Search Results For: estonia

Why is Estonia Considered Crypto Capitol of Europe?

At this point, cryptocurrencies will play a major role in the global financial industry soon. Millions of people are already using them, and these digital assets had a massive breakthrough in 2021. What’s even more important is that many companies and countries are starting to accept them.

In a world’s first, El Salvador became the only country to fully adopt Bitcoin and even use it for various trading purposes. That allowed the cryptocurrency to grow and stabilize itself even more. Even though many would think that El Salvador will be leading the pack in the crypto world, that did not concern Europeans too much.

Why? Because they already have a country that kind of regulates these digital assets and allows them to trade with them. That country is Estonia, and, in this article, we’ll be looking at why Estonia is considered the crypto capitol of Europe. Let’s dive into the details.

Estonia Was the First Country to Regulate Cryptocurrencies

First, Estonia was among the first countries in the world to start regulating cryptocurrencies. It started accepting them around a decade ago and since then, became a haven for all crypto traders. That ‘tradition’ was kept over the years as all new traders in the continent are advised to invest in crypto here.

Aside from trading and making a profit, crypto users keep these digital assets to pay for services/products and for entertainment. One of the most popular entertainment types that you can participate in with crypto is online gaming, specifically casino sites.

Since online casinos operate on the Internet now and cryptocurrencies are fully optimized for online use, they were more than fond of allowing registered players to deposit and withdraw money with them.

Estonia Is Fond of Using Technology to Its Advance

Next up, Estonia is well-known for leaning towards technology. After all, apart from being known as the first country in Europe to regulate cryptocurrencies, it is also the first country in the world to introduce the e-Residency program, which is like digital citizenship.

This allows participants to use numerous services from the government, including starting an EU-based company without the need of travelling to Estonia.

When it comes to cryptocurrencies and payment methods, one interesting fact about Estonia is that it is a cashless society. Statistics show that 99% of all transactions are conducted digitally. Residents here are always looking for more efficient online payment methods and that is what led the country to cryptocurrencies.

As you may know, crypto transactions are instant, whereas transactions with regular payment methods can take up to a few days to be completed. That makes these digital assets perfect for paying online and conducting business.

The industry is Well-Regulated in the Country

Lastly, the Estonian government has recently tightened regulations as the Financial Intelligence Unit, which is under the wing of Estonia’s Finance Ministry, is now able to revoke crypto licenses in efforts to fight money laundering.

That makes this country extremely safe for all those who are willing to invest in cryptocurrencies. Extra security is always welcomed, especially in times when online scams are proving to be a massive problem. As data shows, more than $240 million has been lost in scams so far in 2021. Millions of people fall victim to this problem and all of us want that extra security layer.

Thanks to the fact that cryptocurrencies utilize cryptography, which provides a certain level of online anonymity, users are safer, but with Estonia’s regulations, that security is taken to the next level.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

World Economic Forum Blockchain led by Estonia

The World Economic Forum Blockchain created a new working group focused on the distributed ledger with the Estonian President.

This so-called “Global Futures Council on Blockchain Technology” will be met for the first time during an event held in Dubai later this week. According to the World Economic Forum Blockchain the group will be focused on the development of governance models related to the distributed ledger.

Toomas Hendrik Ilves, president of Estonia for 10 years, will co-chair together with Jamie Smith, chief communications and marketing officer for bitcoin mining and blockchain services firm BitFury and a former official in the Obama White House.

Members of the group are: Ma Jun (chief economist for the People’s Bank of China’s research outfit) and Claire Sunderland Hay (head of the Bank of England’s fintech startup accelerator).

The group also include representatives from bitcoin-related startups such as BitPesa, Everledger, Ripple and Chain; and institutions such as Barclay’s and Deutsche Bank.

Here you can read the full list of the “World Economic Forum Blockchain” members.

“The distributed ledger or blockchain system of preserving data integrity and security is one of the most promising new technologies to emerge in the past decade. Its full potential is only now beginning to be realized. This Council will play a leading role exploring how blockchain can be used to improve security on the internet.”

The WEF counducted an internal research about the blockchain since 2015 and this new working group is part of a broader network of Global Agenda Councils, focused on problems such as climate change, AI and cybersecurity.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Estonia bank to study benefits of integrating Bitcoin technology

![etukuva[1]](http://bitcoinexaminer.org/wp-content/uploads/2014/03/etukuva1.png)

(CoinDesk) Estonia-based bank LHV has announced a new project that will explore

the legal framework and potential uses of bitcoin’s block chain

technology in banking so it might develop bank services for bitcoin and

other digital currencies.

“We are interested in the technological

side of digital currencies as we hope it could make bank services more

simple and efficient,” Priit Rum, head of communications at LHV, told

CoinDesk.

The project manager will examine all digital currencies, not limiting itself to bitcoin.

For

now, the bank won’t engage in trading bitcoin, Rum said, but more

likely, could develop its payments system using block chain technology.

The company claims to be the first bank in the world to implement such a program, stating:

“We

have been aware of crypto currencies for some time now […] we decided

last month that establishing a side project to explore the block chain

technology and analyse possibilities of cryptocurrencies would be a good

opportunity to stay with the innovation.”

Regulatory uncertainty remains

While the news of this action by a major bank is perhaps encouraging, in Estonia, bitcoin is tangled in regulatory uncertainty.

Earlier this year, the country’s central bank issued a warning

against bitcoin and digital currencies calling it a Ponzi scheme,

saying “virtual currency schemes are an innovation that [deserve] some

caution”, but that it would continue to monitor their development.

Shortly after, local bitcoin trading site BTC.ee put a halt on trades, coming under pressure from Estonian authorities who challenged the site’s compliance with the Money Laundering and Terrorist Financing Prevention Act.

Said Rum:

“LHV

is a regulated bank and we take all the regulations and guidelines very

seriously […] For us, all the questions about ‘know your customer’ and

concerns of money laundering have to be dealt with before we can really

develop new bank services using new technology.”

Local enthusiasm grows

Estonians have been enthusiastic about bitcoin for some time, despite the regulatory difficulties the domestic ecosystem faces.

The

country’s capital Talinn had a successful week-long bitcoin showcase

last month, during which bitcoin advocates came together to educate

those new to the digital currency and boost its popularity.

For more on the latest developments in the eastern European economy, read our most recent report.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Nasdaq Blockchain: new investments in more startups

Nasdaq Blockchain – related venture initiatives include new investment in distributed ledger based startups.

Today Nasdaq Ventures announced it has decided to invest in startups and companies that work with blockchains and/or artificial intelligence, next-generation data analysis and machine learning.

Nasdaq Blockchain budget is $10m to be awarded to deserving startups that are focused on both seed-stage and late-stage placements.

This Nasdaq Blockchain effort is a natural extension of the firm’s work in the blockchain field.

Back in 2015, Nasdaq started a partnership with Chain, an enterprise-grade blockchain infrastructure that enables organizations to build better financial services from the ground up.

This effort saw the two companies develop a distributed ledger market focused on pre-IPO offerings.

President and CEO of Nasdaq, Adena Friedman, explained in a statement:

“With the launch of our new venture investment program, we are reinforcing our focus on driving growth and innovation by evaluating, distributing, licensing and integrating disruptive technologies for the long-term benefit of our global clients.”

Nasdaq has been testing the blockchain even in other areas.

In fact, back in February 2016, Nasdaq announced its blockchain tests on e-voting prototypes with Estonia’s sole securities exchange.

Also, in January, Nasdaq published a report arguing that the distributed ledger is also useful beyond transaction settlement.

Read more about Nasdaq Blockchain – related projects by clicking here.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Why governments should embrace the Blockchain

How governments should embrace the Blockchain

- Verification: licenses, proofs of records, transactions, processes or events.

- Movement of assets. E.g. Transferring money from one person/entity to another.

- Ownerships: the blockchain is a perfect ledger to custody any asset.

- Blockchain can be used to give e-identities to its citizens, enabling a safer kind of voting.

- Study the blockchain and explore its potential.

- Let people develop a blockchain strategy.

- Start experimenting with blockchain technology

- Develop new ideas to improve the quality of life of the citizens

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How to buy Bitcoin through PayPal

Improving the Bitcoin Use

How E-Coin works

E-Coin Fees

Step-by-Step Guide to Buy Bitcoin

- Log in into your PayPal account

- Go to “Money” and then click on the “Add A Card” button

- Click on “Add another card”

- Fill the form with Name, Card Type and Billing address

- Click on “Save”

- Then, you need to provide a PayPal code. Return to your PayPal account and insert the 4-digit code. This way you will link the E-Coin card to your PayPal account.

- Go to your E-Coin account and under “card transactions,” there is a 4-digit code from PayPal

- Return to your PayPal account

- Go to “Withdraw Money.”

- Select “Withdraw Funds To Your Card”

- Enter the amount to withdraw, click on E-Coin Visa card, and then on “Continue.”

Open your free digital wallet here to store your cryptocurrencies in a safe place.

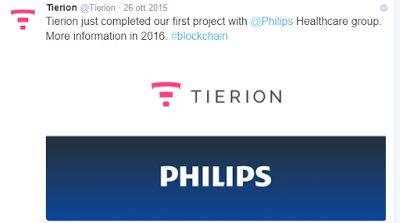

Philips announces its own Blockchain Lab

Previous Statement

Open your free digital wallet here to store your cryptocurrencies in a safe place.

How to use the blockchain to secure medical records

Guardtime, a blockchain platform for ensuring the integrity of systems, is now working together with the Estonian eHealth Foundation to develop a blockchain network to secure one million patient medical records.

eHealth will use the Guardtime’s KSI (Keyless Signature Infrastructure) into its database to improve the security and the real-time availability of patient medical records.

Guardtime aims at protecting those records with an “independent forensic-quality audit trail”, so it will be impossible to edit the information.

During a recent interview conducted by Coindesk, a spokesperson for Guardtime said:

“In guarding sensitive records, the danger is that they could be altered, deleted, improperly changed or updated, affected by hackers, malware, system issues, etc. The blockchain in this case can prove the integrity of the record, and everything that has happened to it over time”

Why in Estonia?

Maybe you are asking yourselves why this kind of innovation is being conducted in Estonia.

Well, Estonia is already famous for its e-government system which use a chip-embedded ID card that allows citizens to access government services including filing taxes and voting online.

Guardtime Insights

In 2007 Guardtime invented a “Keyless Signature Infrastructure”, a blockchain platform created to ensure the integrity of systems, networks and data at industrial scale.

Keyless Signature Infrastructure (KSI) is designed to provide scalable digital signature based authentication for electronic data, machines and humans. KSI uses only hash-function cryptography, allowing verification to rely only on the security of hash-functions and the availability of the blockchain.

According to the company itself, Guardtime’s method is similar to the one used by the blockchain startup Factom. In both cases, in fact, every time a file changes, a new signature is generated and stored in the blockchain.

Open your free digital wallet here to store your cryptocurrencies in a safe place.