How to study with Bitcoin payments

Bitcoin at University

Why in Prague

Bitcoin worldwide recognition

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Philips announces its own Blockchain Lab

Previous Statement

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ethereum used for Car Charging in Germany

Germany supports green power

Car Charging with Smart Contracts

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Burger King accepts bitcoin

But, why Arnhem?

Growing bitcoin enthusiasm

Life on Bitcoin

Where to live using bitcoin: CoinMap and BitMap

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How the blockchain can improve the Australian voting system

Flux Party is a new Australian political party that wants to renovate the voting system by using the blockchain.

How it works

Too old for the Internet era

A revolutionary but not so new idea

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Infographic: What is Bitcoin Mining?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Infographic: A basic overview of storage practices

Open your free digital wallet here to store your cryptocurrencies in a safe place.

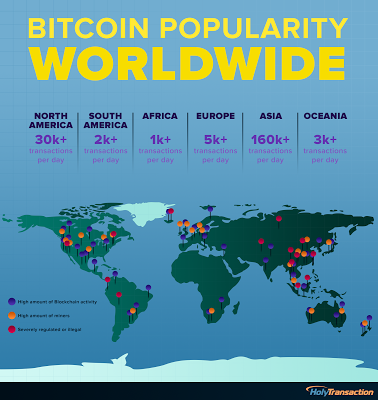

Infographic: Bitcoin Popularity Worldwide

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin: the future of payments

Payments networks revisioned with bitcoin

Why bitcoin is held back

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Google update now supports Bitcoin price in search results!

“You can also ask Google to do conversions – if you have the Google Search app on your smartphone, for example, ask it, ‘How many bitcoin are in 500 U.S. dollars?’ and you’ll get the answer in a handy conversion tool.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.