Search Results For: Lightning Network

Uncovering the Widespread Adoption and the Advent of the Lightning Network in El Salvador and Lugano

Acknowledging the unprecedented potential of Bitcoin’s Lightning Network, El Salvador and Lugano are two of the most significant adopters of this remarkable technological breakthrough.

El Salvador & Lugano Propel the Bitcoin Adoption

As a cornerstone moment for the Bitcoin economy, a memorandum of understanding (MOU) was signed on 28 October 2022 between the nation of El Salvador and the city of Lugano in Switzerland. Moving forward, the goal of the MOU is to increase the use of Bitcoin not only in their respective areas but also in the states and nations that are nearby.

Overall, the anticipated aims of the partnership include bolstering cooperation in education and research for both El Salvador and Lugano, assisting initiatives to promote the adoption of Bitcoin and other digital tokens in their respective regions, and encouraging the exchange of students and talent between the two countries.

Exploring the Innovation Brought by the Lightning Network

So far, the scalability of the Blockchain has been a significant barrier to the widespread acceptance of cryptocurrencies from their inception. The Lightning Network’s second layer introduces a cutting-edge solution to this matter, as it intervenes by processing transactions outside the first-layer blockchain mainnet while retaining the mainnet’s robust decentralized security model. By bypassing the official Bitcoin blockchain, the Lightning Network can grow Bitcoin transactions per second (TPS), charge reduced fees, and allow new use cases like micropayments.

In addition, the Lightning Network has the potential to bring financial inclusion and freedom to the developing nations involved, in part because it is a trusted and private network that does not require the participation of third parties or intermediaries. Moreover, it could also lessen the likelihood of governments enacting policies restricting the free flow of capital. It also helps people who do not have access to bank accounts by facilitating transactions in a manner that is almost instantaneous and free of charge, thereby making Bitcoin usable not only as a means of payment but also as a means of exchange.

How Lugano is Leading Crypto Adoption in Europe

Lugano appears to have the same goal as El Salvador: to have all local businesses routinely accept cryptocurrencies as a form of payment. However, Lugano does not appear to have the same goal as El Salvador of making Bitcoin or any other cryptocurrency legal tender. Although Lugano does not hold such a position in Switzerland, the city of 70,000 people did launch its Plan B programme approximately seven months ago to increase the use of Bitcoin.

In March of 2022, Lugano announced that it would be implementing the Plan ₿ Initiative. Additionally, the technology company Polygon joined as a critical infrastructure partner. Plan ₿ Foundation, a partnership between the City of Lugano and Tether, the technology company behind the public blockchain that supports the largest stablecoin by market capitalization (USDT), has been announced today. This partnership will allow Bitcoin, Tether, and LVGA payments to be accepted in the city of Lugano.

Tether and the city of Lugano have collaborated to create a Plan ₿ aiming to increase the use of Bitcoin and stablecoins throughout the city. This, in turn, is expected to have a beneficial effect on all aspects of inhabitants’ everyday lives. As a result, the city’s financial system will be revolutionized faster than ever, thanks to the widespread use of Bitcoin.

El Salvador – the Pioneering Nation in the Cryptocurrency

In 2021, El Salvador was the first country to acknowledge Bitcoin as a legal tender. Through this avenue, El Salvador became a pioneer in demonstrating how technologies such as Bitcoin, decentralized ledgers, and peer-to-peer networks can accelerate financial literacy and inclusion

Furthermore, Latin America appears to follow El Salvador’s lead and powering Bitcoin mining farms with natural resources (such as energy generated by geothermal activity). Countries of Costa Rica in Central America and Paraguay in South America are also heading in this direction.

Bottom Line

Since most people in Europe are not yet familiar with this idea, a closer relationship between El Salvador and a nation located in Europe could usher in uncharted territory.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

HolyTransaction adds support for Bitcoin Lightning Network

Today, we are pleased to announce that HolyTransaction is adding support for swapping to Bitcoin on Lightning Network and thus introducing the ability to deposit and withdraw using Lightning Network.

By adding this capability, HolyTransaction is set to revolutionise the speed, cost and security of depositing and withdrawing Bitcoin on to its platform.

Lightning Network is a software stack which sits on top of the Bitcoin blockchain and, as the name implies, ensures faster and cheaper transactions for its users.

Other than super fast speed and lower fees users will notice a new format of address called invoice when they send or receive Bitcoin via the Lightning Network. The team at HolyTransaction reported that the integration has been successful and hassle free.

Lightning Network brings three essential product benefits to the HolyTransaction exchange:

• Instant Payments. With the use of smart contracts security across the network is much higher and because the stack is built ‘on top’ of the Bitcoin network no transaction confirmations are required. This makes instant payments super fast, super secure and, of course, super cheap.

• Scalability. The massive upscale in transactions per second eclipses any traditional legacy payment rail on the market today. Furthermore, payment ‘with click’ becomes a true reality as the need for financial custodians are eliminated.

• Low Cost. Because Lightning Network does not interact directly with legacy Bitcoin infrastructure itself Lightning Network enables transaction with incredibly low fees. This in turn will stimulate economic growth in new and emerging markets.

In real terms this means Bitcoin deposits and withdrawals on HolyTransaction will be much faster and much cheaper when using Lightning Network.

At the time of press average costs for sending a Bitcoin transaction currently stand at around $2 with confirmation times of around 10 minutes. This clearly has limitations. However, a Lightning Network enabled transaction will cost less than $0.01 and take somewhere in the region of 1-3 seconds.

Adopting Lightning Network will make HolyTransaction more attractive for users who wish to send transactions with added security at much lower cost and super fast speed. HolyTransaction is happy to report that Lightning Network has been integrated for both desktop and mobile application versions.

Lightning Network was envisioned in 2015 and has seen significant growth throughout 2021 which has lead to it being regarded as the most popular layer 2 scaling solution on the market for Bitcoin today. With continued adoption Lightning Network may just help to finally realise the original Bitcoin goal of providing a scalable, fast and cheap financial payments network to the world.

The team at HolyTransaction believe the adoption of the Lightning Network is the logical step in the development of the platform. Lightning Network adoption will enable HolyTransaction to continue to provide a first class crypto trading experience and offer competitive fees with super fast finality times.

Need to open a channel to us?

021744d86987a91958461117cd9e7c0e3160f7b86de11f5998018f4b4984a5c330@54.194.246.117:9735

Lightning Network Node links:

1ML

Amboss

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Revolutionizing Bitcoin: An In-depth Exploration of the Runes Protocol

Introduction to Bitcoin Runes

Bitcoin Runes represents an innovative step forward in the evolution of the Bitcoin blockchain, offering a new protocol for fungible tokens. Developed by Casey Rodarmor, the mind behind the Ordinals protocol, Runes aims to streamline the process of token creation and management within Bitcoin’s existing framework.

The Underlying Technology of Runes

Runes utilize the Unspent Transaction Output (UTXO) model of Bitcoin, differing from the account-based systems used by other blockchain protocols like Ethereum. This choice leverages Bitcoin’s native data structures for enhanced efficiency and simplicity in token transactions. Unlike other token standards that might require off-chain data or depend on separate native tokens, Runes operates entirely on-chain, integrating with the OP_RETURN opcode to record transaction details directly on the blockchain.

Key Features of Bitcoin Runes

One of the standout features of Runes is its approach to minting tokens, which can be configured as either open or closed systems. This flexibility allows developers to set specific conditions for how tokens are generated, whether freely by the community or under more controlled circumstances. Additionally, the protocol is designed to handle issues like blockchain bloat efficiently by ensuring that only valid transactions contribute to the network’s data load.

Preparing for Runes

As the anticipation for Runes builds, potential users and developers are advised to prepare by setting up Bitcoin wallets that support the protocol, staying informed about updates, and perhaps most crucially, securing some Bitcoin to handle transaction fees once Runes goes live.

Integration with Bitcoin’s Ecosystem

Bitcoin Runes not only introduces a new token standard but also integrates deeply with Bitcoin’s existing systems, such as the Lightning Network. This integration allows Runes to utilize Lightning for faster and cheaper transactions, bypassing the usual congestion and high fees associated with the Bitcoin network. The compatibility with Lightning showcases Runes’ potential to enhance Bitcoin’s scalability by leveraging second-layer solutions. This feature is particularly appealing to developers and users who are looking for efficient transaction methods without compromising the security and decentralization that Bitcoin offers. The seamless integration of Runes with Bitcoin’s broader ecosystem could lead to increased adoption of both Runes and the Lightning Network, further solidifying Bitcoin’s position as a versatile and robust platform for financial innovation.

Future Prospects and Community Involvement

The launch of Runes is set against the backdrop of a growing trend towards tokenization on the Bitcoin blockchain, highlighted by the surge in popularity of the Ordinals protocol earlier. Runes takes this a step further by offering a fungible token standard that could potentially host a variety of digital assets, including memecoins and utility tokens. The community’s role in shaping the future of Runes is crucial, as evidenced by the protocol’s design that allows for open minting processes where the community can actively participate in the creation of new tokens. This aspect fosters a more inclusive and dynamic development environment, encouraging innovation and engagement from a broad spectrum of users. Looking forward, the ability of Runes to attract a diverse range of projects and maintain high levels of community engagement will be key indicators of its long-term viability and success within the cryptocurrency ecosystem.

Market Impact and Adoption

Before its official launch, which is timed with Bitcoin’s halving event in 2024, Runes has already garnered significant attention. Various projects have begun building around the Runes ecosystem, and its introduction is expected to reinvigorate interest in Bitcoin by providing new avenues for creating and trading digital assets. This development aligns with the broader trend of integrating more complex functionalities like tokenization into Bitcoin, which has historically been seen primarily as a value transfer system.

Runes represents a significant technological advancement within the Bitcoin ecosystem, promising to introduce a new layer of functionality that supports the creation and management of fungible tokens directly on the blockchain. By optimizing the UTXO model and eliminating the need for off-chain data, Runes could set a new standard for efficiency and simplicity in blockchain token systems. The community’s response, as seen through engagements and project developments, suggests a strong future for this protocol.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Big Four of Bitcoin’s L2 Ecosystem: Unleashing Innovation and Efficiency

The Big Four of Bitcoin’s L2 Ecosystem: Unleashing Innovation and Efficiency

As the cryptocurrency landscape evolves, Bitcoin’s Layer 2 (L2) ecosystem emerges as a beacon of innovation, promising to redefine the scalability, speed, and efficiency of transactions. Among the burgeoning projects within this space, four stand out for their unique contributions and potential to shape the future of Bitcoin: the Lightning Network, Stacks, Liquid, and Rootstock. Each project brings its own set of capabilities and innovations to the table, collectively enriching the Bitcoin ecosystem with new functionalities and applications.

Lightning Network: Speed and Micropayments Revolution

The Lightning Network is perhaps the most well-known of the L2 solutions, designed to enable instant, low-cost transactions. By creating a network of payment channels operating off the main Bitcoin blockchain, it significantly reduces transaction times and fees, making Bitcoin practical for everyday transactions and microtransactions. This innovation is not only crucial for scaling the network but also for facilitating new use cases, such as micropayments, that were previously impractical due to high transaction costs and slow confirmation times.

Stacks: Building Smart Contracts on Bitcoin

Stacks, formerly known as Blockstack, takes a different approach to enhancing Bitcoin’s functionality. By enabling smart contracts and decentralized applications (DApps) on Bitcoin, Stacks introduces the capabilities of Ethereum-like platforms without compromising the security and stability of Bitcoin. This opens up a new realm of possibilities for developers to build on Bitcoin’s robust network, offering a unique blend of innovation without sacrificing the core principles that make Bitcoin the gold standard of cryptocurrencies.

Liquid: Enhanced Privacy and Efficiency

The Liquid Network focuses on improving the privacy and efficiency of Bitcoin transactions, especially for traders and exchanges. As a sidechain solution, Liquid allows for faster settlements, enhanced confidentiality through confidential transactions, and the issuance of digital assets. Its role is particularly pivotal in the context of institutional and professional trading environments where speed and privacy are of the essence. Liquid’s contributions to the Bitcoin ecosystem highlight the growing need for scalable and confidential transaction solutions that cater to a diverse range of user needs.

Rootstock (RSK): Smart Contracts Meet Bitcoin Security

Rootstock (RSK) adds yet another layer of functionality to Bitcoin by integrating smart contracts into the network. Similar to Stacks, RSK aims to leverage Bitcoin’s unmatched security by allowing developers to create smart contracts and DApps within the Bitcoin ecosystem. However, RSK operates as a sidechain that is merge-mined with Bitcoin, providing a unique blend of smart contract functionality with the security and decentralization of the Bitcoin network. This makes it a compelling option for developers looking to deploy secure and interoperable DApps.

Synergies and the Future of Bitcoin’s L2 Ecosystem

The synergy between these four projects exemplifies the potential of Layer 2 solutions to not only alleviate the scalability concerns associated with Bitcoin but also to introduce a wide array of functionalities that extend beyond simple transactions. From enabling microtransactions with the Lightning Network to fostering new applications through Stacks and Rootstock, and enhancing privacy and efficiency with Liquid, the L2 ecosystem is at the forefront of Bitcoin innovation.

The future of Bitcoin’s L2 ecosystem lies in its ability to harmoniously integrate these solutions, fostering an environment where efficiency, scalability, and functionality coexist. As these projects continue to evolve and mature, the Bitcoin network stands to benefit from increased adoption and utility, further cementing its position as the cornerstone of the cryptocurrency world.

Moreover, the success of Bitcoin’s L2 projects offers valuable insights into the potential of Layer 2 solutions across the broader cryptocurrency ecosystem. By addressing the inherent limitations of blockchain technology, such as scalability and transaction speed, without compromising on security or decentralization, L2 solutions represent a pivotal step towards achieving the mass adoption of cryptocurrencies.

Conclusion

The “Big Four” of Bitcoin’s Layer 2 ecosystem—Lightning Network, Stacks, Liquid, and Rootstock—symbolize a significant leap forward in the quest for a more scalable, efficient, and functional Bitcoin. Through their individual and collective contributions, these projects are not only enhancing the capabilities of the Bitcoin network but also paving the way for a future where digital currencies are seamlessly integrated into everyday life. As the cryptocurrency landscape continues to evolve, the innovations stemming from Bitcoin’s L2 ecosystem will undoubtedly play a critical role in shaping its trajectory.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Layer 2 Solutions in 2024: Paving the Way for a Scalable and Efficient Blockchain Future

In 2024, Layer 2 solutions in the cryptocurrency space have become an essential tool for addressing the limitations inherent in traditional blockchain networks, particularly scalability issues. These solutions, built atop existing blockchains (Layer 1), offer a way to handle transactions more efficiently without compromising the underlying network’s security and integrity.

Understanding Layer 2 Solutions

The concept of Layer 2 solutions arises from the need to improve blockchain efficiency. The primary blockchain, also known as Layer 1, can only process a limited number of transactions within a given time frame. This limitation leads to congestion, slower transaction times, and higher fees, especially on networks like Ethereum, which hosts a multitude of decentralized applications and smart contracts.

Layer 2 solutions are akin to creating express lanes alongside a busy highway. While the main road (Layer 1) remains intact, these new lanes (Layer 2) allow for faster and more efficient travel of data. By handling transactions off the main chain but still anchored to it for security, Layer 2 solutions enhance transaction speed and reduce costs, offering a more scalable approach for blockchain networks.

Lightning Network and Bitcoin

The Lightning Network stands out as a prime example of a Layer 2 solution, primarily associated with Bitcoin. It enables quick, low-cost transactions by creating off-chain payment channels between parties. This system is revolutionary for Bitcoin, pivoting its use from a store of value (“digital gold”) to a practical medium for everyday transactions.

Ethereum’s Rollups

Ethereum, known for its smart contracts, has actively embraced Layer 2 solutions, particularly through the implementation of rollups. These rollups work by bundling multiple transactions into a single one that is processed on the main chain. This innovation significantly speeds up the transaction process while reducing Ethereum’s notorious gas fees, making transactions more user-friendly.

Arbitrum and Optimistic Rollups

Arbitrum, a Layer 2 solution using optimistic rollups, has garnered significant attention within the crypto community. It offers scalable, efficient transaction processing and has become a hub for decentralized finance (DeFi) projects due to its user-friendly infrastructure. With a robust Total Value Locked (TVL) and a growing user base, Arbitrum represents a major advancement in Layer 2 technology.

BASE by Coinbase

BASE, developed by Coinbase, is another Layer 2 solution that has witnessed remarkable growth. Leveraging Coinbase’s reputation and reach, BASE has attracted a significant number of users, reflected in its high transaction volumes and position in the TVL rankings. While BASE continues to evolve, it represents a significant step in the wider adoption of Layer 2 solutions.

Challenges and Future Prospects

Despite the numerous advantages, Layer 2 solutions also face challenges, primarily relating to interoperability and maintaining the decentralized ethos of blockchain technology. Ensuring seamless integration with various Layer 1 networks and other Layer 2 solutions, while preserving security and decentralization, remains a key area of development.

Looking ahead, Layer 2 solutions are poised to play a critical role in the broader adoption and utility of blockchain technology. By addressing scalability and efficiency issues, they open up new possibilities for complex and interactive decentralized applications, fostering innovation in fields like DeFi and NFTs.

The Impact on the Crypto Ecosystem

The introduction and evolution of Layer 2 solutions have profound implications for the cryptocurrency ecosystem. They enhance the user experience by reducing transaction fees and waiting times, crucial for mainstream adoption. Moreover, Layer 2 solutions pave the way for more sophisticated and practical applications of blockchain technology, extending its reach beyond traditional financial transactions to areas like gaming, supply chain management, and more.

In summary, the development and integration of Layer 2 solutions in 2024 mark a significant milestone in the evolution of blockchain technology. They offer a practical and scalable way to overcome the limitations of Layer 1 networks, paving the way for a more efficient, user-friendly, and diverse blockchain ecosystem.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

The Role of Bitcoin in Building a Decentralized Financial System

Bitcoin, the world’s first and most widely-used decentralized digital currency, has an important role in building a decentralized financial system. One of the key advantages of Bitcoin is its potential for appreciating in value, thanks to its limited and predetermined supply. This can make it a potentially attractive investment, as it may increase in value over time.

In addition to its potential for growth, Bitcoin offers security and transparency through its distributed ledger, the blockchain. This means that transactions on the network are almost impossible to cheat or make fraudulent, making it a secure option for conducting financial transactions.

Bitcoin’s decentralized nature also means that it is not subject to the same risks as traditional currencies, such as inflation or government seizure. This makes it a useful option for individuals in countries with unstable currencies or high inflation rates, as it allows them to store value and make payments in a more stable and secure way.

The rise of DeFi, or decentralized finance, has also seen the development of a number of projects built on top of the Bitcoin network. These include RSK and tBTC, which allow users to access a wide range of financial services in a decentralized and trustless manner.

The Lightning Network, another layer built on top of the Bitcoin network, also offers users the ability to make fast and cheap transactions. This can make transactions faster and cheaper, and can also enable new use cases such as micropayments and instant payments. One such wallet that integrates with the Lightning Network is HolyTransaction, which offers a wide range of digital assets and other benefits such as an easy-to-use interface and fast and cheap transactions.

A leading project is Blockstream’s Liquid Bitcoin, also known as L-BTC. Liquid Bitcoin is a sidechain-based token that is pegged to the value of Bitcoin, allowing users to transfer value between the two networks quickly and securely. The Liquid Network is a federated sidechain that uses a consortium of trusted nodes to provide increased privacy and security for users.

Another project that leverages the Liquid Network is Fuji Money, a Lightning-enabled non-custodial synthetic asset protocol. Fuji Money allows users to create and trade synthetic assets, such as stablecoins or synthetic commodities, on the Liquid Network in a trustless and decentralized manner. This allows users to access a wider range of financial instruments and services, further expanding the capabilities of the decentralized financial system.

Overall, the role of Bitcoin in building a decentralized financial system is significant, thanks to its potential for appreciation in value, security and transparency, and ability to provide financial inclusion.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Welcome to the Universal Wallet and Exchange, Groestlcoin.

If you thought about holding or exchanging GRS Groestlcoin, now you can do so directly with your HolyTransaction Universal Wallet.

It’s now possible to add GRS wallet to your dashboard and use it to access and exchange 25 different crypto, instantly. This is just one of the many recent adoptions that increased the possibilities of pur platform, by bringing the number of cryptocurrencies accepted to 25.

Now you are free to store GRS on HolyTransaction, transfer them to any other wallet, and make crypto-to-crypto transfers from and to GRS. All HolyTransaction customers can create a new address for their own Groestlcoin Wallet.

Groestlcoin Wallet features

Just like Bitcoin and all the other 24 digital currencies supported, you can now:

• Send GRS to any address, even to addresses of other crypto, with instant conversion on the fly;

• Receive transactions;

• Exchange GRS with any supported coins;

• Make instant transactions between HT users;

• Get real time exchange rates on the website;

• Set OTP for additional protection.

If you are not able to see your newest Groestlcoin Wallet, you just need to click on the “plus” button on the top right of the balance page, once you successfully login into your own wallet.

About GroestlCoin:

Groestlcoin is a fast and secure coin with almost zero fees that is privacy oriented. Launched on 22nd March 2014 with a focus on technological advancement, Groestlcoin has major development releases every 3 months.

Groestlcoin is a blockchain pioneer due to it being the first coin that activated SEGWIT and first to performed Lightning Network transactions on mainnet.

“ You can send GRS across the blockchain with almost zero fees. The fee for transferring 10,000 GRS with Groestlcoin Core wallet is 0.000045 GRS, that means $0.0006 at current price.”

The Groestlcoin Team has developed wallets for every platform: Android, iOS, BlackBerry, Windows, macOS, Linux, Chrome OS and Web. And besides that, the Groestlcoin Samourai wallet enables you to send GRS anonymously.

“The Groestlcoin Samourai wallet, boasts its anonymity and security, as it allows for private stealth addresses with both TOR and VPN support, as well as onboard AES-256 encryption.”

The main idea of creating Groestlcoin was to establish an electronic payment model that was purely based on mathematical proof. It uses the proof of work system (POW) to facilitate secure online money transactions. A system that is independent of influence from centralized authorities, a currency transferable electronically, and instantly at a very small fee.

Using 2 rounds of Grøstl-512 mining algorithm, makes Groestlcoin an ASIC resistant cryptocurrency.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Bitcoin vs. Litecoin: What makes them different?

When it comes to cryptocurrencies, one name stands out from the rest: Bitcoin. Bitcoin is the gold standard upon which all the other cryptocurrencies, cumulatively known as altcoins, are evaluated. And that’s rightly so because Bitcoin is the most popular, the biggest in terms of market capitalization and so far, the one most likely to break into mainstream use. But among the contenders for the throne, one cryptocurrency that closely resembles Bitcoin and the earliest altcoin is Litecoin. It was created primarily to be a “lighter” version of Bitcoin. In fact, many people refer to it as ‘silver’ to Bitcoin’s ‘gold’.

Why is that the case? An attempt to answer brings us to the issue of Bitcoin vs. Litecoin, exactly what we are trying to explore here. Let’s point out the similarities as well as explain the differences between these two cryptocurrencies.

A brief history

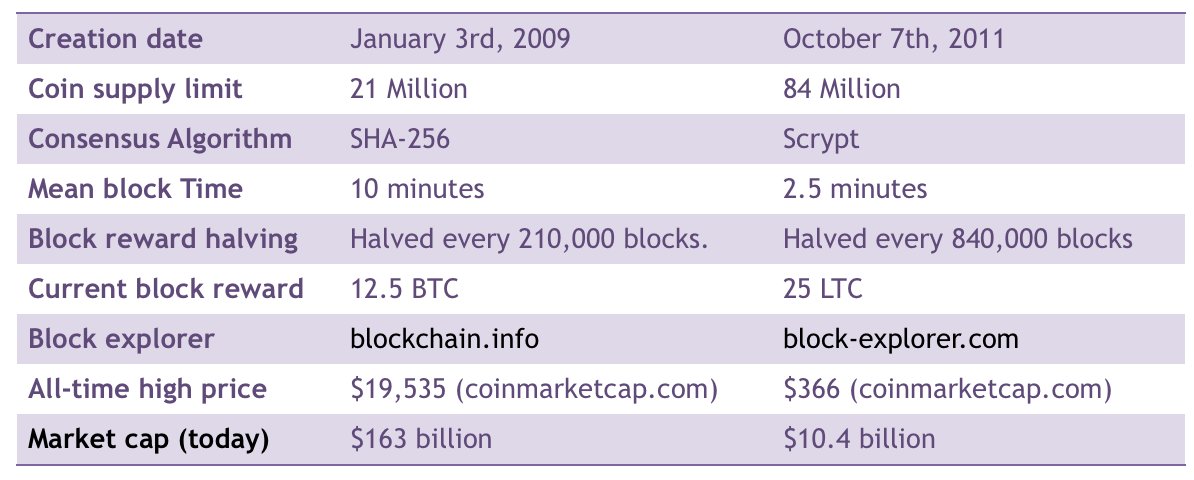

Bitcoin was created by Satoshi Nakamoto who released the Bitcoin whitepaper in 2008, before Bitcoin Core was launched on 3rd January 2009. On the other hand, Litecoin was created by Charles Lee and released on October 7th, 2011.

Price and Market capitalization

Whereas Bitcoin and Litecoin share a lot in terms of their blockchain protocols, the same cannot be said about their prices and market valuation. We could say both are dependent on the market trends and user flexibilities, but the variation isn’t even close. Today, bitcoin commands the largest market share, dominating by 42% of the total market capitalization to stand at $163 billion. BTC trades at $9636 against the USD and was at its all-time high of $19,535 on Dec 17, 2017. Bitcoin has a current circulating supply of 16,914,275 BTC against a maximum supply of 21 million coins.

Litecoin, on the other hand, is ranked 5th on coinmarketcap.com with a market cap of $10.4 billion. Its price today is $187, though it climbed to an all-time high of $366 on 19 December 2017 when its market cap was also just shy of $20 billion. Incidentally, Litecoin on that day had a daily volume of an incredible $2.3 billion. The circulating supply of LTC is currently 55, 592,093 LTC with a maximum supply of 84 million LTC.

When compared in terms of Market capitalization and price valuation, Bitcoin is 10x bigger or more than Litecoin. The same applies to popularity and use. While they both function as a store of value and can be used to make payments for goods and services, Bitcoin is accepted by far more companies and individuals than Litecoin.

Coin supply and transaction speed

Bitcoin and Litecoin differ in terms of the maximum coin supply. While Bitcoin’s total supply is capped at 21 million coins, Litecoin will have a total of 84 million coins. Though they differ in this aspect, both coins are deflationary, and their coin trajectory may appear similar. Another similarity is that both coins are divisible into smaller parts that enable micro-payments for goods and services. The smallest Bitcoin part is called a “Satoshi”.

But the two coins do differ in relation to the amount of time it takes to generate a new block. Litecoin block generation is halved after every 840,000 blocks, which is four times more than bitcoin at 210,000 blocks. For Bitcoin, a new block is generated after approximately 10 minutes. However, Litecoin miners use about two and half minutes to generate a new block. This results in the variation of transaction speeds between the two coins.

Due to having a faster block time, Litecoin’s network is normally able to confirm transactions much faster than Bitcoin. For instance, it would take 10 minutes to confirm four transactions on the Litecoin network, whereas the same amount of time would be just enough to verify one block of transactions on the Bitcoin network. Bitcoin has been implementing changes to its protocol to scale better and increase transaction speed.

It is expected that Lightning Network will make Bitcoin faster. However, Litecoin will look to implement the same protocol as it often times, does with every Bitcoin update.

Mining algorithms

Mining is a very vital component of cryptocurrency, precisely those that use the proof of work mining consensus mechanism. What we said earlier about block generation essentially amounts to the concept of mining. Basically, mining refers to the addition of new blocks to the main chain on the network to form a “blockchain”. Cryptocurrencies utilize different cryptographic algorithms to secure transactions on the blockchain. Bitcoin uses the SHA-256 algorithm that allows for the use of ASICs (Application Specific Integrated Circuits) for mining.

This hardware equipment came to replace the GPU and FPGA miners. Bitcoin mining is a complex activity but can be summarized as the solving of computational math problems to verify and secure a new block to the blockchain. Bitcoin miners (nodes) get rewarded 12.5 Bitcoins for every new block. One criticism leveled at bitcoin mining is that the process consumes a lot of energy resulting in massive electricity bills.

Mining is also an important aspect of Litecoin. Scrypt is the mining algorithm used on the Litecoin network. The Scrypt algorithm is designed to be resistant to customized ASIC miners due to its memory-hard nature. This makes mining Litecoin a lot easier as you can do it using a CPU or GPU. however, there are concerns that Litecoin’s CPU/GPU mining days may be soon over as ASIC miners targeting the Scrypt algorithm have been developed by companies like Zeus and Flower Technology. While miners on the Bitcoin platform get rewarded 12.5 BTC for every new block, Litecoin miners get 25 LTC for every new block validly added to the blockchain. It should be noted that mining Litecoin is relatively cheaper than bitcoin, but Bitcoin could be more profitable for those with the right equipment.

Conclusion

Bitcoin and Litecoin share a lot in common when it comes to the functional aspect of being stores of value. However, Bitcoin beats Litecoin on numerous fronts, specifically on price valuation and market adoption. Naturally, bitcoin would be an attractive coin for investment, but if you are looking for an affordable crypto with the potential to grow then Litecoin could be it.

This Article was provided by our friend Ronni Martelli

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Litecoin Segwit has been finally approved

Litecoin Segwit has been finally implemented, so this long-debate to change to change the digital currency network can be said to be closed now.

Originally intended to improve the bitcoin blockchain, Segwit – or Segregated Witness – had to solve the so-called block size debate, but it has been used on the lesser known litecoin chain, with some in the community that believes that it will help to finally have a quick implementation on the bitcoin network too.

Litecoin Segwit: how does it work?

Segregated Witness, in fact, is a new system that will allow litecoin to improve its block size, by modifying how transaction data is stored by the blockchain itself.

The change was first locked-in two weeks ago, when the proposal reached the 75% threshold level.

Then, the community had to wait two more weeks (8,064 blocks) to ensure that the upgrade approval was consistent.

After that, yesterday (on May 10th) the change was officially activated at block 1201536.

What does it mean?

Litecoin users can now start using a new kind of network, and there has been at least one transaction so far.

Anyway, several supporters are thrilled about the new techs that can now be created on the Segwit-supported network.

For example, the Lightning Network could boost litecoin transactions by million times; thanks to Segwit it can now be used to move real money.

Developer Loshan T explained to CoinDesk:

“I think today will be a great day for pushing more awesome tech into Litecoin. With SegWit activated on litecoin’s mainnet, I cannot wait until we deploy confidential transactions, Lightning Networks, MAST and Schnorr signatures.”

Unfortunately, these projects are early stage right now, but developers from the Lightning Labs seem thinking that it is too early to talk about sending money over an experimental network, so they plan to continue to develop the chain.

The future is unwritten

It not so clear where the Segwit activation will lead to or what role Litecoin will have in the next future.

Loshan explained that some in the community are skeptical about litecoin needs of the Lightning Network tech because litecoin blocks are not full yet, but they would like to have trustless cross-chain transactions between bitcoin and litecoin as a potential Lightning use case; and developer believes could be a benefit for both the digital currencies.

Anyway, at the moment, the Litecoin blockchain seems to work properly, without any issue, even after the Segwit activation.

Open your free digital wallet here to store your cryptocurrencies in a safe place.

Decred 1.0. claims to have a decentralized governance

Decred, a creation of Bitcoin developers, rolls out decentralized governance, claiming a first in blockchain technology.

Decred is a cryptocurrency project and platform built from the ground up to leverage the will of its constituents to drive change. This approach eliminates the conflicts that arise when powerful entities attempt to assert control over a cryptocurrency.

Tomorrow, April 25, 2017 marks the release of Decred v1.0. This historic release puts Decred stakeholders in charge of shaping the future of Decred through direct community consensus voting.

For the first time in the history of cryptocurrencies, governing control moves away from centralized authorities, such as developers and miners, and is given to the community of stakeholders. Decentralization struggles without decentralized governance; this is especially true when it comes to a rapidly growing global currency.

Most cryptocurrencies distinguish themselves by how they secure the transactions on their network.

For example, Bitcoin is famous for using a proof-of-work algorithm that rewards miners for finding solutions to a cryptographic hash puzzle. Other cryptocurrency projects rely on proof-of-stake algorithms that reward users who hold the currency in a “staking” wallet with interest on the balances they carry.

Both approaches have strengths and limitations; Decred takes advantage of the best of both worlds with a hybrid proof-of-work and proof-of-stake consensus system. This allows the platform to strike a balance between benefits to both miners and stakeholders, giving rise to a more robust notion of consensus.

The 1.0 release of Decred will include the first community vote on two important issues.

After 75% or more of miners and stakeholders have updated to 1.0, Decred stakeholders will be able to vote on one consensus change and one signaling vote. Due to the rapidly growing popularity of Decred, the number of stakeholders buying vote tickets has increased dramatically, leading to large oscillations in the ticket price.

This is a good example of an unanticipated condition which needs to be resolved though community consensus. A new ticket price algorithm will aim to ease the large oscillations in ticket price and lead to better ticket price discovery while still maintaining the target ticket pool size.

A consensus change of this magnitude is very difficult to achieve in more traditional cryptocurrencies and requires the voluntary acceptance of the code by miners that may or may not have their own agendas. If it passes, the new ticket price algorithm will activate seamlessly for everyone with no further intervention. The second vote will allow stakeholders to signal support for Lightning Network development.

The Lightning Network is a payment layer that makes it economical and fast to process payments, especially small payments, like buying a cup of coffee without having to pay a large transaction fee to process the transaction. If this signaling vote passes, the developers will begin work on integrating Lightning Network on the Decred blockchain. Once development is complete and tested, a future consensus vote can be taken to automatically activate the Lightning Network code.

The recent 2017 roadmap highlights some of the other massive innovations that the team hopes to put up for a vote throughout the year. In addition, a new improvement proposal system will be put in place soon to allow for the community to contribute directly to the agenda.

The release of Decred 1.0 is a watershed moment in the cryptocurrency movement. This digital currency finally does what has never been done before, putting the power of change in the hands of the very people that care about it most. Decred is celebrating version 1.0.0 release with a puzzle challenge.

The ‘Autonomy Puzzle’ challenge features an initial prize of 500 decred (DCR) to the first solver, equivalent to approximately USD 7,500 at the time of this release. However, players will be working against the clock, as the prize will be reduced every 24 hours. The puzzle difficulty level has been rated ‘easy to medium’, as Decred is aiming to include participants of all skill levels.

Decred Wallet

We recently added Decred among the available digital currencies you can store on the HolyTransaction multicurrency wallet.

We define it as “multicurrency” because you can store more than 10 different cryptocurrencies within the same account and login details.

Open your Decred Wallet here and store it right next to your own Bitcoin, Ethereum and more.

Open your free digital wallet here to store your cryptocurrencies in a safe place.