Blockchain Healthcare Applications for US FDA

The US Food and Drug Administration (FDA) revealed today its intent to study Blockchain Healthcare Applications.

The American agency who approves and regulates medical products announced its decision in a press release published by IBM Watson Health, that will team together with the FDA.

IBM will study how data from electronic medical records, clinical trials and health data from devices can be better shared and audited by using the distributed ledger.

To do so, it is not clear if IBM and the FDA will use a private blockchain or the Bitcoin one. Details may be published during next months.

Initial tests will be focused on clinical trials and real-world evidence data related to oncological data.

However, the two companies positioned the trial as one that could one day mitigate the potential of patient privacy breaches during electric exchanges.

The official press release revealed:

“By keeping an audit trail of all transactions on an unalterable distributed ledger, blockchain technology establishes accountability and transparency in the data exchange process.”

According to the press release, the IBM and the FDA will work together for a two-years period and their goal is publishing their researches in 2017.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

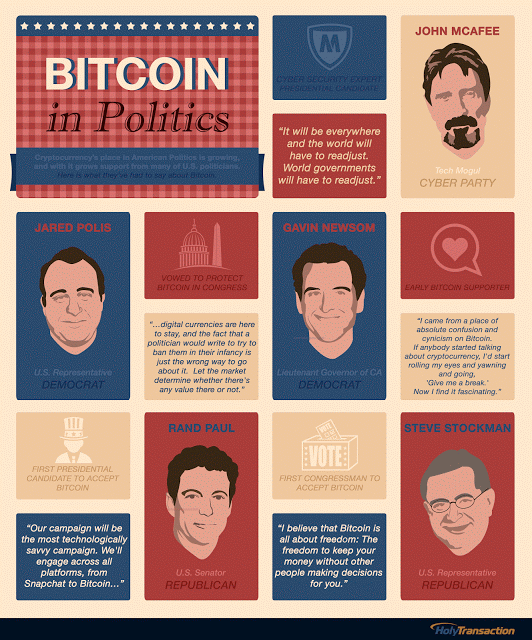

Infographic: Bitcoin in Politics

Open your free digital wallet here to store your cryptocurrencies in a safe place.

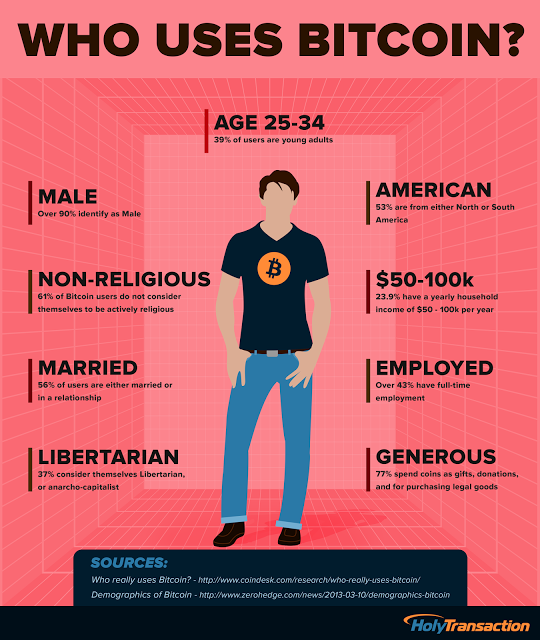

Infographic: Who Uses Bitcoin?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

New North Carolina Money Transmitter Bill Could Push Out Bitcoin Companies

The Politician Forgot to Take Off his Banker Hat

Coinbase Supports This Bill

Proposed Changes May Harm Some Bitcoin Companies

About the author: Caleb Chen is a cryptocurrency advocate and is a research assistant at the Chamber of Digital Commerce.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Goodbye For Now, NYC

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Shakil Khan: cryptocurrencies are here, embrace them

already disrupting payments and won’t be stopped, serial investor

Shakil Khan told the audience at Wired Money 2014. So get on board

with change.

much-misunderstood, unstable currency, to a more mature offering

that is finding its place in ecommerce and investor portfolios. So

rather than focus on regulation, which will only delay the

inevitable, the financial sector needs to focus on supervision and

take on the opportunities cryptocurrencies provide.

David Rowan, has invested in Spotify and YPlan, and advised teen

founder of Summly Nick D’Aloisio. But it was in 2012, when he first

heard about a payment company attempting to tackle the Bitcoin

ecosystem, that the cryptocurrency crossed his path. In the

following years, he found himself becoming a point-of-contact for

investors, suddenly intrigued by a currency that went from $10-25

per Bitcoin in 2012 to $260 in 2013.

entrepreneurs asking who is this company Mt Gox? Not because I was

the smartest person, but because there was a different wave of

people who weren’t publicly talking about Bitcoin. Morgan Stanley

was phoning me not because we had a relationship, but because

people were calling them and asking advice, and they were coming to

me.”

BitPay. That’s a lot of hard cash for a currency that dips and

peaks dramatically according to government opinion — for instance

when the FBI referred to it as a currency, Bitcoin became stronger;

when China restricted exchanges and warned it would keep an eye on

the currency, its value tumbled.

average consumer to participate in this — it’s the same as

stocks,” said Khan. We in the tech industry are more than familiar

with Bitcoin, beyond the Silk Road headlines, and those in the

financial sector have followed suit. But it is not yet something

that is impacting the average banking customer. “Right now, it’s

something that’s not for the faint hearted, just like stock trading

where people make 3 percent gains one day, and 25 percent losses

the day after.”

made in the cryptocurrency ecosystem — and this is because, as

Khan reiterated onstage, there is a “fundamental problem with

payments”.

three seconds. But if I want to pay someone 200 kroner online it’ll

cost be $32 and might take four days for the payment to arrive.

That makes zero sense, and cryptocurrencies solve this

problem.”

result of this, says Khan.

Andreessen Horowitz, Fred Wilson and Redpoint. This is a sector

everyone knows is going to get disrupted, and they need to be part

of that journey. Companies like Bit Pay were very early, now we

have ecommerce companies starting accepting Bitocin. Amazon has its

own plans on virtual currency.

then we had email. We’ve seen this over and over, and if you have

passion and an appetite for risk, why wouldn’t you? I don’t want to

turn around and five years say why wasn’t I part of this.”

evidenced by the stories being published by Khan’s own site

Coindesk, which are picked up by the likes of the Wall Street

Journal and Dow Jones. “Over the last 12 months it’s

much less of Silk Road, and more of Visa setting up a group looking

into cryptocurrencies and Western Union or Ebay looking into

Bitcoin.”

Bitcoin, Khan points out that the US $100 note is the chosen

currency of the criminal world — it’s what they’ll find in raids,

and its what the CIA drops in bales of cash into Afghanistan.

“They’re not sending smartphones, they were sending US dollars.”

Recently, the US government sold off the 30,000 Bitcoin it seized

during the Silk Road shutdown. Khan points, “I don’t remember the

US government selling cocaine seized from raids, so you can’t say

it’s illegal and shouldn’t be allowed.”

you don’t understand something, you get fearful of it.”

there is something attractive here for investors — Khan says the

coins, currently priced at $650 each, went for above that

value.

not broken. “I’m guessing there are laser printers out there

devaluing that money quicker than the paper can be printed,” Khan

said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

One auction bidder claimed all 30,000 Silk Road Bitcoins

undisclosed bidder claimed all of the roughly 30,000 bitcoins seized

from online black market Silk Road and sold in its recent auction.

blocks, according to the USMS. Further, the bitcoins have already been

transferred to the winner, according to Blockchain.

whether they had secured any of the blocks on 30th June. The auction

took place on Friday, 27th June over a 12-hour span.

“The US Marshals Bitcoin auction resulted in one winning

bidder. The transfer of the bitcoins to the winner was completed today.”

Results trickle in

from the USMS on 30th June, when the agency said that 45 registered

bidders took part in the process. At the time, the federal agency didn’t

have a clear number on the final amount of winning bids.

auction date and procedural details last month. At the time, the

federal agency outlined how participants could express interest in the

roughly $18 million worth of bitcoin.

including SecondMarket founder and CEO Barry Silbert, have outlined

their participation in the auction. Silbert later announced via Twitter

that his auction syndicate, which consisted of 42 bidders for a total of

186 bids, was outbid on every bitcoin block.

by the USMS. Other bidders included Pantera Capital and Bitcoin Shop,

both of which have confirmed that they did not enter the winning bid.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Family to travel across the US, apending only Bitcoin

their family of four this week, during which they will only spend

bitcoin.

Washington on Friday, the first stop on the “Uncoinventional Living

Tour”, for the Bitcoin in the Beltway conference.

annual Porcupine Freedom Festival and then to Kansas City, Missouri –

Bleish’s hometown – over the Independence Day holiday before returning

back to Texas.

Fighting a different way

and Bleish are both grassroots activists that spent years fighting the

political system in the US. Each helped start local political action

committes that focused on constitutional activism, civil liberties and

anti-police state causes in their hometowns of Austin, Texas and Kansas

City, respectively.

realisation that they needed to change their lifestyle choices – opting

instead to look for ways of being self-sufficient and building

communities separate from government influence. Bush told CoinDesk:

“We

started to think that if we really want to change the world to create a

more free society, the first thing we can do is to change the way we

live and start to live more free ourselves, and stop participating in

centralised or coercive institutions … Both of us began to realise that a

lot of work we were doing wasn’t making us more free. In fact, it was

just exhausting us and spending all our energy and our money and our

time.”

The Blush family farm

off the grid, the family moved just outside of Austin, to start a farm

on which it produces its own food, provides its own source of water and

harvests its own alternative energy.

lifestyle to be realised, they’ve set goals: to produce 50% of their own

food, store 50% of their own water, and reduce their dependency on the

central energy grid by 50%.

said Bush. “Trying to document and educate people about the values of

living a voluntary, natural life.”

their lives as they learn each day from their lifestyle, their

communities and themselves, as well as teach others how everyone can be

self-reliant and free from government influence – without fighting.

After they’ve wrapped filming for episodes five and six of “Sovereign

Living” they hope to be able to share it with the world through a media

streaming service like Netflix or Hulu.

Planning ahead

mentioned that this is the first time in their bitcoin experience where

they’ve had enough tools and resources to live on bitcoin alone, citing

platforms such as Gyft and eGifter, as well as the recent news by Expedia. Nevertheless, she emphasised the amount of effort it takes to plan a bitcoin-only itinerary:

“It’s

hard, it’s taken a lot of pre-planning. I had to look at every single

stop along the way and see what gas stations they had to make sure that

we were buying the appropriate amount of gift cards for each gas

station.”

the northeast of the country, she found Exonn gas stations at each stop,

but that on the drive back home there weren’t any – but there were BP

stations.

added: “I want the world to know that it is possible to travel the

country using bitcoin only. And it’s not only possible but you can do it

comfortably and take care of a family of four along the way.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Josh Wise will suit up in the Dogecar two more times this year!

(NewsBTC) Shibes: get ready to start your engines. That’s right, Josh Wise will suit up in the Dogecar two more times this year, it’s being reported. One of those times will be in Sonoma, California, Wise’s home state. That race will take place Sunday, June 22.

For all of the people who make fun of NASCAR for only having left turns, Sonoma will be sporting right turns in addition to some left ones. That means things might get a little crazy so you should watch.

Josh then announced it.

The race god (dogecar backwards) has raced twice in the dogecar this year. Once was at Talladega and the other time was in North Carolina for the Sprint All-Star race, which Wise was voted in as the Sprint Fan Vote winner. Wise finished 20th and 15th in those respective races.

Wise will also race in the dogecar at Talladega for the last known time this year on October 19.

The reasons are obvious. Since Josh’s announcement of the dogecoin partnership his fan base has grown tremendously. Wise’s twitter followers have grown by about 20% in the last three months and the partnership has also helped dogecoin get noticed since the news was featured on several major media outlets.

Dogecoin supporters can only hope this will boost the coins price since another halving day is coming up in 31 days. Usually a lot of miners leave as the rewards lessen, but this comes at a time when scrypt asics are hitting the market. One thing for sure is that the community is on dogecoins side. The community is on their side and CoinGecko ranks dogecoin #2 by its metrics which include community.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

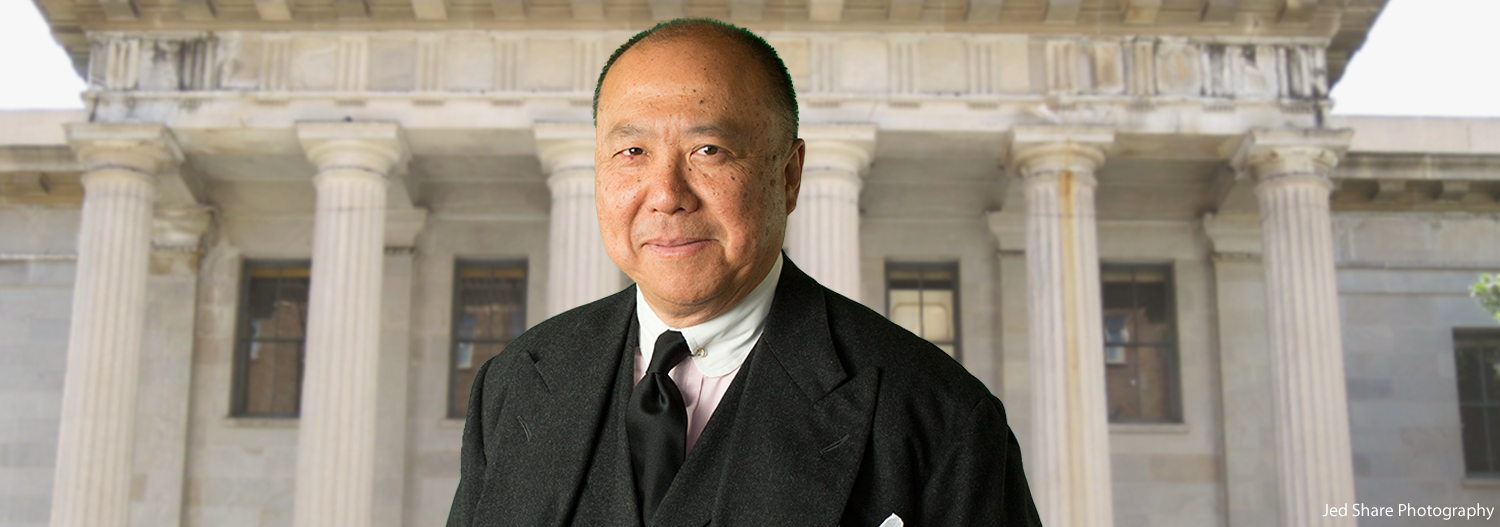

Former US Mint Chief: Bitcoin a serious challenge to government money

body responsible for producing the country’s physical coins, made waves

in the bitcoin community this week when he took to Twitter to voice his

enthusiasm for digital currencies.

$2.6B fine ‘won’t do much damage’: Credit Suisse CEO. It’s time banks got competition. Time for cryptocurrencies. http://t.co/OT3dBTDlrq

— Edmund Moy (@EdmundCMoy) May 22, 2014

However, Moy didn’t stop there. The former member of the Department of Homeland Security took to his blog on 23rd May to issue an entire post on how bitcoin is leading to “a revolution in payment systems”.

“Bitcoin,

and the ideas behind it, will be a disruptor to the traditional notions

of currency. In the end, currency will be better for it.”

full post lightheartedly addressed bitcoin and its strengths and

weaknesses, with Moy offering a perhaps surprisingly optimistic

assessment of how the technology will impact the global financial

marketplace.

Bitcoin removes government monopolies

most notably, Moy suggested that digital currencies can even help

prevent some of the more severe drawbacks associated with fiat

currencies. In particular, he predicts it will eliminate what he views

as the government monopoly on money, writing:

“It has a

low risk of collapse unlike a sovereign government’s currency (just ask

the Greeks or more broadly, the European Union).”

Bitcoin an innovative means of exchange

“As

a medium of exchange, bitcoin offers several unique innovations to

currency: global nature, infinite divisibility and easy to carry.”

today’s transaction systems “archaic”, he argued that bitcoin’s ability

to divide effortlessly would allow for new methods of monetization via

micropayments, and that it could eliminate existing barriers to global

markets.

Bitcoin will be a safe store of value

he took aim at critics of the idea who believe that government-backed

alternatives are perhaps more secure, saying that the US dollar is

driven mostly by market demand.

bitcoin could even allow governments the ability to dedicate more time

to monetary policy that could positively impact their economies should

it reach its full potential.

Open your free digital wallet here to store your cryptocurrencies in a safe place.