How to create a Bitcoin Paper Wallet

- Computer

- Printer

- DVD with latest version of Ubuntu

- USB Pen Drive

- Papers

- Smartphone

- Download .zip of bitaddress: https://github.com/pointbiz/bitaddress.org and move it in your USB pen drive.

- Download Ubuntu at http://www.ubuntu-it.org/download and burn it on dvd

- Boot your computer with Ubuntu’s dvd and choose to run “Live”, without installing. Now that Ubuntu is ready to use, disable internet connection.

- Insert your USB pen drive. Open the file bitcoinaddress.org.html and click on Paper Wallet tab. Remove your USB pen drive.

- Connect your printer.

- Go back to bitaddress and generate the address.

– Addresses per page: 1

– Print!

– Turn off your computer and printer. - On your smartphone you need a QRcode scanner.

- Scan your Bitcoin Address (or public key).

- Send the public key to your email.

- Boot your computer without Ubuntu’s dvd inside. Check your email and double-check if the Bitcoin Address is correct. To finish copy-paste the address and in your wallet and send the desired amount to the paper wallet!

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Governor says Bank of Japan is “very interested” in cryptocurrency

(BitcoinExaminer) The governor of the Bank of Japan recently said that the institution is “very interested” in Bitcoin. Haruhiko Kuroda talked about cryptocurrency during a news conference, according to the site Jiji Press.

(BitcoinExaminer) The governor of the Bank of Japan recently said that the institution is “very interested” in Bitcoin. Haruhiko Kuroda talked about cryptocurrency during a news conference, according to the site Jiji Press.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Winklevoss twin says Bitcoin valuation will top $40k

(TheNextWeb) Cameron Winklevoss, one half of the notorious twin brothers who once

battled Mark Zuckerberg over the origin of Facebook, took to Reddit to host an AMA this weekend to discuss the duo’s big interest: Bitcoin.

The Winklevoss twins were early Bitcoin advocates but have never revealed their total holding — though it was said to be worth

$11 million in April, when the crypto-currency peaked at $266. Given

today’s price ($875 average on Mt. Gox, at the timing of writing) and

Cameron’s admission that he is yet to sell a single Bitcoin, it could

now be worth as much as $35 million.

The twins are in the process of setting up the Winklevoss

Bitcoin Trust, a listed fund to manage their Bitcoin wealth and bring

greater legitimacy to the virtual currency. Papers for the initial

public offering were filed in July, but the final decision is still

pending. Due to regulations, Cameron was unable to discuss the trust in

the AMA.

The brothers are unsurprisingly bullish on Bitcoin. Cameron’s conservative

bet is that its US dollar valuation will surpass $40,000 per coin — a

potentially colossal figure — as he explained in a response to one

Reddit user:

small bull case scenario for Bitcoin is a 400 billion USD

dollar market cap, so 40,000 USD a coin, but I believe it could be much

larger. When this will happen, if it happens, I don’t know, but if it

happens, it will probably happen much faster than anyone imagines.

In another answer, Cameron played down the significance of the closure of The Silk Road

— the underground market place for illicit goods that many saw as a key

outlet for Bitcoin — instead arguing it is positive for the virtual

currency:

The Silk Road closure, and resulting price gains

demonstrate how the demand for BTC has little to do with illicit

transactions. If anything, Silk Road was holding Bitcoin back by

disproportionately dominating its narrative in a negative way.

It is estimated that the volume of bitcoin transacted on Silk Road

only represented ~4% of the total volume of bitcoins transacted on the

Block chain over the same period of time.

Bitcoin’s growth has seen interest in other alternate currencies — such as Litecoin and Quarkcoin – but Cameron says he and his brother have no interest in anything other than Bitcoin:

Do you see BTC ‘replacing’ currencies we have today, or being used alongside them?

Have you invested in any altcoins, if so, which and why?

I view BTC more as an alternative to fiat currencies than a replacement.

I have not invested in any altcoins because I don’t believe that any

of the “problems” or issues that they address can’t be addressed by

Bitcoin itself.

You can see the full range of answers — which include mentions of

rowing (the brothers represented the US at the Olympic Games) and the

Simpsons — at the thread here.

Given their background and early adoption of Bitcoin, the twins’

opinions and predictions for the future are interesting. They have both

predicted that there will be some form of regulation for the currency in

the future. They see it as an ‘answer’ to many fiscal problems and are

keen to help take it more mainstream.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

British Island wants to make physical Bitcoins with UK Royal Mint deal

(CoinDesk) A tiny island in the English Channel, Alderney, wants to mint physical bitcoins as part of a larger campaign to become one of the world’s first financial services centers devoted to digital currency.

The Financial Times reported

that Alderney, just three miles long with a population of 1,900, wants

to become known as an international center for bitcoin transactions.

Intended to be fully compliant with anti money-laundering and other

financial regulations, it would offer merchant payment services,

exchanges, and a bitcoin storage vault of some kind.

The physical

bitcoins, like other such tokens, would be collectors’ items rather than

circulated, and would likely have a gold content (apparently around

£500 worth) to further their appeal and allow them to retain value

should bitcoin’s price crash.

They would also serve as promotional

tokens for the more ‘serious’ bitcoin payment and exchange services.

Alderney’s

coins would hopefully be minted in a collaboration with the UK’s Royal

Mint as part of a commemorative collection. Rather than having a private

key sealed inside, like the popular Casascius physical bitcoins

and their contemporaries, the Alderney bitcoins would be exchangeable

for the more useful digital kind by its holder paying a visit to the

island. They would not be official legal tender otherwise.

Production

would be overseen by an independent company, who would also take the

hit if bitcoin’s value vanished. The same company would also hold the

coins’ keys in an escrow service. If the deal goes ahead, The Royal Mint

would handle orders and take some of the money from sales.

With current bitcoin values hovering around $1,100 on CoinDesk’s BPI

(over $1,200 on Mt. Gox) and seeming to jump higher with each passing

day, more daring segments of the financial world are sensing an

opportunity to create a whole new industry. The high values, including

not only bitcoin’s but those of other digital currencies

as well, are wrenching the concept out of the hands of tech-savvy

entrepreneurs and delivering it to people more accustomed to

billion-dollar movements.

Bitcoin and digital currencies, despite

occasional murmurings and investigations by authorities, still have no

legal recognition as currencies in any major jurisdiction. No

legislation has been tabled specifically for digital currencies, though

exchanges and payment processors generally fall under the same

know-your-customer (KYC) and anti-money laundering (AML) regulations as other ‘money transmitters’.

The

Channel Islands, just off the coast of France, are ‘Crown Dependencies’

and not officially part of the UK. This special legal status has

traditionally made them a hub for offshore financial services, with most

of the activity happening on larger Guernsey and Jersey.

Alderney falls under the jurisdiction of the Bailiwick of Guernsey

but has been looking for ways to gain more financial independence from

its neighbors. The island has long produced stamps and minted its own

coins, called the Alderney pound, pegged 1:1 to UK pound sterling. The

coins are produced in denominations of £1, £2 and £5 in ordinary

cupro-nickel as well as gold and silver versions, and are also aimed

primarily at collectors.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

China’s third-largest mobile network now accepts Bitcoin!

(CoinDesk) Consumers in China can now purchase smartphones with bitcoin from a

major carrier, after a local division of China Telecom announced a

promotional offer for new Samsung phones this week.

China Telecom’s subsidiary Jiangsu Telecom, in Jiangsu province on the east coast of the country, posted the offer on its website. Translated details were scarce, but it appears customers have the chance to use bitcoin instead of yuan to pre-order Samsung’s 2014 clamshell form-factor Android phone.

Any business newly accepting bitcoin, even in a small way, is

guaranteed to gain disproportionate attention in these times. So on the

surface, many recent stories of bitcoin acceptance from China seem more

promotional than revolutionary. Indeed, this is a limited offer for one

model phone from a local provider and not a major announcement of

large-scale bitcoin adoption.

However, it’s also a sign large state owned enterprises in China, or at least

certain divisions of them, are more open to experimentation with bitcoin

than their overseas counterparts.As of this month, most bitcoin

acceptance in other parts of the world remains limited to owner-operated

small businesses and startups. A division of Chinese internet search

giant Baidu also announced recently it would accept bitcoin as payment.

Jiangsu

Telecom’s offer also strikes a more positive note than previous reports

from China earlier in 2013, which suggested China Telecom was trying to block

bitcoin-related traffic from its services. China Telecom is China’s

largest fixed-line provider and its third-largest mobile carrier.

If

bitcoin can be used as a promotional tool to attract younger and more

technology-aware consumers, it also indicates the Chinese market itself

is more ready for alternate forms of payment.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin in the UK: HMRC suggests bitcoins are ‘taxable vouchers’

As Tom Gullen described on his blog, Her Majesty’s Revenue & Customs (HMRC) seems to be classifying bitcoins as vouchers, which means VAT would be due on any sales. A 20% mark-up on bitcoin prices would make UK exchanges untenable. In addition to Gullen’s statement, an independent source told us that HMRC had given them the same classification. We also spoke to Dr Tom Robinson of the UK-based bitcoin exchange BitPrice and consulting firm Blockchain Consulting, who recently attended the Financial Innovators Summit at 10 Downing Street. At the time, it was said that he “left the meeting feeling largely optimistic”. However, his subsequent communications yielded the following statement from HMRC: “Our Policy teams’ view is that these are not currency. It is our view that the provision of bitcoins is the sale of vouchers. These arelikely to be ‘single purpose’ vouchers.”

Robinson said: “This is obviously an entirely inappropriate classification for

bitcoin: they aren’t issued by anyone, they don’t have a ‘face value’

and they can be redeemed for a wide range of goods and services.”

Robinson also posted to reddit, saying: “We do now have a commitment from the Treasury that they will seriously consider how bitcoin might achieve official recognition in the UK. In doing this the government is seeking input from bitcoin businesses.” Any businesses that want to submit a comment should do so through this link. HMRC told CoinDesk that “There is a VAT exemption for currency transactions but the currency in question must be legal tender. We will of course listen to arguments for alternative VAT treatments under existing VAT law.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Korea announces favorable tax policy for Bitcoin

The bitcoin community in Korea is small, but growing, and it seems that governments around the world are taking the US Senate’s recent hearings as a signal to begin determining at least temporary policies regarding our favorite cryptocurrency.

Posted in Korea’s Bitcoin Community on Facebook is a statement from Korea’s National Tax Service stating that Koreans will not be taxed for capital gains on bitcoin for the time being.

While this is clearly good news for the few long-time miners in Korea as well as speculators that have experienced a windfall in the past month, it is important to remember that this is not a good long-term position toward bitcoin. Essentially, the Korean government is taking the stance that bitcoin investments are not real.

Currently, bitcoiners are happier to be left alone by the governments of the world and such a policy supports this in the long term. But if we hope to see bitcoin rise to a more commonly-accepted and competitive currency, we will need governments to recognize that BTC does, in fact, bear value and follow “safe and sane” regulatory procedures. While this is not the time to hold the argument over how much and what kind of regulation would be appropriate and positive, I think that most bitcoiners will agree that we don’t want it to be seen as monopoly money forever. Near-universal recognition and respect is needed.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin defeats PayPal thanks to massive transaction of 194,993 BTC

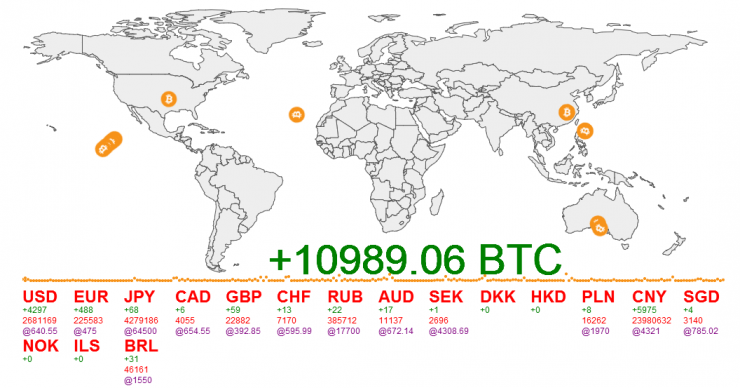

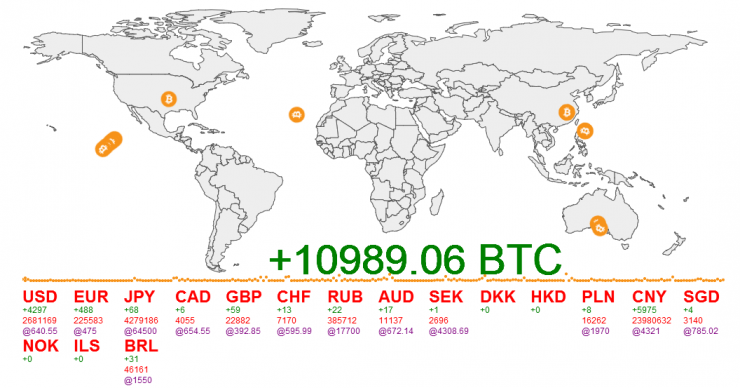

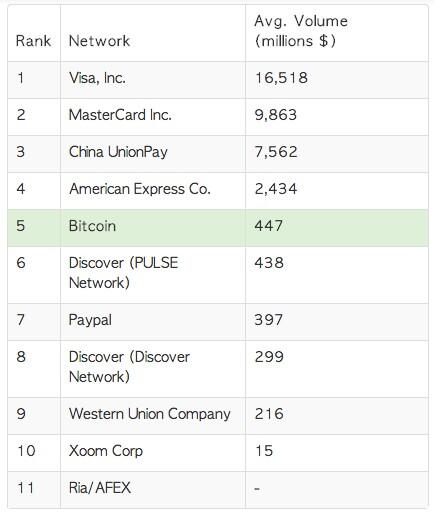

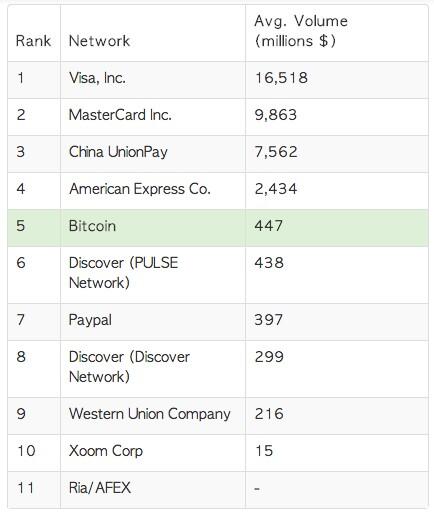

(BitcoinExaminer) The end of last week brought a symbolic milestone for Bitcoin. The cryptocurrency network recorded over $447 million in transactions in a single day, topping PayPal and Discover.

in the amount of daily transactions in US dollars and becoming the world’s fifth biggest payment network. Above cryptocurrency you could only find “giants” like Visa, MasterCard, China UnionPay and American Express.

With the Bitcoiners getting curious, some experts discovered the transaction involved a large number of sending addresses. Some of them were from blocks mined in February 2010 or even earlier. Of course, it’s impossible not to think about Satoshi Nakamoto, Bitcoin’s mysterious founder.

With the Bitcoiners getting curious, some experts discovered the transaction involved a large number of sending addresses. Some of them were from blocks mined in February 2010 or even earlier. Of course, it’s impossible not to think about Satoshi Nakamoto, Bitcoin’s mysterious founder.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

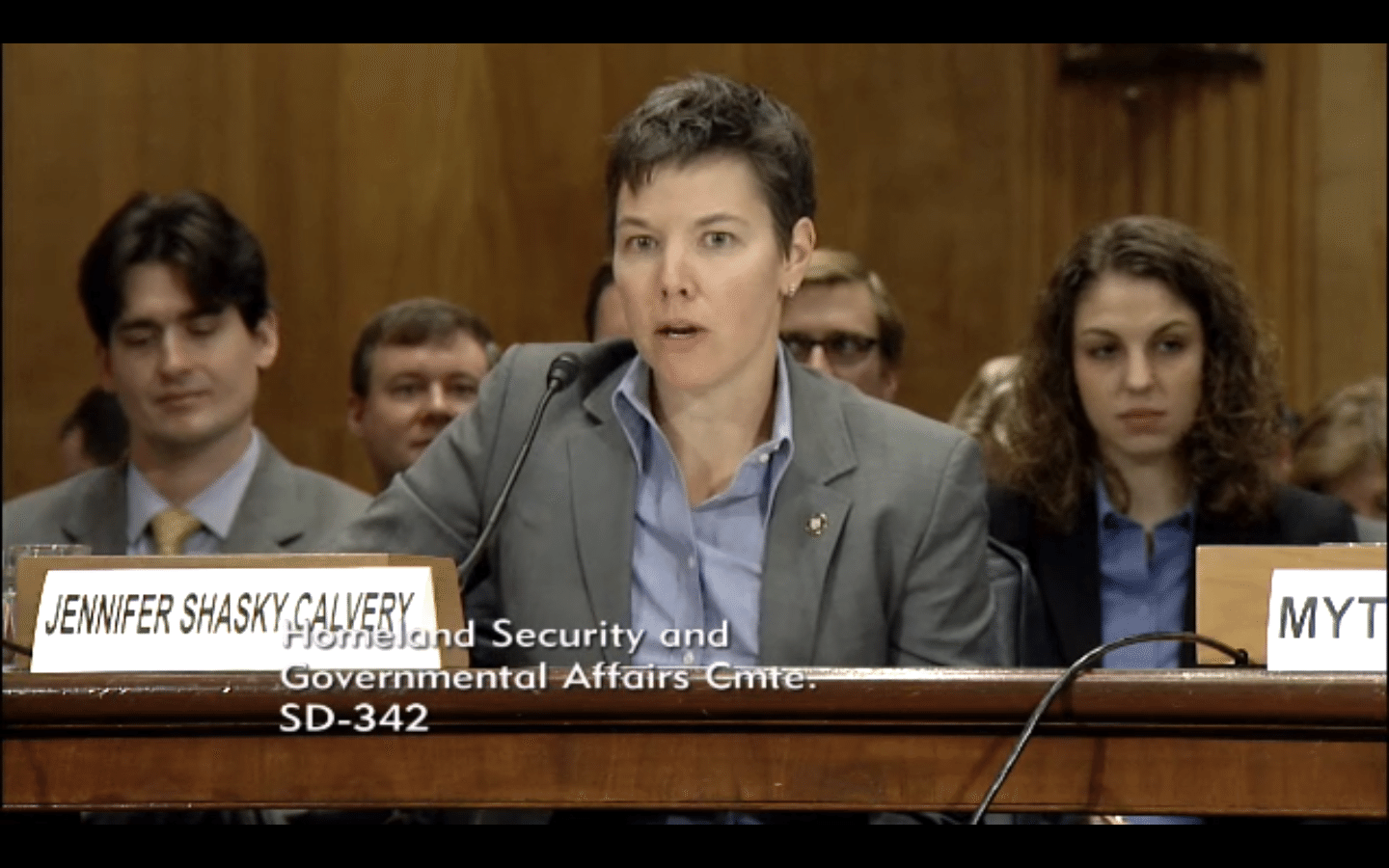

This Senate hearing is a Bitcoin lovefest

(WashingtonPost) The Senate Committee on Homeland Security and Governmental Affairs,

chaired by Sen. Tom Carper (D-Del.), is holding the first congressional

hearing on the future of Bitcoin. The first panel features senior

figures from the Obama administration. And their comments about Bitcoin

have been remarkably positive.

After the officials gave their opening statements, Carper’s first

question drew a parallel to the Internet. He pointed out that in the

early days of the Internet revolution, many people raised concerns about

illicit use of Internet technologies. Yet in the long run, he argued,

the Internet has had a hugely beneficial effect on peoples lives, making

possible previously unimagined services like Facebook and YouTube.

Carper wanted to know if the witnesses saw Bitcoin in the same light.

Jennifer Calvery, director of the Financial Crimes Enforcement

Jennifer Calvery, director of the Financial Crimes Enforcement

Network, agreed with Carper. “Innovation is a very important part of our

economy. It’s something for us to be proud of,” she said.

“We are attuned to the criminal use,” added Mythili Raman of the

Justice Department. But “there are many legitimate uses. These virtual

currencies are not in and of themselves illegal.”

“There is good reason for us to remain watchful” about Bitcoin being

used for illicit purposes, Raman added. “But we also intend to balance

that against the need for legitimate users” to use the technology.

Later in the same panel, Edward Lowery of the Secret Service

testified that cyber criminals “have not by and large gravitated toward

peer-to-peer cryptocurrencies.” Rather, they “have by and large

gravitated toward centralized digital currencies that are based in a

locale that may have less regulatory guidelines and less aggressive law

enforcement.”

That’s been the tenor of the entire hearing so far. All three Obama

administration officials expressed concern about Bitcoin being used for

illicit uses. But they also stressed that Bitcoin has important

legitimate uses and that regulators need to be careful not to stifle

innovation in virtual currencies. And they seemed to believe that the

situation was under control, and none asked for new regulatory powers to

crack down on illicit uses of the currency.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

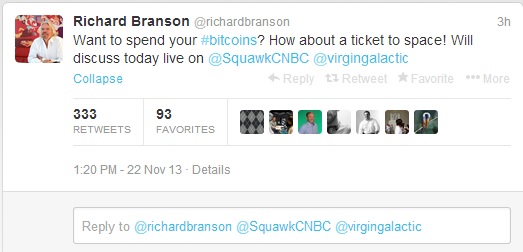

Virgin Galactic to accept Bitcoin for space flights

flight venture created by the billionaire entrepreneur Richard Branson,

is accepting Bitcoin: this means the new crypto-millionaires and space

aficionados can now use their digital coins to pay for an exciting and unique trip. The news was announced by Branson himself on CNBC’s show “Squawk Box”.

Branson said. The lucky space traveler is a flight attendant from

Hawaii. Apparently, the woman made “quite a lot of money getting into

Bitcoin early on”, he told CNBC.

and then Virgin Galactic converted the amount into US dollars,

specifically $250,000. “There’s a fixed price [and] we can actually pay

her money back, if she changes her mind about going to space in a few

months”.

and is holding on for the long-term. “I have invested in some Bitcoins

myself and find it fascinating how a whole new global currency has been

created”, he wrote on Virgin’s website. Brason even compared the virtual coin with his own business.

aren’t yet formally recognized by governments as a currency, but with some regulation I hope that it will become more widely accepted.

A few years ago many people had doubts about whether Virgin Galactic

would ever get off the ground. Now we have gone supersonic, are a long

way along the testing process, and are looking forward to launching

commercial space travel”.

Open your free digital wallet here to store your cryptocurrencies in a safe place.