Search Results For: regulation

Tokenized Gold Tops $1 Billion Market Cap Amid Banking Crisis Concerns

Tokenized Gold Market Cap Surpasses $1 Billion

Tokenized gold has recently achieved a significant milestone, with its market capitalisation surpassing $1 billion amid growing concerns about the stability of the banking system and increasing interest in alternative investments. Tokenized gold refers to digital tokens that represent ownership of physical gold, providing investors with a way to trade and hold the precious metal in a digital format.

Alternative Investments Gaining Popularity

Investors have been seeking alternatives to traditional investments such as stocks and bonds, which have experienced significant volatility in recent years. As a result, they have increasingly turned to alternative assets such as cryptocurrencies and tokenized assets like gold as a means of diversification and hedging against market volatility.

Benefits of Tokenized Gold Over Physical Gold

Tokenized gold has gained popularity due to its ability to provide investors with exposure to physical gold without the logistical challenges of storage and transportation. Unlike physical gold, which requires secure storage and transportation, tokenized gold can be easily traded and held in digital wallets. This convenience makes tokenized gold accessible to a wider range of investors and removes many of the barriers to entry associated with investing in physical gold.

In addition, it also offers greater transparency and accessibility than traditional gold investments. Investors can track the movement of the underlying physical gold and verify the authenticity of the tokens, mitigating concerns around the integrity of the traditional gold market such as counterfeiting and price manipulation. This increased transparency and accessibility makes tokenized gold a more appealing investment option for investors looking for a more secure and trustworthy way to invest in gold. The recent surge in the market capitalisation of tokenized gold is also a reflection of concerns around the stability of the banking system amidst the ongoing global financial crisis. Governments around the world are injecting trillions of dollars into their economies to combat the economic fallout from the COVID-19 pandemic, leading to concerns about the long-term impact on inflation and the stability of the banking system.

Historically, gold has been viewed as a safe-haven asset during times of economic uncertainty, and tokenized gold offers investors a way to access the benefits of physical gold without the logistical challenges. In this sense, tokenized gold may be seen as a form of digital gold, providing investors with a means of diversification and hedging against the potential risks of inflation and financial instability.

Risk and Potential Downsides

However, as with any investment, tokenized gold carries its own risks and potential downsides. One of the primary concerns around tokenized gold is the potential for fraud and the lack of regulation in the industry. As with any emerging industry, there are risks associated with investing in tokenized gold, and investors should conduct thorough research and due diligence before investing.Another concern associated with tokenized gold is its correlation with the price of physical gold, which can be volatile in its own right. While tokenized gold may provide investors with exposure to physical gold without the logistical challenges, it is important to remember that it is still a speculative investment and subject to the same risks and potential downsides as any other investment.

Despite these concerns, the increase in the market capitalization of tokenized gold is a positive development for the broader digital asset market. It provides further evidence of the growing interest in digital assets as an alternative to traditional investments and highlights the increasing importance of tokenization in the financial industry. Tokenization has the potential to transform the way we invest and trade assets. By creating digital representations of physical assets, tokenization removes many of the barriers to entry associated with traditional investments and provides investors with greater transparency and accessibility.

Final Thoughts

To conclude, the recent surge in the market capitalization of tokenized gold is a reflection of the growing interest in alternative investments and the potential benefits of tokenization in the financial industry. While tokenized gold may not be suitable for every investor and carries its own risks, it represents a significant development in the broader digital asset market and highlights the potential for tokenization to transform the way we invest and trade assets. As the industry continues to mature and regulations are put in place, we are likely to see an increasing number of investors turning to tokenized assets like gold as a means of diversification and hedging against market volatility.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Azimut’s €40 Million Investment in Alps Blockchain Signals Growing Interest in Blockchain Technology

Azimut Invests €40M in Alps Blockchain: A Sign of Growing Blockchain Interest

Azimut, an asset management company based in Italy, has recently announced a major investment of €40 million in Alps Blockchain, a company focused on blockchain technology. The investment by Azimut represents a growing interest in the potential of blockchain technology to revolutionise various industries.

Blockchain technology is the core tech behind cryptocurrencies, the most popular of which are Bitcoin and Ethereum. Yet, blockchain technology’s potential applications go far beyond cryptocurrency. Blockchain technology can be used to build safe and tamper-proof systems for a variety of purposes, including supply chain management, voting systems, and secure data storage.One industry that blockchain technology has already impacted is the mining industry. Mining is the process by which new coins or tokens are created on a blockchain network. Miners are responsible for verifying transactions and adding them to the blockchain, and they receive a reward in the form of new coins or tokens. The mining process is crucial for the security and integrity of the blockchain network.

Addressing Energy Consumption in Blockchain Mining

However, mining can also be a resource-intensive process that requires significant computational power and energy consumption. Bitcoin, the largest cryptocurrency by market cap, has been estimated to consume more energy than entire countries like Argentina and the Netherlands, which has raised environmental concerns.There are attempts underway to make mining more environmentally friendly. Some mining corporations are looking into using renewable energy sources like solar and wind to power their operations. Furthermore, several cryptocurrencies, like as Ethereum, are going to switch to a different consensus process that will use far less energy than mining.

Aside from concerns about energy usage, blockchain technology has the potential to improve data privacy and security. Since more personal and sensitive data is shared online, secure and private data storage has become an urgent problem. Blockchain technology, by providing a decentralized and tamper-proof mechanism for data storage and sharing, may provide a potential solution to this problem. Data can be encrypted and kept on several nodes in the network using blockchain, making it practically impossible for hackers to access or change.

Blockchain Tech and its Applications

This has important implications for industries such as healthcare, where the privacy and security of patient data is critical. Blockchain-based solutions can enable secure sharing of medical records and other sensitive information among healthcare providers while maintaining patient privacy. In addition to healthcare, blockchain technology has the potential to transform various industries. The supply chain management industry is one area that has already seen significant interest in blockchain technology. Blockchain can be used to create a secure and transparent supply chain network, enabling businesses to track products from the point of origin to the end customer. This can increase efficiency and reduce costs, while also providing consumers with more transparency and trust in the supply chain.

Another potential application of blockchain technology is in voting systems. With concerns around the security and integrity of voting systems, blockchain technology offers a potential solution by providing a tamper-proof and transparent system for recording and verifying votes. This could increase trust in the electoral process and ensure the accuracy of election results.

Exploring the Future of Blockchain: Innovative Use Cases and Emerging Trends

Overall, the investment by Azimut in Alps Blockchain indicates the growing interest in blockchain technology and its potential applications. As more companies and institutions begin to explore the potential of blockchain technology, it is likely that we will see more innovative applications and use cases emerge. Blockchain technology has the potential to transform various industries, and its benefits outweigh the potential risks and challenges.

Yet, there are still obstacles that must be overcome before blockchain technology can realize its full potential. One issue that needs to be addressed is energy use, and the industry is already moving toward more sustainable alternatives. Another issue is the industry’s lack of standards and regulation, which can lead to uncertainty for firms and investors.Despite these challenges, the potential of blockchain technology is too great to ignore. The investment by Azimut in Alps Blockchain is just one example of the growing interest in the technology, and we can expect to see more investments and developments in the future. As the technology continues to evolve and mature, it has the potential to disrupt industries and create new opportunities for innovation and growth.

In conclusion, the investment by Azimut in Alps Blockchain represents a significant development in the blockchain industry. While blockchain technology has already had a significant impact on various industries, its potential applications are still being explored. The challenges of energy consumption and lack of standardisation and regulation need to be addressed, but the potential benefits of blockchain technology in data privacy, supply chain management, and voting systems make it a promising technology for the future. As more companies and institutions begin to invest in and explore the potential of blockchain technology, we can expect to see more innovative applications and use cases emerge in the coming years.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Exploring the Use of Geothermal Energy for Bitcoin Mining: Opportunities and Challenges in El Salvador and Beyond

Introduction

As the cryptocurrency industry continues to grow, the energy consumption of Bitcoin mining has become a concern for many. Bitcoin mining, the process by which new bitcoins are created, requires high computational power, which in turn requires a large amount of energy. This has led to an increased focus on sustainable energy sources for Bitcoin mining. Geothermal energy, a renewable and low-carbon energy source, is one potential solution to this problem.

Advantages of Using Geothermal Energy for Bitcoin Mining

Geothermal energy has several advantages that make it an attractive option for Bitcoin mining. Firstly, geothermal energy is a reliable source of power as it is generated from the Earth’s heat, which is constant and abundant. Secondly, geothermal energy is relatively low-cost compared to other forms of renewable energy. This can help reduce the overall energy costs of Bitcoin mining operations. Lastly, geothermal energy has a low environmental impact, making it a sustainable option for Bitcoin mining.

One example of a company that is successfully using geothermal energy for Bitcoin mining is Genesis Mining, one of the largest cloud mining companies in the world. They have a geothermal-powered mining farm in Iceland, which allows them to use renewable and low-cost energy to mine bitcoins. This has helped them to reduce their overall energy costs and increase their profits. Another example is the case of El Salvador, where the government is actively promoting the use of geothermal energy for Bitcoin mining through incentives and regulations.

Limitations of Using Geothermal Energy for Bitcoin Mining

While geothermal energy has many advantages, there are also limitations to using it for Bitcoin mining. One limitation is that geothermal resources are not widely available, and are mostly concentrated in certain areas such as Iceland and New Zealand. This can make it difficult for companies to access geothermal energy, especially if they are located in areas without geothermal resources. Another limitation is the high cost of setting up geothermal power plants. This can be a significant barrier for companies that want to switch to geothermal energy for Bitcoin mining.

Current State of Research and Development

Despite these limitations, the use of geothermal energy for Bitcoin mining is an area of active research and development. Companies such as Genesis Mining are actively researching ways to improve the efficiency and scalability of geothermal energy for Bitcoin mining. Additionally, research and development of geothermal energy for Bitcoin mining can help increase the availability of geothermal resources, making it more accessible for companies around the world.

Conclusion

In conclusion, geothermal energy is a promising option for Bitcoin mining. It offers several advantages such as reliability, low cost, and low environmental impact. However, there are also limitations to using geothermal energy such as limited availability and high costs. With ongoing research and development, it is likely that geothermal energy for Bitcoin mining will become more widely available and cost-effective in the future. Countries like El Salvador are showing how it is possible to use geothermal energy to power Bitcoin mining operations while reducing environmental impact. By promoting the use of renewable energy sources and providing incentives for companies, governments can play a key role in encouraging the sustainable development of the cryptocurrency industry.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How Zcash is Changing The Crypto Game With its Wrapped Debut

When it comes to cryptocurrencies and altcoins, there are a huge range of diverse crypto offerings, each offering unique value in its own way. While mainstream attention continues to be directed towards altcoins such as Ethereum and Ripple, privacy coin Zcash (ZEC) is an intriguing alternative that is flying under the radar of many investors.

Here is a rundown of Zcash and how it is using Wrapped and Anchorage to increase its functionality while maintaining the privacy and security benefits that it already offers.

How Zcash Provides Privacy with Cryptography

Zcash, based on Bitcoin’s codebase, is an altcoin that was initially released in 2016, and shares many similarities to Bitcoin. With this being said, the areas in which it differs are in regard to privacy and anonymity.

Zcash offers enhanced privacy through its ability to offer two types of addresses – those that are transparent, and those that are shielded. With shielded accounts, while Zcash transaction data is still posted to a blockchain that is public, personal and transaction data remain confidential. This is achieved through zero knowledge proofs, which allow for verified transactions without information such as transaction amount, sender and receiver.

Wrapped Zcash

Wrapped, which is a partnership between Anchorage and Tokensoft, launched WZEC as their first asset in late 2020. In understanding how wrapped Zcash is providing value, it is important to understand the idea of wrapping a token.

Essentially, wrapping a token involves representing a blockchain asset on another blockchain – with the example of Bitcoin, it would involve issuing a BTC equivalent on the Ethereum blockchain network. This exists in the form of wrapped bitcoin (WBTC). Wrapped tokens are backed on a 1:1 basis with the cryptocurrency upon which they were based, and need to be held in reserve by a qualified custodian.

Wrapped Zcash follows this same process, and as a result provides a number of benefits which are in many ways unprecedented.

How WZEC Provides the Best of Both Worlds

When it comes to the benefits of wrapped Zcash as opposed to ZEC, the functionality of this altcoin is dramatically shifted with WZEC.

Put simply, shielded Zcash holders can now use their Zcash whilst keeping their information private. They can now keep their assets in a shielded account, and are able to privately use a fraction of them on Ethereum blockchain by wrapping these assets. This addition means that Zcash users can benefit from the best of both crypto privacy and functionality.

In addition to this added capability, WZEC also provides benefits in regard to regulation – this is because wrapping Zcash on the Tokensoft platform results in a know-your-customer (KYC) process for shielded ZEC, in addition to the fact that ZEC holders need to be on the same page as Anchorage in terms of their compliance as qualified custodians.

Finally, it allows ZEC holders to invest and make transactions within the various Dapps built on Ethereum.

The Importance of Privacy in the Crypto World

When it comes to cryptocurrency in 2021, the growing demand for crypto is bringing with it an increase in the demand for safety, security and privacy in making transactions and using crypto assets.

While it was once not an option for shielded ZEC to be traded on crypto exchanges, WZEC makes this functionality a reality. Essentially, Wrapped is creating a crypto offering that includes the best of privacy and usability.

This is a product that is catering to a growing audience of crypto enthusiasts and investors, whether retail or institutional, and is a contributing factor to the increasing price of ZEC – 2020 saw huge increases in ZEC value, and this growth has so far continued into 2021.

While cryptocurrencies such as Bitcoin and Ethereum are popular within the wider crypto community, their shortcomings in regard to privacy are meaning that more and more investors with concerns regarding privacy are beginning to consider crypto offerings such as Zcash – with this being said, only time will tell whether ZEC ends up as a success.

Author Bio:

Chelsea Rogers is a marketing student and freelance writer for Current.com.au based in Melbourne, Australia. She is passionate about growing her crypto and finance portfolios. She is an avid music lover and regularly performs at local venues with her band.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why is Estonia Considered Crypto Capitol of Europe?

At this point, cryptocurrencies will play a major role in the global financial industry soon. Millions of people are already using them, and these digital assets had a massive breakthrough in 2021. What’s even more important is that many companies and countries are starting to accept them.

In a world’s first, El Salvador became the only country to fully adopt Bitcoin and even use it for various trading purposes. That allowed the cryptocurrency to grow and stabilize itself even more. Even though many would think that El Salvador will be leading the pack in the crypto world, that did not concern Europeans too much.

Why? Because they already have a country that kind of regulates these digital assets and allows them to trade with them. That country is Estonia, and, in this article, we’ll be looking at why Estonia is considered the crypto capitol of Europe. Let’s dive into the details.

Estonia Was the First Country to Regulate Cryptocurrencies

First, Estonia was among the first countries in the world to start regulating cryptocurrencies. It started accepting them around a decade ago and since then, became a haven for all crypto traders. That ‘tradition’ was kept over the years as all new traders in the continent are advised to invest in crypto here.

Aside from trading and making a profit, crypto users keep these digital assets to pay for services/products and for entertainment. One of the most popular entertainment types that you can participate in with crypto is online gaming, specifically casino sites.

Since online casinos operate on the Internet now and cryptocurrencies are fully optimized for online use, they were more than fond of allowing registered players to deposit and withdraw money with them.

Estonia Is Fond of Using Technology to Its Advance

Next up, Estonia is well-known for leaning towards technology. After all, apart from being known as the first country in Europe to regulate cryptocurrencies, it is also the first country in the world to introduce the e-Residency program, which is like digital citizenship.

This allows participants to use numerous services from the government, including starting an EU-based company without the need of travelling to Estonia.

When it comes to cryptocurrencies and payment methods, one interesting fact about Estonia is that it is a cashless society. Statistics show that 99% of all transactions are conducted digitally. Residents here are always looking for more efficient online payment methods and that is what led the country to cryptocurrencies.

As you may know, crypto transactions are instant, whereas transactions with regular payment methods can take up to a few days to be completed. That makes these digital assets perfect for paying online and conducting business.

The industry is Well-Regulated in the Country

Lastly, the Estonian government has recently tightened regulations as the Financial Intelligence Unit, which is under the wing of Estonia’s Finance Ministry, is now able to revoke crypto licenses in efforts to fight money laundering.

That makes this country extremely safe for all those who are willing to invest in cryptocurrencies. Extra security is always welcomed, especially in times when online scams are proving to be a massive problem. As data shows, more than $240 million has been lost in scams so far in 2021. Millions of people fall victim to this problem and all of us want that extra security layer.

Thanks to the fact that cryptocurrencies utilize cryptography, which provides a certain level of online anonymity, users are safer, but with Estonia’s regulations, that security is taken to the next level.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Six Cryptocurrencies to Watch in 2019

Following last year’s very well publicised crisis moment for Bitcoin, it’s very tempting to believe that the moment for cryptocurrency has passed. Confidence in these new technologies has waned significantly, and there’s a general understanding of how volatile the market is. But though it is still true that cryptocurrency is not as stable as more established currencies, the technology isn’t going anywhere any time soon.

So while you may have missed the first major boom in digital currency, there is a likelihood that we are going to see some interesting developments in 2019. Here are some cryptocurrencies to watch this year.

Ethereum (ETH)

Ethereum works not just as a digital currency but as a platform for users to build their own cryptocurrency. Users take the building blocks provided by Ethereum’s blockchain and create their own application so that it can be used to manage things like supply chain.

At the end of 2018, Ethereum had started to show growth again after the 2017 peak. At it’s highest peak, it had grown around 3000%, the second largest after Bitcoin. “During the course of this year,” says Jay Stokes, author at researchpapersuk.com, “ Ethereum is expected to continue to rise in value, as plans roll out to improve its technology.”

Decred (DCR)

Launched in 2016, Decred has become a well regarded currency that aims to democratize its model. There’s a focus on the actual work of data mining, with partial rewards going back to those who can offer proof of work. These individuals can have a direct say in the management and direction of the project.

To facilitate this decentralized governance, the developers have created an efficient and simple voting system to achieve consensus. Utilizing smart contracts the model is resistant to any potential outside parties that would seek to influence votes being cast.

Cardano (ADA)

Founded by Ethereum’s Charles Hoskinson, Cardano works through a smart contract platform. The developers take remarkable care to maintain the platform, and seek to standardise and promote Cardano’s protocol technology.

Charles Hoskinson claims that Cardano is the next stage in evolution for blockchain technology. It is built on meticulous academic and scientific research in order to combat issues surrounding blockchain technology, including scalability, interoperability and sustainability.

Dash (DASH)

Created in 2014, Dash is a decentralized autonomous organization as well as a cryptocurrency. As an open source asset, it works on a principle of self-governance. In its early days, it was known as Xcoin, a ‘fork’ of the Bitcoin protocol, but as an altcoin, it earned a bad reputation as the cryptocurrency used on the dark web.

However, following a rebrand as Dash (Digital Cash), it ceased operating on the dark in 2016. Payments via Dash are almost instantaneous, and through user engagement protocols, the community which uses it are all geared towards improving its development.

ZCash (ZEC)

Developed in late 2016, ZEC is geared around security and transparency. The two main protocols of Zcash involve either shielded or transparent pools.

Private transactions can be disclosed to aid transparency, allowing users to prove payments in order to comply with governmental regulation and tax services. In this way, Zcash has been at the forefront of creating a sustainable future for cryptocurrency.

“The developers of ZCash have been very public in meeting with law enforcement agencies” says Carina Rodriguez, contributor to draftbeyond.com, “This, finally, is a bid to show a united front against illegal cryptocurrency activity.”

Monero (XMR)

Monero has had a somewhat controversial year. Some studies during the year showed that around 4.3% of the total supply of XMR had been mined illegally. For many, this is a worrying part of cryptocurrency. However, as the industry as a whole move towards a more legitimate, less shady mode of practice, it is interesting to note that during the time these studies were published, XMR’s value seemed to have fluctuated very little. It is based on the CryptoNight ‘Proof of work’ algorithm, pushing miners to seek legitimate sources of data.

Unlike, for instance, ZCash, Monero is developed around utter financial privacy, allowing payments and balances to remain hidden. Though it remains a controversial choice of Bitcoin, it continues to be a versatile crypto asset used across the world.

Benjamin Schmitt is an experienced lifestyle writer and app developer. He writes on app development and a range of other topics for Gum Essays and Lucky Assignments.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

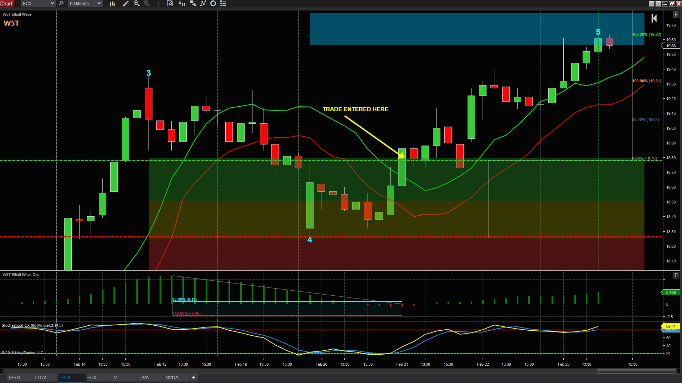

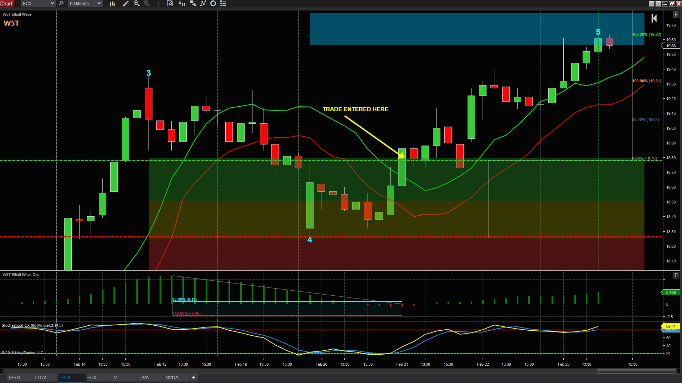

What Are the Investment Returns on Bitcoin Mining

You know about Bitcoin: The original digital currency based on blockchain. Every transaction is written to a shared ledger and verified by the rest of the network. Each set of approved transactions is a “block” added to the chain.

But you may have missed the buzz on Bitcoin mining. It’s not just for web geeks or digital currency traders. There are thousands of people around the world looking to profit in this way.

What is Bitcoin Mining?

Participants try to guess a random number generated by the system. Those who get the answer “own” the next block of transactions and collect a reward; currently 12.5 bitcoins. If you manage this, you can also collect fees on transactions in the block you created.

This number comes from a complex equation. In the early days it was handled by ordinary computers, and then GPUs (graphics processing units), which were better suited to the task. Over the years the equation has evolved in difficulty to regulate the rate of discovery.

Technology

Bitcoin miners now rely on hardware-intensive systems known as ASICs (Application-Specific Integrated Circuit), which appeared in 2013. If you own or can get access to such a system, you stand to guess a fair amount of numbers on the blocks constantly taking shape.

If this sounds like an easy way to profit, it is. Many people have joined the ranks of digital currency miners. However, with so much competition, the big question is whether there are still decent profits to be made.

Can You Still Make Money?

The more computers that are trying to capture the number, the harder the equation becomes and the fewer numbers you get.

But Bitcoins also tend to go up in value. It was a price spike in 2013 that launched mining as a popular investment option. Speculators agree that the value of Bitcoin should continue rising as its popularity grows.

Investments Required

To maximize your return on Bitcoin mining, you need an ASIC system. These computing solutions utilize high-end hardware that generates a lot of heat. Such a setup requires state-of-the-art cooling and ventilation systems along with higher utility bills to operate all of this.

Without an ASIC of your own, your odds of scoring aren’t good. It is possible to save some money by leasing an ASIC rather than buying one outright.

Other Options

Fortunately for the smaller investor, recent years have seen the rise of cloud mining, or cloud hashing. This response to growing demand is basically another cloud service where you get to lease a portion of someone else’s ASCI-enabled data center.

A cheaper option, albeit with smaller potential rewards, is a mining pool. This is a third-party service that uses investor funds to do their own mining and shares out the profits. The upside of this is that you don’t need technical or financial knowledge at all; you just need to come up the minimum investment required by the service.

Profit Potential

You can join some of these investment pools for as little as $500. Some of these third-party services state that you could earn your investment back in as little as two months or so, and start seeing profit after three. When these claims are legit, or even close to it, you’re seeing a remarkable and fairly consistent ROI better than most forms of investment.

However, transaction fees are currently voluntary on the part of individual users of Bitcoin, as is whether the transaction should even be included in a block. This is encouraged as the transaction is more quickly verified if it’s part of a block. Even so, your profit depends on the current value of Bitcoin, the number and size of transaction fees involved, and the number of people sharing the rewards.

Federal Regulation

In 2015 the Commodity Futures Trading Commission (CFTC) declared that digital currency trading is legal and subject to fair trading laws. However, this doesn’t guarantee that you’re protected. Prudent investors always do the homework: Know who you’re dealing with and determine realistic expectations.

Risks in Bitcoin Mining

The Bitcoin reward is halved every 210,000 blocks, or about four years. As the reward approaches zero, it may not be profitable at all unless transaction fees are increased and enforced. And while the general trend is up, there’s also fluctuation in Bitcoin value.

There’s also a question of integrity. As more cloud services spring up, you’ll have a widely varying scenario of payouts, contract stipulations, and the potential for dishonest reporting; even outright fraud. Also, on the downside: The IRS says that mining profits may be taxed as individual investment gains!

Is Bitcoin mining still a good investment? At the present time, yes, and hopefully for years to come with appropriate changes. Are you ready to sit back and let the computers make you bitcoins?

Jen McKenzie is a writer at Assignyourwriter company (https://assignyourwriter.co.uk/team/jen-mckenzie/) and an independent business consultant from New York. She writes extensively on business, education and human resource topics. When Jennifer is not at her desk working, you can usually find her hiking or taking a road trip with her two dogs. You can reach Jennifer (https://twitter.com/jenmcknzie) @jenmcknzie (https://twitter.com/jenmcknzie)

Open your free digital wallet here to store your cryptocurrencies in a safe place.

4 Places Where Bitcoin Can Actually Be Used

Bitcoin has transitioned into a stage of its evolution at which it is viewed almost entirely as a commodity. We discuss how to store it, compare it to gold, consider its long-term value, and generally treat it as a financial asset – even, to some extent, like a stock. This is perfectly appropriate given that the cryptocurrency’s volatility, as well as constantly wavering government positions on regulation, have kept it from being adopted as a widely used currency. The argument is over as to whether it is “more” currency or “more” commodity. It is the latter.

What sets bitcoin apart in some respects though is that it never did have to be one or the other. Consider the comparison to gold again. You may hold a stash of gold as a long-term protection of a chunk of your assets, and with the hope that it will appreciate in value. But you can’t exactly buy something online by chipping off a piece of gold (which in most cases you don’t even hold in a physical sense) and handing it over. This is true of most major investable commodities – but it is not true of bitcoin. As you’re likely aware, there are still places that it can be used like ordinary money, even though it is best viewed as a long-term vehicle.

For those interested, the following are among the most noteworthy places you can actually use the cryptocurrency for practical purposes.

1.) Travel Booking Websites

Bitcoin made something of a loud entry into the travel booking business when it was accepted by Expedia and Air. These were among the biggest or at least best known companies to embrace cryptocurrency early on, and even though Expedia has since renounced cryptocurrency, the notion of using bitcoin for travel-related costs caught on. Travel platforms accepting bitcoin or other cryptocurrencies still include various air travel and hotel booking companies, which means people are free to address what are often some of their biggest expenses in a given year via cryptocurrency.

2.) Microsoft Gaming

Fairly early on in bitcoin’s expansion to the mainstream, it was attached to video games, not necessarily through Microsoft so much as Steam. An online service that allows people to download a gigantic range of games, Steam was in some ways a perfect vehicle for purely digital transactions. However, the services topped accepting bitcoin due to volatility. In the meantime, Microsoft kept right on accepting cryptocurrency and is now one of the more significant companies doing so. In particular, Xbox-related purchases through Microsoft platforms can be conducted via bitcoin.

3.) Gaming

gaming is an interesting category, because it is almost like its own separate gaming industry. It’s comprised of and table games, digital slot arcades, roulette, and more, and in some cases a site will also have an included sportsbook. Payment options vary greatly, with some sites requiring credit card information and others using payment processors; in some cases, games are presented for free play as well. However, there is now a small but growing list of online sites that do take cryptocurrency deposits, and which also issue crypto payouts. It’s not a stretch to say that in short time bitcoin could be the norm for this particular form of entertainment.

4.) Shopify

Shopify is a more specific mention here, but feels like one of the more significant areas for bitcoin adoption, simply because it represents a busy, peer-to-peer marketplace. The fact that bitcoin can be used to buy goods via Spotify indicates that in some cases people prefer it when dealing with other people, rather than companies, and opens the door to all kinds of potential crypto marketplaces in the future.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Battle of ROI: Should You Invest in Shares or Cryptocurrencies?

Investment opportunities are a dime a dozen in the digital world, but unsurprisingly, cryptocurrencies are among the most interesting prospects aspiring investors are looking at. Unlike their traditional counterparts such as gold, stocks, traditional currencies, and other, cryptocurrencies and the blockchain platform they reside on offer a chance at the big leagues for any investor that makes the right move at the right time. However, that doesn’t mean that established assets shouldn’t be ignored.

Bitcoin has turned eight years old this year, and the now mature digital asset has had a strong ROI rate throughout its life, fueled by its constant and steady adoption around the globe. With outstanding payouts that topple some of the most lucrative investment assets on the market, it’s time to take cryptocurrencies more seriously.

However, there are a number of factors that make shares a strong and secure investment opportunity that cryptocurrencies might not be able to match. Let’s consider the market trends and help you discern between shares and cryptocurrencies as viable investment prospects.

The potential of the cryptocurrency market

Through trial and error, through success and failure, Bitcoin has become a sound investment portfolio option. Out of the six previous years, Bitcoin has yielded a great return on investment and will only continue to rise in the months and years to come. With the computational networks becoming more secure and stronger than before, and with the coming of flexible and reliable wallet services, it only stands to reason that modern investors should look towards cryptocurrencies as viable investment opportunities.

Even though investors have had difficulties penetrating the market over the years because of the inherent volatility of the market and the unpredicted growth and fluctuations, modern market trends indicate a more secure investment arena for the upcoming period. The increase in market liquidity, regulatory oversight, and overall security is making Bitcoin and other cryptocurrencies more appealing to investors worldwide, as well as countries willing to adopt the cryptocurrency as a new method of payment in select instances.

A case for the stock market

The stock market is a veteran among investment assets and remains one of the most stable markets on the planet. Buying a share in a company that is operating profitably will grant you smaller or greater returns over a number of years, depending on the fluctuations in the market and the worth of the company’s stocks. You can choose to invest in a range of businesses varying in size and equity though a broker or an investment fund.

Over the last year, though, profitable small cap stocks have made a boom in the industry and created a lucrative investment arena that aspiring investors should take into consideration when planning their next big move. Even though major tech companies continue to garner the attention of the investment world, small cap stocks prove to be an easier way into a stable market and show a great potential for grand financial returns in the years to come. However, financial return should not be your only guiding star.

Regulation and governmental oversight

One of the greatest concerns for any investor is whether or not the market in question is safe and stable enough for storing assets without them vanishing into the abyss with no prior warning. It’s a well-known fact that the cryptocurrency market is not regulated by any traditional means, but rather is was envisioned and still serves as a public ledger that works as a decentralized data management system – a system where every transaction is stored.

This means that the cryptocurrency market is not regulated by any governmental body, nor is it recognized by legislature or financial institutions. As such, cryptocurrency transactions cannot be influenced, capped, reserved, or identified by third parties. However, this creates a possibly volatile investment environment the stock market is protected from.

The stock market is one of the safest investment markets in the world. The fact that it is extremely well-regulated by federal law and financial institutions ensures a higher level of security and accuracy, while the strict vetting process for participants from both sides ensures transparency for investors. All of this works together towards creating a safe investment arena, and it also helps make sound forecasts in terms of market fluctuations, giving more control to the investor.

The security of assets on the blockchain

With all of that said, it’s important to note that Bitcoin has never been hacked, nor is it likely to get hacked any time in the future. The projected amount of computing power and time needed to crack into individual transactions and wallets is almost impossible to replicate in real-life scenarios, and so blockchain stands tall as the most secure platform on the web.

While it is true that Bitfinex and Mt.Gox have been hacked in the past, nowadays the cryptocurrency game offers far more superior security options to its investors. With cryptocurrencies, the assets you store in your wallet are safe. This cannot be said for other investment assets, as every digital trading game has its set of liabilities and risks the hackers can exploit.

Investors are constantly looking for emerging opportunities and lucrative assets that will yield a high ROI over a specified number of years, and both the stock market and the crypto market offer a good chance of a high return on investment. That said, the stock market offers a more stable and well-regulated investment arena, whereas cryptocurrencies offer extreme returns to those who invest in the next big project.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

What’s Wiser: Storing Crypto at the Exchange or in a Wallet?

Exchanges are the entry gate for newcomers in the crypto world. Apart from direct deals which are pretty rare at the moment, these platforms represent a great option to get some cryptocurrency for fiat money. But are the exchanges fully secure?

Surely, websites are pretty convenient and user-friendly as they are targeted on different traders including total newbies. But their security isn’t ideal. Just remember the hack of Coincheck in January 2017 or the famous history of Mt.Gox’s rise and fall.

Despite threats and risks, some crypto investors keep their money at the exchanges’ in-built storages. Others prefer private wallets. Who is right? Let’s try to figure it out and reveal where your coins will be safer.

Basics of storing crypto

Crypto isn’t tangible as fiat money. It exists online and records transactions by using blockchain. For storing assets, you can use in-built storages at the exchange platforms and crypto wallets which are unique addresses and can function both online and offline.

Each wallet consists of public and private keys. Public keys can be compared to email addresses – in order to receive some coins, you have to share this number with a sender. Private keys work like a password, as only the owner knows them. They can be subjected to frauds which is why it’s essential to secure your crypto as much as possible.

Storages at the exchanges – easy to use but vulnerable

Centralized crypto trading platforms which allow users buying and selling various coins are similar in one: they control accounts by not disclosing private keys to users. Сustomers just have to trust exchanges in keeping their coins secure. Of course, large projects like Coinbase, Binance, or CEX.IO have strong security teams and offer offline storages and multi-signatures to protect users’ funds better. But they also can be a sweet spot for hackers who focus on big-volume websites. Any reputable guide will warn you about the dangers of storing coins this way.

Cryptocurrency exchanges are vulnerable to market manipulations and can be hacked even when they have all the security measures needed. While choosing a platform to trade at, check hacking statistics, explore different opinions and overviews to be sure that the website you’ll be using cares about keeping your funds safe.

Apart from the problems with ownership and security, there’s an issue with the lack of regulation. Your coins aren’t totally protected as long as your country doesn’t move to the crypto legislation. While influential countries like China ban crypto activities, the market remains highly unstable which affects the level of security.

Keeping crypto at the exchanges has its advantages, too. These platforms are really convenient in terms of using the funds for trading. Customers like doing everything in one place: buying crypto with fiat (this option is not available everywhere, though), selling or trading coins. Using crypto-to-fiat exchanges like Kraken or CEX.IO, you can perform different actions at once.

Briefly summarizing, in-built storages at the exchanges are very convenient, especially when you don’t want to lose time and effort on setting up a wallet. But it’s better to keep coins there only for active trading, as there are no solid guarantees that your funds will remain safe.

Storing in wallets – various options

The level of security varies depending on the wallet’s type. Similarly to exchanges, you can store coins online or offline: the first option is represented by web-based and software wallets, while the seconds one is about paper and hardware ones.

Hot wallets

Web-based wallets are connected to the Internet. Desktop and mobile ones can be installed offline, but for their security not to be compromised, you need to keep them on a spare device with no access to the Internet. The main advantage of hot wallets is that they allow transferring money anytime and very quickly which is especially beneficial for active traders.

As for drawbacks, such systems are extremely vulnerable to fraudsters and phishers, no less than exchanges. It’s not recommended to use them for large amounts of crypto. If you’re still going for hot wallets, make sure you realize what risks it entails. Use it for day-trading or petty cash and avoid common mistakes: not calculating fees or spending unconfirmed outputs.

Cold wallets

Unlike the first type, these systems work offline which makes them practically immune to hackers and frauds. The most secure wallets are paper and hardware ones. Using the paper type is easy and free, but it holds risks of damage (paper can easily be destroyed) and the human factor (users can simply forget where they’ve put their wallets).

Hardware wallets that function as a flash drive are the most flexible: you can connect them to your device any time you want to perform a transaction and you can do it as many times you need. There’s one notable flaw, though – hardware devices are not free. For wallets like Trezor or Ledger, you’ll have to pay about $100. Also, they may be not that easy to use, but this is not important in contrast to the security they offer.

Final tips

If you’re planning on having active and diverse crypto activities, it’s advisable to combine both approaches to crypto storing: keep your main funds offline and have some money at the exchange. While dealing with hot storage, choose trusted platforms and wallets, enable two-factor-authentication, don’t open suspicious links that might look like actual services. As an additional measure, write your private keys down – keep this backup in a place only you can access, and do the same with paper wallets.

Risks related to storing crypto bring the issue of trust to the foreground: while centralized systems designed to work with decentralized currencies often fail to guarantee a perfect security level, it indicates the need for a new approach which would be more relevant to the very idea of crypto.

Open your free digital wallet here to store your cryptocurrencies in a safe place.