LinkedIn co-founder: Bitcoin is in my five-year Investment plan

In the interview, Hoffman discussed his personal experience with bitcoin, confirming that he has purchased “a few bitcoins” to date in addition to his investment in Xapo.

In the interview, Hoffman discussed his personal experience with bitcoin, confirming that he has purchased “a few bitcoins” to date in addition to his investment in Xapo.Open your free digital wallet here to store your cryptocurrencies in a safe place.

The great unknown Bitcoin killer app

Open your free digital wallet here to store your cryptocurrencies in a safe place.

A cashless society, in three years ATMs in all majot cities will accepting cryptocurrencies

The consumer financial services company based in North Palm Beach, Florida, Bankrate, predicts that within three years, ATMs in all major cities will accepting digital currencies such as bitcoin.

The report, which assesses the future functionalities likely to be provided by the ATMs of tomorrow, focuses on how mobile payment solutions will play a significant role in terms of the next generation of banking.

With ATMs becoming increasingly flexible when its comes to meeting the needs of customers, Senior Vice President Tom Ormseth of the Chicago-based bank holding company Wintrust Financial says that “banks now need to think like Google, they’ve got to quit being slow adopters.”

The ATMs of today now let you talk to a teller on video, make cash withdrawals via your smartphone, and in many cases let you withdrawal as littles a $1. In essence, the need for physically located banks are becoming less necessary with time, which is why many are saying that the ATMs of tomorrow could replace banks all together. A threat that the advent of bitcoin has only made greater.According to Jay Weber, vice president of debit and ATM product solutions at the Jacksonville, Fla ATMs have long been viewed as nothing more than a tool for withdrawing cash on the fly; however, he says that now, the technology is being driven by a younger, more tech-savvy demographic.

The emergence of cardless ATMs, for instance, which are starting to pop-up in major cities throughout the world thanks to the Chicago-based Wintrust Financial group, allow customers to withdrawal cash through your phone without the need for a physical debit card.

Working much like the emerging bitcoin ATMs, you simply request a withdrawal, then within eight seconds, your money is there waiting for you at your local ATM.

THE DIGITAL DIVIDE

According to Frank Natoli, chief innovation officer at Diebold, the banking industry, once seen as a conservative sector is quickly moving ahead. He further predicts, that thanks to the emergence of mobile banking alternatives, using your smartphone to transact will become even more seamless.

Acording to Natoli:

“Within three years, ATMs in major cities also will accept alternative currencies like bitcoin […] a digital currency that exists only in cyberspace, [that] already is starting to get its own ATMs worldwide. And mobile transactions are more appealing to bitcoin users.”

As the senior analyst at Aite Group, David Albertazzi explains, “it’s about rethinking and redefining the branch network.”

As Wintrust’s Ormseth explains:

“These futuristic ATMs are destined to become bank must-haves. Better security measures such as voice recognition or even biometrics, where you can use your fingerprint to prove your identity, will become commonplace at ATMs too.”As for whats at stake, echoing Ormseth’s predictions, Maclyn Clouse, professor of finance at the University of Denver also believes that given the separation between new technology and old, banks, especially smaller local banks, could soon be left behind. “A lot of transactions will be done on the ATM, which big banks can roll out more profitably than smaller banks,” he told Bankrate.

What will the ATMs of tomorrow look like? According to Clouse — cashless.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How the Bitcoin landscape is evolving in 2014

(CoinDesk) Like any new industry, there are so many areas to explore in the bitcoin space that sometimes make a week’s worth of developmentsit feel like a month or two have gone by.

1. Big-name retailers jumping on board

2. A warming regulatory climate

3. VC firms keep betting big

4. Building on the block chain

5. New emphasis on transparency

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Someone is giving away Bitcoin in San Francisco

|

| Image: CoinDesk |

You don’t pay $10m for a house without making a few enemies #Bitcoinpic.twitter.com/WSN2snj3XQ

— SF Hidden Bitcoin (@sfhiddenbitcoin) July 3, 2014

1KeKnYh4hX6LR12AHetbQVjknXdti8TusZ #bitcoin right here – you can virtually poke it.#hiddenbitcoin #hiddencash pic.twitter.com/WqcukMmcmm

— SF Hidden Bitcoin (@sfhiddenbitcoin) July 4, 2014

Open your free digital wallet here to store your cryptocurrencies in a safe place.

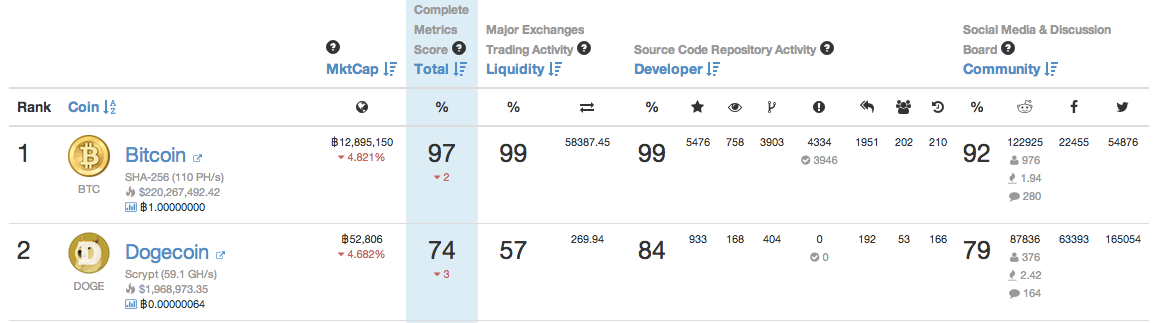

Does Dogecoin have the most active community?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

New Zealand central banker: cryptocurrencies could supplant cash

Advantages and drawbacks

“[Bitcoin] is a very low cost payment method with strong security features and usable for cross-border transactions, making it advantageous in some regards relative to more traditional payment mechanisms.”

“Key attributes of trust (that the ‘money’ gives rise to settlement of the obligation) and anonymity (it is often efficient for the sale/purchase parties not to have to identify one another) must be met, but if these can be accomplished reliably and sustainably, new technologies could supplant cash as we know it in years to come.”

Banks need to keep up

Apart from the carefully worded statement, regulators have taken any measures to curb or control the development of the bitcoin economy in the region.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why Bitcoin may re-write banking practice

(BusinessTech) Bitcoin has grown from an experiment in digital cash to a vibrant, global economy supporting multi-million dollar companies with a market cap of $10 billion.

“While the road has been bumpy, and quite a rollercoaster ride, it is still nascent and holds immense promise to change the world in unprecedented ways,” said Simon de la Rouviere, speaking at the recent Nedgroup Investments Cash Solutions Treasurers Conference.

“In 2013, the hockey-stick growth often found in the technology space kicked off for Bitcoin, seeing adoption increase worldwide.” De la Rouviere, a technology entrepreneur who develops cryptocurrency applications, believes that Bitcoin’s global, public, distributed asset ledger is a fundamental innovation that could upset various industries – from banking to public records. “Any business in the field of recording information fit into a ledger that charges fees to be a middleman is at risk of becoming obsolete,” he said. As copy of Bitcoin’s ledger exists on every network participant’s computer, and is continually updated, reconciled and synchronized in real-time. Each member can make entries into the ledger, which records transactions of a certain amount of currency from one participant to another. Each entry is propagated to the network, so that every copy on every computer is updated near simultaneously and all copies of the ledger remain synchronized. “This blockchain technology could easily be adopted to work with title deeds, physical keys, private equity, derivatives, escrow, dispute mediation, passports, wills, domain names, and sim cards – to name but a few,” De la Rouviere said.

The future

Looking farther ahead, the technology could potentially bring about a new apolitical reserve currency that allows programs and machines to own forms of value without the requirement of human intervention.

This could herald an almost sci-fi era, where machines earn their keep by providing services to humanity at an even more cost-efficient, break-even level than currently possible, De la Rouviere said.

“By thinking of Bitcoin not as a currency, but as a single solution to a previously unsolved algorithmic problem in distributed systems, colloquially known as the Byzantine Fault Tolerance, humanity can create global systems of consensus powered by mathematics.” Bitcoin is a grand experiment, currently at the forefront of showing the equalizing force that the internet brought about. “It might still one day fail,” he added, “but rest assured, it is spurring innovative thinking across the board.” Sean Segar, head of cash solutions at Nedgroup Investments, said that while the bank believes in staying abreast of trends or fads that may affect the industry, “we have no plans to launch a Bitcoin fund”.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Four charts that suggest Bitcoin value could be at 10,000 USD next year

The chart below shows us the Bitcoin/USD value over the same 2013-2104 period on a logarithmic scale.

Google Trends on Bitcoin

“Bitcoin is still in the earliest phases of industry development. The first years of Bitcoin were about building the infrastructure. Bitcoin entrepreneurs were busy setting up the most basic but fundamental aspects, including wallet and mining services. Today, Bitcoin is just starting to enter the investment phase, where venture capitalist, hedge funds and other financial firms are starting to invest money and capital into this nascent technology. Bitcoin isn’t quite ready for the consumer phase, where end users begin to utilize the services. If the entire history of Bitcoin was a clock, we’re still in the very early time. I would say were maybe in the second second of the entire history.” Nicholas Cary, CEO of Blockchain.info (source)

Disclaimer: The (funny) definition of an economist is “Someone that can use economic theory today to explain why he got all his predictions wrong yesterday“. The market is unpredictable and I can’t always be right

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Shakil Khan: cryptocurrencies are here, embrace them

already disrupting payments and won’t be stopped, serial investor

Shakil Khan told the audience at Wired Money 2014. So get on board

with change.

much-misunderstood, unstable currency, to a more mature offering

that is finding its place in ecommerce and investor portfolios. So

rather than focus on regulation, which will only delay the

inevitable, the financial sector needs to focus on supervision and

take on the opportunities cryptocurrencies provide.

David Rowan, has invested in Spotify and YPlan, and advised teen

founder of Summly Nick D’Aloisio. But it was in 2012, when he first

heard about a payment company attempting to tackle the Bitcoin

ecosystem, that the cryptocurrency crossed his path. In the

following years, he found himself becoming a point-of-contact for

investors, suddenly intrigued by a currency that went from $10-25

per Bitcoin in 2012 to $260 in 2013.

entrepreneurs asking who is this company Mt Gox? Not because I was

the smartest person, but because there was a different wave of

people who weren’t publicly talking about Bitcoin. Morgan Stanley

was phoning me not because we had a relationship, but because

people were calling them and asking advice, and they were coming to

me.”

BitPay. That’s a lot of hard cash for a currency that dips and

peaks dramatically according to government opinion — for instance

when the FBI referred to it as a currency, Bitcoin became stronger;

when China restricted exchanges and warned it would keep an eye on

the currency, its value tumbled.

average consumer to participate in this — it’s the same as

stocks,” said Khan. We in the tech industry are more than familiar

with Bitcoin, beyond the Silk Road headlines, and those in the

financial sector have followed suit. But it is not yet something

that is impacting the average banking customer. “Right now, it’s

something that’s not for the faint hearted, just like stock trading

where people make 3 percent gains one day, and 25 percent losses

the day after.”

made in the cryptocurrency ecosystem — and this is because, as

Khan reiterated onstage, there is a “fundamental problem with

payments”.

three seconds. But if I want to pay someone 200 kroner online it’ll

cost be $32 and might take four days for the payment to arrive.

That makes zero sense, and cryptocurrencies solve this

problem.”

result of this, says Khan.

Andreessen Horowitz, Fred Wilson and Redpoint. This is a sector

everyone knows is going to get disrupted, and they need to be part

of that journey. Companies like Bit Pay were very early, now we

have ecommerce companies starting accepting Bitocin. Amazon has its

own plans on virtual currency.

then we had email. We’ve seen this over and over, and if you have

passion and an appetite for risk, why wouldn’t you? I don’t want to

turn around and five years say why wasn’t I part of this.”

evidenced by the stories being published by Khan’s own site

Coindesk, which are picked up by the likes of the Wall Street

Journal and Dow Jones. “Over the last 12 months it’s

much less of Silk Road, and more of Visa setting up a group looking

into cryptocurrencies and Western Union or Ebay looking into

Bitcoin.”

Bitcoin, Khan points out that the US $100 note is the chosen

currency of the criminal world — it’s what they’ll find in raids,

and its what the CIA drops in bales of cash into Afghanistan.

“They’re not sending smartphones, they were sending US dollars.”

Recently, the US government sold off the 30,000 Bitcoin it seized

during the Silk Road shutdown. Khan points, “I don’t remember the

US government selling cocaine seized from raids, so you can’t say

it’s illegal and shouldn’t be allowed.”

you don’t understand something, you get fearful of it.”

there is something attractive here for investors — Khan says the

coins, currently priced at $650 each, went for above that

value.

not broken. “I’m guessing there are laser printers out there

devaluing that money quicker than the paper can be printed,” Khan

said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.