Search Results For: china

Bitcoin can stabilise volatile market in India

(TimesOfIndia) At a time when the country has suffered devaluation of rupee against

dollar, inflation and fuel price volatility in exchange market, two

students of Fellow Programme in Management (FPM) at Indian Institute of

Management, Indore (IIM-I) have rekindled hopes to address the problems

through introduction of ‘Bit Coin’ currency system.

Bitcoin is

a crypto currency which currently has market capitalisation of $8.1

billion. The recognition is mainly because of its introduction during

financial crisis, when trust on government and policy makers was low. It

is an alternative to card networks and money transfer system.

Khadija Vakeel and Nitya Saxena of IIM-I in their study found out that

at a time, when the country is struggling to achieve a respectable

position on matters of financial inclusion, Bit Coin can be a game

changer.

Bitcoin can also lead to a new industry and challenge

for IT youths and can address the problem of brain drain. While

Singapore is pro bit coin, China stands against it. India is yet to take

a side. Users having Bit Coin can enter into virtual goods and services

exchange. The study states that inflation is simply a rise in prices

over a period of time, which is generally the result of the devaluation

of currency.

This is a function of supply and demand. Given the

fact that the supply of bit coins is fixed at a certain amount, unlike

fiat money, the only way for inflation to get out of control is for

demand to disappear.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Malaysian retail giant i-Pmart will hold 100% of its Bitcoin Payments

Malaysian online mobile phone and electronic parts retailer i-Pmart

adding it to the list of accepted payment methods last week.

and founder Mart Tang also said the company will hold onto the bitcoins

it earns and watch the price rise, rather than convert them into local

fiat currency.

worldwide from outlets in its home country, plus China and the US. The

bitcoin option was introduced first to the Malaysian site only, though

international customers may still use that version.

Low-key launch

decision is the lack of fanfare with which bitcoin was added to the

list of options. Rather than publicizing it, or even celebrating the

announcement with its 730,000+ fans

on Facebook, the company added the bare-bones line “We accept bitcoin”

and an icon into its long list of existing payment options.

is also a big seller of litecoin mining equipment, selling GPU-based

rigs both to advanced users to self-assemble with the ‘Savvy Pack’, and a ‘Newbie Pack’ for beginners that includes the option to have i-Pmart assemble, host and even operate the hardware for them.

Bitcoin fan

Tang said his interest in bitcoin came from being an IT entrepreneur

always searching the Internet for the latest tech information and

gadgets.

and other digital currencies, he began hearing about merchants in other

countries accepting bitcoin and studied how to become a digital

currency miner himself.

“That’s

how I have started to think if I have customers who want to use bitcoin

to purchase my products online which gives convenience of various types

of payment choice especially those who do not prefer to pay using their

credit card, cash or other mode of payment.”

sat down with his web development team to discuss how to integrate

bitcoin as a mode of payment in the business portal www.ipmart.com

globally.

“[I’m] looking forward to the new world of

virtual payment choice, which I believe can be the future of global

virtual currency that people might embrace, especially the Gen Y.”

“I

am holding the bitcoin. Because having a very big confidence the price

of bitcoin is not the rates of today USD 650, should be higher than this

price very soon.”

Company background

group now consists of domestic and internationally-focused retail

sites, plus arms specializing in management, development, and logistics.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Canada is second most popular country for bitcoin investment

(TorontoSun) Some $10.5 million of venture capital has been invested in bitcoin in

Canada, putting us behind the U.S. and just ahead of China, the

Montreal Economic Institute says.

government regulation puts its growth and development at risk in Canada,

the think-tank warned.

number of users, clear rules are required, along with some kind of

governmental acceptance,” study author David Descoteaux said in a

statement.

Montreal, alleges the Bank of Montreal shut down its account and those

of other businesses that trade in bitcoin.

of currency innovation — elsewhere to set up shop, the think-tank said.

be used as a currency, explain why the digital currency is popular in

Germany and why this country was one of the first bitcoin hubs,”

Descoteaux said.

its own regulatory framework, it should ensure that it remains so.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

What Dogecoin must do to survive

Tim Swanson is an educator, researcher and the author of ‘Great Wall of Numbers: Business Opportunities and Challenges in China’. Here, he explores the mining systems of dogecoin and litecoin to show how the dogecoin economy can thrive.

(CoinDesk) The key ingredient to the success of any decentralized public ledger, such as bitcoin, is incentivizing its transactional network to simultaneously secure the network from attackers and process transactions.

In the case of bitcoin, and in the case of virtually all other cryptocurrencies, this incentivization process is handled through seigniorage. Every 10 minutes (or 2.5 minutes for litecoin, or one minute for dogecoin) a fixed amount of bitcoins is paid to the labor force called “miners.” These miners are computational systems that perform never-ending mathematical calculations dubbed hashing. This hashing in turn creates security for the network; so as long as more than 50% of the hashrate is maintained by “good” systems, bad actors are prevented from manipulating the ledger.

The other key role these miners also fill is processing and including transactions into packages called blocks. Every 10 minutes, one miner is rewarded for processing these blocks with fixed income. Last month David Evans published a good overview of how this process looks from a labor input and supply output perspective.

For some advocates, one of the purported advantages of cryptocurrencies is that their money supply creation rate is actually deflationary (or contractionary) in the long run – in the short run, bitcoin’s expansionary rate is quite high, with inflation at 11.1% this year alone. That is to say, it is a hardcoded asymptote, tapering off over a known time period. In the case of bitcoin, the wage for the labor force (miners) is split in half roughly every four years (every 210,000 blocks), for approximately the next 100 years – until its money supply is exhausted at a final 21 million bitcoins.

Roughly 12.7 million bitcoins have already been paid to miners. With dogecoin’s 100 billion dogecoins, this process is accelerated, with the mining income dividing in half every two months. While it took about five and a half years for about 60% of bitcoin’s total monetary base to be distributed, as of today 78% of dogecoin’s reward (income) has already been divvied out to its workforce in less than six months.

What now for the workforce?

While this frenetically fast money supply has provided a psychological motivation for early adopters to partake in the dogecoin ecosystem, economic law suggests that this network will probably cease to exist in its current form within the next six months probably through a 51% attack.

The reason is simple: with every block reward halving, also called “halvingday”, the labor force is faced with a 50% pay cut. The contractors (laborers) incapable of profitably providing hashrate at this level can and will leave the work force for greener pastures. This same issue has impacted other altcoins in the past, such as MemoryCoin, which died after nine months due to a combination of factors including diminished block rewards (it attempted to divvy out its entire monetary supply in two years).

Early advocates of dogecoin like to point to outlier events such as the Doge bobsled team or sponsored NASCAR driver at Talladega or even a vaunted tipping economy (which is actually just faucet redistribution) as goal posts for growth and popularity, yet after two halvingdays the actual dogecoin block chain has lost transactional volume each month over the past four months and the labor force has also left for new employment elsewhere.

This is visualized in the following two graphs.

The first chart shows dogecoin’s collective hashrate. The black lines indicate when the “halvingday” or rather “income halvingday” occurred. Because the price level of a dogecoin remained relatively constant during this time frame, there was less incentive for miners to stay and provide labor for the network. If token values increased once again, then there may be incentives in the short-term for laborers to rejoin the network. Yet based on this diagram, roughly 20-30% of the labor force left after each pay cut.

The second chart shows on-chain transactional activity. The first three months are erratic because of how mining pools (similar to lottery pools) paid their workforce (miners). Following the first halving day in February, the network transaction rate fell to roughly 40,000 transactions per day and then leveled off to around 20,000 until 28th April 2014, when another halvingday occurred and the subsequent transactional volume remained relatively flat to negative. It is currently at 12,850 transaction per day, or roughly the same level it was during the first week of its launch five months ago.

Dogecoin’s falling hashrate

Now, some readers may claim that a lot of the transactional volume such as tip services and tip bots are being conducted off-chain and thus the total number of transactions is likely higher. And they would be correct. But that would completely defeat the purpose of having a block chain in the first place – a trustless mechanism for bilateral exchange that negates the need for “trust-me” silos (as Austin Hill calls them).

Also, while this topic deserves its own series of articles, there is little literature that suggests that tipping can grow

an economy; it is not a particularly good signaling mechanism or way to grow a developing economy (i.e., “China, you need more tipping activity to grow and prosper”).

However the key issue is this: if the trend continues and the network hashrate continues to fall 20-30% after each halvingday, then within the next two to four months it will be increasingly inexpensive for competing mining pools on other ledgers to conduct a 51% attack on dogecoin’s network, destroying its credibility and utility.

For instance, the chart below is the litecoin hashrate over the past six months. Litecoin is dogecoin’s largest competitor based on its proof of work (PoW) mechanism called scrypt:

One of the reasons the litecoin hashrate is not rising or falling at a constant rate but is instead jumping up and down erratically is that miners as a whole are economically rational actors. When the cost of producing security is more than the reward (block reward income), the labor force turns towards a more profitable process such as another alternative scrypt-based “coin” (note: bitcoin’s hashing method uses SHA256d whereas litecoin and dogecoin use scrypt). The same phenomenon of hashrate jumping up and down occurs with the bitcoin network.

For the sake of simplicity, the litecoin network can be viewed as roughly 200 GH/s versus the dogecoin кошелек network which is roughly 50 GH/s. To conduct a 51% attack on dogecoin today, an entity would need to control roughly 25-26 GH/s which is roughly one eighth the processing power of the litecoin network. The current ‘market cap’ for dogecoin is $35 million, assuming marginal value equals marginal cost, ceteris parebus on paper it could cost $17.5 million in capital and operating expenses to successfully attack the dogecoin network.

The chart above shows both the hashrate of litecoin (in red) and dogecoin with the vertical black lines representing the dogecoin “halvingday.” What this shows is that while dogecoin, for roughly one month in early 2014 was more profitable to mine than litecoin, the halvingday led to an exodus of labor.

If current prices and trends continue, which they may not, in two months the litecoin collective hashrate may hit 240 GH/s and dogecoins hashrate could shrink due to halvingday by another 20% to 40 GH/s. At this rate a successful 51% attack on dogecoin would require just one twelfth of the hashing power of litecoin which at the same prices levels would entail less than $10 million in capital and operating expenses to do.

Will dogecoin survive?

While the development team could theoretically switch its proof of work algorithm (to X11 as used in Dash), the doge community is really faced with six options:

- Merge mine. Namecoin was (and is) an independent block chain, but since block 19,200 about 80-85% of its network hashrate (and block rewards) are tied to bitcoin mining pools through a process called “merged mining.” The new sidechains project from Blockstream is attempting the same process. Charlie Lee, creator of litecoin explained how dogecoin could be “merged mined” with litecoin in a series of posts last month.

- Transaction fees. Both the development team and mining community could agree to float or raise transaction fees on the doge network, similar to what Mike Hearn has been discussing for bitcoin. In practice however, even if approved, very little actual commerce, and therefore transactions, is conducted on the dogecoin network. Thus it is unlikely that this will compensate the large drop in mining income. Similarly, as Gavin Andresen pointed out in Amsterdam this past Friday, increased transaction fees reduces the participation rate. It is important to note the actual transaction costs are much higher than stated – block rewards (token dilution) are usually not factored in.

- Proof of stake. There are several variations of proof of stake. Whereas bitcoin, litecoin, dogecoin and most other cryptocurrency experiments use a “proof of work” mechanism to protect the network from malicious entities, a proof of stake system, such as that used in NXT, will randomly assign a “mining node” called a “forger” – a poor marketing term for sure – to process all the blocks for the next minute. Because all of the other nodes in the network know which miner to trust, this lowers the amount of infrastructure needed to protect the network. In theory this sounds amazing. In practice however, most proof of stake systems end up almost immediately centralized in one manner or the other. Andrew Miller, Andrew Poelstra and Nicolas Houy call it “proof of nothing”. Perhaps Stephen Reed’s version can work in the future.

- Increase in market price. This would incentivize the labor force to continue providing security of the network with the expectation that the tokens they are given in return for their labor will continually appreciate in value. This is betting on hope. Charlie Lee pointed out the uphill task this would require beginning next year when rewards fall to less than one tenth what they are today, stating last month, “At dogecoin block 600,000, only 10,000 coins will be created per block. So in order for dogecoin to keep the same amount of security as today, dogecoin price would need to go up by 25 times. And dogecoin price would need to gain on litecoin by 50 times in order to catch up on litecoin’s security. And assuming everything stays the same, the market cap of dogecoin needs to reach $1.5 billion by January of next year.” For comparison, the ‘market cap’ of dogecoin today is roughly $35 million (note: it is probably not accurate to call it a ‘market cap,’ see Jonathan Levin’s explanation).

- Migration. Dogecoin could also migrate to a platform like Counterparty and become a fully secured altcoin with a dash of proof of transaction thrown in to inflate the coin with ongoing usage that this particular community likes to embrace. It could be fully protected by the bitcoin hashrate with no further need to try to acquire miners to protect it.

- Further experimentation. While it is unlikely the dogecoin has the resources to create secure production code in the shortened time frame, Robert Sams “growthcoin” and Ferdinando Ametrano’s “stablecoin” could provide a mechanism that enables the network to live on in a different manner.

While any or all of these may be tried out, it may be too little, too late. With that said, stranger things have happened. A rising tide lifts all boats and thus in the event that “bitlicense” approved exchanges on Wall Street come online this summer and new capital actually flows into bitcoin and other alternative ledgers, perhaps similar speculative funding will flow into dogecoin as well. However, this is not something that can be known a priori.

I contacted Jackson Palmer, creator of dogecoin for his thoughts on the situation. In his view:

“It is definitely a challenge that dogecoin (and all current-gen crypto currencies) will face in the future. As we discussed recently, it’s kind of a sad reality that people are purely profit driven and these decentralized networks we’ve built are reliant on profit-mongers to power and secure their viability. I’m very concerned about the impact of centralized mining and reliance on transaction fees could hold for bitcoin as it becomes less enticing to mine – really, the network can be held at ransom to attach hefty transaction fees if the mining pools are cherry picking as they create blocks. At the end of the day, I think the viability of cryptocurrency really hinges on a move away from PoW-based mining to something new and innovative that doesn’t just stimulate an arms race and put all the power back into the hands of the fiat-wealthy. I don’t have a solution unfortunately, but hopefully someone will find one and bring about a new generation of digital currencies in the coming five to ten years. That being said, cryptocurrency as a space is very unpredictable so it wouldn’t surprise me at all if dogecoin beats the odds and overcomes these challenges in some weird, wacky way. It’s in the community’s hands, and they’re certainly passionate about seeing it reach the moon, as am I.”

Can this happen to bitcoin?

To be balanced, below is the network hashrate for the Bitcoin network following its first halvingday on November 28, 2012:

The following two months, from December 2012 through January 2013, the hashrate stayed flat and in some weeks even declined. There were three reasons why the network did not decline precipitously like dogecoin:

- Despite the fact that very little real commerce actually takes place on the bitcoin network, there was some amount that did in 2012 and does today (primarily gambling and illicit trading of wares). Thus there was external demand for the tokens beyond miners and tippers.

- The token prices rose creating appreciation expectations. The price rose from $12.35 on 28th November 2012 to $20.41 on 31st January 2012. If miners believe and expect the price to increase in value, they may be willing to operate at a short-term loss.

- The first batch of ASICs from Avalon shipped and arrived to their customers at the very end of January. These provided roughly two to four orders of magnitude per watt in performance than the top competing FPGAs and GPUs. This is equivalent of miners being given sticks of dynamite instead of pick axes to tunnel through mountains.

While more research will be conducted and published in the following months and years before the next bitcoin halvingday (estimated to occur probably before August 2016), the bitcoin network faces a similar existential hurdle, though perhaps less stark once more ASIC processes hit similar node fabrication limitations. That is to say, in the next couple of years there will no longer be performance gains measured in orders of magnitude. They will likely compete on energy costs. Since most participants do not like paying transaction fees, incentivizing miners to stay and provide security will likely be problematic for the same income reduction issues. This scenario will likely be revisited by many others in the coming months and years.

Nothing personal

From a marketing perspective Dogecoin has done more to bring fun and excitement to this sub-segment of digital currencies than most other efforts – remember, USD can also be digitized and encrypted. In turn it brought in a new diverse demographic base to block chain technology, namely women. While some of the more outlandish gimmicks will likely not be enough to on-ramp the necessary token demand which in turn leads to token appreciation, this project has not gone unnoticed.

For instance, two weeks ago I had coffee with a bank manager in the San Francisco financial district. As we were wrapping up he asked me to explain dogecoin. I mentioned that what sets doge apart from the rest was its community was much more open towards self-ridicule, self-parody, less elitist and most importantly, women actually attended meetups.

He quickly surmised, “Oh, so it’s the wingman currency. It’s the friend you bring to the bar who is willing to look goofy to help you out.”

That is probably a fair enough assessment and it will likely need a wingman to survive.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

What are Bitcoin nodes and why do we need them?

peer-to-peer (P2P) network. However, what’s often lost in translation is

the sheer amount of machinery that is needed to maintain this global

infrastructure.

transactions, bitcoin requires more than a network of miners processing

transactions, it must broadcast messages across a network using ‘nodes’.

This is the first step in the transaction process that results in a

block confirmation.

network must not only provide an avenue for transactions, but also

remain secure. By using a number of randomly selected nodes, the network

can reduce the problem of double spending – when a user attempts to spend the same digital token twice.

bitcoin doesn’t just need nodes, it requires lots of fully functioning

nodes – nodes that have the bitcoin core client on a machine instance

with the complete block chain. The more nodes there are, the more secure

the network is.

Waning support

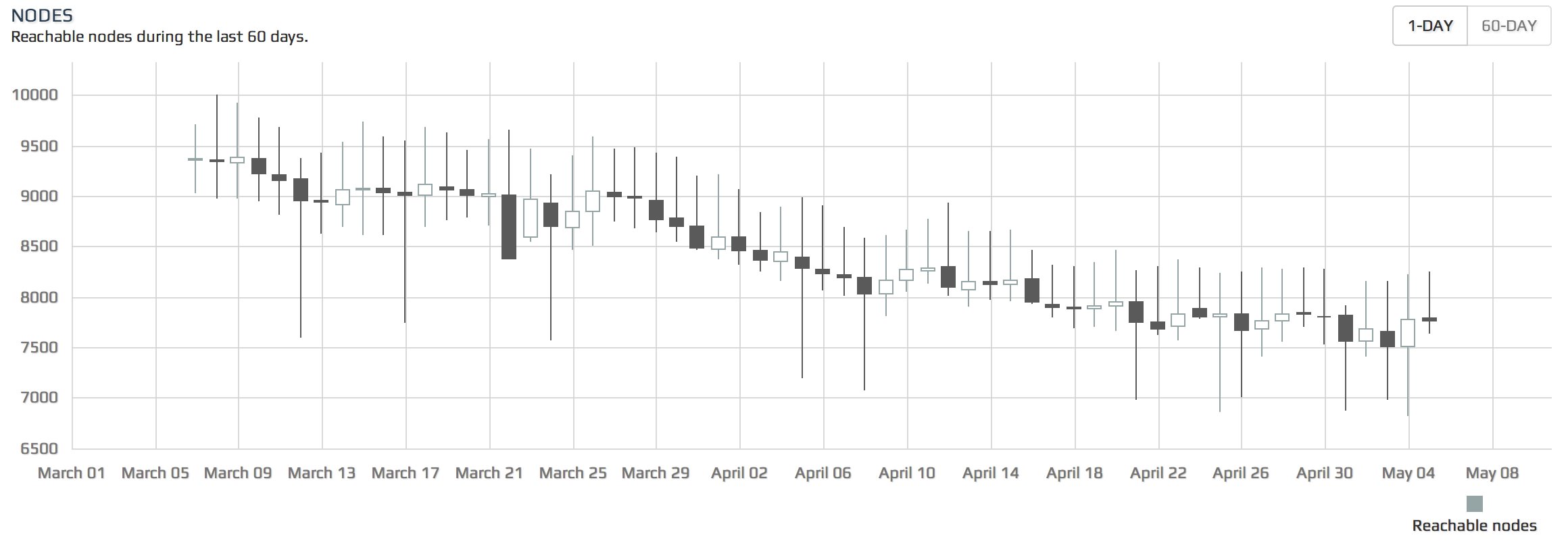

at a 60-day chart of bitcoin nodes shows that the number has gone down

significantly. It went from 10,000 reachable nodes in early March to

below 8,000 at the beginning of May.

|

|

Source: Bitnodes |

interesting is that during a recent 24-hour period, the number of

reachable nodes went down from 8,200 to 7,600 and back to 8,200 again.

This suggests that a portion of users running nodes are turning off

their machines at night, meaning that this contingent of nodes are being

run on desktops or laptops.

|

|

Source: Bitnodes |

|

|

A map based on Bitnodes data. Source: Coinviz |

Lack of incentive

running a bitcoin node does not provide any incentive. The only benefit

for someone to run a node is to help protect the network, and based on

the Bitnodes data, the number of people interested in supporting the

network with a full node is waning.

Centralization of mining

terms of supporting the bitcoin network, it used to be a lot easier for

the average user to participate. However, the advent of massive ASIC

data centres has weakened the consensual nature of mining, and by

extension providing nodes, for many people.

“As

bitcoin grows, so does the network and the computing power behind the

scenes required to run it. The majority of bitcoiners won’t be able to

support their own nodes and will be taken over by companies like KnC.”

pushing bitcoin towards a more centralized future. McKelvie also

believes that major technology companies that take interest in bitcoin

will have to put their computing resources behind the digital currency:

“I

wouldn’t be surprised if we see large tech companies like Google and

Amazon throwing resources at bitcoin as they adopt the currency.”

Feedback from nodes

sees the issue of nodes dropping from 10,000 down to under 7,000 as a

significant problem. To Hearn, the core of the issue is disinterest in

both expending computing resources and electricity toward something that

may have diminishing value.

Hearn has proposed added functionality that would allow communications

between nodes and the developers to better understand why so many are

dropping out.

is because their number will continue to decline no matter what – and

they appear to only be working when users are awake during the day.

“It

makes [the bitcoin network] ‘seem’ bigger, more robust and more

decentralised, because there are more people uniting to run it. So

there’s a psychological benefit.”

Moving forward

believes that community attention to the lack of nodes supporting the

network is what the industry needs in order to boost numbers:

“I agree we need more full nodes. I’ve long been a proponent of such calls for more nodes.”

such calls for voluntary support might not be enough motivation for

people to do so, though, so, one logical idea that has been floated is

to give nodes some sort of incentive.

feasible right now: over the past six months, miners have been

averaging a daily reward of 15.98 BTC per day, according to Blockchain.

bitcoin prices would peg that value at around $7,040 per day for the

entire network – and the growth in transaction fees has been incredibly

flat over the past six months. As a result, miners would likely be

reluctant to concede any revenue to bitcoin nodes, which don’t require

pricey ASIC hardware to run.

|

|

Transaction fees on the network for past six months. Source: Blockchain |

of the bitcoin community seem to be losing interest in hosting full

nodes. And it’s something to pay attention to, because over time it

might mean that the major companies in the industry may have to pick up

the slack.

the network as full nodes, though, it continues to lessen the amount of

decentralization the network has at an infrastructure level.

is all down to circumstances surrounding bitcoin sentiment – the rise of

ASICs, the selloffs in China and complete collapse of Mt. Gox – plus

little in the way of incentives for someone to run a node.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Federal reserve advisory council sheds positive light on Bitcoin

In February, much of the community rejoiced when Federal Reserve Chairwoman Janet Yellen insisted that the regulatory entity had no authority to when it came to the digital currency.

A recently obtained document from a Federal Reserve Advisory Committee meeting early this month has shed some light on this very topic, in return, revealing exactly how the Fed plans on reacting to the relatively new and emerging technology.

The Federal Advisory Council and Board of Governor’s record of meeting devoted a special section of the outline to bitcoin specifically. Among the key topics of concerns listed in respect to the digital currency were whether or not bitcoin has the potential to cause the “disruption of traditional channels of commerce with high potential for illicit use.” In respect to banking, the document also questions the possible “disintermediation of traditional payment networks, promoting shadow transacting.”

In the eyes of the Fed, indications point that the outlook is unanimous in that rather than posing as threat, bitcoin, with increased regulation, may hold promise:

Bitcoin does not present a threat to economic activity by disrupting traditional channels of commerce; rather, it could serve as a boon … Its global transmissibility opens new markets to merchants and service providers … Driving capital flows from the developed to the developing world should increase consumption.

The Federal Advisory Council (FAC) is comprised of twelve elite representatives of the banking industry. The committee meets four times a year, as required, to consult with and advise the Board on all matters within the Board’s jurisdiction. The overall rhetoric among the committee is that the board echoes the voice of Silbert in that the current financial institutions will play a key role in bitcoin’s future. The FAC ‘s conclusion was that, “should [bitcoin] adoption accelerate, banking could participate increasingly in bitcoin fund flows, especially as multicurrency accounts proliferate and reputational concerns subside.”

The FAC’s stance on bitcoin supports a reversal in the plethora of bad news encompassing the digital currency. Following easing tensions in China, the wildly successful Bitcoin2014 conference in Amsterdam, which delivered a surplus of positive news along with several major announcements, bitcoin has surged in value over that past several hours. Prices on Bitstamp rose from an opening of $448.34, while spiking as high as $500.00 mid-day as optimism surrounding the digital currency continues to influence bitcoin’s value.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

“Commodity” is the right way to pitch Bitcoin

nothing like holding a stash of bitcoins and watching the price to make

you hold on for dear life (HODL – the cry of many a bitcoiner) or want

to get off. Its volatility is also a draw for people who would never

even consider such a thing to take a stab at day trading. The frequent

swings up and down make it seem like it should be easy to simply follow

the old rule of buy low and sell high. Most of those who try this,

though, soon learn that it’s not so easy to predict the market, time it

well enough to get a return, and make enough to beat the spread and the

fees.

news for Bitcoin. Price and volatility are important, of course, and the

price of a bitcoin is going to need to rise astronomically in price if

it’s going to fulfill its role as a global asset and currency. But price

is actually a feature of Bitcoin and not its make or break point. On

any given day, the fact that the price is soaring on the seeming

blessing of a hedge fund manager or crashing on some rumored meeting of

the PBOC in a back room somewhere in China is actually fairly

irrelevant.

right. Adoption is progressing, and for sure there are more and more

sellers accepting Bitcoin, but many of the sellers I’ve been in contact

with admit that they have gotten few, if any, Bitcoin sales. Merchants

have natural reasons to accept bitcoins in payment, but it isn’t nearly

as clear to consumers what the benefits to them are. The technical

difficulties, bad press, and risk of theft are great enough to easily

offset the advantages of saying bye bye to their bank accounts and

credit cards.

No,

No,Bitcoin’s time to act as a currency has not yet arrived. Right now it’s

a commodity with an excellent appreciation outlook. And that’s how

Bitcoin should be being pitched. Purchase one or ten or twenty bitcoins,

put them in a paper wallet and forget about them; that small investment

may be the same as buying Microsoft stock or Berkshire Hathaway stock

20 or 30 years ago. Bitcoin is designed to be deflationary, and as

adoption increases, so will its value. Given the state of the political

and financial systems, for those worried about their retirement, their

kid’s university, or just the state of the economy, Bitcoin might be the

best investment there is.

in. When demand to hold Bitcoin as an investment has risen sufficiently

high that people stop looking at what a bitcoin is worth in terms of a

local currency and start pricing things directly in Bitcoin, Bitcoin POS

payments are going to take off. At this point, the fiat currency will

be valued against Bitcoin rather than the other way around. At this

point also, many of the concerns we currently have about regulation and

taxation are going to become moot as the regulators and taxmen will have

to recognize the reality on the ground and adapt or die.

an apt comparison. Bitcoin’s most famous feature is as a currency, but

the blockchain itself is a powerful development. Right now there are

companies and projects underway to create smart property (where you can

prove or transfer ownership of anything with a chip by showing

possession of a bitcoin ‘marked’ as that property), smart contracts

(where you can encode the terms of the contract to fulfill automatically

once certain conditions checkable on the Internet are met), distributed

shares in companies, anonymous, verifiable voting, and much more. It’s

possible that we are going to start to see some of these applications

gain wide adoption before most people are buying a coffee with Bitcoin.

People will come to Bitcoin, probably without meaning to, because of its

simple usefulness. This will dispel some of the myths and fears

associated with it. From there, people will start dropping their bank

accounts and credit cards in favor of saving in their own (by this point

easy and secure) wallets and paying for their coffee by keying in a PIN

on their phone.

and easily, bad press, and security are going to dog Bitcoin’s

development for the foreseeable future. But the trend lines are also

easy to see. Bitcoin is developing, expanding, and gaining in usefulness

every day. So the next time someone tells you they’re worried about

their retirement or their kid’s education, let them know that they

should do their own research and make their own choice, but that Bitcoin

might just be the best investment they could make.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bobby Lee, Brock Pierce Join Bitcoin Foundation’s Board of Directors

(CoinDesk) Bobby Lee and Brock Pierce have joined the Bitcoin Foundation’s board

of directors, after coming top in a second round of votes cast by the

organisation’s industry members.

The run-off election featured three candidates, including BTC China CEO Bobby Lee, venture capitalist Brock Pierce and CEO of mobile gift card provider Gyft, Vinny Lingham.

The results were particularly close, with Lee receiving 79% approval

and Pierce scoring 65% – just 2% above Lingham, who received 63%.

With the announcement, Lee and Pierce join a board that includes executive director Jon Matonis, bitcoin chief scientist Gavin Andresen, Bitcoin Magazine’s Elizabeth Ploshay and Ribbit Capital’s Micky Malka, alongside founder and chairman Peter Vessenes.

This news follows the 1st May results of an initial round of voting, which ended with none of the original 15 candidates reaching the necessary vote threshold to win a seat.

These industry seats have been vacant since the resignation of two founding members – former BitInstant CEO Charlie Shrem and Mt. Gox CEO Mark Karpeles – earlier this year.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Is it too late to get Involved in Bitcoin?

(CoinDesk) So, you’ve only just learned about bitcoin, you’ve seen that people have become millionaires through investing in it. Your question is: “Can I still do the same, or has the bitcoin boat sailed?” Unfortunately there’s no simple answer to this. Can you still make millions from bitcoin? Possibly. Has the bitcoin boat sailed? Certainly not. Bitcoin,

and digital currency as a concept, is still very young. Created just five years ago, it’s still trying to find its feet and its price is suffering rather wild volatility. On top of this, recent company failures have left a lot of bitcoiners out of pocket. That said, there are plenty of people who have made a lot of money from

bitcoin, having invested in the early days and watched the price rocket since then. Those who invested two years ago, when the price was $5 a pop, have seen their investment increase a sickening 9,560% to $483 per bitcoin (at the time of writing). In order to enjoy the same percentage return over the next two years, the price of bitcoin would

have to increase from $483 to around $46,500. Sounds ridiculous, right? Actually, some people don’t think it’s that far fetched at all.

Bullish bitcoiners

A number of extremely bullish bitcoin price predictions have been voiced over the past year by some pretty notable commentators.

Ex-Facebook executive Chamath Palihapitiya kicked things off in May last year, writing in a piece for Bloomberg stating that each bitcoin could go on to be worth more than $400,000, provided it establishes itself as a “useful reserve currency”.

The Winklevoss twins (of the Facebook lawsuit fame) said in November that they believe the price could go on to increase 100-fold, with the market cap reaching $400bn (the market cap is currently $5.8bn).

A few weeks later, a report from Wall Street analysts Gil Luria and Aaron Turner predicted that the price of one bitcoin could increase to almost $100,000.

Titled ‘Bitcoin: Intrinsic Value as Conduit for Disruptive Payment Network Technology’, the report predicted the price of bitcoin could increase to 10-100 times its value at the time, which was around $1,000.

Political and financial pundit Max Keiser has been championing bitcoin for years, but in December he suggested it wouldn’t be long before the price hit $5,000.

CoinDesk polled its readers in January and found 56% of the respondents believed the price of bitcoin will reach a whopping $10,000 this year. Of the ‘young people’ quizzed for a separate survey by Wired, 42% said they believe bitcoin is a lasting currency and 30% consider investing in or mining bitcoins as safer than the more traditional stock market.

While it seems there are plenty of people flying the flag for bitcoin, it’s worth noting there is an endless supply of pessimists who think digital currency will crash and burn in the not-so-distant future.

Bearish naysayers

Warren Buffett recently nailed his colours to the mast, telling CNBC in no uncertain terms that he thinks bitcoin is an utter waste of time. “Stay away from it. It’s a mirage, basically,” the billionaire investor said, adding that “the idea that it has some huge intrinsic value is just a joke”.

American economist Paul Krugman voiced similar views in an opinion piece he wrote for the New York Times back in December called ‘Bitcoin is Evil’.

He said he was “deeply unconvinced” that bitcoin could actually work as a form of currency and he doesn’t think it works as a “store of value”. Sir Bob Geldof followed suit shortly after, damning bitcoin by saying digital currency “simply won’t work”. However, Max Keiser told the world not to pay any attention to the singer’s protestations, claiming that asking his opinion on bitcoin is a “worthless exercise”, akin to “asking a blind man his opinion on a Turner”. American economist Nouriel Roubini, who anticipated the collapse of the US housing market and the worldwide recession that started in 2008, is also not bitcoin believer. He has taken to his Twitter feed to label it an “irrational useless bubble fad”, a “Ponzi game” and a “lousy store of value”.

How to get involved

If the above ranting hasn’t put you off getting involved in bitcoin, it’s likely you’re now wondering how best to start.

You’ve probably heard that bitcoins are generated through a process called mining, which involves the use of computer hardware to solve complicated mathematical equations. In the past, people could use their own PCs to mine bitcoins, but things have now evolved so that to make any significant return, you have to first invest in application-specific hardware that can cost thousands of dollars.

Most people are choosing, instead, to get involved in bitcoin simply by buying some of the digital currency via online exchanges, such as Bitstamp, BTC-e and BTC China, or marketplaces such as LocalBitcoins.com.

“Digital currency isn’t going to go away any time soon. So, when are you going to take the plunge?”

Once you’re in possession of some bitcoins, you then have to make a decision about what to do with them – do you stash them away and hope for the

best, do you spend them or do you do a bit of both? That’s completely up to you, but bitcoin’s value will only increase if its popularity increases, and for this to happen people need to use it, to spend it and to take advantage of the benefits it provides. By all means, store some in a bitcoin wallet, but don’t just leave all of them in there, gathering virtual dust. Create another wallet that you use for spending. Make some purchases, test it out, explore how easy it is. Tell your friends about it and give your investment the best possible chance of blossoming into the millions you’re praying for.

It’s important that you treat bitcoin like you would any high-risk investment – there’s a chance you could end up making a lot of money, but there’s also the chance you could lose everything. So, just be sensible and don’t invest more than you can afford to lose.

For now, the bottom line is that digital currency isn’t going to go away any time soon. So, when are you going to take the plunge?

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Canada and Israel take a different approach to Bitcoin

(SiliconAngle) Bitcoin gained a lot of momentum in 2013, as many people

experimented with it for the first time. It’s not surprising that 2014

also started with a bang for Bitcoin, when its value hit close

to $1,000. Some online shops have started accepting the cryptocurrency

as a form of payment, online sites use it so people can send donations,

and the Chicago Sun-Times has begun experimenting with it to raise funds for the Taproot Foundation.

many governments aren’t too keen about accepting it as a legal tender

just yet. Both India and China

have both warned against Bitcoin in recent weeks, resulting in some

significant fluctuation of its value. But even though there’s been some

strong opposition in these countries, it seems that most others are open

to the possibility of Bitcoin becoming a legal currency in the future.

monitoring what others are doing about it before coming up with a plat

as to how to approach the cryptocurrency.

clarified that only Canadian bank notes and coins are considered as

legal tender. It doesn’t consider Bitcoin as a legal tender, but that

doesn’t mean that the Canadian government doesn’t see its potential,

reports The Verge.

but not for paying taxes, and businesses will not be required to accept

it as a form of payment.

many substitutes — like Bitcoin — should generally require much less

intensive oversight and regulation because they pose much less risk to

the Canadian financial system as a whole,” said Bank of Canada

spokesperson Alexandre Deslongchamps.

how it all unfolds, but this policy may change in the near future.

Currently, some financial institutions in Israel are already engaged in

Bitcoin transactions, but regulators haven’t said a thing about it yet,

reports CoinDesk.

that wrong kind of attention. Bitcoin could be used to dodge tax

payments and can even be useful for money laundering, but regulators

feel like they don’t currently need to take a stand regarding any form

of digital currency, since they are still trying to figure out what the

rest of the world will do with it.

succeed, and it would be a pity if it were to occur in the shadows and

not under the supervision of the banking system,” Attorney Shiri Shaham,

who specializes in banking law, stated.

Open your free digital wallet here to store your cryptocurrencies in a safe place.