By far the biggest threat to banking in, well, living memory, has been blockchain technology. More specifically, cryptocurrency, but we’ll focus on the technology as a whole since this is what has been driving the movement.

All the tech companies in the world have been using it, including Google, Facebook, Apple, and Amazon, and a vast number of FinTech services, which is why it’s being seen as such a threat to traditional banks, but why is this happening?

What’s so important about blockchain?

In today’s post, we’re going to explore how and why blockchain technology is making such a big difference to the traditional banking format, and how the future of this industry is looking.

Source: Adarsh Goldar

First and foremost, and by far the biggest form of change that blockchain is bringing into the world, is how financial payments are made and the way modern-day payment systems work. Whereas traditional banks can take a few working days to make a payment, meaning some international payments can take a very long time, blockchain payments are instant.

Since all you need is an internet connection to make the transaction, most will be handled and completed in a matter of minutes. These transactions can happen across borders to anywhere in the world, are extremely secure (especially when compared to traditional methods) and happen pseudoanonymously.

Due to the nature of blockchain technology, the costs involved in these transactions are usually very small, typically only several cents per transaction. This means that sending money across to the other side of the world is far cheaper than traditional wire companies, such as Visa or Western Union.

In the same way, remittances are also changing. Whereas overseas remittances are expensive and long-winded, with high processing times and the fact the money can be stolen, taxed, or subject to legal issues along the way, a blockchain process basically eradicates all these issues. There are dozens of companies already set up and operating to offer these services.

In the traditional way the world works, consumers tend to use banks to hold money in either their savings or checking accounts. Then, the bank will loan out the money being held to make money on top of the money you’re saving, and the cycle continues. This means when you look into your bank account, much of the money you have isn’t actually being held by the bank, but instead is out in other people’s accounts as loans.

If every customer of a bank went to the bank and withdrew everything they had, the bank would collapse. It’s a very fragile system that many consumers are unaware of. However, while this system isn’t going to change any time soon, blockchain technology can make the management of this system far more effective.

Due to the benefits that blockchain technology provides, these account ledgers are far more secure, far more reliable, and far more accessible. This means banks can accurately manage their ledgers to ensure that they aren’t taking out too many loans and will actively help reduce the risk of bank run, or the system crumbling.

Fraud has always been a problem in the financial industry, and it costs people around the world billions of dollars every single year. However, for the similar benefits, we’ve spoken about above, blockchain is making things far more secure.

Since the vast majority of traditional banks are set up and organised around a centralised system, malicious people can target the centralised system to commit the acts of fraud. While there have been many measures to make the system as secure as possible, this isn’t fall-proof, and statistics show around 45% of all financial institutions are prone to fraud attempts.

Blockchain is a decentralised system, which means it’s everywhere and nowhere at the same time, which makes it incredibly difficult to fraud and theft to take place. There’s no single point of access like there is with a centralised banking system and trying to get into such a system means diving into layer upon layer of encryption, all spread out in hundreds of thousands of locations.

What’s more, every single change that takes place on the ledge is capable of being seen by every other person and system that has access to the ledger. This means if any fraudulent activity takes place, everyone can see it instantly and correct it. This will help protect people’s money and keep the system afloat.

Katherine Rundell is a finance writer at Academic Writing Services and Essay Writing Services. She writes about blockchain and banking and aims to help the world get educated about finances in a time where they can seem so out of control.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

BTC Accepted here

A short infographic on industry acceptance of BTC

Cryptocurrencies skyrocked in 2017.

Everybody has heard for sure some friends speaking about it or read news about blockchain revolutionary potential.

The topics mostrly discussed are the highs and lows of crypto prices, the volatility of it, the mindblowing innovation and projects, the best places where buy cryptos or authority’s point of view on them.

But here’s one of the most interesting topics, that sometimes is left unexplored:

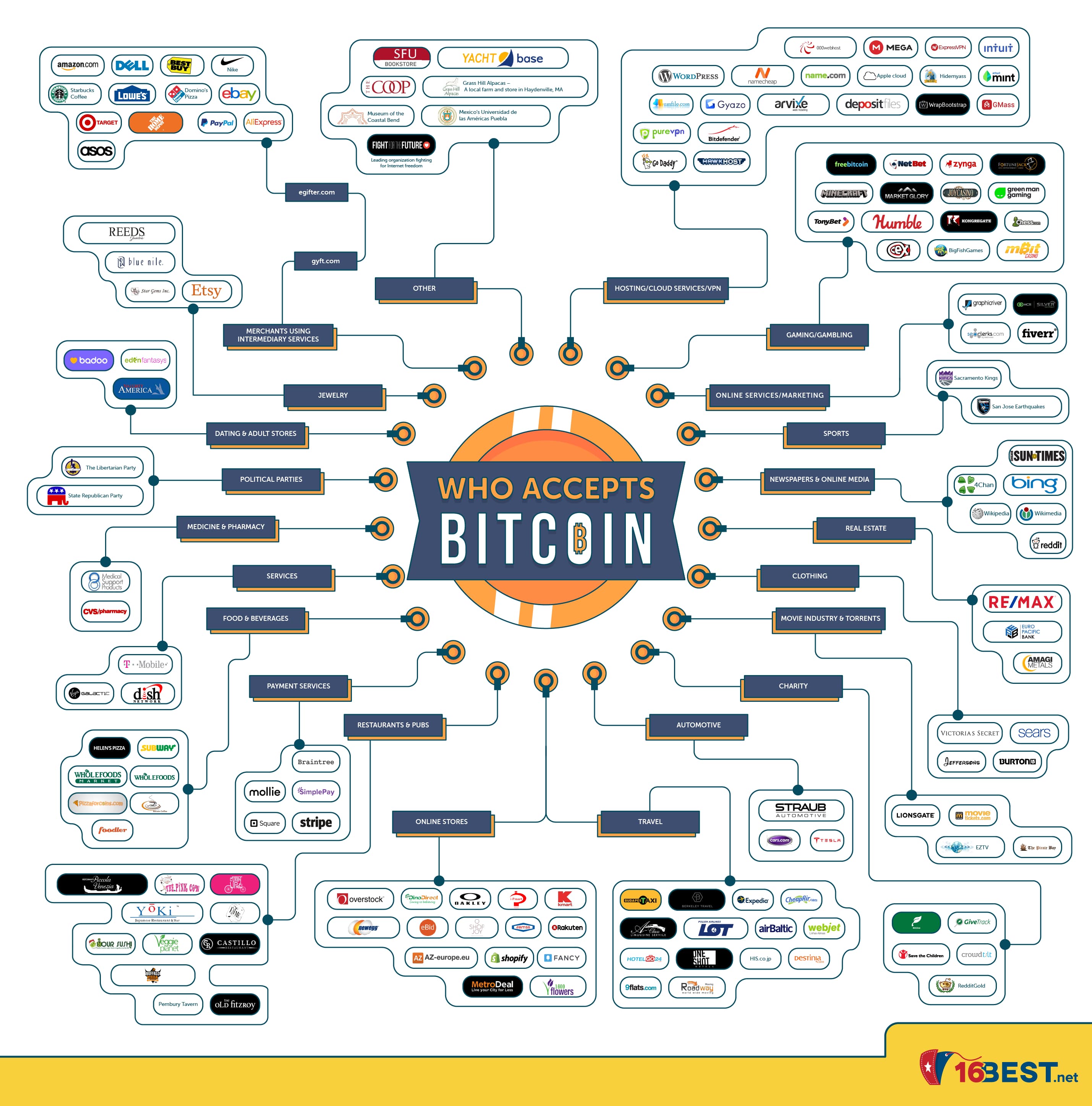

Who is actually accepting Bitcoin payments?

This is a very good question which can give a more thoroughful perspective on how companies look at the crypto-world; and that can help everyone understanding the potential spread of the blockchain philosophy.

In fact companies like Shopify, Subway, and Tesla have fully accepted Bitcoin payments, and you can pay for any of their products or services with them. However, even if a company doesn’t support Bitcoin, there are some creative ways to buy their best products with it. For example, Gyft.com will help you buy Nike shoes with Bitcoin, while Expedia has embraced this cryptocurrency altogether.

To better understand who accepts bitcoin payments, we are happy to share with you this amazing infographic provided by our friends of 16Best.net

Enjoy the reading

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.