Earn Interest With a HolyTransaction Cryptocurrency Savings Account

Decentralized finance is quite literally taking the entire blockchain industry by storm.

After a relatively slow buildup over the past few years, the spotlight has well and truly fallen on the cryptocurrency space’s ability to do what traditional finance does — but better.

HolyTransaction, the world’s most trusted cryptocurrency web wallet, is making access to DeFi solutions available to all of its users starting now.

How? HolyTransaction developers have integrated DeFi savings accounts for stablecoins into HolyTransaction web wallets.

If the whole decentralized finance thing is new to you, and you’re having trouble understanding the importance of cryptocurrency savings accounts with stablecoins, then read on!

Decentralized Finance (#DeFi) Explained

Blockchain has promised to do a lot over the years.

However, at the end of the day, its first and best use case going back to the invention of Bitcoin is, and has always been, money.

If you’re looking for a one-liner, it’s this:

Cryptocurrencies do it better.

So, why shouldn’t cryptocurrencies one-up the traditional financial industry?

Decentralized finance refers to blockchain-based protocols that enable peer-to-peer financial solutions like loans and, yes, savings accounts. Anything the traditional financial industry offers via institutions like banks, you will soon be doing in a decentralized manner without third parties at all.

A Quick Guide to Stablecoins

The truly clutch tool in the development of the #DeFi industry has been the stablecoin, a workhorse digital asset used to minimize value volatility by pinning a cryptocurrency’s worth to an outside asset.

Some stablecoins, like Tether (USDT), pin their value to government currencies such as the US dollar. To maintain value, $1 is stored in a reserve for every 1 USDT circulating in the open market.

Other stablecoins peg their value to assets like gold, oil, and electricity.

Today, stablecoins are gaining immense popularity as digitally-native alternatives to slow, centralized, and costly to use fiat currencies like the EUR, RUB, USD, and YEN.

HolyTransaction Interest-Generating Cryptocurrency Savings Accounts

When using traditional banking savings account solutions, you’ve probably noticed that APY rates are pretty low.

Even so-called high yield accounts don’t yield much with limits as low as 0.5%.

Decentralized finance is changing that. By removing third parties from banking scenarios, you can often earn as much as 3% APY by keeping your stablecoins in an interest-generating crypto savings account.

The great news is HolyTransaction has integrated such interest-earning features directly into its trusted cryptocurrency web wallets.

With HolyTransaction, there is no need to download, install, or otherwise figure out another piece of software.

Instead, you can use your HolyTransaction cryptocurrency web wallet directly via the web, allowing you to get started generating rewards on your stablecoins right away.

If you’re concerned about a learning curve of some kind — worry not.

Using a DeFi savings account is the same as using a basic cryptocurrency wallet. Just deposit your stablecoins, click on “stake” and you’re good to go — the longer you store them, the more they yield in return.

Want to get started today? Jump over to HolyTransaction to quickly create an account and start saving.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction supports five new crypto assets

HolyTransaction has added five new crypto assets to the platform: USDC, MANA, ENG, ANT, and LINK.

USD Coin (USDC) is a fully collateralized US dollar stablecoin. It is an Ethereum powered coin and is the brainchild of CENTRE,

Decentraland (MANA) defines itself as a virtual reality platform powered by the Ethereum blockchain. In this virtual world, users purchase plots of land that they can later navigate, build upon, and monetize. Decentraland uses two tokens: MANA and LAND.

Enigma (ENG) is a crypto platform that’s trying to solve the problem of privacy on the blockchain by giving access to data storage and privacy while remaining scalable. Enigma aims to extend Ethereum Smart Contracts by introducing secret contracts.

Aragon (ANT) is a decentralized platform built on the Ethereum network that offers a modularized way to create and manage dApps, cryptoprotocols, and decentralized autonomous organizations (DAO). The ANT ERC-20 token will enable its holders to govern the Aragon Network.

Chainlink (LINK) connects decentralized peer-to-peer networks and smart contracts to real-world data, events, and payments. Since blockchains cannot access data outside their network, oracles (a defi instrument) are needed to function as data feeds in smart contracts.

To create your web wallet you don’t need to have a bank account, so you can set it up in just one minute.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction supports Multi-Collateral DAI

DAI users will retain the balance of their DAI addresses, which will be migrated to a new multi-collateral contract with the DAI ticker symbol. Balance totals for HolyTransaction DAI users will reflect the same DAI total that they had prior to the contract swap.

DAI has been upgraded from a single-collateral token to a Multi-Collateral DAI token.

SAI (single-collateral token) will no longer be supported or traded on HolyTransaction.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Update for Customers With Tether Stored on HolyTransaction

Please note that we have migrated your Tether balance to USDT on Ethereum (ERC20). Thank you for your continued support for HolyTransaction. If there are any doubts or questions, please don’t hesitate to contact us.

Stay tuned!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Stablecoins: How they Strike a Balance between Crypto and Fiat

There appears to be no end to the growing popularity of cryptocurrency and its related technology. The real world uses and applications of crypto are increasing and blockchain technology has found use outside, instead of just being a basis for the recording of crypto exchange. More ICOs are in development and a wider range of working cryptocurrencies is becoming available to the growing crypto community. The advent of crypto technology is not just a trend that people are getting hyped up about, it is an actual breakthrough in technology.

Bitcoin, the first functioning cryptocurrency, was developed in 2009 by an anonymous party known as Satoshi Nakamoto. The main goal of this new “currency”? To function as an international currency, created with the hope of minimizing costs and increasing efficiency of exchange through the development and use of a decentralized public ledger that distributes the verified records. This makes it a permanent and immutable documentation of what has happened to each and every bitcoin that has been mined and exchanged.

The new concept of decentralization is one of the breakthrough innovations of bitcoin which has been put to use in many other ways. However, too much emphasis has been placed on the investment and earning potentials of bitcoins and other cryptocurrencies. Owed to how it was able to gain popularity as being the digital currency that bore millionaires from investments that were once worth a few pennies, there is a large majority in the worldwide community that know about Bitcoin but fail to comprehend what it is and why it was created in the first place. Alarmingly, there are quite a number of people who are so quick to join the bandwagon of investors, hoping to get in early, as profits are rising for those already investing in Bitcoin, but have not equipped themselves with the necessary know-how for managing their bitcoin. Aside from being a recipe for failure for these individuals investors, it also negatively impacts the real purpose of Bitcoin as a cryptocurrency as it is unable to function as an actual currency.

The value of Bitcoin is dependent on the interrelation of two things – supply and demand. Getting into where the supply of Bitcoin comes from would take too much discussion. The important thing to note, however, is that there is a finite supply of bitcoins and, because of the rise in its value late in 2017, there has been a rise in its demand. The seesaw between supply and demand markedly changes the value of Bitcoin, making it a volatile currency. This means that it’s value changes, not just every day but consistently throughout a day. As an investment or commodity, this makes it one of the favorites for many investors or traders since it provides a great opportunity for trading. With the rises and falls in the market, it provides great trading opportunities.

It’s not just Bitcoin that follows this trend, other crypto currencies are also very volatile. However, this has now defined the crypto world as being more of a world of trading than as one made of alternative currencies. Luckily, there are now a few cryptocurrencies with values are so closely linked with a fiat currency that they do not behave like the others. For a trader, these are the cryptos to avoid, as there is little to no growth in your investments, but, for the person looking for a way to store, instead of invest, their assets, these stablecoins provide the advantages of both fiat and crypto – stability and efficiency.

Stability

From their names alone, stablecoins are stable or not as volatile as other cryptocurrencies. They are “stable” in a sense that although there are still rises and falls to their market values, these are not as frequent or as big a change. As introduced earlier, these coins are linked to an existing fiat, which helps to steady and maintain their values.

Crypto “currency” also defines its purpose by name. It aims to function as a currency, a medium which can be used to exchange goods, services and the like. However, due to the volatility of a majority of crypto, using it as a mode of payment is difficult. There is a need to constantly update the prices on items, based on the value of a certain crypto. Purchases that are made over a span of a few days may seem cheap and affordable on the first day, but upon finalization of payment may turn out to be too costly. With a currency that has a value that changes at an hourly rate, would one really prefer to pay items through bitcoins?

Efficiency

The underlying technology that supports Bitcoin or any other cryptocurrencies – the blockchain – provides many advantages that still make it a good mode of payment. Not only is it a secure method, due to its decentralized system of verifying any transactions, but it is also a fast method of exchange, which can be done at a low cost. Saying that it is efficient is an understatement as it removes the need for costly transactions that have to be checked, confirmed and processed by a centralized body. Add to the fact that there is always room for error in these centralized systems and there has been not just one incident where issues on the management of finances have come up. Putting too much trust on a single company to handle your money may be what we have become used to, but having a public ledger which is immutable and secure surely changes things.

What are stablecoins again?

They are cryptocurrencies with fiat properties. They are both stable and efficient alternatives that provide wallet owners with the best of both worlds. Are you a trader looking to find a storage for your assets without having to transfer it into your bank or are you just someone who dislikes the centralized banking system but would prefer not to hoard cash at home? Storing your assets online as a stablecoin may be a great option.

Author Bio: Kim Hermoso is a content writer. Her articles are mostly guides and feature pieces on all things related to cryptocurrency, such as blockchain technology and smart contracts.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Wallet TrueUSD: how to store TUSD

We always work to provide you with a better service, and now we are glad to announce our new Wallet TrueUSD.

We are very proud about this new implementation for storing safely this disruptive digital currency.

You can instantly purchase TrueUSD through your own HolyTransaction wallet now. Send them to any HolyTransaction’s user for free, and do crypto-to-crypto transfers from/to TUSD, and more than 25 cryptocurrency’s networks.

This stablecoin provides yet another instrument that can facilitate wider adoption. The team at TrueUSD has been able to create a trustable product that can enhance the cryptocurrency world.

The TrueUSD team plans to tokenize different assets like, TrueEuro, TrueBond, TrueYen, and stable baskets of tokenized products.

All HolyTransaction customers can create a new address for their own Wallet TrueUSD and use the simple HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any other supported cryptocurrency.

Just like Bitcoin and the other 29 cryptocurrencies we support, you can now:

- Send TUSD to any address, even to addresses of other cryptocurrencies with instant conversion on the fly;

- Receive transactions;

- Exchange TrueUSD with any supported coins;

- Make instant transactions between HT users;

- Get real time exchange rates on the website;

- Set OTP for additional protection.

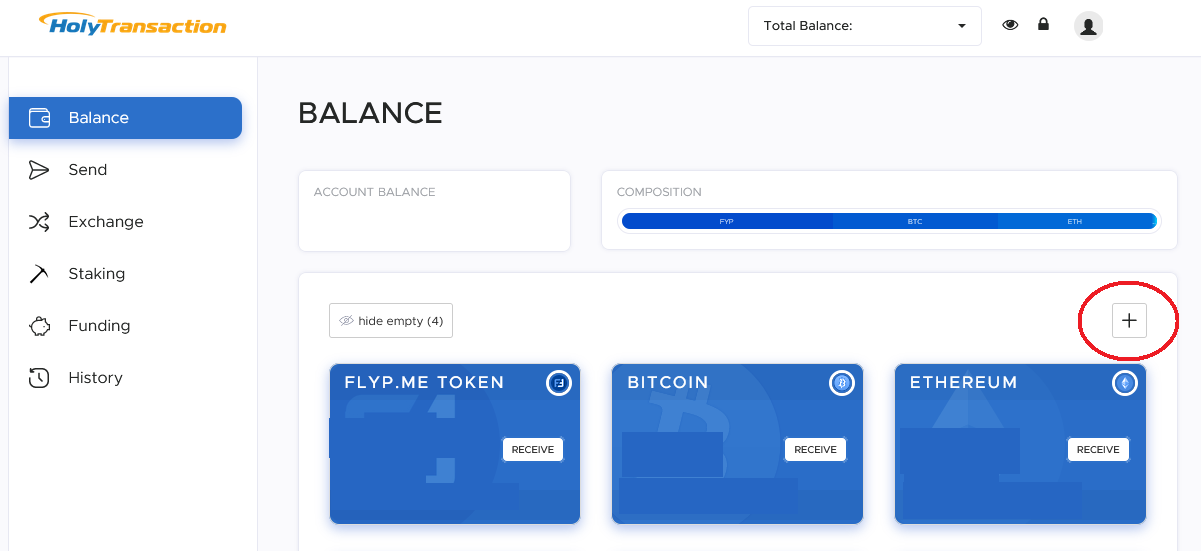

If you can’t see your newest Wallet TrueUSD, just click on the “plus” button that you find at the top right of the balance page, after that you login into your wallet.

You can use the “plus” button to select the wallets you want to see in the dashboard:

We’re really excited to be part of this new community!

NOTE: Our multicurrency wallet can store more than 25 digital currencies, including: Bitcoin, Dash, Ethereum, Dogecoin, Litecoin, Decred, Zcash, Dai Stablecoin, Augur, Enjincoin, Peercoin, Blackcoin, Gridcoin, Syscoin, Groestlcoin, BAT, BlockV, Vertcoin and TrueUSD, among the others.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Welcome to the Universal Wallet, DAI Stablecoin.

If you thought about holding or exchanging DAI Stablecoin, now you can do so directly with your HolyTransaction Universal Wallet.

It’s now possible to add DAI wallet to your dashboard and use it to access and exchange 24 different crypto, instantly. This is just one of the many recent adoptions, which brought the number of cryptocurrencies accepted on our platform to 24.

Now you are free to store DAI on HolyTransaction, transfer them to any other wallet, and make crypto-to-crypto transfers from and to DAI. All HolyTransaction customers can create a new address for their own DAI Wallet.

DAI Wallet features

Just like Bitcoin and all the other 23 digital currencies supported, you can now:

• Send DAI to any address, even to addresses of other crypto, with instant conversion on the fly;

• Receive transactions;

• Exchange DAI with any supported coins;

• Make instant transactions between HT users;

• Get real time exchange rates on the website;

• Set OTP for additional protection.

If you are not able to see your newest DAI Wallet, you just need to click on the “plus” button on the top right of the balance page, once you successfully login into your own wallet.

About DAI:

DAI is a cryptocurrency that is price stabilized against the value of the U.S. Dollar. DAI is created by the Dai Stablecoin System, a decentralized platform that runs on the Ethereum blockchain.

With DAI, anyone, anywhere has the freedom to choose a money they can place their confidence in. A money that maintains its purchasing power.

MKR holders govern Dai

Maker is a decentralized autonomous organization on the Ethereum blockchain seeking to minimise the price volatility of its own stable token — the DAI — against the U.S. Dollar.

Maker smart contract platform controls and sells Dai. Indeed, decentralised and trustless, the Maker platform stabilises the value of Dai to one U.S. dollar using external market mechanisms and economic incentives.

Eliminating the necessity to trust a centralised organisation and the hassle of third-party audits, Maker offers a transparent stablecoin system that is fully inspectable on the Ethereum blockchain.

Maker’s Dual Coin System

The Maker Platform has two coins: Maker (MKR) and Dai (DAI).

Maker – A token with a volatile price that is used to govern the Maker Platform. Maker DAO is a decentralized autonomous organization within the Ethereum blockchain. Maker works to minimise the volatility of DAI, its stable token, compared to the U.S. dollar, with holders of MKR tokens governing DAI.

DAI – A price stable coin that is suitable for payments, savings, or collateral. With DAI, the team at MKR hopes to overcome the extremely volatile prices of cryptocurrency. The team at Maker DAO feels that stablecoins are necessary to let blockchain technology reach its full potential. Because of this, it introduced DAI, which is backed by ETH collateral.

Open your free digital wallet here to store your cryptocurrencies in a safe place.