Cryptocurrency: Fundraising Evolved

Open your free digital wallet here to store your cryptocurrencies in a safe place.

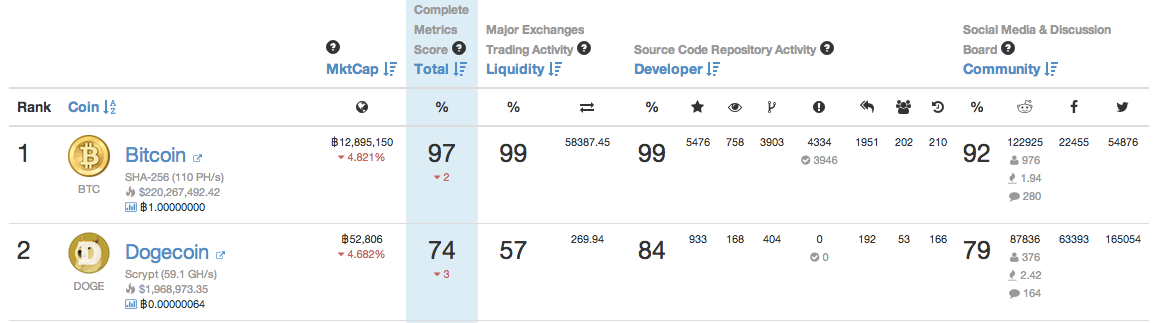

Does Dogecoin have the most active community?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Cryptocoins for good: Cryptocurrencies Empowering Citizens Against Oppressive Governments

How cryptocurrencies can change the balance of power between dictators and citizens

the “control by the ruble” of the Soviet Gosbank, to the dual currency

system in Cuba, China’s overvaluation of the Yuan, or the exchange

controls in countries like Venezuela and Iran, regimes of all types have

relied on these kind of controls to rein, or at least try to rein,

capital flights, inevitable when -sooner or later- markets try to

correct the excesses committed by money-hungry “revolutions”.

|

| The Gosbank controlled the currency markets using what it came to be known as the “control by the ruble” |

citizens are usually the most affected by such currency controls: as a

pseudo-monopoly is established, a black-market is instantly created and

exchange rates climb inexorably, specially in left-leaning regimes where

the government aims for greater control of all aspects of the economy,

affecting the efficiency of the production system and pushing the

trade-balance the wrong way, increasing in consequence the amount of

foreign currency required to cover internal demand. In short, more

expensive currency is required to buy each time more stuff, the result?

Rampant inflation and even more poverty.

Marxist theory says that the structure of society must be based in

keeping people in poverty, ruled by an upper class with certain rules,

norms and such in order so they can keep people like that. This

old-proven-wrong-policy is still used by many governments today, in

February 2014, for example, some education minister of a Latin American

country said that the government “wasn’t going to take people out of

poverty so they can become political opponents”. This proves that

currency controls are not a consequence of failed economic policies, but

tools for the governments to exert repressing power over its citizens.

what would happen to oppressive regimes if they were to lose control of

the currency exchange, so the people is free to manage their wealth

beyond the power of government currency controls? Currency

decentralization is not new, 20th century economist and Nobel Prize

Winner, Friedrich August Von Hayek (F.A. Hayek), theorized extensively

on this subject, and though polemic, his writings provided an important

part of the theoretical framework for modern economics, specially in

areas such as theory of money and economic fluctuations.In his book Theory of Liberty he wrote:

“The

experience of the last fifty years has taught most people the

importance of a stable monetary system. Compared with the preceding

century, this period has been one of great monetary disturbances.

Governments have assumed a much more active part in controlling money,

and this has been as much a cause as a consequence of instability. It is

only natural, therefore, that some people should feel it would be

better if governments were deprived of their control over monetary

policy. Why, it is sometimes asked, should we not rely on the

spontaneous forces of the market to supply whatever is needed for a

satisfactory medium of exchange as we do in most other respects?It

is important to be clear at the outset that this is not only

politically impracticable today but would probably be undesirable if it

were possible. Perhaps, if governments had never interfered, a kind of

monetary arrangement might have evolved which would not have required

deliberate control; in particular, if men had not come extensively to

use credit instruments as money or close substitutes for money, we might

have been able to rely on a self-regulating mechanism. This choice,

however, is now closed to us. We know of no substantially different

alternatives to the credit institutions on which the organization of

modern business has come largely to rely; and historical developments

have created conditions in which the existence of these institutions

makes necessary some degree of deliberate control of the interacting

money and credit systems (my emphasis). Moreover, other circumstances

which we certainly could not hope to change by merely altering our

monetary arrangements make it, for the time being, inevitable that this

control should be largely exercised by governments”

|

| Governments have assumed a much more active part in controlling money, and this has been as much a cause as a consequence of instability F.A. Hayek |

what if it was no longer inevitable? During the 20th century creating

and managing currencies was only possible for governments, so it was in

essence exclusively a political matter, but technology is changing that,

money issuing is not only government turf anymore, they now must

compete with cryptocurrencies. In governments with an effective rule of

law, this can be fair competition, for example, currencies can be

somehow regulated -as the IRS recently did in the US- and a legal

framework can be established so everyone can play by the rules. But,

there are many countries where the line between state and nation is

blurred, these countries may also take two additional paths, they can

prevent financial institutions or businesses from transact with

cryptocurrencies (e.g. Colombia and China) or they can declare an

outright ban (as it is rumored about China every single day). In both

scenarios cryptocoins could have a very important role, in the former

-while remaining legal- they can create a new channel for the flow of

foreign currencies, in the latter they can work as a relief valve, as an

alternative for the black market. In any case, by increasing the supply

of foreign currency, these coins can effectively push prices down, with

all the benefits that comes with it.

once, the development model that could arise from an efficient

cryptocoins market presents a development plan that is not based on

plain charity, in giving away something with the hope that the recipient

will make a good use of it and luckily return it back in future

productivity. People cannot only mine their own coins but they can rest

assure that the value of such money will be subject to fair rules of

supply and demand, not to devaluation-based political planning; and most

important, they may not be held hostage in poverty by exchange

controls, giving back to them a little of that sovereignty that

dictators keep claiming or themselves.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Polish Finance Ministry says Bitcoin can be used as financial instrument

document confirming that under the country’s existing financial

regulations, bitcoin can be considered a financial instrument.

opposition member of Parliament for the liberal Twoj Ruch (Your

Movement) party. At the time, Pacholski asked Poland’s Ministry of

Finance to explain the legal status of bitcoin transactions.

Specifically, his query focused on whether or not “options and futures

contracts can be considered as a financial instrument” if they are

denominated in a digital currency.

“Options or futures contracts which are based on

[bitcoin] as a base instrument can be considered as derivative

instruments, and as such, they can be considered as financial

instruments, according to the bill on financial instruments.”

Bitcoin’s legal status clarified

recognized currency in Poland. He said in the policy document:

“An analysis of national regulations allows to conclude

that bitcoin … is not a legally defined and universally accepted

currency, because it cannot be classified as either a national currency …

or a foreign currency.”

possibility of issuing options and futures contracts in the form of

derivatives based on bitcoin market indexes. These issuances, he said,

would be similar to the derivatives which are based on stock market

indexes.

available to Polish investors. This, the Finance Ministry said, is in

accordance with the country’s banking services regulations.

Regulators accept bitcoin usage

derivatives markets suggests the continued evolution of government

policy toward digital currencies in Poland. While bitcoin can be used as

a medium of exchange and financial tool, it remains unrecognized as a

legal currency by regulators.

Szymon Wozniak, a Finance Ministry representative, said that the

ministry does not consider bitcoin to be illegal, but it does not

consider it to be a legal currency either. He remarked:

“What is not forbidden is permitted. However, we certainly cannot consider bitcoin to be a legal currency.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin history: pre-blockchain digital currencies

(CoinTelegraph) For anyone not involved in

mid-90s cypherpunk scenes or early e-cash projects, the term “digital

currency” probably never came up in conversation until quite recently,

after the advent of Bitcoin.

But Satoshi’s white paper

did not invent digital money; that’s an idea as old as mainstream

internet usage itself. Bitcoin, and the altcoins it spawned, just

happened to be so revolutionary that all those electronic currencies

pre-2009https://holytransaction.com/page/before-bitcoin get overshadowed.

It’s like the Christian calendar. There is before-Bitcoin (BB), and then there is the current era, (AB).

Let’s take a look at some pre-Bitcoin technologies to get an idea of how far cryptocurrencies have come since.

1990: DigiCash

In 1982, cryptographer David Chaum applied the idea of blind signatures to money in his paper “Blind Signature for Untraceable Payments.”

Eight years later, he took these cryptographic protocols to market with

DigiCash, a company that ultimately went bankrupt in 1998.

1996: E-Gold

E-Gold sounded like a fine idea at the time: Create an account, send

in your gold or silver, and your accounted would be credited. Those

credits could then be easily transferred among accounts. The company

slowly built a successful operation through the late 90s.

By 2001, E-Gold was running into problems, however. The US Patriot

Act, first of all, tightened regulations on businesses that could be

classified as money transmitters. Gaining money transmitter licenses for

all 50 states proved too big of a hassle for E-Gold and its

competitors.

Furthermore, a campaign began to grow against E-Gold that marked it

as the currency of money launderers and child pornographers. A federal

indictment followed in 2005, which marked the end of E-Gold as a

meaningful alternative currency.

1998: Beenz.com

Beenz was a currency created to incentivize behavior such as visiting

specific websites, logging on through specific ISPs or shopping at

certain stores. This was back before the dot-com bubble burst, when

bored teenagers could take online quizzes, and marketing companies would

send them free stuff in the mail.

But the fetten Jahren ran their course, and Beenz.com was gone by 2001.

1999: Flooz.com

Flooz had a similar name and similar model to Beenz: Users were

rewarded for activity with flooz, which served as a medium of exchange

among its network of partners. Like Beenz, also, Flooz went bust in the

dot-com crash.

1999: InternetCash.com

InterenetCash.com filed a number of patents to protect its monetary

system based on prepaid cards, and it also relied on a network of

participating merchants where that cash could be redeemed. The company

ultimately raised $10 million in funding and had a staff of about 70

employees before the dot-com crash forced the company to close in August

2001.

After 2001, when economic realities hit many internet startups hard,

digital money never really caught on again, beyond some niche users,

until Nakamoto published the Bitcoin white paper in 2008. Of course, it

took a few years for most of us in the cryptocurrency community to catch

on, at which point cryptocurrencies took off far beyond what their

predecessors did.

We asked some community experts what present feature or

present reality in cryptocurrency tech today we will find funny and

old-fashioned in 15 years or so?

Aleksey Bragin:

“So many useless (or sometimes funny, as DogeCoin for example) alt

cryptocurrency clones emerged so quickly. That would go out of fashion

quicker than within 15 years, I suppose.”

Gideon Gallasch (coinsulting.eu): “I think mining – so much power and electricity is not sustainable long term.”

Lech Wilczyński (Co-Founder/CEO / Developer at InPay S.A.): “Centralized exchanges.”

J. Ryan Conley (CEO & Founder at Ryan Conley

Marketing & Training and CEO & Founder at Team Extreme

Worldwide): “That the banks were last to catch on to this awesome

concept! Staged viral video marketing platform.”

Patrick Dugan (CIO of Crypto Currency Concepts): “Centralized exchanges for sure, mining possibly.”

Lech Wilczyński (InPay.pl): “Bitcoin payment gateway.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Blackcoin Announces Proof-of-Stake Protocol v2

(CoinTelegraph) Blackcoin is one of the most

exciting altcoins in the cryptospace right now. It has a 30 second

confirmation time, large market cap, their BlackHalo project is keeping

it in the forefront of the Bitcoin 2.0 space and they seem to be the

only team to get altmining pools done in a responsible way that doesn’t

harm other coins.

It is also proof-of-stake based, with its proof-of-work mining period long over. While, as the team and the white paper is quick to point out,

proof-of-stake has been secure enough to prevent any serious security

breaches to its 15 – 20 million dollar market (not to mention the

markets of other proof-of-stake coins like NXTCoin, Peercoin and

Novacoin) there have been some concerns voiced by the community.

Rather than waiting to see if their coin can withstand a serious

attack when potentially hundreds of millions of dollars are on the line

(assuming Blackcoin continues to grow) the developers are taking a

proactive approach and plugging up those potential vulnerabilities now.

Proof-of-stake protocol v2 ditches the somewhat controversial Coinage

system completely. Coinage is a system that has only coins, which have

been moved into a wallet recently (after thirty days but less than

ninety days), accruing interest in the minting process. This system was

designed to encourage transactions and therefore spending. However, it

resulted in a less secure system as nodes were able to gain enough

influence over the system to perform a double spend. There was also an

issue where honest nodes would only remain on while their coins were

gaining interest. More nodes equates to a more secure network, so the

new system is designed to encourage nodes to participate at all times by

not deactivating minting on coins.

Adjustments have also been made to stop pre-computations of

proof-of-stake. Proof-of-stake pre-computations had attackers matching

or exceeding the network hashrates for short amount of times and

rewriting the blockchain to double spend coins they do not yet have.

Blackcoin’s new system addresses this by changing the stake modifier at

every modifier interval.

Blackcoin will also be switching from Scrypt to SHA256d because

Scrypt doesn’t offer any advantages in a proof-of-stake system and since

Blackcoin’s proof-of-work phase is over, it is no longer needed.

The team behind Blackcoin is dedicated, talented and apparently has a

real knack for solving problems. Steve McKie, Project Manager for the

Blackcoin Development team and representative of the Blackcoin

Foundation stated:

“With PoS Protocol V2.0, we wanted to plug any searing

vulnerabilities that may have existed in the protocols previous version

that were left over from previous attempts at PoS (Peercoin, NovaCoin).

The main developer of the protocol, Rat 4 (Pavel Vasin) has been hard at

work making sure that BlackCoin users and merchants are as protected as

possible from malicious attacks on the network”

In the same vein, Blackcoin is switching its Timestamp rules from

ones that mirrored Bitcoin’s to one that is designed to take advantage

of the proof-of-stake system. You can see the differences below:

Bitcoin

Past limit: median time of last 11 blocks

Future limit: +2 hours

Granularity: 1 second

Expected block time: 10 minutes

Blackcoin (New rules)

Past limit: time of last block

Future limit: +15 seconds

Granularity: 16 seconds

Expected block time: 64 seconds

McKie and the team have big aspirations for Blackcoin and believe

that the proof-of-stake system will prove to be more effective.

“Proof-of-stake, we believe, will be the leading protocol going forward

in regards to security and overall energy efficiency,” they said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Cryptocurrency Fundamentals

2014 will be a year of revolution, not politically but economically. Sweeping reforms are coming that will forever alter the way our financial system works. In order to understand how cryptocurrency will be so revolutionary, you need to understand who it was made by, why it was made and how it works.

Imagine there were a group of ten nomadic tribes in a valley with a lot of hills. One day they discover a hundred precious stones all with unique symbols written on them. To decide how best to regulate trade and prevent theft and fraud, the tribes decide to make it law that whenever a stone is traded between villages, both of the tribes must record it on this huge wooden board placed where the stones were first found with the stone’s unique symbol telling the other villages that that stone has been traded. They do this when no one is looking and keep their stones hidden from each other. If a stone changes hands without it being recorded on the board, then you know it was a theft or fraud.

Leaving the analogy: the tribes are now computers, the smoke signals are the internet, and the precious stones are Bitcoins. Bitcoin is only one of many hundreds, even thousands, cryptocurrencies out there. Cryptocurrency has three main advantages over national currencies like the US Dollar.

1. It is decentralized; the currency is regulated by the market and community, not by a central bank like our Federal Reserve.

2. It is anonymous; users can spend their money on whatever they want without fear of being tracked by the government.

3. It is digital; you do not need to carry them around with you (even though you can).

Bitcoin – is just one of many cryptocurrencies (AKA altcoins, alternative currencies, etc). It was the first and most famous, mainly for its mob associations in the Silk Road. It was created by an individual or group of individuals known as Satoshi Nakamoto (Personally, I think it’s a small team). It has the greatest market capitalization (as in the quantity of Bitcoins times the value of each Bitcoin given in dollars) of all cryptocurrencies.

Here is a visualization of the market capitalizations of all the cryptocurrencies.

Most cryptocurrencies have nothing unique to them. Some may even be scams, but far more are simply unimaginative wannabes. They are developed by anyone from a leading company to a hacker in his parent’s garage (although you can easily tell). The top fifty cryptocurrencies are usually the only ones with anything creative or innovative about them. But to reach the top you cannot merely have creative mechanics or features to your coin, you must have a community. Coins that want to be in the big boys club must reach out to a group of people online who identify with something about the coin. Often it is as simple as having a “cool” name, like the amusingly blatant Potcoin. A community of people who support and use the coin means that it will have consistent trading and mining and will maintain its value. But don’t take that to mean that you don’t need a well-constructed coin itself. Several times has a coin emerged with a huge opening to a lot of fans before suffering from a massive technical failure and breaking down (looking at you Ripplecoin). This is why we should think of cryptocurrencies as investments like high-volatility bonds than actual mediums of exchange for the time being. Volatility will fall with mainstream adoption and market maturation just like with stocks and bonds.

The competition between altcoins is cutthroat. If your coin/exchange/mining pool gets a bad name as a scam then it will be plastered all over the main cryptocurrency forums (don’t knock forums, these are more influential than maintream media news stations in the crypto community) and your coin/exchange/pool will be ruined. If a coin/exchange/pool comes up just like yours but with that little extra awesome thing about it (I mean literally ANYTHING) then your users can easily notice the rival and switch to it. In order to stay profitable a coin/exchange/pool must not only have value innovation when it release but must continue to create more value and innovation for the user.

Mining – mining is how coins are introduced to the market. In incredibly simplified terms, people with computers download a program that solves very very complex algorithms to generate a unique solution. Each solution is recorded in computer-speak, forming a new cryptocurrency coin. To reclarify: this is almost an oversimplification of the process. This can work in two ways: Proof-of-Work, and Proof-of-Stake. In PoW, you get more blocks containing coins the more work you have done mining that coin in the past. In PoS, you get more blocks containing coins the more total coins you own (so if you continue to own 1% of all the coins then you will continue to receive 1% of coins that are mined) Some cryptocurrencies have a hybrid of both, in which people can mine for coins via PoW or receive them via PoS. Each has its own advantages and disadvantages. If you want to challenge your reading comprehension and computer science skills try reading the articles on both linked above.

PoS (Proof of Stake) was first proposed on Bitcointalk here.

You may think it’s kind of unfair and weird that someone can just go

out and mine cryptocurrency coins “for free” using just a computer, that

makes the coin “not backed by anything.” This belief is full of logical

fallacies. Firstly, the miner must spend money to get computers,

internet access, etc in order to even do the process. Then he must spend

time, effort, expertise and electricity generating the coin. Then he

may sell it. Sounds easy? Wrong. You can similarly trivialize the

process of mining gold, or silver, or any other precious metal. All you

have to do is spend some money to buy a pick, a shovel and a pan then go

out to a river in Oregon and squat in it.

Just because something doesn’t require physical labor doesn’t mean it

isn’t hard, or worthless. Not everyone can or wants to mine, that alone

restricts the supply. In addition, the more miners there are, the

higher the difficulty rate goes. The difficulty rate

decides how many coins are given out in a given time to a given miner;

the higher it is, the less coins the miners get. This also helps to

restrict mining. Today the difficulty rate of Bitcoin is so high that

they are completely mined by big companies with powerful non-personal

computers.

Think of each cryptocurrency as its own precious substance like gold

or diamonds. Gold isn’t “backed by anything” either. Your US Dollar is

only backed by your neighbors’ home mortgages and the debt our banks owe

to other banks. Both cryptocurrencies and precious metals can be mined

“for free,” but that doesn’t mean it is not hard to do so. They may not

be “backed by anything” other than human desire, but that doesn’t mean

they are devoid of value.

Blocks/ Blockchains – here

you can see a infographic explaining how the blockchain system within

Bitcoin works. The blockchain is basically a record of everyone who has

owned each Bitcoin, which Bitcoins they owned, and when. It is a perfect

ledger of all transactions. You may say, “but wait what about

anonymity?” Just about to get there. The ledger doesn’t record your

name, your social security number, your fingerprint etc just your wallet

address. This is not the same as your IP address.

Whenever you want you can go online and download a free unique wallet

with its own address (given anonymously) from the website of each

cryptocurrency. This will sit, just like any other file, in your

computer. While you cannot exactly open it and read or copy the data

within (and thus expose Bitcoin to fraud) you can rest easy knowing your

money is at least digitally in front of you. If you just did something

like buying ten porn magazine subscriptions, you can go download another

unique wallet and toss the old one. This ledger is pretty much useless

for tracking all the transactions, but it does help if one wants to

investigate huge sales that happen all at once.

One of the most important things about cryptocurrency is that it is

not controlled by any government. The most they can do is ban or

restrict it in some way by law, which drives down the price of the coin.

However, this is imprecise and as more countries and companies adopt

the technology, not only will the impact of these laws be lessened but

governments will be face more obvious economic incentives not to. The

fearful prohibitions (which don’t even work as evidenced by at least two

of the top ten crypto exchanges being Chinese at all times) are not

evidence of cryptocurrency’s instability. Rather, they are proof of the

lengths governments which heavily manipulate their currency and repress

their people will go to keep this technology out.

Cryptocurrencies’ decentralized system contrasts greatly with

national currencies or fiat currencies like the dollar or euro. The

federal government has a great deal of control over the US Dollar. I’m

not going to go into the federal reserve

here because I’m sure many non-Libertarians roll their eyes when they

see us go into that stuff and it’s too much for this article. But you

can check it out here:

Want to see a debunking of all those scary things you hear about Bitcoin and cryptocurrency in general? Here.

Written by Mars

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Max Keiser talks altcoins, investment and political disruption

The case for altcoins

“Altcoins offer ways to gain exposure to different segments of the crypto-universe. Dash is a brilliant coin that addresses a real need. As I said before, the market as a whole is set for 100x growth so there is plenty of upside.”

The future of maxcoin

“In the case of maxcoin, this was a coin that was started by students at Bristol University who I don’t think were prepared for the huge interest they got but I supported them and continue to do so because they’re very talented and we’re still very early in the game.”

Bitcoin still the king

“Let me be clear. Everybody should have, as their core holding, some bitcoin. Bitcoin is here to stay and is set to top $400 billion. I agree with the Winklevoss twins on this.”

“As long as Amir [Taaki] and his followers are around, bitcoin and alt coins will be pushing the political envelope and God bless them. We need as much political disruption as can get these days.”

Strange alt of the week

Open your free digital wallet here to store your cryptocurrencies in a safe place.

McShibe! McDonalds Dogecoin burger approved for judging

Back in May, the Dogecoin community decided to take advantage of a competition McDonalds was hosting and tried to add a Dogecoin themed burger to the McDonalds menu. The competition is simple: design a burger online, pick the ingredients, and name it. The top voted burgers would be selected for judging and the winning burgers would sold in McDonalds restaurants for a week.

Early Troubles

Initially, multiple variations of the “Dogecoin” burger were submitted for entry. Examples include the McDogecoin, the McDoge, and the Doge Burger. Despite having been voted to the top, McDonalds had to remove most of these entries due to the name. In hindsight, this decision makes a lot of sense. Some customers (especially those who aren’t aware of the Doge meme) would find it very strange if McDonalds started selling “Doge” burgers all of a sudden.

Redemption

Of all the entries, the McShibe burger was the most tame and an announcement earlier today disclosed that McDonalds had selected the burger and invited the contestant to the kitchen.

Details

The judging will be held on June 29th and 11 other finalists will be invited. Of these 11, judges will select the top 5. These top 5 burgers will be made available on the UK McDonalds menu for a period of one week each.

Conclusion

Well — I guess we can add this to the eternal list of amazing things Dogecoin has done. It remains to be seen whether or not the judges will actually select the burger (or how good it actually tastes). Hopefully one of the judges is secretly a Shibe.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

BlackCoin Team developer creates true smart contracts and a decentralized exchange for Bitcoin and BlackCoin

BlackCoin, a top 10 digital currency by market cap that secures its network entirely through proof of stake, announced today that a member of the BlackCoin development team has created a new method for eliminating risk during peer-to-peer transfers. This revolutionary protocol, called BitHalo for Bitcoin and

BlackHalo for BlackCoin, will be not only the world’s first “smart contracts” client, but also make contracts unbreakable.

is a transparent and accessible digital currency that operates entirely through proof of stake. Proof of stake offers a number of advantages over proof of work systems including much faster confirmation times, less selling pressure due to its unminable protocol, and independence from expensive and energy-intensive mining. The digital currency is supported by the BlackCoin multipool, which pays out in BlackCoin. The BlackCoin Foundation consists of a worldwide network of brand ambassadors, who lead a vibrant international community of BlackCoin advocates.

Open your free digital wallet here to store your cryptocurrencies in a safe place.