Search Results For: bank of america

Bank of America to use the Blockchain to authenticate bank data

Bank of America to use the Blockchain

Open your free digital wallet here to store your cryptocurrencies in a safe place.

George Soros sells out of J.P. Morgan, Bank of America, Citigroup …. time for Bitcoin?

to several news sources billionaire George Soros recently sold nearly

all of his bank stocks, including shares of JPMorgan Chase, Citigroup,

and Goldman Sachs. Between the three banks, Soros sold more than a

million shares. Billionaire John Paulson dumped 14 million shares of

JPMorgan Chase (appr. 750 million dollars). Other billionaires are pulling out of US stocks too.

surely there is a growing discomfort about the all time high levels of

stock market prices. Some are expecting a massive correction. Even if

there is no good reason for it, fear could make such predictions a

reality.At BitcoinOwl we of course speculate that the growing success of

crypto currencies and their promise to revolutionize the financial and

other systems could be a factor as well. Just like email threatened the

business model of the postal services and file sharing scared the music

labels, crypto currencies without a doubt cause some anxiety to

financial institutions who see Bitcoin as a competitor instead of an

opportunity to reinvent themselves.

It may take years before Bitcoin makes any noticeable dent in

Citigroup’s profits, but Bitcoin’s existence alone raises some

uncertainty about the future of such financial institutions and their

profit margins. Some players like Western Union have already been forced

to drop their fees drastically in response to Bitcoin’s extremely low

transaction fees.

The question is where does all that money pulled out of the stock

market will go? Many investors like Kevin O’Leary publicly said that

they’ve put a few percents of their money into Bitcoin already. His

Bitcoins were without a doubt his best performing asset in 2013. It’s

likely that most billionaires pulling out of the stock market will put a

small part of their wealth into crypto currencies as it’s highly

independent from other assets which is important for healthy

diversification.

Let’s just see how much money are we talking about. Let’s assume only

a fraction of those stock dollars will be funnelled into cryptos. Half

percent of NYSE’s total market cap is 83 billion dollars.

If 70% of that 0.5% would flow into Bitcoin it would increase BTC’s

market capital 7 fold raising the price of Bitcoin to over $5,000. If

10% of it went to Litecoin it would increase LTC’s market capital by 13

times raising the price to $325. And we’re talking about just 0.5% of

one stock exchange in the world.

Potentially it is also possible that the crash of stock market prices

will scare crypto currency investors too. Although, it’s hard for me to

find a plausible reason why this would happen.

It will be interesting to see how the predicted decline in the stock

market will influence the valuation of the popular crypto currencies.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Saxo Bank Bitcoin Prediction for 2017

Today the Danish investment bank published its Saxo Bank Bitcoin Prediction for 2017, where it explains that wouldn’t be surprised if the bitcoin price will see huge growth during next year.

Saxo Bank, in fact, recently published its annual “Outrageous Predictions for 2017”, a list of speculations that represent its effort to get financial industry think about more possibilities and revolutionary projects for the next year.

In addition to the prediction that UK will not actually leave the European Union (EU) and that Italian equity prices will soar thanks to the European Union led bailout, Saxo Bank affirmed that the bitcoin price will reach a value of more than $2,100 by the end of 2017.

Among its reasons the prediction explained that the American President’s administration might cause turbulence in the American economy, so this can be a good reason for people to invest in digital currencies like bitcoin.

Saxo Bank Bitcoin prediction explains:

“If the banking system as well as sovereigns such as Russia and China move to accept bitcoin as a partial alternative to the USD and the traditional banking and payment system, then we could see bitcoin easily triple over the next year going from the current $700 level to +$2,100 as the block-chains decentralised system, an inability to dilute the finite supply of bitcoins as well as low to no transaction costs gains more traction and acceptance globally.”

Altough this Saxo Bank prediction doesn’t represent an official position, it is not the first bullish indication the bank has made during its career.

In 2014, then-current CEO Lars Seier Christensen explained his personal interest in bitcoin, describing it as a great opportunity for worldwide investors.

At the time, Christensen had also mentioned about early testing of the technology within Saxo bank, although later he explained that liquidity problems at the time were keeping banks on the sidelines.

Source: coindesk.com

Open your free digital wallet here to store your cryptocurrencies in a safe place.

“Bitcoin is Property, Not Currency”, stated California Bankruptcy Court

Bitcoin: property or currency?

Pasted cases and decisions

About the author: Amelia Tomasicchio is a writer and a journalist of Bitcoin-related news and articles. She started writing about Bitcoin in 2014 and she graduated in Rome with an essay about movie industry related to Bitcoin.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Deutsche Bank Is Bringing Bitcoin-Inspired Blockchain Technology to Germany

In a recently translated piece by the Deutsche bank, originally written by Thomas F. Dapp and Alexander Karollus, the German bank discussed how banks in general might be able to benefit from p2p networks like Bitcoin. The authors specifically mention a hypothetical future scenario where banks might assume new tasks that still play on banks’ perceived trustworthiness – “e.g. as custodians of cryptographic keys.” Other existing centralized services might have to adapt to serve other roles in the coming decentralized world. Don’t be surprised if someday soon Bloomberg to self-proclaim themselves as an oracle? They went on to note that the politics of Bitcoin would eventually lead to a head with regulators, law enforcement, etc. However, in the face of this new technology and potential regulatory backlash, Deutsche bank still wants to push forward… Because the concept of a blockchain really is that compelling, and the banks are finally starting to get it. Dapp and Karollus wrote:“Traditional banks should not rely on the regulator now, though, but instead actively experiment with the new technologies in their labs and collaborate without prejudice in order to create their own digital ecosystem in the medium run.”

In a recently translated piece by the Deutsche bank, originally written by Thomas F. Dapp and Alexander Karollus, the German bank discussed how banks in general might be able to benefit from p2p networks like Bitcoin. The authors specifically mention a hypothetical future scenario where banks might assume new tasks that still play on banks’ perceived trustworthiness – “e.g. as custodians of cryptographic keys.” Other existing centralized services might have to adapt to serve other roles in the coming decentralized world. Don’t be surprised if someday soon Bloomberg to self-proclaim themselves as an oracle? They went on to note that the politics of Bitcoin would eventually lead to a head with regulators, law enforcement, etc. However, in the face of this new technology and potential regulatory backlash, Deutsche bank still wants to push forward… Because the concept of a blockchain really is that compelling, and the banks are finally starting to get it. Dapp and Karollus wrote:“Traditional banks should not rely on the regulator now, though, but instead actively experiment with the new technologies in their labs and collaborate without prejudice in order to create their own digital ecosystem in the medium run.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Ether Price passes $100: how to store Ethereum

Ether price, or the digital currency that fuels the world’s second-greatest blockchain network – Ethereum – reached a value of $100 today.

This means that Ether price hits its new all-time high today.

With a growth of more than 25% over one day only, the Ether price has now increased more than 1,000% during the last year: on January 1st, in fact, it was trading at about $8.

At the moment, while I’m writing this article, the digital currency has a market cap of about $9bn, according to data provided by Coinmarketcap.

Why Ether price is growing

This new all time high comes now when the Ethereum blockchain is fast gaining interest by open-source innovators and financial firms worldwide.

Ethereum became important as the main blockchain used for initial coin offerings (ICO, a process by which people working on blockchain-related projects can sell tokens with the goal of raising funding), while major companies such as JP Morgan and Bank of America are developing a few projects on private versions of the Ethereum blockchain.

On the markets point of view, the development comes also thanks to a strong and continued demand for the Ethereum token.

Ether volume registered 20% of the total digital currency market volumes, below bitcoin (46%) and ahead of litecoin (11.38%).

How to store, buy and sell Ethereum

While the digital currency is gaining more and more interest, reaching new all time highs, you may ask yourself: “How should I buy, sell and store my Ether tokens?”

Well, HolyTransaction provides a safe place where you can store, buy and sell your Ether tokens in a user-friendly platform.

You can exchange Ethereum in a few minutes by using more than 10 digital currencies we support on our HolyTransaction multicurrency wallet.

Click here to know more about our Ethereum wallet and exchange.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

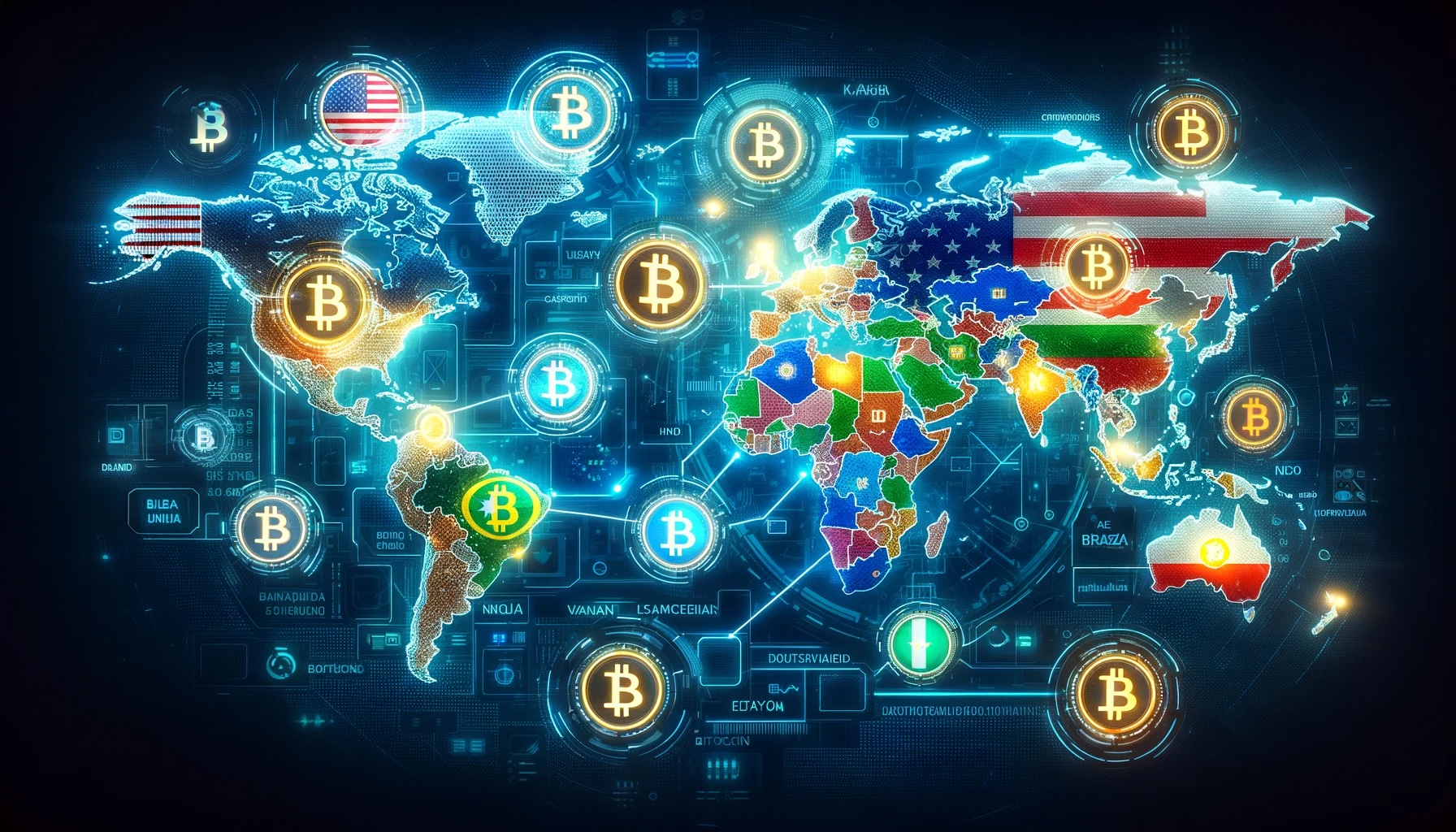

The Global Landscape of Bitcoin Ownership: A Comprehensive Analysis

The world of cryptocurrency, particularly Bitcoin, has seen exponential growth over the last decade, transcending borders and economic statuses to become a global digital asset powerhouse. This surge in popularity and adoption has led to a diverse landscape of Bitcoin ownership, with several countries emerging as key players. In this detailed analysis, we’ll explore the global distribution of Bitcoin ownership, focusing on the leading countries, their unique adoption stories, and the multifaceted benefits of embracing cryptocurrency.

India’s Pioneering Digital Leap

India stands at the forefront of the Bitcoin revolution with an estimated 93 million cryptocurrency users. This remarkable figure not only highlights the country’s rapid digital transformation but also its populace’s eagerness to embrace alternative financial instruments. India’s massive user base is indicative of a broader trend towards digital currencies, driven by factors like technological advancement, economic aspirations, and a young, tech-savvy population.

United States: A Mixed Landscape of Government and Private Ownership

In the United States, the scenario is twofold, with both the government and private citizens holding significant amounts of Bitcoin. The U.S. government’s acquisition of Bitcoin, primarily through seizures related to criminal activities, underscores the complex relationship between state authorities and the cryptocurrency world. On the other hand, with 48 million Americans owning Bitcoin, the country reflects a robust interest in digital currencies as a means of investment and financial diversification. This dual narrative of governmental and retail ownership presents a unique case study in the global Bitcoin ecosystem.

The Asian Giants: Vietnam and Pakistan

Vietnam and Pakistan are noteworthy mentions in the Asian continent, with 20 million and 15 million Bitcoin users, respectively. These numbers are not just statistics but represent a burgeoning interest in digital currencies as tools for economic empowerment, investment, and technological innovation. The widespread adoption in these countries signals a shift towards more inclusive financial systems and the potential for cryptocurrencies to bridge economic disparities.

Brazil and Indonesia: The Rising Titans of Cryptocurrency

Brazil and Indonesia share a remarkable statistic: 41% of their populations are invested in cryptocurrencies, making them two of the most enthusiastic adopters globally. This significant penetration rate is a testament to the growing recognition of cryptocurrencies as viable financial and investment vehicles. In these nations, Bitcoin and other digital currencies are seen not only as hedges against economic instability but also as gateways to the digital economy.

Nigeria, Venezuela, and Kenya: Embracing Bitcoin Amid Economic Challenges

Nigeria, with its vast Bitcoin user base, leads Africa in cryptocurrency adoption, followed closely by Venezuela and Kenya. These countries have turned to Bitcoin and other digital currencies as beacons of hope amidst economic uncertainties. The adoption of Bitcoin in these regions illustrates its potential as a stabilizing force, offering an alternative to traditional financial systems and enabling more accessible and secure transactions.

Government Holdings: A Global Overview

The role of governments in the Bitcoin space is increasingly significant, with countries like the United States and El Salvador holding substantial Bitcoin reserves. These holdings are not merely financial assets but also strategic reserves that reflect the governments’ acknowledgment of Bitcoin’s potential impact on economic stability and sovereignty. El Salvador’s adoption of Bitcoin as legal tender is a pioneering move, signaling a new era of digital currency integration into national economies

The Benefits of Global Bitcoin Adoption

The adoption of Bitcoin and cryptocurrencies at large brings with it a plethora of benefits. For individuals, it offers an alternative to traditional banking systems, especially in regions with unstable currencies or restrictive financial policies. For businesses, accepting cryptocurrency payments can open up new markets, attract a more diverse customer base, and lead to higher transaction values. Moreover, the decentralized nature of cryptocurrencies like Bitcoin provides enhanced security, reduced transaction costs, and greater financial inclusion, making it an attractive option for people and businesses worldwide.

The global landscape of Bitcoin ownership is as diverse as it is dynamic, with each country bringing its unique narrative to the broader story of cryptocurrency adoption. From the massive user bases in India and the United States to the strategic governmental holdings in El Salvador and beyond, Bitcoin’s global footprint is undeniable. As the world continues to navigate the complexities of the digital economy, Bitcoin and other cryptocurrencies will undoubtedly play a pivotal role in shaping the future of finance, offering opportunities for growth, innovation, and financial empowerment across the globe.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Unlocking Argentina’s Future: Milei, Bitcoin, and Economic Revival

The Emergence of Milei: A Libertarian Voice in Argentina

In the annals of Argentine politics, Javier Milei has emerged as a distinct voice, captivating attention not just for his unorthodox demeanor but also for his alignment with libertarian ideals. His advocacy for Austrian economics, coupled with a penchant for outspoken rhetoric, swiftly garnered a following, largely amplified by his appearances on national television. However, it was not just his shaggy hair or vibrant personality that resonated; it was his alignment with libertarian values that struck a chord amid a population grappling with economic turmoil.

Television, Bitcoin, and Milei’s Meteoric Rise

Milei’s entry into the public sphere was catalyzed by his appearances on Argentine late-night television, where his impassioned advocacy of libertarian ideas found resonance. Coincidentally, this period also witnessed the burgeoning interest in Bitcoin within Argentina and Latin America. For many in the region, their journey into the realms of Bitcoin and alternative financial systems aligned with Milei’s vocal criticism of the traditional monetary system.

His alignment with Bitcoin’s ethos became evident, with occasional nods to the cryptocurrency’s potential, although his grasp of its intricacies remained in evolution. Despite this, his staunch views on money, central banking, taxation, and government’s role struck a chord with the Bitcoin community, paving the way for mutual interest.

The Argentine Quandary: Milei’s Mandate and Economic Imperatives

Argentina finds itself ensnared in a vortex of economic challenges, epitomised by skyrocketing inflation, fiscal deficits, and mounting debt burdens. Milei’s rallying cry, “No hay plata” (There’s no money), encapsulates the dire fiscal situation that propelled him to victory. His mandate is not just about solving immediate problems but resurrecting Argentina’s erstwhile global stature.

His proposed policy reforms, including curbing central bank influence and slashing public spending, aim to avert the specter of hyperinflation. Additionally, managing the nation’s staggering debt, especially with the IMF, poses a complex conundrum, compounded by the IMF’s cautionary stance on cryptocurrency use.

Dollarization vs. Hyperbitcoinization: A Dichotomy in Economic Strategy

Milei’s proposal for dollarisation stands at odds with the fervor for hyperbitcoinization, marking a significant contradiction in his economic strategy. However, this move is deemed imperative to stabilize Argentina’s economic turbulence. Simultaneously, his proposition of allowing currency choice resonates with the populace’s inclination toward USDt, locally known as “criptodólares.”

The convergence of Milei’s policies and Bitcoin’s potential engenders a nuanced narrative. While some anticipate gradual Bitcoin adoption aligned with fiscal stabilization, others envisage a comprehensive strategy exploring Bitcoin’s role in altering tax policies, mining initiatives, or even integrating Bitcoin-backed securities.

The Milei Administration’s Economic Overhaul and Bitcoin’s Role

Amidst pledges to reduce onerous taxes, the success of Milei’s administration hinges on taming inflation, executing dollarization, and reshaping the financial landscape. As the administration grapples with the nation’s economic turmoil, Bitcoin proponents eagerly await clarity on its potential integration within Argentina’s economic fabric.

The hope persists that Milei’s appreciation for freedom and Bitcoin’s disruptive nature will converge into policies that align with Argentina’s long-term prosperity. Conversations between Milei’s team and Bitcoin advocates are anticipated in 2024, seeking insights into the administration’s post-policy implementation vision.

Navigating Argentina’s Future Amidst Economic Resurgence

Argentina stands at a crossroads, with Milei’s ascent signifying a departure from traditional political ideologies. The convergence of his libertarian principles with Bitcoin’s disruptive potential presents an intriguing narrative, one that could redefine Argentina’s economic trajectory.

Amidst the uncertainty, there’s a collective assurance that Milei, a proponent of individual freedom and Bitcoin’s potential, possesses the requisite acumen to navigate Argentina’s economic revival. Whether his policies will pave the way for Bitcoin’s integration remains an evolving saga, yet the promise of change hangs palpably in the air, intertwined with the fate of Argentina’s economic resurgence.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Uncovering the Widespread Adoption and the Advent of the Lightning Network in El Salvador and Lugano

Acknowledging the unprecedented potential of Bitcoin’s Lightning Network, El Salvador and Lugano are two of the most significant adopters of this remarkable technological breakthrough.

El Salvador & Lugano Propel the Bitcoin Adoption

As a cornerstone moment for the Bitcoin economy, a memorandum of understanding (MOU) was signed on 28 October 2022 between the nation of El Salvador and the city of Lugano in Switzerland. Moving forward, the goal of the MOU is to increase the use of Bitcoin not only in their respective areas but also in the states and nations that are nearby.

Overall, the anticipated aims of the partnership include bolstering cooperation in education and research for both El Salvador and Lugano, assisting initiatives to promote the adoption of Bitcoin and other digital tokens in their respective regions, and encouraging the exchange of students and talent between the two countries.

Exploring the Innovation Brought by the Lightning Network

So far, the scalability of the Blockchain has been a significant barrier to the widespread acceptance of cryptocurrencies from their inception. The Lightning Network’s second layer introduces a cutting-edge solution to this matter, as it intervenes by processing transactions outside the first-layer blockchain mainnet while retaining the mainnet’s robust decentralized security model. By bypassing the official Bitcoin blockchain, the Lightning Network can grow Bitcoin transactions per second (TPS), charge reduced fees, and allow new use cases like micropayments.

In addition, the Lightning Network has the potential to bring financial inclusion and freedom to the developing nations involved, in part because it is a trusted and private network that does not require the participation of third parties or intermediaries. Moreover, it could also lessen the likelihood of governments enacting policies restricting the free flow of capital. It also helps people who do not have access to bank accounts by facilitating transactions in a manner that is almost instantaneous and free of charge, thereby making Bitcoin usable not only as a means of payment but also as a means of exchange.

How Lugano is Leading Crypto Adoption in Europe

Lugano appears to have the same goal as El Salvador: to have all local businesses routinely accept cryptocurrencies as a form of payment. However, Lugano does not appear to have the same goal as El Salvador of making Bitcoin or any other cryptocurrency legal tender. Although Lugano does not hold such a position in Switzerland, the city of 70,000 people did launch its Plan B programme approximately seven months ago to increase the use of Bitcoin.

In March of 2022, Lugano announced that it would be implementing the Plan ₿ Initiative. Additionally, the technology company Polygon joined as a critical infrastructure partner. Plan ₿ Foundation, a partnership between the City of Lugano and Tether, the technology company behind the public blockchain that supports the largest stablecoin by market capitalization (USDT), has been announced today. This partnership will allow Bitcoin, Tether, and LVGA payments to be accepted in the city of Lugano.

Tether and the city of Lugano have collaborated to create a Plan ₿ aiming to increase the use of Bitcoin and stablecoins throughout the city. This, in turn, is expected to have a beneficial effect on all aspects of inhabitants’ everyday lives. As a result, the city’s financial system will be revolutionized faster than ever, thanks to the widespread use of Bitcoin.

El Salvador – the Pioneering Nation in the Cryptocurrency

In 2021, El Salvador was the first country to acknowledge Bitcoin as a legal tender. Through this avenue, El Salvador became a pioneer in demonstrating how technologies such as Bitcoin, decentralized ledgers, and peer-to-peer networks can accelerate financial literacy and inclusion

Furthermore, Latin America appears to follow El Salvador’s lead and powering Bitcoin mining farms with natural resources (such as energy generated by geothermal activity). Countries of Costa Rica in Central America and Paraguay in South America are also heading in this direction.

Bottom Line

Since most people in Europe are not yet familiar with this idea, a closer relationship between El Salvador and a nation located in Europe could usher in uncharted territory.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

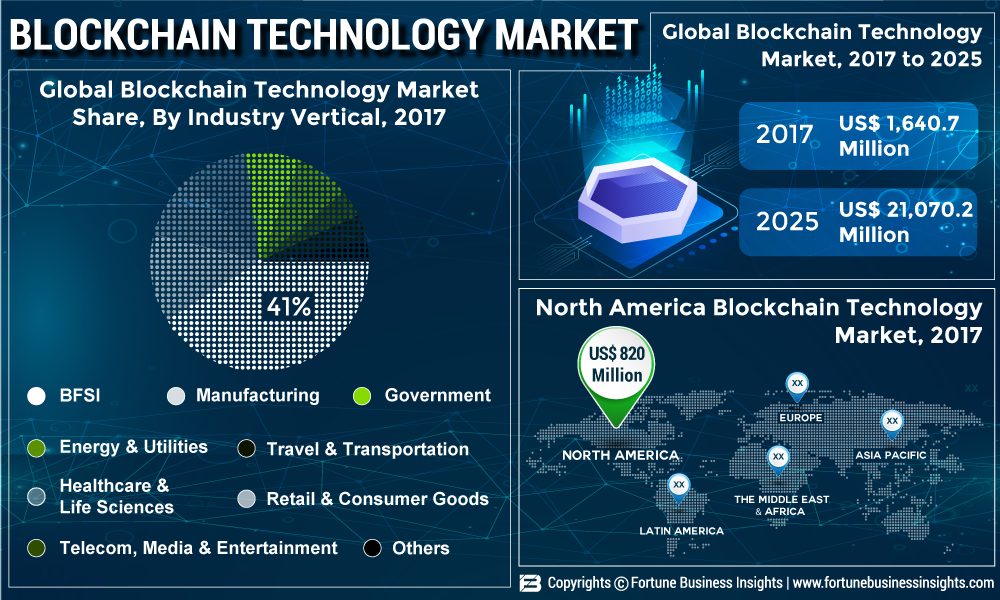

How is Blockchain Technology Market Going to Rise at High CAGR of 38.4% Till 2025?

The global Blockchain Technology Market is forecast to rise exponentially in the coming years. The market is expected to witness high demand from diverse industries, especially the banking, financial services, and insurance (BFSI) industry.

In terms of industry vertical, the banking, financial services, and insurance segment held the leading share of 41% in global blockchain technology market in 2017. The segment will gain further impetus following introduction of bitcoin. “Rampantly increasing cyber-attacks and frauds in the BFSI industry accounts for millions of dollars. This has become a global concern. To make the technology used in the industry safer and more secure, Deloitte and Microsoft Azure and other tech giants are offering blockchain services,” said a lead analyst.

In terms of deployment, the proof of concept segment is gaining traction and is expected to witness impressive growth during the forecast period 2018-2025. Growth witnessed in this segment is backed by high need of transparent transaction across industries such as healthcare, retail and BFSI.

Increasing Demand for Secure Blockchain Technology to Guarantee Growth at Promising Rate

“Government initiated awareness programs regarding benefits of blockchain technology among undeveloped nations is anticipated to fuel the demand in the global blockchain technology market“, said a lead analyst at Fortune Business Insights.

Increasing adoption of e-financial services and rapid adoption of the blockchain technology in developed nations are expected to drive the global blockchain technology market during the forecast period.

Increasing number of new blockchain products and their approval grants is also anticipated to act as a driving factor for the global Blockchain technology market.

Partnerships Among Key Market Players and Blockchain Developers Driving the Market in North America

North America emerged dominant in the global blockchain technology market in 2017. The North America market was worth US$ 820 Mn in 2017. The region will continue leading the market at a global level through the forecast period. Growth witnessed in the market is also attributable to recent collaborations between market players in the U.S. and blockchain service provides. Europe is also anticipated to witness impressive growth during the forecast period owing to high presence of blockchain technology developers.

In 2017, IBM was the leading organization in the global Blockchain technology market. Other companies operating in the global market are Oracle Corporation, Deloitte, Microsoft Corporation, IBM Corporation, The Linux Foundation, Chain Inc., Consensus Systems, Bits, Inc (Tendermint, Inc.), Schvey, Inc. (Axoni), VironIT, Altoros, and Fintech & Blockchain Software House.

Source: https://www.fortunebusinessinsights.com/industry-reports/blockchain-technology-market-100072

Open your free digital wallet here to store your cryptocurrencies in a safe place.