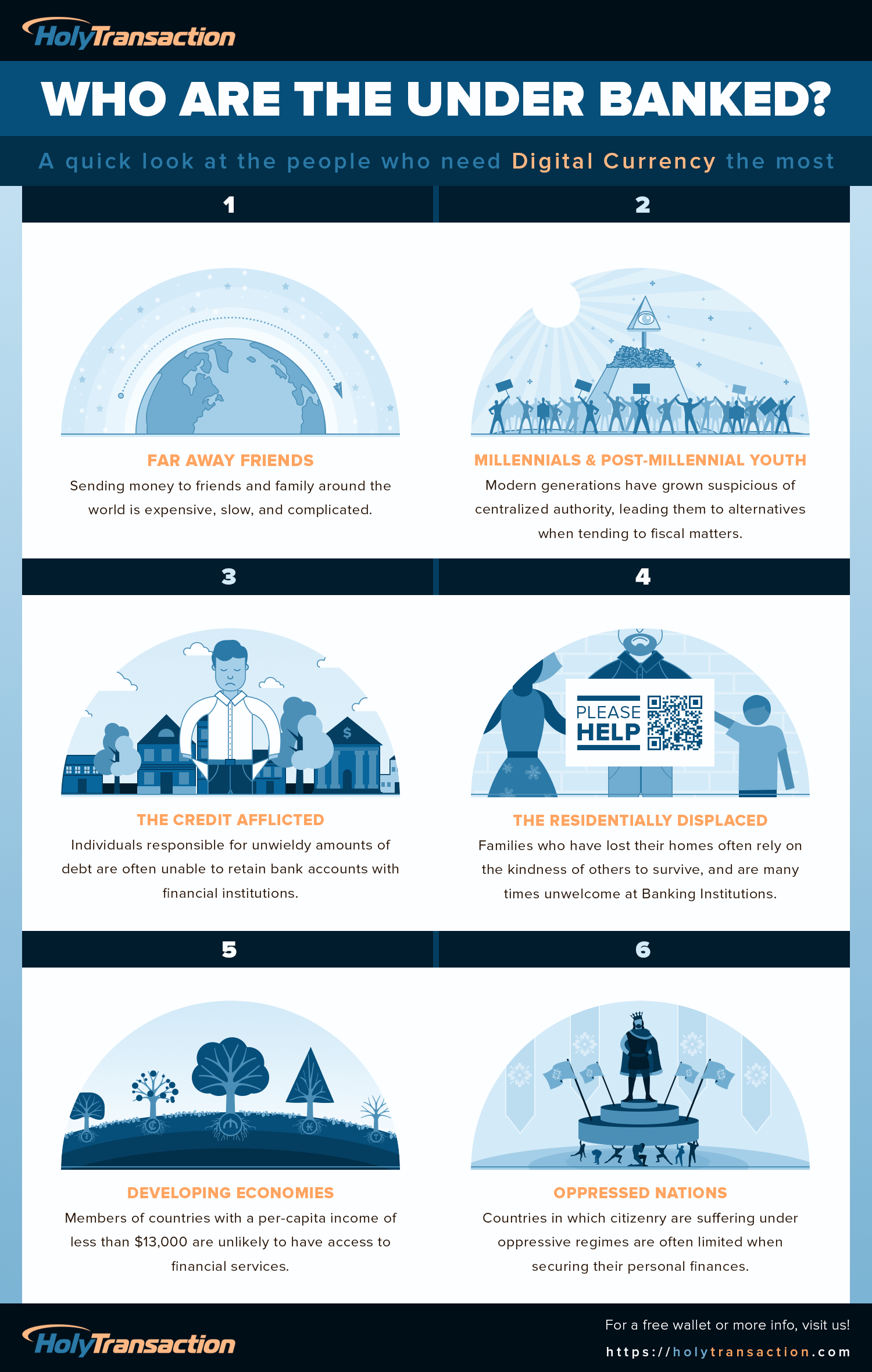

Infographic: Who Are The Under Banked?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin listed on NYSE – Reminiscing

Look at how far we’ve come.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction partners with Netki for human-readable address

Wallet addresses are one of the most aggressive barriers to the mass adoption of digital currency. Trying to explain these lengthy, case sensitive, intimidating strings of numbers and letters to the uninitiated is a daunting task. Much of the general population values simplicity over function, and in this regard wallet addresses seem scary and overly complex.

Netki makes digital money approachable and intuitive for new and veteran users alike, by transforming long and unwieldy Bitcoin addresses into human-readable wallet names. Additionally, your Netki name separates your identity from public blockchain data, providing you multiple layers of privacy, as well as multiple validations to keep you secure.

Netki makes digital money approachable and intuitive for new and veteran users alike, by transforming long and unwieldy Bitcoin addresses into human-readable wallet names. Additionally, your Netki name separates your identity from public blockchain data, providing you multiple layers of privacy, as well as multiple validations to keep you secure.Open your free digital wallet here to store your cryptocurrencies in a safe place.

Russia reconsidering Bitcoin?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

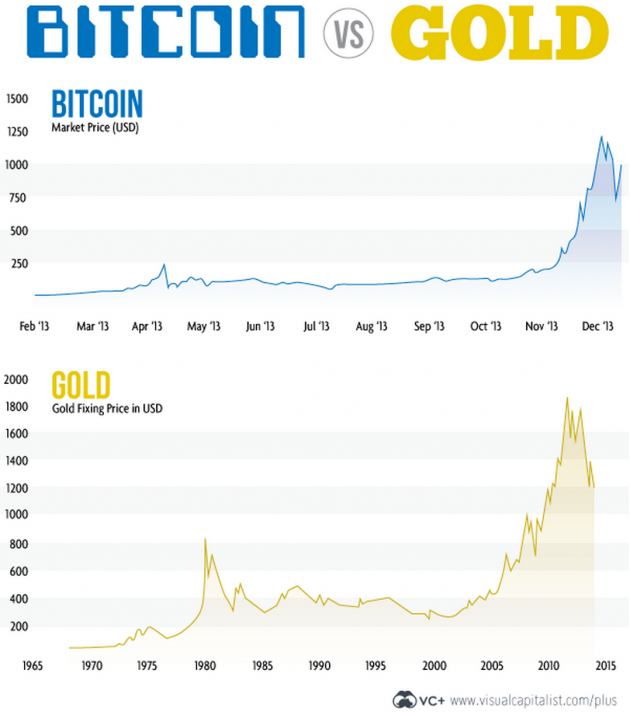

Could Bitcoin be a replacement for Gold?

Digital gold with a twist

“Satoshi [Nakamoto] was right with bitcoin. That’s what amazes me. Satoshi arrived at a foundation for the value of bitcoin that’s valid.”

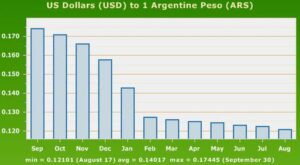

The decline of the Argentine peso versus the US dollar from 2013 to 2014. Source: exchange-rates.org

“Digital gold currencies have been tried and failed many times in the last 20 years. They came to nothing thanks both to state resistance, but also to lack of adoption.”

Role as a currency

“Velocity is what determines value. Not just printing money. Satoshi [Nakamoto] has an absolute 21 million bitcoin limit. Bitcoin is determined by velocity, by turnover rate governed by the people holding the coins.”

Bitcoin believers

Source: CoinDesk

Harris poll question: Would you rather invest in gold or bitcoin? Source: CoinDesk

Open your free digital wallet here to store your cryptocurrencies in a safe place.

All 70,000 residents living in Dominica will be eligible to receive bitcoin

(CoinDesk) All 70,000 residents living on the Caribbean nation of Dominica will

(CoinDesk) All 70,000 residents living on the Caribbean nation of Dominica willbe eligible to receive bitcoin as part of ‘The Bit Drop’ project, an

upcoming collaboration between bitcoin businesses, interest groups and

local government officials.

supporters of bitcoin’, as well as education booths and free giveaways.

suggested the ambitious project started with a simple question: how do

you get bitcoin into the hands of as many people as possible? From

there, she explained, a plan was launched to distribute an undisclosed

amount of bitcoin to island residents via text messaging.

“Who doesn’t like a party? No one in the Caribbean, that is for sure.”

The ‘perfect location’

product (GDP), proved an ideal location for the event, according to

Blincoe.

the most compelling factor. Blincoe believes Dominica’s smartphone users

will be able to solve real-world problems using bitcoin, adding:

“The island has opportunities for remittance due to many

islanders moving for work to [other] islands, as well as the local

medical university with students from around the globe. Dominica

citizens also face currency exchange issues when traveling to nearby

islands.”

a regulatory body overseeing telecommunications in Dominica, bolsters

this claim, suggesting there were roughly 100,000 mobile subscriptions

active in the country in 2012. Additionally, bitcoin penetration is

comparatively low in Dominica.

“The young forward-thinking administration sees the long-term benefits

in the block-chain technology and is eager to support our project in any

way possible.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The bitcoin industry in Australia!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

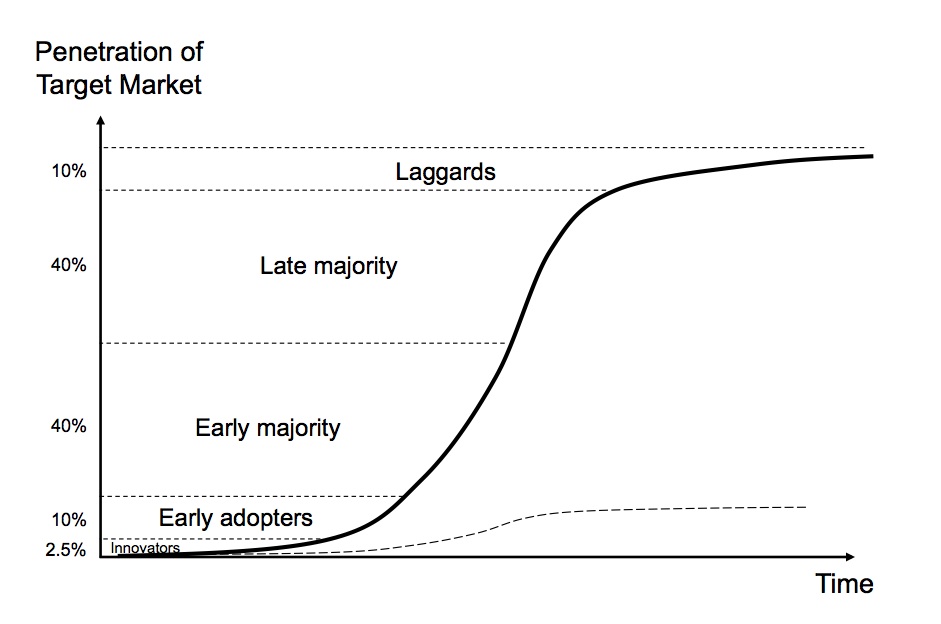

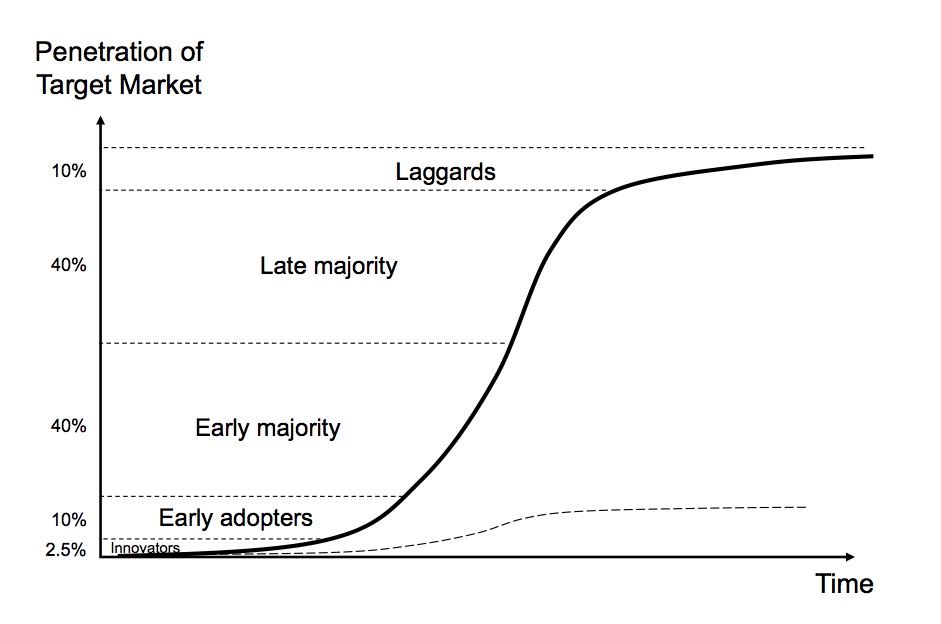

Bitcoin has passed the tipping point

Products and services that are first-to-market often take such a battering that they lose out to competitors with copycat products. Business history is littered with wildly successful products with ultimately spectacular collapses because they lost out to competitors that found a better way of doing things – things they learned at the trailblazer’s expense.

The Sony Betamax is the poster child for products that created a market and lost out to a rival – in this case VHS. Sony created a market for recording TV, but because the tapes where an hour long VHS grabbed the movie rental market.

More recently, Friendster was the first social network to explode, with millions of users in the first 3 months. But it couldn’t manage its growth and lost out to MySpace and of course Facebook.

There are many more examples. Some lost slowly, like the Atari 2600 game console, and some crashed spectacularly like Rio MP3 player. Palm lost to Apple, Netscape to Internet Explorer, WebCrawler to Google, Tivo to the cable companies, and on and on.

So far Bitcoin is an exception to this model. And though it’s been battered by ruinous headlines, including one just this week where the World Bank is calling it a naturally occurring Ponzi scheme, Bitcoin remains resilient.

Kaushik Basu, World Bank economist and author of ‘Ponzis: The Science and Mystique of a Class of Financial Frauds’ argues that most Ponzis today are not always obvious and that today’s Ponzi schemes often don’t have a puppet-master pulling the strings. Bitcoin, he says, is just such a Ponzi. The speculation on the currency raises the demand for Bitcoin making it a bubble.

Bitcoin has hundreds of competitors all built on the Bitcoin model. A handful are gaining some success, like Litecoin which is currently trading at $9, and Darkcoin (I’m not kidding) which is trading now trading at $7.50.

Darkcoin was built to cover perceived flaws in Bitcoin’s anonymity. One reason for the early success of Bitcoin was that it was as anonymous as passing dollars on the street. And while there is a far greater level of anonymity with this electronic transaction than making a purchase with a credit card or PayPal, Bitcoin is not anonymous to those forces who really want to know.

Unlike Bitcoin, Dash mixes up users’ transactions so that it’s nearly impossible to trace a payment to a person. But the promise of Dash’s privacy features solves a problem for only a small subset of Bitcoin users.

Few have heard of other crypto-currencies. If people barely understand Bitcoin, then any competitor has the impossible task of differentiating itself.

In his paper Basu mentioned Bitcoin by name, so did the IRS when it said it was a taxable asset. And this week Benjamin M. Lawsky, the superintendent of financial services for the State of New York, proposed regulations to create a “BitLicense” to include rules on consumer protection, the prevention of money laundering and cybersecurity. That’s akin to Apple successfully rebranding the MP3 to a podcast.

Just search “20 USD in BTC” on Google and you’ll get the exchange rate. It works for any fiat currency. You can’t do that with any other crypto-currency.

Bitcoin is currently trading at $600. Not bad for a five year old Ponzi scheme.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Analysts: Winklevoss Bitcoin ETF to pass SEC approval

Open your free digital wallet here to store your cryptocurrencies in a safe place.

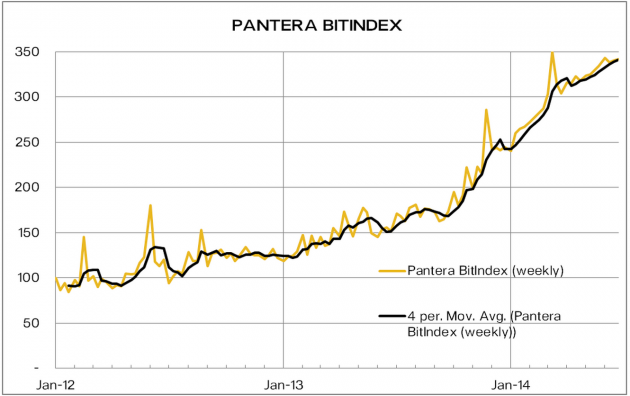

Pantera Launches BitIndex to Track Bitcoin

Components of index

- Developer interest on GitHub.

- Merchant adoption as a measure of consumer adoption.

- Wikipedia views measuring bitcoin education.

- Hashrate by logarithmic scale corresponding to orders of magnitude.

- Google searches captured by the number of times “bitcoin” appears.

- User adoption as measured by wallets.

- Transaction volume on the bitcoin network.

Always about price

Focus on investing

Open your free digital wallet here to store your cryptocurrencies in a safe place.