How cryptocurrencies can change the balance of power between dictators and citizens

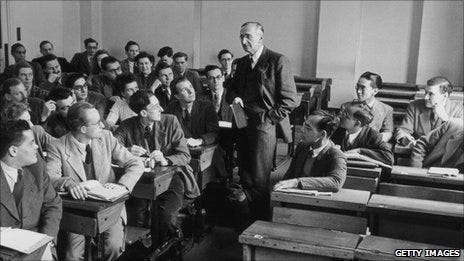

For many years currency exchange control has been a distinctive feature of dictatorships, from

the “control by the ruble” of the Soviet Gosbank, to the dual currency

system in Cuba, China’s overvaluation of the Yuan, or the exchange

controls in countries like Venezuela and Iran, regimes of all types have

relied on these kind of controls to rein, or at least try to rein,

capital flights, inevitable when -sooner or later- markets try to

correct the excesses committed by money-hungry “revolutions”.

|

| The Gosbank controlled the currency markets using what it came to be known as the “control by the ruble” |

Sadly,

citizens are usually the most affected by such currency controls: as a

pseudo-monopoly is established, a black-market is instantly created and

exchange rates climb inexorably, specially in left-leaning regimes where

the government aims for greater control of all aspects of the economy,

affecting the efficiency of the production system and pushing the

trade-balance the wrong way, increasing in consequence the amount of

foreign currency required to cover internal demand. In short, more

expensive currency is required to buy each time more stuff, the result?

Rampant inflation and even more poverty.

Basic

Marxist theory says that the structure of society must be based in

keeping people in poverty, ruled by an upper class with certain rules,

norms and such in order so they can keep people like that. This

old-proven-wrong-policy is still used by many governments today, in

February 2014, for example, some education minister of a Latin American

country said that the government “wasn’t going to take people out of

poverty so they can become political opponents”. This proves that

currency controls are not a consequence of failed economic policies, but

tools for the governments to exert repressing power over its citizens.

Now,

what would happen to oppressive regimes if they were to lose control of

the currency exchange, so the people is free to manage their wealth

beyond the power of government currency controls? Currency

decentralization is not new, 20th century economist and Nobel Prize

Winner, Friedrich August Von Hayek (F.A. Hayek), theorized extensively

on this subject, and though polemic, his writings provided an important

part of the theoretical framework for modern economics, specially in

areas such as theory of money and economic fluctuations.In his book Theory of Liberty he wrote:

“The

experience of the last fifty years has taught most people the

importance of a stable monetary system. Compared with the preceding

century, this period has been one of great monetary disturbances.

Governments have assumed a much more active part in controlling money,

and this has been as much a cause as a consequence of instability. It is

only natural, therefore, that some people should feel it would be

better if governments were deprived of their control over monetary

policy. Why, it is sometimes asked, should we not rely on the

spontaneous forces of the market to supply whatever is needed for a

satisfactory medium of exchange as we do in most other respects?

It

is important to be clear at the outset that this is not only

politically impracticable today but would probably be undesirable if it

were possible. Perhaps, if governments had never interfered, a kind of

monetary arrangement might have evolved which would not have required

deliberate control; in particular, if men had not come extensively to

use credit instruments as money or close substitutes for money, we might

have been able to rely on a self-regulating mechanism. This choice,

however, is now closed to us. We know of no substantially different

alternatives to the credit institutions on which the organization of

modern business has come largely to rely; and historical developments

have created conditions in which the existence of these institutions

makes necessary some degree of deliberate control of the interacting

money and credit systems (my emphasis). Moreover, other circumstances

which we certainly could not hope to change by merely altering our

monetary arrangements make it, for the time being, inevitable that this

control should be largely exercised by governments”

|

Governments

have assumed a much more active part in controlling money, and this has

been as much a cause as a consequence of instability

F.A. Hayek |

But,

what if it was no longer inevitable? During the 20th century creating

and managing currencies was only possible for governments, so it was in

essence exclusively a political matter, but technology is changing that,

money issuing is not only government turf anymore, they now must

compete with cryptocurrencies. In governments with an effective rule of

law, this can be fair competition, for example, currencies can be

somehow regulated -as the IRS recently did in the US- and a legal

framework can be established so everyone can play by the rules. But,

there are many countries where the line between state and nation is

blurred, these countries may also take two additional paths, they can

prevent financial institutions or businesses from transact with

cryptocurrencies (e.g. Colombia and China) or they can declare an

outright ban (as it is rumored about China every single day). In both

scenarios cryptocoins could have a very important role, in the former

-while remaining legal- they can create a new channel for the flow of

foreign currencies, in the latter they can work as a relief valve, as an

alternative for the black market. In any case, by increasing the supply

of foreign currency, these coins can effectively push prices down, with

all the benefits that comes with it.

For

once, the development model that could arise from an efficient

cryptocoins market presents a development plan that is not based on

plain charity, in giving away something with the hope that the recipient

will make a good use of it and luckily return it back in future

productivity. People cannot only mine their own coins but they can rest

assure that the value of such money will be subject to fair rules of

supply and demand, not to devaluation-based political planning; and most

important, they may not be held hostage in poverty by exchange

controls, giving back to them a little of that sovereignty that

dictators keep claiming or themselves.

Open your free digital wallet here to store your cryptocurrencies in a safe place.