The rapid advancement in the concepts such as- Blockchain and Bitcoin are gaining widespread popularity. Nowadays cryptocurrencies have become the talk of the town and the way its value increases, it grabs the attention of various people around.

Concept and importance of blockchain

Today most of the individuals who are working in the blockchain industry for the first time think this is the best career path they have chosen. There are several companies which have already begun to adopt the concept of blockchain technology. It is the most incorruptible digital ledger which is used for the economic transaction that you can also program to record.

The blockchain holds immense importance in a few manners which is why it is highly popular-

With so many advantages, there is no doubt that why taking a Blockchain Course, can be fruitful. Moreover here are the top 5 reasons for why earning blockchain is essential-

1 Good Futuristic Value- Over the past few years, blockchain investment has increased a lot, and it is certainly the best place to make sure career keeping future growth in mind. The blockchain’s productivity has slowly begun to unlock the flexibility of the business and also ensuring that the changing market dynamics are fully met, and the overall efficiency of business gets improved.

2. More ways to Explore- Being a huge sleeping giant, you can utilize blockchain technology as a platform to explore different ways. In order to ensure that various services are well secured and without any error, many engineers are trying to utilize this technology. It has certainly a big scope and various startups are already running with it.

3. Huge demand- As we are aware that the blockchain technology is an ever-increasing sector, and numerous opportunities are waiting for you. Cryptocurrency is one such application for the blockchain technology that is utilized by the startup organizations along with the various famous enterprises.

4.Good salary- As we already know that the demand for this option is very high, and you can expect good salary. As it is both improved and progressive technology, it is quite tough to get placed in here, but once you do there is absolutely no compromising with the salary.

Closing thoughts

Choosing a blockchain industry is certainly a good career path for any individual from any domain. However it is complex in its initial stages, but after a thorough understanding you will be able realize how rewarding it can be.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The cryptocurrency wave has destroyed the traditional schemes which used to regulate money and financial assets. Furthermore this new trending market has created great opportunities for participants, but it also carries significant risk.

Countries and government are trying to understand how they work and how they could be regulated in order to make this market safer. Generally we say “cryptocurrency”, but this market offers different kind of crypto which have been divided in coins, token security and token utility.

Government agencies made this division, but in some cases coins/tokens show several qualities which make labeling them difficult. In other cases, like in muslim countries, also religion can help make regulation and acceptance difficult.

This article was originally published on UpCounsel.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Living in a world of technology, where news through social media and live broadcasting is at our fingertips; it would be foolish to presume that the readers are oblivious of the word “cryptocurrency.”

All of us must have heard this word cryptocurrency on the media and if not there, then at dinner parties surely. But unfortunately, just knowing the word doesn’t mean you can interpret or pick what it is and how does it work.

No worriment, you are not all alone, despite the hype and press releases there is an overwhelming majority of people who have insufficient knowledge about cryptocurrency including bankers, finance dealers etc. Now let’s discover what the fuss is all about, reading the article will end up providing you the information more than most of the people.

Cryptocurrency a digital asset

“Cryptocurrency will do to banks what email did to the postal industry”

The comprehensible definition of cryptocurrency: “A cryptocurrency is a digital or virtual currency.” but why it is called “Crypto” currency because it uses cryptography for security.

Or it is a digital medium of exchange that uses encryption to secure the process involved in the transaction. The encoding process makes it impossible to counterfeit the cryptocurrency; therefore making the fund transfer safer between two parties.

You can easily find more than 800 digital currencies in the market and Bitcoin is just one of them. Need to mention it as many people think that cryptocurrency and Bitcoin is the same thing with two different names. Like cryptocurrency is a whole tree and Bitcoin is just a branch of it.

Although, Bitcoin is the world’s oldest and well-known cryptocurrency, like any other digital currency it is not regulated or backed by the government. Sir Richard Charles said, “There will be other currencies like it that may be far better, but in the meantime, there is a big industry around Bitcoin.”

You might have heard the words Etherium or Litecoin, just other names of Cryptocurrency. Moreover, the name, symbol, and the price of the cryptocurrencies can be different depending on its end goal. When bitcoin first arrived, they were intended to be a way for the world to break away from banks.

The use of cryptocurrency

Other than just an increase in value, many other reasons make it imperative for users to own it. It bestows the possibilities that no other currency allow. For example, the following

Conclusion

The market for cryptocurrency is rapid, vast and wild. Every day it takes a new twist and turns; the new currencies pop up, an old one dies, early adopters get rich, and investors suffer losses. But the fact is that people all over the world are buying cryptocurrencies, investing in it as they are sure that cryptocurrency is here to stay and change the world and that’s an undeniable truth.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

After the success of the very first cryptocurrency, Bitcoin, many investors are now looking for the next big opportunity to invest in. Bitcoin opened the market for more cryptocurrencies and newest blockchain technologies to develop and grow. Nowadays, Bitcoin has seen better days, while there are over a thousand different digital currencies on the market. That being said, Ethereum is taking the lead on the market with their cryptocurrency called Ether and their newest blockchain technology development and implementation.

However, investors can’t sit and wait for years until a new company with their innovative idea starts to grow on the market. Instead, they are trying to predict the next important opportunity and invest in the initial coin offering (ICO) behind that opportunity. That way, they don’t only get to be the first to support the next revolutionizing cryptocurrency, but they also get to earn a considerable return on investment. Still, that’s easier said than done, due to the market’s volatility and unpredictability. Therefore, here are a few things to consider before investing in ICO in 2018.

Initial coin offering, or ICO, is a way for companies to attract investors by offering their cryptocurrency tokens in exchange for support and funding. Simply put, it’s a fundraising method for companies to finance their new projects, by offering their tokens in exchange against other cryptocurrencies, such as Ether and Bitcoin. ICO are also similar to initial public offerings otherwise known as IPOs.

Companies sell their stocks to the public, in order for their shares to be traded on the stock exchange market. However, IPOs offer stock to the public with a security exchange, whereas ICOs are still unregulated and there are no procedures that can validate a company’s or their token’s credibility. That’s why it’s important to take your time to plan out your investments and consider your options carefully.

Before you decide to invest in any ICOs, you have to conduct thorough research first. As mentioned before, ICOs are highly unregulated so far, which means that a bad call can cost you your entire investment. The popularity of the digital currency market has made it possible for various companies to promote their own projects and their unique cryptocurrencies. This trend has led to over a dozen ICOs being offered each day.

However, not all companies have their own blockchain technology like Ethereum. As a matter of fact, many new projects are based on existing blockchain technologies. This makes it difficult for investors to spot out good projects with the potential for considerable ROI. That’s why you must plan your investment and research the ICOs available on the market. For instance, you can check out reliable sources, such as The Blockchain Review, which can offer the latest information about the current ICOs on the market and their overall performance.

After you’ve found a company with an ICO worthy of investing, you should take time to read their whitepaper. The main reason is that many companies haven’t even started their project yet and their whitepaper is the only thing that describes the company and their undertaking. The company itself

might appear interesting enough to invest in, but you must be sure that it’s not, in fact, a scam. That’s why you should take your time to read their whitepaper thoroughly. The better you understand the company and their goals, the more you’ll know about whether to invest or not.

The key points you should be on a lookout for are company’s description and main information, the problem they wish to approach with their project and the solution they offer for that particular problem. Also, make sure you check out their product description and how they plan to implement, as well as commercialize, their tokens. What’s more, you need to keep an eye out for their token value and its distribution, as well as how their tokens differentiate from others on the market. Most importantly, check out their legality and how they use the funds obtained from their ICO.

Doing your research and reading whitepapers is only the beginning. You have to be absolutely certain that the company you’re about to support with your investment is worth it and that you’ll actually profit from your investment. That’s why you need to learn as much as you can about the company you’re about to deal with. For starters, check out their website. You must evaluate every aspect ranging from the website design and security all the way to information a company has available on their website.

In addition, check their online activity and their presence, in order to determine how much effort a company is placing in promoting themselves. Moreover, check out their partners. That will give you insight into which system is a company using, as well as which electronic platforms they are partnered with. Checking out the legitimacy and credibility of a company demands time and effort. However, it will help you minimize the economic risks and ensure your investment is not in vain.

Investing in ICO can prove to be a lucrative strategy for investors. There are various ICOs on the market, but not every one of them has the potential to be the next big cryptocurrency. That’s why it’s important to do your research well and take time to consider all the important factors before you make an important decision.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

For people who have traced the movements of Bitcoin since its inception, it’s hard to believe that it has only been around for less than a decade. As discussed here on HolyTransaction, the world’s first cryptocurrency has had a wild ride so far, from the downright bizarre (two pizzas for 10,000 BTC) to the extremely exciting. As of the start of the year, Bitcoin’s market cap was valued at $280 billion (€226 billion), with cryptocurrency like Ethereum following at impressive valuations of $90.4 billion (€73 billion).

These figures make investing in cryptocurrencies incredibly tempting, but also quite daunting. With such a young market, there aren’t a lot of set rules or trends that can help guide you on your investment journey. This is where looking at similar trading commodities like gold and other precious metals come in. After all, FXCM explains that gold trading is simultaneously one of the oldest and most exciting ways to invest in global markets, and this remains true whether in times of war and turmoil or peace and prosperity. With the right focus and lots of discipline, there’s plenty of wisdom to be uncovered from looking at the history of gold trading.

Whether you’re a beginner looking to dip your toes into the cryptocurrency pool or an experienced trader hoping to build your wisdom in Bitcoin investing, here are five golden lessons for today’s cryptocurrency investors.

Diversify, diversify, diversify!

This tip seems basic, but focusing on a single trading commodity remains one of the most common mistakes investors make. A conservative position in gold investing means a maximum of 10% gold in your portfolio, and this is something that you can keep in mind when investing in cryptocurrencies. This can not only protect you from unexpected Bitcoin price dips, but can also open up better growth opportunities with lower risks and good returns. From the over 1,300 different cryptocurrencies in existence, This is Money recommends looking into altcoins like Litecoin, Monero, and Dash this 2018.

Stay calm in the face of volatility.

Gold can easily swing by a hundred pips and reverse every few minutes, which means trading in gold requires a certain degree of thick skin and steel-like determination. These are also very handy when trading cryptocurrencies, which are infamous for their volatility. In crypto-speak, be ready to “HODL”, or hold on for dear life (your coins), even when everyone else is panicking.

Set a loss limit.

Be sure to set acceptable loss limits for your investments and avoid buying too much. Financial Times reports that even a trusty commodity like gold has its own set of risks, which means it’s healthy to set stops for each individual trade for a maximum allowable loss that you are comfortable with. Invest only what you can stand to lose, and keep evaluating your trading strategies to learn which cryptocurrencies are best suited for you.

Keep your eyes on the prize.

Whatever your feelings are about shiny yellow metals or blockchain-enabled digital currencies, Forbes claims that these are still commodities that can be sold when prices are high and bought when prices are low. Focus on market trends and see where the prices are heading, and use these to inform your decisions. Pay attention to cycles, growth patterns, and market potential to make decisions, instead of which cryptocurrencies everyone else is buying.

Security and safety is a must.

Last but not least, invest only on trusted trading platforms and certified services. Millions of people have been victimised by gold-related scams and fraudulent brokers over the years, and it’s important to carry the same level of vigilance when carrying out cryptocurrency wallet transactions. Keep your money and investments safe with your free digital wallet here at HolyTransaction.

Do you have any other tips for cryptocurrency trading? Let us know in the comments below!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

When ideas and community purpose matter more than the last fin-tech innovation.

Dogecoin is a cryptocurrency, a form of digital money that like bitcoin, enables peer-to-peer transactions across a decentralized network.

If you’ve spent any time on the internet during the last decade, you shall have heard of the Doge meme: the iconic Shibe, barking comic sans quote like, “so scare,” “much noble,” “wow.”

At the peak of the meme’s popularity near the tail end of 2013, Palmer, an Australian marketer for one of the world’s largest tech companies, made a joke combining two of the internet’s most talked-about topics: cryptocurrency and Doge.

It was a joke taking aim at the bizarre world of crypto and at the recent coin-naming hype.

“Investing in Dogecoin,” Palmer tweeted, “pretty sure it’s the next big thing.”

And the tweet got a lot of attention.

So the joke became a true play.

He bought the Dogecoin.com domain and uploaded a photoshopped Shibe on a coin. Adding a note on the site: If you want to make Dogecoin a reality, get in touch.

And this is just the tip. So, If you are interested in knowing the greatest detail of Dogecoin history, we bet you’ll like this article by Alex Moskov published at CoinCentral.com

Open your free digital wallet here to store your cryptocurrencies in a safe place.

When it comes to cryptocurrencies, one name stands out from the rest: Bitcoin. Bitcoin is the gold standard upon which all the other cryptocurrencies, cumulatively known as altcoins, are evaluated. And that’s rightly so because Bitcoin is the most popular, the biggest in terms of market capitalization and so far, the one most likely to break into mainstream use. But among the contenders for the throne, one cryptocurrency that closely resembles Bitcoin and the earliest altcoin is Litecoin. It was created primarily to be a “lighter” version of Bitcoin. In fact, many people refer to it as ‘silver’ to Bitcoin’s ‘gold’.

Why is that the case? An attempt to answer brings us to the issue of Bitcoin vs. Litecoin, exactly what we are trying to explore here. Let’s point out the similarities as well as explain the differences between these two cryptocurrencies.

A brief history

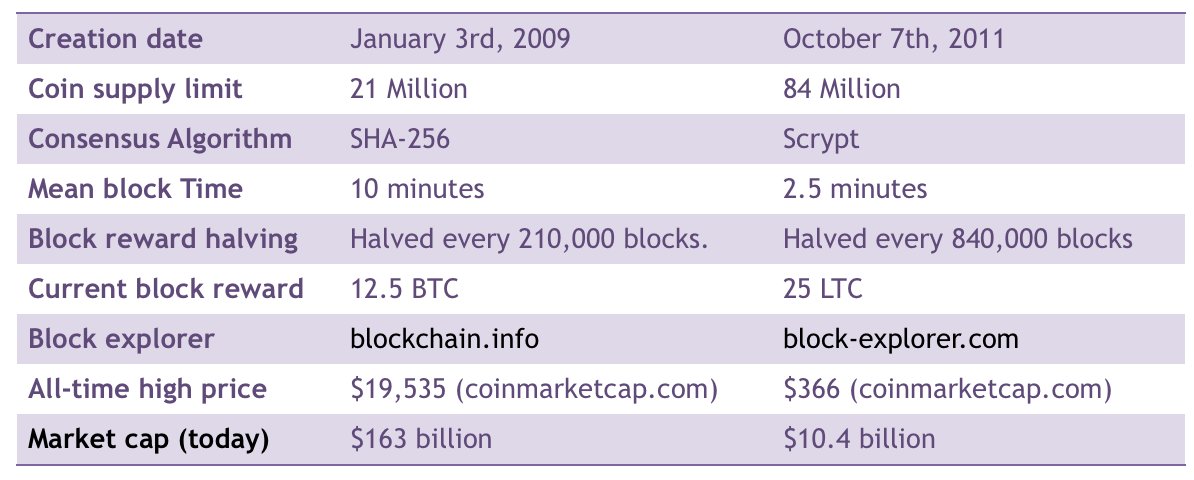

Bitcoin was created by Satoshi Nakamoto who released the Bitcoin whitepaper in 2008, before Bitcoin Core was launched on 3rd January 2009. On the other hand, Litecoin was created by Charles Lee and released on October 7th, 2011.

Price and Market capitalization

Whereas Bitcoin and Litecoin share a lot in terms of their blockchain protocols, the same cannot be said about their prices and market valuation. We could say both are dependent on the market trends and user flexibilities, but the variation isn’t even close. Today, bitcoin commands the largest market share, dominating by 42% of the total market capitalization to stand at $163 billion. BTC trades at $9636 against the USD and was at its all-time high of $19,535 on Dec 17, 2017. Bitcoin has a current circulating supply of 16,914,275 BTC against a maximum supply of 21 million coins.

Litecoin, on the other hand, is ranked 5th on coinmarketcap.com with a market cap of $10.4 billion. Its price today is $187, though it climbed to an all-time high of $366 on 19 December 2017 when its market cap was also just shy of $20 billion. Incidentally, Litecoin on that day had a daily volume of an incredible $2.3 billion. The circulating supply of LTC is currently 55, 592,093 LTC with a maximum supply of 84 million LTC.

When compared in terms of Market capitalization and price valuation, Bitcoin is 10x bigger or more than Litecoin. The same applies to popularity and use. While they both function as a store of value and can be used to make payments for goods and services, Bitcoin is accepted by far more companies and individuals than Litecoin.

Coin supply and transaction speed

Bitcoin and Litecoin differ in terms of the maximum coin supply. While Bitcoin’s total supply is capped at 21 million coins, Litecoin will have a total of 84 million coins. Though they differ in this aspect, both coins are deflationary, and their coin trajectory may appear similar. Another similarity is that both coins are divisible into smaller parts that enable micro-payments for goods and services. The smallest Bitcoin part is called a “Satoshi”.

But the two coins do differ in relation to the amount of time it takes to generate a new block. Litecoin block generation is halved after every 840,000 blocks, which is four times more than bitcoin at 210,000 blocks. For Bitcoin, a new block is generated after approximately 10 minutes. However, Litecoin miners use about two and half minutes to generate a new block. This results in the variation of transaction speeds between the two coins.

Due to having a faster block time, Litecoin’s network is normally able to confirm transactions much faster than Bitcoin. For instance, it would take 10 minutes to confirm four transactions on the Litecoin network, whereas the same amount of time would be just enough to verify one block of transactions on the Bitcoin network. Bitcoin has been implementing changes to its protocol to scale better and increase transaction speed.

It is expected that Lightning Network will make Bitcoin faster. However, Litecoin will look to implement the same protocol as it often times, does with every Bitcoin update.

Mining algorithms

Mining is a very vital component of cryptocurrency, precisely those that use the proof of work mining consensus mechanism. What we said earlier about block generation essentially amounts to the concept of mining. Basically, mining refers to the addition of new blocks to the main chain on the network to form a “blockchain”. Cryptocurrencies utilize different cryptographic algorithms to secure transactions on the blockchain. Bitcoin uses the SHA-256 algorithm that allows for the use of ASICs (Application Specific Integrated Circuits) for mining.

This hardware equipment came to replace the GPU and FPGA miners. Bitcoin mining is a complex activity but can be summarized as the solving of computational math problems to verify and secure a new block to the blockchain. Bitcoin miners (nodes) get rewarded 12.5 Bitcoins for every new block. One criticism leveled at bitcoin mining is that the process consumes a lot of energy resulting in massive electricity bills.

Mining is also an important aspect of Litecoin. Scrypt is the mining algorithm used on the Litecoin network. The Scrypt algorithm is designed to be resistant to customized ASIC miners due to its memory-hard nature. This makes mining Litecoin a lot easier as you can do it using a CPU or GPU. however, there are concerns that Litecoin’s CPU/GPU mining days may be soon over as ASIC miners targeting the Scrypt algorithm have been developed by companies like Zeus and Flower Technology. While miners on the Bitcoin platform get rewarded 12.5 BTC for every new block, Litecoin miners get 25 LTC for every new block validly added to the blockchain. It should be noted that mining Litecoin is relatively cheaper than bitcoin, but Bitcoin could be more profitable for those with the right equipment.

Conclusion

Bitcoin and Litecoin share a lot in common when it comes to the functional aspect of being stores of value. However, Bitcoin beats Litecoin on numerous fronts, specifically on price valuation and market adoption. Naturally, bitcoin would be an attractive coin for investment, but if you are looking for an affordable crypto with the potential to grow then Litecoin could be it.

This Article was provided by our friend Ronni Martelli

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin can rightly be called the “star” of the past year, since its price rise attracted the world attention to the cryptocurrency market, which becomes inexorably popular from day to day. Questions about how to become a member of the crypto community and earn from it provoked the creation of Telegram channels about cryptocurrencies, which provide users with all the information they are interested in the real-time mode.

And the lack of monetization of the application makes it attractive for both individual participants and large projects – so much attractive that many decentralized projects, digital publishers houses and even exchanges use the messenger and create the full-fledged platforms for communication and advertising. There are even whole groups of “whales” – the owners of large states in the cryptocurrency. Such public accounts can have up to 30 000 – 40 000 active users. The most famous have the talking name – Whale Club and Coin Farm. Here you can meet those who bought bitcoin only for $ 1, and sold for $ 9,000.

There are some channels, sending signals, related to the growth of exchange rates, to subscribers. At the same time, the monetization of such communities is quite successful. So, the price of joining a closed paid channel can reach $ 5,000. Many users are willing to pay such amounts, because they are sure: with one signal it is possible to multiply your asset by up to 10 times. You can be part of a speculative market, but it’s much more effective to create it yourself. This is the opinion of the pump groups subscribers, whose goal is to repeatedly increase the price of a particular currency by making a group exchange purchase by using the strategy of increasing. The final sale price is usually announced in advance and exceeds the purchase price by at least 2 times. For example, in the leading Russian-language pump channel Big Russian PUMP no less than + 200% increase is promised. Further, after the agreed sale, the rate may return to the original values. On such jumps in the token price it is easy to understand whether a coin was pumped or it’s a question of growth against the background of natural demand.

Which messenger still can boast of having the games-bots? Of course, there is no sense to expect a wow effect from them, but they can help to spent some time while transit.

Well, finally, no hype is done without memes, especially when it comes to millions of dollars. If you know the crypto market for a long time, then, for sure, you are familiar with the phrase “When moon?”, which means waiting for the coin to grow. We have collected the top 5 phrases and memes, which any self-respecting crypto trader should know:

1st place – To the moon

The growth of each single coin on crypto market is accompanied with the image of a rocket flying to the moon. Originally for bitcoin, the “cosmic” growth was a figure of $ 1000, then it reached 2000, and now, to fly to the moon, it must overcome the barrier of $ 50,000. In general, for altcoins this distance is much less.

2nd place – When lambo?

Along with cosmic symbolism, the sign of the crypto trader’ success is Lamborghini, or, as it was fixed in the community, “lambo”. Why is this car, and not Ferrari or Tesla, is unknown. But you can always count how many coins you need to buy this sport car. For example, according to https://crypto-to-lambo.com/, the bitcoin owner will need only 36 coins.

3 place – Just HODL

Being just some typos, the word hodl (instead of hold – hold), actively spread in the cryptocurrency community’ circles. However, later, it acquired its own meaning: «HODL», Hold on for dear life

4th place – Mr Trader

Judging by the diversity of this set of stickers, the popular Mr. Trader went through all the charms of crypto market.

5th place – Cryptolamb

When it comes to the falling market, no one wants to be known as a “cryptolamb”. This slang characterizes an inexperienced trader who buys the currency at the last stages of growth, often during the pump, without discouraging initial costs.

And, at last, we will be honest, Telegram gives only those mailings on which the user is subscribed. There is no place to spam. The only weighty drawback is the number of channels in the phone of the cryptocurrency community member, which quickly grows to a very significant one, making it difficult to use the messenger for its intended purpose and turning it into a clogged news line.

This Article was provided by our friend Christopher Owen

Open your free digital wallet here to store your cryptocurrencies in a safe place.