Open your free digital wallet here to store your cryptocurrencies in a safe place.

“[Bitcoin] is a very low cost payment method with strong security features and usable for cross-border transactions, making it advantageous in some regards relative to more traditional payment mechanisms.”

“Key attributes of trust (that the ‘money’ gives rise to settlement of the obligation) and anonymity (it is often efficient for the sale/purchase parties not to have to identify one another) must be met, but if these can be accomplished reliably and sustainably, new technologies could supplant cash as we know it in years to come.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

(BusinessTech) Bitcoin has grown from an experiment in digital cash to a vibrant, global economy supporting multi-million dollar companies with a market cap of $10 billion.

“While the road has been bumpy, and quite a rollercoaster ride, it is still nascent and holds immense promise to change the world in unprecedented ways,” said Simon de la Rouviere, speaking at the recent Nedgroup Investments Cash Solutions Treasurers Conference.

“In 2013, the hockey-stick growth often found in the technology space kicked off for Bitcoin, seeing adoption increase worldwide.” De la Rouviere, a technology entrepreneur who develops cryptocurrency applications, believes that Bitcoin’s global, public, distributed asset ledger is a fundamental innovation that could upset various industries – from banking to public records. “Any business in the field of recording information fit into a ledger that charges fees to be a middleman is at risk of becoming obsolete,” he said. As copy of Bitcoin’s ledger exists on every network participant’s computer, and is continually updated, reconciled and synchronized in real-time. Each member can make entries into the ledger, which records transactions of a certain amount of currency from one participant to another. Each entry is propagated to the network, so that every copy on every computer is updated near simultaneously and all copies of the ledger remain synchronized. “This blockchain technology could easily be adopted to work with title deeds, physical keys, private equity, derivatives, escrow, dispute mediation, passports, wills, domain names, and sim cards – to name but a few,” De la Rouviere said.

The future

Looking farther ahead, the technology could potentially bring about a new apolitical reserve currency that allows programs and machines to own forms of value without the requirement of human intervention.

This could herald an almost sci-fi era, where machines earn their keep by providing services to humanity at an even more cost-efficient, break-even level than currently possible, De la Rouviere said.

“By thinking of Bitcoin not as a currency, but as a single solution to a previously unsolved algorithmic problem in distributed systems, colloquially known as the Byzantine Fault Tolerance, humanity can create global systems of consensus powered by mathematics.” Bitcoin is a grand experiment, currently at the forefront of showing the equalizing force that the internet brought about. “It might still one day fail,” he added, “but rest assured, it is spurring innovative thinking across the board.” Sean Segar, head of cash solutions at Nedgroup Investments, said that while the bank believes in staying abreast of trends or fads that may affect the industry, “we have no plans to launch a Bitcoin fund”.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

“Bitcoin is still in the earliest phases of industry development. The first years of Bitcoin were about building the infrastructure. Bitcoin entrepreneurs were busy setting up the most basic but fundamental aspects, including wallet and mining services. Today, Bitcoin is just starting to enter the investment phase, where venture capitalist, hedge funds and other financial firms are starting to invest money and capital into this nascent technology. Bitcoin isn’t quite ready for the consumer phase, where end users begin to utilize the services. If the entire history of Bitcoin was a clock, we’re still in the very early time. I would say were maybe in the second second of the entire history.” Nicholas Cary, CEO of Blockchain.info (source)

Disclaimer: The (funny) definition of an economist is “Someone that can use economic theory today to explain why he got all his predictions wrong yesterday“. The market is unpredictable and I can’t always be right

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

“The US Marshals Bitcoin auction resulted in one winning

bidder. The transfer of the bitcoins to the winner was completed today.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

(CoinTelegraph) The Philippines welcomes its first Bitcoin ATM. Brought by Satoshi Citadel Industries and Bitmarket.ph,

the machine will be ordered from Skyhook and will cost $US 999. ATMs

are no longer exciting news, yet this one is a lot smaller in size and

it will speak to the success of Bitcoins on a global scale. The ATM will

appeal to a wealth of people and cultures with money to trade and

transactions to process.

What is Skyhook? Skyhook is an open-source Bitcoin ATM.

Selling Bitcoins was once difficult, and many people were tired of

depending on exchanges and centralized banks to buy Bitcoins. Skyhook

changed everything. The company developed a tiny and secure machine

everyone can use to exchange Bitcoins.

It comes with a hefty security mounting plate and a password-on-boot

options. It someone steals it, you have nothing to worry as your

Bitcoins will be safe. The ATM accepts Australian, US, and Canadian

dollars, as well as Argentinean Pesos, Yuan, Euros, and numerous other

currencies.

Easy to set up, Skyhook comes with a detailed guide you should use to

get started. Buyers will require a Wi-Fi or wired internet connection, a

power cable, and Bitcoins to sell. The touch-screen graphical interface

of Skyhook will ease your job to buy Bitcoins and make use of the QR code for wallet address recognition.

Skyhook sets Bitcoin prices automatically using major exchanges.

Afterwards, it adds a minimum price protection so that you can get paid

for using Bitcoins. The ATM machine is excellent for vendors,

storefronts, bars, meet-ups, and merchants. Set your rate and start

trading.

Unlike the other two popular Bitcoin machines, Lamassu and Robocoin,

Skyhook is a lot smaller, and of course, less expensive. Owned by a

Filipino company known as Bitmarket.ph, locals will finally be able to

trade Bitcoins with Philippine pesos and not have to worry about

exchange rates. To use Bitmarket.ph all you have to do is activate and

access your account. Next, type your transaction’s details (details of

the buyer and item for sale). Enter your selling price and exchange it

in Bitcoins immediately.

Generate a QR code and use the code to share it with clients.

Bitmarket additionally offers cash settlements where you can convert

Bitcoins into Philippine pesos daily. Bitcoins provide fast, real time

transactions to customers. Trading Bitcoins keeps people away from

chargebacks, bank fees, and commissions. Unlike other forms of exchange,

Bitcoins provide transparency where you can track each one of your

transactions in real time. Vendors accepting Bitcoins are essentially

adding value to their business by gaining a competitive advantage as a

first adopter and cutting costs.

Now that the Philippines is finally welcoming its first Bitcoin ATM,

people will “dispense Bitcoins for Pesos on the spot in a matter of

seconds at competitive and fair rates.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Except … this approach to innovation clusters hasn’t really worked. Some have even dismissed

these government-driven efforts as “modern-day snake oil.” Yet

policymakers are always searching for the next Silicon Valley because of

the critical link between tech innovation, economic growth and social

opportunity.

Previous efforts at such clusters failed

for a variety of reasons, but one big reason is that government efforts

alone simply don’t draw people. That’s why a recent crop of experiments

has focused more on building entrepreneurial communities, urban hubs and districts, and hackerspaces. Still, we’re “splitting the logic” on how to create an innovation ecosystem, according to MIT expert Fiona Murray in Technology Review:

We’re either going top-down by focusing primarily on

infrastructure—plunking down an office park next to a university—or

bottom-up by focusing on just the networks. None of these efforts

successfully pursue both paths at once, with government, academia and

entrepreneurial communities proceeding together in lockstep—as was the

case in the development of Silicon Valley.

Imagine a Bitcoin Valley, for instance, where some country fully

legalizes cryptocurrencies for all financial functions. Or a Drone

Valley, where a particular region removes all legal barriers to flying

unmanned aerial vehicles locally. A Driverless Car Valley in a city that

allows experimentation with different autonomous car designs,

redesigned roadways and safety laws. A Stem Cell Valley. And so on.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

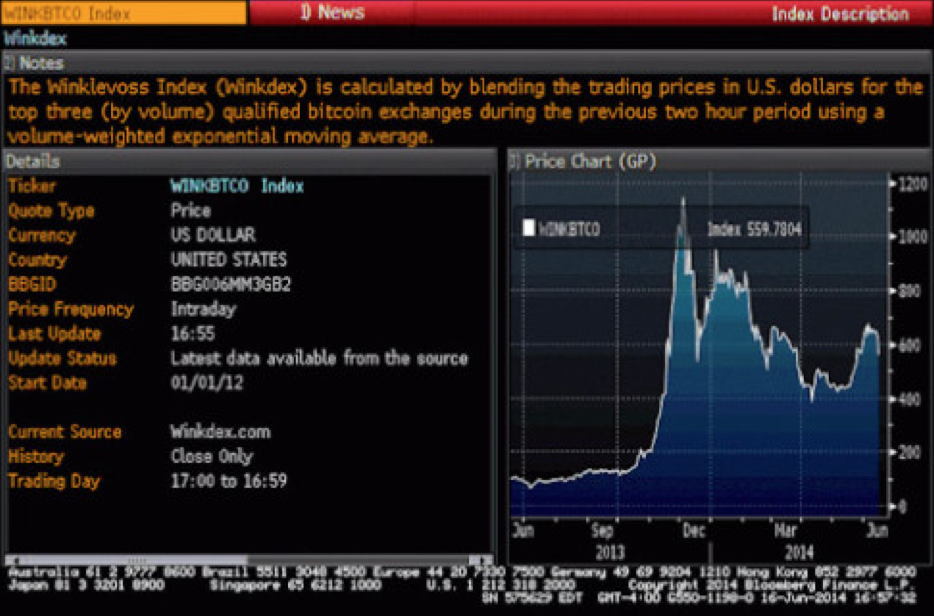

And according to a post made on the Winklevoss Capital website,

the price data is now available on Bloomberg in a move some suggest may

further legitimize the digital currency in the eyes of traditional

financiers.

“We are honored to be working with Bloomberg to bring a blended

bitcoin price index to their wide-reaching investor community,” the post

read, adding that some new features (of which include an API) will be

unveiled in the weeks upcoming.

According to the announcement, the ticker for the WinkDex is very apt: WINKBTCO.

The Bloomberg terminal is a professional service used by financial

professionals. Each license to the service costs upwards of $20,000 per year.

For more information on the WinkDex, visit their official website.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.