“Alternative blockchain transports are critical to the success and survivability of the Bitcoin system.”

Bitcoin core developer – Greg Maxwell

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

At the end of April, mining hardware manufacturing company started shipping a whole stack of their products. It was the same time when the Litecoin hashrate was somewhere around 173,225 MH/s. The increasing exposure of Scrypt ASICs mining machines further influences other manufactures as well. In just two months since April, the Litecoin hashrate went up to 200$, while its mining difficulty also tripled.

The next Scrypt ASICs to hit the market will have the hashing power between 200 and 400 MH/s; indicating the possible surge in Litecoin mining difficulty and network hashrate as well. Some companies are also building hardware that can sustain hashing power up to 650 MH/s. As many believes, these events will somewhat impact the Litecoin standings in the market. The question however is, in which way?

The Litecoin community seems to have divided on this question. There is a section which believes that the increasing hashrate will have a fruitful impact on Litecoin prices, citing Bitcoin as a key instance; while another section does not acknowledge any relation between the Litecoin prices and its hashrate.

Explanations are coming from both sides, each with a unique perspective. The ones that support the prediction of Litecoin’s escalation believe it to be the network’s strength that will multiply by over 1,000 times in future. It is the economics of scale in mining that will play a major role in boosting the Litecoin’s stand in the market.

On the other hand, there are those who do not support this theory even in thoughts. They outright rubbish the history that certifies increasing hashrate proportional to the coin’s market cap. Their logic dictates a scenario in which miners are faced with increased selling pressures in order to cover their investments on such expensive mining hardware. This aims at a lower demand and higher supply rate that will eventually cause a huge drop in Litecoin prices. They event say that the current imbalance of Litecoin market is caused by such selling pressures.

Considering both the sections, we believe that market conditions have changed a lot since the launch of new cryptocurrencies in the market. The reason why BTC did so well after the increased hashrate was it being used only for trading. Litecoin too cashed only because of the bubble fuelled by China. The moment these coins were introduced to the real merchant world, its basics changed completely. Seeing today’s scenario, Bitcoin is backed by multiple major organizations while Litecoin is still far away from reaching this point. In short, the continual acceptance of BTC over LTC thickens the latter chances to repeat history. Hashrate increased or decreased, it won’t hold any meaning until Litecoin grabs some major investments from big players.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

As Bitcoin’s first-mover momentum spreads the digital currency’s adoption, the “proof of work” model it uses to confirm transactions is coming under scrutiny within the crypto-community.

The proof of work algorithm rewards the individuals, called miners, who confirm blocks of transactions in exchange for an amount of the digital currency. Individual miners join pools to mine collectively as a group, increasing the computing power available to confirm Bitcoin transactions.

This model seems to benefit by encouraging a large number of participants, but it is vulnerable to what is called a 51% attack. A miner or pool that holds 51% of the total computing power could in theory control the blockchain, which is the public ledger of Bitcoin transactions. This control could enable double-spending bitcoins as well as blacklisting certain users or computing equipment. Until recently, the 51% attack was widely considered an unrealistic threat.

“The proof of work algorithm is robust and has been resilient in the face of continuous attacks for the past five years,” says Andreas Antonopoulos, a technologist and entrepreneur who is active in the Bitcoin community. But a mining pool called Ghash.io gave the community a scare when it took over 51% of the network for 12 hours on June 13.

If a pool used its control for nefarious purposes it would only hurt Bitcoin’s use and, in turn, its price. This result would hurt any miners who become attackers, since they are rewarded for their mining efforts in Bitcoin and likely hold a generous amount of the digital currency. Since the incident, Ghash control has decreased substantially, hovering now at around 35%.

“Certainly miners didn’t sign up for unfair play and they would abandon that pool,” lowering the percentage of its control, Antonopoulos says. The 51% attack “is a theoretical attack that’s narrow in scope and goes against the incentives for the miners and owners of the pool.“

Last year, Ghash said it would try to prevent itself from capturing 51% of the network power and that it would not do any damage even if it did reach this level of control. And since the power is split over the many individuals who mine in the Ghash pool, it’s unlikely the pool could reach a consensus among its members to damage the network.

Nevertheless, some in the Bitcoin community are calling for a splintering, or “fork,” in the Bitcoin blockchain, and the forked version of Bitcoin would add features that discourage pooled mining. Others are talking about the benefits of a “proof of stake” algorithm, which secures cryptocurrency networks by asking users to show ownership of a certain amount of the currency.

BlackCoin is an alternative digital currency that uses a pure proof of stake model. It was created about five months ago and has generated enough support to be integrated into CoinKite’s merchant point of sale system.

“A user chooses to ‘stake’ his coins to generate the next block in the chain, and his chance of doing so is proportional to the weight of his own coins,” says Adam Kryskow, U.S. representative for the BlackCoin Foundation.

Proof-of-stake algorithms enable faster payments. BlackCoin transactions confirm in under a minute, whereas Bitcoin transactions usually take about 10 minutes. And proof of stake is also more eco-friendly, consuming far less energy than proof of work algorithms.

|

| Image: Peercointalk.org |

Peercoin is one of the most recognized altcoins that uses a hybrid proof of stake/proof of work model. New coins are awarded to miners who do work to authenticate transactions, but are also given to users who hold a higher stake in the system.

“The current proof of work system that is in place incentivizes centralization,” says Kryskow. “Specifically as mining payouts decrease, small mining operations will be forced to close up shop. With little to no incentive to continue mining, network power will fall dangerously low and security will be severely threatened.“

But proof of stake has its own vulnerabilities. Kryskow admits that since proof of stake algorithms are not completely decentralized, they are susceptible to a “nothing at stake” attack, where older coins could be used to fork the blockchain to create a competing one.

The proof of stake model hasn’t been stress-tested enough over a long period of time, and it worries Antonopoulos when proponents argue that the nascent mining algorithm is better than Bitcoin’s proof of work.

Bitcoin has survived a number of attacks over the years, says Antonopoulos. “There is much better monitoring and tracking [of the network]…a lot of DDoS protections and countermeasures built into the core client because of Bitcoin‘s experience with widespread attacks over the years,” he says.

Proof of stake was created in 2011 with the launch of Peercoin. “It was attacked and beaten; bugs were found, security issues were rampant and countless vulnerabilities were exposed,” Kryskow says. That’s when Peercoin moved to the hybrid proof of stake/proof of work model.

BlackCoin‘s developer argues that, like Bitcoin’s proof of work, proof of stake will be stress-tested in real-world use. BlackCoin “is a great proof of stake experiment,” Kryskow says.

Antonopoulos agrees that the development of new proof models is advantageous. “I don’t think we’ve found the perfect solution yet,” he says. “Everything comes with compromises…so you just have to identify which ones are the good compromises to make.” Other algorithms include “proof of burn,” in which a small portion of a cryptocurrency is destroyed to create value through scarcity; and “proof of resource,” which takes a resource, such as bandwidth, and assigns it a certain value for sharing.

“The real issue, though, is until we see a problem in Bitcoin that impacts the price, knowledge of Bitcoin is so much higher than [all other altcoins] that any other solution out there will be irrelevant,” says Tim Sloane, vice president of payments innovation at Mercator Advisory Group.

Sloane doesn’t expect everyone using the Bitcoin protocol to switch over to another digital currency just because there’s a threat

of disaster. But it may happen if a disaster actually strikes.

“As Bitcoin gets bigger and bigger, the problem gets bigger and bigger,” he says.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

“Instead of using hard-coded rules for what fees to pay,

the [new] code observes how long transactions are taking to confirm and

then uses that data to estimate the right fee to pay so the transaction

confirms quickly – or decides that the transaction has a high enough

priority to be sent for free but still confirm quickly.”

“The current situation is even worse for free,

high-priority transactions: the hard-coded ‘high-priority’ constant is

much too low, so transactions sent for free can take a very long time to

confirm.”

“I expect to see transaction fees rise until a good

solution for optimizing the propagation of blocks across the network is

deployed, because I expect transaction volume to increase and I don’t

think miners will include more transactions in their blocks until

somebody fixes the ‘bigger blocks take longer to broadcast’ problem.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Except … this approach to innovation clusters hasn’t really worked. Some have even dismissed

these government-driven efforts as “modern-day snake oil.” Yet

policymakers are always searching for the next Silicon Valley because of

the critical link between tech innovation, economic growth and social

opportunity.

Previous efforts at such clusters failed

for a variety of reasons, but one big reason is that government efforts

alone simply don’t draw people. That’s why a recent crop of experiments

has focused more on building entrepreneurial communities, urban hubs and districts, and hackerspaces. Still, we’re “splitting the logic” on how to create an innovation ecosystem, according to MIT expert Fiona Murray in Technology Review:

We’re either going top-down by focusing primarily on

infrastructure—plunking down an office park next to a university—or

bottom-up by focusing on just the networks. None of these efforts

successfully pursue both paths at once, with government, academia and

entrepreneurial communities proceeding together in lockstep—as was the

case in the development of Silicon Valley.

Imagine a Bitcoin Valley, for instance, where some country fully

legalizes cryptocurrencies for all financial functions. Or a Drone

Valley, where a particular region removes all legal barriers to flying

unmanned aerial vehicles locally. A Driverless Car Valley in a city that

allows experimentation with different autonomous car designs,

redesigned roadways and safety laws. A Stem Cell Valley. And so on.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

{

"txid": <a unique transaction identifier>

"inputs": <an array of inputs>

"outputs": <an array of outputs>

"tx_hex": <transaction content as a hexcode string>

"blockhash": <a unique block identifier this transaction belongs to>

"time": <the time this transaction's block was processed>

"confirmations": <number of blocks that confirmed this transaction>

}

Open your free digital wallet here to store your cryptocurrencies in a safe place.

(TimesOfIndia) At a time when the country has suffered devaluation of rupee against

dollar, inflation and fuel price volatility in exchange market, two

students of Fellow Programme in Management (FPM) at Indian Institute of

Management, Indore (IIM-I) have rekindled hopes to address the problems

through introduction of ‘Bit Coin’ currency system.

Bitcoin is

a crypto currency which currently has market capitalisation of $8.1

billion. The recognition is mainly because of its introduction during

financial crisis, when trust on government and policy makers was low. It

is an alternative to card networks and money transfer system.

Khadija Vakeel and Nitya Saxena of IIM-I in their study found out that

at a time, when the country is struggling to achieve a respectable

position on matters of financial inclusion, Bit Coin can be a game

changer.

Bitcoin can also lead to a new industry and challenge

for IT youths and can address the problem of brain drain. While

Singapore is pro bit coin, China stands against it. India is yet to take

a side. Users having Bit Coin can enter into virtual goods and services

exchange. The study states that inflation is simply a rise in prices

over a period of time, which is generally the result of the devaluation

of currency.

This is a function of supply and demand. Given the

fact that the supply of bit coins is fixed at a certain amount, unlike

fiat money, the only way for inflation to get out of control is for

demand to disappear.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Image Credit: screenmediadaily

CEO of Laureate Trust, Peter Tasca, explains:

“Whenever you have an instrument that trades over 300 million US dollars a day, it must be recognized; the digital currency works, bitcoin has greater volume transactions than Western Union and we anticipate it will overtake PayPal later this year.” According to Statistic Brain, PayPal processes just $315.3 million in transactions everyday, just slightly above the dollar amount of bitcoin’s daily transactions despite the digital currency still remaining at a relatively low percentage rate of consumer and merchant adoption.

The developer of the first biometrically protected bitcoin payment card, remains heavily leveraged in respect to bitcoin adoption; however, the company’s CEO, Chaya Hendrick, says that bitcoin’s sheer transaction volume will continue to rise at a staggering rate:

“In the next one or two years, Bitcoin can surpass the dollar transaction volumes of other established payment companies including Discover, and even American Express, MasterCard, and Visa.” While both Laureate and Hendrick see the number of bitcoin transactions climbing, Laureate, who currently manages a $5 billion hedge fund, predicts that along with increased volumes will come an increase in price, which he expects to be somewhere in the 50% range.

Meanwhile, SecondMarket CEO Barry Silbert, recently explained at the Core Club hosted forum in New York City that bitcoin currently remains in the “early majority” stage in which he refers to as the “venture capital stage”. However, the CEO and Bitcoin Investment Trust (BIT) founder says that “we’re probably just a few months away from Wall Street banks starting to trade bitcoin, starting to invest in bitcoin, and starting to create investment products for bitcoin.”

While bitcoin becomes an increasing threat to existing payment processors, in an interview with EcommerceBytes, CEO, John Donahoe, reffered to the digital currency as an exciting, new and emerging technology. “We think Bitcoin will play a very important role in the future. Exactly how that plays out, and how we can best take advantage of it and enable it with PayPal, that’s something we’re actively considering. It’s on our radar screen,” he said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

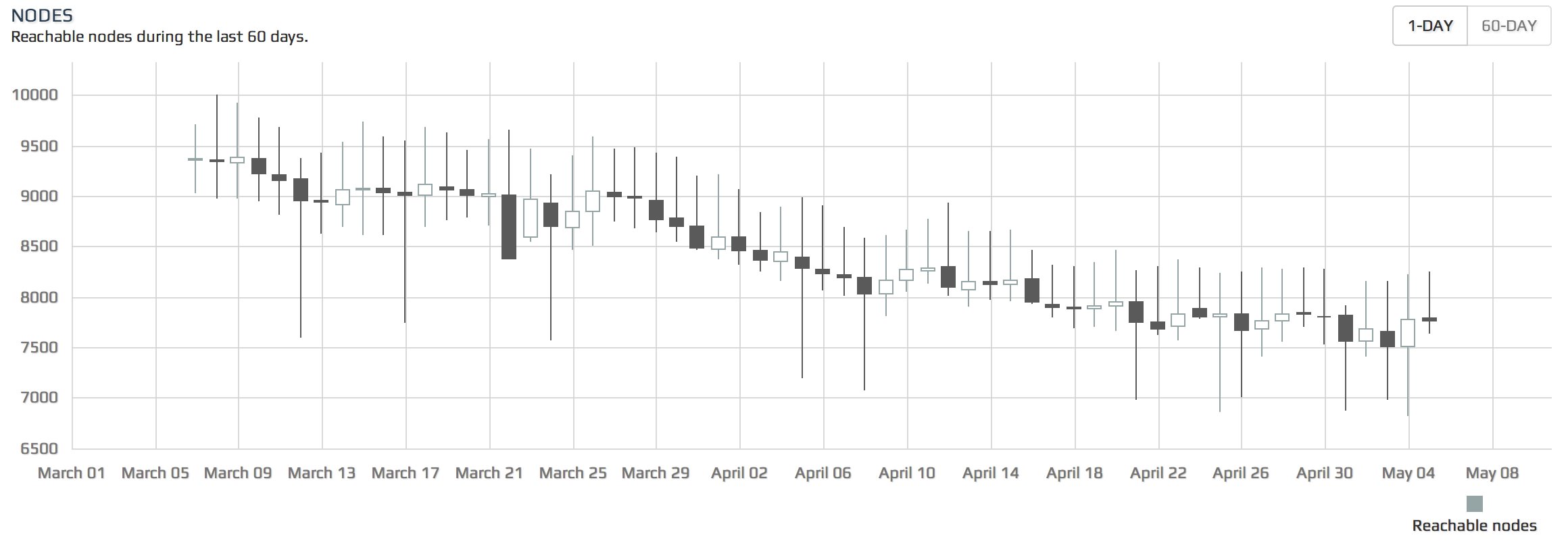

|

|

Source: Bitnodes |

|

|

Source: Bitnodes |

|

|

A map based on Bitnodes data. Source: Coinviz |

“As

bitcoin grows, so does the network and the computing power behind the

scenes required to run it. The majority of bitcoiners won’t be able to

support their own nodes and will be taken over by companies like KnC.”

“I

wouldn’t be surprised if we see large tech companies like Google and

Amazon throwing resources at bitcoin as they adopt the currency.”

“It

makes [the bitcoin network] ‘seem’ bigger, more robust and more

decentralised, because there are more people uniting to run it. So

there’s a psychological benefit.”

“I agree we need more full nodes. I’ve long been a proponent of such calls for more nodes.”

|

|

Transaction fees on the network for past six months. Source: Blockchain |

Open your free digital wallet here to store your cryptocurrencies in a safe place.