Search Results For: europe

Blockchain is the “perfect technology” according to the European Parliament

During the last week, a European parliament member gave a speech about consumer protection for the latest campaign that aims at realizing new rules related to the blockchain.

The perfect technology

The committee said yes

Watch the full video of the speech

Click here to listen to the entire Antanas Guoga’s speech.

Multicurrencies Wallet

Open your free digital wallet here to store your cryptocurrencies in a safe place.

European Parliament hosts a conference on Bitcoin

About EDCAB

Open your free digital wallet here to store your cryptocurrencies in a safe place.

European Union wants to monitor virtual currencies

In fact, a few days ago Europol concluded that there is no connection between Bitcoin and terrorism: “Despite third party reporting suggesting the use of anonymous currencies like Bitcoin by terrorists to finance their activities, this has not been confirmed by law enforcement”, said Europol.“Virtual currencies and their underlying technologies can provide faster and cheaper financial services, and can become a powerful tool for deepening financial inclusion in the developing world,” said IMF Managing Director Christine Lagarde, who presented IMF paper at the World Economic Forum, in Davos, during the panel Transformation of Finance.

A conclusion of the report is that virtual currencies fall short of the legal concept of currency or money. While acknowledging that there is no generally accepted legal definition of currency or money, the authors note that both are associated with the power of the state to issue currency and regulate the monetary system.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction welcomes new users from Greece, Europe, and the World over

Everyone with a finger on the pulse of the world’s financial health has been keeping their eyes peeled for the latest on the potential “Grexit” (Greek Exit) from the European Union. With negotiations of a final deal once again bearing no fruit, the average citizen’s faith in the traditional financial system is eroding at an ever-increasing rate. A few years ago, it was Cyprus; now, it is Greece. Frankly, the rest of the fiat-using world is right to believe that they may be next. In times like these, interest in Bitcoin tends to spike. In just the last week, Greek Google searches for the keyword ‘Bitcoin’ have increased notably. Let’s not forget that historically we have always seen a trickling effect where new Bitcoin users find themselves researching altcoins in an attempt to get ahead of the next big thing. It is possible that the current economic turmoil in Greece is the next big thing that pushes interest in Bitcoin and other digital currencies.

Everyone with a finger on the pulse of the world’s financial health has been keeping their eyes peeled for the latest on the potential “Grexit” (Greek Exit) from the European Union. With negotiations of a final deal once again bearing no fruit, the average citizen’s faith in the traditional financial system is eroding at an ever-increasing rate. A few years ago, it was Cyprus; now, it is Greece. Frankly, the rest of the fiat-using world is right to believe that they may be next. In times like these, interest in Bitcoin tends to spike. In just the last week, Greek Google searches for the keyword ‘Bitcoin’ have increased notably. Let’s not forget that historically we have always seen a trickling effect where new Bitcoin users find themselves researching altcoins in an attempt to get ahead of the next big thing. It is possible that the current economic turmoil in Greece is the next big thing that pushes interest in Bitcoin and other digital currencies.

We have seen fellow digital currency companies focus their attention and marketing on Greece and Europe, which is another indicator of the breadth of this event. The classical way to buy bitcoins is to use your bank. Unfortunately, with Greece’s banks closed for the next week and possibly more time after that, it is arguably too late for the Greek people to buy Bitcoin easily.

Since most Greeks have their money tied up in the banks that are currently shut down. The people on the ground can’t even buy Bitcoin through the banks. Bitcoin isn’t going to be accepted by Greece over night, but Bitcoin also isn’t going to be shut down by anyone over night. In the coming weeks, the contrast between digital currency and banks will sharpen for many onlookers. Observers the world over will be struck with a sort of enlightenment: their vision will clear. Bitcoin might not be able to help the Greeks buy a loaf of bread in their local economies tomorrow morning; however, Bitcoin and blockchain technology can and will be able to prevent similar economic disasters from happening ever again.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

European Central Bank hacked, personal data stolen

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Regulation Of Bitcoin – The European Bitcoin Convention — 2013 Amsterdam

Regulation Of Bitcoin at the European Bitcoin Convention

Wieske

Ebbe (Dutch Central Bank), Michael Maier (Fidor Bank), Niels Ploeger

(Amsterdam Police), Joerg Platzer (Crypto Economics Consulting Group)

& Casper Riekerk (Finnius Lawyers)

Recorded By IamSatoshi

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Investigating the use of blockchain technology in digital identity management

Blockchain Technology and its Potential in Digital Identity Management

Digital identity management is a crucial aspect of our digital lives, as it enables us to prove our identities online and access a wide range of services. However, current digital identity management systems are often centralised and controlled by a few large corporations, which can lead to issues such as data breaches and lack of control over personal information. Blockchain technology has the potential to revolutionise digital identity management by creating a decentralised, secure, and user-controlled system.

Blockchain technology is a decentralised, digital ledger that records transactions across a network of computers. It is the technology behind the popular cryptocurrency, Bitcoin, but its potential uses go far beyond just financial transactions. One of the key features of blockchain technology is its ability to enable secure and transparent transactions, without the need for a central intermediary.

In digital identity management, blockchain technology can be used to create a decentralised system, where users have complete control over their personal information and can prove their identities without relying on a central authority. This would allow for greater security and privacy, as personal information would be stored on the blockchain and protected by cryptographic techniques. Additionally, the use of blockchain technology would increase transparency, as all transactions and changes to personal information would be recorded on the blockchain, creating an auditable and immutable record.

OpenTimestamp and Digital Identity

The importance of OpenTimestamp in digital identity management cannot be overstated. OpenTimestamp is an open-source protocol that enables secure and verifiable time-stamping of data in the blockchain. This means that it can be used to create a tamper-proof record of a user’s digital identity, making it more difficult for others to manipulate or alter the data. This added security and trust will further contribute to the success and widespread adoption of blockchain-based digital identity management systems.

Decentralised Identity Management

A decentralised digital identity management system would allow for greater control over personal information, as users would be able to store and manage their own personal information, rather than relying on a central authority. This would also increase security, as personal information would be stored on the blockchain and protected by cryptographic techniques. Additionally, a decentralised system would be more resilient to data breaches and cyber attacks, as there would be no central point of failure.One of the key benefits of a decentralised digital identity management system is that it would allow for greater interoperability between different systems and platforms. This would enable users to prove their identities across a wide range of services, without the need to create multiple identities or share personal information with multiple organisations.

Self-Sovereign Identity

Another potential use of blockchain technology in digital identity management is the concept of self-sovereign identity. This would allow users to have complete control over their personal information and use it to prove their identities across a wide range of services. This would be done through the use of digital identity credentials, which are stored on the blockchain and can be used to prove identity without the need for a central intermediary. The use of blockchain technology in self-sovereign identity would also increase transparency and trust in the digital identity management system, as all transactions and changes to personal information would be recorded on the blockchain, creating an auditable and immutable record. This would help to prevent fraud and manipulation in the digital identity management system, and increase trust among users.

Conclusion

Blockchain technology has the potential to revolutionise digital identity management by creating a decentralised, secure, and user-controlled system. This would allow for greater control over personal information, increase security and privacy, and enable users to prove their identities across a wide range of services. While the technology is still in its early stages, the potential benefits of blockchain technology in digital identity management are clear, and it will be interesting to see how it develops in the coming years.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Uncovering the Widespread Adoption and the Advent of the Lightning Network in El Salvador and Lugano

Acknowledging the unprecedented potential of Bitcoin’s Lightning Network, El Salvador and Lugano are two of the most significant adopters of this remarkable technological breakthrough.

El Salvador & Lugano Propel the Bitcoin Adoption

As a cornerstone moment for the Bitcoin economy, a memorandum of understanding (MOU) was signed on 28 October 2022 between the nation of El Salvador and the city of Lugano in Switzerland. Moving forward, the goal of the MOU is to increase the use of Bitcoin not only in their respective areas but also in the states and nations that are nearby.

Overall, the anticipated aims of the partnership include bolstering cooperation in education and research for both El Salvador and Lugano, assisting initiatives to promote the adoption of Bitcoin and other digital tokens in their respective regions, and encouraging the exchange of students and talent between the two countries.

Exploring the Innovation Brought by the Lightning Network

So far, the scalability of the Blockchain has been a significant barrier to the widespread acceptance of cryptocurrencies from their inception. The Lightning Network’s second layer introduces a cutting-edge solution to this matter, as it intervenes by processing transactions outside the first-layer blockchain mainnet while retaining the mainnet’s robust decentralized security model. By bypassing the official Bitcoin blockchain, the Lightning Network can grow Bitcoin transactions per second (TPS), charge reduced fees, and allow new use cases like micropayments.

In addition, the Lightning Network has the potential to bring financial inclusion and freedom to the developing nations involved, in part because it is a trusted and private network that does not require the participation of third parties or intermediaries. Moreover, it could also lessen the likelihood of governments enacting policies restricting the free flow of capital. It also helps people who do not have access to bank accounts by facilitating transactions in a manner that is almost instantaneous and free of charge, thereby making Bitcoin usable not only as a means of payment but also as a means of exchange.

How Lugano is Leading Crypto Adoption in Europe

Lugano appears to have the same goal as El Salvador: to have all local businesses routinely accept cryptocurrencies as a form of payment. However, Lugano does not appear to have the same goal as El Salvador of making Bitcoin or any other cryptocurrency legal tender. Although Lugano does not hold such a position in Switzerland, the city of 70,000 people did launch its Plan B programme approximately seven months ago to increase the use of Bitcoin.

In March of 2022, Lugano announced that it would be implementing the Plan ₿ Initiative. Additionally, the technology company Polygon joined as a critical infrastructure partner. Plan ₿ Foundation, a partnership between the City of Lugano and Tether, the technology company behind the public blockchain that supports the largest stablecoin by market capitalization (USDT), has been announced today. This partnership will allow Bitcoin, Tether, and LVGA payments to be accepted in the city of Lugano.

Tether and the city of Lugano have collaborated to create a Plan ₿ aiming to increase the use of Bitcoin and stablecoins throughout the city. This, in turn, is expected to have a beneficial effect on all aspects of inhabitants’ everyday lives. As a result, the city’s financial system will be revolutionized faster than ever, thanks to the widespread use of Bitcoin.

El Salvador – the Pioneering Nation in the Cryptocurrency

In 2021, El Salvador was the first country to acknowledge Bitcoin as a legal tender. Through this avenue, El Salvador became a pioneer in demonstrating how technologies such as Bitcoin, decentralized ledgers, and peer-to-peer networks can accelerate financial literacy and inclusion

Furthermore, Latin America appears to follow El Salvador’s lead and powering Bitcoin mining farms with natural resources (such as energy generated by geothermal activity). Countries of Costa Rica in Central America and Paraguay in South America are also heading in this direction.

Bottom Line

Since most people in Europe are not yet familiar with this idea, a closer relationship between El Salvador and a nation located in Europe could usher in uncharted territory.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How Blockchain Is Changing Media and Entertainment Industry

When people talk about the entertainment industry and media, blockchain isn’t exactly the first thing that comes to their mind.

Wall Street and eCommerce are way ahead of the entertainment industry in terms of blockchain adoption, there’s growing evidence that things could change pretty soon. As more and more use cases for the technology emerge, major players in the industry are increasingly looking at blockchain as something that has the potential to resolve some pressing issues.

Warner Music Group, for example, has recently joined an $11 million investment round in Dapper Labs, a blockchain company seeking to create Flow, a rival to Ethereum. Already, the company is exploring a number of use cases for the cryptocurrency, including sales of digital merchandise with financial tokens.

The slow but sure progress of blockchain in the media and entertainment might be a sign that a breakthrough might be approaching. Currently, the technology is known to provide the following solutions.

Reduce the Dependence of Artists on Middlemen and Labels

The problem of middlemen is persistent and very well-known in the music industry. Even though it has come so far in terms of technology, it’s still in the same place when it comes to compensation distribution. The biggest losers in this situation are often the artists, who end up with a lack of opportunities to get sponsorship contracts with big-time labels.

The only viable option for an artist to minimize the dependence on managers and distribution services is streaming services. However, the compensation they get for the music is often inadequate, even for the well-known artists. Here are some examples (source: CNBC):

- Taylor Swift’s compensation for her famous song “Shake it Off” was between €240,000 and €335,000 even though it attracted more than 46 million streams

- 1 million plays on a streaming service like Shopify translates only about €6,000 in earnings for the artist

- 1 million plays on Pandora gets the artist less than €1,700.

All of this translates into between €0.004 and €0.007 of pay per play.

Blockchain can reduce artists’ dependence on labels and other middlemen because it’s not run by a central body but rather everyone on the network. This means that the financial transactions – compensation for songs, etc. – could be conducted without the involvement of the middlemen.

Secure Peer-to-Peer Sales

Contract distribution and payment for property in the entertainment industry can be a complicated thing. The biggest problem is the sheer amount of work involved in payment processing, making exclusive distribution agreements, providing licensing, and other things. On top of that, there’s high fees and a lack of control over the process for artists.

Many artists delegate these business administration responsibilities surrounding contacts, licensing, and payment to their agents. As a result, the artists are once again left with high losses because they simply cannot sell their work directly peer to peer.

A blockchain-powered marketplace for entertainment content is a solution here.

“Since blockchain is a distributed digital ledger system, it can enable almost complete automation of all business administration work surrounding payments, contracts, and licensing,” says Jason Rowe, a technology reporter. “The biggest benefit here, however, is the ability to enable artists to license their content directly to customers.”

WeMark is one example. It’s a distributed marketplace for stock photography that seeks to reduce the dominance of agencies like Getty Images and Shutterstock. According to WeMark’s white paper, these agencies now charge photographers up to 85 percent of the photos’ sale price, so the latter are left with a fraction of potential earnings.

Here’s how the WeMark platform works to provide artists with distribution agreements.

The solutions offered by blockchain-powered marketplaces like WeMark include:

- Reform of the super-centralized system for distributing digital content

- Artists license their content directly to users, keep all the rights and manage pricing

- More secure content distribution terms and fees with smart contracts that are programs that are unchangeable unless all the conditions are met

- More effective referral programs to assist artists to share their content and reach more customers.

Once blockchain marketplaces get more popularity among artists, chances are good they will prefer to use them instead of agencies like Getty Images. Each of the marketplaces will accept the most common cryptocurrencies as a payment method; moreover, as the costs of crypto mining gradually go down as blockchain gets more acceptance, chances are that artists will be willing to use cryptocurrencies for peer-to-peer sales.

Combat Piracy

The number of visits to media piracy sites in 2018 rose to 17.3 billion in the U.S. alone. With the volume of video-based traffic rapidly increasing around the world, online media piracy has skyrocketed; in fact, the television and film industry estimates about $52 billion in lost revenues by 2022.

Blockchain might be one of the solutions that will finally start to battle online privacy effectively. Its main promise, more comprehensive protection of digital assets, is perfectly aligned with the goal of combating pirates. For example, the technology can allow artists to transfer media files securely while having the complete visibility of the operation.

Another benefit of bitcoin is allowing it to catch pirates by identifying illegally obtained files. For example, if you’re a moviemaker looking to distribute a file to reviewers, you can use a blockchain-powered video distribution platform that embeds a special code, or a wallet, in every copy that gets distributed. The code remains in the file despite conversions or other processing operations.

If the file is leaked and found, then identifying the presence of the code, therefore, an illegally obtained file, becomes possible. The adoption of blockchain is still a problem, but it’s clear that the technology is on the way to become the future of the anti-piracy tactics (Warner is already investing in a blockchain company, remember?)

Blockchain: The Missing Link in the Entertainment Industry?

When people hear blockchain, they tend to think about Bitcoin. However, the technology stands to benefit many industries, including entertainment, and is already showing some good progress. The industry is highly centralized and there’s a great potential to increase earnings for people doing the creative work.

As the applications of blockchain become more common and the benefits visible, it’s possible that artists will be more willing to use the technology. However, the massive adoption is still yet to come, so stay tuned to blockchain news.

About the author: Jessica Fender is a content editor for TopWritersReview.com and a tech blogger. She is passionate about technology trends and finding new ways to help students improve their skills and become more successful.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How is Blockchain Technology Market Going to Rise at High CAGR of 38.4% Till 2025?

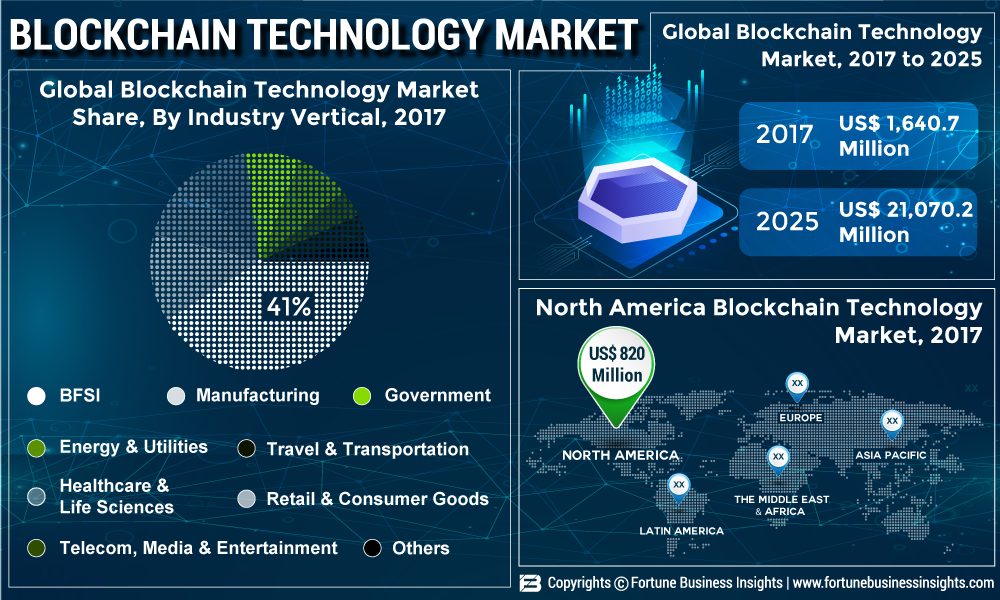

The global Blockchain Technology Market is forecast to rise exponentially in the coming years. The market is expected to witness high demand from diverse industries, especially the banking, financial services, and insurance (BFSI) industry.

In terms of industry vertical, the banking, financial services, and insurance segment held the leading share of 41% in global blockchain technology market in 2017. The segment will gain further impetus following introduction of bitcoin. “Rampantly increasing cyber-attacks and frauds in the BFSI industry accounts for millions of dollars. This has become a global concern. To make the technology used in the industry safer and more secure, Deloitte and Microsoft Azure and other tech giants are offering blockchain services,” said a lead analyst.

In terms of deployment, the proof of concept segment is gaining traction and is expected to witness impressive growth during the forecast period 2018-2025. Growth witnessed in this segment is backed by high need of transparent transaction across industries such as healthcare, retail and BFSI.

Increasing Demand for Secure Blockchain Technology to Guarantee Growth at Promising Rate

“Government initiated awareness programs regarding benefits of blockchain technology among undeveloped nations is anticipated to fuel the demand in the global blockchain technology market“, said a lead analyst at Fortune Business Insights.

Increasing adoption of e-financial services and rapid adoption of the blockchain technology in developed nations are expected to drive the global blockchain technology market during the forecast period.

Increasing number of new blockchain products and their approval grants is also anticipated to act as a driving factor for the global Blockchain technology market.

Partnerships Among Key Market Players and Blockchain Developers Driving the Market in North America

North America emerged dominant in the global blockchain technology market in 2017. The North America market was worth US$ 820 Mn in 2017. The region will continue leading the market at a global level through the forecast period. Growth witnessed in the market is also attributable to recent collaborations between market players in the U.S. and blockchain service provides. Europe is also anticipated to witness impressive growth during the forecast period owing to high presence of blockchain technology developers.

In 2017, IBM was the leading organization in the global Blockchain technology market. Other companies operating in the global market are Oracle Corporation, Deloitte, Microsoft Corporation, IBM Corporation, The Linux Foundation, Chain Inc., Consensus Systems, Bits, Inc (Tendermint, Inc.), Schvey, Inc. (Axoni), VironIT, Altoros, and Fintech & Blockchain Software House.

Source: https://www.fortunebusinessinsights.com/industry-reports/blockchain-technology-market-100072

Open your free digital wallet here to store your cryptocurrencies in a safe place.