Bitcoin is a trustless money

For centuries the use of money evolved according to available technologies and society needs. Bitcoin is a currency and each currency is information.

The information must be exchanged, only this way it can be recognized and associated with a value, especially in today’s world drawn as a network.

How trust can be betrayed

Problems arise when – while exchanging information – there are intermediaries who betray the trust, for example:

1 .central banks, if it inflates the currency (es. quantitative easing, or a tool to inject more liquidity into the market in order to indirectly encourage households and consumer businesses);

2. banks, if they fail, taking away our funds on current accounts (see bail-in or, in case of failure, no longer pays the state, but shareholders , creditors and depositors);

3. governments, if it confiscates assets or block transfers (Amato government in ’92) ;

4. national currency, if it is accepted everywhere (or if it is excluded from a stronger system, for example euro ) ;

5. privacy, if it is violated during the online shopping;

Whoever believes in a cryptocurrency such as bitcoin, knows that history (Argentina, Cyprus, Greece, etc.) has already shown that it is not possible to have confidence in all these linked subjects, because each one carries its own interests.

A centralized entity can actually change, omit or delete any data that passes through its control, since in these entities work people that have a corruptible nature.

What is the “pre-trust” ?

Now, not only friction, costs and transaction times can be reduced, but corruption can be eliminated too. It is virtually impossible to corrupt the ledger: you cannot write on it, and you cannot change what other people write on it: it is no longer a human job.

So, if there is no trust, to have a secure system we need a network that can perform an action associated with a cost. Since you don’t know the other person you are exchanging the value with you have to “pre-trust” in 3 basic elements: mathematicians, economists, technicians.

1. Mathematicians, with the asymmetric encryption, or the concept of public and private keys, you need to certify who is the true owner of the property;

2. Technicians, with the network that reaches consensus through the “proof-of-work” system, and valid the transactions before they are permanently written onto the blockchain, so it is no longer possible to repeat the processing fraudulently (thus solving the problem of double spending)

3. Economists, because of the incentive to earn money with bitcoin. For these reasons a public blockchain cannot live without the use of bitcoin if we want to have its maximum security .

All the above systems are designed to work together without the need for intermediaries.

Now people are starting to use cryptocurrencies, such as Bitcoin, as a method of payment and at the same time entities that accept it are spreading quickly.

On

CoinMap you can see the map of all the places where these exchanges take place. And, what is the infrastructure that supports this exchange? The blockchain.

Blockchain, the infrastructure that runs bitcoin

The blockchain – to define it in simple terms – is a timestamp, so it is only a consequence. The important thing is the protocol, the safe encryption with which transactions are signed.

It is not important the account balance, but how reliable is that publicly available data.

So far, paradoxically, it relied on the piece of paper in the hands of anyone. But the paper documents are now easily forged, to be trusted more if we read the declaration of property on blockchain .

Lavoiser stated: “Nothing is created, nothing is lost , everything is transformed .”

But it was a law that applies only to the material world . For the digital world , in blockchain format , the new law is : “Everything is created , nothing is lost , nothing can be changed.”

This article was originally written by Massimo Chiriatti on Startup Italia.

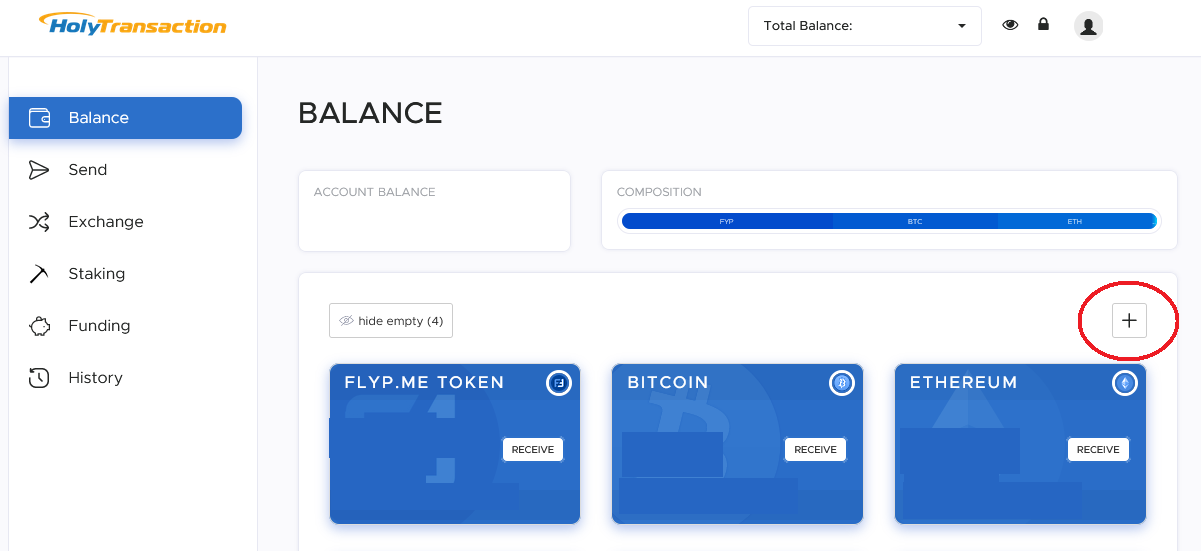

Open your free digital wallet here to store your cryptocurrencies in a safe place.