Google update now supports Bitcoin price in search results!

“You can also ask Google to do conversions – if you have the Google Search app on your smartphone, for example, ask it, ‘How many bitcoin are in 500 U.S. dollars?’ and you’ll get the answer in a handy conversion tool.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

LinkedIn co-founder: Bitcoin is in my five-year Investment plan

In the interview, Hoffman discussed his personal experience with bitcoin, confirming that he has purchased “a few bitcoins” to date in addition to his investment in Xapo.

In the interview, Hoffman discussed his personal experience with bitcoin, confirming that he has purchased “a few bitcoins” to date in addition to his investment in Xapo.Open your free digital wallet here to store your cryptocurrencies in a safe place.

The great unknown Bitcoin killer app

Open your free digital wallet here to store your cryptocurrencies in a safe place.

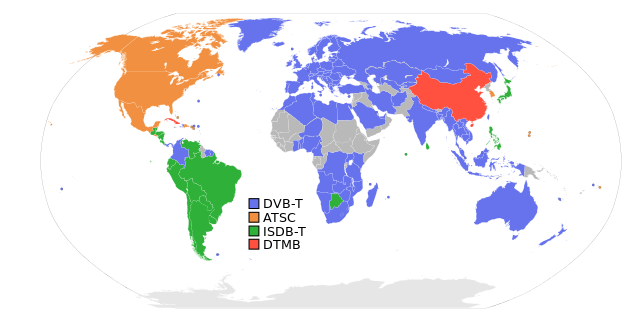

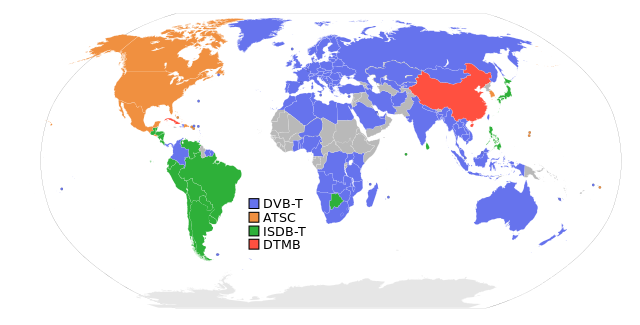

Kryptoradio: Connect to the bitcoin network from anywhere – even without the Internet!

What is Kryptoradio?

- transmits bitcoin transactions, blocks, and currency exchange data,

- does all this in real-time,

- uses terrestrial television (DVB-T) transmitters around the world.

- Bitcoins in the air, literally speaking.

Why?

- creating unprecedented devices and applications,

- making the bitcoin network more resistant to attacks,

- promoting bitcoin as a viable payment platform, and of course

- because they can!

“Alternative blockchain transports are critical to the success and survivability of the Bitcoin system.”

Bitcoin core developer – Greg Maxwell

What happens next?

2014 and last for 2 months. The broadcast area covers 95% of Finnish population, approximately 5 million

people. More information in the press release.

including maintenance costs is about € 2000 per month (VAT included). They are currently looking for partners to that stage.

technologically or by the number of users. If someone has ideas how to collect funds for this project, please contact us!

How to contribute

without compensation. However, in this case the compensation is the radio broadcast.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Cryptocurrency: Fundraising Evolved

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Someone is giving away Bitcoin in San Francisco

|

| Image: CoinDesk |

You don’t pay $10m for a house without making a few enemies #Bitcoinpic.twitter.com/WSN2snj3XQ

— SF Hidden Bitcoin (@sfhiddenbitcoin) July 3, 2014

1KeKnYh4hX6LR12AHetbQVjknXdti8TusZ #bitcoin right here – you can virtually poke it.#hiddenbitcoin #hiddencash pic.twitter.com/WqcukMmcmm

— SF Hidden Bitcoin (@sfhiddenbitcoin) July 4, 2014

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Nick Szabo (Bitcoin founder Satoshi Nakamoto?) Breaks his Silence with a Tweet

to bitcoin, the person who coined the term smart contracts in 1993, and

believed by many to be Satoshi himself, published a one line blog post

today which simply contained a link to his twitter account.

2013, almost seven months ago, leaving many to wonder whether he would

ever post again. The seven months silence seems to have followed

increasing attention on Nick Szabo after numerous suggestions that he might be Satoshi.

In April 2014, researches from Aston University’s Centre for Forensic

Linguistics claimed that forensic analysis of Bitcoin’s White Paper

suggests that Nick Szabo was the author of the paper.

that he is Satoshi and many argue that it is highly unlikely that he is

the author of the white paper. Nick seems to have been focused on

bitgold, writing a blog post about bitgold two months after Satoshi

announced bitcoin.

pictures of him, no verifiable details of his age, location, profession

or education. Previously, in a Wikipedia article, it was claimed that he

was a law professor at George Washington University, but reporters claim

that after contacting the University they found no record of a person

named Nick Szabo ever being a professor at that university, although

there was one record of a person having studied at that university under

that name. The name therefore might be a pseudonym, a pen name.

Nick Szabo Highlights the Dangers of Centralized Currencies

retweet of a statement by Proton Mail complaining that their PayPal

account had been frozen, blocking access to $275,000 of funds. In a

statement in their blog Proton Mail details what happened:

details, he questioned whether ProtonMail is legal and if we have government approval to encrypt emails.”

Paypal froze $215K in encrypted email startup, @ProtonMail‘s account over “government approval to encrypt emails”? https://t.co/VoqpHSTrEE

— lilia (@liliakai) July 1, 2014

intermediaries as emphasized by both Nick Szabo in his blog post and

Satoshi in his announcement on bitcointalk. We need to trust that our

accounts will not be blocked, our funds will not be tampered, our

government will not arbitrarily take funds, or that our banks will not

bankrupt our country as they did in Greece and Cyprus.

need no such trust. There is no authority that can block our private

keys to interact with our public keys, so accessing our wealth and using

it in whatever way we alone see fit.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Shakil Khan: cryptocurrencies are here, embrace them

already disrupting payments and won’t be stopped, serial investor

Shakil Khan told the audience at Wired Money 2014. So get on board

with change.

much-misunderstood, unstable currency, to a more mature offering

that is finding its place in ecommerce and investor portfolios. So

rather than focus on regulation, which will only delay the

inevitable, the financial sector needs to focus on supervision and

take on the opportunities cryptocurrencies provide.

David Rowan, has invested in Spotify and YPlan, and advised teen

founder of Summly Nick D’Aloisio. But it was in 2012, when he first

heard about a payment company attempting to tackle the Bitcoin

ecosystem, that the cryptocurrency crossed his path. In the

following years, he found himself becoming a point-of-contact for

investors, suddenly intrigued by a currency that went from $10-25

per Bitcoin in 2012 to $260 in 2013.

entrepreneurs asking who is this company Mt Gox? Not because I was

the smartest person, but because there was a different wave of

people who weren’t publicly talking about Bitcoin. Morgan Stanley

was phoning me not because we had a relationship, but because

people were calling them and asking advice, and they were coming to

me.”

BitPay. That’s a lot of hard cash for a currency that dips and

peaks dramatically according to government opinion — for instance

when the FBI referred to it as a currency, Bitcoin became stronger;

when China restricted exchanges and warned it would keep an eye on

the currency, its value tumbled.

average consumer to participate in this — it’s the same as

stocks,” said Khan. We in the tech industry are more than familiar

with Bitcoin, beyond the Silk Road headlines, and those in the

financial sector have followed suit. But it is not yet something

that is impacting the average banking customer. “Right now, it’s

something that’s not for the faint hearted, just like stock trading

where people make 3 percent gains one day, and 25 percent losses

the day after.”

made in the cryptocurrency ecosystem — and this is because, as

Khan reiterated onstage, there is a “fundamental problem with

payments”.

three seconds. But if I want to pay someone 200 kroner online it’ll

cost be $32 and might take four days for the payment to arrive.

That makes zero sense, and cryptocurrencies solve this

problem.”

result of this, says Khan.

Andreessen Horowitz, Fred Wilson and Redpoint. This is a sector

everyone knows is going to get disrupted, and they need to be part

of that journey. Companies like Bit Pay were very early, now we

have ecommerce companies starting accepting Bitocin. Amazon has its

own plans on virtual currency.

then we had email. We’ve seen this over and over, and if you have

passion and an appetite for risk, why wouldn’t you? I don’t want to

turn around and five years say why wasn’t I part of this.”

evidenced by the stories being published by Khan’s own site

Coindesk, which are picked up by the likes of the Wall Street

Journal and Dow Jones. “Over the last 12 months it’s

much less of Silk Road, and more of Visa setting up a group looking

into cryptocurrencies and Western Union or Ebay looking into

Bitcoin.”

Bitcoin, Khan points out that the US $100 note is the chosen

currency of the criminal world — it’s what they’ll find in raids,

and its what the CIA drops in bales of cash into Afghanistan.

“They’re not sending smartphones, they were sending US dollars.”

Recently, the US government sold off the 30,000 Bitcoin it seized

during the Silk Road shutdown. Khan points, “I don’t remember the

US government selling cocaine seized from raids, so you can’t say

it’s illegal and shouldn’t be allowed.”

you don’t understand something, you get fearful of it.”

there is something attractive here for investors — Khan says the

coins, currently priced at $650 each, went for above that

value.

not broken. “I’m guessing there are laser printers out there

devaluing that money quicker than the paper can be printed,” Khan

said.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Tim Draper, venture capitalist, wins government Bitcoin auction

(OnBitcoin) Tim Draper,

a Silicon Valley venture capitalist, was the sole winner of the US

Marshal Bitcoin auction. Mr. Draper purchased all 30,000 BTC, outbidding

many other participants in the auction such as Barry Silbert’s

SecondMarket.

Draper is an investor in Vaurum, an exchange platform for financial institutions.

In a statement,

Vaurum founder Avish Bhama said that Draper’s new bitcoins will be used

to provide liquidity to emerging markets through Vaurum.

“Bitcoin frees people from trying to operate in a modern market

economy with weak currencies. With the help of Vaurum and this newly

purchased bitcoin, we expect to be able to create new services that can

provide liquidity and confidence to markets that have been hamstrung by

weak currencies,” said Draper. “Of course, no one is totally secure in

holding their own country’s currency. We want to enable people to hold

and trade bitcoin to secure themselves against weakening currencies.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Education to consider for the Bitcoin user

(CoinTelegraph) This month, the number of educational institutions welcoming students who wish to pay using digital currency has increased substantially. This comes as no surprise, however, since the current academic year just ended, registration is opening up for the fall semester.

The King’s College, NYC, US

One of the leading institutions in the United States – The King’s College announced that it will be welcoming students who want to pay using Bitcoin.

The King’s College is a Christian liberal arts college founded in 1938 by Percy Crawford, located in Lower Manhattan, New York.

Now with help of New York’s Coin.co it becomes the first accredited

college in the US to accept digital currency. Dr. Gregory Alan

Thornbury, President of The King’s College stated:

“The King’s College seeks to transform society by preparing students

for careers in which they help to shape and eventually to lead strategic

public and private institutions. Allowing Bitcoin to be used to pay for

a King’s education decreases our costs while simultaneously allowing

our students to be a part of this exciting new technology.”

Team Treehouse

On Thursday June 12, a famous US-based online education provider – Team Treehouse – officially announced that it will be accepting Bitcoin via Coinbase as one of a payment options. The company’s press release stated:

“As one of the fastest growing payment methods, Bitcoin will give

more people across the world the opportunity to learn with Treehouse.”

Treehouse is a place for people who want to learn how to coup with HTML or CSS, make iPhone apps, start their own business.

University of Nicosia, Cyprus

Once again we mention the University of Nicosia,

which was the first to accept Bitcoin for payment of tuition and other

fees. Dr. Christos Vlachos, Chief Financial Officer for University of Nicosia stated:

“Digital currency will create more efficient services and will serve

as a mechanism for spreading financial services to under-banked regions

of the world. In this light, we consider it appropriate that we

implement digital currency as a method of payment across all our

institutions in all cities and countries of our operations.”

Anyone who wants to advance their education here will probably find a

an area of interest they’re looking for – University of Nicosia offer

schools of business, education, humanity, social science, law,

engineering and arts.

A big advantage of the University of Nicosia is that it is accepting

Bitcoin throughout their whole University network, including affiliated

institutions in London, Cyprus, Greece, Romania and others.

University of Cumbria, UK

In the beginning of the year, the University of Cumbria in the United Kingdom also announced that it will accept Bitcoin for the payment of fees. The founder and director of IFLAS, Professor Jem Bendell, stated:

“We believe in learning by doing, and so to help inform our courses

on complementary currencies, we are trialling the acceptance of them.

The internal discussions about currency and payment innovation and the

practical implications for different departments have been insightful.”

The acceptance of Bitcoin is limited to the two programs only – Certificate of Achievement in Sustainable Exchange and Postgraduate Certificate in Sustainable Leadership. Both courses are already in progress as a trial though it shouldn’t be the last one as “the university will learn from this trial and develop its awareness of innovations in complementary currencies and payment technology.”

Language centers

Additionally, there are also various private languages studios all over the world happy to accept digital currency.

A2Z School of English could be the first English as a Second Language (ESL) school in the world to accept digital currency. The announcement that it will adopt Bitcoin as a payment method was published back on November 5, 2013. A2Z School of English was founded in 2006 by James and Luciene Taylor and today has locations in Manchester, London and Dublin, offering various English language classes. BairesClases accept Bitcoin for Spanish classes. You can have face to face lessons in Buenos Aires Argentina or classes over the Internet for students anywhere in the World for anyone from beginner to advanced. Ru-SprachStudio.ch offer Russian courses in Zürich or Zug, Switzerland for Bitcoin. Customers may choose one-on-one private lessons or lessons in groups of 3-4 people. Their teaching approach also uses modern methods to develop your ability to communicate in the Russian language. Cinta Bahasa in Bali, Indonesia, offers Indonesian Language courses to foreigners and they also accept Bitcoin. They have schools in Ubud, Sanur, Kuta, and Canggu, Bali to teach students the language they will need to feel comfortable travelling around in Indonesia. Educational institutions are a major driver in the world’s progress. By embracing cryptocurrencies, these schools and universities are demonstrating their willingness to prepare students for a world with cryptocurrencies and a better future.

Open your free digital wallet here to store your cryptocurrencies in a safe place.