Today we come back to talk about ICO, Initial Coin Offering.

As we mentioned in our previous article here , an ICO is a way for companies to attract investors by offering their cryptocurrency tokens in exchange for support and funding. ICO are also similar to initial public offerings otherwise known as IPOs.

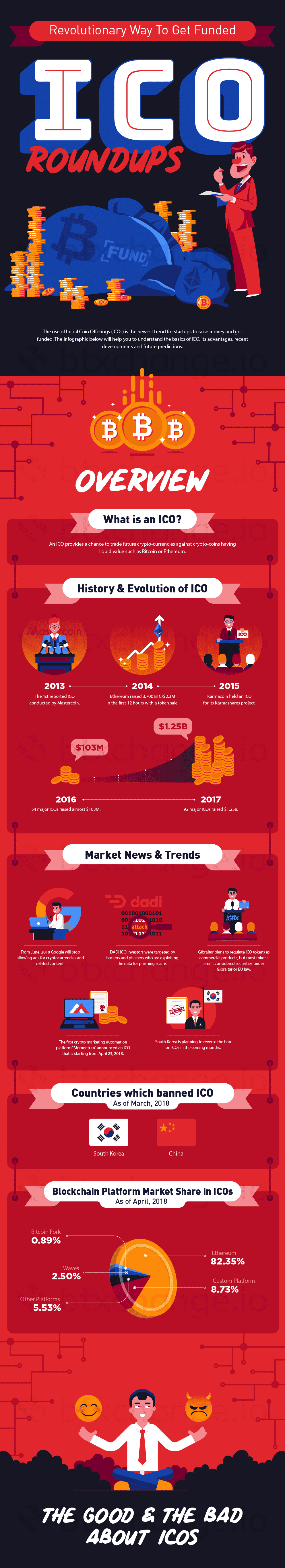

Despite being just a couple of years old, ICOs have managed to attract a lot of attention. It seems that in the past few months every news outlet had something to say about them, both good and bad. To avoid future confusion and to help our readers, here at HolyTransaction we decided to publish this amazing infographic by Btxchange which will support you to understand the basics of ICO, its advantages, recent developments and future predictions.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

After the success of the very first cryptocurrency, Bitcoin, many investors are now looking for the next big opportunity to invest in. Bitcoin opened the market for more cryptocurrencies and newest blockchain technologies to develop and grow. Nowadays, Bitcoin has seen better days, while there are over a thousand different digital currencies on the market. That being said, Ethereum is taking the lead on the market with their cryptocurrency called Ether and their newest blockchain technology development and implementation.

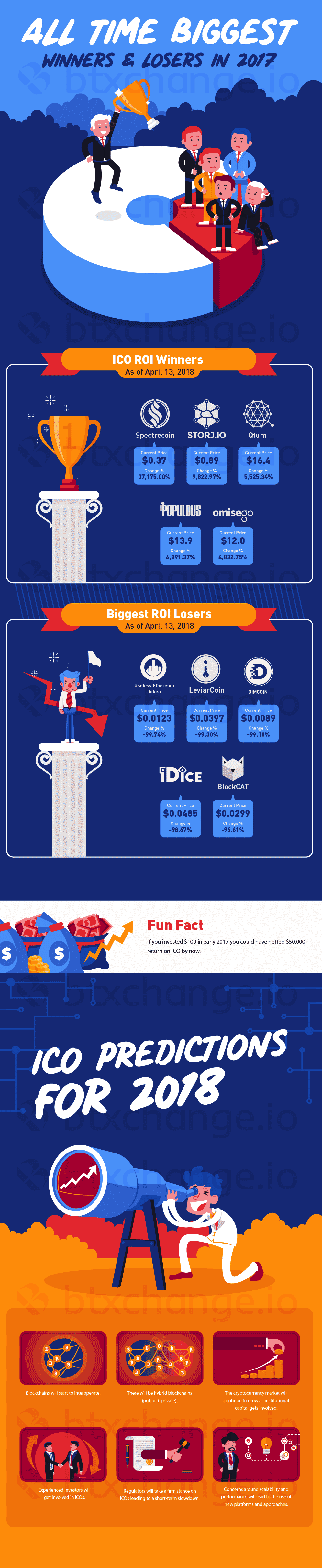

However, investors can’t sit and wait for years until a new company with their innovative idea starts to grow on the market. Instead, they are trying to predict the next important opportunity and invest in the initial coin offering (ICO) behind that opportunity. That way, they don’t only get to be the first to support the next revolutionizing cryptocurrency, but they also get to earn a considerable return on investment. Still, that’s easier said than done, due to the market’s volatility and unpredictability. Therefore, here are a few things to consider before investing in ICO in 2018.

Initial coin offering, or ICO, is a way for companies to attract investors by offering their cryptocurrency tokens in exchange for support and funding. Simply put, it’s a fundraising method for companies to finance their new projects, by offering their tokens in exchange against other cryptocurrencies, such as Ether and Bitcoin. ICO are also similar to initial public offerings otherwise known as IPOs.

Companies sell their stocks to the public, in order for their shares to be traded on the stock exchange market. However, IPOs offer stock to the public with a security exchange, whereas ICOs are still unregulated and there are no procedures that can validate a company’s or their token’s credibility. That’s why it’s important to take your time to plan out your investments and consider your options carefully.

Before you decide to invest in any ICOs, you have to conduct thorough research first. As mentioned before, ICOs are highly unregulated so far, which means that a bad call can cost you your entire investment. The popularity of the digital currency market has made it possible for various companies to promote their own projects and their unique cryptocurrencies. This trend has led to over a dozen ICOs being offered each day.

However, not all companies have their own blockchain technology like Ethereum. As a matter of fact, many new projects are based on existing blockchain technologies. This makes it difficult for investors to spot out good projects with the potential for considerable ROI. That’s why you must plan your investment and research the ICOs available on the market. For instance, you can check out reliable sources, such as The Blockchain Review, which can offer the latest information about the current ICOs on the market and their overall performance.

After you’ve found a company with an ICO worthy of investing, you should take time to read their whitepaper. The main reason is that many companies haven’t even started their project yet and their whitepaper is the only thing that describes the company and their undertaking. The company itself

might appear interesting enough to invest in, but you must be sure that it’s not, in fact, a scam. That’s why you should take your time to read their whitepaper thoroughly. The better you understand the company and their goals, the more you’ll know about whether to invest or not.

The key points you should be on a lookout for are company’s description and main information, the problem they wish to approach with their project and the solution they offer for that particular problem. Also, make sure you check out their product description and how they plan to implement, as well as commercialize, their tokens. What’s more, you need to keep an eye out for their token value and its distribution, as well as how their tokens differentiate from others on the market. Most importantly, check out their legality and how they use the funds obtained from their ICO.

Doing your research and reading whitepapers is only the beginning. You have to be absolutely certain that the company you’re about to support with your investment is worth it and that you’ll actually profit from your investment. That’s why you need to learn as much as you can about the company you’re about to deal with. For starters, check out their website. You must evaluate every aspect ranging from the website design and security all the way to information a company has available on their website.

In addition, check their online activity and their presence, in order to determine how much effort a company is placing in promoting themselves. Moreover, check out their partners. That will give you insight into which system is a company using, as well as which electronic platforms they are partnered with. Checking out the legitimacy and credibility of a company demands time and effort. However, it will help you minimize the economic risks and ensure your investment is not in vain.

Investing in ICO can prove to be a lucrative strategy for investors. There are various ICOs on the market, but not every one of them has the potential to be the next big cryptocurrency. That’s why it’s important to do your research well and take time to consider all the important factors before you make an important decision.

Open your free digital wallet here to store your cryptocurrencies in a safe place.