In a recently translated piece by the Deutsche bank, originally written by Thomas F. Dapp and Alexander Karollus, the German bank discussed how banks in general might be able to benefit from p2p networks like Bitcoin. The authors specifically mention a hypothetical future scenario where banks might assume new tasks that still play on banks’ perceived trustworthiness – “e.g. as custodians of cryptographic keys.” Other existing centralized services might have to adapt to serve other roles in the coming decentralized world. Don’t be surprised if someday soon Bloomberg to self-proclaim themselves as an oracle? They went on to note that the politics of Bitcoin would eventually lead to a head with regulators, law enforcement, etc. However, in the face of this new technology and potential regulatory backlash, Deutsche bank still wants to push forward… Because the concept of a blockchain really is that compelling, and the banks are finally starting to get it. Dapp and Karollus wrote:“Traditional banks should not rely on the regulator now, though, but instead actively experiment with the new technologies in their labs and collaborate without prejudice in order to create their own digital ecosystem in the medium run.”

In a recently translated piece by the Deutsche bank, originally written by Thomas F. Dapp and Alexander Karollus, the German bank discussed how banks in general might be able to benefit from p2p networks like Bitcoin. The authors specifically mention a hypothetical future scenario where banks might assume new tasks that still play on banks’ perceived trustworthiness – “e.g. as custodians of cryptographic keys.” Other existing centralized services might have to adapt to serve other roles in the coming decentralized world. Don’t be surprised if someday soon Bloomberg to self-proclaim themselves as an oracle? They went on to note that the politics of Bitcoin would eventually lead to a head with regulators, law enforcement, etc. However, in the face of this new technology and potential regulatory backlash, Deutsche bank still wants to push forward… Because the concept of a blockchain really is that compelling, and the banks are finally starting to get it. Dapp and Karollus wrote:“Traditional banks should not rely on the regulator now, though, but instead actively experiment with the new technologies in their labs and collaborate without prejudice in order to create their own digital ecosystem in the medium run.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bot Commands:

/exchange

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Author: Massimo Chiriatti, technologist and member of Assob.it

Source: The Future of the Web Looks a Lot Like Bitcoin (http://ow.ly/PqmJF)

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

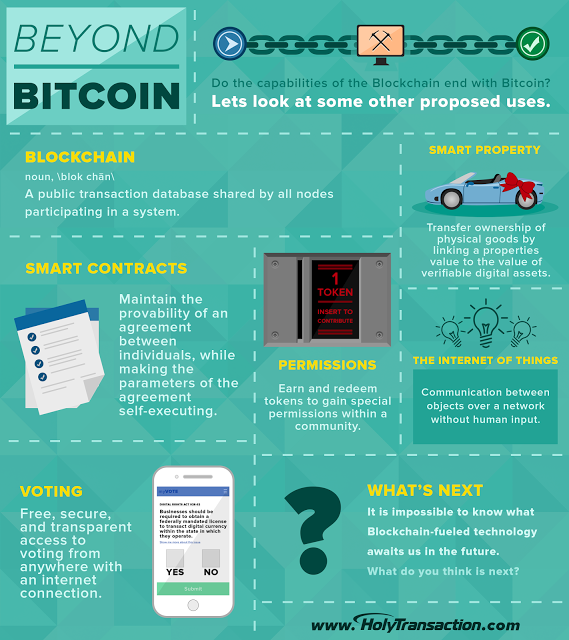

(CoinDesk) Just when people were getting used to the idea that bitcoin might not be a boom-and-bust fad destined for failure, entirely new applications of the technology have joined digital currency on stage.

(CoinDesk) Just when people were getting used to the idea that bitcoin might not be a boom-and-bust fad destined for failure, entirely new applications of the technology have joined digital currency on stage.“Bitcoin can be used to pay for things like a cup of coffee, but that’s not bitcoin’s ‘killer app’. To the average customer it’s just as easy to pay with their credit card. A killer app would need to offer massive advantages in another area.”

“We ought to be paying very close attention to crypto 2.0 because bitcoin has redefined how we launch web services.”

“Essentially you can take the technology from bitcoin, which is a $5bn–$6bn industry, and apply it to an existing area like cloud storage, which is a $150bn dollar industry.”

“Bitcoin already provides a global currency and distributed ledger – there is no need to reinvent those wheels. Combining real-world information with bitcoin is where things start to get really interesting.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Bitcoin Foundation announces a set of education resources (hosted on GitHub) here: http://t.co/BbYNwLDlny

— a16z (@a16z) July 25, 2014

Open your free digital wallet here to store your cryptocurrencies in a safe place.