins have been in a wallet for 30 days. Their odds of finding valid blocks go up with the age of the coin until it reaches 90 days, at which point the probability is maxed out. Once a node finds a new block, new PPC are then minted and, for each new block, that node gets a block minting reward. After a new block has been minted, the age of the coins in the node’s address that are involved in the minting is reset. The address will then not be eligible to be chosen based on those particular coins until 30 days have passed. Staking your Peercoin assets does lock them up from being spent or moved. However, you can sell or spend the PPC at any time—you will just lose the opportunity to mint new blocks.

Why stake Peercoin and not other cryptocurrencies? The return on staking is lower with Peercoin than with most other proof of stake cryptocurrencies. Vast majority of economic studies shows that ideal inflation is 2-3%. However, Peercoin is serious about keeping inflation low, currently at 3.33%. Peercoin’s reliance on proof of stake means that it should not suffer from the same scalability problems that have plagued proof of work platforms like Bitcoin. This means quicker transaction times and an overall better experience for retail and vending applications—which means great potential for the coin’s success in the future. You can learn more about its ecosystem in the Peercoin Primer video series.

Peercoin was the originator of proof of stake in its whitepaper, even though it took some time for proof of stake to actually make its way into widespread use on the blockchain. Staking Peercoin and its minting process presents a great opportunity to earn coin that will, in turn, earn you more coin. All you need is just to deposit PPC to start staking on your HolyTransaction wallet.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Recently we at HolyTransaction created a new add-on for the Firefox browser only to see the exchange rates for cryptocurrency pairs.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

As Bitcoin’s first-mover momentum spreads the digital currency’s adoption, the “proof of work” model it uses to confirm transactions is coming under scrutiny within the crypto-community.

The proof of work algorithm rewards the individuals, called miners, who confirm blocks of transactions in exchange for an amount of the digital currency. Individual miners join pools to mine collectively as a group, increasing the computing power available to confirm Bitcoin transactions.

This model seems to benefit by encouraging a large number of participants, but it is vulnerable to what is called a 51% attack. A miner or pool that holds 51% of the total computing power could in theory control the blockchain, which is the public ledger of Bitcoin transactions. This control could enable double-spending bitcoins as well as blacklisting certain users or computing equipment. Until recently, the 51% attack was widely considered an unrealistic threat.

“The proof of work algorithm is robust and has been resilient in the face of continuous attacks for the past five years,” says Andreas Antonopoulos, a technologist and entrepreneur who is active in the Bitcoin community. But a mining pool called Ghash.io gave the community a scare when it took over 51% of the network for 12 hours on June 13.

If a pool used its control for nefarious purposes it would only hurt Bitcoin’s use and, in turn, its price. This result would hurt any miners who become attackers, since they are rewarded for their mining efforts in Bitcoin and likely hold a generous amount of the digital currency. Since the incident, Ghash control has decreased substantially, hovering now at around 35%.

“Certainly miners didn’t sign up for unfair play and they would abandon that pool,” lowering the percentage of its control, Antonopoulos says. The 51% attack “is a theoretical attack that’s narrow in scope and goes against the incentives for the miners and owners of the pool.“

Last year, Ghash said it would try to prevent itself from capturing 51% of the network power and that it would not do any damage even if it did reach this level of control. And since the power is split over the many individuals who mine in the Ghash pool, it’s unlikely the pool could reach a consensus among its members to damage the network.

Nevertheless, some in the Bitcoin community are calling for a splintering, or “fork,” in the Bitcoin blockchain, and the forked version of Bitcoin would add features that discourage pooled mining. Others are talking about the benefits of a “proof of stake” algorithm, which secures cryptocurrency networks by asking users to show ownership of a certain amount of the currency.

BlackCoin is an alternative digital currency that uses a pure proof of stake model. It was created about five months ago and has generated enough support to be integrated into CoinKite’s merchant point of sale system.

“A user chooses to ‘stake’ his coins to generate the next block in the chain, and his chance of doing so is proportional to the weight of his own coins,” says Adam Kryskow, U.S. representative for the BlackCoin Foundation.

Proof-of-stake algorithms enable faster payments. BlackCoin transactions confirm in under a minute, whereas Bitcoin transactions usually take about 10 minutes. And proof of stake is also more eco-friendly, consuming far less energy than proof of work algorithms.

|

| Image: Peercointalk.org |

Peercoin is one of the most recognized altcoins that uses a hybrid proof of stake/proof of work model. New coins are awarded to miners who do work to authenticate transactions, but are also given to users who hold a higher stake in the system.

“The current proof of work system that is in place incentivizes centralization,” says Kryskow. “Specifically as mining payouts decrease, small mining operations will be forced to close up shop. With little to no incentive to continue mining, network power will fall dangerously low and security will be severely threatened.“

But proof of stake has its own vulnerabilities. Kryskow admits that since proof of stake algorithms are not completely decentralized, they are susceptible to a “nothing at stake” attack, where older coins could be used to fork the blockchain to create a competing one.

The proof of stake model hasn’t been stress-tested enough over a long period of time, and it worries Antonopoulos when proponents argue that the nascent mining algorithm is better than Bitcoin’s proof of work.

Bitcoin has survived a number of attacks over the years, says Antonopoulos. “There is much better monitoring and tracking [of the network]…a lot of DDoS protections and countermeasures built into the core client because of Bitcoin‘s experience with widespread attacks over the years,” he says.

Proof of stake was created in 2011 with the launch of Peercoin. “It was attacked and beaten; bugs were found, security issues were rampant and countless vulnerabilities were exposed,” Kryskow says. That’s when Peercoin moved to the hybrid proof of stake/proof of work model.

BlackCoin‘s developer argues that, like Bitcoin’s proof of work, proof of stake will be stress-tested in real-world use. BlackCoin “is a great proof of stake experiment,” Kryskow says.

Antonopoulos agrees that the development of new proof models is advantageous. “I don’t think we’ve found the perfect solution yet,” he says. “Everything comes with compromises…so you just have to identify which ones are the good compromises to make.” Other algorithms include “proof of burn,” in which a small portion of a cryptocurrency is destroyed to create value through scarcity; and “proof of resource,” which takes a resource, such as bandwidth, and assigns it a certain value for sharing.

“The real issue, though, is until we see a problem in Bitcoin that impacts the price, knowledge of Bitcoin is so much higher than [all other altcoins] that any other solution out there will be irrelevant,” says Tim Sloane, vice president of payments innovation at Mercator Advisory Group.

Sloane doesn’t expect everyone using the Bitcoin protocol to switch over to another digital currency just because there’s a threat

of disaster. But it may happen if a disaster actually strikes.

“As Bitcoin gets bigger and bigger, the problem gets bigger and bigger,” he says.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

|

| User river333 from PeercoinTalk is ready to start giving out tips for spreading Peercoin on Pi! |

Here’s how to get the 10 PPC tip!

1. Follow Tea42’s guide on how to set up Peercoin on your Raspberry Pi. A full node is required to receive the tip, so be sure to complete the part of the guide entitled “Contribute to the Peercoin network” in part 2, which shows you how to allow port forwarding.

2. Post in this thread with a photo of your Pi, and also a photo of your Pi screen.

The following should be visible in the photo of your Pi’s screen:

A: A window showing your Raspberry Pi serial number.

B: The Peercoin Qt wallet with the green checkmark in the lower right hand corner indicating that the RPi is now a currently synced Peercoin node.

The “Receive coins” tab should be clicked so your wallet address to receive coins is visible.

C: The Peercoin Qt debug window open showing the command “getconnectioncount” having been typed in at the bottom and the window showing a number greater than 8.

3. Paste your PPC address into your forum post. This should match the one visible in the photo of your Pi’s screen.

If you follow the above instructions correctly, you will receive your tip!

A big thank you to NewMoneyEra for donating the PPC that will be used for tipping.

FAQsWhat is a Raspberry Pi?A Raspberry Pi is a low cost, credit-card sized computer that can be plugged into a monitor/tv, and a standard keyboard and mouse (https://www.raspberrypi.org/help/what-is-a-raspberry-pi/). It is used in programming education and also has a wide variety of other uses. Its low energy consumption makes it perfect for running a Peercoin node.

What model of Raspberry Pi should I buy?

Model B is the most used at the moment. I’ve read that the new model has the same hardware, and only the form is different, but I have no experience

with it. As for an SD card, it’s best to buy a class 10 or better, that is 10MB/s minimum write speed. Don’t get fooled by the read speed they mention on the packaging, that is always much higher. https://en.wikipedia.org/wiki/Secure_Digital#Speed_class_rating

A case is not necessary but recommended because it protects against stuff falling on your pi, small coffee spills etc

I have a pi I ordered for playing round with and remember you will need a power supply to for it, that and the SD card u need to buy, its a micro usb charger same as many android phones or tablets so u can use one of those if it gives a high enough voltage. I just remember when I ordered mine the wait on charges was 3 weeks longer than the 5 weeks for the pi, but I hope they more readily available now.

What is the purpose of this project? The purpose of this project is to encourage the use of Peercoin on Raspberry Pi, while also increasing the number of full nodes on the network. A connection count of more than 8 indicates that port forwarding is enabled and that you are running a full node. Minting is beyond the scope of this project. Can I mint on my Raspberry Pi too?

Yes, you can. However, for the moment it is advisable not to mint on a full node (i.e. with port forwarding) until more research has been done. You can find out more about this here and here if you are interested.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

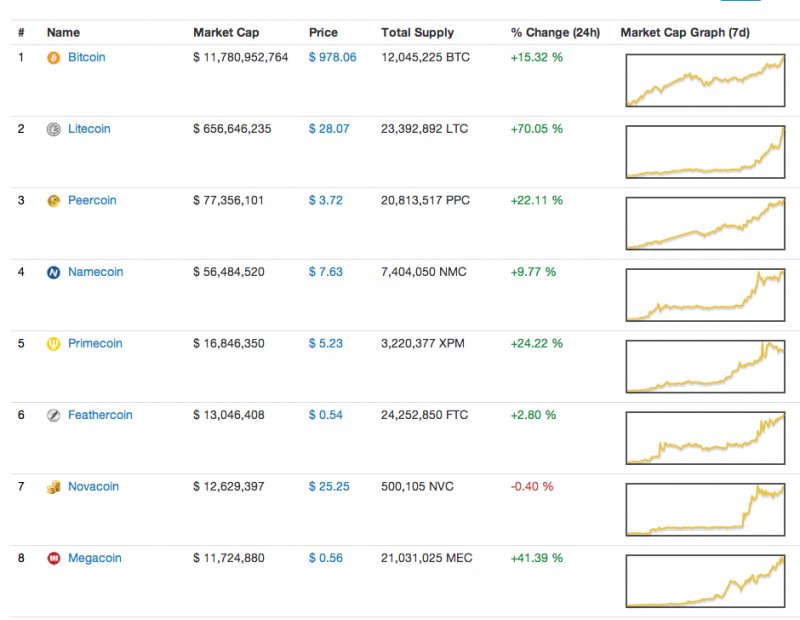

We just told you why another cryptocurrency, Litecoin, has been able to ride Bitcoin’s digital coattails to a 400% gain over the same period. But Litecoin is not alone.

According to that site, Peercoin, which now has the third-largest

market cap among digital currencies, is up 22% in the past 24 hours.

Peercoin‘s main feature is that it’s based on a protocol which, though

different from Litecoin‘s, achieves the same effect of preempting mining

cartels from forming and gaining too much control over prices.

Namecoin, with the fourth-largest market cap, is up 70% in the past

24 hours. Its principal attribute is that it exists outside the regular

Internet and therefore beyond control of The Internet Corporation for Assigned Names and Numbers (ICANN), the Internet’s regulatory body.

Open your free digital wallet here to store your cryptocurrencies in a safe place.