Search Results For: bitcoin price

Bitcoin Price Drops because of the Bremain

Bremain and Bitcoin

Bitcoin price Drops

Multicurrency Wallet

Open your free digital wallet here to store your cryptocurrencies in a safe place.

5 reasons Bitcoin price is rising

Reasons Bitcoin Price is rising

Halving of Rewards

More interests in the Blockchain

Chinese Domain

FIAT Currencies Flow

UK out of Europe

Universal Wallet

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin price future: it is alive and well

Reason of the Bitcoin Price jump

Positive news about Bitcoin

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Craig Wright Announcement affected the Bitcoin price

Craig Wright announcement

Bitcoin Price results

News to reduce Bitcoin volatility

Open your free digital wallet here to store your cryptocurrencies in a safe place.

That’s why $440 Bitcoin price is low

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Google update now supports Bitcoin price in search results!

“You can also ask Google to do conversions – if you have the Google Search app on your smartphone, for example, ask it, ‘How many bitcoin are in 500 U.S. dollars?’ and you’ll get the answer in a handy conversion tool.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Google joins Yahoo in offering Bitcoin prices

information across several major fiat currencies as well as access to

breaking news in the digital currency world.

Google Finance bitcoin tool enables quick BTC-to-fiat conversions as

well, allowing for calculations across dozens of currencies such as the

Yemeni rial and the Bangladeshi taka.

Simple design

though it utilizes different layout schemes for graphs and news

tickers. However, Yahoo! Finance does not offer bitcoin price

conversions to other currencies.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin price skyrockets as Senate hearing concludes

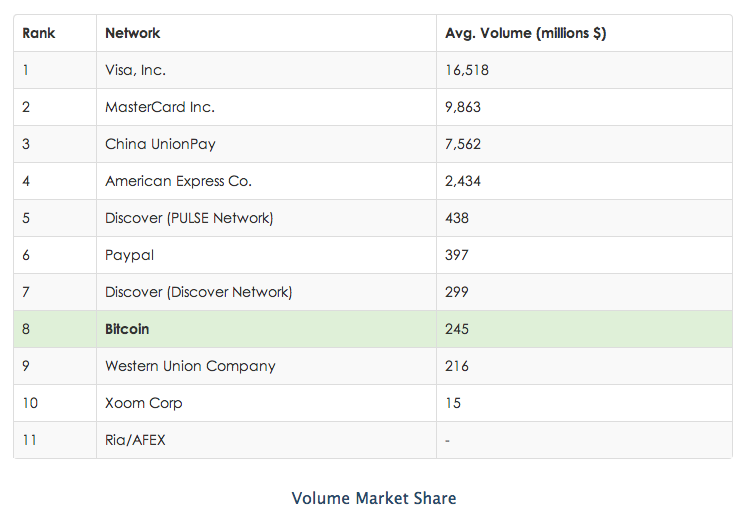

(CoinDesk) The price of bitcoin spiked dramatically last night and the

transaction volume on the Bitcoin protocol (in USD) eclipsed that of

Western Union.

The spike took place after Jerry Brito, Patrick

Murck and Jeremy Allaire presented their testimonies on bitcoin and the

future of virtual currencies to the Homeland Security and Governmental

affairs committee in the US senate at the Senate hearing titled Beyond Silk Road: Potential Risks, Threats and Promises of Virtual Currencies.

The CoinDesk BPI read $650 on conclusion of the hearings, with Mt. Gox reporting a jump to $750 and, later, BTC China reaching a record high of 6,989 CNY (approximately $1,147) before crashing to almost 60% of this value in seconds, and then recovering to about $850. At the time of writing, the CoinDesk BPI puts the price at $602.

The

senate hearing is being hailed as an historic moment for bitcoin, with

even Ben Bernanke, current chairman of the Federal Reserve remarking

that virtual currencies “may hold long term promise” in an open letter

to Senator Thomas Carper (D) published 12th November.

At the

hearing, Senator Carper listened to commentary, criticism and praise of

bitcoin with a temperament that left many in the bitcoin community

impressed and even delighted, whilst Jennifer Shaskey Calvery from

FinCEN was measured in her analysis and assessment of the promises and

threats that virtual currencies present.

This morning, data analysis website Coinometrics reported

that bitcoin passed Western Union in daily transaction volume,

transacting an average of $245m compared with Western Union’s estimated

$216m but is still behind on the average number of daily transactions at

approximately 62,000, with Western Union clocking up approximately

633,000 transactions per day by comparison.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Japan eliminates Bitcoin Taxation; Rise in Price expected

Japan government officially eliminates bitcoin taxation after it recognized as legal method of payment a few months ago.

Consumption taxes on the sale of bitcoin will come into effect on July 1st.

According to a Deloitte’s report entitled “Japan: Inbound Tax Alert, 2017 Tax Reform Proposals,” digital currencies including Bitcoin will be exempt from the 8% consumption tax in Japan.

Deloitte’s report explains:

“The supply of virtual currency will be exempt from Japanese Consumption Tax (“JCT”). Currently, virtual currencies such as Bitcoin do not fall under the category of exempt sales, and as a result, the sale of virtual currencies in Japan have been treated as taxable for JCT purposes. Following the enactment of the amended Fund Settlement Law in May 2016, which newly defined “virtual currency” as a means of settlement, the sale of virtual currency as defined under the new Fund Settlement Law will be exempt from JCT. This change will apply to sales/purchase transactions performed in Japan on or after 1 July 2017.”

Bitcoin Industry in Japan

Back in March, the Japanese National Diet approved the tax reform proposed by Deloitte. The bill, which came into effect on July 1st will drastically increase bitcoin and cryptocurrency trading activities within the Japanese digital currency exchanges.

The bill will probably increase bitcoin and cryptocurrency trading activities within the Japanese digital currency exchanges.

On April 1, the Japanese government officially recognized Bitcoin as a legal payment method and currency.

The Japanese Bitcoin exchange industry is well regulated with Know Your Customer (KYC) and Anti-Money Laundering (AML) systems. AML policies are very strict in Japan and South Korea, and it is difficult for traders to take advantage of utilizing digital currencies to move large amounts outside of Japan.

Price growth because of bitcoin taxation

Although it could be a coincidence- since Japan has proposed the end of Bitcoin taxation, Bitcoin price increased from around $2,450 to $2,570.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Price tripled in 1 year: why you should hold bitcoin

Bitcoin price is nearing its all-time high price of $1,277, maybe because of the impressive growth within the Japanese bitcoin industry. Read here why you should hold bitcoin.

Experts argue that bitcoin price will increase consistently in the mid-term if Japan and the US sustain their growth and if small markets such as India will decide for a massive change related to bitcoin regulation.

Bitcoin price drove by India and Japan

India has always been considered the more important Bitcoin markets because of its poor banking system.

Right now, in fact, 40% of India population can be defined as “underbanked“.

The greatest part of people in India cannot rely on banks and financial institutions to manage their funds.

Recently, the demonetization of 500 and 1,000 bank notes decided by the Indian government led to a national financial crisis, as banks and ATMs ran out of cash to dispense, so Indian citizens cannot obtain cash for their daily basic needs.

Also, PwC explained that 233 mln Indians didn’t have any access to bank accounts since October of 2015 and 43% of adults in India made no deposits or withdrawals in any banks or financial institutions.

Bitcoin hold: why?

Bitcoin exchanges in India – such as Zebpay and Unocoin – began to see a huge growth in their user base and trading volumes.

One key factor that would allow the Indian Bitcoin industry to grow at a rapid rate similar to China, South Korea and Japan is the legalization of Bitcoin.

Bitcoin regulation in India should arrive this summer, according to recent press releases.

This way millions of new users would emerge, and Bitcoin price will rise in the mid-term.

That’s why you should hold bitcoin and store them in a safe place.

Open your bitcoin wallet here on the HolyTransaction multicurrency wallet. You can store more than 10 digital currency within the same account, so it is very easy to manage.

Open your free digital wallet here to store your cryptocurrencies in a safe place.