Holytransaction Trade is a new virtual exchange to convert your Bitcoin into fiat currencies and vice versa, offered by the HolyTransaction wallet company.

You would think that Holytransaction Trade is a service that can be found anywhere on the web to sell and buy bitcoins. But it is not true, as HolyTransaction Trade allows you to do much more.

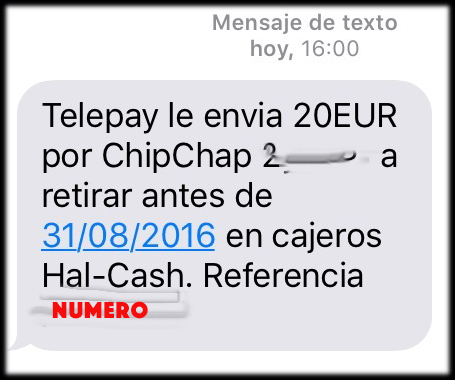

HalCash Bitcoin ATM in Spain

On HolyTransaction Trade you can convert bitcoin into fiat currencies and pick them up physically in a banking ATM.

Thanks to a partnership with HalCash, in fact, you can convert your Bitcoin into Euro and withdraw cash in every banking ATM (only banks that are members of HalCash’s network) based both in Spain and Poland with a total of more than 10,000 ATMs in Europe.

HalCash Bitcoin withdrawal process is very simple and you can do it in a few steps following the official guide provided by HolyTransaction.

Instead of typical platform, Holytransaction Trade will provide you an instant exchange as soon as the deposit is confirmed on the Bitcoin network.

Also, the newest HolyTransaction platform allows you to buy Bitcoin in Spain with Teleingreso, a fast, easy and secure payment option that allows you to buy Bitcoin through its network of more than 3000 ATM machines, 2000 post offices and 300 retail outlets.

When you select Teleingreso as online payment method, the system automatically generates a unique 9-digit transaction code. The transaction is pending until you visit any of the locations to make a payment, and then the information is instantly provided to us.

To use HolyTransaction Trade, you don’t need a wallet on HolyTransaction.com.

In fact, to use HolyTransaction Trade there is no need of registering on the platform and you can also use our exchange platform if you have a different wallet provider.

Also, the newest HolyTransaction platform allows you to create a prepaid virtual visa card with Bitcoin to buy everything you want online, as almost every e-commerce accepts VISA payments.

HolyTransaction Trade for mobile

Each service is available and works in less than 24h, and can also be done on your smartphone, using the HolyTransaction Trade app you can download on Google Play for free.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

LuxTrust, together with a Massachusetts-based startup and the support of the Luxembourg government, is building a new Blockchain ID platform.

LuxTrust, together with a Massachusetts-based startup and the support of the Luxembourg government, is building a new Blockchain ID platform.