Bitcoin is a decentralized digital currency that has gained popularity in recent years for conducting online transactions. Unlike traditional currencies that are controlled by central banks, Bitcoin is not subject to the whims of any one entity, making it an attractive option for those looking to conduct transactions online.

One of the key benefits of using Bitcoin for online transactions is its security. Because it is decentralized, there is no central point of failure that attackers can target. In addition, each transaction is verified by the network of computers that run the Bitcoin software, making it virtually impossible to forge or counterfeit.

Another benefit of using Bitcoin for online transactions is its low transaction fees. Because there are no intermediaries such as banks or credit card companies involved in the process, transaction fees are typically much lower than they would be with traditional forms of payment. This can be especially beneficial for those who conduct a large number of transactions, such as small business owners or online merchants.

In addition to these benefits, using Bitcoin for online transactions can also offer users more control over their own money. Because it is decentralized and not controlled by any one entity, users are free to store, send, and receive Bitcoin without third parties.

Some other potential benefits of using Bitcoin for online transactions include:

Faster transaction times: Because Bitcoin transactions are processed on a decentralized network, they can be completed much more quickly than traditional bank transfers or credit card payments. This can be especially useful for people who need to make or receive payments quickly, such as when making an emergency purchase or receiving payment for a time-sensitive project.

Immutability: This means that once a transaction is recorded on the Bitcoin blockchain, it cannot be altered or deleted. This provides a high level of security, as it ensures that transactions cannot be tampered with or reversed without the consensus of the network. This feature also helps to prevent fraud, as it makes it difficult for someone to modify or falsify records. Overall, the immutability of the Bitcoin blockchain provides a level of trust and security for users of the network.

Greater global accessibility: Because it is decentralized and not tied to any specific country or currency, Bitcoin can be used for online transactions anywhere in the world. This can be especially helpful for individuals and businesses in countries with unstable economies or limited access to traditional financial institutions.

Overall, the use of Bitcoin for online transactions offers a number of potential benefits, including security, low transaction fees, and greater control over one’s own currency. As more businesses and individuals begin to recognize the potential of this cryptocurrency, its use is likely to continue to grow. In fact, the use of Bitcoin is already starting to become more widespread, with many online merchants and small business owners choosing to accept it as a form of payment.

One final note about using Bitcoin for online transactions is its potential environmental benefits. Because it uses a decentralized network of computers to verify transactions, it does not require the same energy-intensive processes as traditional money transfer services. In fact, many of the computers that run the Bitcoin network are powered by renewable energy sources, which can help to reduce its carbon footprint. This is in contrast to traditional financial systems, which often rely on fossil fuels and other sources of pollution. In this way, using Bitcoin for online transactions can not only provide security and convenience, but also contribute to a cleaner and more sustainable world.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Emerging at the forefront of Bitcoin innovation, El Salvador is working toward achieving a level of financial independence and openness independent from a centralised banking system. El Salvador has paved the way for other nations to follow in its footsteps by becoming the first nation in the world to recognise Bitcoin as a legitimate currency.

To encourage worldwide collaboration and proliferate networking avenues for Bitcoin enthusiasts, El Salvador hosted the “Adopting Bitcoin” Conference over 3 days, between November 15 and 17. The event took place in San Salvador and at Bitcoin Beach and brought together members of the Bitcoin ecosystem from a multitude of states.

More than 110 speakers from over 30 countries discussed the most recent breakthroughs throughout the whole range of Bitcoin-related disciplines, including those pertaining to technology as well as economics.

In this setting, the presentation of the Bitcoin core engineer Jon Atack was a significant highlight, focused on technology and development, while the presentation of Mexican senator Indira Kempis will be the most famous name in the track focused on economics. The multi-stage event will be held in English, with Spanish translations provided in real-time for the most critical phases.

Paolo Ardoino, the Chief Technical Officer of Bitfinex, is one of the attendees at the crypto conference in El Salvador who gained the greatest notoriety. Arduino said in his statement that his company “would redouble its efforts to establish a free, unstoppable, robust, and open Bitcoin and technological infrastructure for El Salvador.”

Overall, Bitfinex has committed to working closely with the government of El Salvador, which is currently mired in debt and is governed by President Nayib Bukele, to devise an appropriate regulatory framework for the cryptocurrency market and other digital assets in the nation. Ifinex, the parent company of Bitfinex, has agreed with the government of El Salvador to work together on developing a regulatory framework for digital assets and securities.

While adverse market dynamics hindered the optimism around the event, there is a suite of conclusions that indicate the ongoing commitment of Bitcoin leaders and pioneering nations like El Salvador to still pursue the broader adoption of Bitcoin as a payment medium.

As the blockchain industry, as well as all the other financial sectors, witnessed in 2022, the price of Bitcoin and other cryptocurrencies declined primarily due to the Federal Reserve’s strategy of dramatically raising interest rates to curb rising inflation in the United States, which caused the cost of money to increase. Subsequently, the remainder of the decline was caused by a succession of events, including the bankruptcy of organisations involved in cryptocurrency trading and the collapse of currencies such as Terra USD. Large investors sold out these high-risk assets, precipitating a precipitous value decline.

El Salvador’s President, Nayib Bukele, announced that the nation would begin buying one Bitcoin each day starting with November 17, 2022. The use of dollar-cost-averaging (DCA) in Bitcoin transactions is widespread among the community, yet it is unprecedented for a nation-state. When Bukele’s proclamation was made, the nation possessed a Bitcoin treasury that included 2,381 BTC and had a worth of more than $39 million.

So far, Bukele has made it a pattern in the past to acquire a significant quantity of Bitcoin during periods of market instability and to “buy the dip.” This action would signal the end of a nearly five-month pause amid severe bear market circumstances and the collapse of Sam Bankman-massive Fried’s $32 billion FTX enterprise.

According to NayibTracker, Bukele made his most recent purchase of Bitcoin on June 30, 2022. At that time, he paid $1.52 million for 80 Bitcoins (worth around $1.33 million), which works out to an average price of $19,000 per coin.

Overall, El Salvador’s “Adopting Bitcoin” conference serves as a reminder of the ongoing commitment of crypto pioneers and their belief in the long-term potential of this cutting-edge technological revolution.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Acknowledging the unprecedented potential of Bitcoin’s Lightning Network, El Salvador and Lugano are two of the most significant adopters of this remarkable technological breakthrough.

As a cornerstone moment for the Bitcoin economy, a memorandum of understanding (MOU) was signed on 28 October 2022 between the nation of El Salvador and the city of Lugano in Switzerland. Moving forward, the goal of the MOU is to increase the use of Bitcoin not only in their respective areas but also in the states and nations that are nearby.

Overall, the anticipated aims of the partnership include bolstering cooperation in education and research for both El Salvador and Lugano, assisting initiatives to promote the adoption of Bitcoin and other digital tokens in their respective regions, and encouraging the exchange of students and talent between the two countries.

So far, the scalability of the Blockchain has been a significant barrier to the widespread acceptance of cryptocurrencies from their inception. The Lightning Network’s second layer introduces a cutting-edge solution to this matter, as it intervenes by processing transactions outside the first-layer blockchain mainnet while retaining the mainnet’s robust decentralized security model. By bypassing the official Bitcoin blockchain, the Lightning Network can grow Bitcoin transactions per second (TPS), charge reduced fees, and allow new use cases like micropayments.

In addition, the Lightning Network has the potential to bring financial inclusion and freedom to the developing nations involved, in part because it is a trusted and private network that does not require the participation of third parties or intermediaries. Moreover, it could also lessen the likelihood of governments enacting policies restricting the free flow of capital. It also helps people who do not have access to bank accounts by facilitating transactions in a manner that is almost instantaneous and free of charge, thereby making Bitcoin usable not only as a means of payment but also as a means of exchange.

Lugano appears to have the same goal as El Salvador: to have all local businesses routinely accept cryptocurrencies as a form of payment. However, Lugano does not appear to have the same goal as El Salvador of making Bitcoin or any other cryptocurrency legal tender. Although Lugano does not hold such a position in Switzerland, the city of 70,000 people did launch its Plan B programme approximately seven months ago to increase the use of Bitcoin.

In March of 2022, Lugano announced that it would be implementing the Plan ₿ Initiative. Additionally, the technology company Polygon joined as a critical infrastructure partner. Plan ₿ Foundation, a partnership between the City of Lugano and Tether, the technology company behind the public blockchain that supports the largest stablecoin by market capitalization (USDT), has been announced today. This partnership will allow Bitcoin, Tether, and LVGA payments to be accepted in the city of Lugano.

Tether and the city of Lugano have collaborated to create a Plan ₿ aiming to increase the use of Bitcoin and stablecoins throughout the city. This, in turn, is expected to have a beneficial effect on all aspects of inhabitants’ everyday lives. As a result, the city’s financial system will be revolutionized faster than ever, thanks to the widespread use of Bitcoin.

In 2021, El Salvador was the first country to acknowledge Bitcoin as a legal tender. Through this avenue, El Salvador became a pioneer in demonstrating how technologies such as Bitcoin, decentralized ledgers, and peer-to-peer networks can accelerate financial literacy and inclusion

Furthermore, Latin America appears to follow El Salvador’s lead and powering Bitcoin mining farms with natural resources (such as energy generated by geothermal activity). Countries of Costa Rica in Central America and Paraguay in South America are also heading in this direction.

Since most people in Europe are not yet familiar with this idea, a closer relationship between El Salvador and a nation located in Europe could usher in uncharted territory.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Today, we are pleased to announce that HolyTransaction is adding support for swapping to Bitcoin on Lightning Network and thus introducing the ability to deposit and withdraw using Lightning Network.

By adding this capability, HolyTransaction is set to revolutionise the speed, cost and security of depositing and withdrawing Bitcoin on to its platform.

Lightning Network is a software stack which sits on top of the Bitcoin blockchain and, as the name implies, ensures faster and cheaper transactions for its users.

Other than super fast speed and lower fees users will notice a new format of address called invoice when they send or receive Bitcoin via the Lightning Network. The team at HolyTransaction reported that the integration has been successful and hassle free.

Lightning Network brings three essential product benefits to the HolyTransaction exchange:

• Instant Payments. With the use of smart contracts security across the network is much higher and because the stack is built ‘on top’ of the Bitcoin network no transaction confirmations are required. This makes instant payments super fast, super secure and, of course, super cheap.

• Scalability. The massive upscale in transactions per second eclipses any traditional legacy payment rail on the market today. Furthermore, payment ‘with click’ becomes a true reality as the need for financial custodians are eliminated.

• Low Cost. Because Lightning Network does not interact directly with legacy Bitcoin infrastructure itself Lightning Network enables transaction with incredibly low fees. This in turn will stimulate economic growth in new and emerging markets.

In real terms this means Bitcoin deposits and withdrawals on HolyTransaction will be much faster and much cheaper when using Lightning Network.

At the time of press average costs for sending a Bitcoin transaction currently stand at around $2 with confirmation times of around 10 minutes. This clearly has limitations. However, a Lightning Network enabled transaction will cost less than $0.01 and take somewhere in the region of 1-3 seconds.

Adopting Lightning Network will make HolyTransaction more attractive for users who wish to send transactions with added security at much lower cost and super fast speed. HolyTransaction is happy to report that Lightning Network has been integrated for both desktop and mobile application versions.

Lightning Network was envisioned in 2015 and has seen significant growth throughout 2021 which has lead to it being regarded as the most popular layer 2 scaling solution on the market for Bitcoin today. With continued adoption Lightning Network may just help to finally realise the original Bitcoin goal of providing a scalable, fast and cheap financial payments network to the world.

The team at HolyTransaction believe the adoption of the Lightning Network is the logical step in the development of the platform. Lightning Network adoption will enable HolyTransaction to continue to provide a first class crypto trading experience and offer competitive fees with super fast finality times.

021744d86987a91958461117cd9e7c0e3160f7b86de11f5998018f4b4984a5c330@54.194.246.117:9735

Lightning Network Node links:

1ML

Amboss

Open your free digital wallet here to store your cryptocurrencies in a safe place.

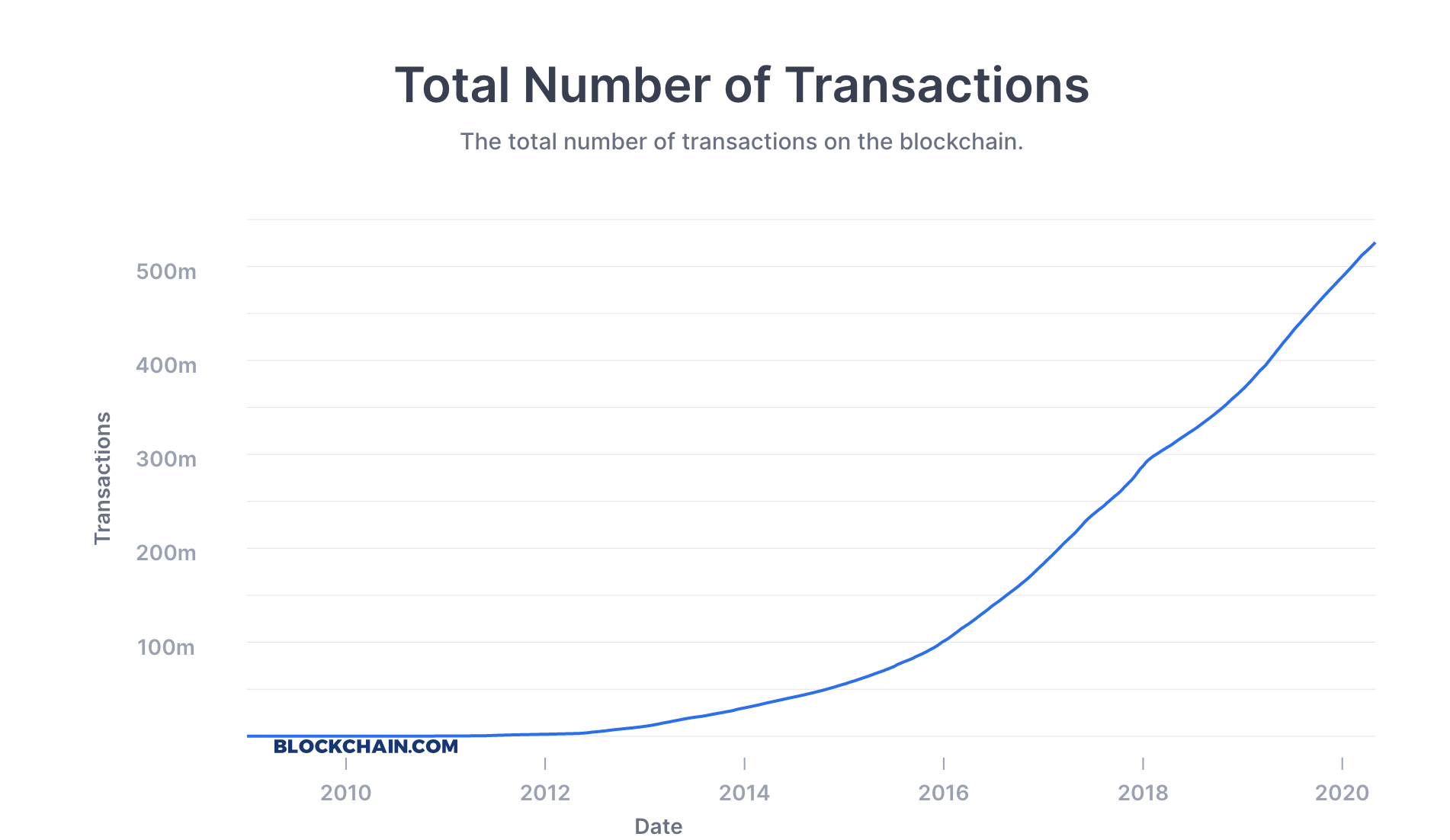

Cryptocurrency users are still a small minority. The total number of users was at 106 million as of January 2021. That sounds like a lot, but when you consider a global population that is nearing 8 billion, you can see that it is just a tiny fraction of people using crypto.

Whether you are in crypto or not, it is going to have an increasing effect on business. You can see Bitcoin mining operations selling shares on stock exchanges, large businesses looking into uses for crypto coins, and more people taking an interest in buying and using cryptocurrency.

At the current trend, crypto coins are becoming more common every year. If it holds, it might not be a matter of if people start using different cryptocurrencies, it could just be a question of when.

In the digital age, businesses are now connected internationally like they never before. Beyond the large multinationals, it is increasingly becoming common for smaller businesses to have significant international connections. This is not only true as it concerns deals with other companies, but businesses now have employees or contractors they work with from around the world.

Using cryptocurrency as a medium of exchange for international transactions could solve a lot of problems for these businesses. First, cryptocurrency could ease the burden of having to convert currency for several different countries. Beyond that, it could also make transactions faster, cheaper and more convenient by cutting out the traditional middlemen that would typically be in the middle of these transactions.

One of the factors that have held back many cryptocurrency markets is the lack of support from mainstream institutions. Banks wouldn’t let you make transactions with crypto exchanges, and it was hard to find businesses that would allow you to use your cryptocurrency. This is changing rapidly.

Beyond the ability of investors to use an ultra fast trading app to make trades, we now see a range of big institutional investors buying cryptocurrency. Along with that, some of the world’s largest financial businesses are starting to work with crypto. As an example, PayPal started offering a range of cryptocurrency services earlier this year. You also have major credit card companies that are starting to work with crypto on a limited level.

One of the main claims of many crypto skeptics is that the coins have no inherent value. This is true in a sense. The value of most crypto coins is solely based on the perception of people in the market. While that might be true, you could make the same argument for most fiat currencies. The value is based on the fact that people will accept it in exchange for goods and services.

Crypto has an advantage over many fiat currencies: the fact that many crypto coins have a limited supply. As inflation acts on fiat currencies, crypto could grow in popularity as a hedge. In the future, many investors will hold crypto in the way that they hold gold as a protection against inflation.

Raising or distributing equity usually means creating conventional shares of the business. While this could be a way to raise money or provide value to employees, it does come with a range of hurdles. One way to get around many of these hurdles would be to create crypto coins that represent shares in the company.

Instead of jumping through all of the regulatory hoops to issue shares, the business could give people crypto coins as equity. Instead of holding an IPO, the business could do an ICO as a way to raise capital from investors.

With the rise in crowdfunding platforms, the ability to raise money is easier than it ever has been. These platforms not only make it easy to raise money from the public, but they also offer a level of transparency that is popular among those looking to donate or invest. With that said, these platforms often take a significant portion of the funds in fees.

Using a blockchain wallet for crowdfunding could be a way to get the transparency of a crowdfunding platform while avoiding the fees. This would allow those looking to raise funds to do so off a platform, but with the blockchain ledger, potential donors or investors could still see the donations coming in.

Crypto is a field that is always evolving. As businesses see the benefits and new applications become available, it will become more common. With that said, the markets are unpredictable. The only thing that we can be sure of is that there will be ups and downs along the way.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Today, we are pleased to announce that HolyTransaction Wallet is adding support for swapping L-BTC and thus introducing the ability to deposit and withdraw bitcoin using Liquid Network.

Bitcoin on the Liquid Network, or L-BTC, is verifiably backed 1:1 by bitcoins on the mainchain as Liquid is a federated sidechain between bitcoin exchanges and market makers. Once the coins are transferred from BTC to L-BTC, HolyTransaction users can take advantage of the massive speed and increased security features.

Why is Liquid support such a big deal?

Liquid Network is capable of operating ten times faster than Bitcoin’s own network, which opens up a world of possibilities for the users, particularly when it comes to the speed, faster transactions, and lower costs of making payments. Imagine having to only wait for one minute for your transaction to be processed, as opposed to at least 10 minutes, which is what Bitcoin’s blockchain requires. That is what Liquid Network offers, and what customers of HolyTransaction will now have the ability to do from within their wallet.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The debate about Bitcoin’s inventor, known as Satoshi Nakamoto but otherwise shrouded in mystery, has raged for years. As Bitcoin continues to rise in value, this unknown inventor is presumed to have become a very rich individual indeed. When Satoshi invented Bitcoin, was he driven to profit, mining and hoarding early Bitcoin aiming to accumulate great wealth?

In 2013 first Sergio Demian Lerner presented his research on the early mining patterns Satoshi is presumed to have taken, it revealed around 1 million BTC (now worth around $10bn) hoarded by the creator. For many who see Bitcoin as an anti-establishment currency with an equalizing power, to attribute such vast wealth to Bitcoin’s creator is anathema, undermining the main narrative around Bitcoin and Nakamoto’s original motives. If Nakamoto is as driven by capitalist economics as the nearest banker, is Bitcoin fundamentally different from traditional currencies after all?

Nakamoto’s defenders argued that these 1 million missing Bitcoin were simply forgotten by early miners, and the inventor himself had no such hoard. Indeed, even researching these Bitcoin was taboo. Yet Lerner was unsatisfied with this answer. That’s why he has spent the last seven years unravelling the mining techniques used to unearth these early Bitcoin. What these techniques reveal is that Satoshi (if that is who mined them, Lerner refers to this individual as “Patoshi” to emphasize that we can’t truly know) seems to have been protecting the security of the network rather than pursuing profit after all. The reputation of Bitcoin, and its mysterious inventor, remains intact.

Early Mining Techniques

In order to learn more about the missing Bitcoin – and the individual who mined them – Lerner decided to remine the first 18,000 Bitcoin blocks to see what it revealed. He assumed that these blocks would have been mined with software that was similar, if not identical, to that which came with the first Bitcoin release. This public code was how early miners set about Bitcoins first blocks. The “Patoshi” pattern of how these Bitcoin were mined could ultimately reveal something about the motives of Bitcoin’s inventor, assuming Nakamoto and Patoshi are one and the same.

Through remining these early blocks, Lerner came to a startling discovery. Patoshi’s software was in fact nothing like the software being used by other early Bitcoin miners. Was this Nakamoto giving himself a leg up in the early gold rush of Bitcoin mining? The difference in the mining patterns of the public software and Patoshi’s processes became the keystone of Lerner’s research. Two theories stood out. Firstly, that Patoshi was using an early version of today’s pooled mining processes by combining multiple CPUs. The second theory – seemingly borne out in Lerner’s research – is that Patoshi was multi-threading.

Patoshi’s Multi-Threading

Multi-threading is a hashing technique using intensive computer processing to sweep for multiple nonces (the cryptographic element that Bitcoin miners are searching for) at once, rather than on an individual basis. By rescanning the early blocks, Lerner was able to assess which nonces Patoshi discovered, thus revealing the patterns by which Bitcoin’s inventor was mining blocks. Ultimately, Lerner has demonstrated that Patoshi/Nakamoto was generally finding higher-value nonces thanks to the multi-threading technique, and not because they had superior processing power, but because they had a better process for using their CPU.

Ideology Before Profit

Lerner’s meticulous analysis of the early mining patterns attributed to Bitcoin’s founder reveal that each time Patoshi mined a new block, his miner was turned off for a short interval. If Nakamoto was driven by profit, this is contradictory behaviour as it gives the rest of the community an opportunity to unearth new blocks. Lerner posits that Nakamoto wanted to see fair competition amongst early miners, and distribute Bitcoin equally at the start of the network.

At the same time, Patoshi’s multi-threading would have allowed them to uncover new blocks when they were not being mined by other early users, thus enabling the network to continue ticking over. These patterns have led Lerner to argue forcefully that the security of the network – and not profit – was Nakamoto’s motivation for their early mining patterns.

Still Unknown

It remains an assumption that Patoshi and Nakamoto are one and the same, and the identity of this individual is still unknown. But Lerner’s research strongly indicates that profit was not an early motivator of the Patoshi pattern.

Kristin Herman is a tech enthusiast and a project manager at Essayroo.com and Boomessays.com online writing services. When she takes a break from the screen she likes to curl up with a good book, albeit one about cryptotrends and digital landscapes!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

We all know how cryptocurrency rose to power and the impact it’s having on the world, but now it’s confirming its place as a form of finance that is used and accepted around the world, it’s time to look to the future, in particular, hedge funds.

Have you ever thought about how cryptocurrencies are effective hedge funds, and how many believe that cryptocurrencies are, in fact, the future of hedge funds? Well, the future is now. Crypto hedge funds are already popping up here and there, and while 150 exist at the time of writing, there are many more on their way.

In fact, many believe that this number could double, if not triple, over the coming year. While it’s clear the venture capital industry is changing as we know it, today we’re going to share what we already know, and what we can expect in the coming years.

It’s Far from Ready

By many estimates, there are over 15,000 hedge funds around the world, 150 cryptocurrency hedge funds don’t seem like a lot. Even if you triple this number to 450, that still such a small percentage of the total hedge funds count, so why is this such a big deal?

The truth is, the industry is still growing and finding its feet, which means once it’s able to stand up for itself, so to speak, then it will really start to take up. At the moment, it’s still in its crawling days.

Rough estimates state that the hedge fund industry is worth around $3 trillion, whereas the amount of money going to cryptocurrencies is only around $3 billion. I know these are still huge sums of money, but on the grand scale of things, it’s tiny. However, this is predicted to change over the next 12 months.

This is because cryptocurrency values and estimates are still way too high, and many cryptocurrencies are way too volatile, which means investors are being cautious around them. Additionally, with so much competition in the industry, it’s hard for investors to know what to focus on, and what investment opportunities are worth the risk.

Many people still see investing in cryptocurrency as gambling, and it’s true, there’s still a huge factor in investing it. However, if the rate of integration of cryptocurrency into the mainstream continues as well as it is already, this shouldn’t continue to be a problem over the next few years.

When you consider that the top 35 cryptocurrencies are valued at over $1 billion, so it’s not going to be ignored any time soon.

Technology is Evolving

Of course, blockchain technology is responsible for making cryptocurrency work in the way it does, but it’s important to note that this technology is still evolving. There’s no denying that the technologies and services are still being invested in, but it’s a long way off being where it needs to be, although this is changing rapidly, and the hedge funds markets are reflecting this.

The more success that comes from the technology, the more it will be developed, and the more funds it will have invested in it, and therefore the faster it will evolve. This will be represented by a rapidly spiking curve over time and will happen fast.

The Tides are Changing

Look at the market, and what do you see? There’s no denying that cryptocurrency is the way that the market is going to go. After all, millennials are already ‘unbanking’ and moving their money in cryptocurrency deposits, rather than traditional banking systems and networks.

Traditional banking systems are noticing this and now, of course, have to consider cryptocurrencies in their banking strategies, and will continue to do so over the coming years. From an investor’s point of view, it’s important to start looking at these strategies and at how cryptocurrencies can be incorporated into their investment strategies.

If you don’t already have a cryptocurrency investment strategy existing, this is something you need to think about because you’re going to be left behind.

Although investors with cryptocurrency strategies are already ahead of the curve, the tides are changing fast, and you don’t want to be left behind and without a strategy when cryptocurrencies play such an integral role in the markets.

Michael Dehoyos is an economic consultant and editor at Coursework Writing Services. He assists companies in their marketing strategy concepts, and contributes to numerous sites and publications, as well as offering investment advice.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Image courtesy of GammaLaw

Digital currencies have created a buzz since the sudden rise of the Bitcoin price. They have, over time, become a new trend in the global money market due to their incredible benefits. Here are some of the aspects that tend to make cryptocurrencies so important.

Bitcoin and Litecoin are arguably the most trusted and safest digital currencies in the world. In a world where looters and cons are everywhere, virtually everyone wants to trade safely. Cryptocurrencies give online traders that assurance, and that’s why people consider them as a reliable means of exchange.

The recent increase in the demand for Litecoin and Bitcoin can be attributed to policies that govern cryptocurrency networks. Cryptocurrencies are a digital currency, which means traders rarely need a third-party to complete a transaction. That often gives online traders a sense of security and reassurance. Cryptocurrencies tend to allow online retailers to transact anytime and anywhere.

Bitcoin and Litecoin are considered a low-cost means of transaction. The cost of transacting with cryptocurrencies can be far less than other currencies. The fact that the cryptocurrency network is responsible for compensating miners tends to eliminate transaction fees. Low-cost transactions could mean that cryptocurrency users won’t shell out money in exchange for Bitcoin and Litecoin. All a cryptocurrency user may need to transact is knowledge of cryptocurrencies and a smart phone.

Cryptocurrencies can be stored in a safe e-wallet or USB drive. Storing your bitcoin or Litecoin in either an e-wallet or USB drive may not attract any fee.

Privacy has been a concern for most people transacting over the internet. Cryptocurrency users can expect their financial transactions to be highly confidential. You can transact using bitcoin and still be anonymous. With digital currencies, the seller and buyer don’t transfer money directly. Instead, the cryptocurrency network often serves as an intermediary, which means that users may not share their credentials with anyone. Cryptocurrencies can be used as a new measure to curb identity theft, which has become a menace in the global money market. If something seems doubtful, you are at liberty to share any information you may want with your merchant. By accepting payment in digital currencies, online traders tend to accept and welcome clients who would wish to remain anonymous. Accepting payments in bitcoin can make a brand an industry leader and increase its awareness.

Cryptocurrencies can be bought in a fraction. That means you can invest any amount of money in cryptocurrencies. For example, if you can’t afford a full unit of bitcoin, you can split it and invest in a quarter or half of it. That can help reduce the cost of investing in cryptocurrencies and avoid overspending. With a crypto converter, an investor can find out the price of any digital currency in their country.

Using digital currencies can make you autonomous. Cryptocurrencies tend to eliminate third-parties, so you can be sure that no fees or commissions are involved. These currencies can also allow online traders to manage their accounts.

Decentralization is a feature that often makes cryptocurrencies lucrative for merchants and customers alike. It means that digital currencies can’t be subservient to any authority or agency. No one owns digital currencies, which means no individual can have control over it. Digital currencies can provide online retailers with the freedom to transact without worrying about geographical barriers.

Digital currencies are considered a game-changer in the global money market. Their incredible benefits are arguably the reason behind their recent popularity. Cryptocurrencies are considered the safest and most trusted currencies around the world. You can store Bitcoin and Litecoin in the cloud or USB drive and move with them anywhere around the world. By using bitcoin, online traders can expect their transactions to be confidential. Digital currencies are also a reliable medium of exchange that can give sellers and buyers control over their accounts. The fact that Bitcoin and Litecoin can be bought in a fraction can make digital currencies an affordable investment.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The second half of 2019 was really difficult for Bitcoin. According to independent experts, the total volume of public digital assets has decreased by more than 50% – from $388 billion to $166 billion. However, there is other evidence. Yes, the cryptocurrency market really fell to the bottom if you look at these statistics, but let’s not forget that market conditions are dynamic. And the factor that means failure today may well mean success tomorrow.

There were periods of stabilization of the exchange rate, but for a long time cryptocurrency lost much in price. At one time, panic even started on the market, and Bitcoin was predicted to soon fall to zero. Against this background, the results of the year sounded quite unexpectedly: cryptocurrency turned out to be the most profitable investment. The coin rate rose from $4035 to $ 7344, providing investment growth by 82%.

This year will be great for Bitcoin, Wall Street analyst and Fundstrat founder Tom Lee suggested. The destabilization of relations between Iran and the United States is one of the reasons.

Plus, modern realities make it possible to add a supposedly modern coronavirus epidemic to these factors. However, at the moment there is no consensus among experts on how the coronavirus will affect the Bitcoin exchange rate. It is still unclear whether we are dealing with a real threat to people’s lives or is this another hype, a political company, or an attempt to distract investors from other, more important issues.

However, even those experts who believe that the disease can affect the main digital coin explain that this will happen only if the outbreak develops into a full-fledged epidemic.

Venture capitalist Tim Draper is also confident in the long-term growth in Bitcoin value. In an interview with FOX Business, he advised millennials to invest in cryptocurrencies, as they are on the verge of a new financial revolution. However, the explosion of the financial revolution will slow down due to the influence of the values of older generations and the obsolescence of the current banking system.

Bitcoin exchange rates are very unstable. Cryptocurrencies have already shown that it can rapidly fall and take off at a breakneck pace. Due to this state of affairs, bitcoin does not inspire confidence among many investors who would be happy to invest big money in the development of the blockchain, but fear for their savings. In 2020, we are unlikely to have to observe the strong influence of this factor, but we should not forget about it.

About the author: Gregory is passionate about researching new technologies in both mobile, web and WordPress. Also, he works on Best Writers Online the best writing services reviews. Gregory in love with stories and facts, so Gregory always tries to get the best of both worlds.

Open your free digital wallet here to store your cryptocurrencies in a safe place.