BitShares 2.0 – Will Users and Banks Be Using Graphene in the Future?

Graphene, the super material that our computer chips might be made of soon, still isn’t very well known. However, with BitShares 2.0 being called Graphene, the word might become a stable part of your lexicon soon. The BitShares 2.0 has been long anticipated by both the BitShares and cryptocurrency communities. Since its announcement earlier this summer, BitShares has started to restructure themselves in preparation for BitShares 2.0. Though they are adding a lot of functionality, the core stake distribution is not changing at all. In testing, they have been able to sustain 3000+ tx per 3sec block, compared to the 7 transactions per second that the Bitcoin network is theoretically limited to. To reach even larger network sizes, Graphene is tapping into the same future expectations that Bitcoin users expect to keep their network viable: Moore’s Law. The pace of technology is such that eventually just one rented VPS will be able to handle all of the world’s financial transactions.

Graphene, the super material that our computer chips might be made of soon, still isn’t very well known. However, with BitShares 2.0 being called Graphene, the word might become a stable part of your lexicon soon. The BitShares 2.0 has been long anticipated by both the BitShares and cryptocurrency communities. Since its announcement earlier this summer, BitShares has started to restructure themselves in preparation for BitShares 2.0. Though they are adding a lot of functionality, the core stake distribution is not changing at all. In testing, they have been able to sustain 3000+ tx per 3sec block, compared to the 7 transactions per second that the Bitcoin network is theoretically limited to. To reach even larger network sizes, Graphene is tapping into the same future expectations that Bitcoin users expect to keep their network viable: Moore’s Law. The pace of technology is such that eventually just one rented VPS will be able to handle all of the world’s financial transactions.BitShares Style Decentralization Is What Banks Need

Open your free digital wallet here to store your cryptocurrencies in a safe place.

EU’s Top Court Rules That Bitcoin Exchange Is Tax-Free

European Union’s top court said in a ruling that puts them on a more

equal footing with traditional cash.

sales levy — needn’t be applied because the business involves “the

exchange of different means of payment,” the EU Court of Justice in

Luxembourg ruled Thursday. The case was triggered by a dispute in

Sweden, where David Hedqvist set up a service for the exchange of

mainstream money for bitcoin and vice versa.

currency, introduced in 2008 by a programmer or group of programmers

under the name Satoshi Nakamoto, has no central issuing authority and

uses a public ledger to verify encrypted transactions. It has gained

traction with merchants selling legitimate products but also has been

used to facilitate illegal transactions because money can be transferred

anonymously.

to exchange traditional currencies for units of the bitcoin virtual

currency (and vice versa) constitute the supply of services” under the

bloc’s law “since they consist of the exchange of different means of

payment,” the court ruled. As such they are exempt from value-added

taxes, it said.

exemptions given to traditional exchanges “would deprive it of part of

its effects,” given that the exemption’s aim is to counter “the

difficulties connected with determining the taxable amount and the

amount of VAT deductible” in cases of taxation of financial

transactions, the court said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The 7 Best Bitcoin Youtube Video

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Deutsche Bank Is Bringing Bitcoin-Inspired Blockchain Technology to Germany

In a recently translated piece by the Deutsche bank, originally written by Thomas F. Dapp and Alexander Karollus, the German bank discussed how banks in general might be able to benefit from p2p networks like Bitcoin. The authors specifically mention a hypothetical future scenario where banks might assume new tasks that still play on banks’ perceived trustworthiness – “e.g. as custodians of cryptographic keys.” Other existing centralized services might have to adapt to serve other roles in the coming decentralized world. Don’t be surprised if someday soon Bloomberg to self-proclaim themselves as an oracle? They went on to note that the politics of Bitcoin would eventually lead to a head with regulators, law enforcement, etc. However, in the face of this new technology and potential regulatory backlash, Deutsche bank still wants to push forward… Because the concept of a blockchain really is that compelling, and the banks are finally starting to get it. Dapp and Karollus wrote:“Traditional banks should not rely on the regulator now, though, but instead actively experiment with the new technologies in their labs and collaborate without prejudice in order to create their own digital ecosystem in the medium run.”

In a recently translated piece by the Deutsche bank, originally written by Thomas F. Dapp and Alexander Karollus, the German bank discussed how banks in general might be able to benefit from p2p networks like Bitcoin. The authors specifically mention a hypothetical future scenario where banks might assume new tasks that still play on banks’ perceived trustworthiness – “e.g. as custodians of cryptographic keys.” Other existing centralized services might have to adapt to serve other roles in the coming decentralized world. Don’t be surprised if someday soon Bloomberg to self-proclaim themselves as an oracle? They went on to note that the politics of Bitcoin would eventually lead to a head with regulators, law enforcement, etc. However, in the face of this new technology and potential regulatory backlash, Deutsche bank still wants to push forward… Because the concept of a blockchain really is that compelling, and the banks are finally starting to get it. Dapp and Karollus wrote:“Traditional banks should not rely on the regulator now, though, but instead actively experiment with the new technologies in their labs and collaborate without prejudice in order to create their own digital ecosystem in the medium run.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Infographic: What is the Block Size debate, and will it lead to a hard fork?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Gridcoin Wallet joins HolyTransaction Today!

All HolyTransaction customers can create new address for Gridcoin wallet and use the easy HolyTransaction Web Wallet to send and receive transactions or to instantly convert them to any 9 supported cryptocurrency.

Just like Bitcoin, you can now:

– Send Gridcoin to your GRC wallet address.

– Receive transactions

– Make instant transactions between HT users

– Set OTP for additional protection

We are really excited to be part of a new community!

About Gridcoin:

Gridcoin is a cryptocurrency that rewards individuals for contributing to computational research in math, science and several other areas of study with their home computer, laptop and android devices.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

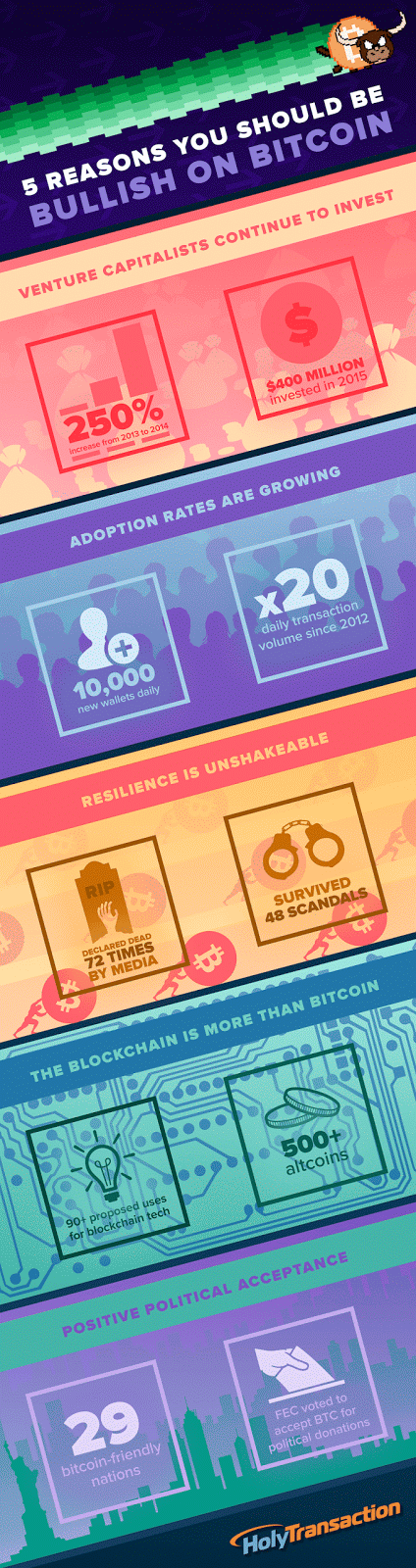

Infographic: 5 reasons you should be bullish on Bitcoin!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction partners with RibbitRewards to further Blockchain-based rewards programs

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Infographic: The 4 Properties of Bitcoin

Open your free digital wallet here to store your cryptocurrencies in a safe place.

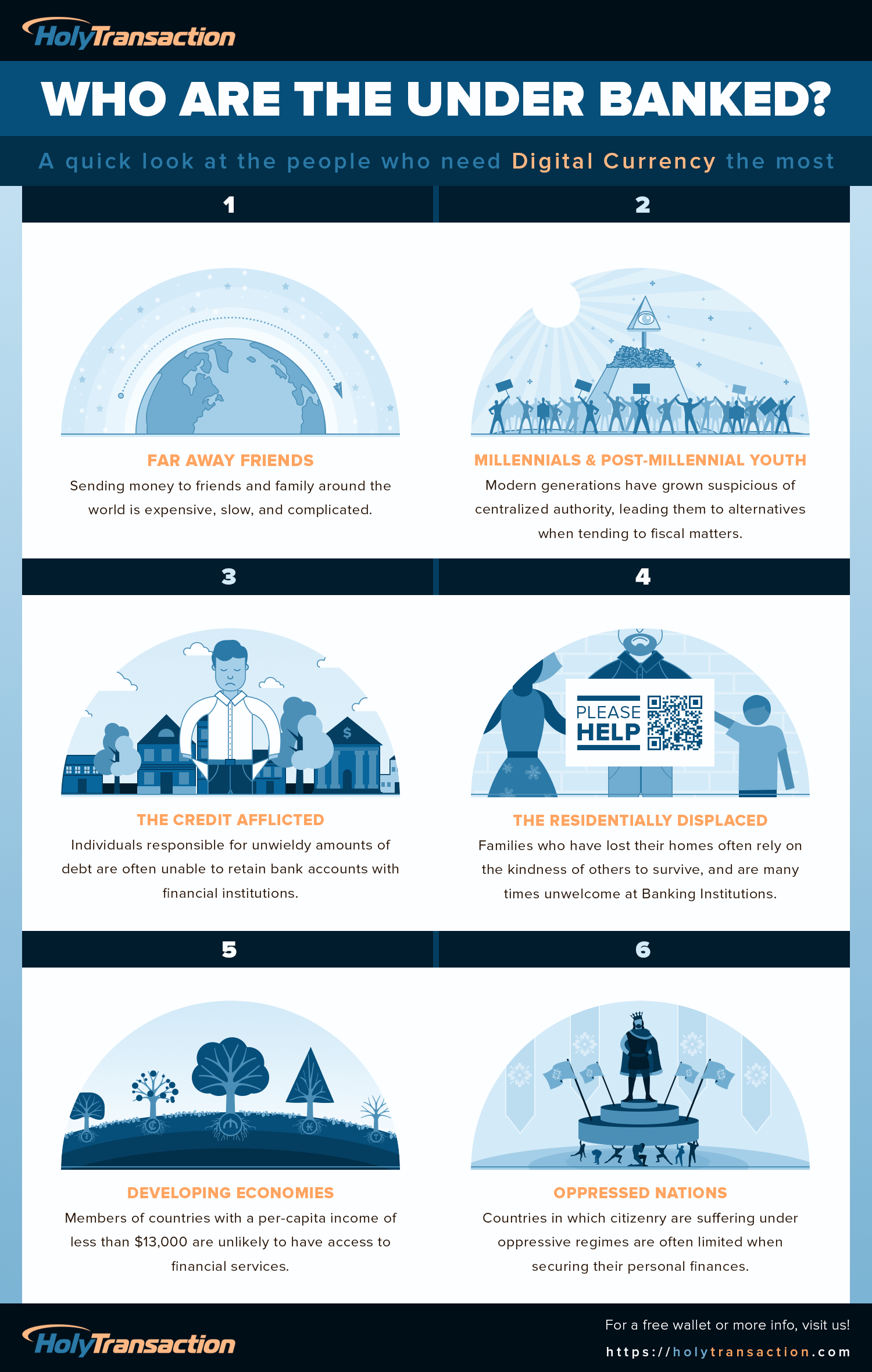

Infographic: Who Are The Under Banked?

Open your free digital wallet here to store your cryptocurrencies in a safe place.