The 5 must read Bitcoin Books

Blockchain Revolution by Don Tapscott and Alex Tapscott

The Bitcoin Bible by Benjamin Guttman

The Bitcoin Big Bang: How Alternative Currencies Are About to Change the World by Brian Kelly

Mastering Bitcoin by Andreas Antonopoulos

5) Bitcoin revolution: La moneta digitale alla conquista del mondo by Davide Capoti, Emanuele Colacchi, Matteo Maggioni

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin officially recognized in Japan

The open-minded Japan

Multicurrencies Wallet

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bank of England will create its own cryptocurrency

The Bank of England announced its decision to create its own digital currency.

The cryptocurrency will be called RSCoin and it will use the blockchain, the decentralized ledger where bitcoin transactions are written and executed.

More Centralized Control

RSCoin has been developed by researchers at the University College of London.

How could this be positive?

Even if RSCoin is centralized and the opposite thing of Bitcoin, we could say that it is positive as it means that worldwide Central Banks are starting to give importance to cryptocurrencies.

However, RSCoin has its own benefits: for example no double spending, non-repudiable sealing, timed personal audits, universal audits and exposed inactivity.

Read the complete documentation

Univerisity College of London researches George Danezis and Sarah Meiklejohn published an abstract about RSCoin.

The full whitepaper is intitled “Centrally Banked Cryptocurrencies”.

The abstract begins from the bitcoin history, to explain everyone the impact of the digital currencies not only in the finance world:

“Recently, major financial institutions such as JPMorgan Chase and Nasdaq have announced plans to develop blockchain technologies. The potential impacts of cryptocurrencies have now been acknowledged even by government institutions: the European Central Bank anticipates their “impact on monetary policy and price stability”.

People’s Bank of China and its own cryptocurrency

In January 2016, the People’s Bank of China commented about its plans to launch its own digital currency and create a new financial infrastructure for the country.

The project started in 2014, when researches began to study cryptocurrencies related to business operations.

People’s Bank of China commented:

“The issuance of digital currency can reduce the significant costs of issuing and circulating traditional currencies, improve the convenience and transparency of economic transactions, reduce money laundering, tax evasion and other criminal acts, enhance the central bank’s control of over the money supply and currency circulation, better support economic and social development and aid in extending financial services to under-served populations”.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

European Union wants to monitor virtual currencies

In fact, a few days ago Europol concluded that there is no connection between Bitcoin and terrorism: “Despite third party reporting suggesting the use of anonymous currencies like Bitcoin by terrorists to finance their activities, this has not been confirmed by law enforcement”, said Europol.“Virtual currencies and their underlying technologies can provide faster and cheaper financial services, and can become a powerful tool for deepening financial inclusion in the developing world,” said IMF Managing Director Christine Lagarde, who presented IMF paper at the World Economic Forum, in Davos, during the panel Transformation of Finance.

A conclusion of the report is that virtual currencies fall short of the legal concept of currency or money. While acknowledging that there is no generally accepted legal definition of currency or money, the authors note that both are associated with the power of the state to issue currency and regulate the monetary system.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction’s Bitcoin Monthly Roundup of January 2016

Thank you for reading our newsletter with the previous month’s best Bitcoin articles!

We tweet more cryptocurrency news and insights daily @HolyTransaction

Open your free digital wallet here to store your cryptocurrencies in a safe place.

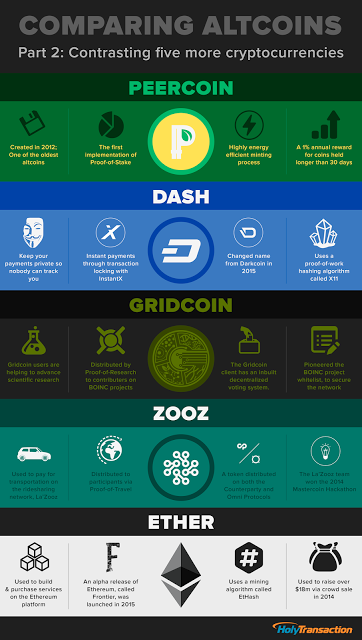

Infographic: Comparing Altcoins – Part 2

Open your free digital wallet here to store your cryptocurrencies in a safe place.

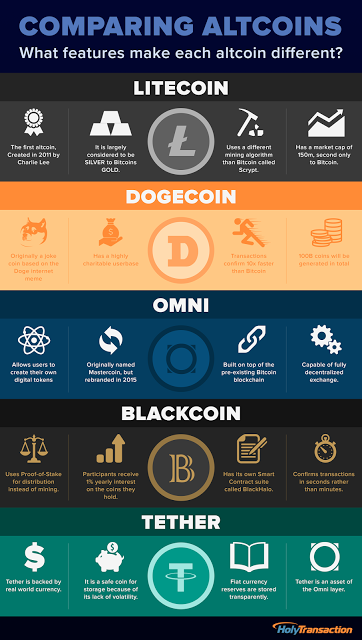

Infographic: Comparing Altcoins

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction adds Ethereum

HolyTransaction is excited to announce support for a new cryptocurrency, as well as a renewed focus on our international customers. The last cryptocurrency that we added was Gridcoin, and now we have added Ethereum’s crypto fuel – Ether.

Ethereum is one of the most interesting decentralized projects that have been released in Bitcoin’s wake and we support its goals. Smart contracts can’t come soon enough!

Now, with HolyTransaction, you have:

– Send and receive Ether

– Ethereum server side wallet creation and transaction signing

– Set OTP for additional protection

About Ethereum

Ethereum is a decentralized platform that users can use to run smart contracts. Smart contracts are applications that run exactly as programmed (with a Turing complete language) without the possibility of downtime, censorship, fraud or 3rd party meddling. The Ethereum platform uses Ether as its “crypto-fuel.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Australia investigating banks for anti-competitive behavior when closing Bitcoin company accounts

Australian authorities are looking into the bank account closures of several Bitcoin companies over the last few years. Specifically, the investigation is looking at anti-competitive behavior. Over the last year, bank actions have increasingly embraced blockchain technology instead of shunning it in the form of bank account closures. Though this type of account closure, for simply being associated with Bitcoin, is a common occurence in the United States, China, and some European countries as well, the Australian authorities are the first to look into at scale – a harrowing victory for those using blockchain technology. The Australia Competition and Consumer Commission (ACCC) chairman, Rod Sims, told the Australian Financial Review:”We are asking the banks why they acted as they did and what contact there was between them.“If ground reports from major Bitcoin companies such as BTC-e and OKCoin, that lost their accounts at the National Australia Bank, are to be believed, the contact was sparse and uninformative. Sims confirmed that the investigation had been ongoing for some time. Australian Senator Matthew Canavan also commented on the investigation:

Australian authorities are looking into the bank account closures of several Bitcoin companies over the last few years. Specifically, the investigation is looking at anti-competitive behavior. Over the last year, bank actions have increasingly embraced blockchain technology instead of shunning it in the form of bank account closures. Though this type of account closure, for simply being associated with Bitcoin, is a common occurence in the United States, China, and some European countries as well, the Australian authorities are the first to look into at scale – a harrowing victory for those using blockchain technology. The Australia Competition and Consumer Commission (ACCC) chairman, Rod Sims, told the Australian Financial Review:”We are asking the banks why they acted as they did and what contact there was between them.“If ground reports from major Bitcoin companies such as BTC-e and OKCoin, that lost their accounts at the National Australia Bank, are to be believed, the contact was sparse and uninformative. Sims confirmed that the investigation had been ongoing for some time. Australian Senator Matthew Canavan also commented on the investigation:

“We have strong laws against one business obstructing another business competing against it. These laws are even tougher for those companies that have the privileged position of a significant market share. Our banks wield great influence in the market and they have a great responsibility under our laws to not misuse that position. I am not sure if that has happened in this instance but there is no doubt that digital currencies do pose a threat to business of banks.”

Australian Senate that Might Actually Understand Bitcoin and its Promise

A Labor Party Senator, Sam Dastyari, was not surprised to hear about the ACCC investigation. He had previously chaired the Senate investigation into digital currencies. At this time, banks such as the National Australia Bank and other similarly sized institutions around the world are delving into blockchain technology. If anything, this is a clear indication that the swift actions of last year, where both domestic and international Bitcoin companies lost their accounts at Australian banks, were anti-competitive in spirit. Even without the emerging facts regarding bank’s research, investment, and involvement with blockchain projects, the majority of domestic companies brought down by Australian bank action were providing services that were in essence competing with banks.Australia has a large immigrant population from South East Asia that sends remittances back home. Some of the largest Bitcoin remittance companies are based in South East Asia in countries like the Phillipines or India. In Indonesia, Bitcoin is buyable at any of ten thousand plus IndoMaret stores. Australia now seems aptly prepared to benefit from the coming Bitcoin technology boom (bubble as called by some). Once the investigation is over, and banks are 100% clear on what not to do to Bitcoin companies, expect to see more Bitcoin companies return to Australia.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

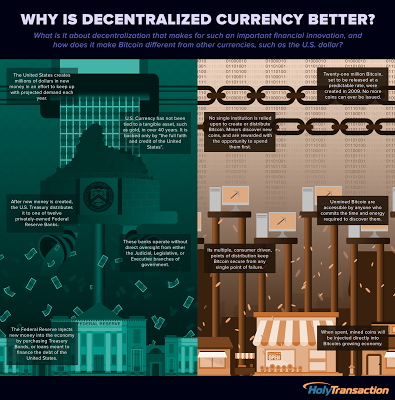

Infographic: Why Is Decentralized Currency Better?

Open your free digital wallet here to store your cryptocurrencies in a safe place.