Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

At the end of April, mining hardware manufacturing company started shipping a whole stack of their products. It was the same time when the Litecoin hashrate was somewhere around 173,225 MH/s. The increasing exposure of Scrypt ASICs mining machines further influences other manufactures as well. In just two months since April, the Litecoin hashrate went up to 200$, while its mining difficulty also tripled.

The next Scrypt ASICs to hit the market will have the hashing power between 200 and 400 MH/s; indicating the possible surge in Litecoin mining difficulty and network hashrate as well. Some companies are also building hardware that can sustain hashing power up to 650 MH/s. As many believes, these events will somewhat impact the Litecoin standings in the market. The question however is, in which way?

The Litecoin community seems to have divided on this question. There is a section which believes that the increasing hashrate will have a fruitful impact on Litecoin prices, citing Bitcoin as a key instance; while another section does not acknowledge any relation between the Litecoin prices and its hashrate.

Explanations are coming from both sides, each with a unique perspective. The ones that support the prediction of Litecoin’s escalation believe it to be the network’s strength that will multiply by over 1,000 times in future. It is the economics of scale in mining that will play a major role in boosting the Litecoin’s stand in the market.

On the other hand, there are those who do not support this theory even in thoughts. They outright rubbish the history that certifies increasing hashrate proportional to the coin’s market cap. Their logic dictates a scenario in which miners are faced with increased selling pressures in order to cover their investments on such expensive mining hardware. This aims at a lower demand and higher supply rate that will eventually cause a huge drop in Litecoin prices. They event say that the current imbalance of Litecoin market is caused by such selling pressures.

Considering both the sections, we believe that market conditions have changed a lot since the launch of new cryptocurrencies in the market. The reason why BTC did so well after the increased hashrate was it being used only for trading. Litecoin too cashed only because of the bubble fuelled by China. The moment these coins were introduced to the real merchant world, its basics changed completely. Seeing today’s scenario, Bitcoin is backed by multiple major organizations while Litecoin is still far away from reaching this point. In short, the continual acceptance of BTC over LTC thickens the latter chances to repeat history. Hashrate increased or decreased, it won’t hold any meaning until Litecoin grabs some major investments from big players.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

As Bitcoin’s first-mover momentum spreads the digital currency’s adoption, the “proof of work” model it uses to confirm transactions is coming under scrutiny within the crypto-community.

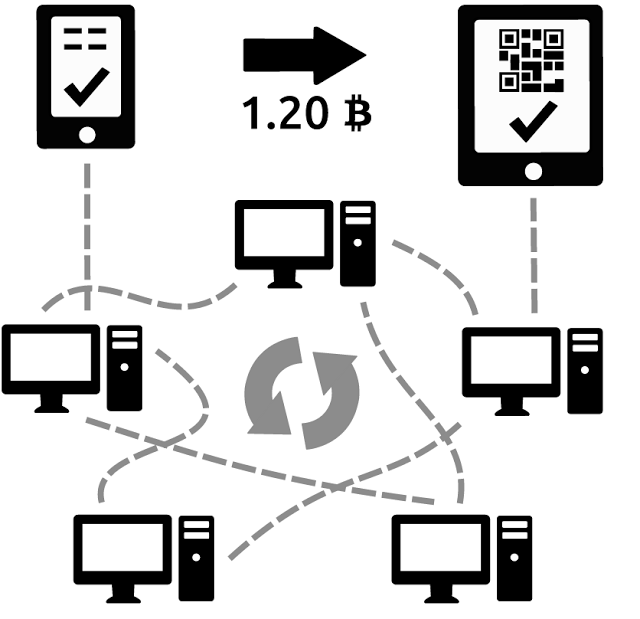

The proof of work algorithm rewards the individuals, called miners, who confirm blocks of transactions in exchange for an amount of the digital currency. Individual miners join pools to mine collectively as a group, increasing the computing power available to confirm Bitcoin transactions.

This model seems to benefit by encouraging a large number of participants, but it is vulnerable to what is called a 51% attack. A miner or pool that holds 51% of the total computing power could in theory control the blockchain, which is the public ledger of Bitcoin transactions. This control could enable double-spending bitcoins as well as blacklisting certain users or computing equipment. Until recently, the 51% attack was widely considered an unrealistic threat.

“The proof of work algorithm is robust and has been resilient in the face of continuous attacks for the past five years,” says Andreas Antonopoulos, a technologist and entrepreneur who is active in the Bitcoin community. But a mining pool called Ghash.io gave the community a scare when it took over 51% of the network for 12 hours on June 13.

If a pool used its control for nefarious purposes it would only hurt Bitcoin’s use and, in turn, its price. This result would hurt any miners who become attackers, since they are rewarded for their mining efforts in Bitcoin and likely hold a generous amount of the digital currency. Since the incident, Ghash control has decreased substantially, hovering now at around 35%.

“Certainly miners didn’t sign up for unfair play and they would abandon that pool,” lowering the percentage of its control, Antonopoulos says. The 51% attack “is a theoretical attack that’s narrow in scope and goes against the incentives for the miners and owners of the pool.“

Last year, Ghash said it would try to prevent itself from capturing 51% of the network power and that it would not do any damage even if it did reach this level of control. And since the power is split over the many individuals who mine in the Ghash pool, it’s unlikely the pool could reach a consensus among its members to damage the network.

Nevertheless, some in the Bitcoin community are calling for a splintering, or “fork,” in the Bitcoin blockchain, and the forked version of Bitcoin would add features that discourage pooled mining. Others are talking about the benefits of a “proof of stake” algorithm, which secures cryptocurrency networks by asking users to show ownership of a certain amount of the currency.

BlackCoin is an alternative digital currency that uses a pure proof of stake model. It was created about five months ago and has generated enough support to be integrated into CoinKite’s merchant point of sale system.

“A user chooses to ‘stake’ his coins to generate the next block in the chain, and his chance of doing so is proportional to the weight of his own coins,” says Adam Kryskow, U.S. representative for the BlackCoin Foundation.

Proof-of-stake algorithms enable faster payments. BlackCoin transactions confirm in under a minute, whereas Bitcoin transactions usually take about 10 minutes. And proof of stake is also more eco-friendly, consuming far less energy than proof of work algorithms.

|

| Image: Peercointalk.org |

Peercoin is one of the most recognized altcoins that uses a hybrid proof of stake/proof of work model. New coins are awarded to miners who do work to authenticate transactions, but are also given to users who hold a higher stake in the system.

“The current proof of work system that is in place incentivizes centralization,” says Kryskow. “Specifically as mining payouts decrease, small mining operations will be forced to close up shop. With little to no incentive to continue mining, network power will fall dangerously low and security will be severely threatened.“

But proof of stake has its own vulnerabilities. Kryskow admits that since proof of stake algorithms are not completely decentralized, they are susceptible to a “nothing at stake” attack, where older coins could be used to fork the blockchain to create a competing one.

The proof of stake model hasn’t been stress-tested enough over a long period of time, and it worries Antonopoulos when proponents argue that the nascent mining algorithm is better than Bitcoin’s proof of work.

Bitcoin has survived a number of attacks over the years, says Antonopoulos. “There is much better monitoring and tracking [of the network]…a lot of DDoS protections and countermeasures built into the core client because of Bitcoin‘s experience with widespread attacks over the years,” he says.

Proof of stake was created in 2011 with the launch of Peercoin. “It was attacked and beaten; bugs were found, security issues were rampant and countless vulnerabilities were exposed,” Kryskow says. That’s when Peercoin moved to the hybrid proof of stake/proof of work model.

BlackCoin‘s developer argues that, like Bitcoin’s proof of work, proof of stake will be stress-tested in real-world use. BlackCoin “is a great proof of stake experiment,” Kryskow says.

Antonopoulos agrees that the development of new proof models is advantageous. “I don’t think we’ve found the perfect solution yet,” he says. “Everything comes with compromises…so you just have to identify which ones are the good compromises to make.” Other algorithms include “proof of burn,” in which a small portion of a cryptocurrency is destroyed to create value through scarcity; and “proof of resource,” which takes a resource, such as bandwidth, and assigns it a certain value for sharing.

“The real issue, though, is until we see a problem in Bitcoin that impacts the price, knowledge of Bitcoin is so much higher than [all other altcoins] that any other solution out there will be irrelevant,” says Tim Sloane, vice president of payments innovation at Mercator Advisory Group.

Sloane doesn’t expect everyone using the Bitcoin protocol to switch over to another digital currency just because there’s a threat

of disaster. But it may happen if a disaster actually strikes.

“As Bitcoin gets bigger and bigger, the problem gets bigger and bigger,” he says.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

“To date, this incident is the single most profitable, illegitimate mining operation.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.