Deutsche Bank Is Bringing Bitcoin-Inspired Blockchain Technology to Germany

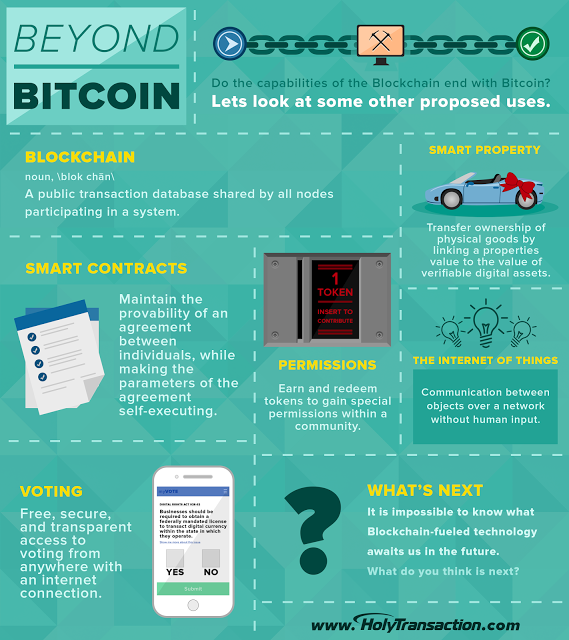

In a recently translated piece by the Deutsche bank, originally written by Thomas F. Dapp and Alexander Karollus, the German bank discussed how banks in general might be able to benefit from p2p networks like Bitcoin. The authors specifically mention a hypothetical future scenario where banks might assume new tasks that still play on banks’ perceived trustworthiness – “e.g. as custodians of cryptographic keys.” Other existing centralized services might have to adapt to serve other roles in the coming decentralized world. Don’t be surprised if someday soon Bloomberg to self-proclaim themselves as an oracle? They went on to note that the politics of Bitcoin would eventually lead to a head with regulators, law enforcement, etc. However, in the face of this new technology and potential regulatory backlash, Deutsche bank still wants to push forward… Because the concept of a blockchain really is that compelling, and the banks are finally starting to get it. Dapp and Karollus wrote:“Traditional banks should not rely on the regulator now, though, but instead actively experiment with the new technologies in their labs and collaborate without prejudice in order to create their own digital ecosystem in the medium run.”

In a recently translated piece by the Deutsche bank, originally written by Thomas F. Dapp and Alexander Karollus, the German bank discussed how banks in general might be able to benefit from p2p networks like Bitcoin. The authors specifically mention a hypothetical future scenario where banks might assume new tasks that still play on banks’ perceived trustworthiness – “e.g. as custodians of cryptographic keys.” Other existing centralized services might have to adapt to serve other roles in the coming decentralized world. Don’t be surprised if someday soon Bloomberg to self-proclaim themselves as an oracle? They went on to note that the politics of Bitcoin would eventually lead to a head with regulators, law enforcement, etc. However, in the face of this new technology and potential regulatory backlash, Deutsche bank still wants to push forward… Because the concept of a blockchain really is that compelling, and the banks are finally starting to get it. Dapp and Karollus wrote:“Traditional banks should not rely on the regulator now, though, but instead actively experiment with the new technologies in their labs and collaborate without prejudice in order to create their own digital ecosystem in the medium run.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Infographic: What is the Block Size debate, and will it lead to a hard fork?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

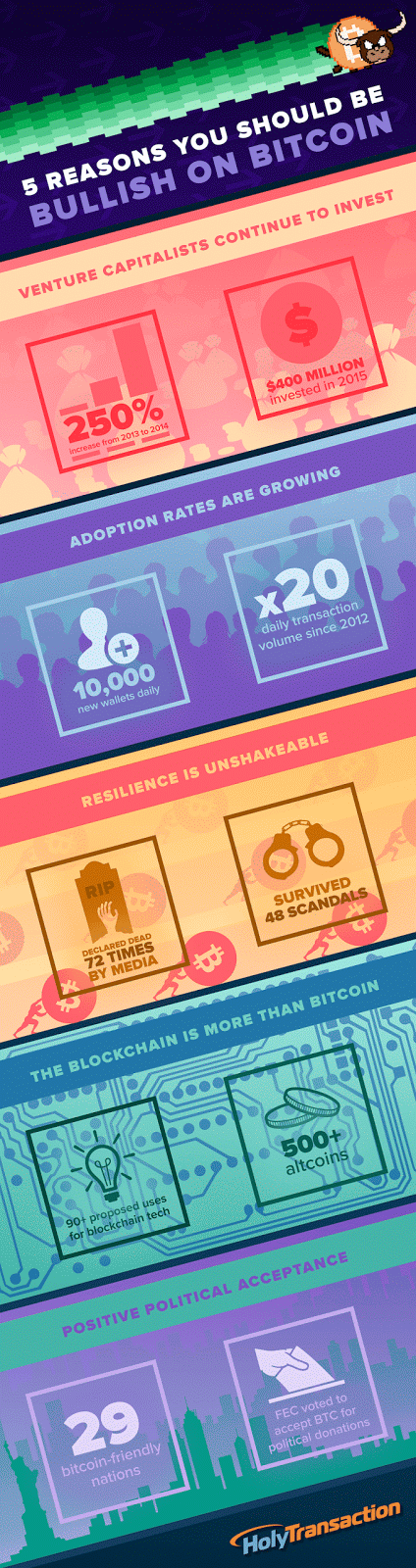

Infographic: 5 reasons you should be bullish on Bitcoin!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction Telegram Bot for Crypto Conversion

/exchange

- ● Conduct a trade between any of our supported currencies on the HolyTransaction

platform.

/getnews - ● View the most recent cryptocurrency news.

/rate - ● Receive details on the current price of any of our supported currencies.

/currencies - ● List currencies available on the platform.

/help● List of BOT commands

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Goodbye For Now, NYC

Open your free digital wallet here to store your cryptocurrencies in a safe place.

With Bitcoin time is not more money

-

Demurrage (the cost associated with owning or holding currency).

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Infographic: The 4 Properties of Bitcoin

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Economic problems Bitcoin solves and why it could change our lives

-

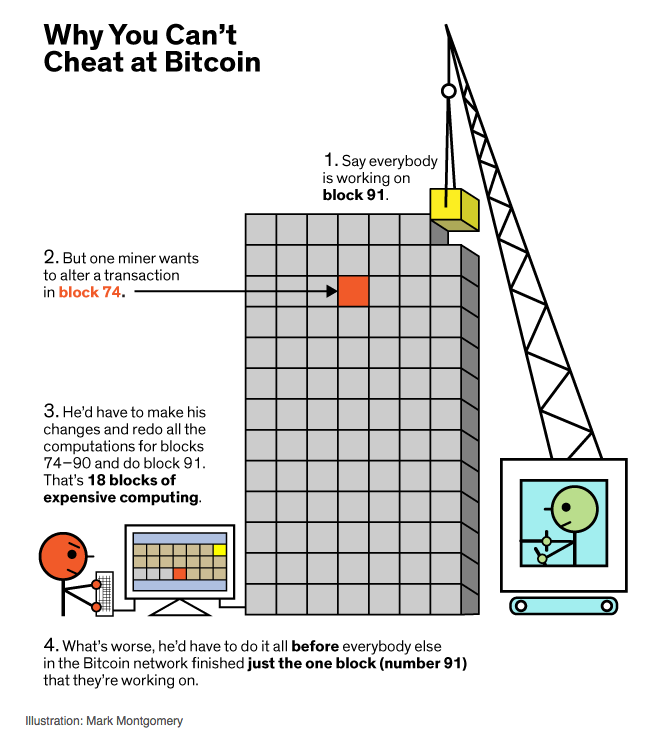

Make digital information (for example, a bitcoin) a “rival good;” and, preventing the owner to spend it a second time

-

Achieving said result with a public register (the blockchain), where the access to information is “not-excludible”, because it is available without intermediaries – it is public and permanent.

-

Anonymity – if no one knows the identity behind the lists of parties.

-

Privacy – in the sense that no one knows what you purchased and at what price.

-

Irreversible – which comes with a lack of monitoring and compensation body.

Author: Massimo Chiriatti, technologist and member of Assob.it

Source: The Future of the Web Looks a Lot Like Bitcoin (http://ow.ly/PqmJF)

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction welcomes new users from Greece, Europe, and the World over

Everyone with a finger on the pulse of the world’s financial health has been keeping their eyes peeled for the latest on the potential “Grexit” (Greek Exit) from the European Union. With negotiations of a final deal once again bearing no fruit, the average citizen’s faith in the traditional financial system is eroding at an ever-increasing rate. A few years ago, it was Cyprus; now, it is Greece. Frankly, the rest of the fiat-using world is right to believe that they may be next. In times like these, interest in Bitcoin tends to spike. In just the last week, Greek Google searches for the keyword ‘Bitcoin’ have increased notably. Let’s not forget that historically we have always seen a trickling effect where new Bitcoin users find themselves researching altcoins in an attempt to get ahead of the next big thing. It is possible that the current economic turmoil in Greece is the next big thing that pushes interest in Bitcoin and other digital currencies.

Everyone with a finger on the pulse of the world’s financial health has been keeping their eyes peeled for the latest on the potential “Grexit” (Greek Exit) from the European Union. With negotiations of a final deal once again bearing no fruit, the average citizen’s faith in the traditional financial system is eroding at an ever-increasing rate. A few years ago, it was Cyprus; now, it is Greece. Frankly, the rest of the fiat-using world is right to believe that they may be next. In times like these, interest in Bitcoin tends to spike. In just the last week, Greek Google searches for the keyword ‘Bitcoin’ have increased notably. Let’s not forget that historically we have always seen a trickling effect where new Bitcoin users find themselves researching altcoins in an attempt to get ahead of the next big thing. It is possible that the current economic turmoil in Greece is the next big thing that pushes interest in Bitcoin and other digital currencies.

We have seen fellow digital currency companies focus their attention and marketing on Greece and Europe, which is another indicator of the breadth of this event. The classical way to buy bitcoins is to use your bank. Unfortunately, with Greece’s banks closed for the next week and possibly more time after that, it is arguably too late for the Greek people to buy Bitcoin easily.

Since most Greeks have their money tied up in the banks that are currently shut down. The people on the ground can’t even buy Bitcoin through the banks. Bitcoin isn’t going to be accepted by Greece over night, but Bitcoin also isn’t going to be shut down by anyone over night. In the coming weeks, the contrast between digital currency and banks will sharpen for many onlookers. Observers the world over will be struck with a sort of enlightenment: their vision will clear. Bitcoin might not be able to help the Greeks buy a loaf of bread in their local economies tomorrow morning; however, Bitcoin and blockchain technology can and will be able to prevent similar economic disasters from happening ever again.

Open your free digital wallet here to store your cryptocurrencies in a safe place.