Winklevii Bitcoin ETF under the ‘COIN’ symbol

As some have speculated, evident of the twins’ latest filing, the first of its kind bitcoin ETF will trade on the NASDAQ under the ‘COIN’ symbol.

“Identifying the ticker symbol and the exchange are two major events that further demonstrate that we are moving forward as expected.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

California lawmakers pass bill to update currency law

|

| Image: GetToKnowBitcoin |

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Swiss government report: Bitcoin too ‘insignificant’ for legislation

for the time being, it will not create legislation relating specifically

to bitcoin or other digital currencies.

claims the economic importance of these currencies is currently “fairly

insignificant” and the council doesn’t expect this to change in the

near future.

of postulates by National Councillors Jean-Christophe Schwaab and

Thomas Weibel last year, which asked the Federal Council to examine the risks and opportunities associated with bitcoin.

No ‘legal vacuum’

point the government is keen to stress in the report is that virtual

currencies are not in a “legal vacuum”, meaning that existing laws apply

to activities associated with these currencies. It states:

“Contracts

with virtual currencies are enforceable in principle and penalties can

be imposed for criminal offences associated with virtual currencies.

Certain business models based on virtual currencies are subject to

financial market laws and need to be subjected to financial market

supervision.

Professional trade in virtual currencies and the

operation of trading platforms in Switzerland generally come under the

scope of the Anti-Money Laundering Act. This includes compliance with

the obligation to verify the identity of the contracting party and

establish the identity of the beneficial owner.”

of the laws that apply to certain uses of digital currency include the

Swiss Code of Obligations, the Federal Act on Combating Money Laundering

and the Financing of Terrorism in the Financial Sector, plus the

Federal Act on Banks and Savings Banks.

Legal certainty

told CoinDesk he was pleased the report had clarified the legal status

of bitcoin: “The report ensures legal certainty. That’s the most

important topic at this point. Now, people who trade bitcoin can know

which financial sector regulation applies or not.”

“The more I learn about bitcoin, the less I remain sceptical about it!”

a big mistake for a country like Switzerland with a strong financial

sector. I hope the banking sector will be cleverer than the Government

on that point, but I’m pessimistic.”

the last months, my personal views about bitcoin have evolved: the more

I learn about bitcoin, the less I remain sceptical about it!”

Roussel, CEO of Swiss based cryptocurrency broker SBEX, said the report

represented good news for the Swiss bitcoin ecosystem.

an ATM would be considered directly as money transmitting service, with

tighter rules. This is starting to shape how bitcoins ATM will work,”

Roussel said.

need to be licensed, unless they can ensure the user is in control of

the private key of the bitcoin wallet they are sending to.

is imposing high standards in the bitcoin financial world, but this will

be beneficial for consumers in the end,” he added.

The risks

report gives examples of the risks associated with bitcoin, stating

that, while there is no risk of it damaging the country’s existing

financial sector, consumers are vulnerable to volatility and security

issues.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Swiss regulators give green light for Bitcoin ATM Network

Jumping through regulatory hoops

“We finally got clearance from ARIF, who were asking FINMA many questions about how they should deal with us. [The clarification from ARIF] is what we were expecting.”

Cancelled ATM launch

“I don’t really know why [Bitcoin Suisse AG] made so much noise [about its ATM]. Maybe they wanted to get themselves known or they want things to move quicker.”

“I think SBEX fulfilled all the regulatory requirements before Bitcoin Suisse did, so they got the approval first.”

Bitcoin Suisse chief executive Niklas Nikolasjen said his firm was working on obtaining the necessary regulatory approvals for their ATM. He said the media had overstated his firm’s cancelled ATM launch and that it had been consistently working to obtain regulatory approval.

“It is now clear to everyone in the industry that the regulatory authorities require certain steps to be undertaken by companies who professionally deal with digital finance. BTCS is naturally following these requests as well,” he said.

Expansion plans

Open your free digital wallet here to store your cryptocurrencies in a safe place.

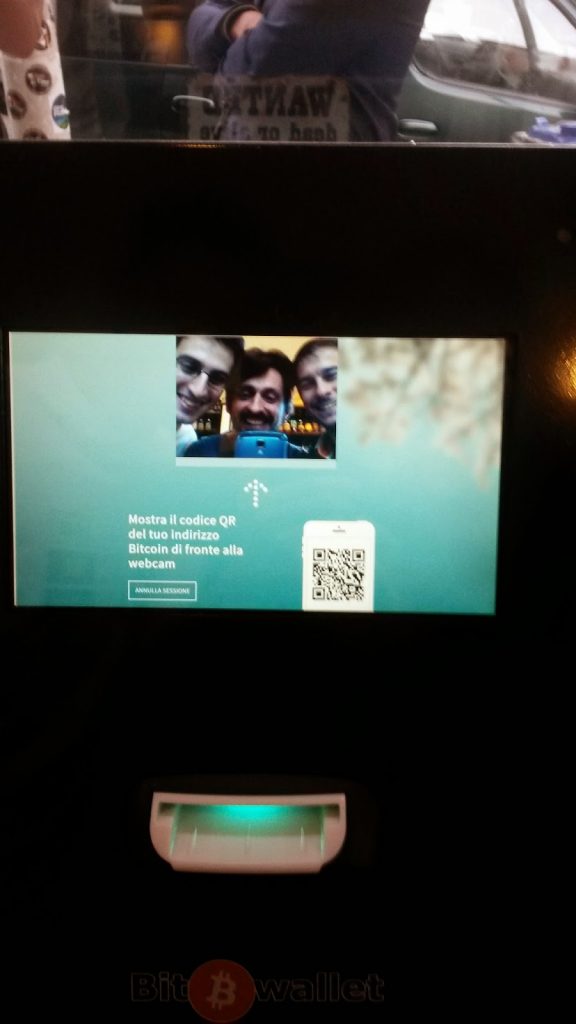

Italy house of parliament hosts bitcoin believers

|

| Bit-Wallet at Bitcoin Meetup in Rome Photo by G. Baroncini Turricchia |

lower house of the Italian parliament, in Rome on Wednesday with the aim

of informing Italian lawmakers about the economic benefits of bitcoin.

“Risk and opportunity were clearly disclosed in a neutral way. In the second part, [a representative moderated a] discussion between politicians, institutions and business, and [many questions were asked by these participants].”

The events come in the wake of the Central Bank of Italy’s May warning that domestic investors should avoid buying, investing in or using bitcoin as a currency due to price volatility and the lack of consumer protection laws to protect consumers.

Proliferating bitcoin

A second, non-affiliated event, organized by digital payment advocacy group CashlessWay, is set to take place on 26th June. Speakers will include bitcoin banking provider Robocoin CEO Jordan Kelly and parliament member Sergio Boccadutri, who presented a proposal for regulating bitcoin under existing Italian law in January.

“Italy is full of cultural tastemakers and has a rich history in banking and finance. These all support Robocoin’s goal of helping proliferate bitcoin.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Japan’s ruling party says won’t regulate bitcoin for now

| A man walks past a building where Mt. Gox, a digital marketplace operator, is housed in Tokyo February 25, 2014. |

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Privatise the pound and replace it with bitcoin, says free-market thinktank

of Economic Affairs says governments should allow competition on a

level playing field between all alternative forms of money.

|

| A man enters a bitcoin conference in New York. Photograph: Mark Lennihan/AP |

cryptocurrency like bitcoin, according to a paper published Wednesday by

the free-market Institute of Economic Affairs.

professor of finance and economics at Durham University, says that

although bitcoin isn’t the first example of private money, it is the

first that governments can’t shut down. Therefore, he says, authorities

should admit that it’s here to stay, and allow competition on a level

playing field between all alternative forms of money.

include allowing taxes to be payed in cryptocurrencies such as bitcoin

and dogecoin, or even fully privatising the pound, selling off the right

to mint the currency to the highest bidder.

bitcoin became a very prominent currency,” Dowd told the Guardian. “[To

ensure a level playing field], the government itself would accept

bitcoin in tax payments. So, in effect, the government should not be

favouring its own currency, or any particular currency, through any of

its unique powers. Nor have regulations against them.

analogy is with some of the old, bad, monopolies like British Gas or

British Telecom. Telecom is a very good example: for a long time, we had

a government monopoly, which stifled innovation, and the service was

poor. Once that got opened up, competition opened, new innovation

prospered, and we got all sorts of innovation that we couldn’t possibly

anticipate, and we’re a lot better off for it.”

bitcoin at the pinnacle of a historical trend of government crackdowns

on attempts to create private money. The Liberty Dollar, a physical,

gold-based private mint, and e-gold, a digital, gold-based e-currency,

both ended up with their creators and proprietors in court, the former

on charges of counterfeiting, and the latter over allegations of money

laundering.

politically-motivated protectionism. “Counterfeit 101 is that you try

make the fake look like the real thing,” he says, “and the whole

business model was predicated on saying that [the Liberty Dollar] is

superior to US currency.”

significantly harder to crack down on using the courts – “you could shut

the whole web down, but they can’t do that,” Dowd adds – and so

governments can’t stop its rise. If it does become popular, they will

have to deal with it some other way.

way of cryptocurrencies before they reach that success, however. For

one thing, Dowd writes, “to displace existing state currency they not

only have to perform the basic functions of money at least as well as

state money, they probably also need qualities that transcend the way in

which state money works.”

as for Dowd himself, those qualities come in the form of protection

from inflation: the cryptocurrency will only ever have 21m coins

created, ensuring that it will always “hold its value” (though also,

critics claim, rendering the bitcoin economy prone to deflationary

slumps).

as the financial equivalent of the internet, saying “The internet was a

new way to transmit data. Bitcoin’s a new way to transmit money. It’s

going to take a long time. The good news it’s a big opportunity. Money

is a very big deal, and so if you can build a new way to deal with

money, it’s very important and valuable. It just takes time.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Swedish central bank acknowledges benefits of cryptocurrencies

(CoinDesk) Sveriges Riksbank, Sweden’s central bank, has published a brief economic commentary on the impact of digital currencies on the retail payments market.

(CoinDesk) Sveriges Riksbank, Sweden’s central bank, has published a brief economic commentary on the impact of digital currencies on the retail payments market.Take-up remains limited

“Households make daily payments using cards and cash totalling 8 million in volume and to a total value of over SEK 3 billion. Even if the use of bitcoin in Sweden were to be much larger than the average exchange value of just over SEK 266,000, this is a relatively low value in relation to other types of payment. At present, there only seem to be around 25 swedish companies accepting Bitcoin.”

Risky but innovative

“It can contribute to meeting new payment needs and to making payments cheaper and more secure. Those who choose to use a particular payment service can be expected to do so because it gives them an added value in relation to other payment services. This also applies to virtual currencies, which can for instance make some cross-border payments simpler, faster and cheaper. Another advantage is if the payer does not need to share sensitive information, such as card number or bank account number, with the payee.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

First Bitcoin hearings at the Italian Parliament tomorrow

- Sebastiano Scrofina – CEO and Co-Founder at Dropis

- Guido Baroncini Turricchia – CoinCapital’s Partner

- Francesco Vatalaro – Università Di Tor Vergata

- Massimo Bernaschi – CNR

- Ferdinando Ametrano – Banca IMI – Università Bicocca

- Roberto Tudini – Studio Tudini&Tudini

In the second part there will be a round table that will allow for the comparison of ideas and the points of view of different stakeholder. The event is organized by the On. Quintarelli and CoinCapital, bringing the Bitcoin inside the walls of the Italian Parliament allowing to highlight the risks and the opportunities.

In the second part there will be a round table that will allow for the comparison of ideas and the points of view of different stakeholder. The event is organized by the On. Quintarelli and CoinCapital, bringing the Bitcoin inside the walls of the Italian Parliament allowing to highlight the risks and the opportunities.Offering to the parliament a first overview and a neutral basis to start an aware and balanced discussion.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The difficulty of getting Bitcoin to catch on in Italy

first Bitcoin ATM was a Lamassu machine, installed in Udine,

a northeastern city nestled between the Alps and the Adriatic

Sea.

down the stuffed gnocchi.

anyone who needs help using the machine (it’s located in the hall of his family’s business).

He’s even had the interface translated into the local Friulian language, as

well as Italian.

his next step at this point is to install more machines around the country.

though.

Legal Obstacles

regarding Bitcoin, forcing him to operate in a grey area with which many

Bitcoin entrepreneurs are familiar.

pool of attorneys and legal experts advise him on what he could and could not

do. Italy,

they told him, does not regulate Bitcoin itself, nor are there any

know-your-customer regulations, but any transactions above 999.99 EUR need to

be reported.

“The use of electronic

currency is restricted to banks and electronic money institutions — that is,

private legal entities duly authorized and registered by the Central Bank of Italy.

Aside from these developments, Italy

does not regulate Bitcoin use by private individuals, and currently the

implementation of initiatives concerning the use of electronic currencies lies

with the EU.”

technology.

“Banca d’Italia is

studying the [Bitcoin] phenomenon, and perhaps — if they were fast — in 10-20

years we could have a law on it.”

local perception is something else entirely, Dordolo said.

“In Italy, we are at the beginning of

Bitcoin’s spreading among the population. There is an interesting Bitcoin

community [in Italy],

but it is still very hard to explain to Italian people the real value that

Bitcoin creates in the economy and the job opportunities it creates.This is because of

misinformation by the national media that actually regard it as a scam or worst

as associated with criminal deeds.Even the local Bitcoin

Foundation is not as active as it should be, so whatever can move this

situation is welcome.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.