Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

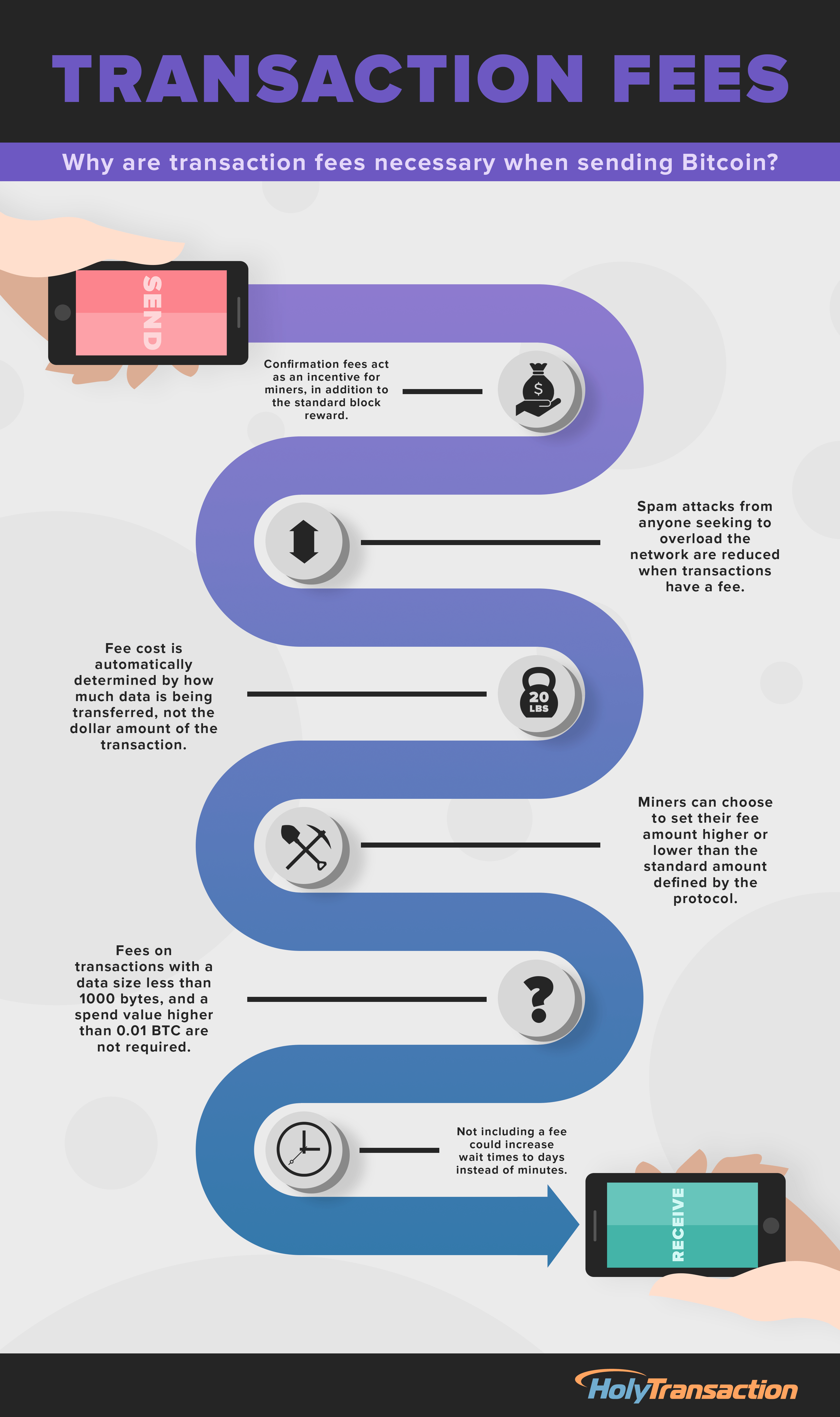

Why are transaction fees necessary when sending Bitcoin?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

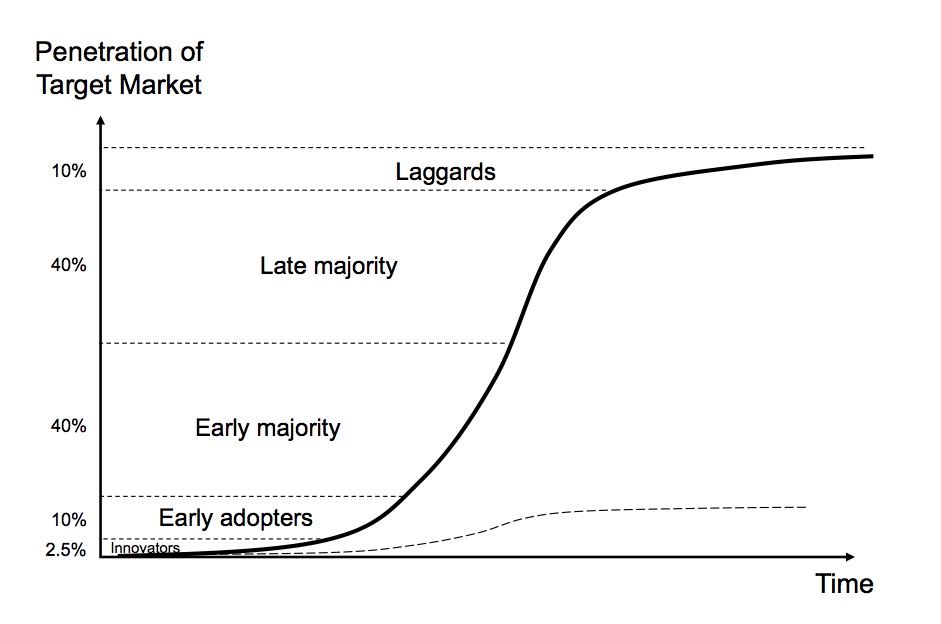

Products and services that are first-to-market often take such a battering that they lose out to competitors with copycat products. Business history is littered with wildly successful products with ultimately spectacular collapses because they lost out to competitors that found a better way of doing things – things they learned at the trailblazer’s expense.

The Sony Betamax is the poster child for products that created a market and lost out to a rival – in this case VHS. Sony created a market for recording TV, but because the tapes where an hour long VHS grabbed the movie rental market.

More recently, Friendster was the first social network to explode, with millions of users in the first 3 months. But it couldn’t manage its growth and lost out to MySpace and of course Facebook.

There are many more examples. Some lost slowly, like the Atari 2600 game console, and some crashed spectacularly like Rio MP3 player. Palm lost to Apple, Netscape to Internet Explorer, WebCrawler to Google, Tivo to the cable companies, and on and on.

So far Bitcoin is an exception to this model. And though it’s been battered by ruinous headlines, including one just this week where the World Bank is calling it a naturally occurring Ponzi scheme, Bitcoin remains resilient.

Kaushik Basu, World Bank economist and author of ‘Ponzis: The Science and Mystique of a Class of Financial Frauds’ argues that most Ponzis today are not always obvious and that today’s Ponzi schemes often don’t have a puppet-master pulling the strings. Bitcoin, he says, is just such a Ponzi. The speculation on the currency raises the demand for Bitcoin making it a bubble.

Bitcoin has hundreds of competitors all built on the Bitcoin model. A handful are gaining some success, like Litecoin which is currently trading at $9, and Darkcoin (I’m not kidding) which is trading now trading at $7.50.

Darkcoin was built to cover perceived flaws in Bitcoin’s anonymity. One reason for the early success of Bitcoin was that it was as anonymous as passing dollars on the street. And while there is a far greater level of anonymity with this electronic transaction than making a purchase with a credit card or PayPal, Bitcoin is not anonymous to those forces who really want to know.

Unlike Bitcoin, Dash mixes up users’ transactions so that it’s nearly impossible to trace a payment to a person. But the promise of Dash’s privacy features solves a problem for only a small subset of Bitcoin users.

Few have heard of other crypto-currencies. If people barely understand Bitcoin, then any competitor has the impossible task of differentiating itself.

In his paper Basu mentioned Bitcoin by name, so did the IRS when it said it was a taxable asset. And this week Benjamin M. Lawsky, the superintendent of financial services for the State of New York, proposed regulations to create a “BitLicense” to include rules on consumer protection, the prevention of money laundering and cybersecurity. That’s akin to Apple successfully rebranding the MP3 to a podcast.

Just search “20 USD in BTC” on Google and you’ll get the exchange rate. It works for any fiat currency. You can’t do that with any other crypto-currency.

Bitcoin is currently trading at $600. Not bad for a five year old Ponzi scheme.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The consumer financial services company based in North Palm Beach, Florida, Bankrate, predicts that within three years, ATMs in all major cities will accepting digital currencies such as bitcoin.

The report, which assesses the future functionalities likely to be provided by the ATMs of tomorrow, focuses on how mobile payment solutions will play a significant role in terms of the next generation of banking.

With ATMs becoming increasingly flexible when its comes to meeting the needs of customers, Senior Vice President Tom Ormseth of the Chicago-based bank holding company Wintrust Financial says that “banks now need to think like Google, they’ve got to quit being slow adopters.”

The emergence of cardless ATMs, for instance, which are starting to pop-up in major cities throughout the world thanks to the Chicago-based Wintrust Financial group, allow customers to withdrawal cash through your phone without the need for a physical debit card.

Working much like the emerging bitcoin ATMs, you simply request a withdrawal, then within eight seconds, your money is there waiting for you at your local ATM.

THE DIGITAL DIVIDE

According to Frank Natoli, chief innovation officer at Diebold, the banking industry, once seen as a conservative sector is quickly moving ahead. He further predicts, that thanks to the emergence of mobile banking alternatives, using your smartphone to transact will become even more seamless.

Acording to Natoli:

“Within three years, ATMs in major cities also will accept alternative currencies like bitcoin […] a digital currency that exists only in cyberspace, [that] already is starting to get its own ATMs worldwide. And mobile transactions are more appealing to bitcoin users.”

As the senior analyst at Aite Group, David Albertazzi explains, “it’s about rethinking and redefining the branch network.”

What will the ATMs of tomorrow look like? According to Clouse — cashless.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

That’s not the only infographics that the people over at Visual Capitalist have made regarding the subject of Bitcoin. Back in February of this year Visual Capitalist released an infographic entitled, “The Definitive History of Bitcoin” which explores the history of Bitcoin ranging from; the Bitcoin design paper by Satoshi Nakamoto that was published back in October of 2008, the first real transaction with bitcoins, the rise and downfall of Mt.Gox, and ends in December when China announced they would not allow banks to handle bitcoins.

That’s not the only infographics that the people over at Visual Capitalist have made regarding the subject of Bitcoin. Back in February of this year Visual Capitalist released an infographic entitled, “The Definitive History of Bitcoin” which explores the history of Bitcoin ranging from; the Bitcoin design paper by Satoshi Nakamoto that was published back in October of 2008, the first real transaction with bitcoins, the rise and downfall of Mt.Gox, and ends in December when China announced they would not allow banks to handle bitcoins.Open your free digital wallet here to store your cryptocurrencies in a safe place.

(CoinDesk) Like any new industry, there are so many areas to explore in the bitcoin space that sometimes make a week’s worth of developmentsit feel like a month or two have gone by.

1. Big-name retailers jumping on board

2. A warming regulatory climate

3. VC firms keep betting big

4. Building on the block chain

5. New emphasis on transparency

Open your free digital wallet here to store your cryptocurrencies in a safe place.