Does Satoshi’s Identity Matter?

We all love a good mystery.

SATOSHI DID NOT WORK ON BITCOIN AS WE KNOW IT

THE IDEA FOR DIGITAL CURRENCY HAS BEEN AROUND FOR DECADES

IT IS BETTER THAT WE DON’T KNOW

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction opens it’s doors to the world of crypto 2.0 with new Mastercoin WebWallet

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why Timothy Coles is selling his $2 Million Gold Mine for Bitcoin

city of Dawson currently for sale for just over 3,200 BTC on luxury

marketplace BitPremier.

With more than 30 years of experience in the gold mining industry,

Coles brings a unique perspective to digital currency and the concepts

that underly the technology. He sees bitcoin as a one-of-a-kind type of

asset.

wintering in the Philippines. Casual research grew into more active

investigation, leading to discussions about how bitcoin might fit into

plans to sell off his gold interests in the Yukon.

“I believe bitcoin has nowhere to go but up. In the long run, it’s just going to get stronger and stronger and stronger.”

in it should the BitPremier sale succeed. While he has no active plans

to invest were he to enter the market, Coles expressed an openness to

invest in the broader bitcoin industry, including the mining sector.

Bitcoin vs gold

bitcoin, Coles cited the fact that the prices in digital currency

markets are set by supply and demand.

in his eyes, made it a less attractive option over the years:

“The people that have the bitcoin are the ones that can

drive the price up, or drive it down, depending on what ups. Whereas

gold, the people that have the gold are really at the mercy of

politicians, financial institutions, London fixes that we really know

nothing about. People that have gold really have no control over the

direction that goes.”

on bitcoin. However, he said that the decentralized nature of digital

currency technology makes it “less susceptible to manipulation compared

to gold”.

went too high too quickly, resulting in an equally swift correction. In

the months since – which has seen a raft of both positive and negative

news for bitcoin – the price, he said, has risen on the merits of its

strength rather than pure hype or speculation.

Bitcoin needs education

education among the broader public. This is due to the novel

characteristics of bitcoin that make it not quite a currency, commodity

or property. Instead, it lies somewhere in the middle.

hinges on whether or not more people learn about how it works, how they

can acquire it and, most importantly, how they can use it.

“I believe that bitcoin needs some advertising the world

over to learn more about what it’s all about. Nine out of 10 people I

talk to have heard of bitcoin, but they don’t know about it, they don’t

understand and they don’t want to because it’s out of their realm of

understanding.”

environment in which more people understand how to use digital currency –

and do so – could enable the bitcoin market to operate without

manipulative influence from the outside.

More gold plans ahead

after the sale of his mining interest in the Yukon he’d stay on the

lookout for new opportunities. Issues aside, he said that he makes a

“good living” in the gold market, joking that the industry was “spoiled”

in 2012 and 2013, when gold prices surged above $1,700 an ounce.

“I would still always keep my eyes open for opportunities in gold mining. It’s something that’s in your blood.”

help provide logistical and managerial support to a potential owner. The

sale actually has two components: Canyon Creek, a developed, three-mile

property with drilling and exploration already conducted on the plot,

and an existing lease in the Bonanza Creek region.

a waterway in the Yukon made famous for the abundance of gold

discovered in the region. He suggested they are the heart of something

that offers “big potential” to interested investors.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

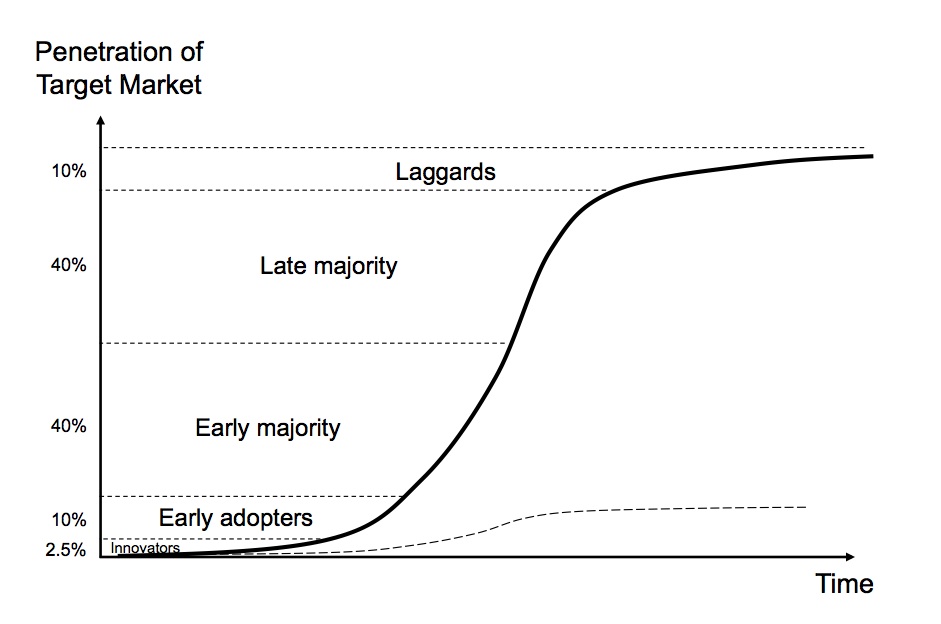

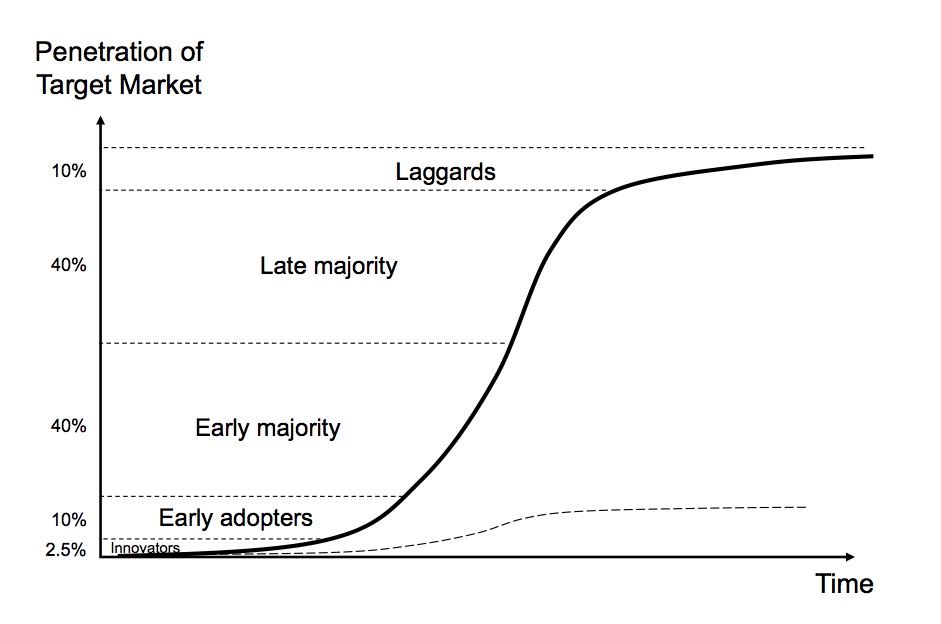

Bitcoin has passed the tipping point

Products and services that are first-to-market often take such a battering that they lose out to competitors with copycat products. Business history is littered with wildly successful products with ultimately spectacular collapses because they lost out to competitors that found a better way of doing things – things they learned at the trailblazer’s expense.

The Sony Betamax is the poster child for products that created a market and lost out to a rival – in this case VHS. Sony created a market for recording TV, but because the tapes where an hour long VHS grabbed the movie rental market.

More recently, Friendster was the first social network to explode, with millions of users in the first 3 months. But it couldn’t manage its growth and lost out to MySpace and of course Facebook.

There are many more examples. Some lost slowly, like the Atari 2600 game console, and some crashed spectacularly like Rio MP3 player. Palm lost to Apple, Netscape to Internet Explorer, WebCrawler to Google, Tivo to the cable companies, and on and on.

So far Bitcoin is an exception to this model. And though it’s been battered by ruinous headlines, including one just this week where the World Bank is calling it a naturally occurring Ponzi scheme, Bitcoin remains resilient.

Kaushik Basu, World Bank economist and author of ‘Ponzis: The Science and Mystique of a Class of Financial Frauds’ argues that most Ponzis today are not always obvious and that today’s Ponzi schemes often don’t have a puppet-master pulling the strings. Bitcoin, he says, is just such a Ponzi. The speculation on the currency raises the demand for Bitcoin making it a bubble.

Bitcoin has hundreds of competitors all built on the Bitcoin model. A handful are gaining some success, like Litecoin which is currently trading at $9, and Darkcoin (I’m not kidding) which is trading now trading at $7.50.

Darkcoin was built to cover perceived flaws in Bitcoin’s anonymity. One reason for the early success of Bitcoin was that it was as anonymous as passing dollars on the street. And while there is a far greater level of anonymity with this electronic transaction than making a purchase with a credit card or PayPal, Bitcoin is not anonymous to those forces who really want to know.

Unlike Bitcoin, Dash mixes up users’ transactions so that it’s nearly impossible to trace a payment to a person. But the promise of Dash’s privacy features solves a problem for only a small subset of Bitcoin users.

Few have heard of other crypto-currencies. If people barely understand Bitcoin, then any competitor has the impossible task of differentiating itself.

In his paper Basu mentioned Bitcoin by name, so did the IRS when it said it was a taxable asset. And this week Benjamin M. Lawsky, the superintendent of financial services for the State of New York, proposed regulations to create a “BitLicense” to include rules on consumer protection, the prevention of money laundering and cybersecurity. That’s akin to Apple successfully rebranding the MP3 to a podcast.

Just search “20 USD in BTC” on Google and you’ll get the exchange rate. It works for any fiat currency. You can’t do that with any other crypto-currency.

Bitcoin is currently trading at $600. Not bad for a five year old Ponzi scheme.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

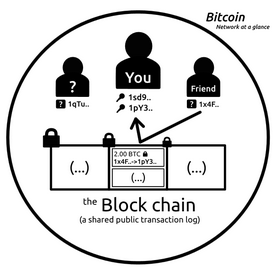

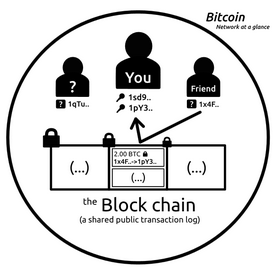

Think the Internet’s disruptive? Hold tight for blockchain!

This matters because, as Sparkes sets out under his provocative headline of The coming digital anarchy,

this is a system that can be applied not just to money but to any kind of transaction, from domain name registration to legal arbitration or public elections. In between those two extremes, it could completely overturn the way enterprises organize themselves and tout for business.

Where’s the distributed, anonymous, permission-less system for chatty machines to allocate their scarce resources? Where is the ‘virtual money’ to create this ‘virtual economy?’ …

Someday, they will be used by the machines in our network, on our desk, in our garage, and in our pocket to exchange value and achieve consensus at blinding speeds, anonymously, and at minimal cost.

What Ravikant is really describing here is not Bitcoin per se but the work of the blockchain, providing a trusted, shared transaction record that allows machines to own and exchange value without human intervention. Although in strict engineering terms it’s not really a protocol, its impact is potentially as huge as any of these other building blocks of the Internet.

Effectively, Ravikant is arguing the blockchain is how the Internet of Things will exchange value — not just monetary value, but also many of those other components of business transactions that we currently find much harder to quantify, such as trust and reputation.

Autonomous things

Autonomous things

Now back to Sparkes, who recounts a scenario imagined by Mike Hearn, an ex-Googler who now works on Bitcoin:

Far-fetched it may be, but this is the kind of scenario that is getting venture investors excited about blockchain right now — and you can understand why.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin like the Internet In 1995

is receiving more venture capital investment than early stage Internet

companies were in 1995. Remember what the Internet was like in 1995?

looked like. If not, the piece discusses how hard it was to stream

video, how there was no safe way to process credit cards, how ugly the

websites looked and how slow the Internet was.

anyone uses it, it isn’t safe, and it is hard to use. However digital

currencies are so much cheaper, more convenient and more powerful than

their analog counterparts that, like the Internet, their widespread

adoption seems assured.

competing digital currencies have entered the market. So far none has a

clear shot at overtaking bitcoin. Bitcoin’s network effect is growing at

a fast rate, making its dominance even more likely.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

A little altcoin sanity: Peercoin

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Under the microscope: conclusions on the costs of Bitcoin

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The line between fiat and cryptocurrency is getting fuzzier.

(BitcoinMagazine) The line between fiat and cryptocurrency is getting fuzzier. With the advent of Bitcoin 2.0 technology, we can now use cryptocurrency to exchange stocks, property, commodities, and even state-backed money. But if the whole point of cryptocurrency was to decentralize the financial system, what’s the point of a dollar-backed coin?

Dollar-backed digital coins have been attempted many times before. The Canadian government even tried to get in on the action, and unsurprisingly failed. Some claim that the first cryptocurrency to attempt this was Coinaaa, but this is technically incorrect. Coinaaa sells premined coins, and does invest a lot of the revenue in Norwegian krone, but their intention is to maintain a stable value independent of any state-backed currency. The company invests their earnings, and uses some of the money to buy back coins when the price drops, or sell coins when it rises.

The company promises 0% transaction fees, but at the cost of a centralized mining system. While this fails to represent actual kroner one could trade in a decentralized manner, it does serve as a great transactional currency. This is theoretically possible without having to rely on humans–decentralized autonomous software could do this by adjusting block rewards or destroying transaction fees in response to price fluctuations–but if they make the right investments, it functions for now.

Given the possible and existing options available, one might then wonder why Brock Pierce chose to introduce Realcoin, the first cryptocurrency backed by US dollars. Although they claim to hold US dollars in “conservative investments,” this probably means they’re doing the same thing Coinaaa is with your money. The major difference is that they aren’t trying to maintain a stable value: Realcoin claims they will maintain a fully-auditable 1-to-1 reserve of US dollars, which can be redeemed for their coins. This is all enabled by the Mastercoin protocol (Omni Layer) on the existing Bitcoin blockchain.

This will cause Realcoin to fluctuate with the value of the dollar, for better or for worse. It will inflate with time, as all fiat money does, meaning you won’t want to keep your savings in it–Bitcoin would be a better choice. A good transactional currency should be neither inflationary nor deflationary, so Coinaaa is clearly the superior choice for daily use; both will likely make their profit by trading and investing with your money, and require very similar amounts of trust.

Why, then, create Realcoin? Although the Coinaaa company will definitely hold some kroner, a Coinaaa will not represent the value of a Norwegian krone. This means that if you want to do FOREX trading involving Norwegian currency, you have no choice but to return to centralized exchanges. Even if you don’t want to hold or use kroner, there’s profit to be had in exchanging it.

Realcoin, therefore, represents an opportunity to speculate with fiat currency for the first time. If you have reason to believe its price will move for or against a digital currency on the market, now you can take advantage of that. Given that the Mastercoin protocol will almost certainly contain a decentralized exchange, Realcoin allows you to trade in US dollars without ever touching a traditional financial institution. The state is just like any other company, issuing money that you can choose to use–or not.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How the Bitcoin landscape is evolving in 2014

(CoinDesk) Like any new industry, there are so many areas to explore in the bitcoin space that sometimes make a week’s worth of developmentsit feel like a month or two have gone by.

1. Big-name retailers jumping on board

2. A warming regulatory climate

3. VC firms keep betting big

4. Building on the block chain

5. New emphasis on transparency

Open your free digital wallet here to store your cryptocurrencies in a safe place.