Liquid Bitcoin Wallet: HolyTransaction adds support for L-BTC – Bitcoin on the Liquid Network!

Today, we are pleased to announce that HolyTransaction Wallet is adding support for swapping L-BTC and thus introducing the ability to deposit and withdraw bitcoin using Liquid Network.

Bitcoin on the Liquid Network, or L-BTC, is verifiably backed 1:1 by bitcoins on the mainchain as Liquid is a federated sidechain between bitcoin exchanges and market makers. Once the coins are transferred from BTC to L-BTC, HolyTransaction users can take advantage of the massive speed and increased security features.

Why is Liquid support such a big deal?

Liquid Network is capable of operating ten times faster than Bitcoin’s own network, which opens up a world of possibilities for the users, particularly when it comes to the speed, faster transactions, and lower costs of making payments. Imagine having to only wait for one minute for your transaction to be processed, as opposed to at least 10 minutes, which is what Bitcoin’s blockchain requires. That is what Liquid Network offers, and what customers of HolyTransaction will now have the ability to do from within their wallet.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Impact of DeFi on the Cryptocurrency market of 2021

Short for decentralized finance, DeFi is a new wave taking over the world’s financial market; the cryptocurrency world. DeFi is the conception that entrepreneurs can provide traditional financial institutions functions through a decentralized medium. There are cryptocurrencies like Bitcoin and Ethereum, the former of which has been causing significant ripples in the crypto-world since the last quarter of 2020 and the beginning of this year.

Although Bitcoin and Ethereum are the forerunners of DeFi, newer and somewhat better altcoins are coming into view. An example is Dai, a bitcoin-resembling digital token that hopes to remain independent of the world’s central banks’ influence. Unlike centralized finance and traditional banks, DeFi takes away all the cumbersome operations, go-betweens, and high costs often involved. This it does via smart contracts and to the benefit of the end-user. The closure of many industries during this era of the COVID-19 pandemic has served as a wake-up call to consumers of fiat currencies on the futility and loss of value of such coins.

This wake-up call has been occurring in places where the government has been pumping more money into their economies even though they have taxes to be paid. Such practices make the value of such currencies questionable. As a result of such act, fiat currencies’ values have been seen to fluctuate and fall considerably, often leading to inflation. An example is in Venezuela’s economy where inflation has risen by more than 1,000,000% due to the influx and pumping of more bills into the economy.

Often, the influx of newly minted bills into the economy does not mean these bills will get to such currencies’ end-users. These often serve as injections into the banking sector. But when they come as benefit checks and government aids, this inflation in money supply results in taxes. Also, they help boost the stock market and the stocks of the top 1%, rather than help the thousands and millions of individuals and businesses that need such aids.

The Impact of DeFi in the cryptocurrency market

The increasing dissatisfaction and discontent with traditional banks and centralized financial systems are momentous. The high availability of information about the growing offers in the crypto sector is finally providing people with better alternatives to traditional banks. These alternatives come in the form of DeFi (decentralized finance) where people can now take part in a mode of operation that will work for them. This means that people’s money will now work for them instead of the other way round.

Investing in the cryptocurrency market is becoming more comfortable and more widespread than when it first emerged with Bitcoin as its forerunner. As the first DeFi system, this paved the way for other altcoins, including Ethereum, Tether, Polkadot, XRP, and Cardano. These cryptocurrencies have come a long way and have become potential collaterals when taking out traditional bank loans. These loans can be collected regardless of what your credit score is. They serve as a way of getting cash when you need it irrespective of the availability of physical collateral.

The influence of cryptocurrency is rising steadily in developing countries where inflations often caused by government policies and central bank cash injections result in the loss of value of people’s savings and business capitals. Buying and investing in DeFi systems has provided a remedy to that, whereby the value of fiat currencies that have been converted to cryptocurrencies experience growth and provide means of decentralized financial transactions with relatively low costs from traditional banks.

Opportunities and Growth

The opportunities created by cryptos seem even better in developed countries. Large amounts of money are readily available and can be invested in trusted cryptosystems where stable profit and immense gain are assured. This steady return has been made evident in Bitcoin and Bitcoin price prediction, which has been steadily increasing more than fiat currencies. Its independence from centralized financial systems has served as a contributing factor rather than a deterring factor.

Amidst the use of DeFi systems by individuals and some businesses, there is a need to increase its development and efficiency to encourage its adoption by institutions. Through this, the DeFi industry will rise from the position now as a Billion-dollar transaction pathway to a trillion-dollar one, where the costs of transactions go down while profits and investment increase. This aim of getting institutions into the DeFi industry is already in motion. Individuals and groups are coming together to develop decentralized financial apps that are better and more decentralized than their forerunner. Such a better DeFi system could come in the form of large and small security circles where a single user cannot overturn the currency’s stability, and a central body cannot determine a price change.

With this growth in the use of DeFi systems and the coming in of institutions into the crypto market, real-world assets can be brought into the blockchain, which will help and promote the growth of DeFi. This would include transferring trillions of fiat currencies and precious stones such as gold or silver onto the blockchain. And their movement can be done at the cost of no more than a nickel and no intermediary fees and liquidity limits. With DeFi as an alternative to centralized financial systems, governments will have little to no control over the wealth that cannot be generated by individuals that make use of the system.

Conclusion

With the growth of decentralized financial systems in the last two decades, the move from fiat currencies to cryptocurrencies seems irreversible. And that’s a good thing since, through DeFi systems, the distribution of wealth among crypto-users can be regularized and stabilized. This would ensure equal wealth distribution on the platform, which can only be influenced by cryptocurrency owners when they invest more fiat currency into the platform.

BIO John Edwards

John Edwards is a writing specialist who works at The Writing Judge. He is looking for ways of self-development in the field of writing and blogging. New horizons in his beloved business always attract with their varieties of opportunities. Therefore, it is so important for him to do the writing.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Generation X vs. Generation Y | Adopting Cryptocurrencies

Generation X and Generation Y Adoption of Cryptocurrencies: A Comparison

The world’s financial institutions are currently observing a vast digital ecosystem being expanded with reports for new digital currencies akin to the likes of cryptocurrencies to be launched soon. While these CBDCs (central bank digital currencies) are proclaimed not to harm or replace cash and other forms of legal tenders, we cannot help but talk about the ones instigating the change.

Cryptocurrency became popular since the launch of Bitcoin back in Jan 3rd, 2009. Ever since then, cryptocurrencies have seen a rise in popularity amongst the masses.

According to a recent study by Tech Jury, the cryptocurrency market cap has reached $265.545 billion as of May 2020. By 2023, the global blockchain market is expected to reach $23.3 billion. Furthermore, Bitcoin alone accounts for $6 billion of daily online transactions.

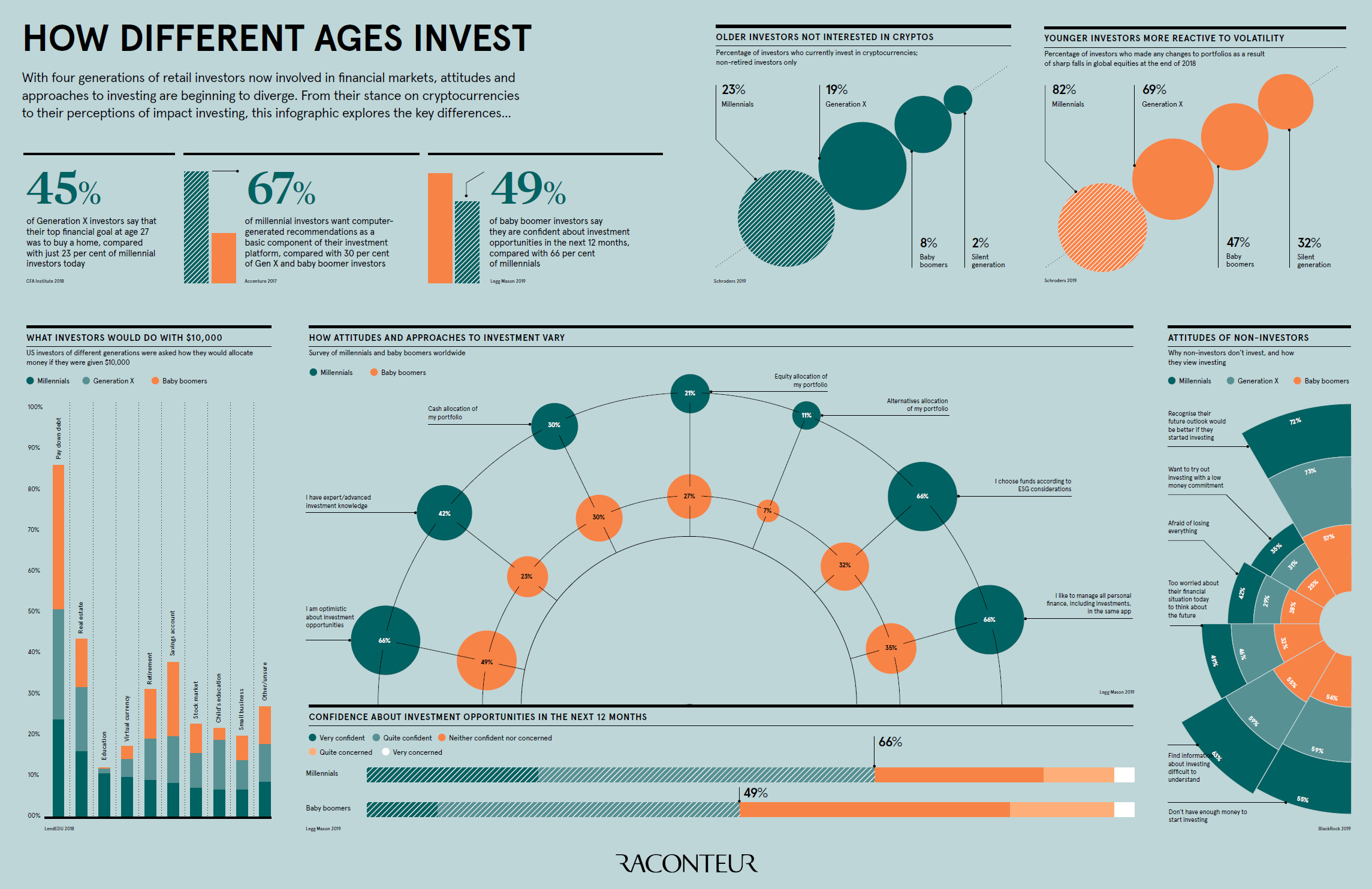

Moreover, cryptocurrency users have exceeded 40 million globally. In light, of this information, let’s take a quick look at how Millennials compare to Generation X when it comes to adopting cryptocurrencies.

Generation X

Generation X is widely regarded as the generation that followed Baby Boomers and preceded Millennials. Their age groups range from 40 to 55 years old as of 2020. Here is how Generation X is reacting towards cryptocurrency:

-

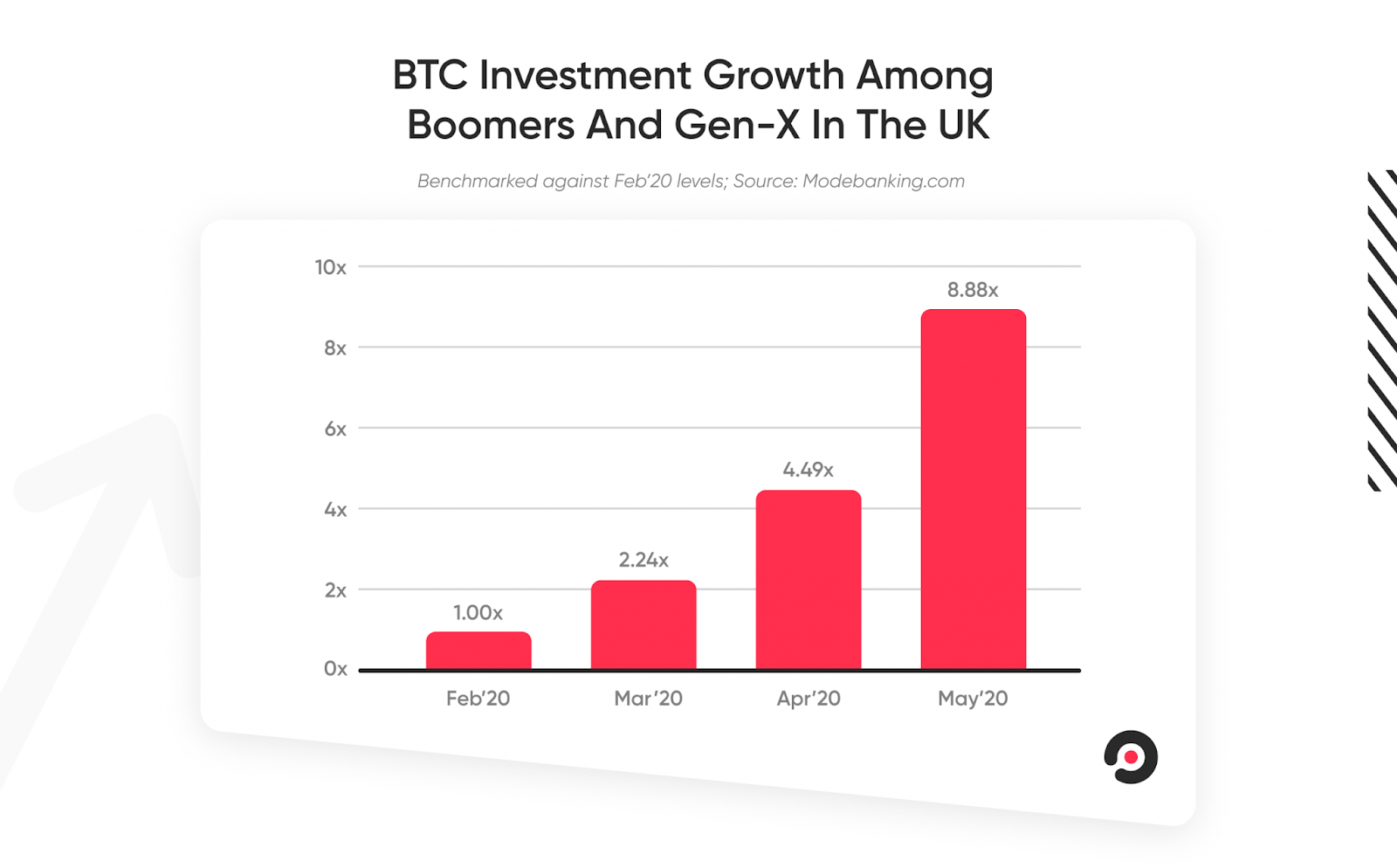

Investment Growth among Boomers & Gen X

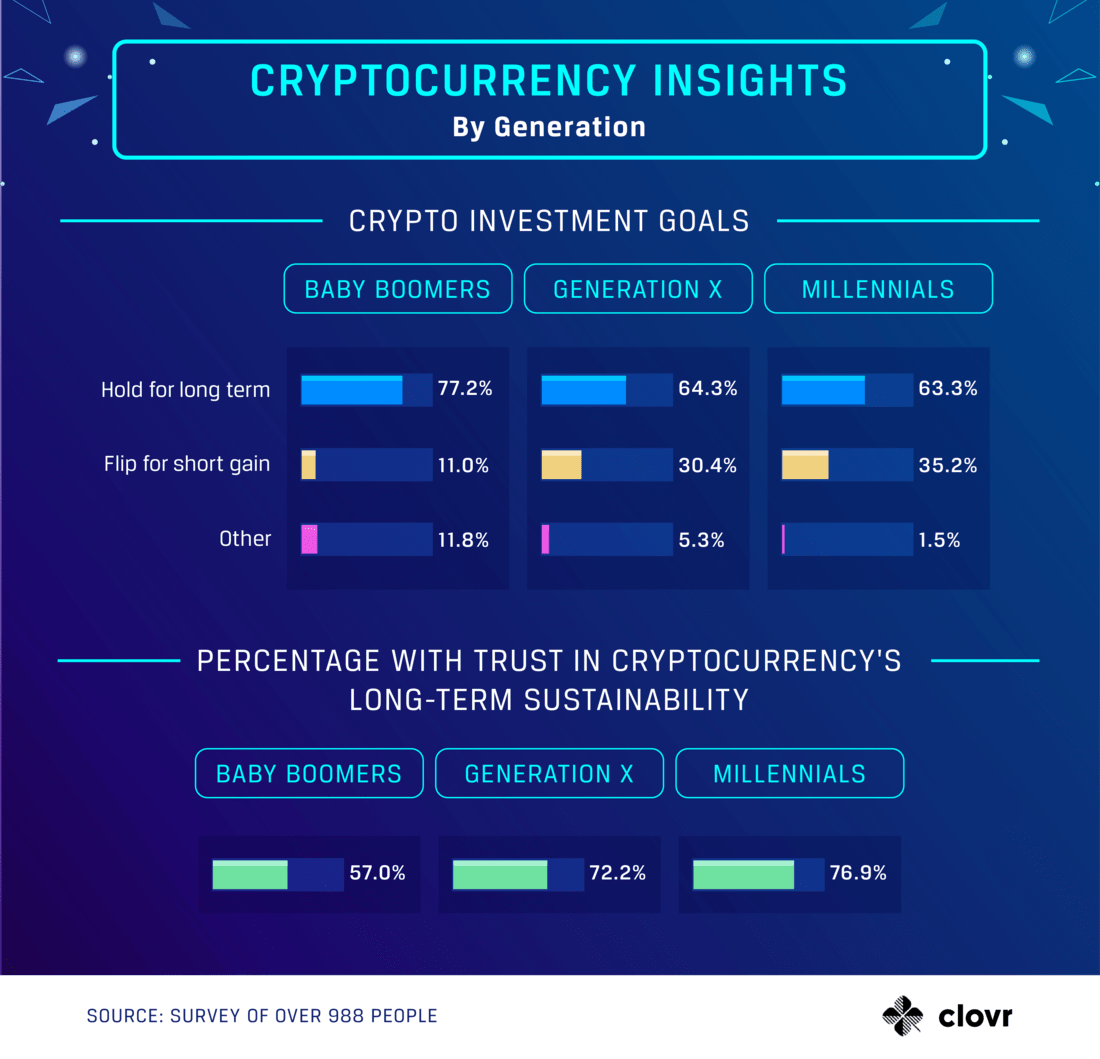

While Millennials are regarded as the prime suspects for capitalizing on the crypto market, surprisingly both Baby Boomers and Gen X are being currently observed to closely follow the trends.

Hence in recent years, many sources have cited an increase in investment of cryptocurrency as both Boomers and Generation X take charge to close the gap. In some cases, they were also found to have more than doubled their investments.

-

Month on Month Growth

It seems like the word of mouth and awareness about cryptocurrency is spreading like wildfire as Generation X is seen to understand the value and find blockchain as a reliable security measure. Understanding the benefits of fast and instantaneous transactions, the group of disaffected people and entrepreneurs is already showing signs of crypto is affecting their thinking for the future.

Reports are coming in, showing an evident increase and Month on Month growth patterns. According to a study by Mode Banking, both Baby Boomers and Gen-X have shown a trend of increasing their investment in cryptocurrency by over 100%, especially during the COVID-19 pandemic.

-

Wealth Protection & Asset Diversification

With the current economy ridiculed by the pandemic, the growing fear for wealth protection has led Baby Boomers and those belonging from Gen-X to invest in resources that can allow for asset diversification. Cryptocurrency so far has been observed as the most favorable type of investment to safeguard personal wealth.

Generation Y

Otherwise known as Millennials, Generation Y is widely regarded as the generation succeeding Gen-X and Baby Boomers. Their age groups range from 24 to 39 years of age. Often regarded as the parents of Generation Alpha (like my darling son!) they were born into a world that as quickly becoming familiarized with the internet, mobile devices, and social media.

-

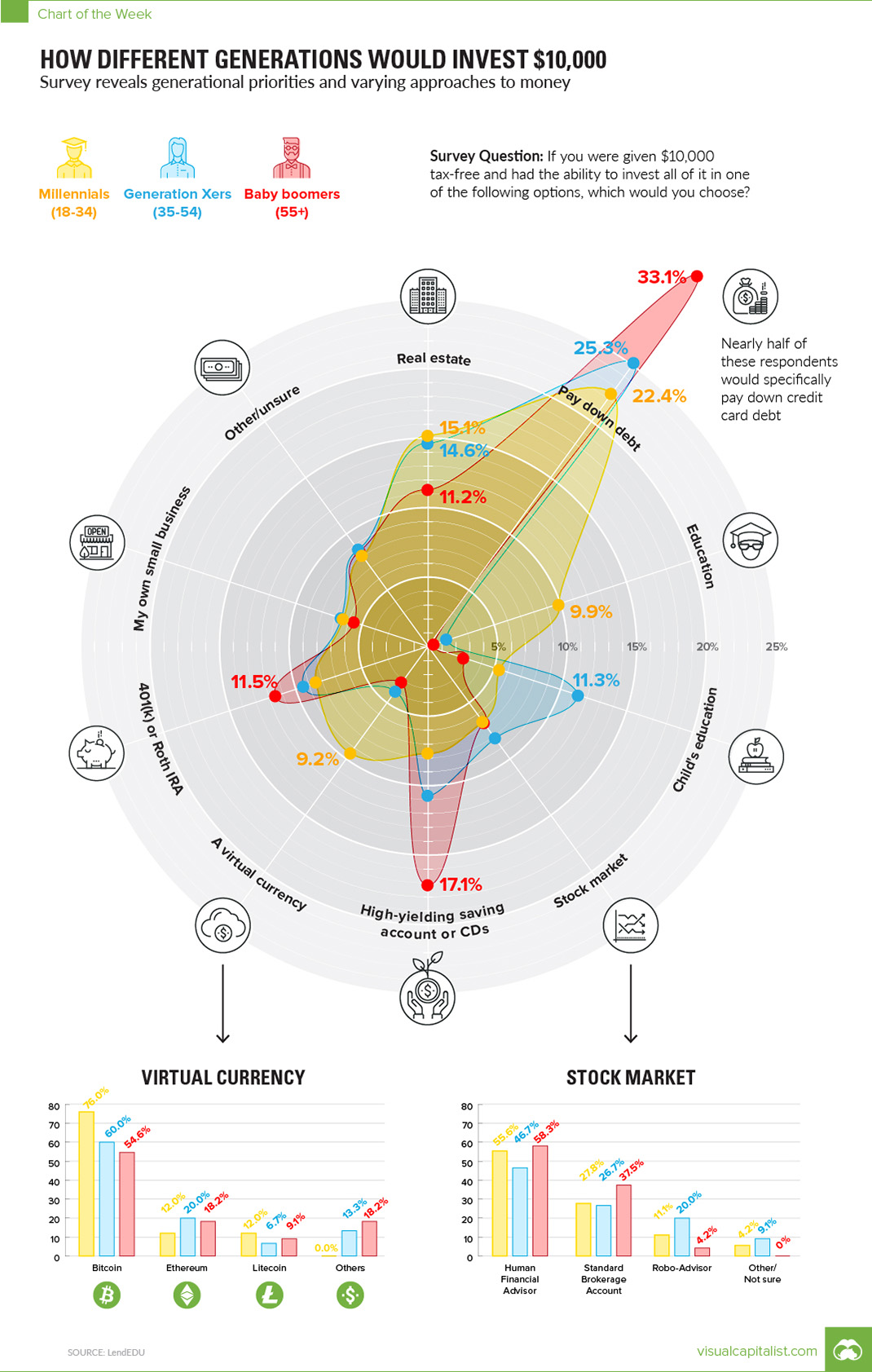

Growth of Alternative Asset

Millennials view of cryptocurrency is that of an alternative asset. Surprisingly not many of us want to invest in stocks and are more interested in assets that are backed by technologies. According to a recent study by Coin Telegraph, Millennials are three times more likely to invest in cryptocurrency as compared to Generation X. Furthermore, 9% of Millennials chose crypto as their long-term investment option.

Students applying for and seeking dissertation assistance are also looking for ways to invest alternative asset that can help secure their personal wealth for the future. It is important to note here that while both real estate and stocks are also good options for Millennials, they are currently dominated by Baby Boomers in the present times.

-

Shifting Presence for Everything Digital

Studies from different financial institutions and digital currency markets are coming in showcasing Millennials as a driving force for the adoption of Bitcoin for years to come. Zac Prince, the CEO and founder of BlockFi, identifies a major trend for Millennials where they seek everything digital.

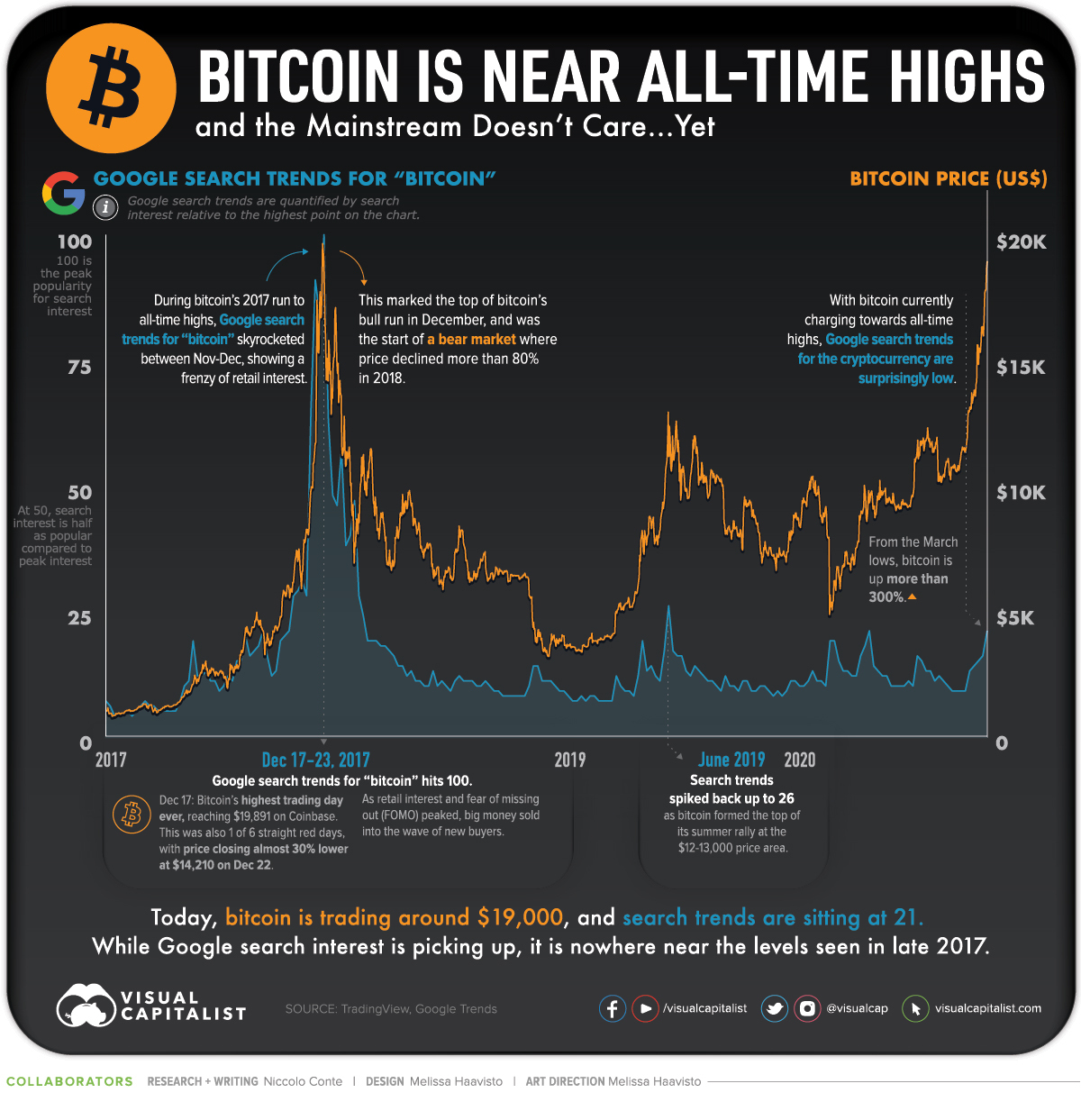

Furthermore, with Bitcoin reaching its all-time high and pushing over $23,000 per coin as of Dec 17, 2020, who can blame Millennials for making the right choice so far!

-

Wealth Transfer to the Young

There is a Japanese idiom that states the next generation as the actual king of the world. Come to think of it this world will always belong to the next generation that is how our life expectancy is all about. We may get to live 100 years, but eventually, the circle of life catches up to us. As we depart, the new generation takes to the throne.

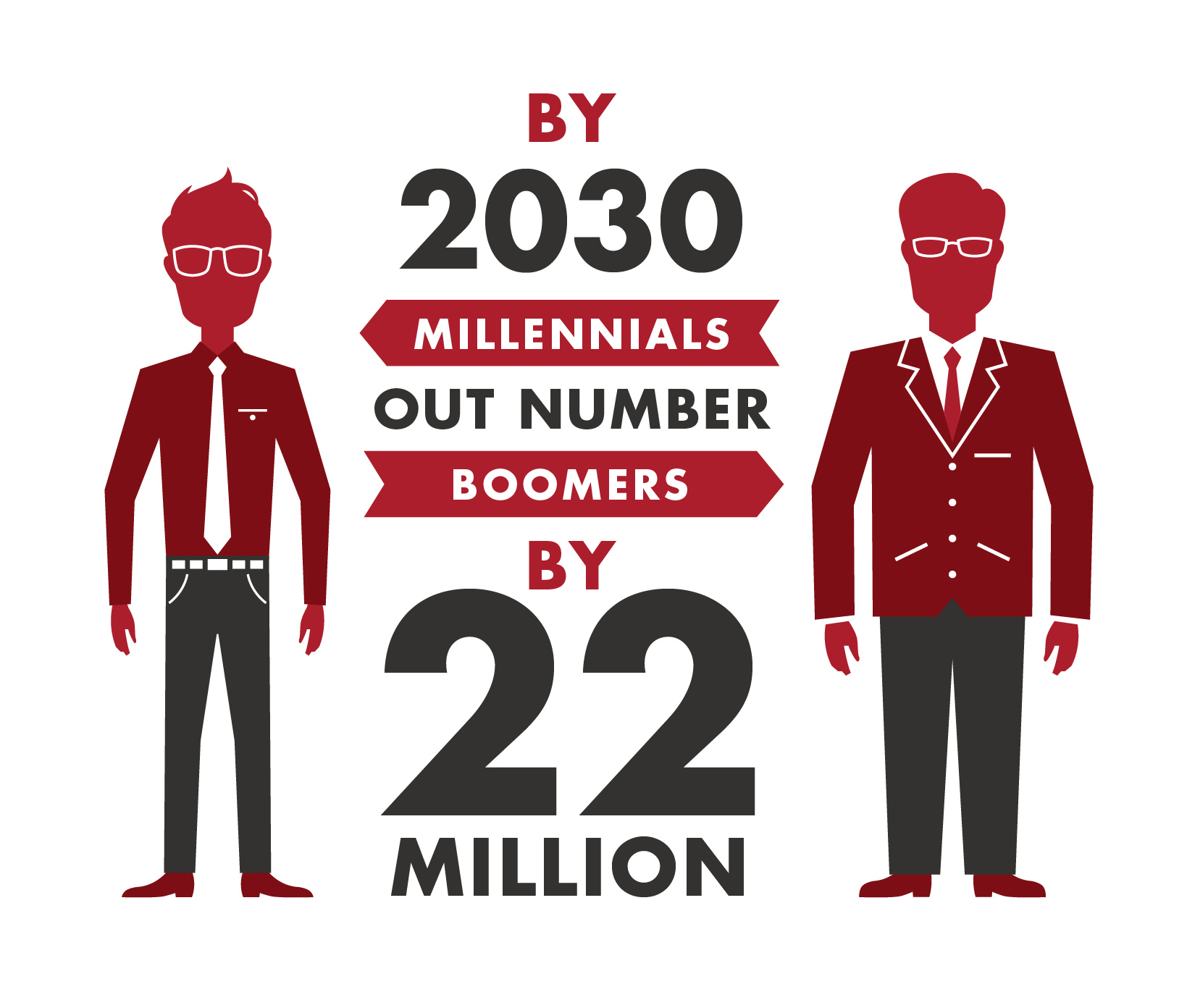

For countless eras, this is how wealth has been passed down from old to the young. Currently, Millennials are in the process to take control and eventually move Boomers out to take their seat on the ruling chair. This transfer of power and wealth on a massive scale will indefinitely cause investment in cryptocurrency to rise by a tremendous rate.

Conclusion

Cryptocurrency is on the rise with Bitcoin riding the tidal wave in recent times. Not only digital assets and crypto are skyrocketing, but even the BIS (Bank of International Settlements) is also considering launching digital currencies with the help of IMF and 60 central bank members.

Someone really has to be blind enough to not see how things are rapidly changing and converging towards digital resilience. So far Millennials and Gen-X have shown their growing interest in adopting cryptocurrencies with Boomers lagging behind to catch up on the trend.

Author Bio

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Samantha Kaylee currently works as an Assistant Editor at Crowd Writer. This is where higher education students can acquire literature review writing service UK from professionals specializing in their field of study. During her free time, she likes to catch up on all the latest tech developments happening across the globe.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How Zcash is Changing The Crypto Game With its Wrapped Debut

When it comes to cryptocurrencies and altcoins, there are a huge range of diverse crypto offerings, each offering unique value in its own way. While mainstream attention continues to be directed towards altcoins such as Ethereum and Ripple, privacy coin Zcash (ZEC) is an intriguing alternative that is flying under the radar of many investors.

Here is a rundown of Zcash and how it is using Wrapped and Anchorage to increase its functionality while maintaining the privacy and security benefits that it already offers.

How Zcash Provides Privacy with Cryptography

Zcash, based on Bitcoin’s codebase, is an altcoin that was initially released in 2016, and shares many similarities to Bitcoin. With this being said, the areas in which it differs are in regard to privacy and anonymity.

Zcash offers enhanced privacy through its ability to offer two types of addresses – those that are transparent, and those that are shielded. With shielded accounts, while Zcash transaction data is still posted to a blockchain that is public, personal and transaction data remain confidential. This is achieved through zero knowledge proofs, which allow for verified transactions without information such as transaction amount, sender and receiver.

Wrapped Zcash

Wrapped, which is a partnership between Anchorage and Tokensoft, launched WZEC as their first asset in late 2020. In understanding how wrapped Zcash is providing value, it is important to understand the idea of wrapping a token.

Essentially, wrapping a token involves representing a blockchain asset on another blockchain – with the example of Bitcoin, it would involve issuing a BTC equivalent on the Ethereum blockchain network. This exists in the form of wrapped bitcoin (WBTC). Wrapped tokens are backed on a 1:1 basis with the cryptocurrency upon which they were based, and need to be held in reserve by a qualified custodian.

Wrapped Zcash follows this same process, and as a result provides a number of benefits which are in many ways unprecedented.

How WZEC Provides the Best of Both Worlds

When it comes to the benefits of wrapped Zcash as opposed to ZEC, the functionality of this altcoin is dramatically shifted with WZEC.

Put simply, shielded Zcash holders can now use their Zcash whilst keeping their information private. They can now keep their assets in a shielded account, and are able to privately use a fraction of them on Ethereum blockchain by wrapping these assets. This addition means that Zcash users can benefit from the best of both crypto privacy and functionality.

In addition to this added capability, WZEC also provides benefits in regard to regulation – this is because wrapping Zcash on the Tokensoft platform results in a know-your-customer (KYC) process for shielded ZEC, in addition to the fact that ZEC holders need to be on the same page as Anchorage in terms of their compliance as qualified custodians.

Finally, it allows ZEC holders to invest and make transactions within the various Dapps built on Ethereum.

The Importance of Privacy in the Crypto World

When it comes to cryptocurrency in 2021, the growing demand for crypto is bringing with it an increase in the demand for safety, security and privacy in making transactions and using crypto assets.

While it was once not an option for shielded ZEC to be traded on crypto exchanges, WZEC makes this functionality a reality. Essentially, Wrapped is creating a crypto offering that includes the best of privacy and usability.

This is a product that is catering to a growing audience of crypto enthusiasts and investors, whether retail or institutional, and is a contributing factor to the increasing price of ZEC – 2020 saw huge increases in ZEC value, and this growth has so far continued into 2021.

While cryptocurrencies such as Bitcoin and Ethereum are popular within the wider crypto community, their shortcomings in regard to privacy are meaning that more and more investors with concerns regarding privacy are beginning to consider crypto offerings such as Zcash – with this being said, only time will tell whether ZEC ends up as a success.

Author Bio:

Chelsea Rogers is a marketing student and freelance writer for Current.com.au based in Melbourne, Australia. She is passionate about growing her crypto and finance portfolios. She is an avid music lover and regularly performs at local venues with her band.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ethereum Miners Raked in Nearly $300 Million Last Month as Hashrate Breaks New Highs

Can you imagine the speed required to make 250 trillion attempts to solve a puzzle in one second? Stop imagining! We already have the answer figured out for you!

On 6th October 2020, the Ethereum-mining hash rate made a new record by reaching a figure of 250 trillione hashes per second. Ether miners are more active than ever before, and the Ethereum network is now more powerful than ever before.

To your surprise, Ethereum is not a mineral found in the mountains. Miners have made $300 million without even stepping outside their homes. Without confusing you any further, let me explain how ETH mining can make you a millionaire.

What is Ethereum?

It is a platform that makes use of a blockchain database to allow developers to create applications on it. The apps that are built on Ethereum are decentralized; Any computer that connects to the Ethereum network can access these apps. You can make online payments, trade cryptocurrency, and sell products without the involvement of third parties like banks.

Ether (ETH) is Ethereum’s cryptocurrency that has $40 billion worth of market capitalization in 2020.

What is Hashrate?

It indicates the overall health or power of the Ethereum network. The combined computing power of all the mining machines is directly proportional to the hash rate; When power increases, the hash rate goes up. This means that the miners play a vital role in strengthening the cryptocurrency network.

Initially, low-power machines were used, but as the popularity of the network grew, more users jumped in, and more powerful mining rigs were introduced. This caused the hash rate to reach trillion hashes per second and enhanced the network’s security.

What is the hype all about? How are the hash rate and mining rigs related to money? Let us find out!

What are the Mining Rigs?

People spend thousands of dollars on building powerful mining rigs that can generate more ETH in less time.

Mining rigs are basically computers with an extremely powerful graphics processing unit. Application-Specific Integrated Circuits have now been introduced for mining purposes. Mining is not an easy task, so it requires a lot of energy in the form of electricity.

The main reason behind using GPUs and ASIC instead of simple CPUs is to lower energy consumption.

Components of a Mining Rig

-

Power Supply Unit

The capacity of the supply unit (in watts) must be greater than the total power consumption of all the units of your rig. If you have 4 GPUs that consume a total of 800 watts and other units consume 200 watts, a supply unit of at least 1000 watts is needed for the smooth working of the rig.

-

Hard Drive

Your SSD requirement depends on the operating system of your rig. A 120 GB hard drive is required for mining rigs that run windows. For Linux users, 60 GB SSD would get the job done.

-

Motherboard

The number of PCIe slot connectors in a motherboard corresponds to the number of GPUs that can be installed. ASRock H110 Pro BTC+, Asus B250 Mining Expert, and Gigabyte GA-H110-D3A are some of the best motherboards for mining. The average cost of these motherboards is around £110.

-

RAM

Your rig’s processing speed depends on the size of its RAM. At least 4GB RAM is required for fast calculations.

-

GPU

GPUs are the actual driving force in a rig, so make sure that you have plenty of them. GeForce GTX 1060, RTX 2080 Ti, and RX Vega 56 are some of the most popular graphics cards on the market.

Let me link all the dots here!

The Role of Mining Rigs

A powerful mining rig can make more attempts at solving puzzles in one second. More attempts mean that there are high chances of working out the right answer. When the right answer is generated, a new block is added to the chain, and the miner gets ETH as a reward. It would not be wrong to say that ETH is sitting in the coaxial cables of your rig.

How Ethereum Mining Generates Money?

Mining is not just about solving the mathematical puzzle but being the first miner to discover or guess the solution is a must for earning a reward. Millions of people are working on the same puzzle at one time, so the processing speed of your rig determines your success rate.

Today, one ETH is worth $467. An ETH miner makes money by processing transactions for the application users on the Ethereum network. ETH is a miner’s reward for solving the complex puzzle. When the miner has processed a certain number of transactions, he/she is rewarded with ETH.

Ethereum serves as the platform for the buying and selling of ETH. Miners’ task is to verify and secure transactions resulting from trading on which they also earn a transaction fee.

One important point to note here is that when the hash rate goes up, the difficulty level of the puzzle also increases to balance it out.

Is Mining Profitable?

Eth miners working with powerful graphics cards can make $15 in 24 hours, which is much higher than the profit in Bitcoin.

High profits do not come solely from ETH mining, but from the transaction fee, which is the main attraction.

The transaction fee in the Ethereum network rose to $11.61 in September 2020, producing millions of dollars in profits. Experts suggest that Ethereum is a good investment as Ether’s price is expected to grow over $2000 by the end of 2025.

Summing It Up!

Cryptocurrency is on the rise these days, and according to the experts, it is the future of online trading. Although there are security issues like double spending and 51% attacks, Ethereum and Bitcoin continue to attract investors.

If you have some extra cash lying in your bank, my advice would be to invest it in buying cryptocurrency. You do not need to go big at this point! Start with 1 token and just analyze its value in the market.

Where do you see the price of 1 Ether going in 2030?

Author Bio:

Myrah Abrar is a computer science graduate with a passion for web development and digital marketing.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Earn Interest With a HolyTransaction Cryptocurrency Savings Account

Decentralized finance is quite literally taking the entire blockchain industry by storm.

After a relatively slow buildup over the past few years, the spotlight has well and truly fallen on the cryptocurrency space’s ability to do what traditional finance does — but better.

HolyTransaction, the world’s most trusted cryptocurrency web wallet, is making access to DeFi solutions available to all of its users starting now.

How? HolyTransaction developers have integrated DeFi savings accounts for stablecoins into HolyTransaction web wallets.

If the whole decentralized finance thing is new to you, and you’re having trouble understanding the importance of cryptocurrency savings accounts with stablecoins, then read on!

Decentralized Finance (#DeFi) Explained

Blockchain has promised to do a lot over the years.

However, at the end of the day, its first and best use case going back to the invention of Bitcoin is, and has always been, money.

If you’re looking for a one-liner, it’s this:

Cryptocurrencies do it better.

So, why shouldn’t cryptocurrencies one-up the traditional financial industry?

Decentralized finance refers to blockchain-based protocols that enable peer-to-peer financial solutions like loans and, yes, savings accounts. Anything the traditional financial industry offers via institutions like banks, you will soon be doing in a decentralized manner without third parties at all.

A Quick Guide to Stablecoins

The truly clutch tool in the development of the #DeFi industry has been the stablecoin, a workhorse digital asset used to minimize value volatility by pinning a cryptocurrency’s worth to an outside asset.

Some stablecoins, like Tether (USDT), pin their value to government currencies such as the US dollar. To maintain value, $1 is stored in a reserve for every 1 USDT circulating in the open market.

Other stablecoins peg their value to assets like gold, oil, and electricity.

Today, stablecoins are gaining immense popularity as digitally-native alternatives to slow, centralized, and costly to use fiat currencies like the EUR, RUB, USD, and YEN.

HolyTransaction Interest-Generating Cryptocurrency Savings Accounts

When using traditional banking savings account solutions, you’ve probably noticed that APY rates are pretty low.

Even so-called high yield accounts don’t yield much with limits as low as 0.5%.

Decentralized finance is changing that. By removing third parties from banking scenarios, you can often earn as much as 3% APY by keeping your stablecoins in an interest-generating crypto savings account.

The great news is HolyTransaction has integrated such interest-earning features directly into its trusted cryptocurrency web wallets.

With HolyTransaction, there is no need to download, install, or otherwise figure out another piece of software.

Instead, you can use your HolyTransaction cryptocurrency web wallet directly via the web, allowing you to get started generating rewards on your stablecoins right away.

If you’re concerned about a learning curve of some kind — worry not.

Using a DeFi savings account is the same as using a basic cryptocurrency wallet. Just deposit your stablecoins, click on “stake” and you’re good to go — the longer you store them, the more they yield in return.

Want to get started today? Jump over to HolyTransaction to quickly create an account and start saving.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How Blockchain Is Changing Media and Entertainment Industry

When people talk about the entertainment industry and media, blockchain isn’t exactly the first thing that comes to their mind.

Wall Street and eCommerce are way ahead of the entertainment industry in terms of blockchain adoption, there’s growing evidence that things could change pretty soon. As more and more use cases for the technology emerge, major players in the industry are increasingly looking at blockchain as something that has the potential to resolve some pressing issues.

Warner Music Group, for example, has recently joined an $11 million investment round in Dapper Labs, a blockchain company seeking to create Flow, a rival to Ethereum. Already, the company is exploring a number of use cases for the cryptocurrency, including sales of digital merchandise with financial tokens.

The slow but sure progress of blockchain in the media and entertainment might be a sign that a breakthrough might be approaching. Currently, the technology is known to provide the following solutions.

Reduce the Dependence of Artists on Middlemen and Labels

The problem of middlemen is persistent and very well-known in the music industry. Even though it has come so far in terms of technology, it’s still in the same place when it comes to compensation distribution. The biggest losers in this situation are often the artists, who end up with a lack of opportunities to get sponsorship contracts with big-time labels.

The only viable option for an artist to minimize the dependence on managers and distribution services is streaming services. However, the compensation they get for the music is often inadequate, even for the well-known artists. Here are some examples (source: CNBC):

- Taylor Swift’s compensation for her famous song “Shake it Off” was between €240,000 and €335,000 even though it attracted more than 46 million streams

- 1 million plays on a streaming service like Shopify translates only about €6,000 in earnings for the artist

- 1 million plays on Pandora gets the artist less than €1,700.

All of this translates into between €0.004 and €0.007 of pay per play.

Blockchain can reduce artists’ dependence on labels and other middlemen because it’s not run by a central body but rather everyone on the network. This means that the financial transactions – compensation for songs, etc. – could be conducted without the involvement of the middlemen.

Secure Peer-to-Peer Sales

Contract distribution and payment for property in the entertainment industry can be a complicated thing. The biggest problem is the sheer amount of work involved in payment processing, making exclusive distribution agreements, providing licensing, and other things. On top of that, there’s high fees and a lack of control over the process for artists.

Many artists delegate these business administration responsibilities surrounding contacts, licensing, and payment to their agents. As a result, the artists are once again left with high losses because they simply cannot sell their work directly peer to peer.

A blockchain-powered marketplace for entertainment content is a solution here.

“Since blockchain is a distributed digital ledger system, it can enable almost complete automation of all business administration work surrounding payments, contracts, and licensing,” says Jason Rowe, a technology reporter. “The biggest benefit here, however, is the ability to enable artists to license their content directly to customers.”

WeMark is one example. It’s a distributed marketplace for stock photography that seeks to reduce the dominance of agencies like Getty Images and Shutterstock. According to WeMark’s white paper, these agencies now charge photographers up to 85 percent of the photos’ sale price, so the latter are left with a fraction of potential earnings.

Here’s how the WeMark platform works to provide artists with distribution agreements.

The solutions offered by blockchain-powered marketplaces like WeMark include:

- Reform of the super-centralized system for distributing digital content

- Artists license their content directly to users, keep all the rights and manage pricing

- More secure content distribution terms and fees with smart contracts that are programs that are unchangeable unless all the conditions are met

- More effective referral programs to assist artists to share their content and reach more customers.

Once blockchain marketplaces get more popularity among artists, chances are good they will prefer to use them instead of agencies like Getty Images. Each of the marketplaces will accept the most common cryptocurrencies as a payment method; moreover, as the costs of crypto mining gradually go down as blockchain gets more acceptance, chances are that artists will be willing to use cryptocurrencies for peer-to-peer sales.

Combat Piracy

The number of visits to media piracy sites in 2018 rose to 17.3 billion in the U.S. alone. With the volume of video-based traffic rapidly increasing around the world, online media piracy has skyrocketed; in fact, the television and film industry estimates about $52 billion in lost revenues by 2022.

Blockchain might be one of the solutions that will finally start to battle online privacy effectively. Its main promise, more comprehensive protection of digital assets, is perfectly aligned with the goal of combating pirates. For example, the technology can allow artists to transfer media files securely while having the complete visibility of the operation.

Another benefit of bitcoin is allowing it to catch pirates by identifying illegally obtained files. For example, if you’re a moviemaker looking to distribute a file to reviewers, you can use a blockchain-powered video distribution platform that embeds a special code, or a wallet, in every copy that gets distributed. The code remains in the file despite conversions or other processing operations.

If the file is leaked and found, then identifying the presence of the code, therefore, an illegally obtained file, becomes possible. The adoption of blockchain is still a problem, but it’s clear that the technology is on the way to become the future of the anti-piracy tactics (Warner is already investing in a blockchain company, remember?)

Blockchain: The Missing Link in the Entertainment Industry?

When people hear blockchain, they tend to think about Bitcoin. However, the technology stands to benefit many industries, including entertainment, and is already showing some good progress. The industry is highly centralized and there’s a great potential to increase earnings for people doing the creative work.

As the applications of blockchain become more common and the benefits visible, it’s possible that artists will be more willing to use the technology. However, the massive adoption is still yet to come, so stay tuned to blockchain news.

About the author: Jessica Fender is a content editor for TopWritersReview.com and a tech blogger. She is passionate about technology trends and finding new ways to help students improve their skills and become more successful.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

What Early Mining Patterns Tell Us About The Motives Of Bitcoin’s Inventor

The debate about Bitcoin’s inventor, known as Satoshi Nakamoto but otherwise shrouded in mystery, has raged for years. As Bitcoin continues to rise in value, this unknown inventor is presumed to have become a very rich individual indeed. When Satoshi invented Bitcoin, was he driven to profit, mining and hoarding early Bitcoin aiming to accumulate great wealth?

In 2013 first Sergio Demian Lerner presented his research on the early mining patterns Satoshi is presumed to have taken, it revealed around 1 million BTC (now worth around $10bn) hoarded by the creator. For many who see Bitcoin as an anti-establishment currency with an equalizing power, to attribute such vast wealth to Bitcoin’s creator is anathema, undermining the main narrative around Bitcoin and Nakamoto’s original motives. If Nakamoto is as driven by capitalist economics as the nearest banker, is Bitcoin fundamentally different from traditional currencies after all?

Nakamoto’s defenders argued that these 1 million missing Bitcoin were simply forgotten by early miners, and the inventor himself had no such hoard. Indeed, even researching these Bitcoin was taboo. Yet Lerner was unsatisfied with this answer. That’s why he has spent the last seven years unravelling the mining techniques used to unearth these early Bitcoin. What these techniques reveal is that Satoshi (if that is who mined them, Lerner refers to this individual as “Patoshi” to emphasize that we can’t truly know) seems to have been protecting the security of the network rather than pursuing profit after all. The reputation of Bitcoin, and its mysterious inventor, remains intact.

Early Mining Techniques

In order to learn more about the missing Bitcoin – and the individual who mined them – Lerner decided to remine the first 18,000 Bitcoin blocks to see what it revealed. He assumed that these blocks would have been mined with software that was similar, if not identical, to that which came with the first Bitcoin release. This public code was how early miners set about Bitcoins first blocks. The “Patoshi” pattern of how these Bitcoin were mined could ultimately reveal something about the motives of Bitcoin’s inventor, assuming Nakamoto and Patoshi are one and the same.

Through remining these early blocks, Lerner came to a startling discovery. Patoshi’s software was in fact nothing like the software being used by other early Bitcoin miners. Was this Nakamoto giving himself a leg up in the early gold rush of Bitcoin mining? The difference in the mining patterns of the public software and Patoshi’s processes became the keystone of Lerner’s research. Two theories stood out. Firstly, that Patoshi was using an early version of today’s pooled mining processes by combining multiple CPUs. The second theory – seemingly borne out in Lerner’s research – is that Patoshi was multi-threading.

Patoshi’s Multi-Threading

Multi-threading is a hashing technique using intensive computer processing to sweep for multiple nonces (the cryptographic element that Bitcoin miners are searching for) at once, rather than on an individual basis. By rescanning the early blocks, Lerner was able to assess which nonces Patoshi discovered, thus revealing the patterns by which Bitcoin’s inventor was mining blocks. Ultimately, Lerner has demonstrated that Patoshi/Nakamoto was generally finding higher-value nonces thanks to the multi-threading technique, and not because they had superior processing power, but because they had a better process for using their CPU.

Ideology Before Profit

Lerner’s meticulous analysis of the early mining patterns attributed to Bitcoin’s founder reveal that each time Patoshi mined a new block, his miner was turned off for a short interval. If Nakamoto was driven by profit, this is contradictory behaviour as it gives the rest of the community an opportunity to unearth new blocks. Lerner posits that Nakamoto wanted to see fair competition amongst early miners, and distribute Bitcoin equally at the start of the network.

At the same time, Patoshi’s multi-threading would have allowed them to uncover new blocks when they were not being mined by other early users, thus enabling the network to continue ticking over. These patterns have led Lerner to argue forcefully that the security of the network – and not profit – was Nakamoto’s motivation for their early mining patterns.

Still Unknown

It remains an assumption that Patoshi and Nakamoto are one and the same, and the identity of this individual is still unknown. But Lerner’s research strongly indicates that profit was not an early motivator of the Patoshi pattern.

Kristin Herman is a tech enthusiast and a project manager at Essayroo.com and Boomessays.com online writing services. When she takes a break from the screen she likes to curl up with a good book, albeit one about cryptotrends and digital landscapes!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Digital Token Development: the Future of Finance?

The last five years have seen an incredible development in the blockchain industry. Because of its fast development, new and innovative ways of implementing blockchain technology and accepting cryptocurrency have emerged in the business world. One of the most promising developments is that of digital tokens. The idea of digital tokens has its roots in data security. Its scope in the financial field is fast-tracked on the path of transforming the way businesses handle their finances and specifically, secure their assets. Even though it is still a new development, the advantages of digital tokens are already taking the business world by storm. Among these, include accessibility at a lower cost and increased liquidity and security. Businesses who want a competitive advantage are increasingly looking hire C# coder teams with experience in implementing digital token development, to transform their financial processes to include digital tokens.

What Is Digital Token Development?

To understand digital token development, you have to understand what digital tokens are. Just like a coupon can benefit you with a product of a certain value at a grocery store, digital tokens work in the same way. A digital token is a unit of cryptographic information that can be used to facilitate different transactions, which includes trading, redeeming or assigning to another party.

Digital tokens can either be inherited or constructed using the software. Some of the most common examples of inherited digital tokens are Ether and Bitcoin.

Token development exists to represent assets of value which can be traded. This can include basic commodities and cryptocurrencies, such as Bitcoin. With token development, a standard template on a blockchain is followed to develop new tokens. Because it is emerging so quickly, choosing the best token development service provider is important when entering the blockchain technology field.

When Can You Use a Digital Token Development?

Recently, digital tokens have gained a lot of popularity with businesses, specifically because it offers secure transactions. But it has many other uses. Let’s explore a few ways digital token development can be used:

-

Payment between parties

Many businesses are accepting digital tokens as a form of payment. This makes it convenient for two parties to securely trade without involving cash. Some examples of leading businesses and industries that are already using digital tokens include:

-

-

Internet Services Providers (ISPs)

-

The hospitality industry

-

The e-commerce industry

-

-

Digital asset ownership

The process of digital asset tokenization includes the act of breaking a large asset, for example, a real estate investment, into small chunks. Furthermore, each broken chunk of that asset is individually represented with a specific token, and the ownership of that asset is recorded on a ledger system that resembles a blockchain.

Those specific tokens can then be traded in the open market casually, making the broken chunks of the larger asset tradable.

-

Rewards

Some businesses offer digital tokens as rewards to clients or customers. This is typically to encourage people to shop online and can be a valuable award for individuals who invest in digital currencies.

-

Donations

Some organizations are embracing digital tokens as a form of donations. It is a safer and faster way of donating.

-

Investments

Many are realizing the value of digital tokens and are starting to use it as an investment possibility. Instead of investing money in banks, stock markets, mutual funds or investment bonds, investing in digital tokens is faster and much more secure.

As the interest in blockchain and cryptocurrency increases, businesses are slowly starting to adopt the use of digital tokens. Compared to traditional ways of managing finances and transacting, digital token development generally provides both an alternative and more secure currency instrument and a convenient payment infrastructure. Transforming to digital tokens can be complicated for businesses and they generally require expert developers to implement it into their infrastructure. As a result, the C# programmer demand is also increasing. C# programmers are typically experienced in blockchain technology and successful digital token development.

The Emergence of Token Technology Platforms in the Blockchain Ecosystem

Fast-developing blockchain technology combined with the existing finance ecosystems produces new business model opportunities every day. One of the most innovative models is the idea of each finance ecosystem developing its own digital currency. Ever since Bitcoin came into being, it became more attractive for businesses to invest in blockchain technology.

The typical process of blockchains is storing data in different blocks that are interlinked with each other in a way that portrays the entire path of transactions in chronological order. Due to a blockchain’s distributed and transparent nature, people can transfer ownership from one party to another while eliminating the necessity of a trusted intermediary.

An experienced C# coder can develop structures to help businesses invest in token development. With the help of the C# programmer framework, businesses can develop digital tokens that can be used for safe and secure financial transactions.

Why Are Tokens a Big Deal in the Future of Finance and How Can They Be Used in the Field of Finance?

As businesses are embracing the modern world and cutting-edge technology, the field of finance is also changing. Specifically, businesses in the financial field must take the opportunity of implementing digital tokens to gain a competitive advantage. The benefits include:

-

Enhanced liquidity and accessibility

Liquidity means how quickly a business or individual can get access to assets. Digital tokens allow stakeholders to access specific assets which are seldomly traded almost immediately.

-

More transparent transactions

The transactions conducted with digital tokens are much more transparent. Both the seller and the buyer know their rights and are aware of exactly who they are trading with.

-

Lower transaction fees

Because they work on blockchain tech, the administrative cost involved in transacting with digital tokens is much more cost-effective compared to traditional financial functions that involve third parties or legal entities.

Considering this, it is important to keep in mind that bringing the culture of digital currencies in the financial field can be a complex task. Developing and implementing a blockchain can take time because it requires thorough design and consideration. To launch an idea successfully, it is crucial to rent a coder team with experience in the field.

The Bottom Line

With the benefits digital tokens offer, more and more businesses and individuals are adopting it as an alternative to traditional financial processes. With the growing number of things that can be done with cryptocurrencies, it is clear that the world is slowly transforming into a more digital way of doing business.

Businesses who want to achieve better competitiveness by tapping into the liquidity, transparency and accessibility offered by tokenization, should implement digital token development. It appears that it is fast becoming the future of finance. The right way to go about it is to hire senior programming teams with experience in blockchain and digital token development to ensure successful implementation, from start to finish.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How Blockchain Technology is Changing the Banking Industry Forever

By far the biggest threat to banking in, well, living memory, has been blockchain technology. More specifically, cryptocurrency, but we’ll focus on the technology as a whole since this is what has been driving the movement.

All the tech companies in the world have been using it, including Google, Facebook, Apple, and Amazon, and a vast number of FinTech services, which is why it’s being seen as such a threat to traditional banks, but why is this happening?

What’s so important about blockchain?

In today’s post, we’re going to explore how and why blockchain technology is making such a big difference to the traditional banking format, and how the future of this industry is looking.

Source: Adarsh Goldar

How Blockchain Technology is Changing Payments

First and foremost, and by far the biggest form of change that blockchain is bringing into the world, is how financial payments are made and the way modern-day payment systems work. Whereas traditional banks can take a few working days to make a payment, meaning some international payments can take a very long time, blockchain payments are instant.

Since all you need is an internet connection to make the transaction, most will be handled and completed in a matter of minutes. These transactions can happen across borders to anywhere in the world, are extremely secure (especially when compared to traditional methods) and happen pseudoanonymously.

Due to the nature of blockchain technology, the costs involved in these transactions are usually very small, typically only several cents per transaction. This means that sending money across to the other side of the world is far cheaper than traditional wire companies, such as Visa or Western Union.

In the same way, remittances are also changing. Whereas overseas remittances are expensive and long-winded, with high processing times and the fact the money can be stolen, taxed, or subject to legal issues along the way, a blockchain process basically eradicates all these issues. There are dozens of companies already set up and operating to offer these services.

The Way Account Managing and Deposits are Handled

In the traditional way the world works, consumers tend to use banks to hold money in either their savings or checking accounts. Then, the bank will loan out the money being held to make money on top of the money you’re saving, and the cycle continues. This means when you look into your bank account, much of the money you have isn’t actually being held by the bank, but instead is out in other people’s accounts as loans.

If every customer of a bank went to the bank and withdrew everything they had, the bank would collapse. It’s a very fragile system that many consumers are unaware of. However, while this system isn’t going to change any time soon, blockchain technology can make the management of this system far more effective.

Due to the benefits that blockchain technology provides, these account ledgers are far more secure, far more reliable, and far more accessible. This means banks can accurately manage their ledgers to ensure that they aren’t taking out too many loans and will actively help reduce the risk of bank run, or the system crumbling.

A Reduction in Fraud

Fraud has always been a problem in the financial industry, and it costs people around the world billions of dollars every single year. However, for the similar benefits, we’ve spoken about above, blockchain is making things far more secure.

Since the vast majority of traditional banks are set up and organised around a centralised system, malicious people can target the centralised system to commit the acts of fraud. While there have been many measures to make the system as secure as possible, this isn’t fall-proof, and statistics show around 45% of all financial institutions are prone to fraud attempts.

Blockchain is a decentralised system, which means it’s everywhere and nowhere at the same time, which makes it incredibly difficult to fraud and theft to take place. There’s no single point of access like there is with a centralised banking system and trying to get into such a system means diving into layer upon layer of encryption, all spread out in hundreds of thousands of locations.

What’s more, every single change that takes place on the ledge is capable of being seen by every other person and system that has access to the ledger. This means if any fraudulent activity takes place, everyone can see it instantly and correct it. This will help protect people’s money and keep the system afloat.

Katherine Rundell is a finance writer at Academic Writing Services and Essay Writing Services. She writes about blockchain and banking and aims to help the world get educated about finances in a time where they can seem so out of control.

Open your free digital wallet here to store your cryptocurrencies in a safe place.